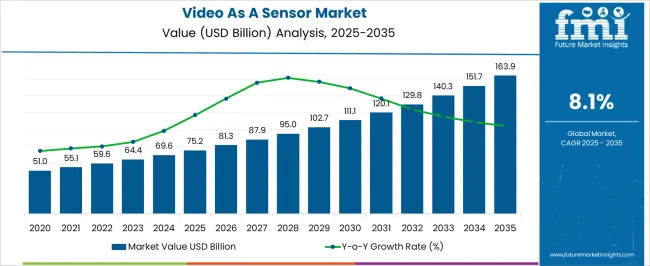

The global video as a sensor market is projected to grow from USD 75.2 billion in 2025 to USD 163.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.1%. In the early adoption phase (2020–2024), growth was driven by experimental deployment in niche applications, with companies evaluating performance and feasibility. Limited production volumes and targeted use cases characterized this period, as stakeholders focused on demonstrating value in real-world scenarios.

By 2025, as the market reaches USD 75.2 billion, broader commercial adoption begins, marking the start of the scaling phase, where production and deployment expand across multiple industries. Between 2025 and 2030, scaling accelerates, with market size increasing from USD 75.2 billion to approximately USD 102–111 billion. Adoption spreads across enterprise, industrial, and consumer sectors, and standardized practices begin emerging. The consolidation phase from 2030 to 2035 sees further stabilization, with the market reaching USD 163.9 billion. By this stage, supply chains, production processes, and deployment strategies are well-established, enabling consistent adoption. The market transitions from rapid growth to stability, with Video as a Sensor becoming a mainstream tool across its application landscape.

| Metric | Value |

|---|---|

| Video As A Sensor Market Estimated Value in (2025 E) | USD 75.2 billion |

| Video As A Sensor Market Forecast Value in (2035 F) | USD 163.9 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The video as a sensor market, growing from USD 75.2 billion in 2025 to USD 163.9 billion by 2035 at a CAGR of 8.1%, demonstrates key breakpoints reflecting shifts in adoption and market dynamics. The first notable breakpoint occurs around 2025, when the market reaches USD 75.2 billion. At this stage, adoption moves beyond early experimental use to broader commercial deployment. Increased production capacity and successful initial implementations build confidence among end-users. This period represents the scaling phase, characterized by expanding adoption across multiple sectors, improved integration into enterprise and industrial systems, and investments in production and distribution infrastructure to support rising demand. A second critical breakpoint emerges between 2030 and 2032, as the market approaches USD 129–140 billion.

By this stage, Video as a Sensor technology is widely adopted across diverse industries, and the market begins transitioning from growth-driven expansion to consolidation. Major players strengthen their positions, supply chains stabilize, and product standards and best practices are established. By 2035, reaching USD 163.9 billion, the market reflects full consolidation, with Video as a Sensor established as a mainstream solution. Mature production capabilities, stable distribution networks, and predictable adoption patterns ensure sustained market stability and long-term operational efficiency across applications.

Demand is being driven by the integration of artificial intelligence and machine learning capabilities that allow video streams to be transformed into actionable insights in real time. Growth has also been supported by the rising need for intelligent monitoring solutions in industries such as transportation, manufacturing, and retail, where operational efficiency and safety are key priorities.

Improvements in camera hardware, sensor precision, and edge computing capabilities have enabled the transition from traditional surveillance to sensor-based video intelligence. Increasing investments in smart infrastructure, coupled with the proliferation of IoT ecosystems, are further strengthening adoption.

As deployment models become more flexible and scalable, and as regulatory frameworks encourage enhanced monitoring and compliance, the market is set to sustain long-term growth.

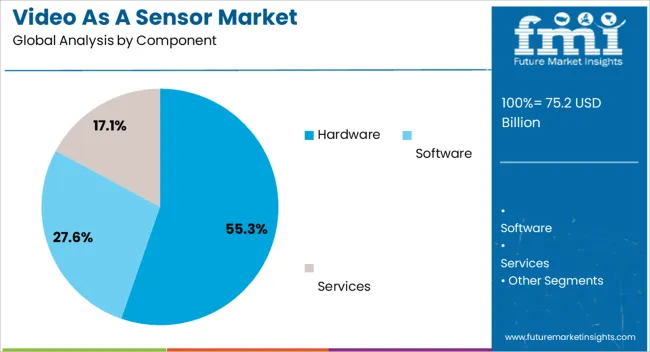

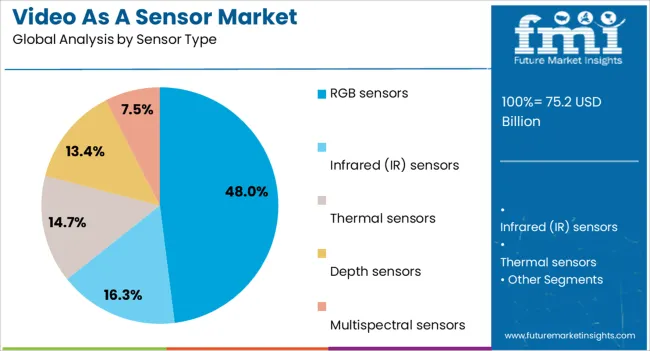

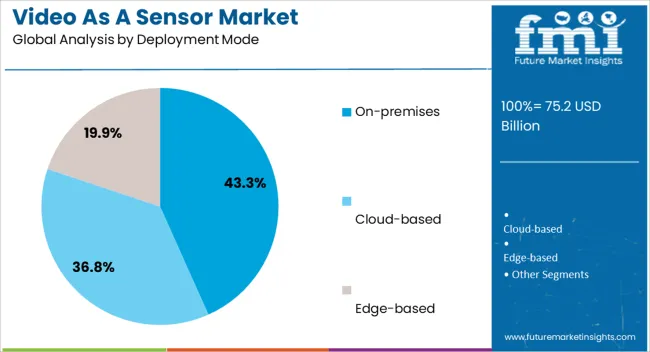

The video as a sensor market is segmented by component, sensor type, deployment mode, connectivity, application, and geographic regions. By component, video as a sensor market is divided into Hardware, Software, and Services. In terms of sensor type, video as a sensor market is classified into RGB sensors, Infrared (IR) sensors, Thermal sensors, Depth sensors, and Multispectral sensors. Based on deployment mode, video as a sensor market is segmented into On-premises, Cloud-based, and Edge-based. By connectivity, video as a sensor market is segmented into Wireless and Wired. By application, video as a sensor market is segmented into Security & surveillance, Traffic monitoring & smart mobility, Industrial automation & robotics, Retail analytics, Healthcare & patient monitoring, Environmental monitoring, Agriculture & livestock monitoring, and Others. Regionally, the video as a sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is projected to hold 55.30% of the Video As A Sensor market revenue share in 2025, making it the dominant category. This position has been supported by the essential role of advanced imaging devices, high-resolution cameras, and processing units in capturing and converting video into structured data. Hardware advancements have been critical in enabling superior image quality, faster frame rates, and improved low-light performance, which are vital for accurate analytics.

The segment has benefited from increasing demand for integrated sensor-camera systems capable of operating in varied environmental conditions. Moreover, hardware innovations have allowed seamless compatibility with software-defined analytics platforms, enhancing system versatility.

The reliance on robust and precise hardware to ensure consistent data capture has reinforced its importance, particularly in mission-critical applications As industries prioritize reliability and high-performance video sensing infrastructure, the hardware segment is expected to maintain its leading market position.

The RGB sensors segment is anticipated to command 48% of the Video As A Sensor market revenue share in 2025, positioning it as the leading sensor type. This dominance has been driven by the ability of RGB sensors to capture true-to-life color imagery, which is critical for accurate object detection, recognition, and classification.

Their widespread integration into surveillance, automation, and monitoring systems has been supported by advancements in resolution, dynamic range, and color accuracy. The segment has also gained from the adaptability of RGB sensors across indoor and outdoor environments, enabling consistent performance under diverse lighting conditions.

As software algorithms become more sophisticated, the high-quality image data provided by RGB sensors enhances AI and machine learning outputs The balance between cost efficiency, reliability, and image fidelity has made RGB sensors the preferred choice in both commercial and industrial deployments, reinforcing their strong market position.

The on-premises deployment mode segment is expected to account for 43.30% of the Video As A Sensor market revenue share in 2025, making it the leading deployment approach. This preference has been influenced by the need for enhanced data security, control, and compliance with strict regulatory standards.

On-premises solutions allow organizations to maintain direct oversight of their video data, reducing risks associated with cloud storage and external networks. The segment has also been supported by industries with mission-critical operations where low-latency processing and uninterrupted access to video feeds are essential.

Integration with existing IT infrastructure and the ability to customize analytics capabilities locally have further strengthened adoption As concerns over data sovereignty and privacy remain high, the on-premises model continues to be favored for sensitive environments, ensuring that it retains a strong share of the overall market.

The Video as a Sensor (VaaS) market is expanding as industries increasingly leverage video analytics for monitoring, security, automation, and operational intelligence. By combining video capture with AI and machine learning, VaaS enables real-time object detection, process monitoring, and predictive insights across sectors such as manufacturing, smart cities, retail, and transportation. Adoption is driven by digital transformation initiatives, demand for automation, and enhanced situational awareness. However, challenges related to data privacy, network infrastructure, and integration complexity persist. Companies offering cloud-based, scalable, and AI-enabled solutions are well-positioned to capture growth across multiple verticals.

VaaS adoption faces challenges related to data privacy, cybersecurity, and high bandwidth requirements. Video streams generate large volumes of data that require secure storage, processing, and transmission, often demanding robust IT infrastructure. Integration with existing enterprise systems, IoT devices, and analytics platforms can be complex and resource-intensive. Compliance with local and international privacy regulations adds further operational constraints. Additionally, real-time processing needs low-latency networks, which may not be available in all regions. Ensuring consistent performance across varied environmental conditions, lighting, and camera placements also adds technical complexity. Companies must invest in secure, scalable, and standardized solutions to overcome these barriers and build trust with enterprise and public-sector customers.

The VaaS market is trending toward AI-driven analytics, edge computing, and intelligent automation. Video feeds are increasingly processed at the edge, reducing latency and bandwidth requirements while enabling real-time decision-making. Machine learning algorithms enhance object recognition, anomaly detection, and predictive maintenance applications. Cloud-based platforms allow scalable storage and analytics for enterprise deployment. Integration with IoT sensors, smart city infrastructure, and robotics is becoming common, enabling multi-modal monitoring and actionable insights. Enhanced video quality, multi-camera fusion, and intelligent event detection are driving adoption across security, industrial automation, retail analytics, and traffic management applications. These trends support broader deployment of VaaS as a key enabler of digital transformation initiatives.

VaaS presents significant opportunities across smart city projects, industrial automation, and enterprise operations. In smart cities, video sensors enhance traffic monitoring, public safety, and infrastructure management. Industrial applications leverage video analytics for process optimization, quality control, and predictive maintenance. Retailers use VaaS for shopper behavior analysis, inventory management, and operational efficiency. Transportation networks benefit from real-time monitoring of vehicles, ports, and logistics hubs. The growing adoption of AI, IoT, and cloud technologies enables scalable deployment across multiple industries. Partnerships with telecom providers, software developers, and system integrators can expand market reach and facilitate the creation of end-to-end, intelligent video sensing solutions for enterprises and municipalities.

The VaaS market is restrained by high infrastructure costs, network dependency, and regulatory considerations. Implementing video-based systems requires investment in high-resolution cameras, edge processing units, and cloud storage. Reliable and low-latency network connectivity is essential for real-time analytics, which may be challenging in certain regions. Privacy laws and data protection regulations limit where and how video can be captured and processed, impacting adoption in sensitive environments. Additionally, integrating VaaS with legacy systems or large-scale enterprise IT infrastructure can be complex and resource-intensive. Until cost-effective deployment models, standardized integration protocols, and regulatory clarity improve, market adoption may remain concentrated in high-value or enterprise-grade applications.

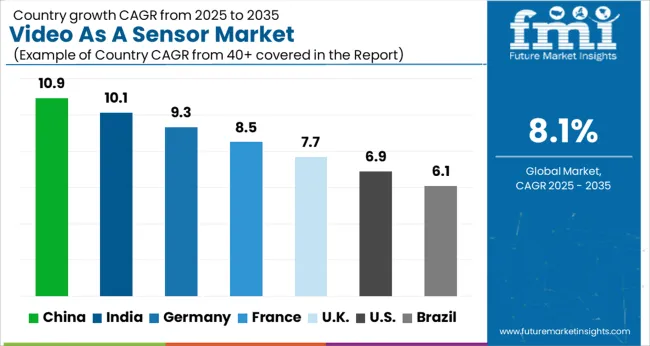

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The global video as a sensor market is projected to grow at a CAGR of 8.1% through 2035, supported by increasing demand across surveillance, automotive, and industrial automation applications. Among BRICS nations, China has been recorded with 10.9% growth, driven by large-scale production and deployment in smart surveillance and automotive systems, while India has been observed at 10.1%, supported by rising utilization in industrial automation and security applications. In the OECD region, Germany has been measured at 9.3%, where production and adoption for automotive, industrial, and security applications have been steadily maintained. The United Kingdom has been noted at 7.7%, reflecting consistent use in surveillance and industrial automation, while the USA has been recorded at 6.9%, with production and utilization across automotive, industrial, and security sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The video as a sensor market in China is growing at a CAGR of 8.1%, driven by rising adoption in automotive, surveillance, industrial automation, and consumer electronics applications. Video sensors are increasingly used for advanced driver assistance systems, factory automation, security monitoring, and smart home devices. Domestic technology firms and startups are investing in AI enabled video analytics, high resolution imaging, and sensor fusion to enhance accuracy and reliability. Government initiatives promoting smart cities, intelligent transportation, and industrial automation are further accelerating market growth. Pilot projects integrating video sensors in traffic management, public safety, and autonomous vehicles are validating performance and operational benefits. Collaboration between universities, research institutes, and industrial partners is improving video sensor algorithms, real time processing capabilities, and low latency performance. Increasing demand for smart monitoring, energy efficiency, and automation continues to support rapid market expansion.

India’s video as a sensor market is expanding at a CAGR of 8.1%, fueled by demand in automotive safety, industrial automation, smart surveillance, and robotics. Video sensors are widely used in advanced driver assistance systems, traffic monitoring, factory automation, and security applications. Technology companies and startups are investing in AI enabled video processing, real time analytics, and sensor integration for improved reliability. Government programs promoting smart cities, traffic safety, and industrial digitization are enhancing market development. Pilot projects and demonstrations in autonomous vehicles, industrial monitoring, and public safety systems are validating sensor performance. Collaborations between research institutions and manufacturers are advancing algorithm optimization, edge computing, and low latency processing. The increasing need for automation, intelligent monitoring, and high accuracy detection is driving consistent adoption across automotive, industrial, and smart city sectors.

Video as a sensor market in Germany is recording a CAGR of 9.3%, driven by automotive innovation, industrial automation, and security systems. Video sensors are integrated in ADAS, factory robots, production monitoring, and building surveillance. Automotive and manufacturing companies are investing in high resolution imaging, AI based object detection, and sensor fusion to enhance reliability and safety. Pilot projects in autonomous driving, industrial robotics, and public safety are demonstrating practical benefits of video sensing technologies. Government regulations promoting traffic safety, energy efficient automation, and smart city initiatives are encouraging adoption. Germany’s strong R&D ecosystem ensures continuous improvements in image processing, edge computing, and sensor integration. Increasing demand for precise monitoring, automated operations, and real time decision making is boosting market growth across automotive, industrial, and security sectors.

The United Kingdom is experiencing a CAGR of 7.7% in the video as a sensor market, supported by applications in automotive, security, industrial automation, and smart buildings. Video sensors are used for advanced driver assistance systems, traffic monitoring, factory automation, and surveillance solutions. Technology firms are investing in AI enabled analytics, edge processing, and high resolution imaging to enhance accuracy, speed, and reliability. Government programs promoting smart city infrastructure, traffic safety, and automation technologies are supporting adoption. Pilot projects integrating video sensors in public safety systems, industrial monitoring, and autonomous vehicle testing are validating operational benefits. Academic and industrial collaborations are advancing algorithms, low latency processing, and real time analytics. Rising demand for intelligent monitoring, automated decision making, and reliable sensing in automotive and industrial sectors is driving steady market growth.

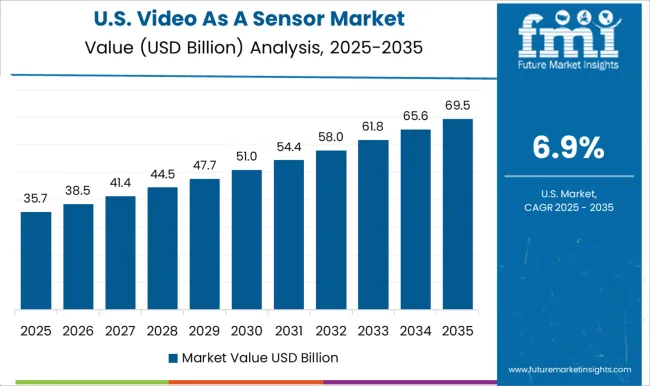

The United States video as a sensor market is growing at a CAGR of 6.9%, driven by adoption in automotive, industrial automation, robotics, and surveillance applications. Video sensors are widely used in ADAS, traffic monitoring, industrial inspection, and smart building solutions. Technology companies and research institutions are investing in AI powered image processing, high resolution sensors, and real time analytics for improved accuracy and operational efficiency. Pilot projects in autonomous vehicles, industrial robotics, and public safety monitoring are demonstrating practical benefits. Government programs supporting smart cities, traffic safety, and energy efficient industrial automation are stimulating adoption. Increasing demand for high precision sensing, automated monitoring, and intelligent analytics is driving consistent market expansion across automotive, industrial, and security sectors in the US.

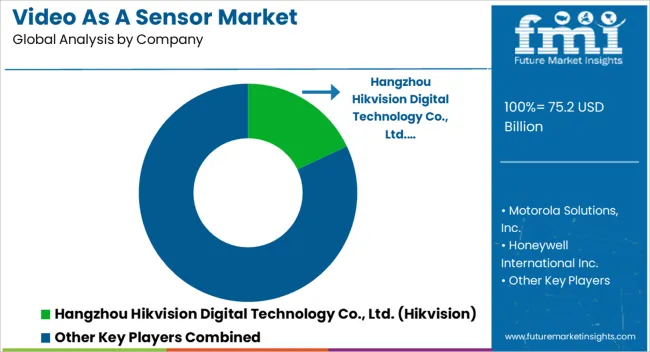

The Video-as-a-Sensor market is highly competitive, led by global technology leaders and specialized imaging innovators. Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision) dominates with high-resolution, AI-enabled video sensors for security, industrial, and smart city applications. Motorola Solutions, Inc. integrates video sensing into public safety and enterprise solutions, emphasizing reliability and real-time analytics. Honeywell International Inc. provides industrial and building automation sensors, focusing on security, energy efficiency, and operational intelligence.

Dahua Technology Co., Ltd. offers advanced video sensor solutions with AI capabilities, targeting surveillance and smart infrastructure. Bosch Security Systems GmbH emphasizes robust, scalable video sensing platforms for industrial and security applications, while Axis Communications AB focuses on network-based video sensors with integration into IoT ecosystems. Sony Corporation contributes high-performance imaging sensors with precision, low-light performance, and advanced processing, supporting consumer and industrial segments. Teledyne and FLIR specialize in thermal and multispectral video sensors, enabling applications in defense, industrial inspection, and critical infrastructure monitoring. Competition revolves around innovation, integration, and data intelligence.

| Item | Value |

|---|---|

| Quantitative Units | USD 75.2 Billion |

| Component | Hardware, Software, and Services |

| Sensor Type | RGB sensors, Infrared (IR) sensors, Thermal sensors, Depth sensors, and Multispectral sensors |

| Deployment Mode | On-premises, Cloud-based, and Edge-based |

| Connectivity | Wireless and Wired |

| Application | Security & surveillance, Traffic monitoring & smart mobility, Industrial automation & robotics, Retail analytics, Healthcare & patient monitoring, Environmental monitoring, Agriculture & livestock monitoring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision), Motorola Solutions, Inc., Honeywell International Inc., Dahua Technology Co., Ltd., Bosch Security Systems GmbH, Axis Communications AB, Sony Corporation, and Teledyne / FLIR |

| Additional Attributes | Dollar sales in the Video as a Sensor Market vary by type including RGB cameras, thermal cameras, and depth sensors, application across automotive ADAS, smart cities, robotics, and industrial automation, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for intelligent video analytics, advancements in computer vision technologies, and increasing adoption in safety and automation systems. |

The global video as a sensor market is estimated to be valued at USD 75.2 billion in 2025.

The market size for the video as a sensor market is projected to reach USD 163.9 billion by 2035.

The video as a sensor market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in video as a sensor market are hardware, software and services.

In terms of sensor type, rgb sensors segment to command 48.0% share in the video as a sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video Walls Market by Component, Display Technology, Industry, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Video Management Software Market

Video Streaming Market Growth – Innovations, Trends & Forecast 2025-2035

AI-Powered Video Streaming – Future of Digital Entertainment

Video Telematics Market Size and Share Forecast Outlook 2025 to 2035

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Video Event Data Recorder Market Report – Trends & Forecast 2016-2026

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Encoder and Decoder Market

Video Content Management Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Video Doorbell Market by Product Type, End User, Sales Channel, and Region - Growth, Trends, and Forecast through 2035

Video-Guided Pericardial Access Device Market

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Video Converter Software Market

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA