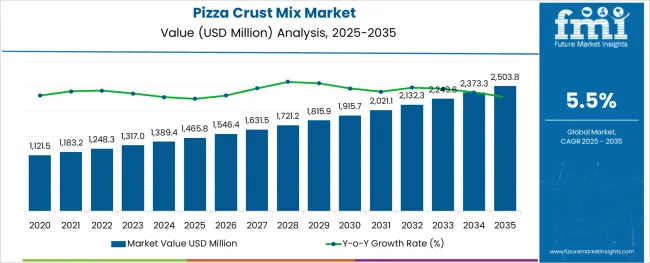

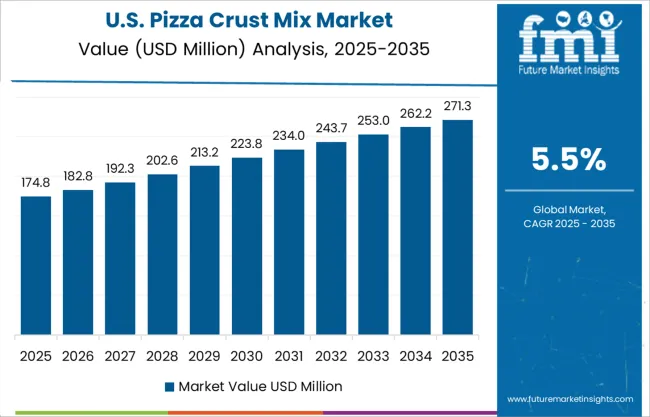

The Pizza Crust Mix Market is estimated to be valued at USD 1465.8 million in 2025 and is projected to reach USD 2503.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The pizza crust mix market is experiencing sustained momentum driven by health-conscious dietary trends, convenience-led meal preparation, and diversification of product offerings. Rising demand for home-baking solutions and gourmet pizza experiences has encouraged manufacturers to develop innovative mixes catering to both traditional and specialty diets.

The growing influence of clean label ingredients, gluten-free options, and organic grains has further expanded consumer engagement. Packaging advancements designed for extended shelf life and minimal storage requirements have supported broader retail penetration. Meanwhile, increased consumption of at-home meals post-pandemic continues to drive household adoption of DIY baking mixes.

Industry participants are responding with product extensions, recipe customization options, and targeted marketing across e-commerce and grocery shelves. As consumers increasingly prioritize nutrition and convenience, future growth is expected to concentrate in functional grain mixes, resealable packaging, and omnichannel retail formats with direct-to-consumer capabilities.

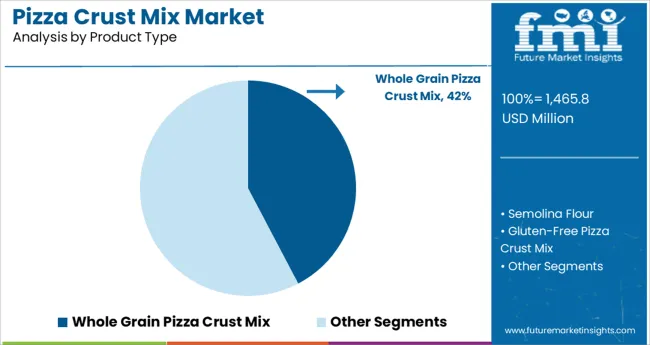

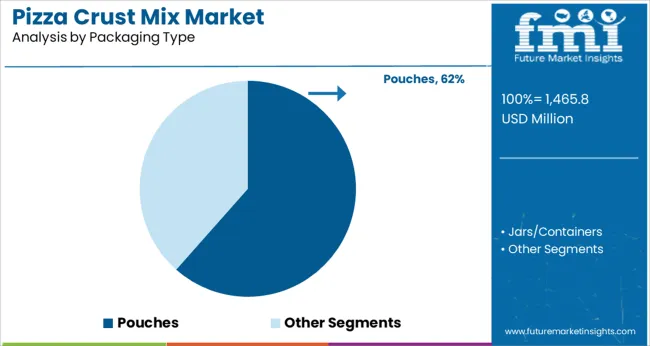

The market is segmented by Product Type, Packaging Type, and Distribution Channel and region. By Product Type, the market is divided into Whole Grain Pizza Crust Mix, Semolina Flour, and Gluten-Free Pizza Crust Mix. In terms of Packaging Type, the market is classified into Pouches and Jars/Containers.

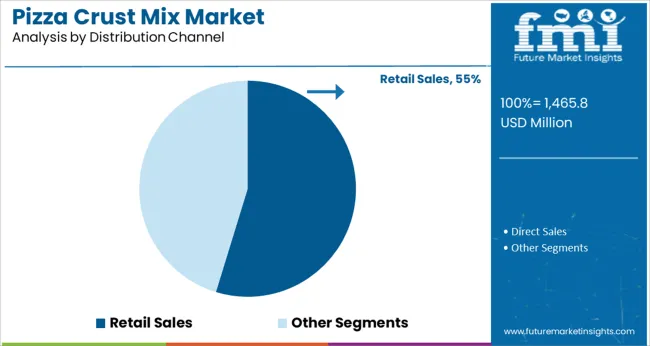

Based on Distribution Channel, the market is segmented into Retail Sales and Direct Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Whole grain pizza crust mix is projected to account for 42.3% of total revenue in 2025 within the product type category, positioning it as the leading variant. Its dominance is attributed to growing consumer preference for high-fiber, nutrient-dense alternatives that align with health-conscious dietary patterns.

As awareness of glycemic control and cardiovascular benefits associated with whole grains increases, demand for enriched flour substitutes in staple categories like pizza has accelerated. Manufacturers are integrating multigrain, ancient grain, and sprouted formulations into their mix portfolios, enhancing nutritional value while retaining traditional taste and texture.

Additionally, product labeling regulations emphasizing fiber content and natural ingredients have increased the visibility of whole grain offerings on retail shelves. These factors combined with rising interest in home-baked healthy meals have reinforced the segment’s leadership position in the pizza crust mix category.

Pouches are expected to generate 61.5 percent of the packaging type revenue in 2025, marking them as the preferred packaging solution. Their convenience, lightweight structure, and resealable designs have made them ideal for dry baking mixes, especially in the home-cooking category.

The format supports controlled portioning, extended freshness, and improved storage, aligning with consumer expectations for practicality and waste reduction. Manufacturers are also adopting eco-friendly materials and recyclable pouches to meet sustainability goals without compromising functionality.

From a distribution standpoint, pouches are easier to stack, ship, and display, offering cost benefits across the value chain. The combination of flexible design, aesthetic shelf presence, and operational efficiency has solidified pouches as the dominant packaging format in the pizza crust mix market.

Retail sales are projected to contribute 54.7% of the revenue in 2025 within the distribution channel segment, positioning it as the leading route to market. Supermarkets, hypermarkets, and specialty grocery stores have been instrumental in driving visibility and accessibility of pizza crust mix products to a broad consumer base.

The physical retail environment enables impulse purchases and supports cross-merchandising with complementary categories such as sauces, cheeses, and toppings. In-store promotions and private label offerings have further incentivized consumer trial and loyalty. Retailers are responding to demand for health-oriented and premium products by expanding shelf space for artisanal and functional pizza crust mixes.

Additionally, the steady growth of organized retail in urban and semi-urban regions globally has expanded the reach of branded mixes. With consistent consumer footfall and the ability to physically evaluate product attributes, retail sales have maintained a competitive edge in the distribution landscape.

The demand for pizza crust mix is surging especially from household and food service use. Some of the key factors such as increasing awareness amongst consumers in using specified ingredients in their food products, growing disposable income, and increasing demand for added tastes and preferences with different varieties of ingredients in the pizza crust mix are all anticipated to promote the global pizza crust mix market during the forecast period.

Globally, there is an increased inclination for packaged and ready-to-eat foods as a result of hectic lifestyle patterns and busy schedules. This is proving to be a lucratively driving factor of the global pizza crust mix market in the future.

Fast urbanization across the world has resulted in growing penetration of global pizza franchises across both emerging as well as developed markets. This has stimulated the consumption of pizza worldwide and eventually promoted the growth of the global pizza crust mix market.

Additionally, the altering conditions socio-economically specifically in developing economies have resulted in increasing consumer affiliation towards the adoption of Western cuisines, such as pizzas, pasta, burgers, etc., thus fueling the demand for pizza crusts and eventually boosting the pizza crust mix market growth.

Supporting this is improved and better consumer living standards encouraged by their growing disposable income levels are propelling their power of purchase, hence resulting in growing disbursements on food products.

Consumers are more health conscious and growing cases of lifestyle diseases owing to increased consumption of fast food have resulted in the initiation of dairy-free and gluten-free pizza crusts.

This has led to the lucrative growth of the pizza crust mix market. Likewise, several manufacturers are also introducing pizza crusts made of vegetables or rice flour, hence encouraging the need for value-added products. Additionally, the advent of several e-commerce platforms that deliver at the doorstep is also stirring the growth of the pizza crust mix market.

Growing advantages such as natural ingredients and accessibility of gluten-free and organic pizza crust mix are said to propel the global pizza crust mix market. The escalating use of bakery products will eventually boost the demand for pizza crust mix during the forecast period.

Besides the market driving factors, the increased presence of MSG as an ingredient in pizza crust mix is anticipated to hamper the growth of the pizza crust mixes market during the forecast period.

North America holds a significant market share of 32.10% of the global pizza crust mix market. Countries like the United States and Canada are the biggest consumers of pizza due to the growing number of fast-food outlets and exclusive pizza outlets. The demand and popularity of pizza are so high in the United States that every year on 9th February, National Pizza Day is celebrated.

In 2020, according to Alto-Hartley Inc., a kitchen equipment and installation company in the United States, over three billion pizzas were sold 2020 in the USA alone. These consumer trends are impelling the demand for pizza crust mix in the North American market. Furthermore, technological advancements in cost-efficient production are expected to boost the market during the forecast period.

Increasing innovation in product developments in terms of health and nutrition which includes low-fat, multigrain, low trans-fat, and low on artificial preservatives offerings will encourage the sales of pizza crust mix in the future.

Europe has been the primary contributor to the pizza crust mix market owing to increased demand and innovations in the bakery industry. Europe accounts for 34.80% of the global market share in the pizza crust mix market. Owing to lifestyle changes and tastes of consumers in this region, Europe is said to have a majority share in the global pizza crust mix market.

Increasing preference towards gluten-free pizza crust mix coupled with budding tourism especially post the pandemic is further anticipated to flourish the pizza crust mix market during the forecast period. Rising consumption and increasing demand for packaged products in the Europe region are predicted to boost the demand for pizza crust mix amongst the manufacturers of bread products.

Also, a growing population along with a rising preference for packaged goods and novel inventions especially in the bakery sector is said to expand the market for the pizza crust mix in the Europe region during the forecast period.

The increasing need for pizza crust mix amongst food manufacturers is anticipated to expand the market owing to multiplying need for bread and loaves as one of the staple foods in the region. Improving urbanization in the region is anticipated to flourish the market in Europe region during the forecast period.

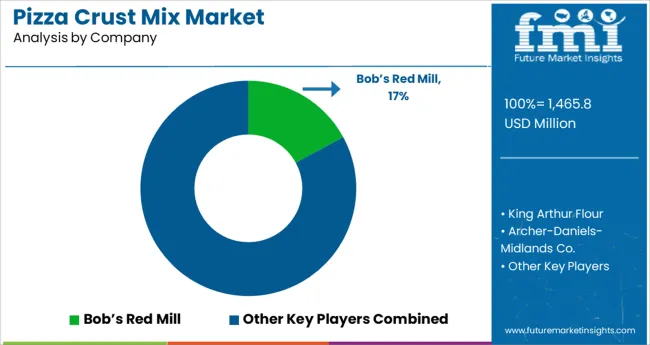

Some of the key players in the pizza crust mix market are Bob’s Red Mill, King Arthur Flour, Archer-Daniels-Midlands Co., Hodgson Mill, and Martha White.

Market players have adopted strategies such as product approvals, product launches, market initiatives, and mergers and acquisitions. King Arthur Flour, one of the oldest flour companies launched six novel inventive products. The company’s new keto wheat flour blend, ‘00’ pizza flour, baking sugar alternative, organic rye flour, and two of the latest gluten-free single-serve dessert cup flavours were created to deliver bakers with superior quality products for every baking need, irrespective of dietary preferences.

Recently, Hodgson Mill Inc., well-known for flour and other grain mill products company upgraded wind turbines for more sustainable energy. They replaced their existing two wind turbines with a much sleeker, more efficient, modern, and more powerful style.

Dr Oetker FunFoods Professional, a leading player in food service for western spreads and sauces recently launched a trendy new flavour i.e., Veg Mayonnaise Smoky Peri Peri. This spread is creamy and thick, filled with peri chilli and a smoky note, this adds spicy zing to burgers, pizzas, sandwiches, wraps etc.

In June 2025, General Mills acquired TNT Crust, a manufacturer of high-quality frozen pizza crusts for national and regional pizza chains, retail outlets, and food service distributors. TNT Crust was a portfolio company of Peak Rock Capital. As part of the acquisition, General Mills has also acquired two manufacturing facilities in Green Bay, Wisconsin, and one manufacturing facility in St. Charles, Missouri.

| Report Attribute | Details |

|---|---|

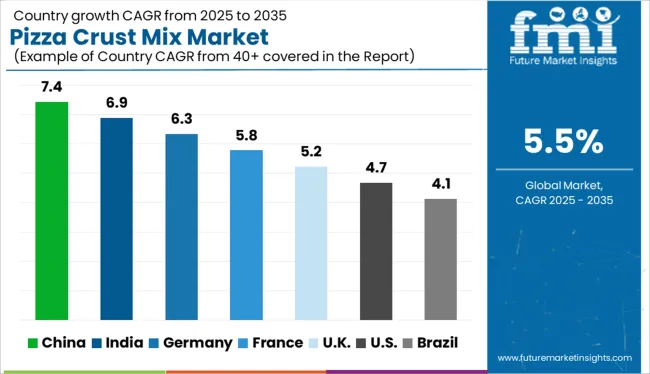

| Growth Rate | CAGR of 5.50% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Packaging Type, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Bob’s Red Mill; King Arthur Flour; Archer-Daniels-Midlands Co.; Hodgson Mill; Martha White |

| Customization | Available Upon Request |

The global pizza crust mix market is estimated to be valued at USD 1,465.8 million in 2025.

It is projected to reach USD 2,503.8 million by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are whole grain pizza crust mix, semolina flour and gluten-free pizza crust mix.

pouches segment is expected to dominate with a 61.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pizza Cutter Market Size and Share Forecast Outlook 2025 to 2035

Pizza Scissors Market Size and Share Forecast Outlook 2025 to 2035

Pizza Ovens Market Insights - Growth & Forecast 2025 to 2035

Pizza Cartons Market

Pizza Preparation Refrigerator Market

Vegan Pizza Crust Market Analysis by Ingredient, Type, Distribution Channel, Application and Region through 2035

Frozen Pizza Market Growth - Consumer Preferences & Industry Expansion 2025 to 2035

Electric Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Tabletop Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Countertop Pizza Warmers & Merchandisers Market - Fresh & Ready Pizzas 2025 to 2035

Gluten-Free Pizza Crust Market Size, Growth, and Forecast for 2025 to 2035

Vegan Frozen Pizza Market Analysis by Nature, Packaging Type, Distribution Channel, and Region Through 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mixed Reality Navigation Platforms Market Forecast and Outlook 2025 to 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mixed Signal IC Market Size and Share Forecast Outlook 2025 to 2035

Mixed Xylene Market Trends - Demand, Innovations & Forecast 2025 to 2035

Mixing Console Market by Type, Sales Channel, Application & Region Forecast till 2025 to 2035

Mixers & Attachments Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA