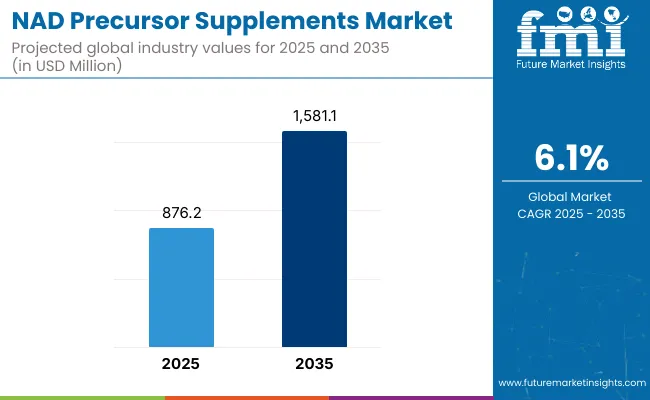

The NAD Precursor Supplements Market is poised to expand significantly, growing from USD 876.2 million in 2025 to an estimated USD 1,581.1 million by 2035. This growth is driven by rising demand in both mainstream and emerging longevity markets, with a projected compound annual growth rate (CAGR) of 6.1%.

NAD Precursor Supplements Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 876.2 million |

| Market Forecast Value in (2035F) | USD 1,581.1 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

During the first half of the forecast period (2025-2030), the market is expected to rise from USD 876.2 million to approximately USD 1,174.5 million, contributing 42% of the decade's total growth. This growth is likely to be driven by rising awareness of cellular health and age-related metabolic decline, particularly among early adopters in North America and select Asia-Pacific countries. Scientific validation of NAD+’s role in energy metabolism and mitochondrial function has been instrumental in influencing clinical interest and supplement demand.

Between 2030 and 2035, a sharper acceleration is projected, with the market forecasted to grow by nearly USD 406.6 million, accounting for 58% of total decade gains. The latter period is expected to witness widespread adoption across mainstream wellness categories, supported by personalized nutrition platforms, precision supplement delivery systems, and pharmaceutical convergence. Premium formulations featuring NMN and NR compounds are expected to dominate the innovation pipeline, while digital health ecosystems are projected to enhance consumer engagement and retention.

From 2020 to 2024, the NAD Precursor Supplements Market expanded from a niche segment into a maturing global wellness category, driven by NMN and NR adoption among aging populations and biohacking communities.

During this phase, product formulations were largely dominated by ingredient-centric players, with companies like ChromaDex and Elysium Health accounting for nearly 20-30% of the global revenue. Competitive positioning was influenced by clinical study credibility, regulatory approvals, and retail expansion through DTC and e-commerce platforms. Service-layer integration remained limited, and recurring revenue was mostly confined to subscription-based delivery models.

By 2025, demand is expected to reach USD 876.2 million, with a strategic shift anticipated toward AI-personalized dosing, biomarker-driven diagnostics, and longevity protocol bundling. Revenue mix is projected to evolve as personalized platforms and digital wellness ecosystems contribute a growing share, challenging product-only brands.

As hybrid clinical-wellness models emerge, leading players are expected to expand into data services, diagnostics partnerships, and app-based wellness tracking. The competitive edge is migrating from ingredient purity alone to bioavailability innovation, clinical validation, and ecosystem strength across preventive health channels.

The NAD Precursor Supplements Market is being driven by a convergence of clinical research breakthroughs, demographic shifts, and increasing consumer awareness surrounding cellular health. Advances in biochemical studies have highlighted the pivotal role of NAD+ in mitochondrial function, DNA repair, and metabolic regulation, prompting heightened interest in supplementation. Aging populations across developed regions have been identified as key consumer segments, with demand being accelerated by the rise of preventive health practices.

Greater accessibility to NAD precursors such as NMN (Nicotinamide Mononucleotide) and NR (Nicotinamide Riboside) has been enabled by regulatory clarity and favorable e-commerce expansion. Personalized wellness platforms are being utilized to match supplementation with genetic predispositions and lifestyle indicators. Strategic endorsements by biohacking communities and longevity-focused influencers have also amplified consumer interest.

Over the next decade, growth is expected to be supported by clinical-grade product development, cross-sector collaborations with pharmaceutical players, and robust retail integration across both online and offline health channels.

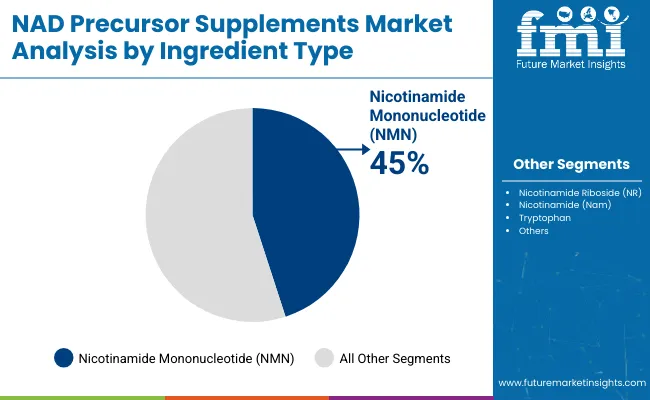

The NAD Precursor Supplements Market has been segmented by ingredient type, health function, product format, application, sales channel, and region, offering a multidimensional perspective on demand shifts and innovation trends. Ingredient segmentation emphasizes biologically active NAD+ boosters, such as NMN, NR, and other precursor blends, which are being leveraged to target core cellular repair pathways. The health function classification identifies targeted physiological benefits ranging from cognitive vitality to mitochondrial function and metabolic balance.

Product formats span from traditional oral forms like capsules and tablets to newer delivery platforms such as functional beverages and sublingual lozenges, each catering to specific user preferences and bioavailability goals. Regionally, differentiated adoption curves are being observed across North America, Europe, East Asia, and emerging economies, reflecting variable consumer awareness and regulatory landscapes.

| Ingredient Type | Market Share 2025 (%) |

|---|---|

| Nicotinamide Mononucleotide (NMN) | 45.0% |

| Nicotinamide Riboside (NR) | 28.0% |

| Nicotinamide (Nam) | 12.0% |

| Tryptophan | 5.0% |

| Other Precursors / Blends | 10.0% |

The NMN segment is projected to account for 45% of total NAD Precursor Supplements Market revenue in 2025, sustaining its dominance across the ingredient landscape. Its leadership is being driven by peer-reviewed clinical data supporting its NAD+ boosting efficacy, especially in age-related decline reversal and metabolic rejuvenation. The segment's growth has been underpinned by robust consumer demand for advanced anti-aging interventions, particularly within the premium nutraceutical category.

NMN-based formulations have been positioned as superior alternatives due to their rapid conversion to NAD+, supported by improved bioavailability in encapsulated or sublingual forms. As regulatory pathways are being clarified and clinical trials progress globally, NMN is expected to remain the flagship compound within the ingredient segment, with partnerships between biotech firms and supplement brands reinforcing commercial scalability.

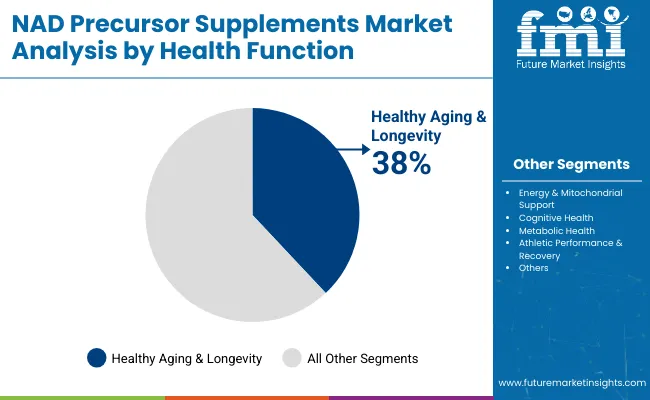

| Health Function | Market Share (%) |

|---|---|

| Healthy Aging & Longevity | 38.0% |

| Energy & Mitochondrial Support | 22.0% |

| Cognitive Health | 15.0% |

| Metabolic Health | 15.0% |

| Athletic Performance & Recovery | 10.0% |

The Healthy Aging & Longevity segment is expected to command 38% of total market revenue by 2025, supported by growing consumer prioritization of lifespan and healthspan optimization. This trend has been catalyzed by increased public engagement with aging science, and amplified through the advocacy of geroscience researchers and wellness influencers.

NAD precursor supplements have been prominently positioned within this movement, with NMN and NR being favored for their cellular energy restoration and sirtuin activation potential. Demand within this segment has also been boosted by the proliferation of biohacking communities and personalized longevity platforms that recommend NAD-enhancing protocols. As aging populations increase in both developed and developing nations, sustained interest in NAD-centric health functions is forecasted to drive long-term growth within this category.

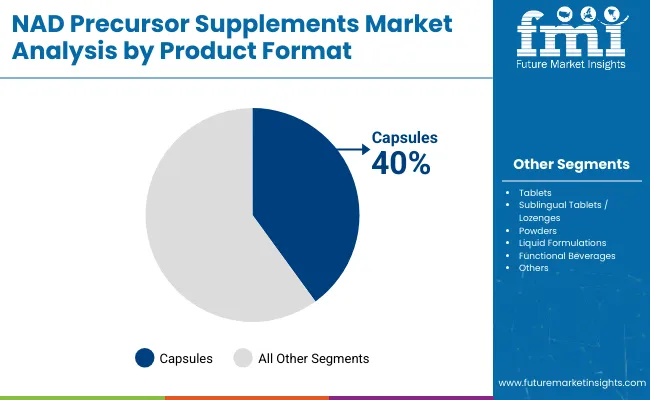

| Product Format | Market Share (%) |

|---|---|

| Capsules | 40.0% |

| Tablets | 18.0% |

| Sublingual Tablets / Lozenges | 10.0% |

| Powders | 12.0% |

| Liquid Formulations | 10.0% |

| Functional Beverages | 10.0% |

The capsules segment is anticipated to lead with 40% of total market share in 2025, driven by consumer preference for familiarity, ease of dosage, and stable shelf-life. Capsule-based formulations have been widely adopted by both direct-to-consumer supplement brands and pharmacy-backed nutraceutical lines, owing to manufacturing scalability and established regulatory pathways.

Innovation in encapsulation technologies particularly sustained release and liposomal delivery has enhanced the absorption profile of NAD precursors, reinforcing capsules' market dominance. As awareness around ingredient purity and traceability continues to grow, capsule formulations are being positioned as premium-grade delivery systems. Their convenience and perceived efficacy are expected to ensure continued leadership across the product format segment, especially among older adult demographics and wellness enthusiasts.

Complexities surrounding clinical validation and product standardization continue to hinder broader adoption, despite rising consumer interest in proactive aging and mitochondrial health. Meanwhile, scientific awareness and health tech integration are accelerating the appeal of NAD precursors across nutraceutical and biohacking domains.

Accelerated Research in Aging and Metabolism

Market expansion is being fueled by the acceleration of scientific research on the role of NAD+ in aging, mitochondrial dysfunction, and chronic disease mitigation. Evidence linking NAD+ depletion to neurodegeneration, metabolic decline, and inflammation has strengthened the therapeutic potential of NAD precursors.

Academic institutions, biotech firms, and pharmaceutical players have been increasingly engaged in preclinical and clinical investigations surrounding NMN and NR compounds. As longevity science gains mainstream traction, funding for translational studies is expected to rise, providing greater legitimacy and consumer trust. This driver is set to reinforce long-term market credibility and innovation.

Convergence of NAD Supplements with Digital Health Platforms

A growing trend has been observed wherein NAD precursor supplements are being integrated into digital health ecosystems, including personalized supplement protocols and biomarker-tracking applications. Wearable-linked platforms and wellness diagnostics are increasingly incorporating NAD+ optimization as part of broader cellular health scoring systems.

This convergence is enabling real-time feedback and precision dosing, thereby improving user engagement and supplement adherence. As consumer expectations shift toward individualized, data-backed wellness solutions, this integration is projected to become a standard differentiator for premium supplement brands.

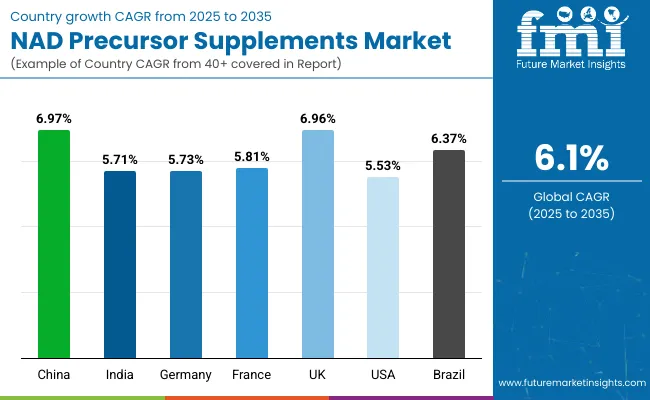

| Countries | CAGR |

|---|---|

| China | 6.97% |

| India | 5.71% |

| Germany | 5.73% |

| France | 5.81% |

| UK | 6.96% |

| USA | 5.53% |

| Brazil | 6.37% |

The global NAD Precursor Supplements Market has demonstrated significant cross-country variation in growth momentum, shaped by demographic aging, wellness consumerism, and regulatory transparency. Asia-Pacific has been identified as a high-opportunity region, with China projected to lead regional expansion at a 6.97% CAGR, driven by rising urban health awareness, cross-border supplement consumption, and increasing alignment with global longevity trends.

India, with a 5.71% CAGR, is witnessing early-stage adoption through digitally native supplement brands and bioavailability-optimized formulations targeting Tier-1 cities.

In Europe, sustained growth is expected across high-regulation economies. The UK is forecasted at a 6.96% CAGR, supported by nutraceutical-tech startups and NHS-initiated longevity dialogues. France (5.81%) and Germany (5.73%) are emphasizing clinically validated aging solutions, with EU-compliant labeling practices reinforcing consumer trust and favoring NAD+ precursors backed by pharmacokinetic data.

North America retains a leading market share, although growth in the United States (5.53%) reflects market maturity and a shift toward differentiation through personalized formulations and biotech partnerships. Brazil, growing at 6.37%, is emerging as a key LATAM node, propelled by health-conscious middle-income consumers and expanded functional ingredient access through relaxed import frameworks.

As regional dynamics evolve, the harmonization of quality standards and innovation in delivery mechanisms are expected to narrow geographic growth gaps and unlock latent demand across underserved nations.

| Year | USA (USD million) |

|---|---|

| 2025 | 210.3 |

| 2026 | 224.3 |

| 2027 | 238.6 |

| 2028 | 253.3 |

| 2029 | 267.7 |

| 2030 | 284.1 |

| 2031 | 299.2 |

| 2032 | 318.3 |

| 2033 | 339.0 |

| 2034 | 358.4 |

| 2035 | 378.7 |

The NAD Precursor Supplements Market in the United States is projected to expand from USD 350 million in 2025 to USD 779 million by 2035, advancing at a compound annual growth rate (CAGR) of 8.4%. Growth is being accelerated by high consumer receptivity to longevity-focused health solutions and the integration of NAD+ optimization into wellness diagnostics and precision nutrition platforms.

Premium adoption has been observed among aging populations and biohacking communities, where NMN and NR-based formulations are being favored for their clinically substantiated efficacy. Institutional demand is also being catalyzed by partnerships with clinical trial networks and personalized supplement startups. A rise in digital health subscription models has enabled tailored NAD supplementation, guided by real-time biomarkers and genetic assessments.

Formulation innovation has been prioritized, with liposomal, time-release, and sublingual formats gaining traction due to their enhanced bioavailability. Growth has been further supported by wellness-centric retail expansion and FDA-aligned labeling practices, strengthening consumer trust and market penetration.

The NAD Precursor Supplements Market in the UK is forecasted to grow from a modest base in 2025 to a significantly larger footprint by 2035, expanding at a CAGR of 6.96%. Market growth is being driven by heightened consumer focus on healthy aging, adoption of longevity supplements by wellness clinics, and increased availability of clinically validated NR and NMN products.

Health-conscious millennials and older adults alike are turning to cellular health regimens, supported by e-pharmacies, wellness apps, and personalized subscription services. Regulatory enforcement on product labeling and quality is prompting brands to invest in transparent sourcing and clinical trials. Partnerships between biotech start-ups and retail channels are expanding consumer reach.

India’s NAD Precursor Supplements Market is projected to advance steadily from 2025 to 2035 at a CAGR of 5.71%, supported by urban lifestyle changes, growing wellness app usage, and social media-driven supplement awareness. The market is being shaped by younger, digital-first consumers who are seeking energy-boosting and anti-aging interventions.

NMN and NR are being introduced via online-only brands with diagnostic integration, enabling personalized dosing models. Regulatory improvements under India’s nutraceutical and AYUSH frameworks are expected to ease market entry. While the Tier-1 city adoption remains dominant, growth in Tier-2 and Tier-3 cities is being unlocked through vernacular health influencers and e-pharmacy expansion.

China’s NAD Precursor Supplements Market is expected to grow at a CAGR of 6.97% between 2025 and 2035, marking one of the highest regional growth rates. Market acceleration is being driven by middle-class expansion, cross-border supplement sales, and high demand for longevity interventions.

NMN, in particular, is gaining traction as a premium offering in the anti-aging and mitochondrial health space. As regulatory clarity improves and local brands receive certification, the domestic market is projected to shift from import-reliant to self-sustaining. Demand is further supported by China’s growing emphasis on healthy life expectancy and integration of wellness into mainstream healthcare.

| Countries | 2025 |

|---|---|

| UK | 16% |

| Germany | 20% |

| Italy | 10% |

| France | 14% |

| Spain | 8% |

| BENELUX | 6% |

| Nordic | 5% |

| Rest of Europe | 21% |

| Countries | 2035 |

|---|---|

| UK | 15% |

| Germany | 19% |

| Italy | 10% |

| France | 13% |

| Spain | 9% |

| BENELUX | 7% |

| Nordic | 6% |

| Rest of Europe | 21% |

Germany’s NAD Precursor Supplements Market is projected to expand at a CAGR of 5.73% from 2025 to 2035, driven by a well-informed senior population and clinical alignment with preventive aging. Regulatory rigor in ingredient quality and safety continues to drive consumer trust, positioning Germany as a hub for clinically validated supplements.

Growth is being led by established pharmacies and wellness clinics introducing NMN and NR into their aging wellness protocols. The market is further supported by interest in mitochondrial health and cognitive performance supplements among health-conscious professionals and older adults. Integration with digital health apps is also enhancing personalized usage.

| Ingredient Type | Market Share (%) |

|---|---|

| Nicotinamide Mononucleotide (NMN) | 55% |

| Nicotinamide Riboside (NR) | 20% |

| Nicotinamide (Nam) | 10% |

| Tryptophan | 5% |

| Other Precursors / Blends | 10% |

The NAD Precursor Supplements Market in Japan whereas NMN accounting for 55% of total value, signifying a strong consumer and clinical preference for high-efficacy formulations. NR holds a 20% share, while other precursors remain niche. The dominant position of NMN is being driven by its early introduction through Japanese biotech channels and its extensive coverage in longevity science discourse across academia and digital health platforms.

Japanese consumers have shown a clear inclination toward clinically validated, high-purity formulations, further elevating NMN’s credibility in the market. Regulatory alignment and cross-sector R&D collaborations are enabling faster product lifecycle advancement.

With Japan's aging population projected to reach nearly 30% of the total demographic, cellular health supplements are being positioned as integral to preventive care strategies. Pharmaceutical retail networks and functional food categories are converging, allowing for seamless integration of NMN products into both daily nutrition and therapeutic routines.

| Health Function | Market Share(%) |

|---|---|

| Healthy Aging & Longevity | 25% |

| Anti-Aging | 15% |

| Energy & Mitochondrial Support | 15% |

| Cognitive Health | 12% |

| Metabolic Health | 10% |

| Energy & Vitality | 8% |

| Athletic Performance & Recovery | 8% |

| Cognitive Performance | 4% |

| Cellular Repair & Protection | 3% |

The NAD Precursor Supplements Market in South Korea is projected to record robust growth through 2025, with demand led by the Healthy Aging & Longevity segment at 25% value share, followed by Anti-Aging and Mitochondrial Support functions, each at 15%. The cultural prioritization of aesthetic wellness, longevity, and energy optimization is creating favorable conditions for NAD-focused formulations to be adopted by a wide demographic, particularly consumers aged 30-60.

Early market traction has been enabled by South Korea’s advanced beauty-nutrition ecosystem, where aging and vitality supplements are increasingly offered alongside dermatological and wellness services. Functional positioning of NMN and NR in skincare clinics, health tech apps, and e-commerce platforms is helping normalize NAD supplementation in daily preventive care. Regulatory alignment under KFDA’s functional food category is reinforcing credibility, while clinical collaborations with academic hospitals are deepening trust in NAD’s therapeutic potential.

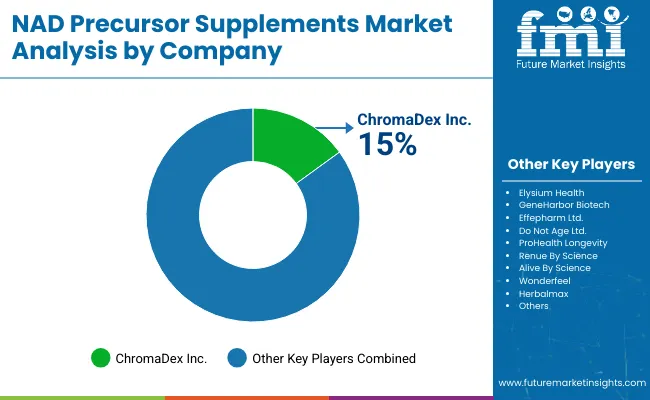

| Players | Global Value Share 2025 |

|---|---|

| ChromaDex Inc.(Tru Niagen ®) | 15% |

| Others | 85% |

The NAD Precursor Supplements Market is moderately fragmented, with global leaders, mid‑sized innovators, and niche specialists competing across distinct segments. Tier 1 players such as Niagen Bioscience (formerly ChromaDex, maker of Tru Niagen®) and Elysium Health are commanding the largest global market shares, collectively accounting for an estimated 20-30% of total NAD supplement revenue Their dominance is underpinned by clinically backed NR and NMN formulations, deep R&D pipelines, and regulatory credibility across North America and Europe.

Mid‑sized innovators, including ProHealth Longevity, RenueBy Science, and Do Not Age Ltd., are being leveraged to target health‑tech‑savvy consumers through direct‑to‑consumer channels. These players are driving adoption via specialty formulations, liposomal delivery, and influencer‑driven product narratives

Niche specialists, such as GeneHarbor (Hong Kong), Alive By Science, Wonderfeel, Herbalmax, and Effepharm (Uthever® NMN), are focusing on country‑specific or function‑specific segments like skincare integration, high‑dose NMN blends, or local dietary contexts. Their competitive edge lies in customization and regional adaptability rather than scale.

Competitive differentiation is shifting away from raw ingredient claims toward integrated platforms that combine predictive analytics, biomarker‑driven personalization, and subscription‑based service models. Collaboration trends with tele‑health diagnostic apps and longevity clinics are reshaping the value proposition especially among premium consumer segments. The competitive landscape is expected to tilt further toward ecosystem‑oriented brands combining science, transparency, and tech integration.

Key Developments in NAD Precursor Supplements Market

| Item | Value |

|---|---|

| Quantitative Units | USD 876.2 Million |

| Ingredient Type | Nicotinamide Mononucleotide (NMN), Nicotinamide Riboside (NR), Nicotinamide (Nam), Tryptophan, Other Precursors/Blends |

| Health Function | Healthy Aging & Longevity, Energy & Mitochondrial Support, Cognitive Health, Metabolic Health, Athletic Performance, Anti-Aging, Energy & Vitality, Cognitive Performance, Cellular Repair & Protection |

| Product Format | Capsules, Tablets, Sublingual Tablets/Lozenges, Powders, Liquid Formulations, Functional Beverages |

| Application Areas | General Wellness, Anti-Aging, Sports Recovery, Cognitive Enhancement, Metabolic Regulation, Clinical Nutrition |

| Sales Channels | Online Retail, Health Stores, Pharmacies, Direct-to-Consumer (DTC), Functional Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea, South Africa |

| Key Companies Profiled | ChromaDex Inc. (Tru Niagen ®), Elysium Health, GeneHarbor Biotech, Effepharm Ltd. (Uthever ®), Do Not Age Ltd., ProHealth Longevity, Renue By Science, Alive By Science, Wonderfeel , Herbalmax |

| Additional Attributes | Market size by ingredient and application, CAGR by region, delivery system innovations (e.g., liposomal), longevity and wellness consumer behavior, DTC and e-commerce disruption, regulatory frameworks by region, and clinical research alignment with supplement innovation |

The global NAD Precursor Supplements Market is estimated to be valued at USD 876.2 million in 2025.

The market size for the NAD Precursor Supplements Market is projected to reach USD 1,581.1 million by 2035.

The NAD Precursor Supplements Market is expected to grow at a CAGR of 6.1% between 2025 and 2035.

The key ingredient types in the NAD Precursor Supplements Market include Nicotinamide Mononucleotide (NMN), Nicotinamide Riboside (NR), Nicotinamide (Nam), Tryptophan, and Other Precursors or Blends.

In terms of ingredient type, the NMN segment is expected to command a 45% share in the NAD Precursor Supplements Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Canada Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Canada Eyeshadow Stick & Blush Stick Market Size and Share Forecast Outlook 2025 to 2035

Canada Space Tourism Market Analysis – Trends, Growth & Forecast 2025-2035

Canada Travel Agency Services Market Trends – Demand, Growth & Forecast 2025-2035

Canada Responsible Tourism Market Insights – Growth, Demand & Forecast 2025-2035

Canada Surfing Tourism Market Growth – Size, Trends & Forecast 2025-2035

Canada Axillary Hyperhidrosis Treatment Market Analysis – Demand, Growth & Forecast 2025-2035

Canada High Tibial Osteotomy (HTO) Plates Market Report – Trends, Demand & Forecast 2025-2035

Canada Home Care Services Market Analysis – Size, Share & Trends 2025-2035

Menadione Market

Vanadium redox battery Market

Lemonade Market Size and Share Forecast Outlook 2025 to 2035

Hypogonadism Treatment Market Size and Share Forecast Outlook 2025 to 2035

Global Shale Gas Hydraulic Fracturing Market Outlook – Trends & Forecast 2025–2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Ferro Vanadium Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA