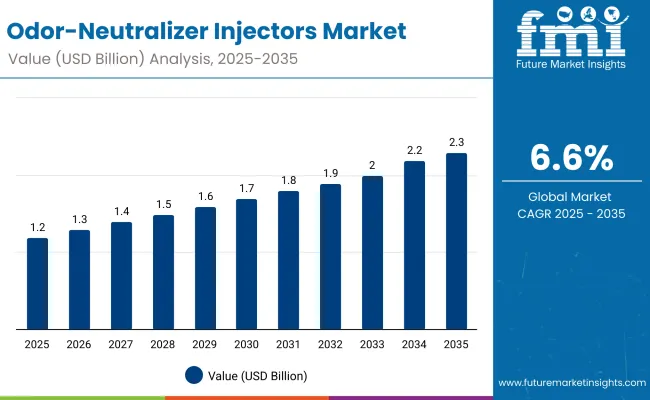

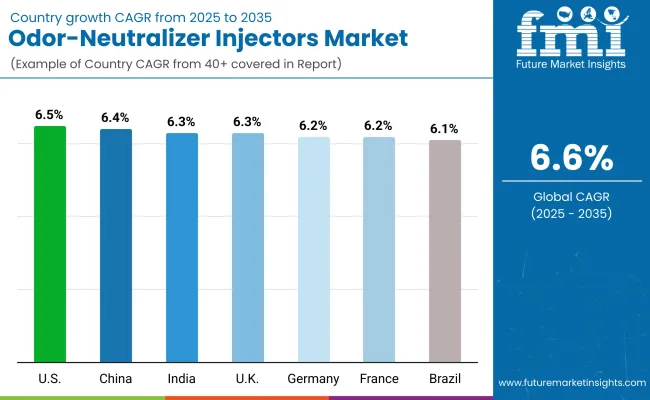

The global odor-neutralizer injectors market will expand from USD 1.2 billion in 2025 to USD 2.3 billion by 2035 at a CAGR of 6.6%. Adoption is driven by industrial and domestic demand for automated odor-management solutions. Vapor-based neutralizers dominate for their rapid dispersion and long-lasting effect. Between 2025 and 2030, micro-dosing and liquid atomizing systems will gain traction in sanitation and manufacturing facilities. By 2035, IoT-enabled odor injection stations with sensors and programmable scent controls will set a new benchmark for air-care and industrial odor management.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.2 billion |

| Forecast Value in (2035F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Between 2020 and 2024, odor-control systems evolved from manual sprayers to automated injection modules integrated with HVAC and manufacturing lines. Innovation in micro-dosing and vapor diffusion improved coverage and reduced chemical consumption. By 2035, the market will reach USD 2.3 billion as industries adopt AI-controlled odor-neutralizing systems to meet environmental compliance and indoor-air quality standards. Asia-Pacific will remain the center of automated odor-injection manufacturing.

Market growth is propelled by rising demand for automated odor neutralization in manufacturing, waste management, and home-care sectors. Air-quality regulations and sustainability requirements encourage use of vapor-based and micro-dosing systems. Consumer preference for cleaner, eco-certified fragrance delivery and industrial upgrades further support adoption globally.

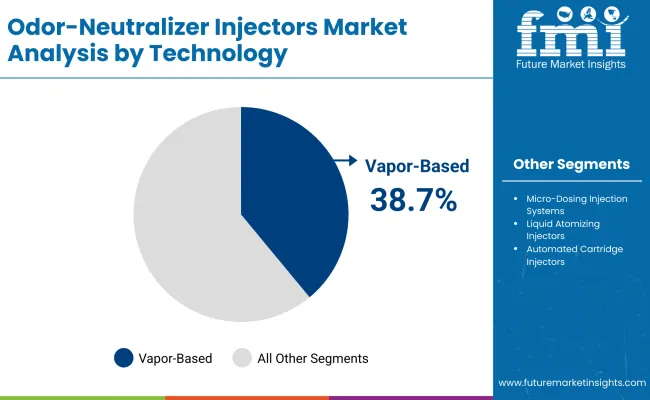

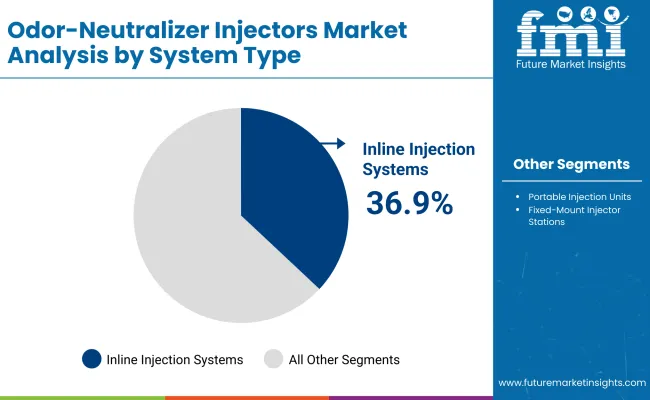

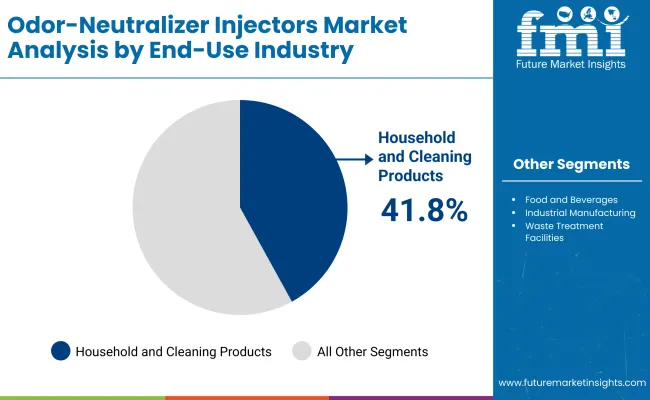

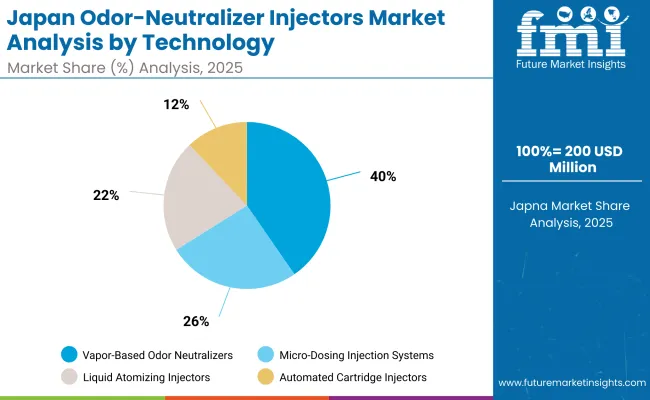

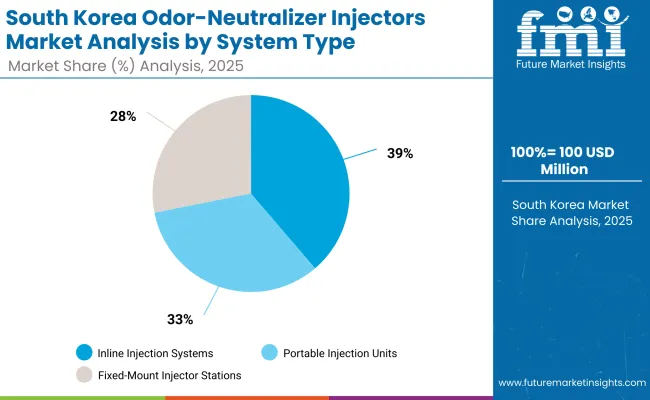

The market is segmented by technology, system type, end-use industry, and region. Technology segmentation includes vapor-based odor neutralizers, micro-dosing injection systems, liquid atomizing injectors, and automated cartridge injectors, providing precise and efficient odor control. System type covers inline injection systems, portable injection units, and fixed-mount injector stations, ensuring adaptable integration across industrial and commercial setups. End-use industries include food and beverages, household and cleaning products, industrial manufacturing, and waste treatment facilities, reflecting widespread adoption for air quality management. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Vapor-based odor neutralizers are projected to hold 38.7% of the market in 2025, driven by their ability to deliver uniform dispersion with minimal chemical residue. These systems utilize controlled vapor diffusion to eliminate odors in large indoor spaces such as manufacturing units, public facilities, and transportation hubs. Their low-toxicity formulation supports safe, continuous operation.

By 2035, next-generation vapor diffusion modules equipped with IoT sensors and programmable release systems will dominate. These advancements enable real-time monitoring and adaptive odor control. With sustainability and air quality gaining global focus, vapor-based neutralizers remain the preferred solution for scalable and efficient odor management.

Inline injection systems are forecast to represent 36.9% of the market in 2025, owing to their ability to integrate directly into existing HVAC and air treatment systems. They provide continuous odor control while minimizing energy use and maintenance requirements, making them ideal for industrial plants, waste facilities, and sanitation networks.

Their adoption is fueled by the demand for modular systems that offer precise dosing and minimal manual intervention. Integration with automated control platforms ensures consistent performance and remote operation. As infrastructure modernization accelerates, inline injection systems remain a cornerstone technology in industrial odor management.

The household and cleaning products segment is expected to account for 41.8% of the market in 2025, reflecting rapid growth in connected air-care devices and premium fragrance systems. Odor-neutralizer injectors are increasingly embedded into smart home appliances to deliver customizable scent and sanitation control.

Rising consumer preference for energy-efficient and chemical-free air solutions drives adoption of vapor-based systems in domestic spaces. Manufacturers leverage automation to improve precision and sustainability. As home hygiene technologies evolve, this segment continues to anchor market demand for odor-neutralizing innovations.

Rising urban population and sanitation standards increase odor-control demand across residential and industrial segments.High system cost and maintenance requirements challenge penetration in developing markets.Integration of smart sensors and AI controllers creates scope for energy-efficient odor neutralization systems.Eco-friendly odor agents, IoT-enabled dispensing, and modular micro-dosing stations are shaping future growth.

The global odor-neutralizer injectors market is expanding rapidly as automation, sustainability, and air-quality management converge across industrial and urban settings. Asia-Pacific leads growth through large-scale adoption in manufacturing and waste management, while North America and Europe focus on clean-air compliance and facility modernization. Advancements in AI-driven dosage control, chemical-free agents, and micro-injection technologies are transforming hygiene standards in both public and private infrastructure, positioning odor-neutralizer injectors as essential components of modern sanitation systems.

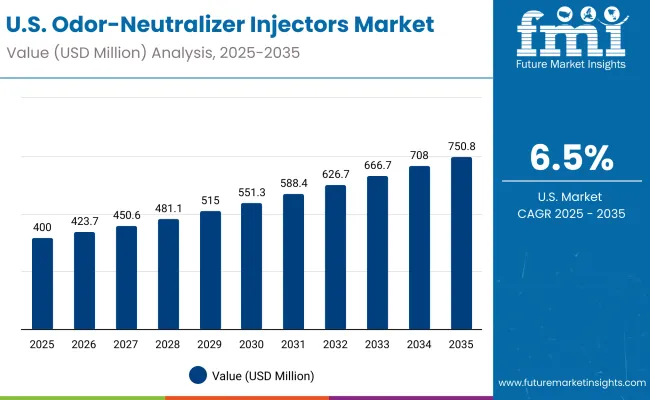

The U.S. will grow at 6.5% CAGR, supported by facility automation and nationwide clean-air initiatives. Integration with HVAC systems is improving odor neutralization in industrial, commercial, and public environments. Public sanitation infrastructure upgrades are increasing demand for odor-injection technologies. Regulatory emphasis on energy-efficient, eco-safe odor-control systems is accelerating adoption in smart buildings and food processing facilities.

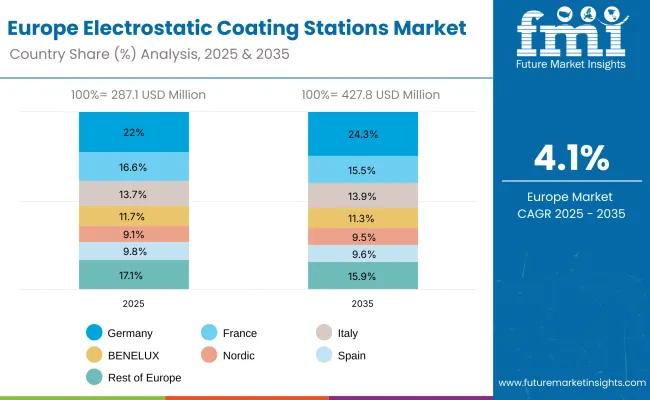

Germany will expand at 6.2% CAGR, emphasizing eco-certified and low-emission odor-control technologies. Industrial hygiene laws are fostering widespread deployment of odor-neutralizer injectors across waste treatment and manufacturing facilities. AI-based systems are optimizing odor dosage and reducing chemical usage. Growing consumer preference for chemical-free neutralizing agents is driving commercial adoption in food, packaging, and hospitality applications.

The U.K. will grow at 6.3% CAGR, driven by urban sanitation programs and enhanced facility management practices. Adoption of odor-neutralization injectors in public infrastructure and smart buildings is rising steadily. Residential and commercial integration of smart home odor systems is expanding across metropolitan areas. Innovations in micro-injection and real-time monitoring technologies are positioning the U.K. as a leader in automated odor-management solutions.

China will grow at 6.4% CAGR, supported by industrial-scale odor neutralization and rapid environmental reforms. Automation in manufacturing and waste management plants is driving large-scale system adoption. Local OEMs are expanding production capacity to meet domestic and export demand. National air-quality mandates are accelerating the rollout of odor-control technologies across industrial, residential, and urban waste applications.

India will grow at 6.3% CAGR, led by urban hygiene programs and industrial modernization. Government-led initiatives in waste management and sanitation are spurring large-scale investments in odor-control systems. Adoption of automated injectors in industrial zones and public facilities is increasing. Low-cost, locally produced odor injectors are penetrating small-scale waste processing and municipal markets, supporting widespread accessibility.

Japan will grow at 6.9% CAGR, focusing on compact, high-performance odor-injection devices. Smart odor modules for home and office environments are expanding rapidly. Advanced systems designed for food processing and hospitality sectors are driving demand. Energy-optimized, low-maintenance injectors are aligning with Japan’s sustainability and innovation standards in environmental management.

South Korea will lead with 7.0% CAGR, spearheading innovation in sensor-driven odor-control systems. Integration of robotics and AI is enhancing precision in odor distribution and system diagnostics. Rising hygiene standards across urban facilities and transportation hubs are fueling adoption. Expanding exports of smart injectors and automated odor solutions are reinforcing South Korea’s position as a global leader in clean-technology systems.

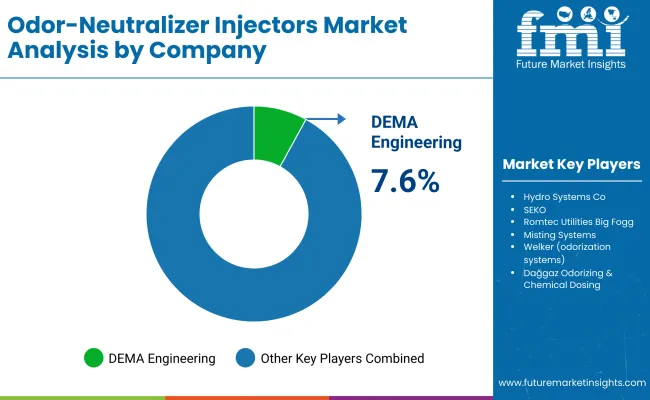

The market is moderately consolidated with DEMA Engineering, Hydro Systems, SEKO, Romtec Utilities, Big Fogg, Welker, Dağgaz Odorization, OMI Industries, Atmos Technologies, and Chemtech as key players. Leading companies focus on vapor-based and AI-controlled injection systems for industrial and commercial odor control applications.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Technology | Vapor-Based, Micro-Dosing, Liquid Atomizing, Automated Cartridge |

| By System Type | Inline, Portable, Fixed-Mount |

| By End-Use Industry | Food & Beverages, Household Cleaning, Industrial, Waste Treatment |

| Key Companies Profiled | DEMA Engineering, Hydro Systems, SEKO, Romtec Utilities, Big Fogg, Welker, Dağgaz Odorization , OMI Industries, Atmos Technologies, Chemtech |

| Additional Attributes | Growth driven by smart odor control, eco-based injection technologies, and automated air sanitization. |

The Odor-Neutralizer Injectors Market is valued at USD 1.2 billion in 2025.

The Odor-Neutralizer Injectors Market will reach USD 2.3 billion by 2035.

The market is expected to grow at a CAGR of 6.6%.

Vapor-Based Odor Neutralizers lead with 38.7% share in 2025.

Key players include DEMA Engineering, Hydro Systems, SEKO, Romtec Utilities, Big Fogg, Welker, Dağgaz Odorization, OMI Industries, Atmos Technologies, and Chemtech.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

Auto-Injectors Market Analysis - Size, Share & Forecast 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Contrast Media Injectors Market Analysis - Size, Share, and Forecast 2025 to 2035

Epinephrine Auto-Injectors Market Insights - Growth & Forecast 2024 to 2034

Patient-Controlled Injectors Market

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA