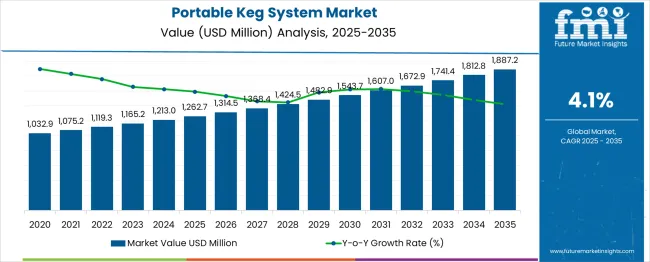

The Portable Keg System Market is estimated to be valued at USD 1262.7 million in 2025 and is projected to reach USD 1887.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The portable keg system market is experiencing steady growth as changing consumption patterns, sustainability trends, and increasing demand for fresh draft beverages converge to create favorable conditions for adoption.

Growing consumer interest in craft beverages and the preference for reusable, hygienic, and transportable solutions have positioned portable keg systems as a desirable alternative to disposable packaging. Industry advancements in material durability and design innovations are enhancing product longevity and user convenience, further strengthening their market acceptance.

Future growth is expected to be supported by expanding hospitality sectors, rising outdoor and event-based consumption, and strategic collaborations between beverage brands and equipment manufacturers. Operational efficiency and reduced waste generation are paving the way for broader deployment of these systems across commercial and leisure applications, establishing a foundation for long-term market expansion.

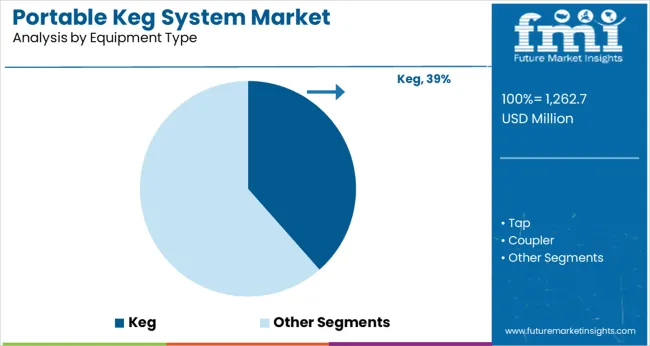

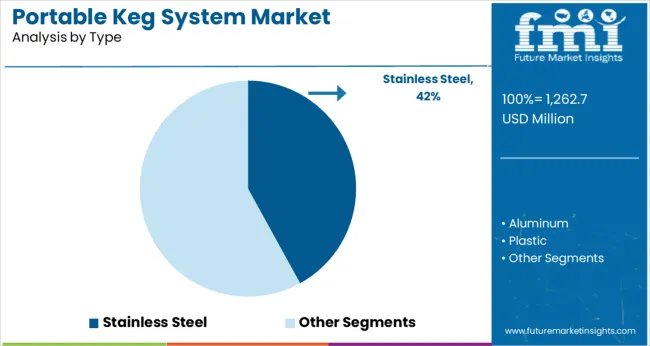

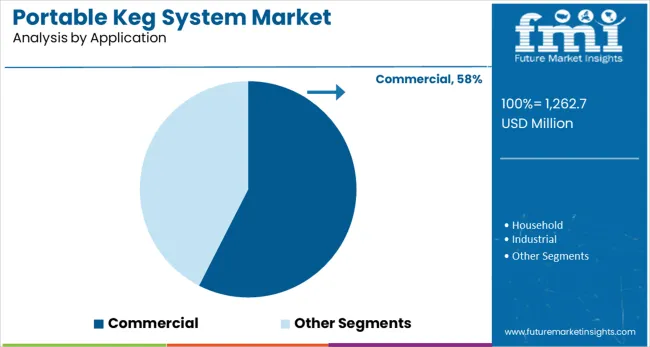

The market is segmented by Equipment Type, Type, Application, Mode of Operation, and Distribution Channel and region. By Equipment Type, the market is divided into Keg, Tap, and Coupler. In terms of Type, the market is classified into Stainless Steel, Aluminum, and Plastic. Based on Application, the market is segmented into Commercial, Household, and Industrial. By Mode of Operation, the market is divided into Tap Systems and Self-serve Systems. By Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Equipment Type, Type, Application, Mode of Operation, and Distribution Channel and region. By Equipment Type, the market is divided into Keg, Tap, and Coupler. In terms of Type, the market is classified into Stainless Steel, Aluminum, and Plastic. Based on Application, the market is segmented into Commercial, Household, and Industrial. By Mode of Operation, the market is divided into Tap Systems and Self-serve Systems. By Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment type, the keg segment is expected to hold 38.5% of the total market revenue in 2025, positioning itself as the leading equipment type. This leadership is being driven by the simplicity, robustness, and widespread familiarity of traditional kegs among both commercial operators and consumers.

Enhanced designs featuring improved sealing mechanisms, lightweight construction, and ergonomic handles have increased usability and reduced maintenance requirements. The ability of kegs to preserve beverage freshness over extended periods and to withstand repeated use has strengthened their appeal in high-volume settings.

Additionally, standardization across dispensing systems and accessories has further reinforced the dominance of the keg segment by ensuring compatibility and operational ease in diverse environments.

Segmented by type, stainless steel is projected to account for 42.0% of the market revenue in 2025, maintaining its position as the top material segment. This prominence is being supported by the material’s inherent strength, corrosion resistance, and ability to maintain beverage quality without imparting off-flavors.

Stainless steel’s durability under frequent handling and cleaning cycles makes it particularly suitable for commercial and repeated-use scenarios. Its recyclability and alignment with sustainability goals have further elevated its adoption among environmentally conscious operators.

Moreover, stainless steel kegs are perceived as a premium option, offering a balance of longevity, hygiene, and brand image enhancement, which has solidified their position as the preferred choice in the portable keg system market.

When segmented by application, the commercial segment is anticipated to capture 57.5% of the market revenue in 2025, securing its leading share. This dominance is being attributed to the extensive use of portable keg systems in bars, restaurants, catering services, and event venues where draft beverages are in high demand.

The ability to serve large volumes efficiently while minimizing packaging waste and ensuring consistent quality has made these systems indispensable in professional settings. Investments in modern dispensing infrastructure and increasing focus on operational sustainability have further driven adoption within the commercial segment.

Additionally, the segment’s prominence is being reinforced by the growing number of establishments seeking to differentiate their service offering through fresh, on-tap experiences that resonate with evolving consumer preferences.

Consumers are shifting towards the adoption of portable keg system as it aids in preserving the true flavor and quality of alcoholic beverages for extended periods. Since portable keg systems are typically used by multiple breweries to serve draught beer to maintain pressure, on-trade sales account for a bigger portion of the product's demand. Furthermore, the sales are spurred by a changing consumer lifestyle and rising per capita income, together with growing demand for luxury goods like craft and draught varieties.

Portable keg systems have lately entered a new market and are still in the early phases of development but have already demonstrated tremendous promise for future growth. Beer, wine, or other beverage kegs can be transported and stored using the portable keg system. This solution is ideal for people who want to enjoy their favorite beverages while on the road without worrying about lugging along bulky kegs.

The beverage sector is expected to benefit from the usage of portable keg systems as a packaging option in the future. Plastic portable keg systems may be recycled, and returning them is less expensive. The popularity of portable keg systems, on the other hand, has prompted manufacturers to offer portable keg systems for lease, which has led to an increase in keg adoption.

Single-use portable keg systems are a more practical and cost-effective substitute for conventional steel kegs, and it is expected that they will be utilized extensively soon. Due to consumer excitement for craft beers, which has boosted the global portable keg system industry, the microbrew industry is also growing. Legislative restrictions that favor lower package weight limitations are expected to promote the usage of portable keg systems.

| Attribute | Details |

|---|---|

| Portable Keg System Market Size (2025) | USD 1,165.2 million |

| Portable Keg System Market Forecast Value (2035) | USD 1,741.4 million |

| Portable Keg System Market CAGR | 4.1% |

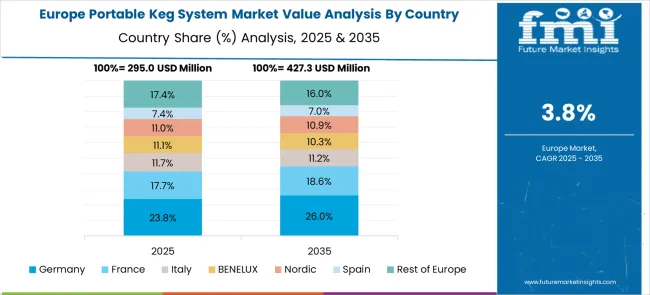

| Share of Germany in the Portable Keg System Market | 23.8% |

According to Future Market Insights, the Wine crusher was growing at a CAGR of 3.6% to reach USD 1,119.3 million in 2025 from USD 1032.9 million in 2020.

The market for portable keg systems has grown as a result of the advantages they have over conventional keg systems. In addition to being substantially simpler to set up and carry, portable keg systems also have several other benefits. However, there is significant disagreement over the market for portable keg systems in the future. In the years to come, some industry analysts predict that the market will expand, while others predict that it will finally stall. The market for portable keg systems is predicted to grow at a CAGR of 4.1% during the expected period, according to research by Future Market Insights.

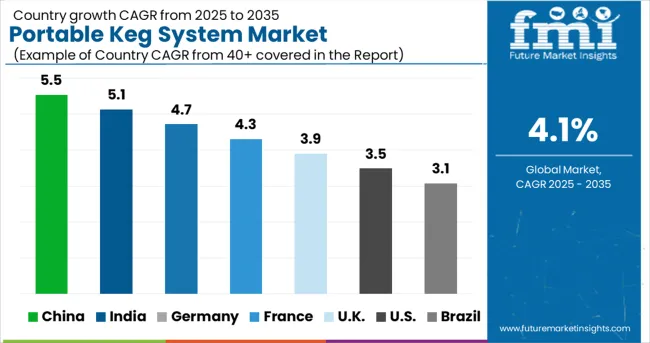

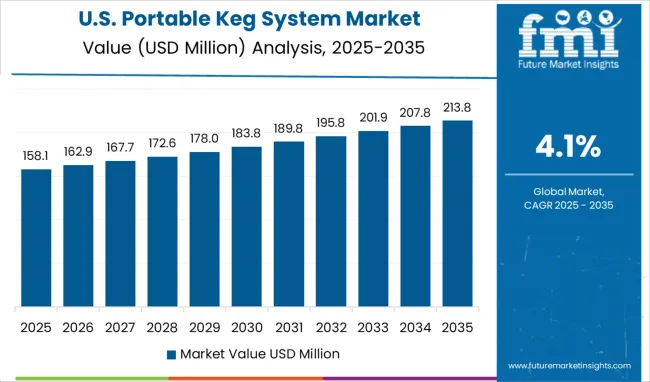

The USA is expected to be the largest market for portable keg systems due to the growing demand from the beer industry. Europe is expected to be the second largest market due to the presence of a large number of breweries. Asia Pacific is expected to be the fastest-growing market for portable keg systems due to the growing demand from countries such as China and India.

The United States dominates the global portable keg system market due to high demand from breweries and wineries in this region. Europe is expected to be the second-largest market for portable keg systems due to the rising popularity of draught beer in this region.

The portable keg system is a unique product that offers many benefits to consumers. This system is perfect for those who enjoy beer but do not want to deal with the hassle of traditional kegs. A portable keg system is also a great option for those who want to have fresh beer on tap without having to worry about storing or transporting kegs.

There are many reasons why Europe is an attractive market for portable keg systems. One reason is that the system is very easy to use. Consumers simply need to fill the tank with beer and then screw on the top. The system will then keep the beer fresh and carbonated for up to 30 days. This means that consumers can have fresh beer anytime they want without having to worry about buying or storing kegs.

This growth can be attributed to the rising demand for portable keg systems in countries such as China, Japan, and India. The increasing number of bars and restaurants in these countries is one of the major factors driving the growth of the portable keg system market in the Asia Pacific.

The other factor fueling the growth of this market is the growing preference for draught beer among consumers in this region. The portability and easy handling of these systems are some of the factors that attract consumers to them.

Asia Pacific is emerging as an opportunistic market for portable keg systems due to the growing demand for premium beer and cider products. Portable keg systems offer a convenient and cost-effective solution for dispensing these products and are therefore becoming increasingly popular in the region.

The food and beverage industry is a major contributor to the growth of the portable keg system market. The popularity of portable kegs has grown exponentially in recent years due to their convenience and portability. Many people prefer to use portable kegs over traditional kegs because they are easier to transport and can be used in a variety of settings.

Food and beverage companies have been quick to capitalize on this trend by investing in the development of new and innovative portable keg systems. These companies are constantly striving to improve the quality and performance of their products to meet the demands of their customers.

Portable keg systems offer several benefits over traditional kegs, which makes them an attractive option for both consumers and businesses alike. They are more efficient, easier to transport, and can be used in a variety of settings.

Portable keg systems are popular in the commercial sector and are expected to experience maximum growth in this category. This type of system is ideal for businesses that want to serve fresh, cold beer on tap without the hassle and expense of a traditional keg system. Portable keg systems are also becoming increasingly popular in the home brewing market.

The global portable keg system market is highly competitive, with a large number of players. Some of the key players in this market are Heineken N.V., Anheuser-Busch InBev, Krombacher Brauerei, Asahi Breweries, Carlsberg Group, and Diageo plc. These players have a strong presence in the global market and are well-positioned to capitalize on the growing demand for portable keg systems.

Heineken has introduced a portable keg beer system as part of a £100 million marketing campaign. Heineken declared in February that it would spend an additional £100 million on marketing and repackaging in 2005 to improve the brand's standing in the premium beer market.

The new draught system, called DraughtKeg, has a tiny barrel with 4.75 liters of beer within. A proprietary pressurized gas system, resembling those seen in bars, is utilized for pouring the beer. The manufacturer asserts that the product produces beer of a higher standard. The BeerTender, Heineken's first at-home draught beer system, was introduced in 2004 and was followed by the keg. DraughtKeg was introduced in France, and later it was sold in the USA. According to the company, there is no specific timeline for a United Kingdom debut. The keg, according to Anthony Ruys, chairman of the executive board of Heineken, was created to boost sales and meet shifting consumer demands for beer.

At IBIE in Las Vegas in September 2025, Sonneveld and KeyKeg presented the Easy Go Keg system to the North American professional baking community. For premium bakery items, this ground-breaking method employs a continuous spray pattern of release agents, producing a flawless release at a low cost of use, a longer shelf-life, and fewer rejections.

The system's handy spray gun and programmable pressure settings enable bakers to efficiently apply uniform, concentrated dosages of release agent on baking moulds, tins, trays, and conveyor belts. By lessening fogging, the spray pattern also aids in maintaining the cleanliness and hygiene of the bakery. To guarantee future growth, American Keg and Blefa Kegs announced in January 2024 that Blefa would invest significantly in American Keg in terms of equity and technology.

Loudoun wine and beer Tour Company plans to saturate Greater Washington, according to a publication published by American City Business Journals in August 2025. In September 2024, Newsmatics Inc. published an article titled Kegs have Become More Popular as a Promising, Long-term Packaging Solution and tells that as a packaging option for beverages, kegs are anticipated to have a promising future. It mentioned that increasing consumption of wine and beer affects the demand for kegs for preparation, preservation, and transport.

In an article titled Keg Wine on Tap: A Swiss Sustainable Innovation, published in September 2024 by Hospitality NetTM, it is said that one innovation was keg wine, which perfectly preserves wine quality while also being practical, eco-friendly, and economical.

| Attribute | Details |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2025 |

| Market analysis | million in value |

| Key regions covered | North America; Eastern Europe; Western Europe; Japan; South America; Asian Pacific; Middle East and Africa (MEA) |

| Key countries covered | USA, Germany, France, Italy, Canada, The United Kingdom, Spain, China, India, Australia |

| Key segments covered | Type, Mode of operation, Equipment Type, Application, Distribution channel, Region |

| Key companies profiled | Heineken N.V; Anheuser-Busch InBev; Krombacher Brauerei; Asahi Breweries; Carlsberg Group; Diageo plc; Cornelius Kegs Ltd; Kegco; Eppelsheimer; Zambelli; Lasotherm Technologies; Alphatech Process Equipments |

| Report Coverage | Market Forecast, Company Share Analysis, Market Dynamics, Challenges, Competitive Landscape, DROT Analysis, Strategic Growth Initiatives |

| Customization and Pricing |

Available upon request |

The global portable keg system market is estimated to be valued at USD 1,262.7 million in 2025.

It is projected to reach USD 1,887.2 million by 2035.

The market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types are keg, tap and coupler.

stainless steel segment is expected to dominate with a 42.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA