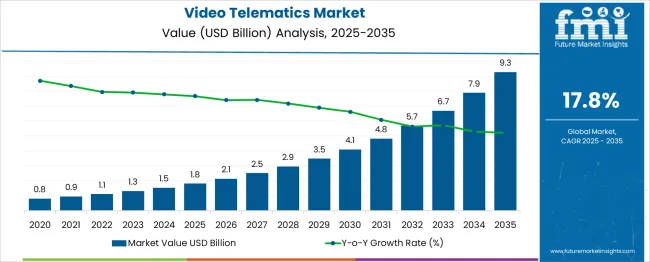

The Video Telematics Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 17.8% over the forecast period. An early vs late growth curve comparison highlights a clear acceleration pattern as adoption shifts from pilot deployments to full-scale integration. In the early phase (2025–2030), the market expands from USD 1.8 billion to USD 4.1 billion, adding USD 2.3 billion, or about 31% of total incremental growth, fueled by regulatory mandates for fleet safety, increasing focus on driver behavior monitoring, and the introduction of AI-enabled cameras for real-time incident detection.

This period emphasizes penetration in developed markets and compliance-driven adoption in logistics and passenger transport fleets. The late phase (2030–2035) contributes a significantly larger share, adding USD 5.2 billion as the market climbs to USD 9.3 billion, accounting for 69% of overall growth. This acceleration is driven by integration with ADAS, predictive analytics, and connected vehicle ecosystems, combined with cloud-based video storage and telematics-as-a-service models. Vendors prioritizing edge AI processing, scalable SaaS platforms, and advanced video analytics for risk mitigation will dominate during this late-stage surge as video telematics evolves into a critical component of intelligent transportation systems.

| Metric | Value |

|---|---|

| Video Telematics Market Estimated Value in (2025 E) | USD 1.8 billion |

| Video Telematics Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 17.8% |

The video telematics segment typically represents 25–28% of the connected vehicle and fleet telematics market, as video-based monitoring becomes a core component of fleet applications. Within the driver safety and risk management systems market, its share climbs to 30–32%, supported by AI-based analysis of driver behavior and incident detection. In the commercial vehicle surveillance and analytics market, video telematics contributes around 15–17%, integral for cargo monitoring, route compliance, and fleet efficiency tracking. Its share in the insurance telematics and usage-based risk assessment market stands at 12–14%, where insurers increasingly leverage dashcam data to reduce fraud and rate risk.

Within the smart transportation and logistics infrastructure market, video telematics occupies 8–10%, as live vehicle imaging integrates with logistics platforms and smart city systems. Rapid growth is driven by demand for real-time visibility, regulatory mandates on fleet safety, and insurer-driven adoption. Advances in high-resolution onboard cameras, edge‑based AI analytics, and cloud integration are boosting capability and reducing latency. Areas such as public transit, delivery logistics, and high-value transport are leading deployments, while cloud-based software subscriptions are increasingly monetized. As 5G connectivity proliferates and predictive analytics mature, video telematics is positioned as a foundational layer enabling safe, efficient, and data-powered transport infrastructure.

The Video Telematics market is undergoing rapid expansion, supported by the convergence of video analytics, GPS technology, and telecommunication networks. Organizations across logistics, transportation, and fleet management are increasingly implementing intelligent video-based solutions to improve safety, monitor driver behavior, and reduce operational risks. Rising concerns related to road safety, insurance fraud, and regulatory compliance have prompted accelerated investment in real-time video-enabled fleet monitoring systems.

The growing deployment of AI-powered cameras and edge computing within vehicle ecosystems has been instrumental in offering advanced insights, such as predictive maintenance and collision detection. Furthermore, commercial fleets are actively integrating video telematics to enhance performance metrics and reduce liability exposure.

With governments and insurers encouraging the adoption of video-based monitoring technologies, the demand for scalable, software-defined, and cloud-compatible systems is expected to increase substantially. As a result, the market is positioned for sustained growth, driven by a combination of technological innovation, regulatory momentum, and industry-wide demand for real-time intelligence..

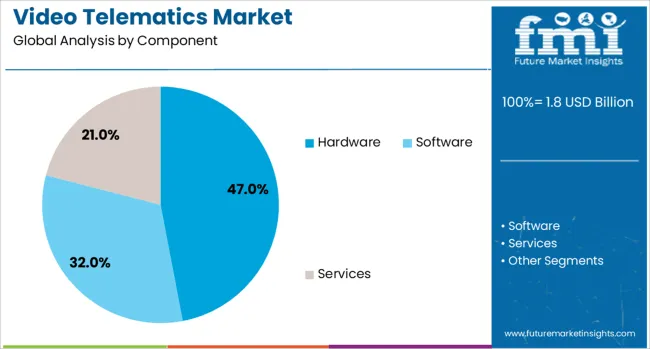

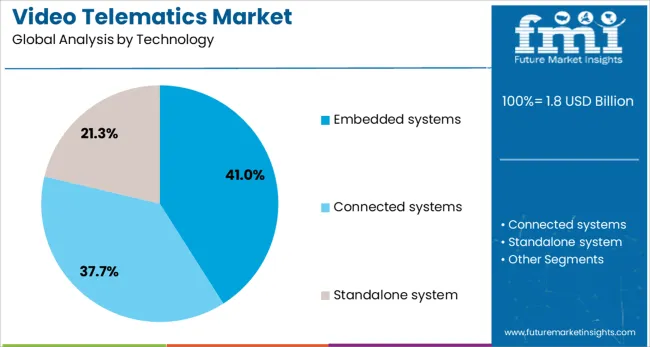

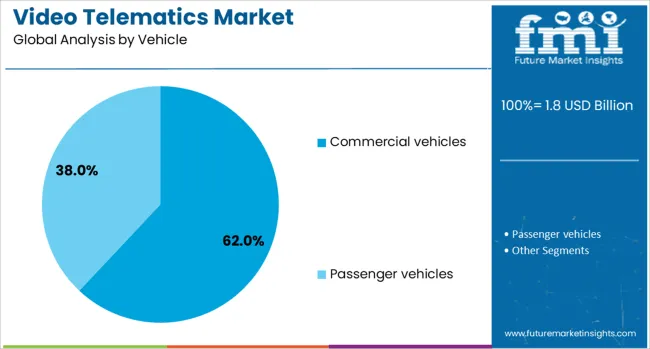

The video telematics market is segmented by component, technology, vehicle, application, end-use industry, and geographic regions. The video telematics market is divided into Hardware, Software, and Services. In terms of technology, the video telematics market is classified into embedded systems, Connected systems, and Standalone systems. The video telematics market is segmented into Commercial vehicles and Passenger vehicles. The video telematics market is segmented into Driver & fleet management, Predictive maintenance, Insurance telematics, Asset tracking, and Law enforcement. The video telematics market is segmented by end-use industry into Transportation & logistics, Construction, Healthcare, Retail, Government & public safety, Oil & gas, and Utilities. Regionally, the video telematics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is expected to account for 47% of the Video Telematics market revenue share in 2025, establishing it as the leading component segment. The dominance of hardware in this market has been driven by the increasing demand for high-definition cameras, sensors, and onboard data processing devices that provide real-time video and telemetry capture. Commercial and industrial fleet operators have prioritized investments in physical devices to ensure continuous and reliable data collection under various driving conditions.

Hardware solutions such as multi-camera systems, in-cab monitors, and ruggedized equipment have enabled businesses to enhance driver accountability and reduce accident-related costs. Moreover, hardware infrastructure has served as the foundation for advanced functionalities, including real-time alerts, driver coaching, and video evidence archiving.

While software continues to evolve, the irreplaceable role of robust, field-deployable hardware in ensuring data fidelity and operational uptime has sustained its market leadership. As fleet sizes grow and demand for compliance intensifies, hardware investment is expected to remain a critical enabler of effective video telematics implementation..

The embedded systems segment is projected to contribute 41% of the Video Telematics market revenue share in 2025, making it the foremost technology type. Growth in this segment has been primarily attributed to its ability to integrate video processing, telemetry, and analytics capabilities within a compact and dedicated platform. Embedded systems have enabled faster data handling at the edge, reducing latency and improving the quality of decision-making in real time.

Their seamless integration into vehicle architecture has facilitated features such as live streaming, event-based recording, and automated driver assistance, all without relying heavily on external computing resources. Additionally, the energy efficiency and cost-effectiveness of embedded systems have supported widespread adoption across both small and large fleet operators.

With the push toward autonomous vehicle capabilities and connected mobility infrastructure, embedded systems have emerged as essential enablers of scalable and intelligent telematics architectures. Their adaptability to support various sensors and modules has further contributed to their market leadership position..

The commercial vehicles segment is estimated to dominate with 62% of the Video Telematics market revenue share in 2025, positioning it as the largest vehicle category. This leadership is driven by the widespread integration of video telematics in delivery trucks, buses, logistics carriers, and service fleets, all of which operate under high regulatory scrutiny and performance pressure. The necessity to monitor driver behavior, ensure cargo security, and minimize insurance liability has led to heightened investment in video-enabled solutions.

Fleet operators have adopted video telematics to gain visibility into real-time operations, reduce accidents, and optimize route efficiency. The commercial vehicle segment has also benefited from insurance incentives and compliance mandates that require accurate video documentation of incidents.

Moreover, the scalability of video telematics solutions has allowed commercial fleets to implement advanced analytics, fuel optimization, and safety scoring systems. As urbanization and e-commerce logistics continue to rise, the demand for intelligent video solutions in commercial transport has reinforced this segment’s commanding market share..

Video telematics combines onboard video recording with vehicle tracking and analytics to support fleet safety, driver coaching, and incident documentation. These systems are deployed by fleet operators, logistics companies, public transport agencies, and insurance providers. Demand has been propelled by interest in driver behavior monitoring, accident reduction, and regulatory compliance. OEMs offering hardware-integrated dash cameras, event-triggered recording, and cloud-based video review platforms have gained traction. Systems enabling remote access to footage, alerts for critical events, and integration into fleet management interfaces continue to guide deployment decisions in service, transit, and commercial sectors.

Corporate fleet owners and logistics operators have prioritized implementation of video telematics to enhance driver safety and reduce incident-related costs. Footage collected from onboard cameras during harsh driving events is used for behavior analysis, coaching, and exoneration in claims disputes. Real-time alerts help detect harsh braking, lane departure, or distracted behavior to promote corrective training. Video-recorded evidence supports regulatory reporting and liability protection. Insight into route usage, idle time, and driver performance metrics also optimizes fleet productivity. Fleet managers favor systems that support multi-camera setups, live view, and recorded event tagging for post-trip review and compliance tracking.

Implementation has been limited by concerns around handling large volumes of video data and associated storage costs. Onboard network bandwidth usage and video transmission may strain LTE or 5G connections, especially in remote areas. Ensuring data security and driver privacy compliance adds software overhead and policy enforcement responsibility. Equipment installation may require integration with vehicle electrical systems, increasing hardware and labor complexity. Requirement for secure cloud hosting and encryption techniques further raises operational cost. Smaller fleets may shy away due to upfront investment in camera hardware, telematics modules, and training for analysis platform use, slowing broader deployment across operators.

Opportunities are emerging through deployment of bundled services offering video telematics integration with behavior coaching programs, telematics-based risk scoring, and insurance premium discounts. Partnerships with insurers to supply video-based risk analytics and loss prevention tools support value-added deployment. Subscription models offering hardware rental and storage services make adoption accessible to operators with limited capital. Expansion into last-mile delivery, ride-share, and light commercial fleets presents new usage contexts. Integration with advanced driver-assistance systems (ADAS) and driver-facing cameras offers potential for predictive safety alerts. Centralized platforms offering aggregated fleet insights and benchmarking across safety events push systems toward recurring value creation.

Machine learning is being used to analyze driver posture, eyelid behavior, and road object recognition for proactive safety insights. Multi-view camera systems providing interior and exterior coverage are gaining traction. Automated redaction tools are supporting privacy compliance by obscuring faces and license plates. Event detection algorithms that trigger video capture during collisions, abrupt maneuvers, or fatigue indicators enable automatic record save. Real-time dashboard visualization of scored driver behavior, harsh events, and fleet trends supports management oversight. Integration with predictive analytics platforms and incident reconstruction tools enables streamlined follow-up. Edge-based inference processing reduces bandwidth requirements and speeds anomaly alerts in live operations.

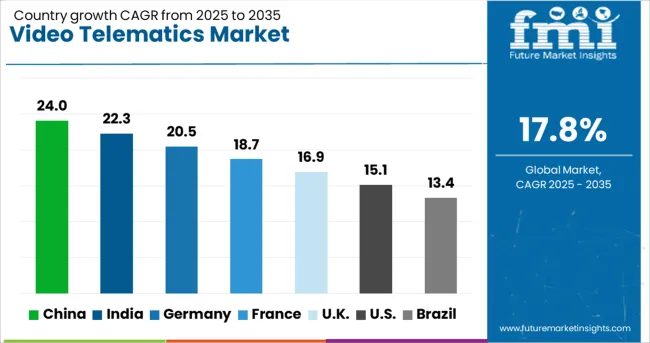

| Country | CAGR |

|---|---|

| China | 24.0% |

| India | 22.3% |

| Germany | 20.5% |

| France | 18.7% |

| UK | 16.9% |

| USA | 15.1% |

| Brazil | 13.4% |

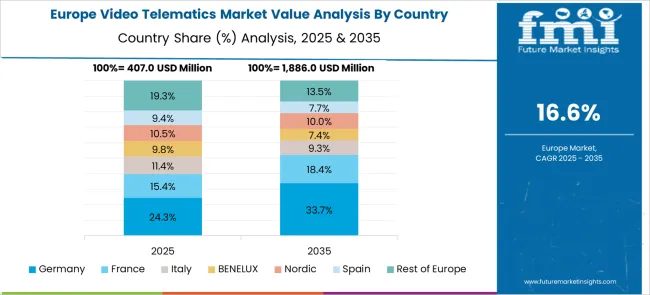

The video telematics market is projected to expand at a CAGR of 17.8% from 2025 to 2035, driven by the growing need for fleet safety, driver behavior monitoring, and AI-enabled video analytics. China leads with 24.0%, supported by rapid adoption in logistics and urban delivery networks. India follows at 22.3%, driven by the growth of e-commerce fleets and smart transportation programs. Among OECD economies, France records 18.7%, the United Kingdom posts 16.9%, and the United States grows at 15.1%, reflecting strong demand for integrated telematics platforms in commercial transport and connected vehicle solutions. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to post a CAGR of 24.0% through 2035, driven by government-mandated safety standards and large-scale fleet digitization projects. Logistics operators and last-mile delivery companies are investing heavily in AI-enabled video systems for real-time driver monitoring and risk assessment. Domestic tech firms are introducing integrated solutions combining video, GPS, and telematics data for predictive maintenance and route optimization. Increased adoption in ride-hailing and smart city transportation programs further accelerates demand. Partnerships between telematics companies and OEMs enable factory-fitted solutions, ensuring compliance and operational efficiency in diverse vehicle categories.

India is projected to achieve a CAGR of 22.3% through 2035, supported by the expansion of logistics networks and regulatory push for vehicle safety systems. E-commerce and on-demand delivery platforms are driving adoption of video telematics for fleet visibility and loss prevention. Startups and established telematics providers are introducing affordable subscription-based models tailored for SMEs. Growth in electric mobility fleets and shared transport services further supports integration of video telematics for security and operational insights. Government initiatives promoting digital fleet management through compliance frameworks also strengthen adoption across transport operators.

France is expected to record a CAGR of 18.7% through 2035, driven by rising investments in smart transportation systems and connected vehicle ecosystems. Commercial fleet operators are integrating dual-camera systems with AI-driven event detection to enhance road safety and comply with insurance requirements. Adoption of cloud-based telematics platforms is enabling real-time data analytics and predictive maintenance in logistics and public transport fleets. French technology providers are focusing on video-based driver training and compliance monitoring tools to meet EU safety directives. The market also benefits from the growing adoption of video telematics in ride-sharing and urban mobility programs.

The United Kingdom is forecasted to grow at a CAGR of 16.9% through 2035, supported by insurance-driven telematics adoption and regulatory measures for commercial fleets. Video telematics is increasingly being deployed in long-haul transportation, construction fleets, and urban delivery services to improve safety standards. Fleet operators are adopting integrated video and telematics platforms with real-time driver scoring systems. Growing emphasis on sustainability and fuel efficiency has accelerated demand for telematics analytics in electric and hybrid fleets. Partnerships between telematics firms and mobility service providers are promoting bundled solutions for fleet optimization.

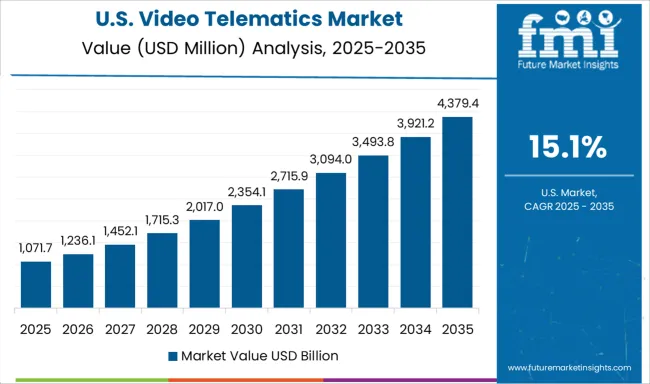

The United States is projected to grow at a CAGR of 15.1% through 2035, driven by strong adoption in logistics, ride-hailing, and school transportation systems. Fleet managers prioritize video-enabled telematics platforms for compliance with safety mandates and litigation risk reduction. Leading vendors are introducing AI-powered dashcams with real-time alert systems to monitor fatigue and distracted driving. Growth in autonomous delivery vehicles and EV-based fleets provides new opportunities for advanced telematics integration. The presence of major telematics solution providers ensures innovation in edge AI processing and cloud-based analytics.

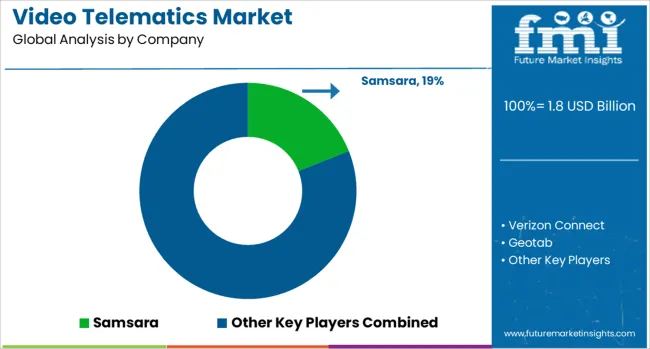

The video telematics market features strong competition among major players such as Samsara, Verizon Connect, Geotab, Lytx, Trimble Inc., and Omnitracs, each offering solutions aimed at improving fleet safety, operational visibility, and compliance. Samsara holds a leading position with its AI-powered platform that integrates video telematics, real-time GPS tracking, and predictive analytics to prevent accidents and support driver training.

Verizon Connect combines HD dashcams with telematics systems to enhance monitoring, driver performance evaluation, and incident reporting. Geotab focuses on providing open-platform video solutions integrated with fleet management tools, enabling third-party application compatibility. Lytx specializes in video-based safety programs, using machine vision and AI to identify risky behaviors and provide actionable insights for fleets. Trimble delivers enterprise-level solutions designed for large fleets requiring operational analytics, while Omnitracs strengthens its market presence with video-enabled compliance tools aimed at safety and regulatory adherence.

Competition revolves around advanced AI-driven video analytics, seamless integration with telematics platforms, and real-time data accessibility. Key differentiators include detection accuracy, cloud connectivity, and system scalability.

Market strategies emphasize partnerships with insurance companies for risk-based premium offerings, development of predictive safety solutions, and implementation of driver scorecard features to enhance accountability. Future demand will be driven by increasing fleet digitization, regulatory mandates, and adoption of connected vehicle technologies across logistics and transportation sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Component | Hardware, Software, and Services |

| Technology | Embedded systems, Connected systems, and Standalone system |

| Vehicle | Commercial vehicles and Passenger vehicles |

| Application | Driver & fleet management, Predictive maintenance, Insurance telematics, Asset tracking, and Law enforcement |

| End-use Industry | Transportation & logistics, Construction, Healthcare, Retail, Government & public safety, Oil & gas, and Utilities |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsara, Verizon Connect, Geotab, Lytx, Trimble Inc., and Omnitracs |

| Additional Attributes | Dollar sales by solution type (video dashcams, dual-facing cameras, advanced AI-enabled telematics platforms) and application (fleet safety, driver monitoring, insurance analytics, compliance), with demand fueled by the need to reduce accident-related costs and improve operational visibility. Regional dynamics highlight strong adoption in North America and Europe due to regulatory frameworks and fleet safety initiatives, while Asia-Pacific records rapid growth driven by logistics expansion and government mandates for video-based compliance. Innovation trends include edge-based video analytics for real-time event detection, integration with ADAS systems, and cloud-based platforms offering predictive risk management for commercial fleets. |

The global video telematics market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the video telematics market is projected to reach USD 9.3 billion by 2035.

The video telematics market is expected to grow at a 17.8% CAGR between 2025 and 2035.

The key product types in video telematics market are hardware, _dash cams, _gps tracking devices, _sensors, _onboard diagnostics (obd) devices, software, services, _installation services, _maintenance & support services, _managed services and _consulting services.

In terms of technology, embedded systems segment to command 41.0% share in the video telematics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Video Content Management Market Size and Share Forecast Outlook 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Video Walls Market by Component, Display Technology, Industry, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Video Doorbell Market by Product Type, End User, Sales Channel, and Region - Growth, Trends, and Forecast through 2035

Video Streaming Market Growth – Innovations, Trends & Forecast 2025-2035

Video Intercom Device Market Analysis by Product, Technology, Vertical, and Region Through 2035

AI-Powered Video Streaming – Future of Digital Entertainment

Video Encoder and Decoder Market

Video-Guided Pericardial Access Device Market

Video Converter Software Market

Video Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA