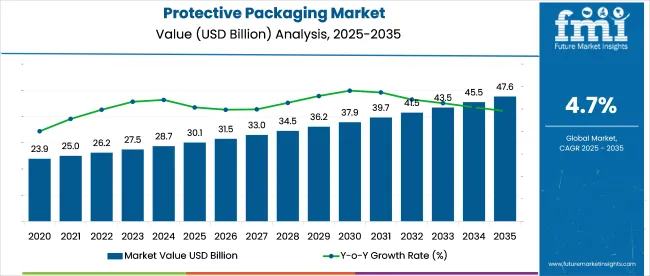

The protective packaging market expands from USD 30.1 billion in 2025 to USD 47.6 billion in 2035 at a CAGR of 4.7%. Early-phase expansion is moderate, reaching USD 31.5 billion in 2026 and USD 33 billion in 2027, driven by increased e-commerce logistics and protective needs in the electronics and food sectors.

Key Industry Attributes

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 30.1 Billion |

| Industry Value (2035F) | USD 47.6 Billion |

| CAGR (2025 to 2035) | 4.7% |

Growth of 4.6% in 2026 reflects baseline demand stabilization across omnichannel retail, while 2027's 4.8% marks acceleration due to rising fulfillment volumes in Asia Pacific and North America.

From 2033 to 2035, the market pivoted toward green and automated solutions. It rises from USD 43.5 billion in 2033 to USD 45.5 billion in 2034 and ultimately reaches USD 47.6 billion in 2035. The 4.6%-4.9% YoY increases during this phase reflect a shift to ESG-aligned, recyclable protective materials and integration of sensor-based packaging for transit tracking.

As of 2025, the protective packaging market accounts for varying shares across its parent markets. It represents approximately 20-25% of the overall packaging industry, driven by rising demand for damage-free shipping. Within the industrial packaging market, it holds a 30-35% share, largely due to its use in machinery, electronics, and automotive goods.

In the e-commerce packaging market, protective packaging captures about 35-40%, reflecting its critical role in product safety during transit. It forms around 15-20% of the logistics and supply chain solutions market, and roughly 10-15% of the manufacturing and industrial goods market, where it supports operational efficiency and product integrity.

In a July 2024 earnings call covered by Packaging Dive, Dustin Semach, President and Chief Financial Officer at Sealed Air (now SEE), acknowledged persistent challenges in the protective packaging segment. He stated that “the weakness in our protective volumes is fully offsetting the strength in our food business,” citing excess capacity in the void fill market as a core issue.

Semach further noted that the company does not anticipate a near-term catalyst for volume recovery in this segment, projecting continued softness into 2025. This reflects ongoing headwinds in the sector, particularly amid slower industrial activity and an evolving mix of packaging demands.

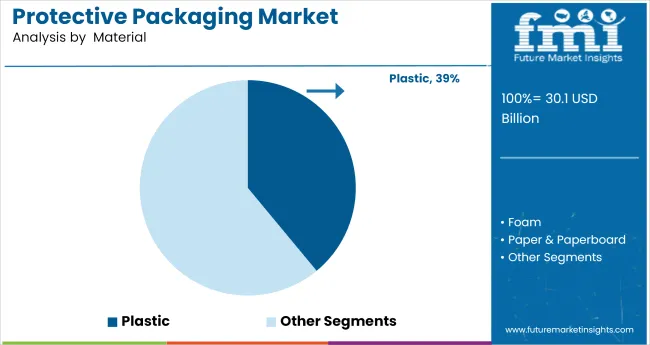

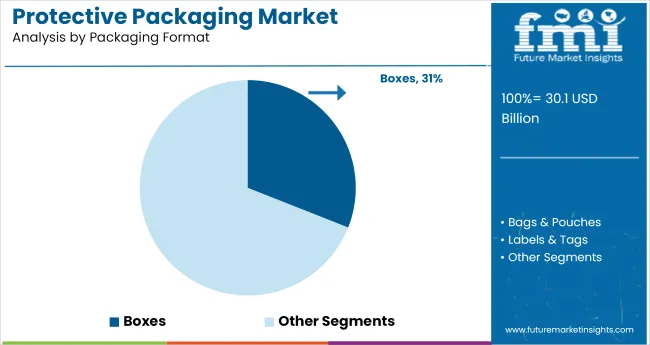

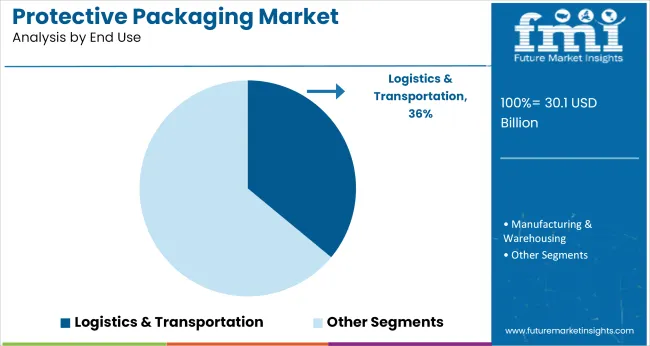

In 2025, over 70% of protective packaging demand is concentrated across plastic materials, corrugated box formats, and logistics-related end use. Plastic leads due to its adaptable cost-performance profile. Boxes dominate the structural segment, while logistics and transportation drive downstream usage through expanding B2B and e-commerce distribution channels.

Plastic is forecasted to hold USD 14.3 billion in global protective packaging revenue in 2025, commanding 39% of material-based demand. Companies such as Sealed Air, Pregis, and Amcor deploy high-resilience plastic solutions including air pillows, shrink films, and bubble wraps across cold chain logistics, electronics, and FMCG sectors. Thermoplastics dominate due to ease of thermoforming and compatibility with automated packaging lines.

Boxes, mainly corrugated and die-cut, hold a 31% market share, equivalent to USD 11.4 billion in 2025. Corrugated units remain indispensable for durable, stackable, and scalable transport packaging. Global manufacturers including International Paper, WestRock, and DS Smith report steady growth in box shipments, especially to 3PL and direct-to-retail platforms. E-commerce accounts for 38% of all box shipments globally.

End-use from logistics and transportation represent USD 13.2 billion of global protective packaging value in 2025, comprising 36% of total market share. Major service providers like DHL, UPS, and FedEx are key demand aggregators, especially for secondary protective formats like foam inserts, stretch films, and padded mailers. Reverse logistics and cross-docking applications are central drivers of this growth.

Protective packaging demand is growing due to e-commerce expansion and stricter return loss targets. Suppliers are shifting to recyclable and fiber-based formats in response to regulatory changes. Compliance costs and damage mitigation metrics are now shaping procurement decisions, with recycled-content solutions accounting for nearly half of the EU market by mid-2025.

Volume Growth Linked to B2C Shipping and Return Loss Mitigation

Protective packaging consumption rose by 8.7% YoY globally in H1 2025, primarily fueled by e-commerce parcel growth and contract packaging volumes. USA-based 3PL operators processed over 1.4 billion protective-packed shipments in Q2 alone, with air cushion usage up 19% from the previous year.

Damage claim rates dropped by 13-18% across apparel and consumer electronics sectors after switching to form-fitting molded pulp and corrugated interior solutions. In Germany, 62% of electronics shipped direct-to-consumer now include corner crush protection inserts, reducing return-related write-offs by €44 million in the 12-month period ending June 2025. Omnichannel retailers are allocating 11-14% of outbound packaging budgets to impact-mitigation formats, up from 9% in 2023.

Compliance-Driven Material Substitution Alters Supply Contracts

Substrate choices are shifting in response to PPWR Phase II rollout and landfill fee hikes. Recycled-content protective formats made up 48% of all protective packaging sold in Western Europe as of Q2 2025, compared to 34% two years prior. EPS and non-recyclable foams declined by 27% in market share across regulated zones.

In France, starch-based protective wrap usage expanded by 22% YoY, supported by national plastic taxation rules introduced in January 2025. In Asia-Pacific, paper honeycomb liners gained 15% share within grocery cold-chain shipments, displacing multi-layer film-based insulation.

Audit data from five EU packaging compliance schemes showed that protective packaging SKUs with end-of-life certification had 1.6× faster uptake in private label procurement contracts. Material conversion cycles are also shortening, with 7 out of 10 large FMCG brands renegotiating packaging terms to phase out fossil-derived polymers in transit packaging before 2027.

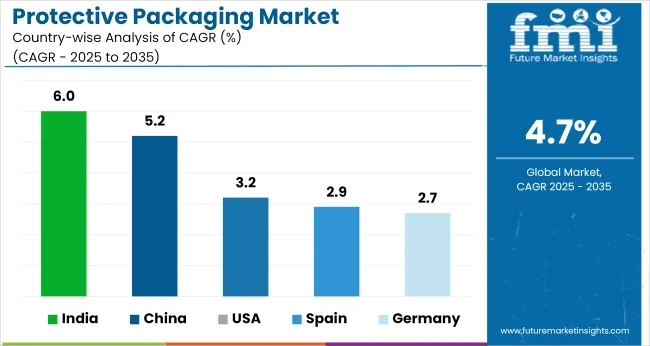

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

| China | 5.2% |

| USA | 3.2% |

| Spain | 2.9% |

| Germany | 2.7% |

The global protective packaging market is projected to grow at a CAGR of 4.7% from 2025 to 2035. India (BRICS) leads among the profiled countries at 6.0%, exceeding the global average by 1.3% points. China (BRICS) follows at 5.2% (+0.5%), while the United States (OECD) trails at 3.2% (-1.5%), Spain (OECD) at 2.9% (-1.8%), and Germany (OECD) at 2.7% (-2.0%).

These differences reflect varying degrees of infrastructure scaling, e-commerce packaging integration, and domestic logistics performance. BRICS economies are seeing faster development, driven by regional industrial expansion and material availability. In contrast, several OECD countries exhibit slower growth tied to supply chain rationalization and limited capital deployment for packaging innovation.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

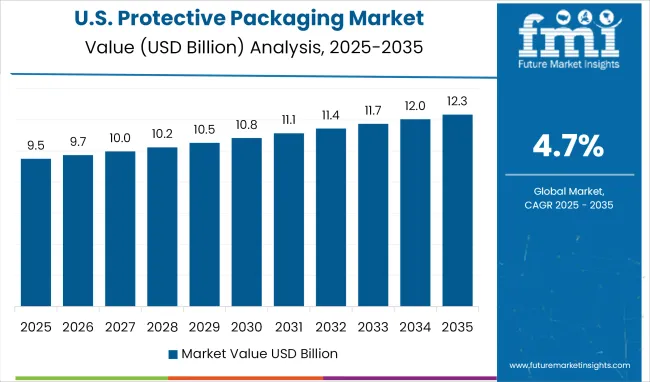

From 2020 to 2024, demand in the United States was dominated by e-commerce expansion and third-party logistics growth. Protective mailers and bubble wrap products were widely used in electronics and consumer goods shipments. Between 2025 and 2035, the market is forecast to grow at a CAGR of 3.2%, driven by packaging automation in warehousing, demand for lightweight materials, and stricter landfill reduction targets.

Environmental pressures are pushing adoption of recyclable and paper-based formats, particularly in retail and medical fulfillment. Logistics firms are increasingly investing in integrated protective packaging lines for greater throughput and waste minimization.

The market grew moderately during 2020 to 2024, supported by industrial machinery, automotive parts exports, and electronic goods. Molded pulp and fiber-based edge protection were preferred by B2B exporters adhering to EU packaging waste directives. With a projected CAGR of 2.7% through 2035, growth will focus on durability and returnable packaging solutions.

Robotics and precision assembly sectors are pushing for anti-static and shock-absorbent inner packaging systems. Regulatory tightening under the Packaging Act (VerpackG) is accelerating material innovation, especially in reducing EPS and polymer-based foams. Tier 1 suppliers are investing in design optimization for reusable transport packaging.

The protective packaging market in china is expected to post a CAGR of 5.2% through 2035. From 2020 to 2024, growth stemmed from electronics exports, high-frequency parcel shipping, and surge in mobile phone manufacturing. Air column bags, foam pouches, and corrugated inserts were widely used across coastal industrial zones.

Over the next decade, demand is shifting toward biodegradable and paper-pulp solutions, supported by national plastic reduction policies and rising automation in e-commerce logistics. The government’s green packaging mandates are influencing procurement by large OEMs and 3PL players. Tiered warehousing infrastructure is accelerating demand for scalable protective systems.

The protective packaging industry in Spain grew modestly at the consumer level during 2020 to 2024, with growth driven by artisan goods, wines, olive oil, and ceramics exports. Traditional foam inserts and multilayer cartons dominated use. The market is projected to expand at a CAGR of 2.9% from 2025 to 2035, supported by eco-design mandates under EU waste policy and increasing SME digitalization.

Eco-packaging is becoming standard among direct-to-consumer brands. Paper honeycomb, molded cellulose inserts, and compostable film wraps are replacing legacy plastics. Growth in B2C exports is further driving demand for cushioning that meets cross-border green benchmarks.

India is set to lead market expansion with a CAGR of 6.0% between 2025 and 2035. From 2020 to 2024, demand surged with growth in mobile manufacturing, pharma exports, and e-grocery deliveries. Foam wraps, laminated films, and paper-based fillers were widely used.

Moving forward, demand is expected from cold chain logistics, consumer electronics, and fulfillment centers in Tier 2 cities. Government incentives for electronics and medtech exports are pushing companies to adopt globally compliant protective formats. Paper-plastic hybrids, anti-static cushioning, and renewable-based films are gaining traction in high-speed packing environments.

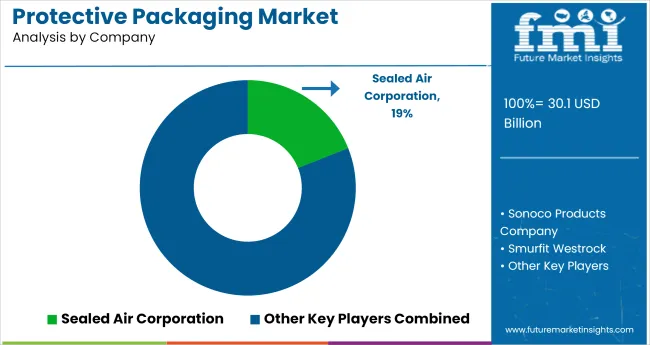

Leading manufacturers include prominent names such as Sealed Air Corporation, Smurfit Kappa, Sonoco Products Company, and Pregis LLC. These companies maintain competitive strength through consistent product development, capacity expansion, and strategic acquisitions.

For example, Sealed Air introduced a new range of protective mailers tailored for e-commerce packaging, enhancing its presence across retail supply chains. Smurfit Kappa continues to invest in advanced corrugated packaging solutions to improve durability and efficiency for logistics-intensive sectors.

Emerging players are gradually entering the market by targeting niche applications and low-cost alternatives, particularly in Asia-Pacific. The high capital requirements, established distributor networks, and regulatory compliance standards pose significant entry barriers for new entrants. R&D capabilities and long-term contracts with industrial clients further strengthen the position of incumbents.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 30.1 billion |

| Projected Market Size (2035) | USD 47.6 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year | 2024 |

| Historical Analysis | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion (revenue), million units (volume) |

| Material Segmentation | Paper & Paperboard, Plastic, Foam, Others (Wood, Metal, Fabric) |

| Packaging Format | Boxes, Bags & Pouches, Labels & Tags, Tapes, Wraps & Rolls, Envelopes & Mailers, Other Formats (Packaging Peanuts, End Caps, Edge Protectors) |

| End Use | Manufacturing & Warehousing (Food, Beverages, Pharmaceuticals, Personal Care & Cosmetics, Homecare & Toiletries, Electrical & Electronics, Chemicals & Fertilizers), Logistics & Transportation |

| Regions Covered | North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, India, Japan, Brazil, GCC countries |

| Leading Playerd | Sealed Air Corporation, Sonoco Products Company, Smurfit Westrock, DS Smith plc, Schur Flexibles Holding GesmbH, 3M Company, Intertape Polymer Group Inc, Storopack Hans Reichenecker GmbH, International Paper Company, Elsons International |

| Additional Attributes | Dollar sales, share by material and end-use, packaging innovations in cold chain logistics and e-commerce, regional growth in warehousing activity, market consolidation trends |

The industry is expected to reach USD 47.6 billion by 2035, growing from USD 30.1 billion in 2025.

The industry is forecast to expand at a CAGR of 4.7% between 2025 and 2035.

Plastic leads with a 39% share.

Logistics and transportation contribute 36% of total demand.

Sealed Air Corporation holds the highest market share at 19% in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.