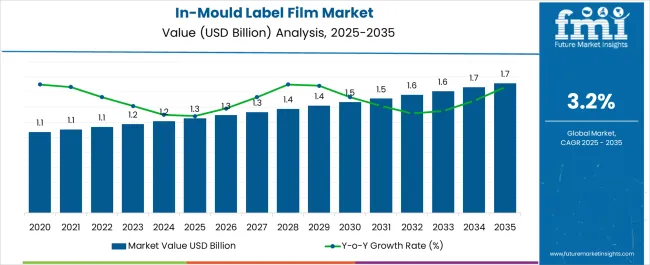

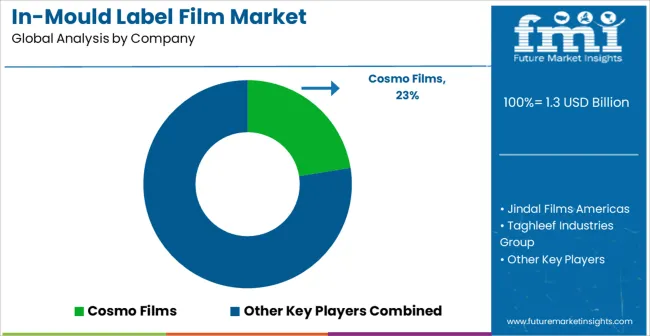

The In-Mould Label Film Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| In-Mould Label Film Market Estimated Value in (2025 E) | USD 1.3 billion |

| In-Mould Label Film Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The In-Mould Label Film market is experiencing strong growth, driven by increasing demand for high-quality, durable, and visually appealing product labeling solutions across diverse industries. The market is being fueled by innovations in film materials, printing technologies, and moulding processes that enhance label adhesion, resolution, and durability. Rising emphasis on brand differentiation, packaging aesthetics, and consumer engagement is further driving adoption of in-mould labeling solutions.

The integration of in-mould label films with advanced manufacturing techniques enables efficient and cost-effective production while reducing post-mould labeling requirements. Growing adoption in food and beverage, personal care, and consumer goods sectors is supporting market expansion, as these industries require consistent, high-quality labeling for packaging compliance and marketing purposes.

Increasing regulatory focus on packaging standards and sustainability, including recyclable and environmentally friendly films, is influencing material development and application With advancements in injection and extrusion moulding techniques, manufacturers are leveraging in-mould label films to enhance operational efficiency, improve production flexibility, and maintain consistent product quality, positioning the market for continued growth.

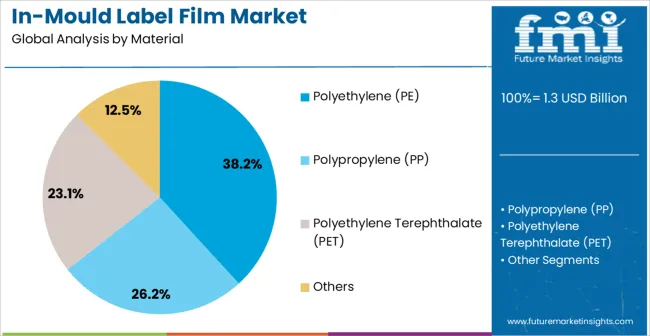

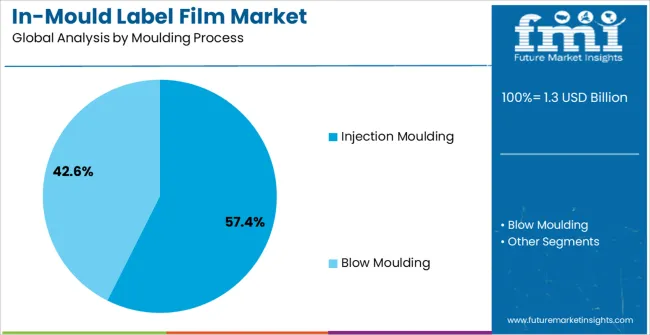

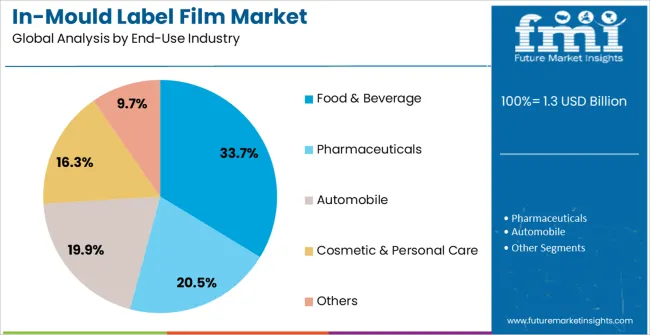

The in-mould label film market is segmented by material, moulding process, end-use industry, and geographic regions. By material, in-mould label film market is divided into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), and Others. In terms of moulding process, in-mould label film market is classified into Injection Moulding and Blow Moulding. Based on end-use industry, in-mould label film market is segmented into Food & Beverage, Pharmaceuticals, Automobile, Cosmetic & Personal Care, and Others. Regionally, the in-mould label film industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene (PE) material segment is projected to hold 38.2% of the market revenue in 2025, establishing it as the leading material type. Growth in this segment is driven by PE’s excellent chemical resistance, durability, and compatibility with various moulding processes, which ensure strong adhesion and long-lasting label performance. PE films provide flexibility, cost efficiency, and consistent quality, making them suitable for high-volume manufacturing environments.

The material’s ability to withstand temperature variations and mechanical stress during injection or blow moulding contributes to its widespread adoption. Environmental considerations, including recyclability and compliance with packaging regulations, have further reinforced preference for PE films.

Manufacturers increasingly rely on PE-based in-mould label films to optimize production efficiency while maintaining aesthetic quality and operational reliability As demand for visually appealing, durable, and cost-effective packaging solutions grows, PE is expected to maintain its leadership, supported by innovations in material formulations and processing technologies that enhance performance in various industrial applications.

The injection moulding process segment is anticipated to account for 57.4% of the market revenue in 2025, making it the leading process type. Its growth is being driven by the high efficiency, precision, and scalability offered by injection moulding in producing complex shapes and consistent product quality. The process enables integration of in-mould label films during production, eliminating the need for secondary labeling and improving operational efficiency.

Advanced injection moulding technologies allow for precise temperature control, uniform film placement, and minimal defects, ensuring superior visual and functional quality of labels. The capability to handle high-volume production while reducing waste and labor costs further strengthens its adoption.

Increasing demand from packaging-intensive sectors such as food and beverage, personal care, and consumer goods is driving widespread use of injection moulding As manufacturers prioritize production efficiency, quality consistency, and cost-effectiveness, the injection moulding process is expected to continue as the preferred method for applying in-mould label films across diverse industrial applications.

The food and beverage end-use industry segment is projected to hold 33.7% of the market revenue in 2025, positioning it as the leading application sector. Growth in this segment is driven by the need for attractive, durable, and hygienic packaging solutions that enhance brand appeal and comply with strict food safety standards. In-mould label films provide high-quality graphics, strong adhesion, and resistance to moisture, chemicals, and temperature fluctuations, making them ideal for beverage bottles, containers, and food packaging.

The ability to integrate labels directly into the moulding process improves production efficiency and reduces post-production labor and costs. Rising consumer demand for visually appealing packaging, combined with stringent regulatory requirements for food safety and labeling, has accelerated adoption in the food and beverage sector.

Manufacturers increasingly rely on in-mould label films to differentiate products, maintain product integrity, and enhance sustainability by using recyclable and eco-friendly materials As the packaging market evolves, the food and beverage industry is expected to remain a key driver of in-mould label film adoption globally.

Manufacturers are creating new labelling possibilities by introducing in-mould label film solutions, with an initial focus on injection moulding applications. They are also focusing on providing their customers with a complete film portfolio for current and future in-mould technologies, including specific needs like a barrier or metallized films.

A certain market player introduced two films which cover the chief injection moulding film technologies, which are solid pigmented white, and high yield solutions. For instance, the Label-lyte 57IMS447 film offers a unique way to create a solid white performance as well as appearance while maximizing yield, to offer more square meters for the same amount of weight supplied.

It delivers very high stiffness, with a thickness of 57-µ, and an unmatched glossy aspect when moulded. Applications requiring a premium glossy finish, along with large containers used in industrial applications, suit ideally to deploy this type of film.

Additionally, the Label-lyte 60IMD447 film matches the lowest densities that are currently available to maximize cost-efficiency while capitalizing on the concerned market player’s unique cavitation technology.

This technology reduces density and enables more polymer to remain in the film compared to CaCO3 cavitated films of the same density. Therefore, this 60-µ film provides robustness and higher stiffness in printing while reducing the “orange peel” aspect when moulded.

Rather than the usual high “orange peel” surface often associated with CaCO3 low-density fins currently available, it offers a satin finish instead. Both films have been specifically curated for the in-mould-label film market share. They deliver die-cutting performance for both offset and flexo printing technologies and efficient printing with high print registration accuracy.

Manufacturers are further offering white voided films for in-mould labels known as LIX and LIM. Moreover, EUP60 is a newly introduced white BOPP film for in-mould labelling produced in Europe. It is a very high opacity, high-yield product, having a density as low as 0.55 g/cm3.

EUP60 is engineered to give outstanding high-speed sheet feeding and adhesion for both UV and oxidative inks, combined with its specially formulated and printable matte surface. It is also designed with special features that make it suitable for any shape lid or container without risk of distortion to the lid or container.

Providing a tactile ‘soft-touch’ finish after moulding, this film is also perfect for use on small-to-medium size, thin or thick wall PP or PE containers. The latest addition to the product portfolio in this market is Titanium. A new metallic IML film was developed to give high visual impact to the final product with either a mirrored reflective “brilliance” finish or an eye-catching “gunmetal” matte finish.

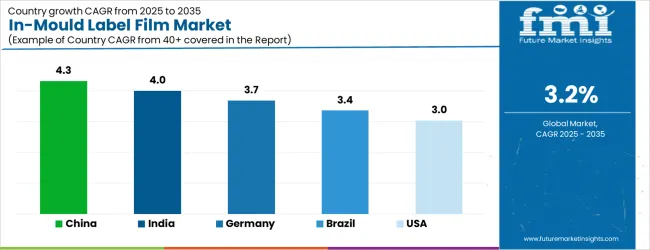

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.0% |

| UK | 2.7% |

| Japan | 2.4% |

The In-Mould Label Film Market is expected to register a CAGR of 3.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.3%, followed by India at 4.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.4%, yet still underscores a broadly positive trajectory for the global In-Mould Label Film Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.7%. The USA In-Mould Label Film Market is estimated to be valued at USD 464.9 million in 2025 and is anticipated to reach a valuation of USD 464.9 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 65.2 million and USD 39.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), and Others |

| Moulding Process | Injection Moulding and Blow Moulding |

| End-Use Industry | Food & Beverage, Pharmaceuticals, Automobile, Cosmetic & Personal Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cosmo Films, Jindal Films Americas, Taghleef Industries Group, Innovia Films, Propyplast SAS, and Bergen Plastics |

The global in-mould label film market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the in-mould label film market is projected to reach USD 1.7 billion by 2035.

The in-mould label film market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in in-mould label film market are polyethylene (pe), polypropylene (pp), polyethylene terephthalate (pet) and others.

In terms of moulding process, injection moulding segment to command 57.4% share in the in-mould label film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Labels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Labelling Machine Market Growth & Industry Trends through 2035

Competitive Overview of Labels Companies

Key Players & Market Share in the Label Applicators Industry

Competitive Breakdown of Labeling Equipment Providers

Labeling Software Market Growth - Trends & Forecast through 2034

Label Printing Software Market – Smart Labeling & Automation

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

GHS Label Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

GMO Labelling Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among USA Labels Providers

Leading Providers & Market Share in GHS Label Industry

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA