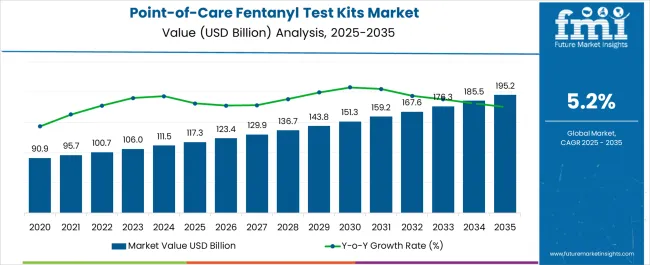

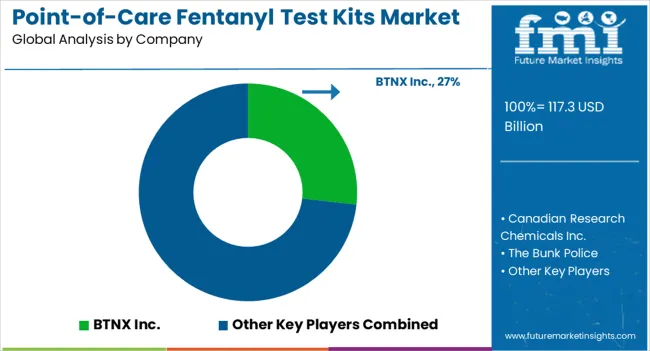

The Point-of-Care Fentanyl Test Kits Market is estimated to be valued at USD 117.3 billion in 2025 and is projected to reach USD 195.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Point-of-Care Fentanyl Test Kits Market Estimated Value in (2025 E) | USD 117.3 billion |

| Point-of-Care Fentanyl Test Kits Market Forecast Value in (2035 F) | USD 195.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The point of care fentanyl test kits market is expanding rapidly due to the rising prevalence of opioid misuse and the urgent need for rapid detection methods in both clinical and community settings. The increasing number of overdose cases has accelerated demand for accurate, portable, and easy to use testing solutions that deliver timely results.

Public health authorities and healthcare institutions are adopting these kits to strengthen early intervention programs and reduce mortality associated with fentanyl exposure. Advancements in assay sensitivity and user friendly formats are enhancing reliability and convenience, making them suitable for diverse environments ranging from hospitals to rehabilitation centers.

With governments and healthcare organizations intensifying focus on opioid crisis management, the outlook remains strong for continued adoption of point of care fentanyl testing as part of comprehensive harm reduction strategies.

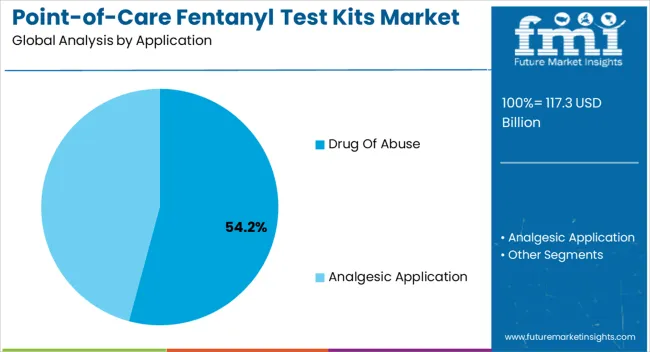

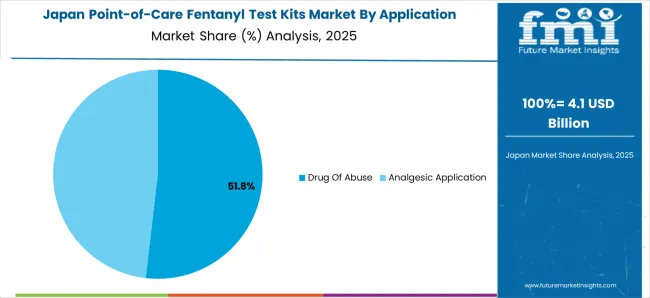

The drug of abuse segment is expected to hold 54.20% of total market revenue by 2025, making it the leading application area. Growth in this segment is being fueled by the rising incidence of opioid addiction and the critical requirement for immediate identification of fentanyl presence in biological samples.

The ability of these test kits to provide quick and reliable results without laboratory infrastructure has accelerated their adoption in emergency response and community level drug monitoring programs.

Their role in supporting preventive care, treatment initiation, and patient monitoring continues to reinforce their dominance in the application category.

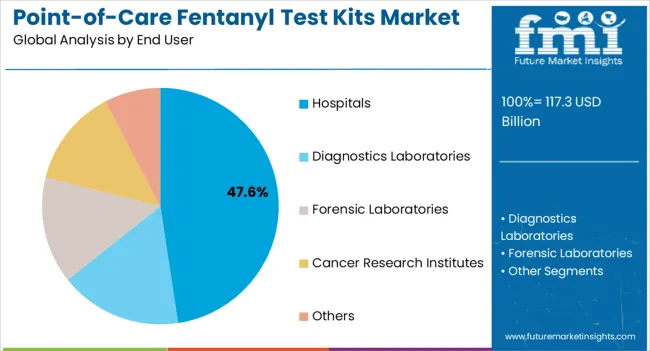

The hospitals segment is projected to contribute 47.60% of the overall market revenue by 2025, positioning it as the largest end user category. The dominance of this segment is attributed to the high volume of emergency admissions related to fentanyl overdoses and the growing emphasis on rapid diagnostic tools for immediate clinical decision making.

Hospitals have been integrating point of care fentanyl test kits into emergency rooms, intensive care units, and toxicology departments to facilitate fast and accurate intervention.

The capacity to streamline workflows, improve patient outcomes, and comply with regulatory safety protocols has further strengthened the presence of hospitals as the leading end user in this market.

From 2020 to 2025, the global point-of-care fentanyl test kits Market experienced a CAGR of 4.5%, reaching a market size of USD 117.3 million in 2025.

From 2020 to 2025, the global point-of-care fentanyl test kits industry witnessed significant growth as regulatory bodies have recognized the need for accurate and reliable fentanyl testing and have provided support and guidelines for the development and use of point-of-care fentanyl test kits. These regulations ensure the quality and safety of the test kits, instilling confidence among end-users and facilitating market growth.

Future Forecast for Point-of-Care Fentanyl Test Kits Market Industry:

Looking ahead, the global point-of-care fentanyl test kits market industry is expected to rise at a CAGR of 5.5% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 195.2 million by 2035.

The point-of-care fentanyl test kits industry is expected to continue its growth trajectory from 2025 to 2035, driven by growing awareness about the risks associated with fentanyl use and the need for early detection is expected to fuel the demand for point-of-care fentanyl test kits. Government initiatives aimed at combating the opioid crisis and reducing fentanyl-related deaths are likely to drive the adoption of these test kits in various healthcare settings.

The growth of the point-of-care fentanyl test kits market will be driven by increasing awareness, technological advancements, expanding point-of-care testing, regulatory support, integration with digital health technologies, customization for specific settings, international market expansion, and emphasis on user-friendly design and simplified workflows.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 195.2 million |

| CAGR % 2025 to End of Forecast (2035) | 6.0% |

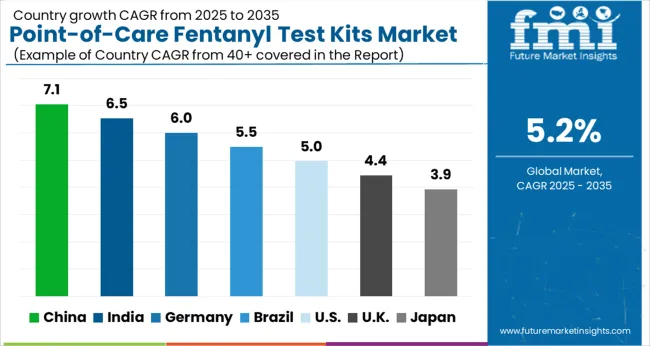

The point-of-care fentanyl test kits industry in the United States is expected to reach a market size of USD 195.2 million by 2035, expanding at a CAGR of 6.0%. The opioid crisis in the United States has reached alarming levels, with fentanyl contributing significantly to overdose deaths. Fentanyl is a potent synthetic opioid that is often mixed with other drugs, leading to accidental overdoses. The need for accurate and rapid detection of fentanyl at the point of care has become crucial in combating the opioid crisis, driving the demand for fentanyl test kits.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 10.0 million |

| CAGR % 2025 to End of Forecast (2035) | 6.2% |

The point-of-care fentanyl test kits industry in the United Kingdom is expected to reach a market size of USD 10.0 million, expanding at a CAGR of 6.2% during the forecast period. The United Kingdom has seen an increase in the misuse and illicit distribution of fentanyl, which has raised concerns about its impact on public health and safety. Fentanyl is a potent synthetic opioid that poses a significant risk of overdose and death. The need for accurate and accessible fentanyl testing at the point of care has become crucial to address this growing concern.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 11.1 million |

| CAGR % 2025 to End of Forecast (2035) | 5.9% |

The point-of-care fentanyl test kits industry in China is anticipated to reach a market size of USD 11.1 million, moving at a CAGR of 5.9% during the forecast period. The Chinese government, along with healthcare organizations and non-profit groups, is actively involved in raising awareness about the risks associated with fentanyl use. Public education campaigns and targeted interventions aim to inform the public, healthcare professionals, and relevant stakeholders about the dangers of fentanyl and the importance of testing. Increased awareness drives the demand for point-of-care fentanyl test kits as a preventive measure.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 8.2 million |

| CAGR % 2025 to End of Forecast (2035) | 5.8% |

The point-of-care fentanyl test kits industry in Japan is estimated to reach a market size of USD 8.2 million by 2035, thriving at a CAGR of 5.8%. The point-of-care fentanyl test kits market in Japan is influenced by advancements in technology and product innovations. Manufacturers are continuously developing more sensitive, specific, and user-friendly test kits that deliver rapid and accurate results. These advancements contribute to the wider adoption and use of point-of-care fentanyl test kits in various healthcare and non-healthcare settings.

table style="width:100%"> Country South Korea Market Size (USD million) by End of Forecast Period (2035) USD 117.3 million CAGR % 2025 to End of Forecast (2035) 5.6%

The point-of-care fentanyl test kits industry in South Korea is expected to reach a market size of USD 117.3 million, expanding at a CAGR of 5.6% during the forecast period. Drug testing and monitoring programs are gaining prominence in South Korea, particularly in workplaces, educational institutions, and rehabilitation centers. These programs aim to identify drug use and provide appropriate interventions. Fentanyl detection is a critical component of these programs due to its high potency and potential risks. Point-of-care fentanyl test kits offer a convenient and rapid screening tool for detecting fentanyl in urine or other samples, supporting the effectiveness of drug testing initiatives.

Drug of Abuse are expected to dominate the point-of-care fentanyl test kits industry with a CAGR of 5.2% from 2025 to 2035. The development of advanced technologies in point-of-care fentanyl test kits has significantly contributed to their market growth. Innovations such as improved sensitivity, specificity, and ease of use have made these test kits more reliable and accessible. Manufacturers continue to invest in research and development to enhance the performance and efficiency of point-of-care fentanyl test kits, driving their adoption in drug abuse testing programs.

Forensic Laboratories is expected to dominate the point-of-care fentanyl test kits industry with a CAGR of 5.7% from 2025 to 2035. Forensic investigations often take place at crime scenes or other field settings, where immediate drug detection is crucial. Point-of-care fentanyl test kits enable forensic professionals to conduct preliminary drug screening at the scene, providing real-time information for decision-making and ensuring the collection of relevant evidence. This aids in the effective investigation of drug-related crimes and enhances the overall efficiency of forensic processes.

The point-of-care fentanyl test kits market is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must develop effective conjugates.

Key Strategies Used by the Participants

Companies are investing in research & development to deliver product that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

The point-of-care fentanyl test kits market is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Mergers and acquisitions are frequently used by key players in the point-of-care fentanyl test kits industry to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Point-of-Care Fentanyl Test Kits Market:

The global point-of-care fentanyl test kits market is estimated to be valued at USD 117.3 billion in 2025.

The market size for the point-of-care fentanyl test kits market is projected to reach USD 195.2 billion by 2035.

The point-of-care fentanyl test kits market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in point-of-care fentanyl test kits market are drug of abuse and analgesic application.

In terms of end user, hospitals segment to command 47.6% share in the point-of-care fentanyl test kits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Point-of-Care Opioid Testing Market Size and Share Forecast Outlook 2025 to 2035

Point-Of-Care Genetic Testing Market

Point-of-Care Food Sensitivity Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Audio Kits Market

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

Lavage Kits Market

Organoids Kits Market

Capacitor Kits Market

Connector Kits Market

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DIY Haircut Kits Market - Trends, Growth & Forecast 2025 to 2035

EMI, Filter Kits Market

Nephelometry Kits Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Chilled Meal Kits Market

1-Step RT-PCR Kits Market Size and Share Forecast Outlook 2025 to 2035

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Antibody Pair Kits Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA