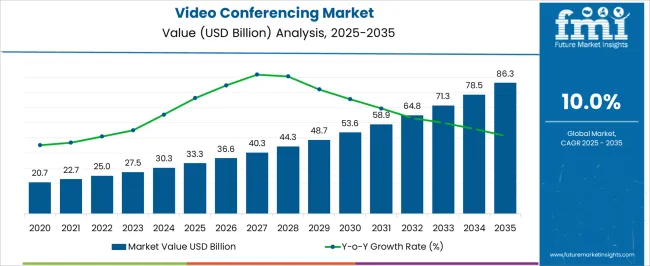

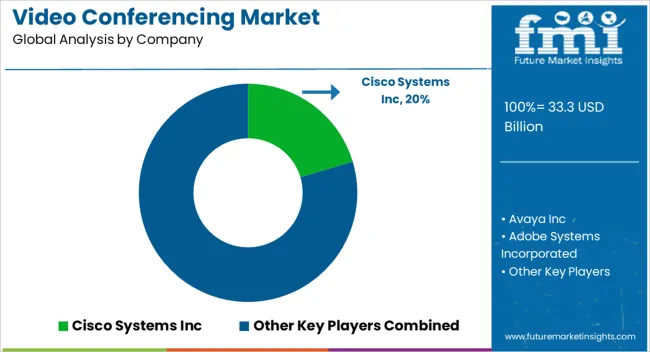

The video conferencing market is estimated to be valued at USD 33.3 billion in 2025 and is projected to reach USD 86.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The growth path highlights a strong and steady rise as enterprises, governments, and educational institutions continue to embed video communication into daily operations. From 2020–2024, the market grows from USD 20.7 billion to USD 30.3 billion, reflecting the early adoption phase supported by rising hybrid work models, digital classrooms, and telemedicine services. Yearly gains such as USD 22.7 billion in 2021, USD 25.0 billion in 2022, and USD 27.5 billion in 2023 underline a rapid shift from traditional communication to cloud-based video platforms. Between 2025–2030, the market advances from USD 33.3 billion to USD 53.6 billion, contributing nearly 47% of the overall increase.

This mid-phase expansion is fueled by broader integration of AI-powered collaboration tools, real-time translation, and immersive meeting experiences, coupled with growing reliance on video for cross-border operations and government services. From 2031–2035, the market progresses from USD 58.9 billion to USD 86.3 billion, generating about 38% of total growth. Growth moderates slightly as video conferencing becomes a standardized enterprise utility, but demand remains robust due to advanced features like augmented reality integration, virtual office spaces, and secure communication frameworks. Overall, the video conferencing market shows a clear maturity curve, shaped by evolving workplace models, continuous innovation, and its role as a cornerstone of global digital collaboration.

| Metric | Value |

|---|---|

| Video Conferencing Market Estimated Value in (2025 E) | USD 33.3 billion |

| Video Conferencing Market Forecast Value in (2035 F) | USD 86.3 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The video conferencing market registers a substantial role within the broader enterprise communication and collaboration ecosystem, contributing approximately 18–20% of the overall unified communication and collaboration segment, where team messaging and VoIP dominate larger shares. Within the corporate IT solutions industry, video conferencing accounts for around 12–14%, driven by the need for remote meetings, virtual collaboration, and distributed workforce management. In the education and e-learning sector, its share is estimated at 20–22%, supported by increasing adoption of online classes, virtual labs, and digital campus initiatives. Within the healthcare telemedicine and virtual consultation category, video conferencing represents roughly 8–10%, facilitating remote diagnosis, specialist consultations, and patient monitoring across hospitals and clinics. The government and public services segment accounts for nearly 6–8%, where video conferencing supports inter-agency meetings, virtual hearings, and remote training programs.

Growth has been shaped by the shift to hybrid work models, cross-border corporate collaboration, and cloud-based adoption of conferencing solutions. Although competition from collaboration platforms with integrated messaging and file sharing is strong, dedicated video conferencing solutions remain vital for secure, high-quality, and real-time interaction. Vendors are focusing on improving video clarity, AI-powered features, and integration with enterprise software, reinforcing their adoption across industries. Despite challenges from bandwidth limitations and cybersecurity concerns, video conferencing has secured a central role in global communication infrastructure, with increasing relevance across both corporate and public sectors.

The video conferencing market is undergoing rapid expansion, driven by enterprise-level hybrid work models, globalization of teams, and growing demand for real-time collaboration tools. Advancements in bandwidth infrastructure, integration with productivity suites, and cloud-based deployment have further accelerated adoption across sectors.

The rising frequency of virtual meetings in education, government, and healthcare has broadened the user base. At the same time, hardware and software innovations focused on user experience, such as AI noise cancellation and real-time translation, are enhancing usability.

Regulatory emphasis on data security in remote communications has also influenced platform selection and infrastructure investment. As remote collaboration continues to become integral to business continuity, the market is expected to show sustained growth through 2035.

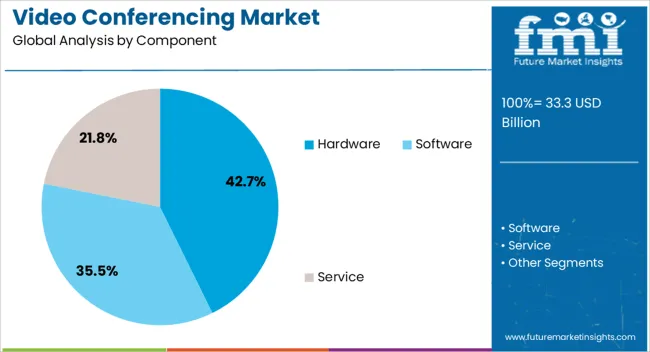

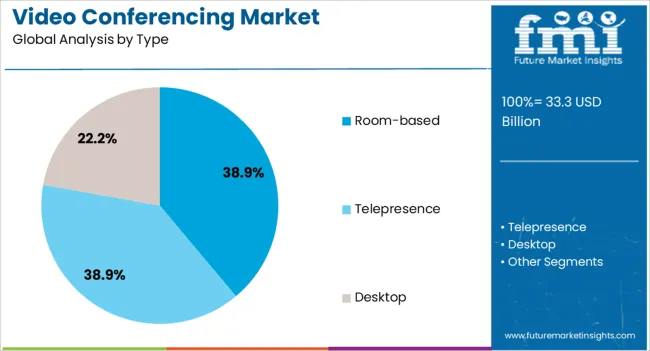

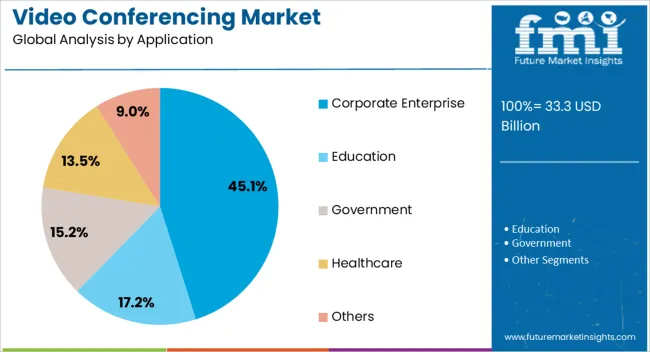

The video conferencing market is segmented by component, type, application, and geographic regions. By component, video conferencing market is divided into hardware, software, and service. In terms of type, video conferencing market is classified into room-based, telepresence, and desktop. Based on application, video conferencing market is segmented into corporate enterprise, education, government, healthcare, and others. Regionally, the video conferencing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hardware is set to dominate the video conferencing component landscape with a projected share of 42.7% by 2025. Growth in this segment is supported by the increasing need for high-quality video endpoints such as cameras, microphones, speakerphones, and multi-screen systems in corporate and institutional settings. Enterprises are investing in dedicated conferencing rooms with specialized audio-visual gear to ensure seamless hybrid interactions. Additionally, innovations in smart cameras, integrated sound systems, and touch-enabled displays have elevated the utility of hardware-based conferencing. With many organizations adopting standardized setups across locations, hardware investments are becoming more centralized and recurring.

Room-based conferencing is projected to hold a 38.9% market share in 2025, leading the video conferencing type segment. Its dominance stems from demand in mid-to-large enterprises seeking consistent, secure, and high-fidelity meeting environments across geographies. Room-based setups are preferred for boardroom meetings, client presentations, and cross-functional planning sessions that require reliable infrastructure and interoperability. Growth is further aided by the integration of room-based systems with enterprise software ecosystems and cloud collaboration tools. As companies prioritize workplace transformation, room-based systems offer scalable, quality-controlled environments essential for high-impact communications.

Corporate enterprise is anticipated to account for 45.1% of total video conferencing usage by 2025, making it the top application segment. The need for seamless cross-border collaboration, reduced travel costs, and higher meeting productivity is pushing businesses to adopt sophisticated conferencing solutions. Sectors such as IT, finance, and consulting are leading adoption due to their operational complexity and global client base. The growing importance of secure communications, team engagement in remote environments, and onboarding processes has made video conferencing an indispensable business tool. As enterprises continue to implement hybrid work policies, this segment will remain the most significant contributor to market demand.

Video conferencing adoption is expanding across enterprises, education, healthcare, and government, driven by remote collaboration, cost efficiency, and accessibility. Platforms offering high security, multi-participant support, and seamless integration are shaping global communication practices.

Enterprise adoption of video conferencing solutions has accelerated as organizations seek efficient tools for remote collaboration, project management, and cross-functional coordination. Companies are leveraging cloud-based platforms to reduce infrastructure costs while improving accessibility for distributed teams. The integration of high-definition video, screen sharing, and real-time document collaboration has enhanced productivity across departments. Regional offices, remote employees, and cross-border teams increasingly depend on secure, reliable video conferencing systems to maintain continuity in business operations. Demand is further fueled by the need to reduce travel costs, improve decision-making speed, and support virtual training initiatives. Enterprises are focusing on scalable solutions that allow multiple participants, robust security, and seamless integration with other communication tools.

Educational institutions are increasingly deploying video conferencing solutions to facilitate remote learning, virtual classrooms, and online examinations. Schools and universities utilize these platforms to provide real-time interaction between instructors and students, bridging geographical gaps. Video-enabled lectures, webinars, and virtual labs support both academic and professional training programs, making learning more flexible. Adoption is further strengthened by government initiatives to modernize digital education infrastructure and by increased use of hybrid learning models combining in-person and virtual teaching. Educational content providers and edtech platforms are collaborating with video conferencing vendors to create interactive course experiences. This trend drives higher engagement and improved knowledge retention for students across multiple regions.

Video conferencing has become a critical tool in healthcare for telemedicine, virtual consultations, and patient monitoring. Hospitals and clinics use secure platforms to connect specialists with patients in remote or underserved areas, reducing the need for physical visits. Integration with electronic health records enables physicians to provide timely guidance while maintaining data privacy and compliance. Adoption also includes mental health services, post-operative care, and chronic condition management, increasing access to care. Remote collaboration among medical professionals improves diagnosis accuracy and treatment planning. Vendors are emphasizing encryption, compliance with healthcare standards, and seamless interoperability with hospital management systems to drive adoption in the medical sector.

Government agencies are leveraging video conferencing to conduct meetings, virtual hearings, and inter-departmental coordination efficiently. Ministries, law enforcement, and public administration bodies are adopting secure platforms to maintain workflow continuity, especially in geographically dispersed regions. Video conferencing enables real-time communication for disaster management, policy discussions, and training programs, reducing dependency on physical gatherings. The shift to digital operations ensures cost reduction, faster decision-making, and higher operational transparency. Adoption is driven by regulatory mandates for secure communication and the need to provide virtual access to public services. Integration with document management and workflow systems strengthens administrative efficiency across government functions.

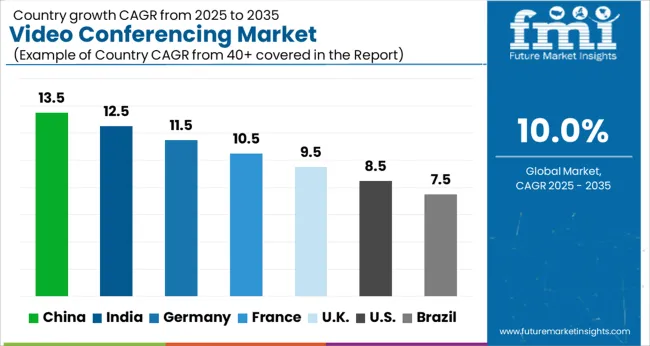

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The video conferencing market is projected to grow globally at a CAGR of 10.0% from 2025 to 2035, driven by rising enterprise adoption, educational integration, telemedicine expansion, and government digitization programs. China leads with a CAGR of 13.5%, supported by widespread corporate digitization, cloud-based adoption, and remote learning initiatives across urban and semi-urban regions. India follows at 12.5%, with growth powered by expanding internet penetration, government-supported digital education, and remote workforce solutions. France posts 10.5%, as enterprises and universities focus on hybrid work and digital classrooms. The United Kingdom grows at 9.5%, with adoption tied to corporate collaboration tools, healthcare teleconsultations, and virtual public services. The United States records 8.5%, driven by enterprise digital transformation and telemedicine demand, though growth is comparatively moderate versus Asian markets. This trajectory demonstrates Asia as the primary growth hub, Europe achieving stable expansion, and North America recording consistent yet slower adoption.

The CAGR for the video conferencing market in the United Kingdom was 7.3% during 2020–2024 and is projected at 9.5% for 2025–2035, reflecting a significant acceleration in adoption across enterprise, education, and healthcare segments. Early growth was shaped by hybrid work initiatives, remote learning integration, and digital healthcare pilots, though bandwidth limitations and hesitancy in small enterprises restrained broader deployment. The next phase sees stronger expansion driven by nationwide adoption of cloud-based collaboration platforms, government-backed digital education frameworks, and virtual healthcare services. Investments in platform interoperability, security enhancements, and enterprise integration further supported the rise in CAGR. These trends position the United Kingdom as a key European hub for video conferencing adoption.

China’s video conferencing market grew at a CAGR of 11.2% during 2020–2024 and is anticipated at 13.5% for 2025–2035, underscoring strong momentum. Early expansion was supported by government initiatives for remote education, enterprise digital transformation, and pandemic-driven remote work adoption. Over the next few years, adoption accelerates due to rapid cloud platform deployment, AI-enabled collaboration tools, and widespread high-speed internet penetration. Corporate, educational, and healthcare sectors drive sustained uptake, while domestic technology providers optimize cost and scalability. Strategic investments in security and platform customization strengthen enterprise confidence, maintaining China as the dominant market globally.

India’s video conferencing market achieved a CAGR of 10.7% during 2020–2024 and is projected at 12.5% for 2025–2035, highlighting rapid growth. Initial adoption was driven by remote workforce requirements, online education initiatives, and government programs promoting digital classrooms. Subsequent growth is reinforced by improving internet connectivity, cost-effective cloud platforms, and rising digital literacy across corporates and educational institutions. Regional players and global technology providers expanded services tailored to enterprise, education, and telemedicine use cases. The combination of large-scale deployment and government incentives positions India as one of the fastest-growing markets in Asia-Pacific.

France’s video conferencing market recorded a CAGR of 8.5% during 2020–2024 and is expected at 10.5% for 2025–2035, reflecting steady adoption in enterprise and academic sectors. Early growth was shaped by hybrid work policies, educational e-learning programs, and government-backed digitalization drives, though smaller enterprises were slower to adopt. Expansion in the next decade is supported by increased investments in cloud-based collaboration platforms, interoperability with existing IT systems, and stronger security protocols. Integration of video conferencing in healthcare and professional services further drives platform penetration, making France a key Western European growth market.

The video conferencing market in the United States posted a CAGR of 7.0% during 2020–2024 and is projected at 8.5% for 2025–2035, marking consistent but moderate growth. Initial adoption was accelerated by enterprise remote work policies, virtual education programs, and telehealth services, though infrastructure and legacy system integration created adoption barriers. Growth in the next decade is driven by cloud platform enhancements, corporate digital collaboration programs, and wider use of AI-enabled meeting analytics. The United States remains a mature market with steady expansion, influenced by large enterprises, educational institutions, and healthcare networks investing in scalable and secure video conferencing solutions.

The video conferencing market is dominated by a combination of global technology leaders and specialized communication platform providers that emphasize reliability, security, and scalability. Cisco Systems Inc holds a commanding position, leveraging its Webex platform to deliver enterprise-grade solutions with advanced security protocols, AI-assisted meeting tools, and seamless integration with existing IT infrastructure. Avaya Inc continues to focus on unified communication offerings, emphasizing flexibility for mid-sized and large enterprises while integrating voice, video, and collaboration tools. Adobe Systems Incorporated has strengthened its foothold with Adobe Connect, targeting education, training, and professional webinars with robust interactive capabilities. Google LLC leverages Google Meet and its G Suite ecosystem to provide cloud-native collaboration solutions suitable for small to large organizations globally. Huawei Technologies Co Ltd plays a growing role, particularly across Asia-Pacific, offering integrated video conferencing endpoints, cloud management systems, and enterprise-grade security features.

Zoom Video Communications Inc has transformed the market through its intuitive, scalable, and high-performance platform, widely adopted for remote work, education, and healthcare services. Microsoft Corporation drives adoption through Teams, integrating video conferencing with collaboration, productivity apps, and enterprise IT environments. Key strategies across the competitive landscape include cloud-based deployment, platform interoperability, AI-driven meeting analytics, and advanced security features. Emphasis is placed on providing flexible, scalable, and user-friendly solutions while integrating collaboration tools, file sharing, and communication across mobile, desktop, and room systems. The market is expected to evolve further as companies expand their global reach, optimize network performance, and pursue strategic partnerships with enterprise IT providers, educational institutions, and healthcare organizations to capture sustained growth opportunities in a rapidly digitalizing world.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.3 billion |

| Component | Hardware, Software, and Service |

| Type | Room-based, Telepresence, and Desktop |

| Application | Corporate Enterprise, Education, Government, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems Inc, Avaya Inc, Adobe Incorporated, Google LLC, Huawei Technologies Co Ltd, Zoom Video Communications Inc, Microsoft Corporation |

| Additional Attributes | Dollar sales, market share, growth by enterprise, education, healthcare segments, adoption trends, cloud vs on-premises deployment, hardware vs software revenue, competitive pricing, and user preferences. |

The global video conferencing market is estimated to be valued at USD 33.3 billion in 2025.

The market size for the video conferencing market is projected to reach USD 86.3 billion by 2035.

The video conferencing market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in video conferencing market are hardware, _multipoint control unit (mcu), _codecs, _peripheral devices, software, _on-premise, _cloud, service, _professional and _managed.

In terms of type, room-based segment to command 38.9% share in the video conferencing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Video Telematics Market Size and Share Forecast Outlook 2025 to 2035

Video Content Management Market Size and Share Forecast Outlook 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Walls Market by Component, Display Technology, Industry, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Video Doorbell Market by Product Type, End User, Sales Channel, and Region - Growth, Trends, and Forecast through 2035

Video Streaming Market Growth – Innovations, Trends & Forecast 2025-2035

Video Intercom Device Market Analysis by Product, Technology, Vertical, and Region Through 2035

Video on Demand (VoD) Service Market - Trends & Forecast through 2034

AI-Powered Video Streaming – Future of Digital Entertainment

Video Encoder and Decoder Market

Video-Guided Pericardial Access Device Market

Video Converter Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA