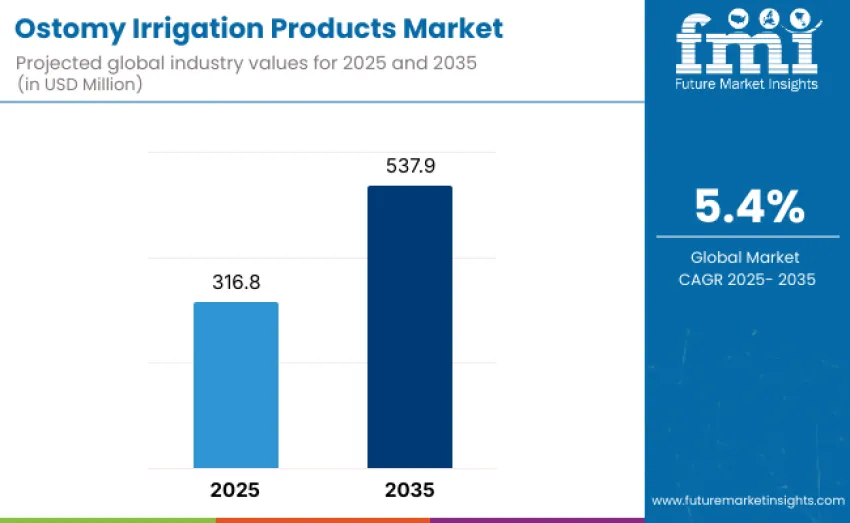

The global ostomy irrigation products market is projected to reach USD 537.9 million by 2035, recording an absolute increase of USD 221.1 million over the forecast period. This market is valued at USD 316.8 million in 2025 and is set to rise at a CAGR of 5.4% during the assessment period. Overall size is expected to grow by nearly 1.5 times between 2025 and 2035, driven by increasing awareness of advanced ostomy care techniques, expanding patient education initiatives, and greater emphasis on long-term ostomy management solutions that improve quality of life.

Technological advancements in irrigation equipment design, materials, and accessory integration are reshaping the landscape. Modern systems feature closed or semi-closed configurations, anti-backflow valves, and odor-resistant materials, enhancing hygiene and user confidence. Product portfolios now include complete irrigation kits, compact travel solutions, and digitally guided irrigation devices that help standardize routines and ensure consistent outcomes. Integration with personalized ostomy care programs and telehealth monitoring tools supports professional oversight and patient adherence.

Government healthcare initiatives and patient support programs play a pivotal role in accelerating growth. Public and private healthcare providers are increasingly incorporating ostomy education, nurse-led training sessions, and reimbursement for irrigation kits into standard post-operative care pathways. Growing healthcare expenditure, improving product accessibility, and enhanced stoma care training among clinicians are expanding the eligible user base. The rise of home healthcare models and aging populations in North America and Europe sustain long-term demand.

Between 2025 and 2030, the ostomy irrigation products market is projected to expand from USD 316.8 million to USD 427.8 million, resulting in a value increase of USD 111.0 million, which represents 50.2% of total forecast growth for the decade. This phase will be driven by rising demand for effective ostomy management solutions, growing awareness of post-surgical quality-of-life improvements, and innovation in irrigation systems, including enhanced ease-of-use, safety features, and patient comfort.

From 2030 to 2035, growth is forecast from USD 427.8 million to USD 537.9 million, adding USD 110.1 million, constituting 49.8% of overall ten-year expansion. This period is expected to see product innovation with advanced irrigation devices offering improved ergonomics, integrated monitoring features, and compatibility with diverse ostomy types. Strategic collaborations between manufacturers, healthcare providers, and patient advocacy groups will enhance reach, while increasing focus on patient education and sustainable device design will support long-term adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 316.8 million |

| Market Forecast Value (2035) | USD 537.9 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The ostomy irrigation products market is growing due to increasing demand for improved post-surgical quality of life, better management of ostomy care, and enhanced patient independence. Rising awareness among patients and caregivers about the benefits of ostomy irrigation, including reduced dependency on disposable products and improved comfort, is driving adoption worldwide. Healthcare providers are increasingly recommending irrigation systems as part of comprehensive ostomy care programs, and the expansion of home care services supports growth by enabling patients to manage their condition safely.

Technological innovations in irrigation products, such as improved ergonomics, easier handling, and customizable solutions for different ostomy types, are encouraging usage. Government initiatives and reimbursement policies supporting post-operative care and chronic disease management contribute to expansion. The global shift toward patient-centered care and emphasis on quality-of-life improvements position irrigation products as essential components in modern ostomy management protocols across diverse healthcare settings.

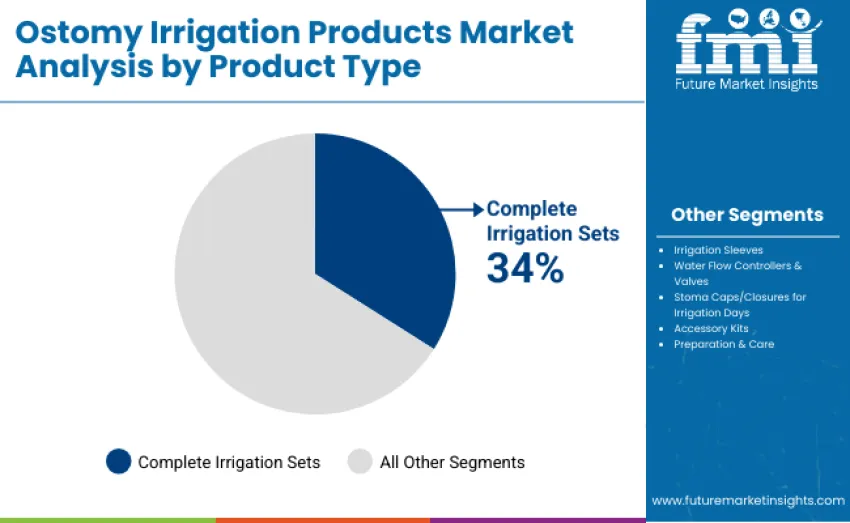

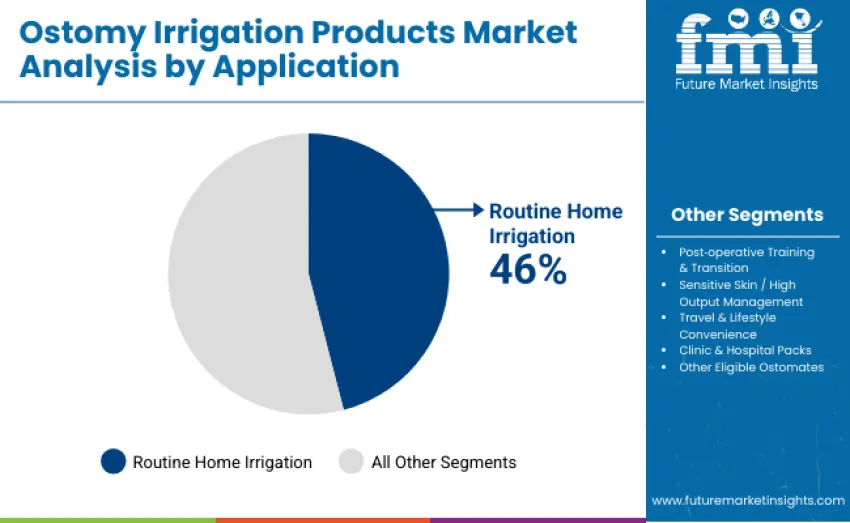

The ostomy irrigation products market is segmented by product type, application, and region. By product type, division includes complete irrigation sets, irrigation sleeves, water flow controllers & valves, stoma caps/closures for irrigation days, accessory kits, and preparation & care. Based on application, categorization covers colostomy routine home irrigation, post-operative training & transition, sensitive skin/high output management, travel & lifestyle convenience, clinic & hospital packs, and other eligible ostomates. Regionally, segmentation spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Complete irrigation sets, which include bags, cones, and tubing, dominate with 34% revenue share in 2025. These comprehensive kits provide all essential components required for routine home-based colostomy irrigation, enabling safe, effective, and independent patient care. Leadership reflects central role in supporting daily irrigation routines for patients performing self-managed ostomy care. Irrigation sleeves, available in standard and long configurations, account for 22.0% of revenue, addressing needs of patients with sensitive skin or high-output stomas.

Water flow controllers and valves contribute 12.5%, providing precise control and customization of irrigation routines. Stoma caps and closures for irrigation days hold 11.0%, facilitating hygiene and convenience during treatment. Accessory kits represent 10.5%, while preparation & care products account for 10.0% of revenue, supporting comprehensive patient care routines. Key factors driving adoption of complete irrigation sets include comprehensive design providing all essential components, ensuring patients can perform home irrigation safely and effectively.

Routine home irrigation for colostomy patients dominates with 46% revenue share in 2025, reflecting growing preference among ostomates for self-managed care and independence in daily routines. Leadership is reinforced by widespread adoption among patients performing descending and sigmoid colostomy irrigation at home, supported by user-friendly kits, pre-measured solutions, and instructional resources that facilitate safe and effective care outside clinical environments.

Post-operative training and transitional support, typically nurse-led, represents 14% of revenue, while sensitive skin and high-output management solutions account for 12%. Travel & lifestyle convenience contributes 11%, clinic & hospital packs hold 10%, and other eligible ostomates represent 7% of revenue. Key dynamics include strong home adoption driven by patient autonomy and convenience, with routine irrigation remaining the dominant practice for self-care. Post-operative and clinical training emphasizes structured guidance to ensure patients develop confidence before transitioning to home-based routines.

The ostomy irrigation products market is driven by three concrete demand factors tied to evolving patient self-care practices and healthcare workflow transformation. Rising preference for home-based ostomy management is increasing demand for comprehensive irrigation solutions, as patients seek greater independence, hygiene, and routine control outside clinical settings, reducing reliance on frequent hospital visits. Post-operative and chronic care needs are fueling adoption, with healthcare providers recommending structured irrigation programs to manage high-output cases, prevent complications, and train patients in long-term self-care routines.

Limited awareness in emerging regions restricts growth, as cultural stigma, misinformation, and lack of specialized distribution channels reduce adoption potential despite clinical benefits. These barriers prevent proper integration of irrigation therapy into routine ostomy care and limit product penetration, particularly in lower-income regions where access to trained ostomy nurses and structured post-operative counseling remains limited.

Key trends indicate accelerated adoption in Asia-Pacific regions, particularly China and India, where government healthcare programs, patient education initiatives, and improved distribution channels provide subsidies and training that incentivize professional ostomy care practices. Technology advancement trends toward pre-configured, ergonomic irrigation kits with anti-leak sleeves and adjustable flow systems are driving next-generation product development.

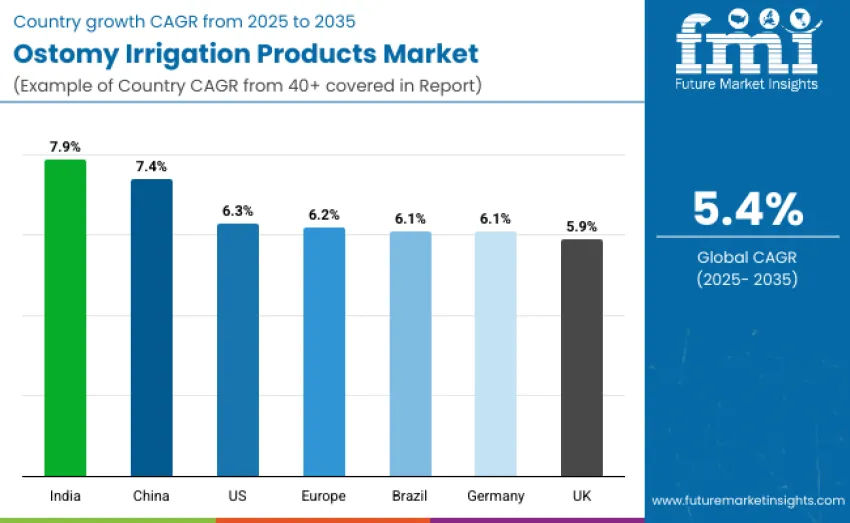

| Country | CAGR (2025 to 2035)% |

|---|---|

| United States | 6.3 |

| Brazil | 6.1 |

| China | 7.4 |

| India | 7.9 |

| Europe | 6.2 |

| Germany | 6.1 |

| United Kingdom | 5.9 |

The ostomy irrigation products market is expanding globally, with India leading at a 7.9% CAGR due to national health schemes, hospital training programs, and rising patient awareness. China follows at 7.4%, supported by government healthcare initiatives and improved ostomy care access. Brazil grows at 6.1% through wider healthcare access and increasing home-care adoption. The United States records 6.3% growth, reflecting a mature healthcare system and strong home-care practices. Europe advances at 6.2%, with Germany at 6.1% and the U.K. at 5.9%, driven by structured patient support and clinical training programs.

China demonstrates the strongest growth potential with a projected CAGR of 7.4% through 2035. Leadership is driven by comprehensive healthcare initiatives, widespread patient education programs, and government policies promoting home-based ostomy management. Growth is concentrated in major urban clusters, including Beijing, Shanghai, Shenzhen, and Hangzhou, where hospitals, clinics, and community health centers are implementing structured ostomy care and irrigation training programs for post-operative and chronic patients.

Distribution channels, including e-commerce platforms, medical device distributors, and direct manufacturer supply, enable rapid deployment of irrigation systems across hospitals, specialized care centers, and home-care patients. National healthcare policies, including provincial health subsidies and patient support schemes, provide financial assistance for purchasing complete irrigation kits and accessories, accelerating adoption. Urban healthcare infrastructure expansion in eastern provinces includes dedicated ostomy care units training thousands of patients annually in proper irrigation techniques.

The ostomy irrigation products market demonstrates strong growth momentum with a CAGR of 7.9% through 2035, linked to increasing focus on home-based ostomy care, patient self-management capability, and post-operative rehabilitation support. Indian patients and caregivers are implementing routine ostomy irrigation workflows and hygiene management systems to improve comfort, prevent complications, and enhance quality of life. National ostomy awareness campaigns, nurse-led training programs, and rehabilitation initiatives create sustained demand for professional-grade irrigation products.

Government and NGO incentive programs provide patient education, subsidy support, and affordable access to ostomy irrigation kits through national and state health promotion schemes. Healthcare partnerships and distribution collaborations accelerate adoption as international and domestic manufacturers establish local supply chains and technical support infrastructure. Policy and training support through patient education initiatives, nurse-led rehabilitation programs, and digital health platforms provide product access, technical guidance, and practical training for safe irrigation practices.

Germany's advanced healthcare and patient support infrastructure demonstrates sophisticated implementation of ostomy irrigation products. Major healthcare centers in Berlin, Munich, Hamburg, and Frankfurt showcase integration of ostomy irrigation products with patient education workflows, leveraging expertise in medical device quality standards and patient care excellence. German healthcare providers emphasize product reliability and long-term durability, creating demand for premium irrigation systems that support daily self-care routines. Growth maintains steady momentum with a CAGR of 6.1% through 2035.

Rehabilitation clinics and home-care programs implement routine irrigation training programs with structured patient education and technical support. Partnerships with medical schools and nursing programs provide student and trainee access to professional-grade irrigation kits at subsidized rates for hands-on training. Strategic collaborations between European distributors and global manufacturers ensure reliable product availability and comprehensive warranty and technical support services. Integration of irrigation products with patient education platforms and digital health tools supports complete home-care and clinical management workflows.

The USA ostomy irrigation products market demonstrates mature implementation focused on hospital networks, rehabilitation centers, and patient-led home-care adoption, with documented integration across major healthcare systems and specialized nursing programs operating throughout California, Texas, New York, and Florida. Growth maintains steady momentum with a CAGR of 6.3% through 2035, driven by widespread patient education initiatives, mature home-care programs, and an expanding population of ostomy patients adopting self-management practices.

Professional adoption across hospitals and clinics includes standardized equipment protocols ensuring safe, consistent irrigation practices. Established distribution infrastructure through pharmacies, medical device suppliers, and online marketplaces provides competitive pricing and comprehensive technical support. Collaboration between healthcare associations, patient advocacy groups, and manufacturers enables product testing, professional feedback integration, and development of next-generation irrigation solutions. Emphasis on ergonomic design, ease of use, and safety features drives patient preference for premium irrigation systems.

In London, Manchester, Bristol, and Edinburgh healthcare clusters, hospitals, rehabilitation centers, and home-care providers are implementing ostomy irrigation product workflows to support patient self-management, post-operative care, and chronic condition management. Growth shows solid potential with a CAGR of 5.9% through 2035, linked to the UK healthcare system's focus on patient independence, home-care support, and digital health skills development. Patients and caregivers are adopting professional irrigation kits and structured care routines.

Hospital and home-care provider adoption across outpatient and rehabilitation programs implements standardized irrigation workflows with comprehensive patient training and monitoring protocols. Educational partnerships between nursing schools, patient advocacy organizations, and equipment manufacturers provide trainee and patient access through subsidized programs and post-training purchase incentives. Strategic collaborations between healthcare associations and product suppliers enable development of patient-centered solutions, professional guidance, and community support programs.

Brazil’s ostomy irrigation products market is strengthening as expanding public healthcare access and nationwide awareness programs support broader adoption among ostomates. Major hospitals in São Paulo, Rio de Janeiro, Brasília, and Salvador increasingly integrate irrigation products into stoma care routines, emphasizing patient training and long-term self-management. Demand for reliable, user-friendly irrigation systems continues to rise, and growth maintains solid momentum with a CAGR of 6.1% through 2035.

Public health initiatives and rehabilitation centers conduct structured irrigation education sessions, helping patients transition confidently to home-based care. Partnerships between regional distributors and global manufacturers ensure consistent product availability, technical support, and after-sales services. Government-supported programs and nonprofit organizations further enhance patient outreach by providing educational materials, community workshops, and access to subsidized supplies. Growing emphasis on self-care, improved stoma management, and integration of irrigation tools into digital health and telecare platforms strengthens Brazil’s position as an emerging leader in developing comprehensive, patient-centric ostomy care ecosystems.

The ostomy irrigation products market in Europe is projected to grow from USD 104.5 million in 2025 to USD 172.1 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain leadership with a CAGR of 6.1% supported by advanced healthcare infrastructure, established hospital networks, and major clinical centers in Berlin, Munich, and Hamburg. France follows with a CAGR of 6.0%, driven by strong post-operative care programs, rehabilitation facilities, and home-care adoption across Paris and Lyon.

The United Kingdom shows a CAGR of 5.9% through 2035, supported by expansion of patient education initiatives and home-care support programs. Italy maintains steady growth through hospital-based rehabilitation programs and specialized treatment centers. Spain demonstrates consistent progress through healthcare modernization and chronic disease management programs. The Netherlands shows stable advancement through comprehensive healthcare systems and specialized patient support networks. Nordic countries record moderate growth through established patient advocacy programs and advanced home-care capabilities.

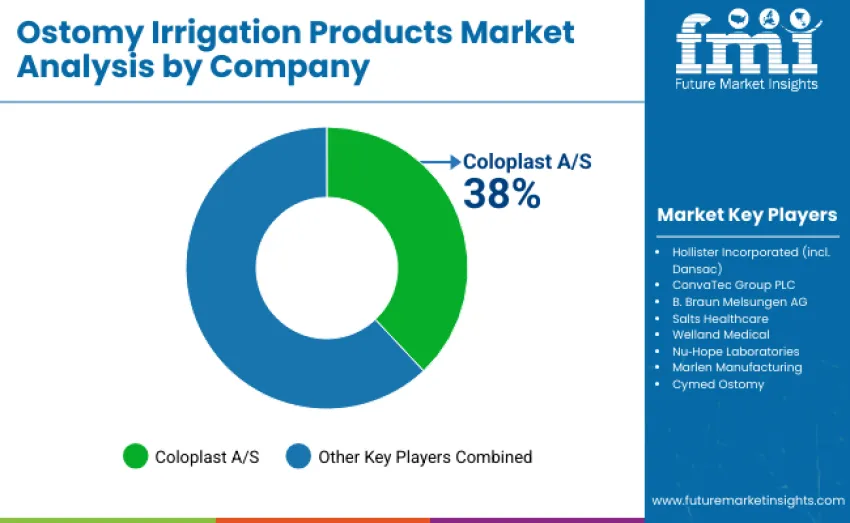

The global ostomy irrigation products market is moderately concentrated, with 12-15 players shaping competitive dynamics. The top three companies, Coloplast A/S, Hollister Incorporated (including Dansac), and ConvaTec Group PLC, collectively command 55-60% of global share. Coloplast A/S leads with a dominant 38% share, supported by strong brand recognition, advanced ergonomic design capabilities, and proven clinical expertise. Competition focuses on product precision, hygiene and safety performance, ease of use, and seamless integration with patient education and home-care workflows rather than price alone.

Market leaders maintain advantages through extensive clinical testing, strong relationships with healthcare professionals, and reliable product performance across hospitals, clinics, and home-care environments. Their investments in safer irrigation systems, user-friendly components, and patient-guided training resources reinforce adoption in both mature and emerging markets. Challengers such as B. Braun Melsungen AG, Salts Healthcare, and Welland Medical compete through value-driven offerings and region-specific strategies tailored to clinical or home-care needs. Specialist manufacturers including Nu Hope Laboratories, Marlen Manufacturing, and Cymed Ostomy target niche requirements with portable systems, high-capacity units, and advanced home-care kits.

| Items | Values |

|---|---|

| Quantitative Units | USD 316.8 million |

| Product Type | Complete Irrigation Sets, Irrigation Sleeves, Water Flow Controllers & Valves, Stoma Caps/Closures for Irrigation Days, Accessory Kits, Preparation & Care |

| Application | Colostomy Routine Home Irrigation, Post-operative Training & Transition, Sensitive Skin/High Output Management, Travel & Lifestyle Convenience, Clinic & Hospital Packs, Other Eligible Ostomates |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Coloplast A/S, Hollister Incorporated (incl. Dansac), ConvaTec Group PLC, B. Braun Melsungen AG, Salts Healthcare, Welland Medical, Nu-Hope Laboratories, Marlen Manufacturing, Cymed Ostomy, Others |

| Additional Attributes | Dollar sales by product type and application, regional trends across Asia Pacific, Europe, and North America, competitive landscape of irrigation product manufacturers, technical specifications, integration with clinical and home-care workflows, innovations in flow control and barrier materials, and development of portable, patient-friendly irrigation kit configurations |

The global ostomy irrigation products market is valued at USD 316.8 million in 2025.

The market is projected to reach USD 537.9 million by 2035.

The market will grow at a CAGR of 5.4% from 2025 to 2035.

Complete irrigation sets lead the market with a 34% share in 2025.

Key players include Coloplast, Hollister (Dansac), ConvaTec, B. Braun, Salts Healthcare, Welland Medical, Nu-Hope, Marlen Manufacturing, and Cymed Ostomy.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Irrigation Syringe Market Size and Share Forecast Outlook 2025 to 2035

Ostomy Product Manufacturing Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Irrigation testing kit Market

Irrigation Liners Market

Ileostomy Market

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Nephrostomy Devices Market

Teff Products Market

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Sinus Irrigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Stoma/Ostomy Care Market Growth - Trends & Forecast 2025 to 2035

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Tracheostomy Securement Tapes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA