The global Mortuary Bag Market is estimated to be valued at USD 447.1 million in 2025 and is projected to reach USD 721.2 million by 2035, registering a compound annual growth rate of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 447.1 million |

| Market Value (2035F) | USD 721.2 million |

| CAGR (2025 to 2035) | 4.9% |

The mortuary bag market is undergoing steady evolution, fueled by rising global mortality rates, increased hospital admissions, and heightened emphasis on hygiene in corpse handling protocols. The healthcare industry’s preparedness for pandemics, natural disasters, and mass casualty events has intensified demand for reliable, leak-proof, and biohazard-compliant mortuary solutions.

Advanced manufacturing is enabling the production of eco-friendly, antimicrobial-coated, and tamper-resistant bags, aligning with global health and safety regulations. Moreover, infrastructural upgrades in public health and forensic services especially in emerging economies are encouraging procurement and stockpiling of essential mortuary equipment.

The market is also benefiting from government initiatives to modernize mortuary facilities and funeral services, further driving innovation and product standardization. These trends collectively position the mortuary bag industry for long-term, demand-driven growth.

The dominance of polyethylene (PE) in the mortuary bag market has been attributed to its exceptional balance between durability, flexibility, and affordability. With a 48.20% revenue share projected for 2025, its preference has been reinforced by its ability to withstand heavy loads, fluid exposure, and temperature fluctuations factors critical for the safe handling of deceased bodies.

Additionally, polyethylene is easy to manufacture in bulk and supports cost-effective logistics, enabling health institutions to stockpile in advance of pandemics or mass casualty events. Environmental adaptability and compliance with international hygiene standards have further enhanced its adoption.

The segment's growth has also been supported by the availability of recyclable and lightweight grades, making it viable for both advanced and emerging healthcare settings. As infection control protocols tighten globally, polyethylene continues to be positioned as the most practical and scalable material in mortuary applications.

Hospitals have emerged as the dominant end user in the mortuary bag market, capturing 49.2% of revenue share in 2025, largely driven by institutional needs for routine and emergency deceased body management. Their centralized role in patient care and emergency response has necessitated consistent and high-volume use of body bags that comply with biohazard containment regulations.

Mortuary bags are routinely stocked as part of hospital preparedness programs particularly in ICUs, trauma centers, and infectious disease wards ensuring readiness for expected and unexpected fatalities. The growth of this segment has been further strengthened by rising global hospitalization rates, aging populations, and stringent sanitation protocols adopted across healthcare systems.

Moreover, government policies mandating safe and respectful handling of the deceased have prompted healthcare institutions to invest in high-grade containment solutions, ensuring operational readiness and public health security. As a result, hospitals continue to anchor market demand for mortuary bags worldwide.

Environmental and Biohazard Concerns

The conventional plastic-type mortuaries create more environmental waste and pollution. Disposal is also a serious environmental concern, particularly in mass casualty crashes. Biohazard contamination is also one of the serious challenges for forensic centres and hospitals.

Infection spread through poor sealing of mortuary bags needs more regulation and quality control. Governments worldwide are making stricter biohazard containment and disposal regulations for manufacturers that force them to innovate their products and employ safer materials that adhere to international standards for global health.

Future-Proofed and Eco-Friendly Containment Solutions

Increased focus on eco-friendly solutions is one of the main opportunities for the mortuary bag industry. Companies are heavily investing in biodegradable body bags that naturally decompose without any toxic residue. Improved materials such as reinforced polyethylene and bio-sealed multi-layer bags also ensure leakage and pathogen transmission prevention.

Mortuary bags are also being RFID-tagged, and this will allow tracking of dead bodies in real-time for forensic and emergency response. These developments hit the sweet spot between environment and performance and get rid of the waste in an ethical and clean way.

The USA mortuary bag market has been developing steadily with a rising aging population and heightened preparedness for mass casualty events. Demand for infection-proof and environmentally friendly mortuary bags has promoted innovation on both the production and material sides. Funeral homes and hospitals are switching to biodegradable, strengthened, and leak-proof products in order to stay ahead of rigorous environmental regulations.

Over the next few years, technology will advance body storage and transportation. Mortuary bags will become standard RFID-tagged to improve stock control and traceability in relief camps and hospitals. Antimicrobial treatment will provide safer storage and transport with improved exposure to biohazard-related issues.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The UK mortuary bag market is increasing faster with most of its support from the funeral service cost and greater care for the environment. The provisions of the stringent Environmental Protection Act are forcing the producers to use mortuary bags that are biodegradable and non-toxic. Mortuaries and hospitals are turning green, and good environmentally friendly purchasing policies are taking the lead.

Personalization is also becoming popular, with color-coded bags designed according to religious and cultural traditions becoming the norm. Expenditure on smart tracking systems is also helping hospitals store bodies effectively, reducing administrative barriers, and adhering to regulatory requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

EU mortuary bag sector is being driven by environmental regulation and funeral industry trend adjustments. Germany, France, and Italy are at the fore in driving the removal of PVC bags and towards biodegradable bags. Increased adoption of environmentally friendly funeral rituals and compostable merchandise innovation is driving green mortuary bag demand at a quicker pace.

In addition, the greater emphasis of the healthcare industry on infection control has led to more tightly-sealed antimicrobial mortuary bags. The transition is in line with the EU's circular economy policies that minimize medical waste while not compromising on the maximum possible standards of safety.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The market for Japanese mortuary bags is expanding with the nation's rapid aging and shrinking population as well as with its rapid interest in readiness for disasters. Natural disasters, especially recurring ones, have led to investments in sophisticated mortuary products like secure, waterproof, and fire-resistant bags.

RFID tracking technology becomes more common, and hospital and forensic laboratory supply chains are optimized. Japanese environmental management starts to introduce biodegradable products in line with environmental policy to track green funeral practice.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea is witnessing growing demand for mortuary bags due to greater spending on medical facilities and above emergency capacity. South Korea's aging population and stringent biohazard regulation have driven development of extremely tough and resistance-to-contamination mortuary bags.

Apart from this, material science has also seen the development of technologies through which biodegradable and water-soluble mortuary bags can be manufactured that inflict minimum damage on the environment. Government policies being green also do a great deal for the market, striking an optimum balance between innovation and regulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

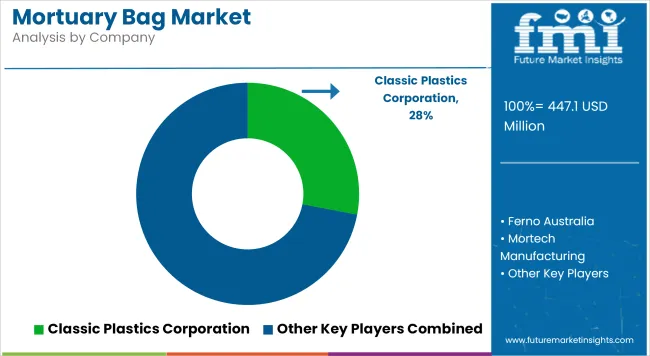

The mortuary bag market is witnessing a moderately consolidated competitive landscape, with key players actively focusing on material innovation, regulatory compliance, and supply chain expansion. Competitive differentiation is being achieved through the development of eco-friendly, antimicrobial, and leak-proof materials, in response to rising demand for sustainability and infection control.

Strategic partnerships with healthcare institutions, disaster response agencies, and defense organizations are also shaping procurement trends. Manufacturers are increasingly investing in automation and scalability to meet the growing global demand, particularly in high-mortality regions and during public health emergencies. Customization options based on size, closure type, and material composition are being offered to cater to varying institutional needs.

The overall market size for mortuary bag market was USD 447.1 million in 2025.

The mortuary bag market is expected to reach USD 721.2 million in 2035.

The increasing demand from hospitals, forensic labs, and disaster management agencies, along with growing concerns for hygienic handling and transportation of deceased individuals, fuels the mortuary bag market during the forecast period.

The top 5 countries which drive the development of mortuary bag market are USA, UK, Germany, China, and India.

On the basis of material type, polyethylene mortuary bags to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mortuary Equipment Market Insights - Trends & Industry Forecast 2025 to 2035

Bag in Tube Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Competitive Landscape of Bag-in-Tube Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA