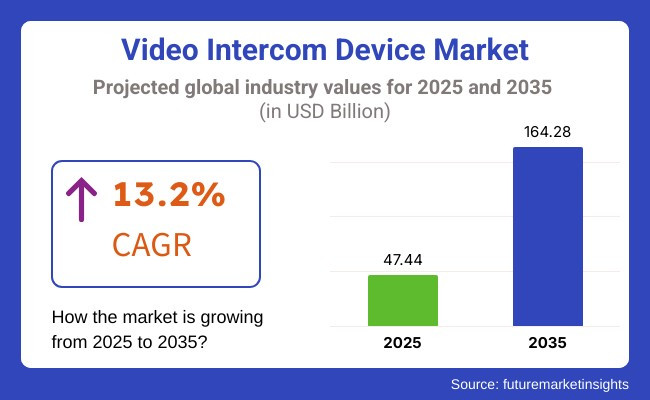

The Video Intercom Device Market will grow substantially between 2025 and 2035, fueled by increasing demand for smart home security, AI-driven surveillance, and IoT-based communication systems. The market is expected to reach USD 47.44 billion in 2025 and grow to USD 164.28 billion by 2035, with a compound annual growth rate (CAGR) of 13.2% during the forecast period.

As security concerns and smart building adoption continue to rise, markets are becoming essential for residential, commercial, and industrial applications. The convergence of cloud-based video surveillance, artificial intelligence-based facial recognition, and mobile app integration is further strengthening security and convenience. On top of that, advancements in wireless communication, touchless authentication, and real-time remote monitoring are fueling the growing adoption across smart city infrastructures.

In addition, the emerging use of biometric authentication, voice authentication, and encrypted video transmission is redefining the scenario. With an increasing emphasis on seamless integration with smart home ecosystems and industrial automation, manufacturers are developing high-definition, cloud-connected, and AI-enhanced intercom solutions.

The Video Intercom Device industry is developing quickly due mainly to the rise in the adoption of smart homes, the demand for security, and the progress of new technologies in AI and IoT. Residential users show great interest in features like high-definition video, remote access through smartphones, and easy integration with the smart home system.

Instead, in commercial buildings, the need for multi-user access, scalability, and improved connectivity for office complexes and retail units reveals security management requirements. In industrial facilities, the focus is on the development of reliable, economical products that are characterized by high durability and integrated with access control systems.

The government and public infrastructure sectors are looking for security features that have higher specifications. They also suggest tools such as real-time monitoring and a secure multi-point communication system to be used for law enforcement and emergency responses. Along with the emergence of wireless, AI-driven facial recognition systems, and cloud-based technologies, the industry is poised for further development, thereby addressing different security and communication requirements.

| Company | Contract Value (USD Million) |

|---|---|

| Aiphone | Approximately USD 30 - 40 |

| Hikvision | Approximately USD 40 - 50 |

| Panasonic | Approximately USD 50 - 60 |

| Comelit Group | Approximately USD 35 - 45 |

| Akuvox | Approximately USD 25 - 35 |

In 2024 and early 2025, the industry experienced steady growth driven by the increasing demand for enhanced security and communication solutions in residential, commercial, and smart city applications. Leading companies such as Aiphone, Hikvision, Panasonic, Comelit Group, and Akuvox have secured significant contracts and strategic partnerships, underscoring the industry's commitment to innovation, improved access control, and seamless integration of digital communication technologies.

Between 2020 and 2024, the video intercom device market expanded significantly, driven by growing demand for smart home security, commercial surveillance, and contactless access control. The integration of AI-powered facial recognition, cloud-based video storage, and mobile app connectivity enhanced the functionality of video intercom systems.

The rise of IoT-enabled smart buildings and multi-tenant residential complexes fueled adoption, while businesses and institutions deployed video intercoms for secure visitor management. The COVID-19 pandemic accelerated demand for touchless access solutions, boosting innovations in voice-activated and AI-driven authentication. However, cybersecurity vulnerabilities, high installation costs, and interoperability issues with legacy systems remained key challenges.

Between 2025 and 2035, the industry will evolve with AI-enhanced security, 6G connectivity, and decentralized identity management. AI-powered real-time threat detection and predictive analytics will improve security monitoring. Blockchain-backed authentication and biometric access control will enhance privacy and security in smart buildings.

Ultra-fast, low-latency 6G networks will enable high-definition, real-time video communication with seamless integration into smart city infrastructure. Sustainability will drive the development of energy-efficient, solar-powered video intercom systems, ensuring long-term reliability and reduced environmental impact.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter regulations (GDPR, CCPA) required video intercom manufacturers to enhance encryption, secure cloud storage, and comply with data privacy laws. | AI-driven, blockchain-secured video intercom systems ensure real-time compliance, decentralized identity authentication, and tamper-proof video logging for residential and commercial security. |

| AI-powered intercoms integrated facial recognition and motion detection to improve security, automate access control, and reduce unauthorized entries. | AI-native, real-time facial recognition intercoms enable adaptive authentication, gesture-based access control, and AI-powered anomaly detection for next-gen security solutions. |

| Video intercoms are integrated with smart home ecosystems, allowing seamless automation with security cameras, door locks, and lighting. | AI-enhanced, IoT-connected intercom networks autonomously optimize security workflows, detect suspicious activity, and provide real-time voice-assisted access management. |

| Wireless video intercoms with cloud storage and remote access via mobile apps became standard for residential and commercial security. | AI-powered, cloud-native intercom platforms enable ultra-secure, decentralized video storage, real-time AI voice recognition, and autonomous visitor verification. |

| AI-driven noise cancellation and voice processing enhanced communication clarity in noisy environments. | AI-integrated, real-time voiceprint authentication and multilingual translation features provide frictionless, high-security interactions for global smart buildings. |

| Faster network speeds improved video clarity, reduced lag, and enabled seamless two-way communication in real-time. | AI-enhanced, 6G-powered video intercoms provide ultra-HD holographic communication, real-time threat detection, and seamless AI-assisted visitor interactions. |

| AI-driven security frameworks protected video feeds against hacking attempts and unauthorized access. | AI-native, quantum-secure encryption ensures real-time, tamper-proof communication, decentralized access logs, and self-healing cybersecurity defenses for smart buildings. |

| Video intercoms became compatible with Alexa, Google Assistant, and Siri for hands-free operation. | AI-enhanced, predictive voice control systems enable conversational AI-powered access management, intent-based intercom automation, and AI-driven guest recognition. |

| Manufacturers focused on low-power, solar-powered, and battery-efficient video intercom solutions to enhance sustainability. | AI-optimized, self-sustaining video intercoms leverage energy harvesting, adaptive power management, and carbon-neutral manufacturing for next-gen eco-friendly smart buildings. |

| Video intercom systems were increasingly deployed in smart city infrastructure for public safety, secure access, and real-time monitoring. | AI-driven, decentralized smart city intercom networks autonomously detect security threats, enable intelligent crowd management, and provide AI-optimized emergency response coordination. |

The Video Intercom Device Market has been affected by technological triumphs, cybersecurity, and supply chain vulnerabilities, as well as regulatory compliance and competition involving the smart home ecosystems.

A major perils surround technological evolution. The rapid development of smart home automation and AI systems for security reasons makes the classic video intercom systems nearly useless. Typically, manufacturers have to include elements such as facial recognition, cloud storage, and IoT connectivity consistently in the operation of new products in order to keep their position.

A key issue is related to cybersecurity threats. The Video intercom devices designed to be attached to the internet or cloud networks turn out to be prone to password cracks, data breaches, and unauthorized access. It is possible for weak encryption protocols or poor firmware security to expose users to privacy risks, which, in return, might tarnish the company's image and cause it to face subsequent legal ramifications.

Fewer semiconductors, camera modules, and networking components would basically result in a shortage of materials or delay in productions that would cost more since it is the result of a supply chain disruption. Different geopolitical issues, raw material shortages, and problems with logistics are some of the factors that will stunt growth.

In order to manage the adverse effects of such risks manufacturers can prioritize cyber security, regulatory compliance, create robust supply chains and lastly, be innovative which will result in product differentiation.

Video intercom device sales in the United States are expanding rapidly, driven by growing security concerns, the increasing adoption of smart home technologies, and the rise of AI-powered video intercom systems. Homeowners, businesses, and residential complexes are investing in video intercoms integrated with AI facial recognition, cloud-based monitoring, and mobile app connectivity to enhance security and convenience.

The Federal Communications Commission (FCC) and leading security technology firms are investing in AI-powered two-way communication, wireless video intercom solutions, and real-time visitor authentication. Additionally, the surge in IoT-enabled home automation, multi-unit residential security systems, and cloud-based access control is fueling growth.

Leading companies such as Ring (Amazon), Aiphone, and Honeywell are developing AI-powered intercoms, smart doorbell cameras, and biometric-based video communication solutions to optimize security and user experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.9% |

The video intercom device market in the United Kingdom is experiencing steady growth, fueled by increasing demand for AI-driven access control, rising adoption of smart residential security systems, and expanding commercial surveillance needs. Property developers and security firms are integrating advanced video intercoms with mobile access, remote monitoring, and AI-based threat detection.

The UK’s Department for Digital, Culture, Media & Sport (DCMS) is promoting AI-enhanced video communication, cybersecurity-integrated smart intercoms, and real-time visitor verification solutions. Additionally, cloud-based intercom management, voice-activated controls, and multi-resident video entry systems are reshaping the market landscape.

Key players such as Comelit Group, Hikvision, and Videx Security are investing in AI-powered facial recognition intercoms, cloud-based door entry systems, and real-time remote monitoring platforms to improve property security.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.6% |

The video intercom device market in the European Union is growing steadily, driven by EU-wide smart city projects, increasing adoption of AI-powered residential security systems, and demand for cloud-based intercom solutions. The EU’s Smart Security and Digital Transformation strategies are fostering innovative security solutions.

Countries such as Germany, France, and the Netherlands are leading in biometric-based intercoms, real-time video authentication, and AI-powered security analytics. The demand for IoT-integrated intercoms, AI-driven building access control, and voice-activated security devices is shaping the industry’s future.

Top security firms such as Fermax, Siedle, and ABB are investing in multi-user video intercoms, AI-enhanced video surveillance, and automated entry verification systems to improve safety and efficiency in residential and commercial spaces.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

The video intercom device market in Japan is evolving rapidly, supported by government-backed smart building initiatives, increasing adoption of AI-powered security devices, and demand for IoT-enabled residential security systems. Japan’s commitment to digital innovation and AI-powered automation is fueling video intercom adoption.

The Ministry of Internal Affairs and Communications (MIC) is investing in real-time AI-driven access control, cloud-integrated video monitoring, and next-gen security automation to enhance safety. Additionally, AI-powered facial authentication, smart video conferencing entry systems, and remote-access intercom solutions are becoming standard in modern residential and office buildings.

Japanese firms such as Panasonic, Toshiba, and Fujitsu are leading advancements in smart door entry systems, AI-assisted home security intercoms, and wireless video communication solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.5% |

The video intercom device market in South Korea is witnessing strong growth, driven by expanding smart city initiatives, increasing reliance on AI-powered home security, and rapid adoption of cloud-integrated intercom systems. The country’s focus on AI-driven access control and smart home automation is driving innovation in video intercom solutions.

The Ministry of Science and ICT (MSIT) is promoting real-time AI-powered video authentication, IoT-enabled residential security, and cloud-based video access control systems. Additionally, the demand for biometric-based door entry solutions, AI-powered remote surveillance, and next-gen video conferencing intercoms is growing rapidly.

Leading South Korean firms such as Samsung SDS, LG CNS, and Hyundai Telecom are investing in AI-enhanced intercom systems, smart building security automation, and high-resolution video communication solutions to optimize security and access management.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.0% |

The baby monitoring systems segment will have a decent 43.5% overall share by 2025. The increase in the demand for the safety of infants, the rise of nuclear families, and technological development in smart monitoring equipment are the reasons for growth. They also include AI-based sleep tracking, improved real-time health monitoring, and HD video capabilities so parents can more easily (and definitely!) monitor their babies from afar.

Technological advancements have further led to a growing interest in Wi-Fi-based baby monitors with end-to-end encrypted cloud storage, two-way comms, and real-time alerts. Nanit, Owlet, and other established brands are investing heavily in AI-powered monitoring features, including automatic sleep detection and regulation of temperature and motion.

The Nanit Smart Baby Monitor, for example, employs cutting-edge computer vision technology to monitor babies' breath patterns without wearables, which is good news for parents looking to double down on peace of mind.

However, the handheld baby monitoring devices segment is proliferating, accounting for ~56.5% of the total share in 2025 since these are portable, cheap, and easy to operate. For many parents, a dedicated standalone handheld monitor with a dedicated display is far more desirable-and reliable, low-latency, uninterrupted-than a smartphone app-based solution. That's why they are the most used in places where internet connection is weak or flaky; they provide secure, interference-free audio and video transmissions.

Others in this category include VTech and Philips Avent, telephones that combine long-range connectivity, lengthy battery life, and encrypted signal transmission. Completely free of interference from any other wireless devices, the Philips Avent DECT Baby Monitor has long-range and crystal-clear audio. These are portable vision checkers, plug-and-play; you don't need to set Wi-Fi, so they are commercially attractive.

The segment of the market is led by IP-based baby monitoring technology, which is projected to account for 55.2% of the market in 2025. The trend towards seamless connectivity across smart home ecosystems, AI-driven surveillance systems, and cloud-based remote property monitoring solutions is paving the way for these smart security systems to gain traction. IP-based monitors also combine high-definition video, two-way audio communication, real-time health analytics, and smartphone integration - features that the modern technology-friendly parent craves.

However, leading brands like Nanit, Arlo, and Google Nest are pouring resources into AI-driven monitoring systems that include features like motion detection, sleep tracking, and encrypted data transmission for added security. Some appliances (i.e., Arlo Baby Monitor) include `air-quality sensors, a music player, and night vision, which allows you to check in on your child at any time of day or under any lighting.

Despite the inundation of markets with IP-based and similar solutions, analog baby monitors still have a significant 44.8% market share as of 2025. Their continued popularity is largely due to cost, useability, and independence of broadband access (the latter being a popular choice for those in areas lacking quality broadband infrastructure).

Analog monitors are the most popular option for parents, with virtually no hacking risk, long transmission distances with low latency on the audio end. Brands like VTech and Philips Avent are also coming into their own in this area. Engineers of analog baby monitors that are more secure than ever have batteries that last longer, are immune from interference, and sound clearer.

The video intercom device market is expanding as security-conscious consumers and businesses embrace smart access control solutions. The rise of AI-powered facial recognition, high-definition video streaming, and wireless connectivity is reshaping how users manage entry points in residential, commercial, and industrial settings. Cloud-based intercom systems with smartphone integration are becoming the standard, allowing for remote monitoring and seamless communication.

Leading companies such as Aiphone Corporation, Honeywell International Inc., and Panasonic Corporation are driving innovation by integrating AI-enhanced security features, automation, and cloud-based access management. Axis Communications and Comelit Group S.p.A. further intensify competition with IP-based video intercoms and mobile-enabled security solutions. The market is also witnessing increased competition from emerging players focusing on advanced motion detection, biometric authentication, and encrypted communication.

As demand for smart home security and enterprise-level access control continues to rise, companies will differentiate through AI-driven analytics, interoperability with broader security ecosystems, and enhanced user-friendly interfaces. Advancements in AI-powered automation, cybersecurity enhancements, and seamless integration with IoT ecosystems will shape the future competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Aiphone Corporation | 20-25% |

| Honeywell International Inc. | 15-20% |

| Panasonic Corporation | 12-16% |

| Axis Communications | 10-14% |

| Comelit Group S.p.A. | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Aiphone Corporation | Develops AI-powered video intercoms with smart access control and remote monitoring. |

| Honeywell International Inc. | Specializes in high-definition video intercoms integrated with security automation. |

| Panasonic Corporation | Focuses on wireless, cloud-connected intercom systems with facial recognition. |

| Axis Communications | Innovates in IP-based video intercom solutions with advanced motion detection. |

| Comelit Group S.p.A. | Provides smart intercom devices with seamless smartphone integration and touchless entry. |

Key Company Insights

Aiphone Corporation (20-25%)

Aiphone leads the video intercom market with AI-driven security solutions, integrating access control and remote monitoring for residential and commercial use.

Honeywell International Inc. (15-20%)

Honeywell is transforming video intercom systems with high-definition video, AI-powered security features, and smart home automation integration.

Panasonic Corporation (12-16%)

Panasonic focuses on cloud-based, wireless intercom solutions, offering facial recognition and AI-powered access management for smart buildings.

Axis Communications (10-14%)

Axis is a pioneer in IP-based video intercom solutions, integrating motion detection, AI analytics, and remote access control for enterprises and smart homes.

Comelit Group S.p.A. (6-10%)

Comelit specializes in sleek, touchless video intercom devices, providing mobile-enabled security solutions for residential and commercial properties.

Other Key Players (20-30% Combined)

By product, the market is segmented into Baby Monitoring System, Handheld Device, and Door/Entrance System.

By technology, the market is categorized into IP-based and Analog-based video intercom systems.

By vertical, the market is divided into Government, Residential, Commercial, and Manufacturing/Industrial sectors.

By region, the market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is slated to reach USD 47.44 billion in 2025.

The industry is predicted to reach a size of USD 164.28 billion by 2035.

Key companies include Aiphone Corporation, Honeywell International Inc., Panasonic Corporation, Axis Communications, and others.

South Korea, driven by the increasing adoption of smart security solutions and technological advancements, is expected to record the highest CAGR of 11.0% during the forecast period.

Baby monitoring systems remain widely used due to the rising demand for child safety solutions in residential and commercial spaces.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Vertical, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Video Telematics Market Size and Share Forecast Outlook 2025 to 2035

Video Content Management Market Size and Share Forecast Outlook 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Walls Market by Component, Display Technology, Industry, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Video Doorbell Market by Product Type, End User, Sales Channel, and Region - Growth, Trends, and Forecast through 2035

Video Streaming Market Growth – Innovations, Trends & Forecast 2025-2035

Video on Demand (VoD) Service Market - Trends & Forecast through 2034

AI-Powered Video Streaming – Future of Digital Entertainment

Video Processing Platform Market Growth – Trends & Forecast 2024-2034

Video Encoder and Decoder Market

Video Converter Software Market

Video Management Software Market

Video Event Data Recorder Market Report – Trends & Forecast 2016-2026

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA