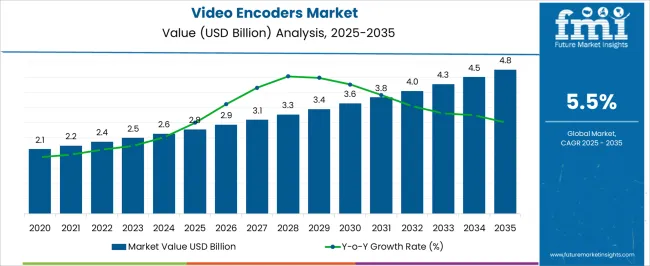

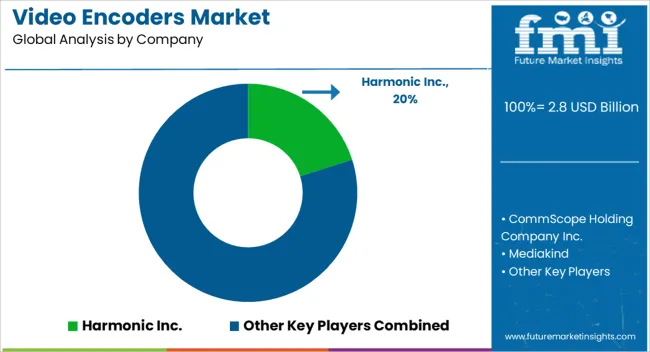

The video encoders market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. This growth can be attributed to the increasing demand for high-quality video streaming and the expansion of content delivery networks (CDNs). With the rise in digital content consumption, particularly through online platforms, video encoders are becoming crucial for ensuring high-definition content delivery across diverse devices and networks. The need for more efficient, cost-effective video encoding solutions is also driving growth in this market. As more industries and sectors invest in streaming services, live broadcasting, and digital media, video encoders are expected to play a pivotal role in improving the overall user experience.

The rise of remote work, education, and online entertainment has further highlighted the importance of smooth, high-quality video streams. Video encoding solutions are increasingly being deployed to handle the higher bandwidth and processing demands required for these services. This trend will likely continue over the next decade, with key players focusing on optimizing encoders for various formats and resolutions, thus accelerating market growth.

| Metric | Value |

|---|---|

| Video Encoders Market Estimated Value in (2025 E) | USD 2.8 billion |

| Video Encoders Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The video encoders market is estimated to hold a notable proportion within its parent markets, representing approximately 8-9% of the video compression market, around 6-7% of the broadcast equipment market, close to 12-14% of the digital video market, about 4-5% of the IPTV market, and roughly 3-4% of the streaming media market. The cumulative share across these parent segments is observed in the range of 33-39%, highlighting the key role video encoders play in digital media and broadcasting operations.

The market has been driven by the increasing demand for efficient video streaming, broadcast, and encoding solutions, where quality, scalability, and latency reduction are highly prioritized. Adoption is guided by procurement strategies that focus on compression efficiency, seamless integration with existing infrastructure, and the ability to handle high-definition video content.

Market participants have concentrated on offering encoders with enhanced video quality, multi-format support, and robust real-time processing capabilities to meet the growing need for both live and on-demand content. As a result, the video encoders market has not only captured a substantial share within video compression and digital video markets but has also influenced IPTV, broadcast, and streaming media markets, underlining its essential role in optimizing content delivery, improving viewer experience, and supporting content providers in scaling operations.

The video encoders market is witnessing rapid expansion due to the escalating demand for high-quality video content transmission across broadcasting, surveillance, and digital media platforms. Market growth is being strongly supported by increasing consumption of live streaming services, proliferation of OTT platforms, and upgrades in broadcasting infrastructure worldwide. Video encoders serve as a critical component in modern video workflows, enabling real-time compression and transmission of video data while optimizing bandwidth and storage.

The shift toward IP-based transmission and remote production is accelerating the adoption of advanced video encoding solutions that support multiple formats, resolutions, and low-latency performance. Additionally, the transition from legacy analog systems to digital broadcasting in many regions is further stimulating demand. Rising investments in cloud-based video processing and edge computing are opening new opportunities for encoder manufacturers.

As technological advancements continue to improve encoding efficiency, image quality, and integration capabilities, the market is expected to experience sustained growth. The increasing preference for flexible, software-driven encoding platforms is also contributing to the evolving dynamics of the global video encoders market.

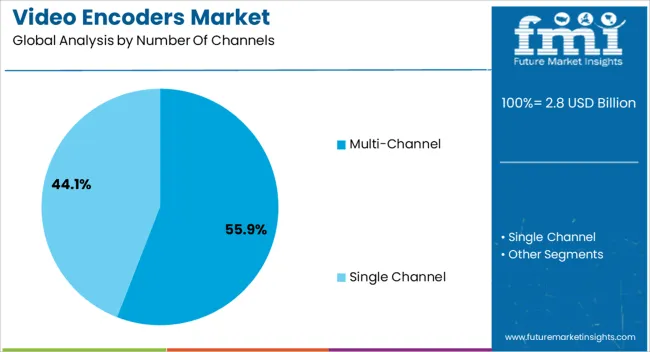

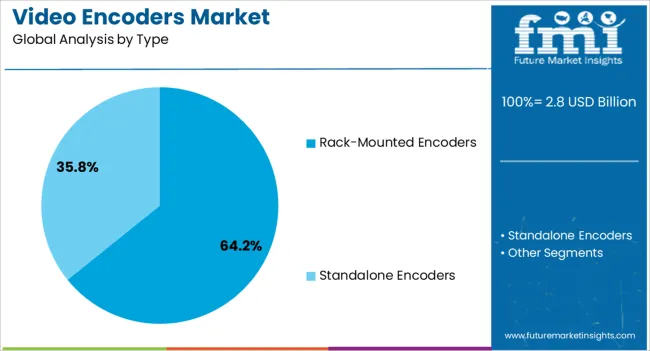

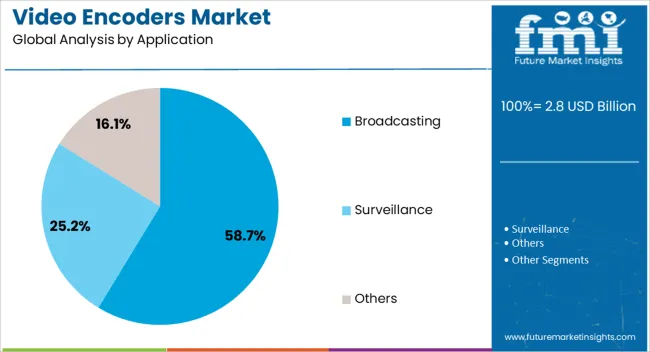

The video encoders market is segmented by number of channels, type, application, and geographic regions. By number of channels, video encoders market is divided into Multi-Channel and Single Channel. In terms of type, video encoders market is classified into Rack-Mounted Encoders and Standalone Encoders. Based on application, video encoders market is segmented into Broadcasting, Surveillance, and Others. Regionally, the video encoders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi-channel segment is projected to account for 55.9% of the video encoders market revenue share in 2025, making it the leading configuration based on the number of channels. This segment’s dominance is being driven by the need to simultaneously encode and stream multiple video feeds in high-resolution formats across broadcasting, security, and enterprise video applications. Multi-channel encoders offer superior scalability and operational efficiency, allowing broadcasters and content providers to consolidate encoding processes into a single unit while managing multiple inputs.

The increasing trend toward centralized video processing, especially in newsrooms, sports broadcasting, and surveillance control centers, is further strengthening segment adoption. Advancements in hardware acceleration and real-time video processing have significantly enhanced the performance of multi-channel systems, enabling them to support ultra-high-definition formats with minimal latency.

The rising use of virtualized and software-based multi-channel encoders in cloud workflows is also reinforcing their relevance in modern broadcasting environments. As organizations continue to expand their content delivery capabilities, multi-channel encoders are expected to maintain their leadership in the market.

The rack-mounted encoders segment is expected to hold 64.2% of the video encoders market revenue share in 2025, making it the most prominent type. This leadership is being supported by their widespread deployment in professional broadcasting, production facilities, and large-scale live streaming setups where space efficiency, reliability, and high processing power are critical. Rack-mounted systems offer the advantage of centralized operation and easy integration into existing server infrastructures, which is essential for broadcasters managing complex workflows.

Their modularity and expandability make them suitable for dynamic production environments where scalability and high input density are required. Continuous improvements in codec support, including HEVC and AV1, along with high-efficiency transcoding capabilities, are enhancing the value proposition of rack-mounted units.

These systems are also preferred in mission-critical applications due to their robust thermal management and uninterrupted performance. As demand increases for 24/7 streaming and multi-format content delivery, rack-mounted encoders are expected to remain the backbone of professional-grade video encoding infrastructure.

The broadcasting segment is anticipated to represent 58.7% of the video encoders market revenue share in 2025, making it the largest application area. This dominance is being fueled by the continuous expansion of digital television services, live event coverage, and the migration of traditional broadcasters to IP-based content delivery models. Video encoders play an essential role in compressing and transmitting high-quality video signals over various networks while maintaining broadcast-grade quality and low latency.

The rise of HD and 4K content production, coupled with growing consumer demand for seamless viewing experiences, is increasing the need for advanced encoding solutions within the broadcasting ecosystem. Government mandates for digital switchover and improvements in broadband infrastructure are further accelerating encoder deployment.

Broadcasters are also leveraging real-time encoding capabilities for live sports, news, and entertainment events, where time-sensitive content delivery is crucial. As broadcasters seek to optimize costs, scale operations, and enhance viewer experiences, the use of professional-grade encoders in broadcasting is expected to maintain its leading position in the market.

The video encoders market is experiencing strong growth due to increasing demand for high-quality, multi-platform video streaming. With opportunities in OTT and broadcast sectors, the market is seeing a shift toward cloud-based encoding solutions. However, challenges related to compatibility and cost optimization remain key factors. As consumer preferences evolve and video quality expectations rise, the market for video encoders is set for significant development, requiring continuous adaptation by solution providers.

The video encoders market is driven by the rising demand for high-quality streaming services. As consumers increasingly prefer video content across platforms, such as OTT services and social media, the need for advanced video encoding solutions has grown. Video encoders are essential for compressing video files without compromising quality, enabling efficient data transmission. The shift toward 4K and 8K content streaming further fuels the demand, pushing broadcasters and streaming platforms to invest in cutting-edge video encoding technology.

Significant opportunities lie in the integration of video encoders within the growing broadcast and OTT sectors. With the increasing consumption of digital video content across global markets, video encoders play a critical role in enhancing viewer experiences by ensuring smooth, high-definition broadcasts. As OTT platforms scale up operations, the need for robust encoding solutions will continue to expand. Content providers are likely to adopt scalable video encoders for different resolution formats to meet market demands.

The adoption of cloud-based video encoding solutions is one of the defining trends in the market. Cloud encoders offer flexibility and cost-efficiency, enabling businesses to scale operations and process video content from any location. Additionally, the trend toward multi-platform streaming demands encoding solutions that can cater to diverse formats, including mobile, smart TVs, and desktops. This trend has prompted businesses to invest in versatile encoders capable of handling varying output requirements across different media.

Despite the opportunities, the video encoders market faces challenges, particularly around compatibility and cost optimization. Video encoding systems must be compatible with a wide range of devices and platforms, requiring constant updates and customizations. Additionally, the costs associated with high-quality video encoding equipment can be prohibitive for smaller companies, hindering market penetration. The challenge lies in striking a balance between cost-effectiveness and maintaining the superior quality required for professional video delivery.

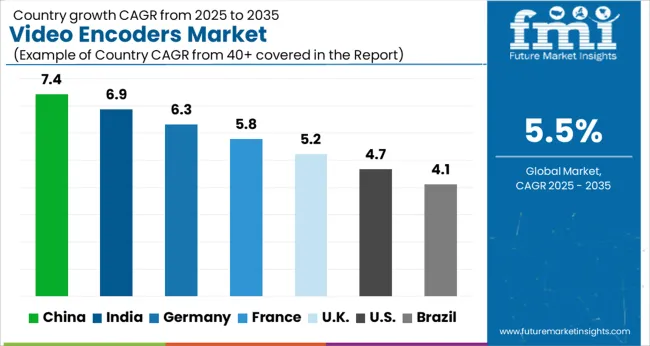

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global video encoders market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and Germany at 6.3%. The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. The increasing demand for video streaming, the rise in video surveillance systems, and the growing adoption of video encoding technologies in the media and entertainment industries are driving the growth. China and India are seeing rapid adoption due to expanding internet penetration and rising media consumption, while developed countries like the USA and UK focus on enhancing video quality and integration with advanced platforms. This report includes insights on 40+ countries; the top markets are shown here for reference.

The video encoders market in China is experiencing rapid growth, projected to grow at a CAGR of 7.4%. The country's rapid digital transformation, expanding internet connectivity, and surging demand for video streaming services are driving the adoption of video encoding technologies. China’s vast consumer base for media and entertainment platforms, such as video-on-demand and live streaming, is increasing the need for high-quality video encoders that ensure smooth, high-resolution streaming experiences. Moreover, the growth of e-commerce and online education platforms is further fueling the demand for video encoders. Government initiatives to support digital infrastructure development and the adoption of 5G technology are also propelling the market forward, as these technologies allow for faster and more reliable video delivery. With China being a global leader in internet video traffic and online content consumption, the video encoders market continues to expand rapidly.

The video encoders market in India is growing at a rate of 6.9%, fueled by the increasing number of internet users, the rising popularity of online video streaming platforms, and the expansion of media and entertainment services. As India experiences a boom in mobile internet usage and affordable data plans, more consumers are engaging with video content across various platforms. This growing demand for high-quality video streaming is prompting media companies and OTT platforms to invest in advanced video encoding technologies. Additionally, India’s thriving e-commerce and educational sectors are adopting video content for product promotions, training programs, and live tutorials, further accelerating the need for efficient video encoding solutions. The integration of artificial intelligence in video encoding is also gaining traction, driving efficiency and reducing latency in content delivery.

The video encoders market in Germany is projected to grow at 6.3%, driven by the country’s strong technological infrastructure and high demand for broadcast-quality video content. With the rise of video streaming services and the increasing trend of digital media consumption, both consumers and businesses are demanding higher video quality and more reliable streaming. Germany’s well-established media and entertainment sector is a key adopter of video encoders, utilizing them for live streaming, sports broadcasting, and professional content creation. The country’s robust e-commerce sector is also turning to video content for product demonstrations and advertising. Additionally, Germany's focus on advanced technologies such as 5G and AI is contributing to the growing need for more efficient and scalable video encoding solutions. As video consumption continues to rise in Germany, the demand for high-performance encoders that can handle large-scale streaming and content delivery is expected to grow steadily.

The United Kingdom video encoders market is experiencing steady growth at a rate of 5.2%, supported by increasing consumer demand for high-quality streaming services and advanced video content. The rise of OTT platforms in the UK is a major contributor to the market, as these platforms require reliable video encoders to deliver seamless content to their users. The UK also has a mature media and entertainment sector, with established broadcasters and production companies that rely on video encoders for high-definition content creation and live broadcasts. The government’s focus on enhancing digital infrastructure and its ongoing 5G rollout will also boost the demand for video encoding solutions that can meet the higher data demands of 5G networks. Furthermore, the growing popularity of online gaming and virtual events in the UK is likely to increase the need for efficient video encoding technologies.

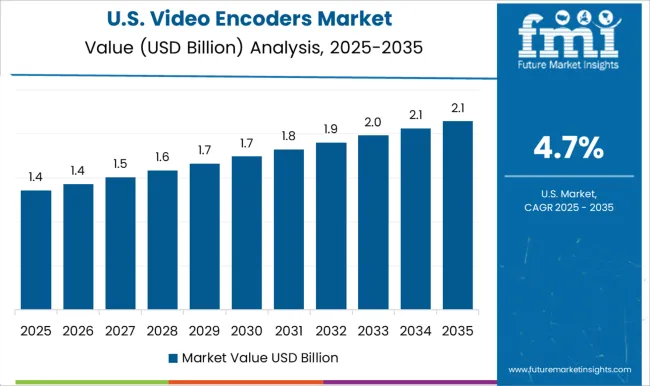

The United States video encoders market, while experiencing slower growth at 4.7%, remains a key player in the video encoders market due to its advanced technological landscape and large-scale media consumption. The USA has a high demand for video encoding solutions across multiple sectors, including media and entertainment, corporate broadcasting, and online gaming. The country is home to major OTT platforms and content providers that require state-of-the-art video encoding technologies to ensure high-quality video delivery to their customers. The continued adoption of 5G networks and cloud services is further accelerating the demand for efficient video encoders, as businesses strive to deliver content faster and more reliably. The USA is also witnessing an increase in the use of video encoding for surveillance systems, as public and private sectors seek advanced solutions for security and monitoring.

The video encoders market is experiencing robust growth due to the rising demand for high-quality video streaming, broadcasting, and surveillance. Companies like Harmonic Inc., CommScope Holding Company Inc., and Mediakind are leading the way in offering cutting-edge video encoding solutions. Harmonic Inc. provides innovative encoding technology that is widely used in content delivery networks (CDNs), enabling broadcasters and OTT platforms to deliver superior video quality. Similarly, CommScope Holding offers flexible encoding systems that cater to a wide range of video transmission applications, from traditional TV networks to modern IP-based services. As more consumers demand high-definition content, the need for efficient and scalable video encoding technologies continues to increase, driving significant market growth.

Cisco Systems Inc., Imagine Communications Corp., and Hangzhou Hikvision Digital Technology Co., Ltd. are also instrumental in shaping the market landscape. Cisco leverages its expertise in networking to provide comprehensive encoding solutions that integrate seamlessly into digital video workflows, enabling smooth, high-quality streaming across various platforms. Imagine Communications delivers highly scalable and reliable encoding systems tailored for large-scale broadcasting, helping companies reduce costs while maintaining excellent video quality. Meanwhile, Hikvision has expanded into video surveillance encoding, offering solutions that support real-time monitoring and high-definition video streaming for security applications. Telairity (VITEC) is also contributing to the market by providing portable, high-efficiency encoders designed for live event broadcasting and remote video production. As video content becomes more prevalent across industries like entertainment, security, and enterprise communications, the demand for advanced video encoding technologies is expected to rise further, positioning these companies as key players in the evolving landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Number Of Channels | Multi-Channel and Single Channel |

| Type | Rack-Mounted Encoders and Standalone Encoders |

| Application | Broadcasting, Surveillance, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harmonic Inc., CommScope Holding Company Inc., Mediakind, Cisco Systems Inc., Imagine Communications Corp., Hangzhou Hikvision Digital Technology Co., Ltd., and Telairity (VITEC) |

| Additional Attributes | Dollar sales by encoder type (hardware, software) and application (broadcast, OTT streaming, surveillance, video conferencing) are key metrics. Trends include rising demand for high-quality video streaming, growth in content delivery networks, and increasing adoption of real-time video encoding solutions. Regional deployment, technological advancements, and bandwidth optimization are driving market growth. |

The global video encoders market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the video encoders market is projected to reach USD 4.8 billion by 2035.

The video encoders market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in video encoders market are multi-channel and single channel.

In terms of type, rack-mounted encoders segment to command 64.2% share in the video encoders market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Video Telematics Market Size and Share Forecast Outlook 2025 to 2035

Video Content Management Market Size and Share Forecast Outlook 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Walls Market by Component, Display Technology, Industry, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Video Doorbell Market by Product Type, End User, Sales Channel, and Region - Growth, Trends, and Forecast through 2035

Video Streaming Market Growth – Innovations, Trends & Forecast 2025-2035

Video Intercom Device Market Analysis by Product, Technology, Vertical, and Region Through 2035

AI-Powered Video Streaming – Future of Digital Entertainment

Video Encoder and Decoder Market

Video-Guided Pericardial Access Device Market

Video Converter Software Market

Video Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA