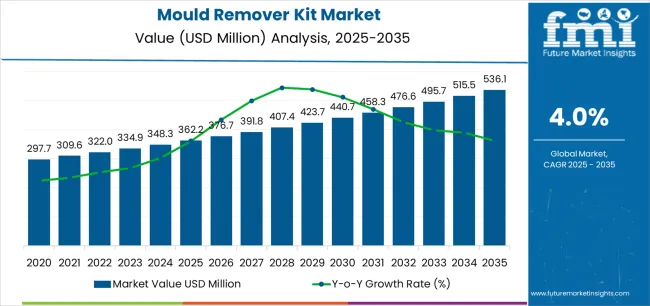

The global mould remover kit market is projected to reach USD 536.1 million by 2035, recording an absolute increase of USD 173.9 million over the forecast period. The market is valued at USD 362.2 million in 2025 and is set to rise at a CAGR of 4% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing awareness of indoor air quality and health hazards associated with mould exposure worldwide, driving demand for effective remediation solutions and increasing investments in building maintenance and property preservation programs globally.

Between 2025 and 2030, the mould remover kit market is projected to expand from USD 362.2 million to USD 440.6 million, resulting in a value increase of USD 78.4 million, which represents 45.1% of the total forecast growth for the decade. This phase of development will be shaped by rising awareness of mould-related health impacts and respiratory illness prevention, product innovation in eco-friendly formulations and application-specific delivery systems, as well as expanding integration with professional remediation services and property management protocols. Companies are establishing competitive positions through investment in safer chemical formulations, consumer-friendly packaging designs, and strategic market expansion across residential renovation, commercial facility management, and healthcare sanitation applications.

From 2030 to 2035, the market is forecast to grow from USD 440.6 million to USD 536.1 million, adding another USD 95.5 million, which constitutes 54.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized treatment systems, including preventative maintenance kits and integrated monitoring solutions tailored for specific building types and climate conditions, strategic collaborations between product manufacturers and building maintenance service providers, and an enhanced focus on environmental safety and occupant health protection. The growing emphasis on green building standards and sustainable maintenance practices will drive demand for advanced, environmentally-responsible mould remover kit solutions across diverse property management applications. However, regulatory restrictions on certain chemical ingredients and consumer price sensitivity may pose challenges to market expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 362.2 million |

| Market Forecast Value (2035) | USD 536.1 million |

| Forecast CAGR (2025-2035) | 4% |

The mould remover kit market grows by enabling property owners and facility managers to address mould infestations effectively while protecting occupant health and preserving building materials from progressive deterioration. Homeowners and building operators face mounting pressure to maintain indoor air quality and prevent mould-related health complications, with mould remover kit solutions typically providing 80-95% elimination of visible mould growth when applied according to manufacturer protocols, making these products essential for property maintenance and health protection programs. The building maintenance sector's need for accessible treatment solutions creates demand for ready-to-use kits that combine cleaning agents, protective equipment, and application tools enabling non-specialist users to address mould problems without requiring professional remediation services for minor to moderate infestations.

Government initiatives promoting healthy indoor environments and building code requirements addressing moisture control drive adoption in residential properties, commercial facilities, and healthcare institutions, where mould presence has direct impacts on occupant wellbeing and regulatory compliance. The global shift toward preventative building maintenance and property value preservation accelerates mould remover kit demand as property managers seek cost-effective solutions for addressing moisture-related damage before requiring extensive remediation. Consumer awareness of mould-related health risks including respiratory problems, allergic reactions, and immune system impacts creates sustained demand for effective treatment products available through retail and professional channels.

Climate change impacts including increased precipitation and humidity levels in many regions drive mould growth frequency, with properties in coastal areas and humid climates experiencing 30-50% higher mould incidence compared to arid regions, necessitating regular treatment and prevention measures. Aging building stock across developed markets creates ongoing maintenance requirements as deteriorating building envelopes and plumbing systems increase moisture intrusion events leading to mould development. However, chemical sensitivity concerns among some consumers and regulatory restrictions on volatile organic compounds may limit formulation options and adoption rates among environmentally-conscious demographic segments.

What is the segmental analysis of the mould remover kit market?

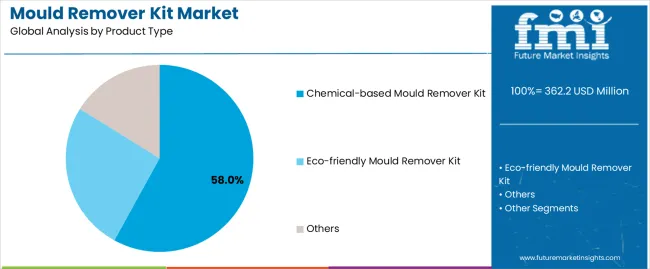

The market is segmented by product type, application, and region. By product type, the market is divided into chemical-based mould remover kit, eco-friendly mould remover kit, and others. Based on application, the market is categorized into residential, commercial, industrial, healthcare, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

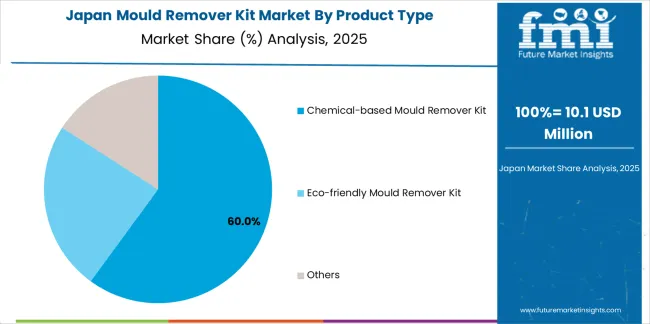

The chemical-based mould remover kit segment represents the dominant force in the mould remover kit market, capturing approximately 58% of total market share in 2025. This established category encompasses formulations featuring sodium hypochlorite, quaternary ammonium compounds, hydrogen peroxide-based solutions, and specialized fungicidal agents, delivering rapid mould elimination with proven efficacy across diverse surface types. The chemical-based segment's market leadership stems from its superior killing effectiveness against mould spores, fast-acting performance enabling quick treatment completion, and extensive track record of successful application across residential and commercial properties.

The eco-friendly mould remover kit segment maintains a growing 28% market share, serving environmentally-conscious consumers and facilities requiring low-VOC solutions through plant-based active ingredients, enzyme formulations, and biodegradable surfactants that minimize environmental impact while providing effective mould removal. The others segment accounts for 14% market share, featuring specialized solutions including preventative treatments, mould-resistant coatings, and combination kits with integrated moisture management components. Key advantages driving the chemical-based segment include proven efficacy through decades of application experience and documented performance data, rapid action enabling same-day treatment completion and immediate occupancy restoration in treated areas, broad-spectrum effectiveness against multiple mould species including toxic black mould varieties requiring aggressive treatment, and cost-effectiveness providing accessible pricing supporting widespread consumer adoption across income levels.

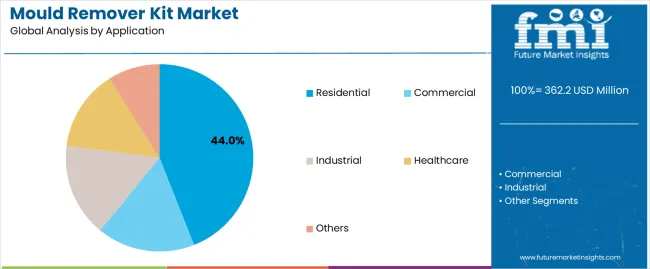

Residential applications dominate the mould remover kit market with approximately 44% market share in 2025, reflecting the widespread occurrence of mould problems in homes and the direct health concerns driving homeowner remediation efforts. The residential segment's market leadership is reinforced by high treatment frequency in bathrooms, basements, kitchens, and other moisture-prone areas where condensation and water leaks create favorable conditions for mould development requiring regular treatment interventions.

The commercial segment represents 26% market share through specialized applications including office buildings, retail facilities, and hospitality properties where mould presence impacts customer experience and regulatory compliance requiring systematic maintenance programs. Industrial accounts for 15% market share, encompassing warehouses, manufacturing facilities, and storage areas where humidity control challenges create ongoing mould management requirements. Healthcare holds 9% market share through hospitals, clinics, and long-term care facilities requiring stringent infection control and indoor air quality standards necessitating aggressive mould prevention and treatment protocols. Others represent 6% market share, covering educational facilities, public buildings, and transportation infrastructure. Key market dynamics supporting application preferences include residential emphasis on health protection driving immediate treatment response to visible mould growth, commercial focus on tenant satisfaction and property value preservation supporting preventative maintenance programs, industrial requirements for product protection and worker safety in storage environments, and healthcare's critical need for infection control supporting comprehensive environmental hygiene protocols including mould management.

The market is driven by three concrete demand factors tied to health protection and property maintenance requirements. First, indoor air quality awareness creates increasing demand for mould treatment solutions, with respiratory illness costs associated with mould exposure exceeding USD 3 billion annually in developed markets, requiring effective remediation products accessible to property owners for timely intervention. Second, property value preservation drives treatment demand as mould damage reduces home values by 5-15% during sale processes and creates disclosure obligations requiring remediation before transactions, necessitating reliable treatment products enabling value protection. Third, insurance claim prevention accelerates adoption of maintenance products, with moisture-related damage representing 20-25% of homeowner insurance claims and insurers increasingly requiring preventative maintenance documentation to maintain coverage, creating demand for documented treatment programs.

Market restraints include health concerns about chemical exposure affecting product selection, particularly among families with young children or individuals with respiratory sensitivities where harsh chemical formulations pose inhalation risks and skin contact concerns requiring protective equipment and ventilation during application. Regulatory restrictions on active ingredients impact formulation development, as environmental protection agencies worldwide implement stricter VOC limits and antimicrobial registration requirements creating compliance challenges and reformulation costs for manufacturers adapting to evolving standards. DIY treatment limitations affect market potential, as severe mould infestations exceeding 10 square feet require professional remediation services under health department guidelines, with improper treatment potentially spreading spores and creating more extensive contamination requiring costly professional intervention.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where rapid urbanization and expanding middle class populations create growing awareness of home maintenance requirements and health protection needs. Technology advancement trends toward plant-based and enzyme formulations with reduced chemical content are transforming product development as manufacturers respond to consumer demand for safer alternatives without sacrificing treatment effectiveness. Preventative product development including mould-resistant coatings and moisture control solutions expands market scope beyond reactive treatment toward proactive mould prevention strategies. However, the market thesis could face disruption if building technology innovations including advanced moisture barriers and automated humidity control systems reduce mould occurrence frequency, potentially decreasing treatment product requirements while maintaining demand for preventative solutions in existing building stock.

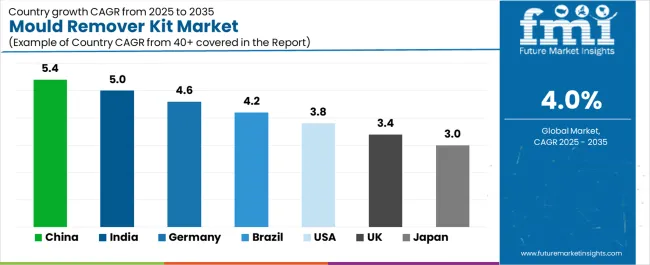

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.4% |

| India | 5% |

| Germany | 4.6% |

| Brazil | 4.2% |

| USA | 3.8% |

| UK | 3.4% |

| Japan | 3% |

The mould remover kit market is gaining momentum worldwide, with China taking the lead thanks to rapid urbanization and growing home maintenance awareness among expanding middle class populations. Close behind, India benefits from increasing property ownership and rising health consciousness regarding indoor air quality, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where stringent building regulations and comprehensive property maintenance culture strengthen its role in European building care markets. Brazil demonstrates robust growth through expanding urban housing development and increasing awareness of moisture-related building problems, signaling continued investment in property maintenance products. The USA maintains solid expansion through aging housing stock and widespread DIY culture, while the UK records consistent progress driven by damp climate conditions and established property maintenance traditions. Meanwhile, Japan stands out for its humidity management focus and meticulous building care practices. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

Why does China lead global market expansion in the mould remover kit market?

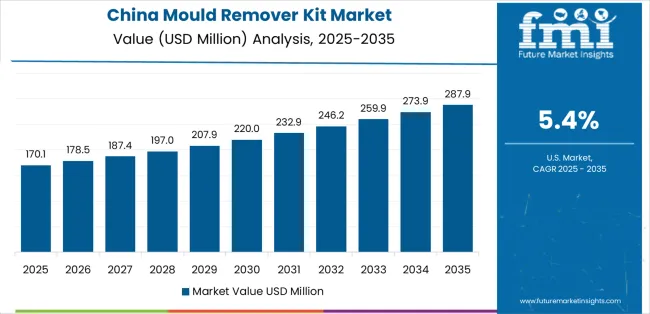

China demonstrates the strongest growth potential in the Mould Remover Kit Market with a CAGR of 5.4% through 2035. The country's leadership position stems from comprehensive urbanization programs, expanding middle class populations with increasing property ownership, and growing health awareness driving adoption of home maintenance products. Growth is concentrated in major urban regions, including Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta, and Chengdu-Chongqing, where apartment owners and property management companies are implementing mould treatment programs for building maintenance and occupant health protection. Distribution channels through home improvement retailers, e-commerce platforms, and property management service providers expand deployment across residential communities and commercial properties. The country's Healthy China initiative provides policy support for indoor air quality improvement, including public education campaigns about mould health risks and building maintenance best practices.

Key market factors include residential construction intensity with comprehensive apartment development and home ownership expansion creating large installed base requiring ongoing maintenance, growing consumer awareness through health education programs and social media information sharing driving treatment product adoption, comprehensive retail ecosystem including established home improvement chains and online marketplaces with proven distribution capabilities, and climate conditions in southern and coastal regions creating high humidity environments favorable for mould growth necessitating regular treatment interventions across millions of properties.

In Delhi NCR, Mumbai Metropolitan Region, Bangalore, and Hyderabad, the adoption of mould remover kit products is accelerating across residential apartments, commercial buildings, and healthcare facilities, driven by increasing property ownership and growing awareness of health impacts associated with mould exposure. The market demonstrates strong growth momentum with a CAGR of 5% through 2035, linked to comprehensive housing development expansion and increasing focus on indoor environmental quality. Indian consumers are implementing mould treatment programs and preventative maintenance routines to protect family health while preserving property conditions in monsoon-prone regions experiencing seasonal moisture challenges. The country's expanding retail infrastructure creates sustained demand for accessible home maintenance products, while increasing middle class incomes enable discretionary spending on health-protective building care solutions.

Leading market development regions, including National Capital Region, Maharashtra, Karnataka, and Tamil Nadu, driving mould remover kit adoption with retail expansion programs enabling widespread product availability through modern trade and traditional distribution channels. Consumer education initiatives through healthcare providers and building management associations accelerate adoption with awareness of mould health risks and treatment options. Market development through e-commerce platforms provides product access in tier-2 and tier-3 cities expanding beyond major metropolitan markets, while monsoon climate conditions in many regions create seasonal demand spikes supporting year-round market activity.

Germany's mature building maintenance market demonstrates sophisticated implementation of mould remover kit products, with documented case studies showing systematic treatment programs reducing recurring mould problems by 60-70% through combined removal and prevention approaches. The country's property management infrastructure in major regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony, showcases integration of mould treatment products with existing building maintenance protocols, leveraging expertise in property care and tenant health protection. German property owners emphasize quality standards and environmental responsibility, creating demand for effective treatment solutions that support building preservation and regulatory compliance with housing quality standards. The market maintains strong growth through focus on sustainable building management and health-conscious property maintenance, with a CAGR of 4.6% through 2035.

Key development areas include rental property management systems requiring comprehensive maintenance programs protecting tenant health and preserving building assets, technical expertise among property managers enabling systematic mould identification and treatment planning, strategic partnerships between product manufacturers and property management companies expanding professional-grade product adoption across residential and commercial portfolios, and integration of preventative maintenance programs and comprehensive building envelope management supporting long-term mould control strategies.

Brazil's developing property maintenance market demonstrates increasing implementation of mould remover kit products, with humid tropical climate conditions and expanding urban housing creating significant mould treatment requirements. The market shows solid potential with a CAGR of 4.2% through 2035, driven by urban housing expansion and increasing consumer awareness of health impacts from mould exposure across major metropolitan regions, including São Paulo, Rio de Janeiro, Salvador, and Recife. Brazilian homeowners are adopting mould treatment products for managing humidity-related building problems, particularly in coastal cities where high moisture levels create persistent challenges requiring regular intervention. Product deployment channels through home improvement retailers, supermarket chains, and local hardware stores expand coverage across diverse income segments and geographic markets.

Leading market segments include residential apartments in humid coastal regions requiring frequent treatment interventions, commercial properties managing tenant health concerns and building preservation, and healthcare facilities maintaining stringent environmental hygiene standards. Growing middle class populations with increasing discretionary income support market expansion through greater willingness to invest in preventative home maintenance, while product manufacturers adapt formulations and pricing strategies for local market conditions balancing efficacy with affordability considerations supporting widespread adoption.

The USA market demonstrates comprehensive implementation of mould remover kit products based on established DIY culture and widespread home improvement retail infrastructure supporting consumer access. The country shows solid potential with a CAGR of 3.8% through 2035, driven by aging housing stock and persistent moisture management challenges across diverse climate zones, including humid Southeast, temperature-variable Midwest, and coastal regions. American homeowners are adopting mould treatment products for basement waterproofing maintenance, bathroom renovation projects, and post-flooding restoration efforts requiring accessible remediation solutions. Product deployment channels through home improvement superstores, hardware chains, and online retailers provide convenient consumer access with extensive product selection.

Leading market segments include single-family home owners managing basement moisture and bathroom ventilation challenges, rental property landlords maintaining housing quality standards and tenant satisfaction, and restoration contractors addressing water damage remediation requiring mould treatment as part of comprehensive recovery programs. Consumer education through retail associates and online content supports informed product selection, while insurance restoration guidelines incorporating mould treatment protocols create professional market segment supporting premium product adoption in severe damage scenarios.

The United Kingdom's mould remover kit market demonstrates mature implementation driven by damp climate conditions and established property maintenance culture, with documented prevalence of mould problems in 20-30% of housing stock requiring regular treatment interventions. The country maintains steady growth momentum with a CAGR of 3.4% through 2035, driven by persistent moisture challenges in older housing stock and strong awareness of health impacts from mould exposure. Major population centers, including London, Birmingham, Manchester, and Leeds, showcase widespread availability of mould treatment products through retail channels serving homeowners and private landlords managing rental properties.

Key market characteristics include older housing stock with limited moisture barriers creating endemic damp problems requiring ongoing treatment, strong rental market with landlords responsible for maintaining housing health standards including mould control, comprehensive retail distribution through DIY chains and specialized building supply merchants ensuring product accessibility, and consumer awareness of mould health risks supported by public health guidance and tenant rights advocacy driving treatment demand.

Why does Japan demonstrate a precision maintenance culture in the mould remover kit market?

Japan's mould remover kit market demonstrates mature implementation focused on humidity management and meticulous building care, with documented integration of mould treatment products into comprehensive seasonal maintenance routines addressing rainy season challenges. The country maintains steady growth through cultural emphasis on cleanliness and building preservation, with a CAGR of 3% through 2035, driven by high humidity climate conditions and strong attention to indoor environmental quality. Major urban regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase sophisticated approaches to mould prevention and treatment integrating products with ventilation management and moisture control practices.

Key market characteristics include apartment living predominance creating concentrated market for consumer-accessible treatment products suitable for small residential units, seasonal moisture challenges during rainy season and typhoon periods driving preventative treatment applications, comprehensive retail distribution through home centers and drugstore chains providing convenient product access, and cultural emphasis on cleanliness and building care supporting regular maintenance routines including mould inspection and treatment protocols.

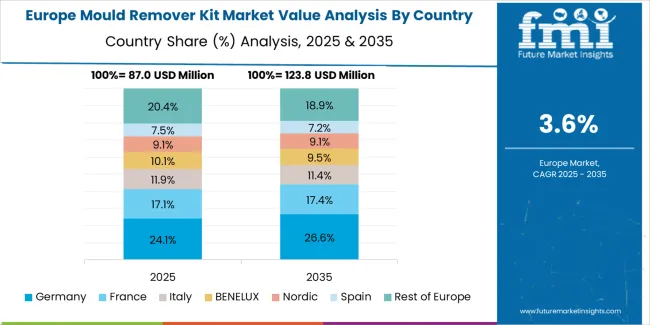

The mould remover kit market in Europe is projected to grow from USD 129.8 million in 2025 to USD 192.5 million by 2035, registering a CAGR of 4% over the forecast period. Germany is expected to maintain its leadership position with a 24.5% market share in 2025, declining slightly to 24.2% by 2035, supported by its extensive rental housing sector and major population centers, including Berlin, Munich, and Hamburg metropolitan areas.

The United Kingdom follows with a 22.3% share in 2025, projected to reach 22.1% by 2035, driven by damp climate conditions and comprehensive housing maintenance requirements. France holds a 18.5% share in 2025, expected to reach 18.7% by 2035, backed by social housing maintenance programs and property preservation culture. Italy commands a 13.2% share in both 2025 and 2035, driven by historic building preservation and coastal humidity management. Spain accounts for 9.8% in 2025, rising to 10% by 2035 on tourism property maintenance and humid coastal region requirements. The Netherlands maintains 5.6% in 2025, reaching 5.8% by 2035 on comprehensive moisture management culture. The Rest of Europe region is anticipated to hold 6.1% in 2025, expanding to 7% by 2035, attributed to increasing mould remover kit adoption in Nordic countries and emerging Central & Eastern European housing maintenance markets.

The Japanese mould remover kit market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of chemical-based and eco-friendly products with existing building maintenance practices across residential complexes, commercial properties, and institutional facilities. Japan's emphasis on environmental hygiene and health protection drives demand for effective mould treatment solutions that support comprehensive cleaning routines and seasonal maintenance programs addressing rainy season challenges. The market benefits from strong partnerships between product manufacturers and retail chains including home centers and drugstore networks, creating comprehensive distribution ecosystems that prioritize product efficacy and consumer education programs. Urban centers in Tokyo Metropolitan Area, Kansai region, Chubu region, and other major population concentrations showcase widespread product adoption where treatment programs achieve mould control through systematic application integrated with ventilation management and dehumidification practices.

The South Korean mould remover kit market is characterized by growing emphasis on environmentally-responsible products, with consumers increasingly demanding low-VOC formulations and plant-based active ingredients supporting health-conscious home care approaches. The market demonstrates increasing focus on apartment maintenance and indoor air quality, as Korean households increasingly prioritize health protection and building preservation in high-density residential environments with moisture management challenges. Domestic manufacturers are expanding market participation through product innovation emphasizing safety and efficacy, offering specialized formulations including odor-neutral treatments and quick-drying solutions suitable for compact living spaces. The competitive landscape shows increasing collaboration between chemical manufacturers and retail distributors, creating consumer education programs that build awareness of proper mould treatment techniques and preventative maintenance approaches supporting long-term mould control in humid climate conditions.

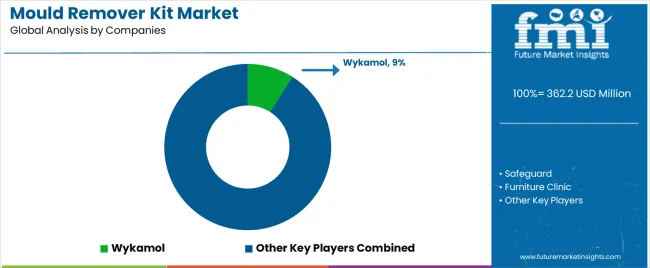

The mould remover kit market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 22-27% of global market share through established distribution networks and recognized brand equity. Competition centers on product efficacy, safety profile, and ease of use rather than price competition alone. Wykamol leads with approximately 9% market share through its comprehensive damp-proofing and mould treatment product portfolio serving professional and consumer markets.

Market leaders include Wykamol, Safeguard, and Furniture Clinic, which maintain competitive advantages through extensive product testing, regulatory compliance across multiple markets, and strong brand recognition among property maintenance professionals and informed consumers, creating trust and reliability advantages with diverse customer segments. These companies leverage research and development capabilities in formulation optimization, delivery system innovation, and ongoing technical support relationships to defend market positions while expanding into preventative treatment and integrated moisture management applications.

Challengers encompass Permagard Products and Mould Growth Consultants, which compete through specialized formulations and professional-grade solutions supporting restoration contractors and property management companies. Product specialists, including Maxam, Kingfisher Building Products, and SCRUBB, focus on specific market segments or distribution channels, offering differentiated capabilities in eco-friendly formulations, private label manufacturing, and professional contractor supply.

Regional players and emerging treatment product providers create competitive pressure through localized manufacturing and targeted marketing strategies, particularly in high-growth markets including China and India, where domestic manufacturers provide cost-competitive solutions adapted to local building types, climate conditions, and consumer preferences. Market dynamics favor companies that combine proven treatment efficacy with comprehensive application instructions, responsive customer support, and product availability through multiple retail channels addressing both professional and consumer market segments requiring accessible solutions for mould management throughout property ownership lifecycles.

Mould remover kits represent essential building maintenance products that enable property owners to achieve 80-95% elimination of visible mould growth through proper application, delivering health protection and property preservation with accessible treatment solutions in diverse residential and commercial applications. With the market projected to grow from USD 362.2 million in 2025 to USD 536.1 million by 2035 at a 4% CAGR, these treatment products offer compelling advantages - health risk mitigation, property value protection, and cost-effective remediation - making them essential for residential property maintenance, commercial facility management, and building operators seeking effective solutions for addressing mould problems before requiring expensive professional remediation services. Scaling market adoption and product accessibility requires coordinated action across building health regulations, treatment product standards, manufacturers, property management professionals, and consumer education initiatives.

How Governments Could Spur Local Production and Adoption?

Building Health Standards should establish clear guidelines for acceptable indoor mould levels, require disclosure of mould problems during property transactions creating treatment incentives, and develop public education programs about health risks associated with mould exposure. Research & Innovation Funding must support development of safer treatment formulations with reduced chemical content, fund efficacy studies validating treatment approaches against different mould species, and invest in preventative technology research addressing moisture control and mould-resistant building materials. Consumer Protection should establish product efficacy standards requiring validated treatment performance claims, implement quality testing programs ensuring product safety and effectiveness, and create labeling requirements providing clear usage instructions and safety precautions.

Housing Quality Programs need to include mould treatment assistance in low-income housing support initiatives, provide grants for property owners addressing systemic moisture problems, and establish inspection programs identifying mould problems in rental housing requiring landlord remediation. Education & Awareness should implement public health campaigns explaining mould health risks and treatment options, support community workshops demonstrating proper treatment techniques, and develop school programs educating about building maintenance and health protection creating next-generation awareness.

How Industry Bodies Could Support Market Development?

Product Standards & Testing should define standardized efficacy testing protocols measuring mould killing effectiveness and recontamination prevention, establish safety standards for chemical exposure during application and post-treatment occupancy, and create certification programs validating product performance claims supporting informed consumer choices. Application Guidelines must develop comprehensive best practices for mould inspection, treatment application, and effectiveness verification, establish training programs for professional applicators ensuring proper treatment execution, and create consumer education materials explaining when DIY treatment is appropriate versus requiring professional remediation services.

Environmental Standards need to develop sustainability guidelines for formulation ingredients and packaging materials, establish recycling programs for treatment product containers, and create eco-labeling systems helping consumers identify environmentally-responsible product options. Professional Integration should establish referral networks connecting treatment product manufacturers with mould remediation professionals, develop training programs for property managers on mould identification and treatment planning, and create industry standards for documentation supporting treatment effectiveness claims.

How OEMs and Technology Players Could Strengthen the Ecosystem?

Advanced Formulations should develop next-generation treatments with improved safety profiles and reduced chemical odors, create specialized products for different surface types and mould severity levels, and implement preventative formulations providing long-term mould resistance after initial treatment application. Delivery System Innovation must provide user-friendly application methods reducing protective equipment requirements, develop precision spray systems minimizing overspray and chemical exposure, and create controlled-release formulations extending treatment effectiveness over time.

Consumer Education Programs need to offer comprehensive instruction materials including video demonstrations of proper application techniques, provide technical support hotlines assisting consumers with product selection and troubleshooting, and develop mobile applications helping users diagnose mould problems and select appropriate treatment approaches. Product Transparency should implement clear labeling explaining active ingredients and safety precautions, provide detailed efficacy data supporting treatment performance claims, and offer satisfaction guarantees building consumer confidence in product effectiveness.

How Suppliers Could Navigate the Shift?

Application-Focused Product Development should create specialized solutions for residential applications emphasizing safety and ease of use, develop professional-grade formulations for commercial and industrial applications requiring aggressive treatment, and offer healthcare-specific products meeting stringent safety standards with formulations optimized for each application's specific requirements. Geographic Market Strategy must establish distribution partnerships in high-growth markets like China and India ensuring product availability through diverse retail channels, while maintaining comprehensive inventory in established markets like USA and Europe through home improvement retailers and online platforms.

Formulation Differentiation should invest in eco-friendly ingredient development reducing environmental impact and health concerns, develop proprietary delivery systems improving application ease and treatment effectiveness, and create combination products integrating cleaning, treatment, and prevention in comprehensive solutions. Consumer Partnership Models need to develop educational relationships with homeowners through workshops and online content, establish professional networks with contractors and property managers through training programs and technical support, and create loyalty programs rewarding repeat purchases while gathering feedback guiding product improvement.

How Investors and Financial Enablers Could Unlock Value?

Treatment Product Manufacturing should finance established mould remover kit manufacturers for capacity expansion, formulation development, and regulatory compliance supporting growing demand in residential and commercial markets. Distribution Infrastructure must provide capital for retail expansion, e-commerce platform development, and logistics networks ensuring product availability across diverse geographic markets and customer segments.

Innovation & Biotechnology should back startups developing next-generation treatment technologies including enzyme-based formulations, microbiome-safe solutions, and long-term preventative treatments that enhance effectiveness while addressing environmental concerns. Market Consolidation should support strategic acquisitions combining complementary product lines, finance partnerships between treatment product manufacturers and building maintenance service providers, and enable vertical integration creating comprehensive mould management solution providers serving professional and consumer markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 362.2 million |

| Product Type | Chemical-based Mould Remover Kit, Eco-friendly Mould Remover Kit, Others |

| Application | Residential, Commercial, Industrial, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Wykamol, Safeguard, Furniture Clinic, Permagard Products, Mould Growth Consultants, Maxam, Kingfisher Building Products, SCRUBB, Ready Steady Defend, GuardianDefence |

| Additional Attributes | Dollar sales by product type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with treatment product manufacturers and distribution networks, formulation specifications and safety profiles, integration with building maintenance programs and property management protocols, innovations in eco-friendly formulations and delivery systems, and development of specialized products with enhanced efficacy and reduced environmental impact. |

The global mould remover kit market is estimated to be valued at USD 362.2 million in 2025.

The market size for the mould remover kit market is projected to reach USD 536.1 million by 2035.

The mould remover kit market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in mould remover kit market are .

In terms of application, residential segment to command 44.0% share in the mould remover kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mould Inhibitors Market

In-Mould Label Film Market Size and Share Forecast Outlook 2025 to 2035

Rotomoulding Powder Market Size and Share Forecast Outlook 2025 to 2035

Blow Moulded Plastic Packaging Market

Pulp Moulding Tooling Market

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Thin Wall Mould Market

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Multi Component Injection Moulding Technology Market Size and Share Forecast Outlook 2025 to 2035

Rust Remover Market Size & Trends 2025 to 2035

Wart Remover Market Analysis by Product, Distribution Channel, and Region Through 2025 to 2035

Makeup Remover Pen Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Removers Market

Pet Stain Remover & Odor Control Market Analysis - Growth to 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Stoma Adhesive Remover Market Size and Share Forecast Outlook 2025 to 2035

Corn and Callus Remover Market Insights-Size, trends and Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA