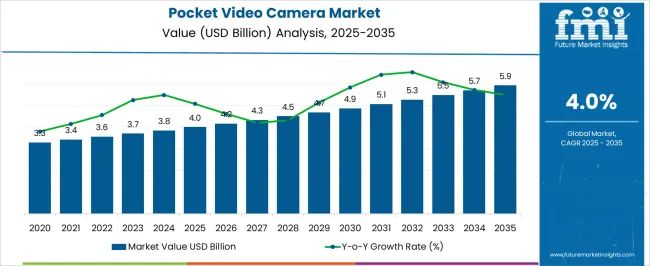

The Pocket Video Camera Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Pocket Video Camera Market Estimated Value in (2025E) | USD 4.0 billion |

| Pocket Video Camera Market Forecast Value in (2035F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The pocket video camera market is experiencing steady traction fueled by increasing content creation trends, demand for portable media devices, and consumer preference for high quality imaging in compact formats. With the rise of digital influencers, travel vloggers, and mobile journalists, the demand for lightweight recording devices that deliver professional quality video has expanded.

Technological advancements in sensor resolution, stabilization, and wireless connectivity have further elevated the appeal of pocket video cameras across user categories. Consumers are seeking devices that balance performance, portability, and aesthetics, which is encouraging innovation in materials and design.

The market is also benefitting from lifestyle shifts toward adventure sports, remote work documentation, and on the go content sharing. As digital storytelling becomes more mainstream, the pocket video camera continues to position itself as a versatile and performance driven tool, particularly among prosumer and enthusiast communities.

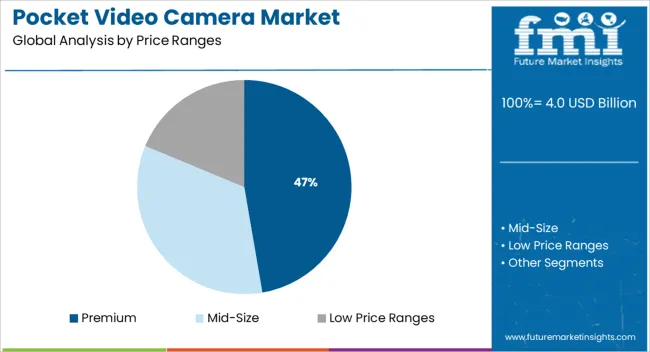

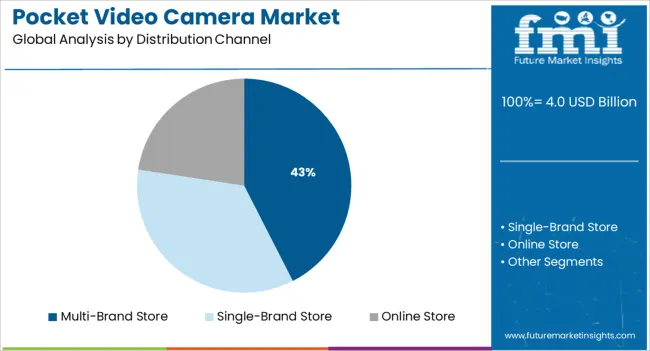

The market is segmented by Price Ranges and Distribution Channel and region. By Price Ranges, the market is divided into Premium, Mid-Size, and Low Price Ranges. In terms of Distribution Channel, the market is classified into Multi-Brand Store, Single-Brand Store, and Online Store. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The premium price range segment is expected to contribute 47.30% of the total market revenue by 2025, establishing it as the leading pricing category. This dominance is supported by growing consumer interest in high specification features such as 4K resolution, advanced stabilization, enhanced low light performance, and seamless device integration.

Buyers in the premium range are typically professionals, content creators, or tech enthusiasts who prioritize build quality, brand reliability, and additional smart features. The ability to deliver cinema grade footage in a pocket sized form factor has further strengthened demand in this segment.

Additionally, manufacturers are focusing on differentiating through design, durability, and post purchase service, which adds value to premium offerings. As content quality becomes central to online engagement, users are increasingly willing to invest in high end devices, making this the most lucrative price category.

The multi brand store segment is projected to hold 42.50% of total market revenue by 2025, making it the leading distribution channel. This growth is attributed to the consumer preference for physical evaluation of camera features and direct interaction with sales professionals before purchase. These retail environments offer a diverse portfolio of brands and models, enabling buyers to compare specifications and access promotions or bundled accessories.

The presence of knowledgeable staff also enhances buyer confidence, especially in the premium product category. Additionally, multi brand stores serve as experiential zones where consumers can test video quality, ergonomics, and usability.

Their ability to offer personalized buying experiences and after sales services has reinforced their relevance, particularly among consumers making higher value purchases. As the market continues to evolve with new product launches and feature upgrades, multi brand retail remains a dominant and trusted distribution channel.

The pocket video camera market’s growth prospects were greatly hampered by the popularity of smartphones in the market starting in 2007, with the introduction of the iPhone. However, there has been a recent attempt to revive the industry through the use of cutting-edge technologies. Furthermore, with greater awareness and openness to adopting new technology, the market is expected to cater to a wider customer base in the coming years.

Lack of proper awareness regarding the varied applications of pocket video cameras is a major restraint to market growth. The majority of consumers still prefer smartphones for regular videography or high-end digital cameras for filmography. Yet, by spreading awareness through advertising campaigns, the market could break into an untapped consumer base. These include YouTubers, vloggers, and others who publish their content regularly on the internet in the form of videos. Further, due to the increasing quality of the cameras, they could find wide applications for scientific journalling or in research laboratories.

Also, with increasing prices of high-end digital cameras, pocket video cameras could become a feasible alternative if marketed properly.

With rising demand for light, portable cameras, many industry giants are diverting investments to compact camera manufacturing. For instance, SONY launched the RX100, which is a compact pocket camera with an enhanced 1-inch sensor class.

Awareness and access to the latest product launch, along with high disposable income in the developed nations of the North American regions, have made it the largest regional market for pocket video cameras. Consumers in the region are more open to adopting and testing the latest technologies.

Prominence of Smartphone and Digital Camera

The demand for pocket camcorders is constantly declining against the growing use of digital cameras and smartphones, which have gained a firm hold within the market. Although relatively lower prices and superior optical zoom remain the camcorders’ strong fortes, the emergence and widespread acceptance of the other two are expected to continue grasping more market size, contrary to camcorders.

High Video Quality Remains Secondary

According to FMI’s market research, a majority of the population that has been using a smartphone for photography as well as video recording,does not prioritise high resolution quality as long as their mobile devices allow quick capturing, easy editing and manipulation, and convenient sharing.This in turn is expected to curb the demand for camcorders in the forecast period as well.

Relatively Lower Prices

The average price of a pocket camcorder ranges between USD 100 and USD 300, which is a key driver expected to sustain its demand in the market. The prices are much lesser compared to digital camera and smartphone.

Rising technology advancements

Leading pocket video camera manufacturers have been introducing various advanced technologies to the market, which aim at providing unparalleled video quality, sharing options, and enhanced features. This could be a stimulant to the demand for camcorders during the forecast period.

Superior Optical Zoom

Compact size and exceptional optical zoom have played a key role in popularising pocket camcorders. While smartphones and digital cameras successfully took over pocket video cameras in terms of compact size, pocket camcorders maintain their optical zoom superiority in the market, which is projected to compel consumers to buy dedicated camcorders, in contrast to the other two.

FMI’s report on the global pocket video camera market offers a 10-year forecast based on the segmentation of the market based on the product size and application.The market is further sub-segmented according to commercial areas, consumer segment, and others.

Apart from this, the global pocket video camera market is also divided on the basis of various price ranges such as premium, mid-size, and low price ranges. The market is further bifurcated on the basis of distribution channel, including multi-brand store, single-brand store, and online store.

Geographically, the global pocket video camera industry is divided by major regions, including North America, Latin America, Western and Eastern Europe, Asia-Pacific excluding Japan, Japan,and Middle Eastand Africa.North America accounts for a major market share for pocket and flip camcorders, and is predicted to maintain a considerable market size on a global level.

Pocket camera manufacturers can invest in web services, which would be complementary to photos or videos, allowing for innovative hardware capabilities, and enhanced features to cater to evolving consumer interests.

The key players identified to capture significant market shares in the global pocket video camera market include Sony Corporation, JVC Corporation, Panasonic, GoPro, Kodak,Cisco, Contour Inc., and Xiaomi. Sony and JVC remain the most sought after brands among pocket camera consumers.

Most of the leading market brands are focusing on innovative product development and brand reinforcement, which is anticipated to push the sales of pocket camera recorders in the near future. Launching of superior pocket video camera models offering ultra-HD video quality, easy shareability, and quick editing feature is expected to reevaluate the pocket camcorders market over the forecast period 2020 to 2029.

If the market continues to decline during the forecast period, major brands such as Sony, Canon, and Samsung might not have to face a major impact, as their adjuvant businesses will continue to bring in significant profits. However, the downfall of the pocket camcorder market will certainly pose a major influence on Nikon, being the only player that capitalises exclusively on cameras.

The report is a compilation of first-hand information,qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends,macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global pocket video camera market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the pocket video camera market is projected to reach USD 5.9 billion by 2035.

The pocket video camera market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in pocket video camera market are premium, mid-size and low price ranges.

In terms of distribution channel, multi-brand store segment to command 42.5% share in the pocket video camera market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pocket Tissues Market Size and Share Forecast Outlook 2025 to 2035

Pocket Containers Market Size and Share Forecast Outlook 2025 to 2035

Pocket Flask Market

Pocket Pedometers Market

Pocket Ventilation Systems Market

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Video Telematics Market Size and Share Forecast Outlook 2025 to 2035

Video Content Management Market Size and Share Forecast Outlook 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Walls Market by Component, Display Technology, Industry, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Video Doorbell Market by Product Type, End User, Sales Channel, and Region - Growth, Trends, and Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA