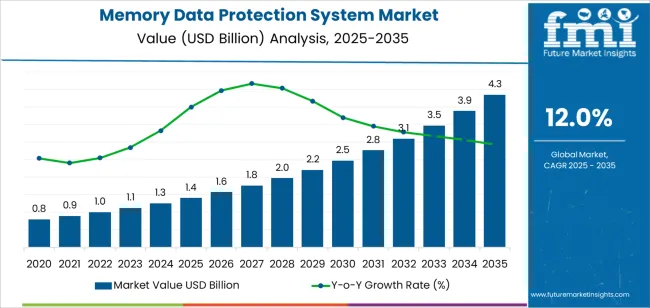

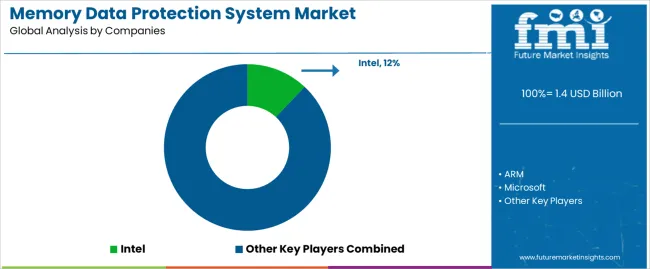

The memory data protection system market expands from USD 1.4 billion in 2025 to USD 4.5 billion by 2035 at a CAGR of 12.0%, driven by rising data security mandates across enterprise IT, cloud infrastructure, fintech, aerospace, and mission-critical computing environments. Unlike conventional cybersecurity, which focuses on data at rest or in transit, memory data protection targets data in use, safeguarding against buffer overflows, row-hammer, speculative execution flaws, and unauthorized memory access. This need becomes more significant as advanced computing models such as edge AI, 5G networks, confidential computing, and high-performance cloud workloads increase exposure to memory-level vulnerabilities.

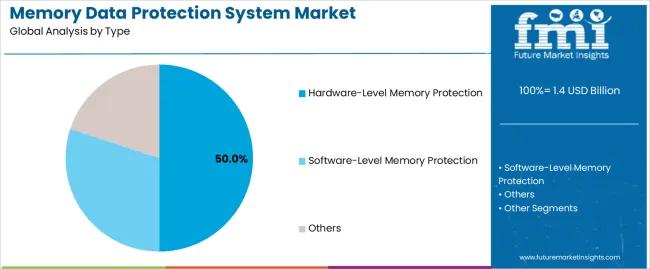

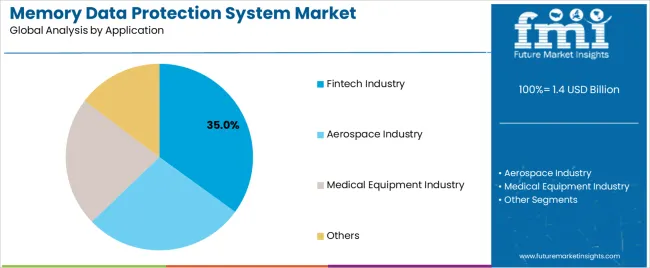

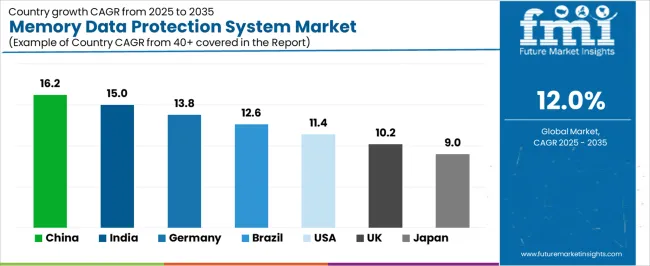

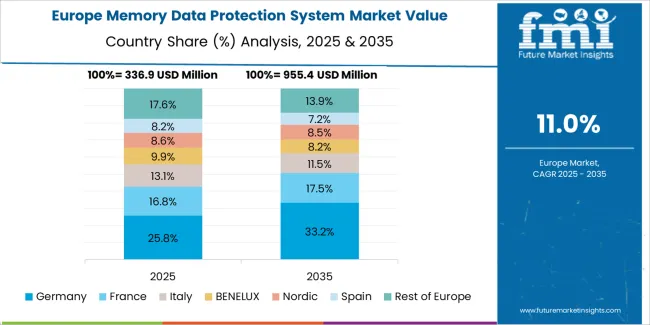

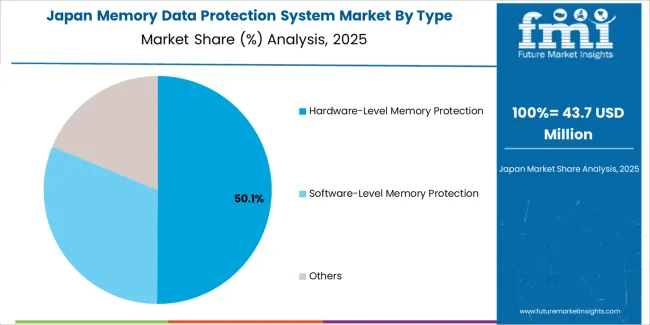

Hardware-level memory protection leads with 50% share, supported by Trusted Execution Environments, Memory Protection Units, and secure enclaves embedded into processors, offering low-latency, tamper-resistant protection at the chip level. Software-based mechanisms complement these functions through anomaly detection, runtime monitoring, and memory-usage integrity validation. Fintech remains the top application segment at 35%, where transactional accuracy, encryption of live data, and compliance with audit-trace requirements make secure memory operations indispensable. Regionally, China leads at 16.2% CAGR, followed by India and Germany, reflecting rapid digitization, strict data governance mandates, and accelerated deployment of secure cloud architectures. North America maintains steady adoption driven by cloud hyperscalers, cybersecurity frameworks, and regulatory pressure across healthcare, aviation, and government sectors.

The increasing adoption of hardware-based memory protection mechanisms, such as Trusted Execution Environments (TEEs), Memory Protection Units (MPUs), and secure enclaves, is gaining traction across industries such as fintech, telecom, healthcare, and the public sector. These technologies are designed to enhance the security of memory operations by creating isolated environments for sensitive data and preventing unauthorized access or tampering. As memory protection systems evolve, they are being integrated into next-generation hardware platforms, including AI accelerators, edge devices, and 5G infrastructure, further expanding their application across industries.

Between 2025 and 2030, the memory data protection system market is projected to grow from USD 1.4 billion to approximately USD 2.2 billion, adding USD 0.8 billion, which accounts for roughly 25.8% of the total forecasted growth for the decade. This period will be characterized by increased enterprise deployment of memory protection systems, driven by growing awareness of memory-centric vulnerabilities and the need for stronger data security in mission-critical systems.

From 2030 to 2035, the market is expected to expand from approximately USD 2.2 billion to USD 4.5 billion, adding USD 2.3 billion, which constitutes about 74.2% of the overall growth. This phase will see large-scale rollouts of memory protection systems, as well as their integration into cutting-edge hardware platforms like AI accelerators and 5G devices. Greater regulatory and compliance pressures regarding data and system integrity will also play a crucial role in the accelerated adoption of these solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.4 billion |

| Market Forecast Value (2035) | USD 4.5 billion |

| Forecast CAGR (2025-2035) | 12.0% |

The memory data protection system market is growing due to the increasing need for enhanced data security and protection in an increasingly digital world. Memory data protection systems are critical for preventing data corruption, loss, or unauthorized access in computing environments, particularly in sectors such as finance, healthcare, and government, where data integrity is crucial. With the rise in cyberattacks, ransomware, and other security threats, businesses and organizations are investing more in robust data protection systems to safeguard sensitive information.

The growing reliance on cloud computing, big data analytics, and IoT devices is also driving market growth. These technologies generate massive volumes of data that need to be securely managed and protected. Memory data protection systems offer solutions that help prevent system crashes, data corruption, and unauthorized access, which is essential as more organizations adopt data-driven decision-making and rely on the availability and integrity of their data.

Advancements in memory technologies, such as non-volatile memory and the increasing adoption of AI and machine learning, are fueling the need for enhanced memory protection systems. As the amount of critical data being processed and stored increases, the demand for reliable and efficient memory data protection solutions continues to rise. Despite challenges such as high implementation costs and integration complexity, the market is expected to expand as businesses focus on strengthening their data protection infrastructure.

The market is segmented by type, application, and region. By type, the market is divided into hardware-level memory protection, software-level memory protection, and others, with hardware-level memory protection leading the market. Based on application, the market is categorized into fintech industry, aerospace industry, medical equipment industry, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The hardware-level memory protection segment leads the memory data protection system market, accounting for 50% of the total market share. This dominance is driven by the superior security features offered by hardware-level protection, which is often seen as more robust and reliable than software-based solutions. Hardware-level memory protection safeguards critical data from attacks, corruption, and unauthorized access by isolating and securing memory from external vulnerabilities.

As the frequency and complexity of cyber-attacks increase, particularly in industries that handle sensitive information such as fintech and aerospace, the demand for highly secure, hardware-based solutions is growing. Hardware-level protection provides an additional layer of defense against memory manipulation or data breaches, making it essential for mission-critical applications. The ability to protect data from physical attacks, combined with its reliability and efficiency, ensures that hardware-level memory protection remains the leading segment in the market.

The fintech industry application dominates the memory data protection system market, holding 35% of the total market share. This is driven by the growing need for secure data protection in the financial sector, where safeguarding sensitive customer information, transactions, and financial data is paramount. As fintech companies increasingly rely on digital platforms for banking, payments, and trading, the risk of data breaches and cyber threats has intensified, creating a high demand for robust memory protection systems.

Memory data protection systems, particularly hardware-level solutions, are crucial for ensuring the integrity and confidentiality of financial data, protecting against hacking and unauthorized access. As fintech companies expand and digital transactions increase globally, the need for reliable, high-performance data protection solutions in the industry will continue to grow. This makes the fintech sector the largest driver of market growth, ensuring that memory data protection systems remain a critical component in the industry’s digital infrastructure.

Memory Data protection systems offer features such as hardware‑level memory isolation, real‑time anomaly detection in memory access, and protection of data in use. Key drivers include rising cybersecurity threats exploiting memory flaws, growth in edge/IoT/embedded computing where memory attackers are more prevalent, and stricter regulatory and compliance requirements for data integrity and system security. Restraints stem from high implementation costs, performance overhead concerns in protected memory environments, and lack of awareness of memory‑level threats among many system‑architects.

Memory data protection systems are gaining popularity because they address a critical and often overlooked attack surface: memory itself. Traditional protections focus on data at rest or in transit, but many sophisticated attacks exploit memory corruption (buffer overflows, use‑after‑free, row‑hammer) or unauthorized memory access. As computing environments become more diverse (cloud, edge, IoT, industrial control) and processing of sensitive workloads expands, system architects need solutions that protect memory integrity and confidentiality. Regulation and compliance in sectors such as finance, aerospace, healthcare and critical infrastructure require robust memory protection to ensure system resilience and data correctness. As a result, hardware‑ and software‑based memory protection solutions are becoming integral to modern secure architectures.

Technological innovations are driving growth in the memory data protection system segment by improving performance, scalability and integration. Advances include hardware‑assisted memory protection (such as memory encryption and isolation built into processors), improved memory integrity verification methods, and lightweight protection schemes tailored for embedded or resource‑constrained devices.

Research‑driven solutions are addressing attack patterns like row‑hammer or access‑pattern leakage, enabling memory systems to defend against novel threats with minimal performance impact. Integration with AI/ML‑powered threat detection and trusted‑execution‑environment (TEE) memory protections allow dynamic, real‑time monitoring of memory integrity. These innovations expand applicability of memory protection systems from high‑end servers to edge devices and help overcome earlier performance and cost barriers.

One major barrier is the performance overhead memory protection mechanisms (encryption, integrity checks, access monitoring) can introduce latency or require additional compute resources, adversely impacting high‑performance applications. Another challenge is cost and complexity of implementation adding hardware‑level memory protection or retrofitting existing platforms demands significant investment and architectural changes. Also, lack of awareness and expertise about memory‑level threats among many system designers means the urgency for such protections is under‑appreciated in some segments. The fragmentation of standards and interoperability issues (especially between hardware, firmware and software protection mechanisms) complicates integration and may slow down adoption in heterogeneous environments.

| Country | CAGR (%) |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| Brazil | 12.6% |

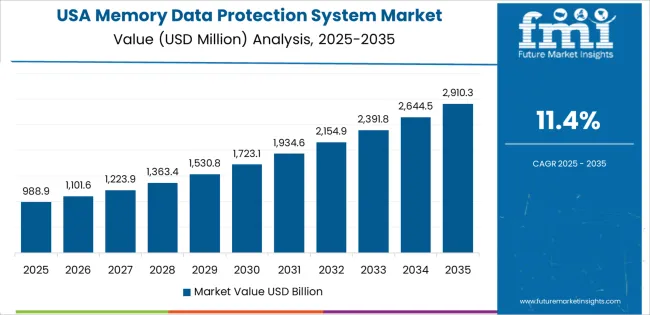

| USA | 11.4% |

| UK | 10.2% |

| Japan | 9.0% |

The memory data protection system market is experiencing strong growth across key countries, with China leading at a 16.2% CAGR. This growth is driven by increasing concerns over data security and the rising adoption of advanced technologies in various industries. India follows closely at 15.0%, supported by the rapid expansion of digital infrastructure and demand for reliable data protection solutions. Germany is growing at 13.8%, fueled by the strong focus on cybersecurity and data protection in the European region. Brazil shows a 12.6% CAGR, driven by increasing data-related threats and demand for secure memory storage solutions. The USA, UK, and Japan show steady growth at 11.4%, 10.2%, and 9.0%, respectively, as organizations continue to prioritize data security and risk management.

China is leading the memory data protection system market with a 16.2% CAGR. The rapid digital transformation in the country and the increasing number of cyber threats are driving the demand for advanced data protection systems. With China’s growing reliance on digital technologies, such as cloud computing, AI, and IoT, there is a heightened need for secure data storage solutions to safeguard sensitive information. This has spurred the adoption of memory data protection systems that can protect data integrity and prevent unauthorized access.

The country’s focus on strengthening its cybersecurity infrastructure has contributed to the market’s growth. As more industries in China, including finance, healthcare, and manufacturing, transition to digital systems, the need for robust memory data protection solutions becomes more critical. The government’s initiatives to improve data security regulations and prevent data breaches further drive the demand for memory data protection systems. As the digital landscape in China continues to evolve, the memory data protection system market is expected to maintain its strong growth trajectory.

India is witnessing significant growth in the memory data protection system market with a 15.0% CAGR. The increasing digitization across industries such as IT, banking, and healthcare is a key driver behind this market expansion. As businesses in India embrace digital technologies, there is a growing need to secure their critical data from cyber threats, prompting the adoption of advanced memory data protection systems. These systems help organizations safeguard sensitive information, ensure compliance with data privacy regulations, and prevent data breaches.

India’s increasing focus on cybersecurity, especially in the wake of rising cyber-attacks, is contributing to the demand for data protection systems. With more organizations moving their operations to cloud-based platforms, there is a heightened need for data security solutions that protect memory storage from cyber threats. As the country continues to develop its digital infrastructure and data-driven economy, the demand for memory data protection systems is expected to remain strong, supporting consistent market growth.

Germany is experiencing strong growth in the memory data protection system market, with a 13.8% CAGR. The country’s robust focus on cybersecurity and data protection regulations plays a pivotal role in the market’s expansion. With the European Union’s General Data Protection Regulation (GDPR) driving data protection measures across businesses, German companies are increasingly adopting advanced memory data protection systems to ensure compliance and prevent data breaches. These systems provide businesses with secure storage solutions, protecting critical information from unauthorized access and ensuring data integrity.

Germany’s strong industrial base and its leadership in sectors like automotive, manufacturing, and finance, where data protection is a top priority, also contribute to the market growth. The increasing need to secure data in highly regulated industries drives the adoption of memory data protection solutions. As German businesses continue to prioritize data security in their digital transformation efforts, the market for memory data protection systems is expected to grow steadily, driven by both regulatory compliance and the need for enhanced cybersecurity infrastructure.

Brazil is witnessing steady growth in the memory data protection system market with a 12.6% CAGR. The country’s growing digital economy, coupled with rising concerns about cybersecurity threats, is driving the adoption of memory data protection solutions. As more businesses in Brazil move toward digital platforms and cloud technologies, the need to secure sensitive data becomes more pressing. Memory data protection systems provide an effective solution to safeguard against data breaches, unauthorized access, and cyber-attacks.

Brazil’s expanding IT sector, along with increased internet penetration and mobile device usage, has led to a rise in digital data storage, further increasing the demand for data protection systems. The country’s focus on improving data security measures and regulatory frameworks to address the growing cybersecurity risks is contributing to the market’s growth. As Brazil continues to modernize its digital infrastructure, the demand for secure memory storage solutions will continue to rise, driving steady growth in the memory data protection system market.

The USA is experiencing steady growth in the memory data protection system market with an 11.4% CAGR. The growing need for robust data protection solutions in the face of rising cyber threats is a key driver of market growth. As businesses across various sectors, including healthcare, finance, and government, move towards digitalization, the need to secure data and protect it from unauthorized access becomes more critical. Memory data protection systems are being adopted to safeguard sensitive information and comply with data security regulations.

The USA’s strong focus on cybersecurity, with both private companies and the government investing heavily in data protection measures, has significantly contributed to the growth of this market. The increasing frequency of data breaches and cyber-attacks has heightened the awareness of the importance of data security, further fueling the demand for memory data protection systems. As digital transformation continues to accelerate in the USA, the demand for advanced data protection solutions will likely continue to rise, ensuring steady growth in the memory data protection system market.

The UK is experiencing moderate growth in the memory data protection system market with a 10.2% CAGR. The country’s focus on data protection and regulatory compliance is driving the adoption of memory data protection systems. With the implementation of data protection laws such as the GDPR, businesses are increasingly adopting solutions to safeguard sensitive data and ensure regulatory compliance. Memory data protection systems provide a secure method of storing and managing data, making them essential in preventing data breaches and protecting organizational information.

The UK’s growing digital economy, with more businesses moving towards cloud-based operations, is contributing to the rise in demand for data protection solutions. The increased frequency of cyber-attacks and data breaches has also heightened awareness of the importance of secure data storage. As companies continue to prioritize data security in their digital operations, the memory data protection system market in the UK is expected to grow steadily, driven by the demand for secure, reliable data storage solutions.

Japan’s memory data protection system market is growing at a steady pace with a 9.0% CAGR. Japan’s strong focus on digital transformation across various industries, coupled with the increasing number of cyber threats, is driving the demand for memory data protection solutions. As businesses in Japan increasingly rely on digital platforms and cloud technologies, there is a growing need to secure sensitive information and prevent unauthorized access. Memory data protection systems provide an effective way to safeguard data and ensure its integrity.

Japan’s well-established technology infrastructure and strong focus on cybersecurity are contributing to the market’s growth. As more organizations in Japan adopt advanced data protection measures to comply with national and international regulations, the demand for memory data protection systems is expected to rise. The country’s commitment to innovation and its efforts to enhance data security across industries such as finance, healthcare, and manufacturing will continue to support the steady growth of the memory data protection system market in Japan.

The memory data protection system market is an increasingly vital segment within the cybersecurity and semiconductor industries, driven by the need to secure sensitive data and protect memory resources against cyber threats, particularly in cloud computing, data centers, and enterprise environments. Intel leads the market with a 12% share, recognized for its innovation in hardware-based security solutions, including advanced memory data protection technologies that safeguard data at the chip level. Intel’s strong portfolio of processors and integrated security features positions it as a key player in this market.

Other major players include ARM, Microsoft, and CrowdStrike, which offer a variety of software and hardware solutions focused on securing memory and data in a range of computing environments. ARM is known for its processor architectures that incorporate advanced memory protection mechanisms, making it a crucial player in the embedded and mobile device markets. Microsoft is investing heavily in memory data protection technologies for its operating systems and cloud platforms, offering both software and hardware solutions to enhance security. CrowdStrike provides cybersecurity software solutions that focus on memory protection and endpoint security, leveraging its expertise in threat intelligence and real-time data protection.

Companies like Synopsys, Trend Micro, and Sangfor contribute to the market by offering specialized memory data protection solutions tailored to enterprise environments. Synopsys provides comprehensive cybersecurity services, including memory protection systems designed for embedded and software applications. Trend Micro is known for its cybersecurity expertise, offering solutions that protect data and memory across different devices and networks. Sangfor focuses on providing integrated cybersecurity and memory protection solutions for enterprises.

Emerging players such as Qi An Xin Technology Group, Huawei, and Tencent further enhance the competitive landscape by developing advanced security technologies aimed at protecting memory data across global enterprises. Qi An Xin focuses on providing next-generation memory protection and cybersecurity solutions in China and beyond. Huawei and Tencent are investing in integrated security solutions, combining hardware, software, and cloud services to provide comprehensive memory data protection.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Hardware-Level Memory Protection, Software-Level Memory Protection, Others |

| Application | Fintech Industry, Aerospace Industry, Medical Equipment Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Intel, ARM, Microsoft, CrowdStrike, Synopsys, Trend Micro, Sangfor, Qi An Xin Technology Group, Huawei, Tencent |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in memory data protection technologies, integration with fintech, aerospace, and medical industries. |

The global memory data protection system market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the memory data protection system market is projected to reach USD 4.3 billion by 2035.

The memory data protection system market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in memory data protection system market are hardware-level memory protection, software-level memory protection and others.

In terms of application, fintech industry segment to command 35.0% share in the memory data protection system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Memory Support Supplement Market Size and Share Forecast Outlook 2025 to 2035

Memory-Enhancing Drugs Market Size and Share Forecast Outlook 2025 to 2035

Memory Integrated Circuits (IC) Market Growth - Trends & Forecast 2025 to 2035

Memory Protection System Market Size and Share Forecast Outlook 2025 to 2035

In-Memory Analytics Tools Market Growth - Trends & Forecast through 2034

In-Memory Database Market Size and Share Forecast Outlook 2025 to 2035

Shape Memory Alloy Market Size and Share Forecast Outlook 2025 to 2035

Shape Memory Polymer Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Memory Market Size and Share Forecast Outlook 2025 to 2035

Static Random Access Memory (SRAM) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Random Access Memory (DRAM) Market Size and Share Forecast Outlook 2025 to 2035

Digital Radio Frequency Memory (DRFM) Market Size and Share Forecast Outlook 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA