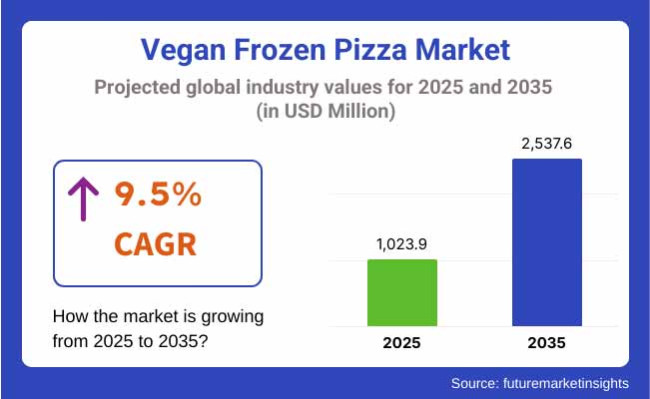

The global vegan frozen pizza market is estimated to be worth USD 1,023.9 million in 2025. It is projected to reach a value of USD 2,537.6 million by 2035, expanding at a CAGR of 9.5% over the assessment period of 2025 to 2035.

Vegan frozen pizza with that globalization runs furious up as this is the only available option for people to not only shift to interruptions free of sugar diets and other dietary constraints but also act accordingly for their health and environment. People who are more careful about problems related to the environment and the human body eat frozen pizzas made only from herbal ingredients.

Growth is determined by people adopting vegan and flexitarian diets. In light of the huge majority of the population that has opted for a vegetarian way of life, plant-based products such as frozen pizza have been one of those branches of goods that have experienced severe shortages. Moreover, progress in food technology has been the key to creating vegan pizzas that imitate the original texture and taste of meat, which has been a gateway for a whole new segment of customers.

The industry faces several challenges. One such setback is that the cost of vegan pizzas is relatively more than that of conventional ones; thus, not many budget-conscious individuals will be attracted to this product category. Furthermore, the scarcity of plant-based materials and the need for specialized processing and equipment can drive up the costs of the manufacturing process, hence contributing to the pricing issue even more.

There are several growth opportunities. With consumer fears over health rising, many people are looking for gluten, dairy, and calorie-free alternatives. This trend has led to new products being created, such as pizza with peculiar toppings such as bean curd cheese and other healthy foods, which in turn will cater to more vegetarian clientele.

Currently, one of the dominant trends is the demand for authentic and high-quality items, along with the growth of e-commerce grocery. Moreover, as sustainable living is still a major concern for consumers, there is a trend for pizzas that are made ofsustainable materials, packaged in recyclable bags, and produced through eco-friendly methods.

Transformation is happening at a rapid pace, which is driven by the major factors increasing the need for plant-based alternatives to traditional pizzas. Firms focus on product quality and creating delicious, high-quality vegan pizzas that cater to consumer needs.

Retailers are responsible for keeping up with demand. With an expanding customer base in need of healthier, plant-based products, retailers are keen to stock high-quality vegan frozen pizzas that satisfy the customer. Retailers also keep a watchful eye on prices to provide customers with affordable products while maintaining availability across stores.

Consumers prioritize the price and quality of the product. With the increasing popularity of veganism, the end consumers also want vegan frozen pizzas to be tasty, convenient, and reasonably priced. Consumers consider ethical sourcing important, but price is still a decisive consideration.

Between 2020 and 2024, there has been an increased demand due to the growing count of health-driven consumers eating plant-based food. As the veganism and flexitarian trend has gained momentum, frozen pizza companies have launched new plant-based offerings to meet the growing segment.

Vegan options, such as dairy-free cheese and meat-free toppings, gained popularity and demand, attractive to shoppers seeking speedy, healthy meal alternatives. DiGiorno and Amy's Kitchen sell vegan pizzas under their product brands, and Whole Foods sells in-store-exclusive lines of vegan pizza.

Growth in the popularity of e-commerce and online supermarket shopping also contributed to the growing industry size by allowing consumers to find and buy such specialty frozen pizzas easily. Consumers have also moved towards organic ingredients, non-GMO, and earth-friendly packages in their pizzas as a part of the broader trend of clean-label products.

During the forecast period, the industry will further grow as the worldwide trend towards plant-based consumption and ongoing innovation in plant-based meat substitutes continues to gather pace. The more advanced technological levels of food will feature more types of vegan cheese, meat alternative foods, and plant-based bases available to make it available at all times and raise the quality of taste and texture for frozen pizzas even higher.

Raising the visibility of vegan food in mainstream chains and food retailers will give vegan frozen pizzas even more consumer visibility. Growing sustainability awareness in the environment will also drive demand for sustainably produced pizzas that use green, ethically produced ingredients and eco-friendly packages. Suppliers will further specialize in producing pizzas that cater to some specific dietary needs, such as gluten-free, low-calorie, and high-protein pizzas, further increasing the growth to adapt to changing consumer tastes.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing trend of plant-based diets and veganism. | Increased demand for healthier, quicker meals. |

| The continuing trend towards plant-based diets. | New plant-based meat and dairy alternatives for better pizza flavor and texture. |

| Introduction of dairy-free cheese and meat-free toppings. | Clean-label products trend with organic and non-GMO ingredients. |

| Introduction of innovative vegan cheese and plant-based crusts. | Introduction of gluten-free and protein-rich pizza varieties. |

| Development of better freezing techniques and preservation methods for ensuring flavor and freshness in vegan pizzas. | Introduction of sustainable packaging systems and novel food technologies for more realistic plant-based foods. |

| Shoppers are looking for healthier options like vegan and plant-based frozen dinners. | Purchase is driven by convenience. |

| Shift towards sustainable food with a consideration of green ingredients and sustainably sourced ingredients. | Creation of personalized vegan pizza options with some diets like gluten-free or low-calorie. |

| Encroachment by leading brands like Amy's Kitchen, DiGiorno , and Whole Foods to introduce vegan pizza flavors. | Organic, sustainable ingredients are a focus. |

The vegan frozen pizza state of affairs is indeed faced with an array of risk factors, including but not limited to supply chain breakdowns and regulatory obligations. Even ingredient sourcing challenges, changing consumer preferences, competition, and discordant views of sustainability are among these. Properly addressing them is a must for companies that want to gain profits in this sector.

Raw materials sourcing is the main issue in this regard. Frozen vegan pizzas are made with special plant-based ingredients such as cheese-free, vegan crusts and plant-based proteins. Such things are dependent on the weather conditions, farming practices, and the cost of production.

Brands must address the interruption of sourcing or the fluctuation of the ingredient's price to solve the problem of low supply or high purchase rates affecting production, pricing, and profits. They can do so by acquiring alternative supplier options, researching green supply chains, and securing a stable product with a high quality and magnitude of supply.

Competitive pressure has also increased. The competition among brands in the food industry is getting more challenging. Plant-based pizza with different flavors is no longer the only thing vegan brands can offer in connection to the plant-based trend.

The proliferation of brands may lead to a drop in prices, as well as heavy investment in marketing and product innovation to be different. However, the enduring brand of pizza companies needs to be the substance of the quality, the taste, the sustainability, and other particularities such as gluten-free, organic, or allergen-free.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 8.2% |

| France | 7.6% |

| Germany | 7.8% |

| Italy | 7.4% |

| South Korea | 8.0% |

| Japan | 7.9% |

| China | 10.1% |

| Australia | 7.5% |

| New Zealand | 7.3% |

The United States will lead for vegan frozen pizza sales at a CAGR of 9.5% during 2025 to 2035. Growth is driven by a strong shift towards plant-based food because of increasing health awareness, greenery, and eco-friendly living. Large food outlets and retail stores are adding more sales of vegan frozen pizzas, thus making the products more accessible to customers.

The increasing direct-to-consumer models and e-commerce are also driving penetration. Manufacturers are pushing premium, a variety of flavors, and ingredient-open plant-based cheese alternatives to reach healthy-conscious consumers. Food technology developments like fermented and cultured plant-based protein are also making the industry ahead.

The United Kingdom market will see robust growth in vegan frozen pizzas at a CAGR of 8.2%. Strong flexitarian movement and increasing levels of full-time vegan shoppers are driving demand. UK grocery stores and convenience channels are enthusiastically establishing plant-based offers, with specialist vegan brands gathering momentum.

There is increased demand for organic and clean-label frozen pizzas with strong levels of ethical sourcing and sustainability packaging. Also, government-supported plant food initiatives are driving consumer adoption, and food ordering apps are significantly contributing to improving accessibility.

France will experience a consistent CAGR of 7.6%, which is due to greater acceptance of plant food despite having rich culinary traditions. An increase in restaurants serving vegan and vegetarian food and an increase in the consumption of substitute dairy products is driving the growth.

French customers have very high taste and quality expectations, and this has challenged producers to highlight artisan-type vegan pizzas made of upmarket ingredients such as truffle oil, organic vegetables, fruits, and locally sourced vegan cheese. Besides this, low-carbon footprint and eco-friendly production-focused sustainability drives also influence purchases.

Germany is likely to witness a 7.8% CAGR, fueled by its strong vegan and vegetarian heritage. Due to over half of its population shifting towards veganism, the demand for new and healthy vegan frozen pizzas is growing. German consumers also prefer high-protein, clean-label, and locally sourced organic ingredients.

Sophisticated food technology in the nation is also propelling innovation in the development of plant-based meat and cheese substitutes with improved taste and texture. Discount stores and supermarkets are increasingly stocking vegan products, bringing the products mainstream.

Italy, traditionally famous for the fervor of relishing traditional pizza, is set to experience a 7.4% CAGR in frozen vegan pizza sales. Italian consumers increasingly embrace plant-based alternatives, specifically those that provide the integrity of authentic pizza flavors. There is increased demand for gourmet-style plant-based substitutes for cheese, naturally fermented crusts, and authentic Mediterranean-style toppings.

Traditional pizza parlors are joining the fray, too, with vegan offerings affecting the frozen foods segment. Organic labels and non-GMO claims are significant purchasing drivers in Italy, where quality is paramount for health-conscious buyers ahead of mass-market alternatives.

The South Korean vegan frozen pizzas market will experience a CAGR of 8.0% as people become aware of plant-based consumption and higher and higher numbers of health-conscious millennials. Western-style fast food eating habits are being combined with a healthy eating habit, and there is a need for new plant-based alternatives.

Convenience is a strong sales driver since urban lifestyle is driving the need for convenient, healthy meal solutions. Retailers are expanding frozen food vegan lines, and cross-branding between local and global brands is expanding the coverage of markets.

Japan will grow at a CAGR of 7.9% due to increasing demand for plant-based food, health trends, and government-endorsed sustainability initiatives. Japanese consumers prefer an umami taste and novel pairing of ingredients, and thus, manufacturers have developed vegan frozen pizza with miso sauce, fermented plant-based cheese, and seaweed-topped crust.

The convenience of frozen food is ideal for Japan's urban way of life, and mass-market grocery retailers are expanding plant-based frozen food options. Food processing technologies are also producing quality meat and dairy substitutes that are acceptable to the Japanese palate.

China's vegan frozen pizza market is poised to grow at a high CAGR of 10.1% with rising urbanization, increasing disposable incomes, and plant-based consumption interest. Western convenience foods are converging with indigenous plant-based consumption habits. Hence, opportunities arise to develop innovative frozen pizza products.

Digital platforms are being used more and more to deliver, enabling the extension of the brands. Foreign vegan companies are entering China through strategic joint ventures, while local players are adding local ingredients such as Sichuan pepper and black bean-based toppings as part of local flavor modifications.

Australia is expected to grow at a CAGR of 7.5%, which is led by consumers' high health consciousness and sustainability concerns. The country's strong popularity for organic food and demand for preservative-free, high-quality frozen food drive growth. Australians prefer gluten-free and whole-grain pizza bases and plant-based protein with a balanced nutritional profile.

Increased vegan food festivals and growing supermarket shelf space for frozen plant-based food are also driving the industry. In addition, the international vegan trend's influence via social media is creating awareness and acceptance.

New Zealand is anticipated to develop at a CAGR of 7.3%. The nation is experiencing a flexitarian and vegan growth population in need of domestically produced, sustainable ingredients for the environment. People prefer easy labeling, and they prefer fewer processes and organic fruits and vegetables.

Premiumization is a dominant trend in New Zealand as consumers seek hand-made, gourmet-style frozen pizzas made with indigenous ingredients like kumara (sweet potato) and locally produced plant-based cheeses. Supermarkets and specialist food retailers are increasing their ranges of vegan frozen foods, driven by growing demand for ethical and health-focused meal solutions.

| Segment | Value Share (2025) |

|---|---|

| Conventional(By Nature) | 78% |

In 2025, the industry is expected to be led by Conventional products with a whopping 78% of the market share, while Organic products will account for the remaining 22% of the market share.

The Conventional segment will dominate its market, following lower pricing, wider availability, and acceptance of flavor profiles of conventional products. Popular Pizza brands such asDiGiorno and Freschetta, who design vegan pizzas to replicate classic pizza offerings, successfully draw a mass following.

Conventional vegan pizzas typically feature processed plant-based cheese and meat substitutes, made to taste and feel like the real stuff, and are attractive for both vegans and flexitarians. This division is also propelled by escalating customer demand for plant-derived substitutes without sacrificing taste and convenience.

Organic food is a small but increasing share of the market, accounting for just 22% of the total market share, and all over the globe, clean-label corresponding food is on the rise. Organic vegan pizzas appeal to purchasers who are focused on socially responsible and health-conscious choices because of their certification with organic ingredients grown without the use of pesticides and synthetic fertilizers.

Brands such as Amy's Kitchen have been an early mover in this category of organic vegan pizza, with high-end pizzas that contain high-value ingredients that keep with health-conscious and environmentally conscious lifestyles.

The growth of both segments is expected to continue, but the major volumes will be through conventional options. At the same time, organic products will gain traction with rising demand for healthier and environmentally friendly options.

| Segment | Value Share (2025) |

|---|---|

| Tubs(By Packaging Type) | 65% |

In 2025, Tubs are anticipated to lead the packaging scenario in the Vegan Frozen Pizza Market with approximately 65% of the total share, followed by Jars with about 20%.

The Tubs segment is expected to lead mainly because of convenience and practical usage. Tubs are mostly used for bulk or family-sized packages, which are the reasons why they appeal more to consumers looking for good value and large portions. This package format is also the easiest to store or transport, benefiting both retailers and consumers.

Tub packaging is now being used for Ben&Jerry's frozen pizzas, which can easily attract both small households and families. Such high shares reaffirm the importance of this type of package for frozen food products, which also offer easy use and flexibility.

The Jars segment has developed its niche and captured about 20% of the market share, meeting emerging demand for gourmet classifieds, artisanal, and specialty pizza types. With jars mostly for premium products, they are most likely gourmet vegan pizzas or artisan pizzas made with special ingredients. Some small-label brands might utilize jar packaging as a quality-inspiring factor to separate themselves in the competitive landscape.

Nonetheless, both packaging types are poised for growth, with tubs remaining stable in their larger share because of convenience and low cost, while jars occupy the higher share.

Growth is rapid due to the demand for plant-based and convenient meal solutions. Among the active players are Amy's Kitchen, Daiya Foods, Sweet Earth Foods, The White Rabbit Pizza Co., and Tofurky Company, who compete through product innovation and expanded distribution, along with sustainability efforts.

Product innovations accentuate flavors, textures, and nutrients. Brands develop plant-based cheese substitutes, high-protein crusts, and clean-label toppings. Daiya Foods has introduced its melty plant-based mozzarella, which would help bring its name in dairy-free cheese to that of melt-in-your-mouth. Sweet Earth’s know-how within Nestlé in plant-based proteins allows it to present unique toppings in its protein-rich vegan pizzas.

This entails augmenting the distribution channels. Companies increase availability through supermarkets, grocery chains, health food stores, and online businesses. For instance, Amy's Kitchen has developed strong retail partnerships to gain premium shelf space in major supermarket outlets. For example, The White Rabbit Pizza Co. is a UK brand that plans to target European expansion via mainstream grocery chains.

Sustainability and ethical sourcing are also quite important factors. Consumers are turning much trade towards responsibly sourced ingredients, earth-friendly packaging, and carbon-neutral production. To mention only one example, Tofurky Company makes a continuum between organic and non-GMO ingredients while also being very compliant with ethical business practices.

More and more intense is the space for competition, where brands would use their respective digital marketing strategies, influencer collaborations, and targeted advertisements to showcase unique selling propositions, taking examples from gluten-free, high-protein content to gourmet plant-based. It is expected to show great progress because of perpetual innovation and consumer shift towards sustainable, convenient plant-based foods.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amy's Kitchen | 18-22% |

| Daiya Foods | 15-18% |

| Sweet Earth Foods | 12-16% |

| The White Rabbit Pizza Co. | 8-12% |

| Tofurky Company | 6-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amy's Kitchen | Leading in organic, non-GMO frozen pizzas, focusing on classic plant-based flavors. |

| Daiya Foods | It specializes in vegan cheese pizzas and is known for its melty, allergen-free dairy alternatives. |

| Sweet Earth Foods | Offers high-protein, nutrient-dense pizzas featuring plant-based meats and superfood ingredients. |

| The White Rabbit Pizza Co. | Targets the gluten-free and allergen-friendly segment with handcrafted, premium pizzas. |

| Tofurky Company | Expanding into meat-alternative toppings, emphasizing protein-rich, soy-based formulations. |

Key Company Insights

Amy's Kitchen (18-22%)

A pioneer in organic and non-GMO frozen pizzas, widely available across major grocery retailers.

Daiya Foods (15-18%)

Renowned for its dairy-free cheese innovation, ensuring authentic pizza texture and taste.

Sweet Earth Foods (12-16%)

Focused on plant-based protein toppings, positioning itself as a nutrient-dense pizza brand.

The White Rabbit Pizza Co. (8-12%)

Gaining traction with handcrafted, gluten-free pizzas, appealing to health-conscious consumers.

Tofurky Company (6-10%)

Known for its soy-based plant proteins, expanding its presence in the frozen pizza segment.

Other Key Players (30-40% Combined)

The segmentation is into organic and traditional frozen pizzas, with traditional leading the segment due to affordability and broader consumer availability.

The segmentation is into jars, tubs, and tins, with the most sought-after being tubs due to convenience, longer durability, and suitability for storage.

The segmentation is into offline and online channels, with online sales observing good growth driven by rising e-commerce penetration and doorstep delivery demand from consumers.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The industry is expected to reach USD 1,023.9 million in 2025.

The market is projected to grow to USD 2,537.6 million by 2035.

China is expected to experience significant growth with a 10.1% CAGR during the forecast period.

The Conventional segment is one of the most popular categories.

Leading companies include Amy's Kitchen, Daiya Foods, Sweet Earth Foods, The White Rabbit Pizza Co., Tofurky Company, Blackbird, American Flatbread, Tattooed Chef, Oggi Foods, and Green Common.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Crust Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Crust Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Toppings, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Toppings, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Size Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Size Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Crust Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Crust Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Toppings, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Toppings, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Size Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Size Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Crust Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Crust Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Toppings, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Toppings, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Size Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Size Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Crust Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Crust Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Toppings, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Toppings, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Size Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Size Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Crust Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Crust Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Toppings, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Toppings, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Size Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Size Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Crust Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Crust Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Toppings, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Toppings, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Size Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Size Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Crust Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Toppings, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Size Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Crust Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Crust Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Crust Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Crust Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Toppings, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Toppings, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Toppings, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Toppings, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Size Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Size Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Size Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Size Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Crust Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Toppings, 2023 to 2033

Figure 28: Global Market Attractiveness by Size Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Crust Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Toppings, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Size Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Crust Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Crust Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Crust Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Crust Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Toppings, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Toppings, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Toppings, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Toppings, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Size Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Size Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Size Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Size Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Crust Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Toppings, 2023 to 2033

Figure 58: North America Market Attractiveness by Size Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Crust Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Toppings, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Size Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Crust Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Crust Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Crust Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Crust Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Toppings, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Toppings, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Toppings, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Toppings, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Size Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Size Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Size Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Size Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Crust Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Toppings, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Size Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Crust Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Toppings, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Size Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Crust Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Crust Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Crust Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Crust Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Toppings, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Toppings, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Toppings, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Toppings, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Size Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Size Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Size Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Size Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Crust Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Toppings, 2023 to 2033

Figure 118: Europe Market Attractiveness by Size Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Crust Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Toppings, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Size Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Crust Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Crust Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Crust Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Crust Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Toppings, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Toppings, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Toppings, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Toppings, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Size Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Size Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Size Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Size Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Crust Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Toppings, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Size Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Crust Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Toppings, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Size Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Crust Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Crust Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Crust Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Crust Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Toppings, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Toppings, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Toppings, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Toppings, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Size Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Size Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Size Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Size Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Crust Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Toppings, 2023 to 2033

Figure 178: MEA Market Attractiveness by Size Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Pizza Crust Market Analysis by Ingredient, Type, Distribution Channel, Application and Region through 2035

Frozen Pizza Market Growth - Consumer Preferences & Industry Expansion 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA