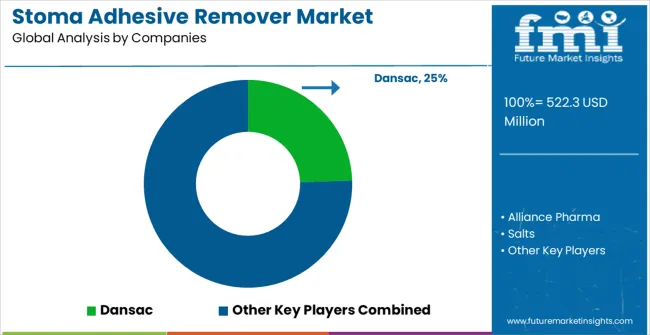

Revenue from the stoma adhesive remover market is growing at USD 522.3 million in 2025, rising to USD 795.7 million by 2035, reflecting a CAGR of 4.3%. The market exhibits steady year-on-year expansion, presenting significant absolute dollar opportunities for manufacturers, distributors, and healthcare providers. From USD 423.1 million in 2020 to USD 522.3 million in 2025, the cumulative increase of USD 99.2 million highlights growing adoption across hospitals, clinics, and homecare settings.

Rising awareness of post-surgical care protocols and patient comfort needs is driving this growth, positioning stoma adhesive removers as a key component in effective ostomy management solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 522.3 million |

| Market Forecast Value (2035) | USD 795.7 million |

| Market Forecast CAGR (2025–2035) | 4.3% |

During the 2025–2030 period, market revenue rises from USD 522.3 million to USD 644.6 million, creating an absolute dollar opportunity of USD 122.3 million. Expansion is supported by increasing procurement in emerging regions and preference for skin-friendly, easy-to-use adhesive removers that reduce irritation. Healthcare providers are adopting advanced stoma care protocols, while manufacturers offering differentiated products with patient-centric designs are positioned to capture incremental revenue. The consistent growth underscores the rising importance of adhesive removers in daily ostomy management routines.

From 2030 to 2035, revenue is expected to increase from USD 644.6 million to USD 795.7 million, providing an additional absolute dollar opportunity of USD 151.1 million. This phase is driven by the rising number of ostomy procedures, an aging population requiring long-term care, and growing patient awareness about adhesive remover benefits. Consistent replenishment cycles in hospitals and homecare settings will continue to support revenue growth. Over the full 2025–2035 period, the cumulative dollar opportunity reaches USD 273.4 million, emphasizing the market’s potential for sustained investment and expansion.

The Stoma Adhesive Remover market is entering a new phase of growth, driven by demand for patient-comfortable ostomy care, aging population expansion, and evolving clinical and quality standards. By 2035, these pathways together can unlock USD 120-155 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Colostomy Care Leadership (Colorectal Surgery & Management) The colostomy segment already holds the largest share due to its prevalence and specific care requirements. Expanding clinical protocols, patient education programs, and specialized formulations can consolidate leadership. Opportunity pool: USD 38-52 million.

Pathway B -- Spray Application Innovation (Precision & Comfort) Spray products account for the majority of demand. Growing patient focus on gentle application and healthcare emphasis on skin protection will drive higher adoption of advanced spray delivery systems.Opportunity pool: USD 32-42 million.

Pathway C -- Home Healthcare & Patient Self-Care Growth Home-based ostomy care and patient independence markets are expanding, especially with aging demographics. Products designed for home use (user-friendly, safe, effective) can capture significant growth. Opportunity pool: USD 20-28 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising healthcare awareness and ostomy care accessibility. Targeting distribution networks and affordable product lines will accelerate adoption. Opportunity pool: USD 15-22 million.

Pathway E -- Ileostomy & Urostomy Applications. With growing recognition of specialized care needs for different stoma types, there is opportunity to develop targeted removers for ileostomy and urostomy patients with specific requirements. Opportunity pool: USD 12-18 million.

Pathway F -- Premium Skin Protection Features. Products with enhanced skin conditioning, anti-inflammatory properties, and hypoallergenic formulations offer premium positioning for sensitive skin and high-use patient populations. Opportunity pool: USD 8-12 million.

Pathway G -- Clinical Services & Patient Education. Comprehensive patient training programs, clinical support services, and ostomy care education create long-term patient relationship opportunities. Opportunity pool: USD 5-8 million.

Pathway H -- Digital Health & Care Management. Integration with ostomy care apps, usage tracking, and patient outcome monitoring can elevate adhesive removers into comprehensive ostomy management solutions. Opportunity pool: USD 3-5 million.

Why is the Stoma Adhesive Remover Market Growing?

Market expansion is being supported by the rapid increase in ostomy surgical procedures worldwide and the corresponding need for specialized stoma care products that provide superior adhesive removal performance and skin protection. Modern ostomy care relies on consistent product quality and patient comfort standards to ensure optimal quality of life outcomes including colostomy, ileostomy, and urostomy management. Even minor skin irritation can require comprehensive care protocol adjustments to maintain optimal patient wellbeing and stoma site health.

The growing complexity of ostomy care requirements and increasing demand for patient-centered care solutions are driving demand for stoma adhesive remover products from certified manufacturers with appropriate medical capabilities and clinical expertise. Healthcare providers are increasingly requiring documented patient comfort and product safety to maintain care quality and patient satisfaction. Industry specifications and clinical standards are establishing standardized ostomy care procedures that require specialized gentle removal technologies and trained healthcare professionals.

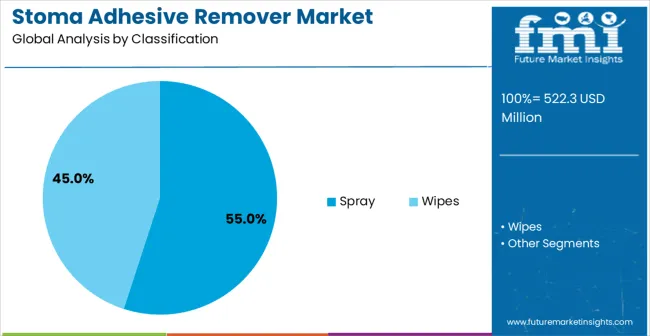

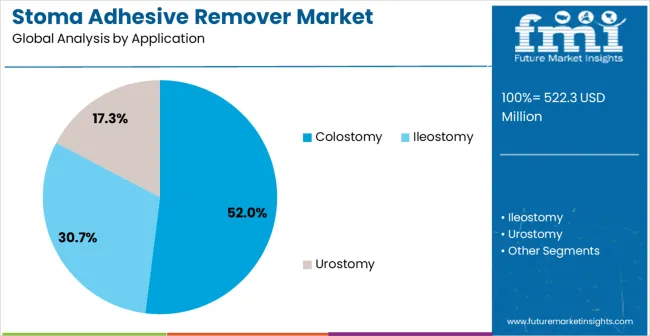

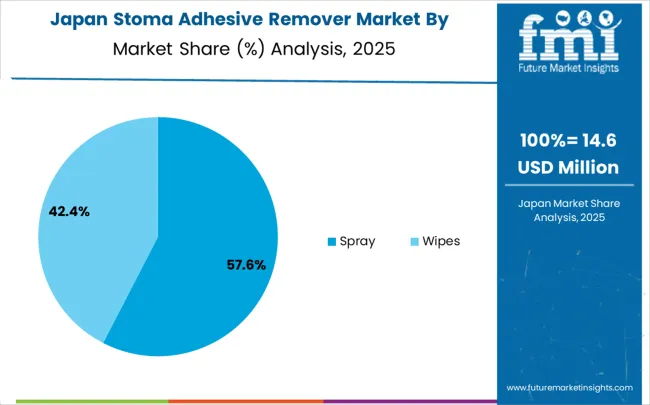

The market is segmented by product type, application, and region. By product type, the market is divided into spray and wipes. Based on application, the market is categorized into colostomy, ileostomy, and urostomy. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the spray stoma adhesive remover segment is projected to capture approximately 55% of the total market share, establishing it as the leading product category. The segment’s dominance is driven by the widespread adoption of spray formulations that provide precise application control and gentle adhesive dissolution, supporting diverse ostomy care needs. Spray removers are preferred for their ability to minimize skin contact, reduce mechanical trauma, and maintain peristomal skin integrity, ensuring patient comfort. Hospitals, ostomy clinics, home healthcare providers, and individual patients favor this format for its ease of use and consistent clinical effectiveness. Well-established product lines, patient education resources, and manufacturer support further strengthen market position. With broad applicability across different stoma types and consistent global demand, spray stoma adhesive removers continue to be the preferred choice for effective, patient-friendly ostomy care.

The colostomy segment is expected to account for 52% of stoma adhesive remover demand in 2025, making it the largest application sector. This dominance is largely attributed to the higher prevalence of colostomy procedures worldwide and the ongoing care requirements of colostomy patients who need frequent appliance changes. Effective adhesive removal is essential for protecting peristomal skin and preventing irritation, making patient-friendly stoma adhesive removers a critical part of care routines. As colorectal disease prevalence and surgical interventions rise globally, demand for safe and gentle adhesive removers continues to grow. The segment benefits from heightened awareness among healthcare providers regarding peristomal skin health, patient comfort, and education on self-care practices. Colostomy patients’ lifelong need for regular appliance maintenance ensures sustained adoption, with stoma adhesive removers remaining the largest and most stable demand driver in the market throughout the forecast period.

The Stoma Adhesive Remover market is advancing steadily due to increasing ostomy patient population and growing recognition of gentle adhesive removal advantages over mechanical removal methods. However, the market faces challenges including higher product costs compared to basic removal methods, need for patient education and proper application techniques, and varying healthcare reimbursement policies across different medical systems. Clinical validation efforts and formulation advancement programs continue to influence product development and market adoption patterns.

The growing development of advanced gentle formulation systems is enabling superior adhesive removal with improved skin compatibility and reduced irritation characteristics. Enhanced solvent technologies and optimized ingredient combinations provide effective adhesive dissolution while maintaining peristomal skin health requirements. These formulations are particularly valuable for ostomy care providers who require reliable removal performance that can support sensitive skin care with consistent patient comfort results.

Modern stoma adhesive remover manufacturers are incorporating advanced comfort features and application improvements that enhance patient experience and clinical effectiveness. Integration of advanced moisturizing systems and optimized delivery methods enables superior skin protection and comprehensive adhesive removal capabilities. Advanced comfort features support use in diverse care environments while meeting various patient needs and skin sensitivity specifications.

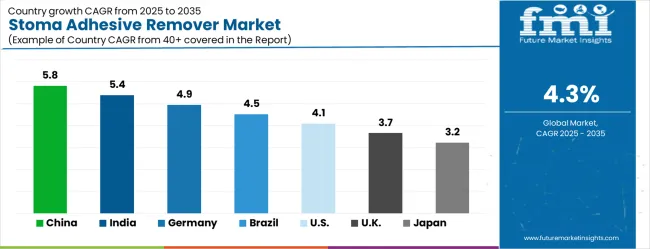

| Country | CAGR (2025–2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| United States | 4.1% |

| United Kingdom | 3.7% |

| Japan | 3.2% |

The stoma adhesive remover market is growing steadily, with China leading at a 5.8% CAGR through 2035, driven by strong healthcare infrastructure development and increasing adoption of specialized ostomy care products. India follows at 5.4%, supported by rising healthcare awareness and growing recognition of advanced ostomy management solutions. Germany grows steadily at 4.9%, integrating gentle removal technology into its established healthcare system infrastructure. Brazil records 4.5%, emphasizing healthcare modernization and ostomy patient care improvement initiatives. The United States shows solid growth at 4.1%, focusing on clinical excellence and patient quality of life optimization. The United Kingdom demonstrates steady progress at 3.7%, maintaining established ostomy care applications. Japan records 3.2% growth, concentrating on technology advancement and clinical precision optimization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from stoma adhesive removers in China is projected to exhibit the highest growth rate with a CAGR of 5.8% through 2035, driven by rapid expansion of healthcare infrastructure and increasing demand for specialized ostomy care products. The country's growing healthcare sector and expanding medical facility capabilities are creating significant demand for advanced ostomy management solutions. Major healthcare product manufacturers are establishing comprehensive distribution networks to support the increasing requirements of hospitals and healthcare providers across urban medical centers.

Government healthcare development initiatives are supporting establishment of modern surgical facilities and patient-centered care programs, driving demand for advanced ostomy care products throughout major healthcare development areas. Healthcare sector modernization programs are facilitating adoption of gentle adhesive removal products that enhance patient experience and clinical quality standards across medical networks.

Revenue from stoma adhesive removers in India is expanding at a CAGR of 5.4%, supported by increasing healthcare sector development and growing awareness of specialized ostomy care product benefits. The country's expanding medical infrastructure and rising healthcare quality standards are driving demand for advanced patient care solutions. Hospitals and medical facilities are gradually implementing professional-grade ostomy care products to maintain care standards and patient outcomes.

Healthcare sector growth and medical infrastructure development are creating opportunities for product suppliers that can support diverse patient care requirements and clinical specifications. Professional training and education programs are building clinical expertise among healthcare providers, enabling effective utilization of stoma adhesive remover technology that meets medical care standards and patient comfort requirements.

Demand for stoma adhesive removers in Germany is projected to grow at a CAGR of 4.9%, supported by the country's emphasis on clinical quality standards and advanced ostomy care technology adoption. German healthcare institutions are implementing advanced stoma adhesive remover systems that meet stringent clinical requirements and patient care specifications. The market is characterized by focus on product effectiveness, patient safety, and compliance with comprehensive healthcare quality standards.

Healthcare industry investments are prioritizing advanced gentle care technology that demonstrates superior clinical performance and patient comfort while meeting German quality and safety standards. Professional certification programs are ensuring comprehensive clinical expertise among healthcare providers, enabling specialized ostomy care capabilities that support diverse medical applications and patient requirements.

Revenue from stoma adhesive removers in Brazil is growing at a CAGR of 4.5%, driven by increasing healthcare facility development and growing recognition of specialized ostomy care advantages. The country's expanding healthcare sector is gradually integrating professional-grade ostomy care products to enhance clinical effectiveness and patient satisfaction. Medical facilities and hospitals are investing in stoma adhesive remover technology to address evolving patient care expectations and clinical standards.

Healthcare modernization is facilitating adoption of advanced ostomy care technologies that support comprehensive patient care capabilities across medical and healthcare regions. Professional development programs are enhancing clinical capabilities among healthcare providers, enabling effective stoma adhesive remover utilization that meets evolving medical standards and patient care requirements.

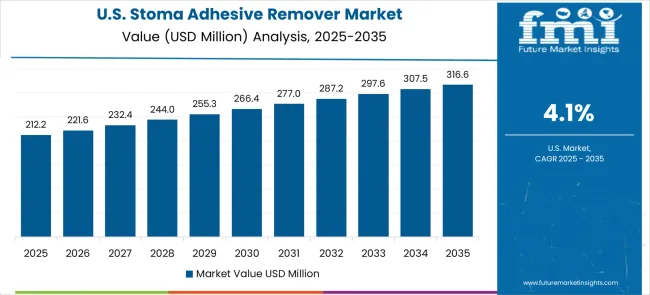

Demand for stoma adhesive removers in the USA is expanding at a CAGR of 4.1%, driven by established healthcare systems and growing emphasis on patient quality of life enhancement. Large healthcare institutions and ostomy care providers are implementing comprehensive stoma adhesive remover capabilities to serve diverse patient care requirements. The market benefits from established healthcare distribution networks and professional training programs that support various ostomy care applications.

Healthcare industry leadership is enabling standardized product utilization across multiple care settings, providing consistent patient care quality and comprehensive clinical coverage throughout regional markets. Professional development and certification programs are building specialized clinical expertise among ostomy care specialists, enabling effective stoma adhesive remover utilization that supports evolving patient care requirements.

Demand for stoma adhesive removers in the UK is projected to grow at a CAGR of 3.7%, supported by established healthcare systems and growing emphasis on specialized ostomy care capabilities. British healthcare institutions and ostomy care providers are implementing stoma adhesive remover products that meet clinical quality standards and patient care requirements. The market benefits from established healthcare infrastructure and comprehensive training programs for medical professionals.

Healthcare facility investments are prioritizing advanced ostomy care products that support diverse patient care applications while maintaining established quality and clinical standards. Professional development programs are building clinical expertise among healthcare personnel, enabling specialized stoma adhesive remover operation capabilities that meet evolving patient care requirements and clinical standards.

Revenue from stoma adhesive removers in Japan is growing at a CAGR of 3.2%, driven by the country's focus on healthcare technology innovation and clinical precision enhancement applications. Japanese healthcare institutions are implementing advanced stoma adhesive remover systems that demonstrate superior clinical reliability and patient comfort. The market is characterized by emphasis on technological excellence, clinical precision, and integration with established medical care workflows.

Healthcare technology investments are prioritizing innovative ostomy care solutions that combine advanced gentle formulation technology with precision application while maintaining Japanese quality and clinical standards. Professional development programs are ensuring comprehensive clinical expertise among healthcare providers, enabling specialized adhesive removal capabilities that support diverse medical applications and patient care requirements.

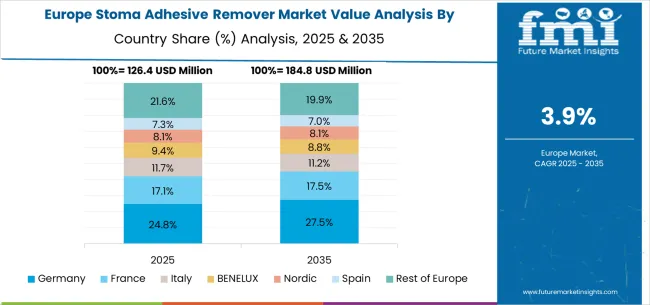

The stoma adhesive remover market in Europe is forecast to expand from USD 140.1 million in 2025 to USD 212.8 million by 2035, registering a CAGR of 4.2%. Germany will remain the largest market, holding 31.0% share in 2025, easing to 30.5% by 2035, supported by strong healthcare infrastructure and advanced ostomy care systems. The United Kingdom follows, rising from 24.0% in 2025 to 24.5% by 2035, driven by healthcare institutions and clinical excellence initiatives. France is expected to decline slightly from 20.0% to 19.5%, reflecting healthcare budget pressures. Italy maintains stability at around 16.0%, supported by medical facilities and ostomy care centers, while Spain grows from 7.0% to 7.5% with expanding healthcare and ostomy care demand. BENELUX markets ease from 1.5% to 1.4%, while the remainder of Europe hovers near 0.5%--0.6%, balancing emerging Eastern European growth against mature Nordic markets.

The Stoma Adhesive Remover market is defined by competition among specialized ostomy care product manufacturers, medical device companies, and patient care solution providers. Companies are investing in advanced gentle formulation development, clinical effectiveness optimization, patient comfort improvements, and comprehensive healthcare support capabilities to deliver safe, effective, and patient-friendly adhesive removal solutions. Strategic partnerships, clinical innovation, and market expansion are central to strengthening product portfolios and healthcare presence.

Dansac offers comprehensive stoma adhesive remover solutions with established ostomy care expertise and patient-focused product capabilities. Alliance Pharma provides specialized healthcare products with focus on clinical effectiveness and patient comfort. Salts delivers advanced ostomy care solutions with emphasis on gentle care and clinical outcomes. Convatec specializes in medical care products with advanced patient comfort technology integration.

Eakin Healthcare offers professional-grade ostomy care products with comprehensive clinical support capabilities. Coloplast delivers established medical care solutions with advanced gentle formulation technologies. Safe N Simple provides specialized healthcare products with focus on patient safety optimization. Smith & Nephew, Oakmed, Clinimed, B. Braun, Hollister, Rhodes Pharma, and Welland Medical offer specialized manufacturing expertise, clinical reliability, and comprehensive product development across global and regional healthcare market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 522.3 million |

| Product Type | Spray, Wipes |

| Application | Colostomy, Ileostomy, Urostomy |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Dansac, Alliance Pharma, Salts, Convatec, Eakin Healthcare, Coloplast, Safe N Simple, Smith & Nephew, Oakmed, Clinimed, B. Braun, Hollister, Rhodes Pharma, Welland Medical, 3M Healthcare |

| Additional Attributes | Dollar sales by product type and application segment, regional demand trends across major markets, competitive landscape with established ostomy care product manufacturers and emerging patient care technology providers, customer preferences for different removal formats and application methods, integration with ostomy care protocols and patient management systems, innovations in gentle formulation effectiveness and patient comfort technologies, and adoption of clinical safety features with enhanced patient experience capabilities for improved healthcare workflows. |

The global stoma adhesive remover market is estimated to be valued at USD 522.3 million in 2025.

The market size for the stoma adhesive remover market is projected to reach USD 795.7 million by 2035.

The stoma adhesive remover market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in stoma adhesive remover market are spray and wipes.

In terms of application, colostomy segment to command 52.0% share in the stoma adhesive remover market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adhesive Removers Market

No Sting Medical Adhesive Remover Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Tester Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Stomach Cancer Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Modifier Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

Stoma/Ostomy Care Market Growth - Trends & Forecast 2025 to 2035

Assessing Adhesive Transfer Tape Market Share & Industry Insights

Market Share Breakdown of Adhesive films market Industry

Adhesive for Resilient Floor Market Growth – Trends & Forecast 2024-2034

Adhesive Bubble Wrap Market

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Non-Adhesive Tags Market Growth - Demand & Forecast 2025 to 2035

Tile Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Self-adhesive Tear Tape Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA