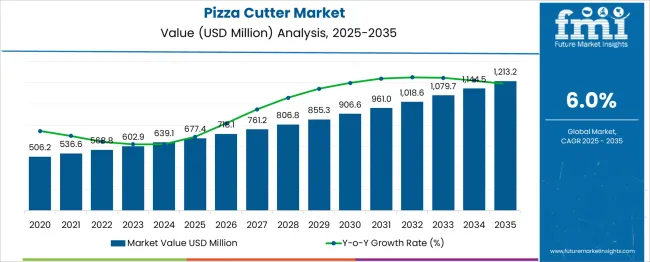

The Pizza Cutter Market is estimated to be valued at USD 677.4 million in 2025 and is projected to reach USD 1213.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Year-on-year (YoY) growth analysis reveals a consistent upward trajectory with minor variations, reflecting stable demand across both residential and commercial food service sectors. Between 2025 and 2027, growth rates average around 5.8%, with the market increasing from USD 677.4 million to USD 761.2 million as global foodservice expansion and home cooking trends boost adoption of ergonomic and premium cutters.

From 2028 to 2031, YoY growth slightly accelerates, adding USD 145.6 million, driven by rising quick-service restaurant chains and customization preferences, including multipurpose cutters and safety-enhanced designs. After 2031, growth stabilizes between 5.5% and 6%, with annual increments exceeding USD 60 million, supported by strong replacement demand and e-commerce-driven distribution channels. By 2035, the market achieves USD 1,213.2 million, with innovation focusing on durable materials, dishwasher-safe designs, and electric pizza cutters for efficiency. Players offering customized, aesthetically designed, and multifunctional tools integrated with ergonomic features will gain competitive advantage as the market maintains steady year-on-year growth across mature and emerging economies.

| Metric | Value |

|---|---|

| Pizza Cutter Market Estimated Value in (2025 E) | USD 677.4 million |

| Pizza Cutter Market Forecast Value in (2035 F) | USD 1213.2 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The pizza cutter market is positioned as a key niche within the broader kitchen and food preparation ecosystem, supported by strong linkages to culinary convenience and specialized cooking tools. Within the kitchen utensils and cutting tool market, pizza cutters account for 6–8%, reflecting their status as an essential slicing tool alongside knives and peelers. In the cooking equipment and bakeware market, their share is 5–7%, driven by demand for complementary tools used with pizza stones, baking sheets, and oven accessories. The foodservice and restaurant kitchen tools market attributes 8–10% of its segment to pizza cutters, as pizzerias and catering services require high-durability, ergonomic slicers for efficiency and safety in commercial operations. Within the retail cookware and kitchenware consumer market, pizza cutters represent 4–5%, supported by increasing household interest in home-style pizza preparation and online purchases of culinary gadgets. Lastly, in the specialty food accessory and novelty kitchen gadget market, their share reaches 6–8%, influenced by themed designs, premium steel rollers, and branded cutter sets targeting gifting segments. Market growth is reinforced by rising at-home pizza consumption, professional foodservice expansion, and innovation in cutter designs featuring ergonomic grips, interchangeable blades, and integrated safety shields. These dynamics position pizza cutters as both a functional necessity and a lifestyle-driven kitchen accessory.

The Pizza Cutter market is experiencing consistent growth, driven by increased global consumption of ready-to-eat food and the expanding footprint of fast-food chains. The rising popularity of pizza across both developed and developing economies has contributed to the strong demand for pizza preparation accessories, particularly those offering precision, durability, and ease of use. As home cooking trends and the demand for convenient kitchen tools increase, both professional and domestic users are seeking efficient slicing tools that offer enhanced ergonomics and consistent performance.

Manufacturers have responded by introducing innovations in blade design, handle ergonomics, and safety features. In addition, growing interest in commercial-grade kitchenware for home use has widened the customer base.

The future growth of this market is expected to be influenced by the rising number of foodservice establishments, cloud kitchens, and international pizza chains, all of which require reliable and long-lasting cutting tools. As quality and material innovation continue, pizza cutters are becoming essential tools in both professional and personal culinary environments..

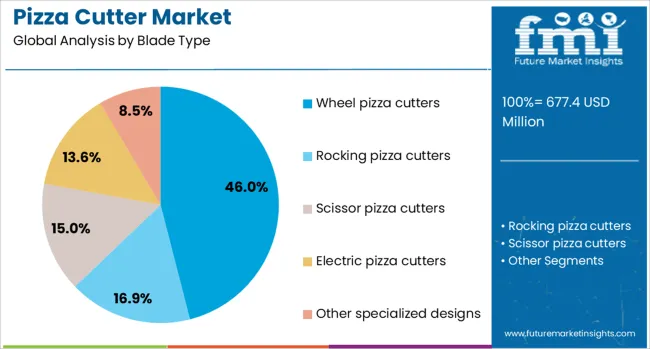

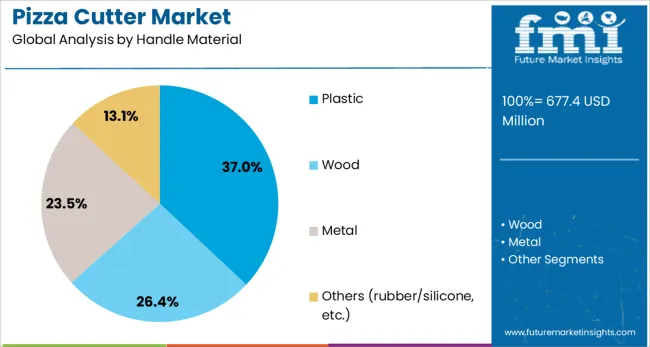

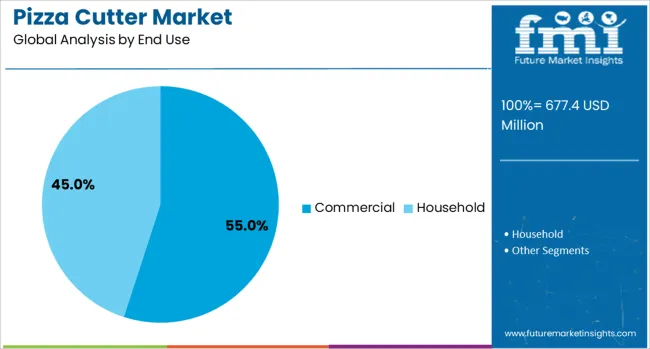

The pizza cutter market is segmented by blade type, handle material, end use, pricing, distribution channel, and geographic regions. By blade type of the pizza cutter market is divided into Wheel pizza cutters, Rocking pizza cutters, Scissor pizza cutters, Electric pizza cutters, and Other specialized designs. In terms of handle material of the pizza cutter market is classified into Plastic, Wood, Metal, and Others (rubber/silicone, etc.). Based on end use of the pizza cutter market is segmented into Commercial and Household. By pricing of the pizza cutter market is segmented into Under USD 10, USD 10–USD 20, USD 20–USD 30, and USD 30 & above. By distribution channel of the pizza cutter market is segmented into Online and Offline. Regionally, the pizza cutter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wheel pizza cutters subsegment under the blade type segment is projected to account for 46% of the total Pizza Cutter market revenue in 2025, establishing it as the leading subsegment. This dominance has been supported by the tool’s ability to deliver consistent, straight cuts with minimal effort, making it suitable for both commercial kitchens and home use. The rolling blade design has allowed users to apply uniform pressure, improving cutting precision while minimizing mess.

Demand has also been sustained by the simple, compact structure of wheel cutters which ensures easy storage, cleaning, and maintenance. The widespread availability of replacement wheels and affordable pricing have further contributed to the high adoption of this blade type.

Additionally, the suitability of wheel cutters for a variety of crust textures and sizes has expanded their applicability in diverse foodservice settings. Their ergonomic compatibility and durable construction are being favored by chefs and consumers seeking reliable, efficient kitchen tools, reinforcing the segment’s top position in the market..

The plastic subsegment within the handle material segment is expected to capture 37% of the Pizza Cutter market’s revenue share in 2025, placing it as the leading choice among handle materials. Growth in this segment has been driven by the affordability, lightweight nature, and design versatility of plastic handles. Plastic has enabled manufacturers to create ergonomically contoured grips, enhancing user comfort and reducing fatigue during repeated use.

Its inherent resistance to corrosion, moisture, and temperature changes has made it highly suitable for kitchen environments. Furthermore, plastic handles allow for a broad range of colors and finishes, catering to both aesthetic preferences and professional branding needs. Commercial foodservice operators have also favored plastic due to its non-slip properties and low maintenance requirements.

As price-sensitive consumers and businesses prioritize functional and hygienic utensils, plastic has maintained a strong preference over metal or wooden alternatives. Ongoing improvements in high-grade food-safe plastics are expected to reinforce this segment’s leadership position in the coming years..

The commercial subsegment under the end use segment is anticipated to hold 55% of the total Pizza Cutter market share in 2025, making it the most dominant application area. The growth of this segment has been driven by the rapid expansion of pizzerias, quick-service restaurants, and food delivery businesses that require efficient, durable slicing tools for high-volume use. Commercial kitchens demand pizza cutters that can withstand continuous operation without compromising on hygiene or precision.

High throughput and standardized portion control have become critical operational needs, prompting commercial buyers to invest in robust, ergonomically designed tools. The ability of commercial-grade pizza cutters to support dishwasher-safe usage and frequent sterilization has also been a contributing factor to their popularity.

Furthermore, the emergence of franchised food chains and large-scale catering services has elevated the need for uniform slicing tools to maintain consistency across locations. As global foodservice operations continue to scale, commercial applications of pizza cutters are projected to remain at the forefront of demand in this market..

Pizza cutters are essential kitchen tools used to slice pizzas into portions, commonly featuring wheel blades, mezzaluna designs, or multifunctional formats. They are widely adopted in households, commercial kitchens, quick-service restaurants, and pizzerias. Demand has been shaped by rising consumption of ready-to-eat meals and the popularity of homemade pizzas. Manufacturers focusing on ergonomic handles, sharp stainless-steel blades, and dishwasher-safe materials have gained customer preference. Products offering durability, easy cleaning, and enhanced safety features continue to influence purchasing decisions across residential and professional culinary environments.

Adoption of pizza cutters has been driven by rising global consumption of pizzas in both home and foodservice environments. Increased popularity of quick-service restaurants and pizza delivery chains has reinforced the need for durable, high-volume cutting tools. Growing consumer preference for preparing artisanal pizzas at home has supported sales of ergonomic and multipurpose cutters. Premiumization in kitchen accessories has encouraged users to choose products with long-lasting sharpness and rust resistance. Features such as easy-grip handles, compact storage designs, and non-slip functionality have become standard. Additionally, rising online retail penetration has provided convenient access to diverse designs and price ranges, boosting overall sales momentum.

Growth has been constrained by the availability of low-cost products with inconsistent material quality, leading to blade dullness and poor durability. Intense price competition among manufacturers in emerging markets has pressured margins for premium brands. Frequent counterfeit product circulation on online platforms has reduced consumer trust. Maintenance challenges such as cleaning blade crevices and ensuring hygiene compliance have impacted adoption in commercial kitchens. Limited consumer awareness about material safety certifications and ergonomic standards has hindered demand for high-quality models. Supply chain fluctuations in stainless steel and plastic components have contributed to inconsistent pricing trends and production delays.

Opportunities are growing for manufacturers developing pizza cutters with innovative blade coatings, protective covers, and integrated safety locks. Personalized designs for gifting, branding for food chains, and themed accessories for events create new product segments. Expanding popularity of kitchenware subscription boxes provides exposure to premium designs. Development of cutters compatible with both pizzas and flatbreads offers multifunctional utility for diverse cuisines. Growth in smart kitchen tools has encouraged exploration of cutters featuring detachable blades for easy cleaning and interchangeable accessories. Collaborations with culinary influencers and partnerships with global pizzerias can further strengthen brand positioning and enhance consumer engagement.

Current trends include the adoption of ergonomic handles with slip-resistant grips and blade guards for enhanced user safety. Stainless steel with non-stick coatings and ceramic blade options are gaining attention for durability and hygiene. Compact storage features, such as foldable handles or hanging loops, are now standard. Growing interest in eco-conscious designs has influenced the use of bamboo handles and recyclable materials in cutter construction. Manufacturers are introducing decorative designs to appeal to gifting and lifestyle markets. Integration of dishwasher-safe components and detachable blade systems for ease of cleaning continues to define premium product segments in both residential and commercial applications.

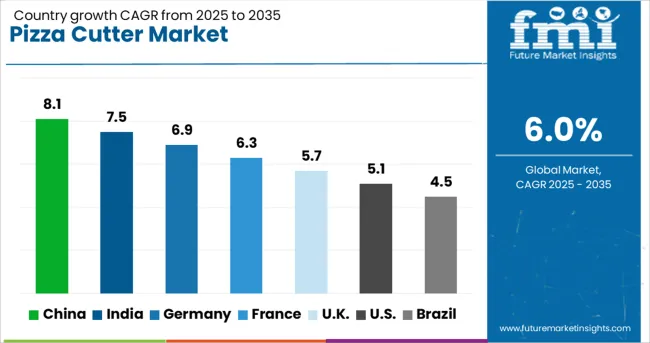

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The pizza cutter market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by rising home cooking trends, growth in food delivery, and increasing demand for kitchen tools in residential and commercial segments. China leads with 8.1%, fueled by domestic manufacturing capabilities and expanding Western-style dining. India follows at 7.5%, supported by strong growth in quick-service restaurants and urban household adoption. Among developed markets, Germany records 6.9%, while the United Kingdom posts 5.7% and the United States 5.1%, driven by premium product innovation and e-commerce-driven retail expansion. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 8.1% through 2035, supported by expanding Western-style food culture and strong local manufacturing capabilities. Domestic brands dominate the market by offering cost-effective pizza cutters in a variety of designs, including rotary wheels and multi-blade cutters. Rapid growth of online retail platforms such as Alibaba and JD.com is making premium stainless steel and ergonomic cutters more accessible to middle-class households. Rising popularity of pizza delivery services and international food chains also boosts sales of commercial-grade cutters. Manufacturers are investing in advanced materials for better durability and incorporating aesthetic designs to attract urban consumers.

India is forecasted to grow at a CAGR of 7.5% through 2035, driven by rising popularity of quick-service restaurants and growth of home cooking. The trend of preparing Western cuisines at home is increasing sales of affordable, multi-purpose cutters. Domestic brands are offering plastic-handle and stainless-steel wheel cutters targeting middle-income households. Premium cutters with ergonomic handles and innovative designs are gaining adoption among urban buyers through e-commerce platforms such as Flipkart and Amazon. Rising consumer preference for functional kitchen tools combined with growing interest in home baking supports consistent demand. Unlike China, where manufacturing scale dominates, India’s growth is shaped by affordability and versatility in product offerings.

Germany is expected to grow at a CAGR of 6.9% through 2035, supported by demand for premium, durable, and ergonomic kitchen tools. Unlike India and China, where affordability dominates, German consumers prioritize quality, aesthetics, and eco-friendly materials in pizza cutters. High demand for stainless steel, dishwasher-safe cutters with safety-enhanced designs is driving innovation in product lines. Specialty kitchenware stores and organized retail channels lead distribution, while e-commerce adoption continues to grow steadily. Manufacturers are focusing on design-oriented products and adding premium wooden or metal handles to appeal to style-conscious consumers. Increasing popularity of homemade pizza and artisanal dining experiences strengthens the market.

The United Kingdom is projected to achieve a CAGR of 5.7% through 2035, with rising preference for compact and stylish pizza cutters in urban households. Unlike Germany, where heavy-duty cutters dominate, the UK market leans toward lightweight, space-saving tools suitable for smaller kitchens. Premium innovations, such as cutters with protective blade covers and multi-function features, are gaining traction. Online sales channels and supermarket chains drive distribution, offering both affordable and luxury options. Growing interest in pizza-making kits and do-it-yourself meal trends contributes to market growth. Demand is further supported by increased gifting of specialty kitchen tools among consumers.

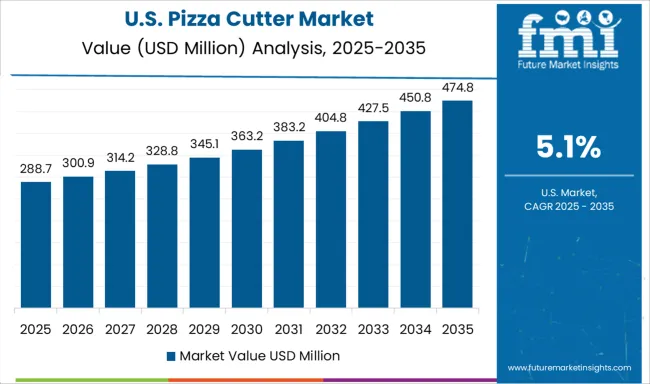

The United States is forecasted to grow at a CAGR of 5.1% through 2035, driven by strong demand for premium, multifunctional pizza cutters. Unlike China and India, where affordability drives growth, the US market focuses on innovation, with products featuring interchangeable blades and ergonomic grips. The growth of pizza delivery and frozen pizza consumption supports the demand for cutters in residential kitchens. Specialty kitchenware brands dominate the premium segment, while mass-market cutters are distributed through retail chains and online marketplaces. Manufacturers are introducing cutters with integrated safety guards and dishwasher compatibility, appealing to health-conscious and convenience-driven consumers.

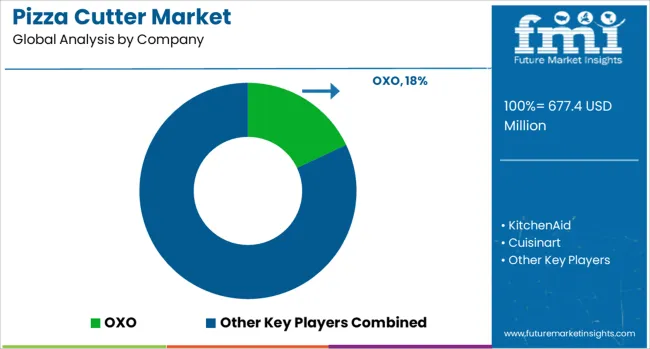

The pizza cutter market is dominated by brands such as OXO, KitchenAid, Cuisinart, Zyliss, and Winco, alongside specialty and premium players like Dreamfarm and Williams-Sonoma. OXO stands out for its ergonomic designs, sharp stainless-steel blades, and strong retail presence in both online and offline channels, targeting consumers seeking durability and ease of use. KitchenAid leverages its brand reputation in kitchen appliances to offer premium pizza cutters with modern aesthetics and high functionality, often marketed as part of coordinated kitchenware collections. Cuisinart emphasizes quality and affordability, positioning its products as versatile and suitable for both home and light commercial use. Zyliss focuses on innovative designs with protective blade covers and dishwasher-safe features, catering to safety-conscious consumers. Winco primarily serves the foodservice segment with heavy-duty, professional-grade cutters designed for high-frequency use in pizzerias and restaurants. Specialty brands such as Dreamfarm differentiate through unique cutting mechanisms, while Williams-Sonoma captures the premium consumer base with stylish, high-end materials and exclusive designs. Competitive strategies in this market revolve around ergonomic innovation, material durability, and the addition of multifunctional features such as integrated blade guards or interchangeable wheels. Entry barriers are relatively low, but brand loyalty and strong retail distribution give established players a competitive edge. Growth opportunities are emerging through premiumization, gifting categories, and expanding e-commerce sales channels. Manufacturers are also focusing on offering bundled kitchen tool sets and customization options to cater to consumer preferences for design and personalization.

On June 6, 2025, Faith Co., Ltd. announced the sellout of an additional 1,000 units of its SUZUKI KATANA-inspired pizza cutter, Pizzacutterna. This officially licensed product, featuring a stainless steel cutter wheel and ABS resin body, combines functional utility with motorcycle-inspired design, appealing to collectors and culinary enthusiasts worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 677.4 Million |

| Blade Type | Wheel pizza cutters, Rocking pizza cutters, Scissor pizza cutters, Electric pizza cutters, and Other specialized designs |

| Handle Material | Plastic, Wood, Metal, and Others (rubber/silicone, etc.) |

| End Use | Commercial and Household |

| Pricing | Under USD 10, USD 10–USD 20, USD 20–USD 30, and USD 30 & above |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OXO, KitchenAid, Cuisinart, Zyliss, Winco, and Others (Dreamfarm, Williams-Sonoma, etc.) |

| Additional Attributes | Dollar sales by product type (wheel cutters, rocker-style cutters, specialty multi-wheel cutters) and application (household kitchens, commercial foodservice), with demand driven by increasing home cooking trends and the global popularity of pizza as a quick meal option. Regional dynamics show strong market presence in North America and Europe due to established pizza culture, while Asia-Pacific exhibits significant growth through rising adoption of Western cuisines. Innovation trends include ergonomic non-slip handles, premium stainless-steel blades for longevity, dishwasher-safe components, and the integration of protective storage covers for enhanced safety and hygiene. |

The global pizza cutter market is estimated to be valued at USD 677.4 million in 2025.

The market size for the pizza cutter market is projected to reach USD 1,213.2 million by 2035.

The pizza cutter market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in pizza cutter market are wheel pizza cutters, _standard wheel cutters, _double-wheel cutters, rocking pizza cutters, _single blade, _multi-blade, scissor pizza cutters, electric pizza cutters and other specialized designs.

In terms of handle material, plastic segment to command 37.0% share in the pizza cutter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pizza Crust Mix Market Size and Share Forecast Outlook 2025 to 2035

Pizza Scissors Market Size and Share Forecast Outlook 2025 to 2035

Pizza Ovens Market Insights - Growth & Forecast 2025 to 2035

Pizza Cartons Market

Pizza Preparation Refrigerator Market

Vegan Pizza Crust Market Analysis by Ingredient, Type, Distribution Channel, Application and Region through 2035

Frozen Pizza Market Growth - Consumer Preferences & Industry Expansion 2025 to 2035

Electric Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Tabletop Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Countertop Pizza Warmers & Merchandisers Market - Fresh & Ready Pizzas 2025 to 2035

Gluten-Free Pizza Crust Market Size, Growth, and Forecast for 2025 to 2035

Vegan Frozen Pizza Market Analysis by Nature, Packaging Type, Distribution Channel, and Region Through 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cutter Box Films Market Growth – Demand & Trends Forecast 2025-2035

Cutter-Box Packaging Market

Die-Cutter Market

Coal Cutter Pick for Mining Market Size and Share Forecast Outlook 2025 to 2035

Tile Cutter Market

Fixed Cutter Bits Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA