The global peristaltic pumps market is valued at USD 1,403.8 million in 2025. This market is projected to grow at a compound annual growth rate (CAGR) of 3.8%, reaching USD 2,038.5 million by 2035. Growth is being driven by increased demand in dosing, sampling, and biopharmaceutical applications-highlighting the role of precise and contamination-free fluid handling.

In mid-2024, NETZSCH launched its NEMO BC peristaltic tube pump, designed to meet demanding dosing requirements. The system was engineered to support high-viscosity and shear-sensitive liquids in industries such as mining and water treatment. As noted in the company statement, consistent flow and low pulsation were prioritized to ensure precise feed rates during chemical dosing processes .

Also in 2024, QED Environmental Systems introduced a new peristaltic sampling pump featuring flow accuracy within ±1%. This pump was designed for use in water analysis and environmental monitoring sectors. It was developed with easy calibration and remote telemetry functions to integrate into automated sampling networks.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,403.8 million |

| Industry Value (2035F) | USD 2,038.5 million |

| CAGR (2025 to 2035) | 3.8% |

In the biopharma segment, High Purity New England unveiled a dedicated biopharmaceutical-grade peristaltic pump in late 2024. The pump was manufactured in cleanroom conditions, using FDA-compliant tubing and single-use flow paths to reduce contamination risk. According to the company’s newsletter, the product was designed to deliver repeatable flow with sterile fluid integrity, supporting downstream processing and media preparation tasks .

A micro peristaltic pump was introduced by JIH Pump & Instrumentation in early 2025. Model 104KA was developed for laboratory automation applications. Flow rates as low as 0.1 ml/min were enabled, allowing integration with microfluidic setups and analytical instruments. According to JIH, precise stepper motor control was implemented to achieve low-flow consistency.

Market demand has been influenced by increasing regulatory oversight in dosing operations across pharmaceuticals, water utilities, and process industries. Peristaltic pump designs have been aligned with ATEX and USP standards to meet compliance requirements. Tubing materials offering chemical and biological compatibility have been adopted to accommodate aggressive solvents and sterile fluids.

Decentralized bioprocessing and on-site water treatment installations have driven adoption of compact, low-pulsation pumps. Deployment in modular skids and test benches has been noted. Vendor partnerships with OEMs and engineering integrators have enabled system-level solution offerings.

Future product development is expected to focus on digitally enabled pumps and intelligent control features-such as IoT connectivity, flow monitoring, and operator safety interlocks. With fluid handling automation progressing and quality systems becoming more robust, demand for peristaltic pumps is expected to strengthen steadily through 2035.

Low-flow peristaltic pumps accounted for 44% of the global market share in 2025 and are projected to grow at a CAGR of 3.9% through 2035. Their adoption was driven by demand for precise fluid handling, contamination-free transfer, and easy sterilization in applications requiring low-volume delivery.

In 2025, these pumps were widely used in medical devices, pharmaceutical production, diagnostic systems, and laboratory equipment where gentle handling and dosing accuracy were critical. Low shear forces, self-priming capabilities, and the ability to handle viscous or shear-sensitive fluids supported continued preference for low-flow models.

Manufacturers emphasized compact pump head design, multiple tubing material compatibility, and stepper-motor control integration for programmable dosing. Growth remained consistent in regulated sectors including healthcare, biotech, and analytical instrumentation, particularly in North America, Western Europe, and advanced Asian markets.

The medical and pharmaceutical segment held 27% of the global market share by application in 2025 and is expected to grow at a CAGR of 4.0% through 2035. Peristaltic pumps were favored in this segment due to their hygienic operation, closed-system fluid transfer, and disposability of contact tubing.

In 2025, the pumps were widely deployed in IV infusion systems, dialysis equipment, vaccine filling lines, and bioprocessing applications requiring contamination-free transfer of biologics and sterile liquids. Regulatory compliance with FDA, EMA, and cGMP guidelines drove continuous design refinement in tubing quality, flow control accuracy, and cleanability.

The COVID-19 pandemic legacy and rising biologic drug production sustained equipment investments in aseptic manufacturing environments. Suppliers developed integrated pump systems for single-use bioprocessing platforms and modular cleanroom installations, reinforcing their positioning in hospital and pharmaceutical production settings.

The segment for peristaltic pumps is on a gradual growth path as demand increases in pharmaceuticals, water treatment, and food processing, where the need for accuracy and contamination-free fluid management is paramount.

Improved technology through automation and predictive maintenance using AI is making processes more efficient and lowering the cost of operation, all to the benefit of manufacturers and industries dependent upon sterile and accurate fluid transfer High upfront costs and limitations in high-pressure applications may hinder widespread adoption, particularly among cost-conscious purchasers in emerging sectors.

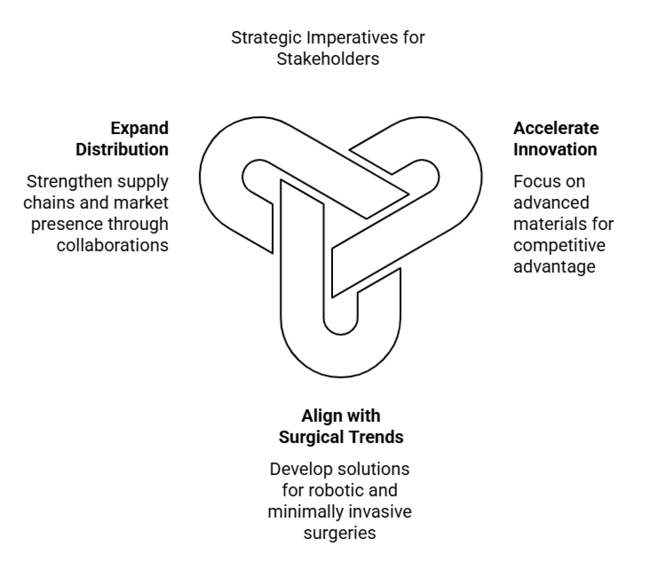

Invest in Smart Pump Technologies

Firms should accelerate R&D and the deployment of automated, AI-powered peristaltic pumps to improve efficiency, reduce downtime, and meet the growing demand for accuracy in pharmaceutical and industrial sectors.

Expand in High-Growth Regions

Businesses ought to bolster their presence in high-growth segments, most importantly in the Asia-Pacific, by tailoring product portfolios to comply with regulatory requirements in sectors and expanding local manufacturing or partnership arrangements.

Strengthen Supply Chain Resilience

Managers should diversify sources, streamline transportation, and consider vertical integration to mitigate supply chain disruptions and ensure regular deliveries to major end-user industries.

Accelerate Innovation in Smart Peristaltic Pumps

Executives should invest in R&D to develop advanced peristaltic pumps with automation, real-time monitoring, and AI-driven predictive maintenance to enhance operational efficiency and meet evolving industry demands.

Align with Sustainability and Regulatory Trends

Companies must focus on developing energy-efficient, eco-friendly pump solutions while ensuring compliance with stringent regulations in pharmaceuticals, water treatment, and food processing to remain competitive.

Expand Industry Reach Through Strategic Partnerships

Firms should strengthen distribution networks, form strategic alliances with regional suppliers, and explore M&A opportunities to enhance production capacity and gain a stronger foothold in high-growth sectors, particularly in Asia-Pacific.

| Priority | Immediate Action |

|---|---|

| Smart Pump Integration | Invest in R&D for AI-driven automation and predictive maintenance features. |

| Regulatory Compliance Readiness | Align product designs with evolving industry regulations, especially in pharmaceuticals and water treatment. |

| Supply Chain Resilience | Diversify supplier base and optimize logistics to mitigate potential disruptions. |

| Emerging Industry Expansion | Strengthen regional partnerships and distribution channels in Asia-Pacific and Latin America. |

| Sustainability & ESG Compliance | Develop energy-efficient, eco-friendly peristaltic pumps to meet sustainability goals and segment expectations. |

In order to remain competitive in the changing peristaltic pumps market, the company will need to maintain competitiveness in intelligent automation, green sustainability, and international growth. Improving efficiency through investment in AI-based predictive maintenance will foster long-term adherence and establish confidence in the industry under tighter regulatory requirements.

Doing so will generate new revenue channels by enhancing supply chain resilience in addition to international expansion in fast-growing markets. To stay competitive through 2035, firms should focus on innovation, strategic partnerships, and sustainability-driven differentiation.

Regional Variance:

ROI Perspectives:

Regional Variance:

Regional Differences:

Manufacturers:

North America: 58% reported skilled labor shortages in pump assembly.

Europe: 52% cited regulatory hurdles (e.g., CE certification).

Asia-Pacific: 61% struggled with fluctuating raw material prices.

Distributors:

End-Users:

Regional Focus:

High Consensus:

There is a high consensus that compliance, efficiency, and price sensitivity are key concerns worldwide.

Key Variances:

Strategic Insight:

| Country | Regulatory Impact on Peristaltic Pumps |

|---|---|

| United States | The Clean Water Act and EPA regulations drive demand for precision chemical dosing pumps in water treatment. The FDA and USP Class VI standards require pharmaceutical and food manufacturers to use hygienic peristaltic pumps. Energy efficiency standards promote the adoption of energy-efficient pump models. |

| United Kingdom | Compliance with the UK Environmental Permitting Regulations and MHRA (Medicines and Healthcare Products Regulatory Agency) guidelines impacts the adoption of peristaltic pumps in wastewater treatment and biopharmaceuticals. Brexit-related import/export tariffs affect supply chain dynamics. |

| France | Strict wastewater treatment laws and EU Food Safety Regulations mandate contamination-free pumps in food and beverage processing. France’s carbon neutrality goals drive demand for energy-efficient and recyclable pumping solutions. |

| Germany | As a leader in industrial automation, Germany enforces Industry 4.0 and VDMA standards, encouraging the use of IoT-enabled peristaltic pumps. The European Green Deal also supports sustainable pump designs for chemical and water treatment sectors. |

| Italy | Pharmaceutical and food safety compliance (EU GMP, HACCP) pushes demand for high-precision peristaltic pumps. Stringent wastewater regulations boost adoption in the chemical and industrial sectors. |

| South Korea | Government initiatives in semiconductor and biopharmaceutical industries promote high-purity peristaltic pumps. Environmental policies focusing on wastewater management also drive demand. |

| Japan | Japan’s strict pharmaceutical and food industry hygiene laws increase the need for sterile, contamination-free peristaltic pumps. Energy efficiency mandates encourage the development of low-power and durable pump systems. |

| China | China’s Environmental Protection Law enforces strict wastewater discharge regulations, increasing demand for chemical dosing peristaltic pumps. Government-led industrial modernization also boosts automation-friendly pump adoption. |

| Australia & New Zealand | Water conservation laws and mining industry safety standards push demand for rugged, reliable peristaltic pumps. The region’s focus on sustainability supports the shift to energy-efficient and recyclable pump designs. |

| India | Stringent pollution control laws and wastewater treatment regulations are expanding the use of peristaltic pumps in industrial and municipal applications. The Pharmaceutical and Food Safety Standards Authority of India (FSSAI) ensures strict compliance in sanitary pump applications. |

The USA peristaltic pumps landscape will witness a growth of 4.2% CAGR from 2025 to 2035, with the growing usage of these pumps in pharmaceuticals, water treatment, and food & beverage industries. The pharmaceutical industry continues to be a key driver of demand due to the requirement of contamination-free fluid handling during drug production.

Besides, EPA water regulations are also compelling municipal and industrial sewage treatment plants to adopt peristaltic pumps because these can manage viscous and abrasive fluids effectively. With heightened automation in manufacturing, peristaltic pumps coupled with IoT-based predictive maintenance solutions are finding popularity.

Top USA manufacturers are investing in smart pumps providing real-time monitoring and automatic control for maximizing efficiency. Additionally, the food and beverages industry, led by growing clean-label products and hygienic processing requirements, is another growth driver.

The peristaltic pumps sector in the UK is expected to register a CAGR of 3.6% between 2025 and 2035, backed by stringent environmental laws, growing pharma investments, and booming food & beverages industry. Stringent wastewater treatment processes are well-defined in the UK Water Industry Act, and industries are compelled to implement high-precision dosing pumps for this very reason.

Biopharmaceutical is another key sector, with the UK being one of the leading hubs for biologics research and development. Continued growth in peristaltic pump demand can be attributed to the need for sterile, contaminant-free transfer of fluids during production of drugs for cell and gene therapy. Additionally, the growth of specialty food manufacturing and craft breweries has driven the increased adoption of peristaltic pumps for hygienic processing.

The landscape for peristaltic pumps in France will expand at 3.7% CAGR from 2025 to 2035. This expansion will primarily be promoted by government funding for wastewater treatment plants, production of pharmaceuticals, and improvements in food manufacturing. France has some of the strictest water treatment and environmental regulations in Europe, driving the adoption of peristaltic pumps for accurate chemical dosing in urban and industrial environments. The pharmaceutical industry in France, supported by robust government grants, is expanding further, driven by growth in biologics and vaccine manufacture.

Hygienic, contamination-free pumping arrangements are in demand. In addition, the wine and dairy industries, with their need for accurate and contamination-free fluid transfer solutions, are increasingly adopting peristaltic pump technology. The government's stringent energy efficiency requirements, however, are challenging conventional pump manufacturers, compelling them to adopt smart, energy-efficient pumps.

Germany's peristaltic pumps sector will grow at 4.0% CAGR during 2025 to 2035, with the support of robust industrial appetite, tight environmental regulations, and the development of automation. The chemical and pharmaceutical sectors of the country are significant users of peristaltic pumps, demanding accurate dosing and contamination-free fluid transfer.

Germany's water treatment industry, as a response to EU environmental directives, is a key growth driver. Peristaltic pumps are finding more application in municipal wastewater treatment facilities, particularly in chemical dosing. Moreover, the automotive and manufacturing industries utilize these pumps for industrial fluid management, specifically in battery and hydrogen fuel cell manufacturing. Industry 4.0 and intelligent manufacturing drives in Germany have pushed the incorporation of AI-based pump monitoring systems faster.

Italy's peristaltic pumps industry is expected to grow at a CAGR of 3.5% during 2025 to 2035, led by the food & beverage industry, wastewater treatment programs, and pharmaceutical innovation. The nation's wine and dairy industries need hygienic, contamination-free fluid transfer solutions, which is why peristaltic pumps are being increasingly adopted. Efforts by the government of Italy towards promoting water conservation and recycling have contributed to higher adoption of peristaltic pumps for wastewater treatment.

The growth in demand for biopharmaceutical production and cosmetics production is also driving segment growth. The Italian landscape is challenged by economic volatility and high import reliance on raw material. Firms that offer energy-efficient and sustainable solutions are most likely to become competitive.

The South Korean peristaltic pumps landscape is estimated to grow with a CAGR of 3.9% during the forecast period of 2025 to 2035. The investments in the biopharmaceutical sector, semiconductor production, and water treatment plants are major drivers for growth.

The government initiatives toward smart manufacturing and industrial automation are driving the adoption of IoT-based pumps at a faster pace. Nevertheless, obstacles like high upfront capital expenditures and Chinese manufacturers' competition remain. Technological innovation and export-led demand, mainly in semiconductor use, will underpin future segment expansion.

The segment for Japan's peristaltic pumps will expand at a 2025 to 2035 CAGR of 3.4%, fueled by drug breakthroughs, semiconductor production, and precision engineering uses. Aging population in Japan has contributed to expanded investment in medical device and pharmaceutical manufacturing that demands contamination-free fluid handling.

Although Japan dominates high-precision manufacturing, the segment also experiences price pressures and gradual automation transition in smaller sectors. Smart pump technologies, portable industrial designs, and green initiatives will shape the future of Japan's peristaltic pump sector.

China's peristaltic pumps industry will expand at 4.5% CAGR, highest amongst large economies. The rise in demand is influenced by industrial automation, investment in water treatment and pharmaceuticals production. China promotes local manufacturing of precision and high-tech pumps. Nonetheless, regulatory complexities and increasing labor expenses pose obstacles. Many top players are investing in AI-enabled monitoring solutions and expanding exports to sustain growth.

India's peristaltic pumps landscape will grow at a CAGR of 4.3% between 2025 and 2035, owing to fast industrialization, water treatment infrastructure investment growth, pharmaceutical production growth, and expansion of the food processing industry. Peristaltic pumps are used widely for sterile fluid management, vaccine manufacture, and accurate chemical dosing.

With the government prioritizing local development of medical and industrial equipment, local manufacturers are redoubling their efforts to limit import dependency and manufacture cost-effective, high-precision pumps. India's food and beverage processing sectors are also embracing peristaltic pumps for edible oil refining, beverage production, and dairy processing. The textile and chemical sectors, which need strong and contamination-free pumping solutions, are also adding to industry growth.

The Australia & New Zealand (ANZ) peristaltic pumps landscape is anticipated to expand at a CAGR of 3.2% from 2025 to 2035, based on growing investment in water treatment facilities, mining, and growing food & dairy processing industries. The region's stringent environmental standards and emphasis on sustainability have accelerated the uptake of low-maintenance and efficient pumping solutions.

Governments in both nations are imposing strict water quality regulations, which are fueling demand for peristaltic pumps in chemical dosing and sludge handling applications in wastewater treatment plants. Australia's booming mining industry heavily relies on peristaltic pumps, especially for slurry transfer, chemical dosing, and mineral processing, where low maintenance and durability are essential.

The ANZ economy's dairy and food sectors, which are major contributors to the economy, are also turning to sanitary peristaltic pumps for contamination-free liquid handling in dairy processing, fruit juice extraction, and certain beverage applications where precise dosing is required.

Dominant players in the peristaltic pumps segment are competing through a combination of price strategies, technology advancements, strategic alliances, and geographical diversification. Some producers focus on cost competitiveness to capture price-sensitive markets, while others aim for high-performance, high-priced pumps suitable for industries with a need for precision and conformance, for example, the pharmaceutical and water treatment industries. Innovation continues to be an area of interest for companies, with investments being made in intelligent peristaltic pumps.

Regional and industry trends influence growth strategies. Industry leaders are expanding production and enhancing distribution in areas such as the Asia-Pacific region and the Middle East, where demand for industrial automation and water treatment products is increasing. Firms are acquiring smaller companies and forming joint ventures to leverage technology expertise and develop new applications, including in biopharmaceuticals and green energy solutions.

Watson-Marlow (WMFTG)

Cole-Parmer

Verder Group

Flowrox

Wanner Engineering

Mergers & Acquisitions

Product Launches & Innovations

Strategic Partnerships

Regulatory & Market Changes

Expansion & Investment

Peristaltic pumps are widely used in pharmaceuticals, food & beverage, water treatment, mining, and chemical processing due to their contamination-free fluid transfer and low-maintenance design.

Compared to centrifugal or diaphragm pumps, peristaltic pumps work without seals or valves, lowering the risk of leakage and contamination; hence, they are used for accurate dosing and will also handle abrasive or viscous liquids.

Low maintenance, self-priming, accurate flow control, high tolerance for corrosive, shear sensitive or high viscosity fluid without damage are some of the benefits of peristaltic pumps.

Features like IoT incorporation, automated surveillance, and energy-conserving layouts are improving longevity, accuracy, and maintenance predictive abilities.

Important considerations include flow rate, pressure requirements, tubing material compatibility, application type, and maintenance needs to ensure optimal performance.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Diaphragm Pumps Market Growth - Trends & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA