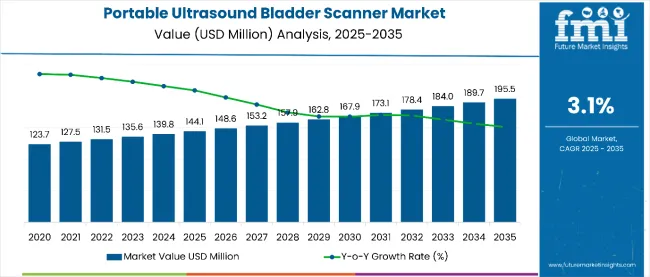

The global portable ultrasound bladder scanner market is projected to grow from USD 144.1 million in 2025 to USD 195.5 million by 2035, advancing at a CAGR of 3.1%.This steady growth is fueled by the increasing prevalence of urological disorders such as urinary incontinence, urinary retention, and benign prostatic hyperplasia (BPH).

These conditions are particularly common among the elderly, leading to higher demand for non-invasive diagnostic tools that enable early and accurate detection. Portable bladder scanners use ultrasound technology to measure bladder volume without the need for catheterization. Their non-invasive nature, ease of use, and real-time imaging capability make them ideal for point-of-care testing across diverse healthcare settings. These scanners reduce patient discomfort and improve diagnostic speed, which is especially critical in emergency departments, urology clinics, and long-term care facilities.

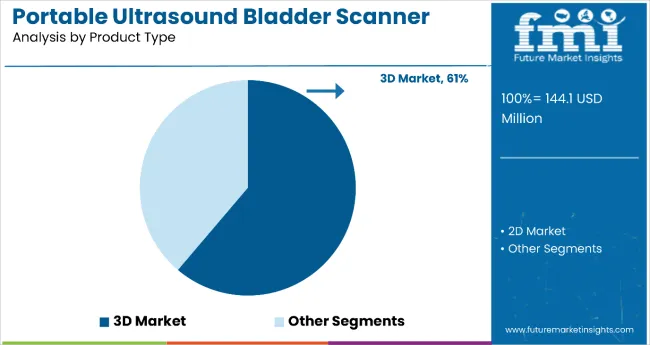

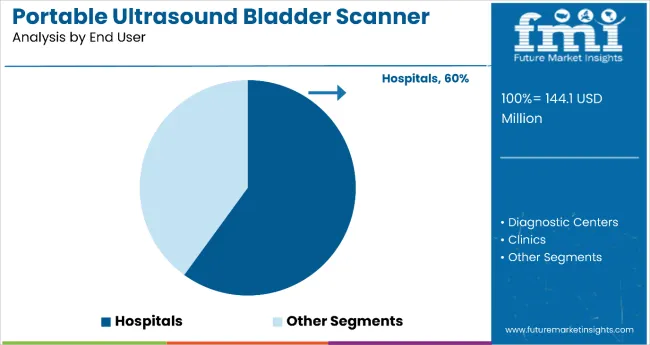

3D portable bladder scanners are gaining significant traction due to their superior imaging capabilities. They allow healthcare professionals to visualize the bladder in three dimensions, improving diagnostic accuracy and reducing the need for repeat scans. In 2025, 3D models are expected to hold a 61% share, outperforming traditional 2D scanners. Hospitals remain the dominant end users, accounting for 60% of total market revenue in 2025.

These facilities rely on portable scanners for bedside diagnostics and post-surgical assessments, particularly in urology and geriatrics departments. In parallel, technological advancements continue to reshape the industry. Devices are becoming more compact and user-friendly, featuring wireless connectivity, touchscreen interfaces, and AI-assisted diagnostics. These upgrades not only enhance performance but also support the integration of scanners into digital hospital systems.

Growing interest in home healthcare and telemedicine is also influencing market dynamics. Portable bladder scanners are increasingly used in home settings, enabling patients with chronic urological issues to monitor their condition remotely. This shift aligns with global healthcare trends focused on decentralized care delivery and reducing hospital readmissions. Regulatory bodies such as the FDA recommend using diagnostic tools with minimal radiation exposure, like ultrasound, wherever appropriate.

This guidance strengthens the role of portable bladder scanners in clinical pathways. In December 2022, As per Otsuka’s press release, Otsuka Pharmaceutical Factory launched the Lilium One, a portable bladder scanner designed for quick and accurate bladder volume measurement. Similarly, Laborie Medical Technologies invested in Bright Uro’s Glean Urodynamic System in late 2023, indicating strong momentum in product innovation and market expansion.

| Attribute | Detail |

|---|---|

| Market Value (2025E) | USD 144.1 million |

| Market Value (2035F) | USD 195.5 million |

| CAGR (2025 to 2035) | 3.10% |

The portable ultrasound bladder scanner market is becoming an essential part of hospital digital infrastructure and integrated diagnostics. In hospital settings, these scanners are now connected to EMR systems like Cerner and Epic to support real-time documentation, streamline data sharing, and reduce manual entry. Their role has also expanded into complex diagnostic workflows, where they function alongside cardiac, renal, and pulmonary assessments within ERs, ICUs, and mobile care units. These devices now contribute not only to urinary diagnostics but to broader fluid management and triage protocols across clinical settings.

The portable ultrasound bladder scanner market is governed by regulatory protocols that focus on safety, clinical accuracy, and non-invasive diagnostic performance. Approvals typically require technical validation, clinical evidence, and post-market surveillance commitments. Devices are classified based on risk level, with most falling under moderate-risk categories. Compliance with electronic data standards, performance reporting, and reimbursement coding is essential to ensure wide adoption across hospitals, clinics, and home healthcare settings.

In 2025, 3D portable ultrasound bladder scanners are projected to hold 61% of market revenue, expanding at a 3.3% CAGR through 2035. Hospitals remain the leading end-users with a 60% share in 2025 and a 2.5% CAGR. Adoption is driven by AI integration, government subsidies, and demand for non-invasive diagnostics in both developed and emerging markets.

The 3D portable ultrasound bladder scanner segment is projected to expand at a CAGR of 3.3% through 2035. In 2025, this product category is anticipated to account for 61% of total market revenue. Growth is being driven by rising demand for higher imaging accuracy and diagnostic confidence in urology departments. These scanners enable clinicians to assess bladder structure and volume in three dimensions, improving diagnosis for irregular bladder shapes and complex cases.

Repeat scanning has been reduced, and patient discomfort is minimized, due to fewer invasive tests. Adoption of 3D bladder scanners is being seen in both public and private healthcare sectors. Manufacturers such as Verathon and Sonostar are integrating AI and machine learning to enhance imaging quality and interpretation. Wireless connectivity and touchscreen interfaces are being incorporated to simplify usage.

Hospitals and diagnostic centers are increasingly using these scanners for pre-surgical evaluations and routine urinary assessments. Investments in R&D and technological miniaturization are accelerating accessibility. In emerging markets, demand is growing due to government support for advanced diagnostics. As 3D imaging becomes standard in urology diagnostics, dominance over 2D systems is expected to continue.

Hospitals are forecast to hold a dominant 60% market share in 2025 and grow at a CAGR of 2.5% through 2035. The high adoption rate is attributed to increased patient admissions and rising demand for point-of-care diagnostic tools. Portable ultrasound bladder scanners are used extensively in emergency rooms, inpatient wards, and surgical recovery units. Real-time imaging, portability, and non-invasiveness make them essential in managing urinary retention and pre-operative assessments.

Public healthcare institutions are investing in equipment upgrades to improve diagnostic efficiency. In developed nations, hospitals are adopting AI-assisted bladder scanners to reduce diagnostic turnaround times. For instance, Echo Nous’ Kosmos platform is being trialed in multiple hospitals to improve training and ultrasound access. Government subsidies and reimbursement support have encouraged hospitals to switch from traditional catheter-based methods to ultrasound diagnostics.

In developing countries, urban hospitals are leading adoption, often supported by multilateral health projects and infrastructure modernization programs. Training modules are being included to upskill medical staff. Hospitals benefit from vendor support programs and procurement partnerships that lower costs and simplify integration. Given their central role in managing urological cases, hospitals will continue to dominate demand for portable bladder scanners.

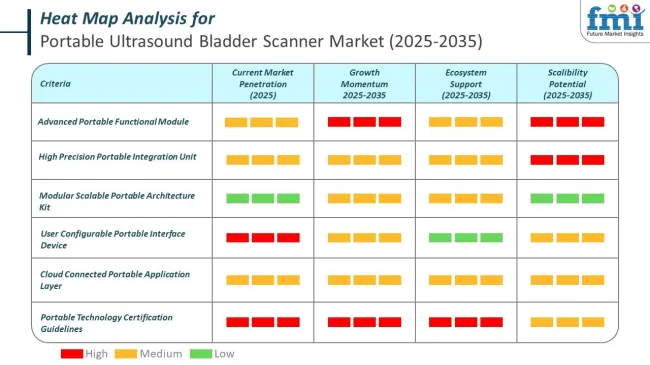

The portable ultrasound bladder scanner market is shaped by strict safety regulations, aging populations, and non-invasive diagnostic demand. Growth is driven by AI integration and regulatory preference for ultrasound. However, complex approval and reimbursement processes, supply chain disruptions, and technician shortages pose challenges. Manufacturers are investing in modular production and digital training to overcome these barriers.

Regulatory bodies such as the USA FDA and European Medicines Agency (EMA) continue to emphasize the use of non-ionizing imaging modalities, particularly ultrasound, over radiation-intensive methods like X-rays and CT scans. These guidelines are aimed at reducing patient exposure to harmful radiation, especially in routine diagnostics. As a result, portable ultrasound bladder scanners are increasingly favored in hospitals, clinics, and long-term care facilities. For instance, the FDA's Image Wisely Campaign encourages clinicians to use safer imaging alternatives where possible.

This regulatory push is prompting procurement shifts toward ultrasound-based diagnostics, boosting adoption across developed markets. The growing implementation of low-dose imaging protocols further complements this trend, reinforcing the case for bladder scanners.

Approving portable ultrasound bladder scanners requires navigating country-specific regulatory frameworks, such as FDA 510(k) in the United States and CE marking in Europe. These processes involve lengthy clinical trials, technical documentation, and post-market surveillance. Reimbursement adds another layer of complexity, with varied coding, cost thresholds, and payer criteria across regions.

In Japan, for example, device pricing approvals by the MHLW can delay commercial availability by 12-18 months. Manufacturers also face challenges in securing public insurance reimbursement without localized clinical evidence. These hurdles restrict market entry for startups and increase go-to-market costs, limiting device accessibility in price-sensitive markets.

Advancements in artificial intelligence (AI) are reshaping how portable bladder scanners operate in clinical workflows. AI-powered scanners such as those from Echo Nous and Butterfly Network can now automatically detect bladder boundaries, calculate volumes, and reduce operator dependency. These smart devices are compatible with electronic health records (EHRs), enabling seamless data integration and telehealth capabilities.

Hospitals are deploying such scanners in emergency and geriatric care, where quick decisions are critical. AI-driven platforms also allow remote specialists to review scans, aiding teleradiology expansion in rural areas. As health systems prioritize data interoperability, investment in connected bladder scanners is accelerating.

Global supply chain disruptions-particularly in semiconductors, microcontrollers, and LCD components-are impacting production timelines for portable bladder scanners. COVID-19-induced backlogs in 2020 to 2022 exposed vulnerabilities in sourcing from single-region suppliers like China and Taiwan. At the same time, a shortage of trained ultrasound technicians hampers adoption in hospitals and clinics, especially across Southeast Asia and Sub-Saharan Africa.

To mitigate these risks, companies such as Clarius Mobile Health are investing in modular manufacturing and cloud-based training platforms. Some governments, like India’s Skill India initiative, have launched programs to certify diagnostic technicians. These efforts aim to build local capacity and streamline market scalability.

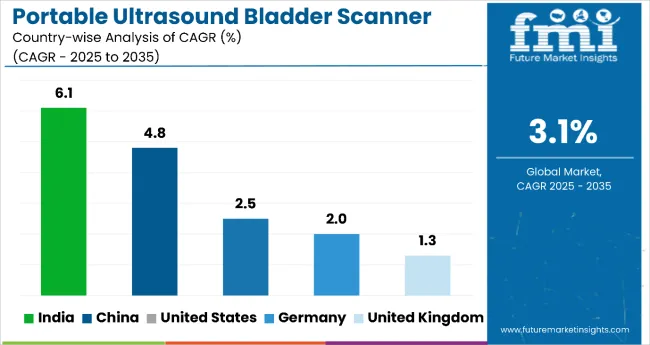

The portable ultrasound bladder scanner market study highlights growth across India, China, United States, Germany, and United Kingdom. Each country is advancing the market through distinct strategies-ranging from localized manufacturing and public health investments to digital health innovation and regulatory support. The table below presents the projected CAGR for each leading country during the 2025 to 2035 forecast period.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.5% |

| United Kingdom | 1.3% |

| India | 6.1% |

| China | 4.8% |

| Germany | 2.0% |

The USA market for portable ultrasound bladder scanners is projected to reach USD 51.7 million in 2025 and grow at a CAGR of 2.5% through 2035. The country leads in clinical innovation, regulatory efficiency, and early adoption of point-of-care diagnostics. High prevalence of urinary retention, postoperative assessments, and elderly care demand are primary drivers. Key players such as Verathon Inc. and Echo Nous operate from the USA, contributing significantly to R&D and device innovation.

Healthcare facilities, from hospitals to nursing homes, are replacing invasive catheterization with bladder scanners to improve patient outcomes. The FDA’s streamlined 510(k) pathway and favorable CMS reimbursement policies have eased market access. Home-based diagnostics and AI-integrated systems are witnessing growth due to the expanding telehealth infrastructure. Overall, the USA remains a mature yet steadily growing market due to its advanced medical ecosystem and high diagnostic quality standards.

The United Kingdom portable ultrasound bladder scanner market is projected to grow at a CAGR of 1.3% from 2025 to 2035. Market expansion is driven by the National Health Service (NHS) emphasis on non-invasive, digital diagnostics for front-line care. These scanners are widely deployed in outpatient clinics, surgical recovery units, and elderly care settings, where real-time bladder volume measurement is essential. NHS procurement frameworks promote cost-effective, patient-friendly tools, while structured training programs ensure standardized usage across facilities.

Partnerships with healthcare technology providers and NHS-backed innovation hubs are fostering the adoption of AI-integrated bladder scanners, especially in pilot projects and clinical trials. Digital health priorities under the UK’s healthcare transformation plan are further encouraging deployment. Although growth is moderate due to saturation in certain sectors, consistent investments in smart diagnostics and public health integration maintain the UK’s relevance in the European portable scanner market.

Portable ultrasound bladder scanner market in India is poised to grow at a CAGR of 6.1% from 2025 to 2035. The growth is led by rising awareness of urological health, increased geriatric population, and substantial healthcare investments in underserved regions. Public hospitals are prioritizing affordable and non-invasive diagnostics, supported by government schemes like Ayushman Bharat and PMJAY, which promote decentralized healthcare. Local manufacturers are establishing assembly lines to reduce import reliance and cost barriers.

Strategic partnerships between diagnostic companies and state governments are facilitating broader deployment of scanners in rural clinics and district hospitals. Additionally, the rise in telehealth adoption and AI-enabled devices is enhancing accessibility and operational efficiency. India’s proactive policy environment and digital health push, alongside the demand for compact, wireless diagnostic tools, make it one of the most promising markets globally for portable bladder scanners.

Portable ultrasound bladder scanner market in China is expected to expand at a CAGR of 4.8% between 2025 and 2035. It stands out as both a major consumer and manufacturing base, supported by government initiatives such as Made in China 2025, which promote domestic innovation in diagnostic devices. Urban tertiary hospitals and rural clinics alike are adopting portable bladder scanners for efficient point-of-care diagnostics, driven by rising cases of urinary disorders and the country’s aging population.

Local companies, including Kaixin and Sonostar, are developing affordable, community-specific models tailored to chronic disease management and public health needs. Export potential is rising due to improved component localization and cost-effective engineering. Investments in diagnostic infrastructure and digital healthcare platforms are accelerating adoption across regions, positioning China as a global supplier and innovation hub in this market.

The Germany market is expected to grow at a 2.0% CAGR from 2025 to 2035, underpinned by strong public healthcare infrastructure and EU medical device regulations. Hospitals are adopting portable bladder scanners for their efficiency in pre- and post-operative diagnostics, particularly in geriatrics and urology. The CE marking process and centralized hospital procurement systems support faster integration into routine care. Government-backed modernization programs are equipping public and university hospitals with advanced point-of-care tools.

Emergency care, outpatient facilities, and long-term care units increasingly use these scanners for non-invasive urinary diagnostics. German manufacturers are focusing on developing ergonomic, high-precision devices that meet export standards across the EU and globally. With growing emphasis on efficient and radiation-free diagnostics, The market in Germany is expanding steadily, benefiting from policy consistency and high standards of clinical care across both urban and rural health centers.

The competitive landscape of the portable ultrasound bladder scanner market is moderately fragmented. Tier 1 companies such as Roper Technologies (Verathon Inc.), Laborie Medical Technologies, and SRS Medical Systems dominate with established global footprints. These firms have maintained leadership through strong investments in R&D, commercial alliances, and regulatory expertise. Verathon’s Bladder Scan series remains a benchmark in real-time bladder volume assessment. Laborie expanded its portfolio with strategic investments, including its 2023 funding in Bright Uro.

Tier 2 players focus on affordability, user-friendly design, and localized production. Companies like Sonostar Technologies and Kaixin are offering cost-effective options, especially in emerging markets. These firms cater to demand from clinics and rural care centers.

New entrants are targeting innovations in AI integration, wireless connectivity, and cloud-based diagnostics. Success depends on compliance with regional medical standards, effective distribution, and responsiveness to localized clinical workflows. Partnerships with public health agencies and training programs are increasingly being used as competitive tools. Overall, innovation and regional adaptability are driving market positioning.

In the portable ultrasound bladder scanner market, recent advancements have highlighted a focus on wireless diagnostics and non-invasive technologies. In November 2023, As per Laborie’s press release, Laborie Medical Technologies made a strategic investment in Bright Uro, supporting the development of the Glean Urodynamic System™. This innovative solution is a wireless, catheter-free diagnostic tool designed to assess lower urinary tract pressure with enhanced patient comfort and clinical precision.

The system enables real-time, remote urodynamic monitoring, addressing key challenges in urodynamic testing. This investment reflects strong industry momentum toward next-generation urological care, prioritizing minimally invasive solutions and smart diagnostic platforms for improved healthcare outcomes.

| Report Attributes | Details |

|---|---|

| Current Market Size (2025) | USD 144.1 million |

| Projected Market Size (2035) | USD 195.5 million |

| CAGR (2025 to 2035) | 3.10% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Product Categories Analyzed | 2D and 3D Portable Bladder Scanners |

| End Users Analyzed | Hospitals, Diagnostic Centers, Clinics, Ambulatory Surgical Centers |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Oceania, Middle East & Africa |

| Key Companies Profiled | Roper Technologies, SRS Medical Systems, Laborie, Sonostar, Kaixin, AvantSonic, Medica SPA, The Prometheus Group, MEDA, Vitacon, Suzhou Peak Sonic, Infinium Medical, EchoNous, MCUBETECH, Clarius, Interson, Butterfly Network, GE Healthcare, dBMEDx, Echo Son SA, iTrason, Innovative Medical B.V. |

| Additional Attributes | Demand driven by non-invasive diagnostics, integration of AI and wireless technology, rise in point-of-care testing, increasing geriatric population, and government-backed diagnostic modernization initiatives. |

The market is categorized into 2D Portable Ultrasound Bladder Scanner and 3D Portable Ultrasound Bladder Scanner.

The market is segmented into Hospitals, Diagnostic Centers, Clinics, and Ambulatory Surgical Centers.

The market is divided into North America, Latin America, Europe, East Asia, South Asia & Oceania, and Middle East & Africa.

The market is estimated to be valued at USD 144.1 million in 2025.

The market is expected to reach USD 194.2 million by 2035.

3D portable ultrasound bladder scanners dominate with an estimated 61.2% share in 2025.

Hospitals are the top end users, accounting for 59% of market value in 2025.

Leading companies include Roper Technologies (Verathon Inc.), Laborie, SRS Medical Systems, EchoNous, and Butterfly Network. Other notable players shaping the competitive landscape include Sonostar Technologies Co., Limited, Caresono Technology Co. Ltd., Kaixin, AvantSonic Technology Co., Ltd., Medica SPA, The Prometheus Group, MEDA Co., Ltd., Vitacon US, LLC, Suzhou PeakSonic Medical Technology Co. Ltd., Infinium Medical, Inc., DiaMedical, MCUBETECH, Clarius, Interson Corporation, GE Healthcare Inc., dBMEDx Inc., Echo Son SA, Beijing iTrason Technologies Co., Ltd, and Innovative Medical B.V.

Table 01: Global Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 02: Global Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 03: Global Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Region

Table 04: North America Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 05: North America Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 06: North America Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 07: North America Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 08: Latin America Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 09: Latin America Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 10: Latin America Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 11: Latin America Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 12: East Asia Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 13: East Asia Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 14: East Asia Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 15: East Asia Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 16: South Asia & Pacific Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 17: South Asia & Pacific Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 18: South Asia & Pacific Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 19: South Asia & Pacific Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 20: Western Europe Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 21: Western Europe Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 22: Western Europe Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 23: Western Europe Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 24: Eastern Europe Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 25: Eastern Europe Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 26: Eastern Europe Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 27: Eastern Europe Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Table 28: Middle East & Africa Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 29: Middle East & Africa Market Value (US$ million) Analysis and Forecast 2019 to 2034, by Product

Table 30: Middle East & Africa Market Volume (Units) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 31: Middle East & Africa Market Value (US$ million) Analysis and Forecast 2019 to 2034, by End User

Figure 1: Global Market Value Share by Product 2024 (E)

Figure 2: Global Market Value Share by Application 2024 (E)

Figure 3: Global Market Volume (Units) Analysis, 2019 to 2023

Figure 4: Global Market Volume (Units) and Y-o-Y Growth (percentage) Analysis, 2024 to 2034

Figure 5: 2D Pricing Analysis (US$) for Per Unit, By Region, 2024

Figure 6: 3D Pricing Analysis (US$) for Per Unit, By Region, 2024

Figure 7: Global Market Value (US$ million) Analysis, 2019 to 2023

Figure 8: Global Market Forecast & Y-o-Y Growth, 2024 to 2034

Figure 9: Global Market Absolute $ Opportunity (US$ million) Analysis, 2024 to 2034

Figure 10: Global Market Value Share (%) Analysis 2024 and 2034, by Product

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Product

Figure 12: Global Market Attractiveness Analysis 2024 to 2034, by Product

Figure 13: Global Market Value Share (%) Analysis 2024 and 2034, by End User

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by End User

Figure 15: Global Market Attractiveness Analysis 2024 to 2034, by End User

Figure 16: Global Market Value Share (%) Analysis 2024 and 2034, by Region

Figure 17: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Region

Figure 18: Global Market Attractiveness Analysis 2024 to 2034, by Region

Figure 19: North America Market Value (US$ million) Analysis, 2019 to 2023

Figure 20: North America Market Value (US$ million) Forecast, 2024 to 2034

Figure 21: North America Market Value Share, by Product (2024 E)

Figure 22: North America Market Value Share, by End User (2024 E)

Figure 23: North America Market Value Share, by Country (2024 E)

Figure 24: North America Market Attractiveness Analysis by Product,

Figure 25: North America Market Attractiveness Analysis by End User, 2024

Figure 26: North America Market Attractiveness Analysis by Country, 2024

Figure 27: United States Market Value Proportion Analysis, 2024

Figure 28: United States Market Share Analysis (%) by Product, 2024 to 2034

Figure 29: United States Market Share Analysis (%) by End User, 2024 to 2034

Figure 30: Canada Market Value Proportion Analysis, 2024

Figure 31: Canada Market Share Analysis (%) by Product, 2024 to 2034

Figure 32: Canada Market Share Analysis (%) by End User, 2024 to 2034

Figure 33: Mexico Market Value Proportion Analysis, 2024

Figure 34: Mexico Market Share Analysis (%) by Product, 2024 to 2034

Figure 35: Mexico Market Share Analysis (%) by End User, 2024 to 2034

Figure 36: Latin America Market Value (US$ million) Analysis, 2019 to 2023

Figure 37: Latin America Market Value (US$ million) Forecast, 2024 to 2034

Figure 38: Latin America Market Value Share, by Product (2024 E)

Figure 39: Latin America Market Value Share, by End User (2024 E)

Figure 40: Latin America Market Value Share, by Country (2024 E)

Figure 41: Latin America Market Attractiveness Analysis by Product,

Figure 42: Latin America Market Attractiveness Analysis by End User, 2024

Figure 43: Latin America Market Attractiveness Analysis by Country, 2024

Figure 44: Brazil Market Value Proportion Analysis, 2024

Figure 45: Brazil Market Share Analysis (%) by Product, 2024 to 2034

Figure 46: Brazil Market Share Analysis (%) by End User, 2024 to 2034

Figure 47: Chile Market Value Proportion Analysis, 2024

Figure 48: Chile Market Share Analysis (%) by Product, 2024 to 2034

Figure 49: Chile Market Share Analysis (%) by End User, 2024 to 2034

Figure 50: East Asia Market Value (US$ million) Analysis, 2019 to 2023

Figure 51: East Asia Market Value (US$ million) Forecast, 2024 to 2034

Figure 52: East Asia Market Value Share, by Product (2024 E)

Figure 53: East Asia Market Value Share, by End User (2024 E)

Figure 54: East Asia Market Value Share, by Country (2024 E)

Figure 55: East Asia Market Attractiveness Analysis by Product, 2024

Figure 56: East Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 57: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 58: China Market Value Proportion Analysis, 2024

Figure 59: China Market Share Analysis (%) by Product, 2024 to 2034

Figure 60: China Market Share Analysis (%) by End User, 2024 to 2034

Figure 61: Japan Market Value Proportion Analysis, 2024

Figure 62: Japan Market Share Analysis (%) by Product, 2024 to 2034

Figure 63: Japan Market Share Analysis (%) by End User, 2024 to 2034

Figure 64: South Korea Market Value Proportion Analysis, 2024

Figure 65: South Korea Market Share Analysis (%) by Product, 2024 to 2034

Figure 66: South Korea Market Share Analysis (%) by End User, 2024 to 2034

Figure 67: South Asia & Pacific Market Value (US$ million) Analysis, 2019 to 2023

Figure 68: South Asia & Pacific Market Value (US$ million) Forecast, 2024 to 2034

Figure 69: South Asia & Pacific Market Value Share, by Product (2024 E)

Figure 70: South Asia & Pacific Market Value Share, by End User (2024 E)

Figure 71: South Asia & Pacific Market Value Share, by Country (2024 E)

Figure 72: South Asia & Pacific Market Attractiveness Analysis by Product, 2024 to 2034

Figure 73: South Asia & Pacific Market Attractiveness Analysis by End User, 2024 to 2034

Figure 74: South Asia & Pacific Market Attractiveness Analysis by Country, 2024 to 2034

Figure 75: India Market Value Proportion Analysis, 2024

Figure 76: India Market Share Analysis (%) by Product, 2024 to 2034

Figure 77: India Market Share Analysis (%) by End User, 2024 to 2034

Figure 78: ASEAN Countries Market Value Proportion Analysis, 2024

Figure 79: ASEAN Countries Market Share Analysis (%) by Product, 2024 to 2034

Figure 80: ASEAN Countries Market Share Analysis (%) by End User, 2024 to 2034

Figure 81: Australia & New Zealand Market Value Proportion Analysis, 2024

Figure 82: Australia & New Zealand Market Share Analysis (%) by Product, 2024 to 2034

Figure 83: Australia & New Zealand Market Share Analysis (%) by End User, 2024 to 2034

Figure 84: Western Europe Market Value (US$ million) Analysis, 2019 to 2023

Figure 85: Western Europe Market Value (US$ million) Forecast, 2024 to 2034

Figure 86: Western Europe Market Value Share, by Product (2024 E)

Figure 87: Western Europe Market Value Share, by End User (2024 E)

Figure 88: Western Europe Market Value Share, by Country (2024 E)

Figure 89: Western Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 90: Western Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 91: Western Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 92: United Kingdom Market Value Proportion Analysis, 2024

Figure 93: United Kingdom Market Share Analysis (%) by Product, 2024 to 2034

Figure 94: United Kingdom Market Share Analysis (%) by End User, 2024 to 2034

Figure 95: Germany Market Value Proportion Analysis, 2024

Figure 96: Germany Market Share Analysis (%) by Product, 2024 to 2034

Figure 97: Germany Market Share Analysis (%) by End User, 2024 to 2034

Figure 98: Italy Market Value Proportion Analysis, 2024

Figure 99: Italy Market Share Analysis (%) by Product, 2024 to 2034

Figure 100: Italy Market Share Analysis (%) by End User, 2024 to 2034

Figure 101: France Market Value Proportion Analysis, 2024

Figure 102: France Market Share Analysis (%) by Product, 2024 to 2034

Figure 103: France Market Share Analysis (%) by End User, 2024 to 2034

Figure 104: Spain Market Value Proportion Analysis, 2024

Figure 105: Spain Market Share Analysis (%) by Product, 2024 to 2034

Figure 106: Spain Market Share Analysis (%) by End User, 2024 to 2034

Figure 107: Nordic Countries Market Value Proportion Analysis, 2024

Figure 108: Nordic Countries Market Share Analysis (%) by Product, 2024 to 2034

Figure 109: Nordic Countries Market Share Analysis (%) by End User, 2024 to 2034

Figure 110: BENELUX Market Value Proportion Analysis, 2024

Figure 111: BENELUX Market Share Analysis (%) by Product, 2024 to 2034

Figure 112: BENELUX Market Share Analysis (%) by End User, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ million) Analysis, 2019 to 2023

Figure 114: Eastern Europe Market Value (US$ million) Forecast, 2024 to 2034

Figure 115: Eastern Europe Market Value Share, by Product (2024 E)

Figure 116: Eastern Europe Market Value Share, by End User (2024 E)

Figure 117: Eastern Europe Market Value Share, by Country (2024 E)

Figure 118: Eastern Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 121: Russia Market Value Proportion Analysis, 2024

Figure 122: Russia Market Share Analysis (%) by Product, 2024 to 2034

Figure 123: Russia Market Share Analysis (%) by End User, 2024 to 2034

Figure 124: Hungary Market Value Proportion Analysis, 2024

Figure 125: Hungary Market Share Analysis (%) by Product, 2024 to 2034

Figure 126: Hungary Market Share Analysis (%) by End User, 2024 to 2034

Figure 127: Poland Market Value Proportion Analysis, 2024

Figure 128: Poland Market Share Analysis (%) by Product, 2024 to 2034

Figure 129: Poland Market Share Analysis (%) by End User, 2024 to 2034

Figure 130: Middle East & Africa Market Value (US$ million) Analysis, 2019 to 2023

Figure 131: Middle East & Africa Market Value (US$ million) Forecast, 2024 to 2034

Figure 132: Middle East & Africa Market Value Share, by Product (2024 E)

Figure 133: Middle East & Africa Market Value Share, by End User (2024 E)

Figure 134: Middle East & Africa Market Value Share, by Country (2024 E)

Figure 135: Middle East & Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 136: Middle East & Africa Market Attractiveness Analysis by End User, 2024 to 2034

Figure 137: Middle East & Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 138: Saudi Arabia Market Value Proportion Analysis, 2024

Figure 139: Saudi Arabia Market Share Analysis (%) by Product, 2024 to 2034

Figure 140: Saudi Arabia Market Share Analysis (%) by End User, 2024 to 2034

Figure 141: Türkiye Market Value Proportion Analysis, 2024

Figure 142: Türkiye Market Share Analysis (%) by Product, 2024 to 2034

Figure 143: Market Share Analysis (%) by End User, 2024 to 2034

Figure 144: South Africa Market Value Proportion Analysis, 2024

Figure 145: South Africa Market Share Analysis (%) by Product, 2024 to 2034

Figure 146: South Africa Market Share Analysis (%) by End User, 2024 to 2034

Figure 147: Other African Union Market Value Proportion Analysis, 2024

Figure 148: Other African Union Market Share Analysis (%) by Product, 2024 to 2034

Figure 149: Other African Union Market Share Analysis (%) by End User, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA