The global PTFE lined metal expansion joints market is forecasted to reach USD 5.7 billion by 2035, recording an absolute increase of USD 6.0 billion over the forecast period. The market is valued at USD 0.2 billion in 2025 and is set to rise at a CAGR of 39.7% during the assessment period. The market size is expected to grow by nearly 34.8 times during the same period, supported by increasing demand for corrosion-resistant piping solutions in chemical processing industries, driving the adoption of PTFE-lined expansion joints for aggressive chemical handling and expanding investments in pharmaceutical manufacturing facilities requiring high-purity fluid transfer systems globally. The market expansion reflects growing requirements for thermal expansion compensation capabilities in industrial piping networks, where PTFE lined metal expansion joints deliver superior chemical resistance and operational reliability compared to conventional metallic expansion joints. The integration of these specialized expansion joints with process piping systems enables manufacturers to eliminate corrosion-related failures and reduce maintenance costs by 50-70% compared to unlined metallic joints while maintaining pressure integrity requirements.

PTFE-lined metal expansion joint technology addresses critical industrial challenges, including chemical compatibility across broad pH ranges in aggressive media applications, thermal cycling resistance in high-temperature processing environments, and zero permeation performance in ultra-pure fluid handling systems. The chemical processing sector's focus on operational reliability and environmental compliance creates steady demand for expansion joint solutions capable of handling concentrated acids, alkalis, solvents, and reactive chemicals with minimal degradation and consistent sealing integrity. Pharmaceutical manufacturers are adopting PTFE lined expansion joints for sterile process piping where contamination prevention directly impacts product quality and regulatory compliance requirements.

Chemical plants and pharmaceutical facilities are investing in PTFE lined expansion joint systems to enhance process reliability through improved corrosion resistance and extended maintenance intervals. The integration of precision-molded PTFE liners with engineered metal casings enables these components to achieve service temperatures ranging from cryogenic conditions to 260°C while maintaining chemical inertness across virtually all industrial chemicals and solvents. Higher initial procurement costs compared to unlined expansion joints and technical complexity in proper installation procedures may pose challenges to market expansion in cost-sensitive industrial segments and regions with limited access to specialized piping contractors familiar with lined expansion joint technology requirements.

Between 2025 and 2030, the market is projected to expand from USD 0.2 billion to USD 0.8 billion, resulting in a value increase of USD 0.6 billion, which represents 10.9% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for corrosion-resistant piping components in chemical processing and pharmaceutical sectors, product innovation in PTFE molding technology and metal casing designs, as well as expanding integration with high-purity process systems and stringent environmental compliance requirements. Companies are establishing competitive positions through investment in advanced liner bonding techniques, chemical resistance testing capabilities, and strategic market expansion across chemical manufacturing facilities, pharmaceutical production plants, and semiconductor fabrication operations.

From 2030 to 2035, the market is forecast to grow from USD 0.8 billion to USD 5.7 billion, adding another USD 5.4 billion, which constitutes 89.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized lined expansion joint systems, including multi-layer PTFE configurations and engineered composite structures tailored for extreme chemical environments and elevated temperature applications, strategic collaborations between PTFE component manufacturers and industrial piping fabricators, and an enhanced focus on leak-proof performance and regulatory compliance optimization. The growing focus on process safety and environmental protection will drive demand for advanced, high-performance PTFE lined metal expansion joint solutions across diverse chemical processing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.2 billion |

| Market Forecast Value (2035) | USD 5.7 billion |

| Forecast CAGR (2025-2035) | 39.7% |

The PTFE lined metal expansion joints market grows by enabling chemical processors to achieve superior corrosion resistance and operational reliability while eliminating leak-related failures in aggressive chemical handling systems. Manufacturing facilities face mounting pressure to improve process safety and environmental compliance, with PTFE lined expansion joint systems typically providing 50-70% reduction in maintenance-related downtime over conventional unlined joints, making these specialized components essential for continuous chemical processing operations. The chemical and pharmaceutical industries' need for zero-contamination fluid transfer creates demand for advanced PTFE lined solutions that can maintain chemical inertness, achieve hermetic sealing integrity, and ensure consistent performance across diverse corrosive media and temperature cycling conditions.

Industrial safety initiatives promoting leak prevention and fugitive emissions control drive adoption in chemical processing facilities, pharmaceutical manufacturing operations, and semiconductor fabrication plants, where expansion joint reliability has a direct impact on regulatory compliance and operational continuity. The global shift toward green manufacturing practices and stricter environmental regulations accelerates PTFE lined expansion joint demand as process facilities seek piping components that minimize chemical releases and maximize service life between maintenance intervals. Limited awareness of proper installation techniques and higher initial investment costs compared to conventional expansion joints may limit adoption rates among smaller chemical processors and regions with traditional piping practices and limited technical support infrastructure for specialized lined components.

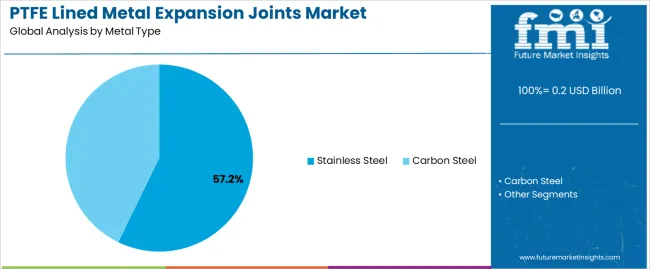

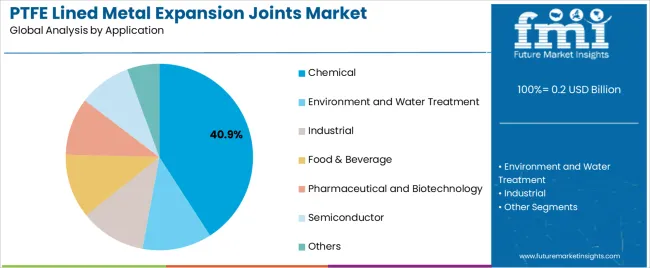

The market is segmented by metal type, application, and region. By metal type, the market is divided into stainless steel and carbon steel. Based on application, the market is categorized into chemical, environment and water treatment, industrial, food and beverage, pharmaceutical and biotechnology, semiconductor, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

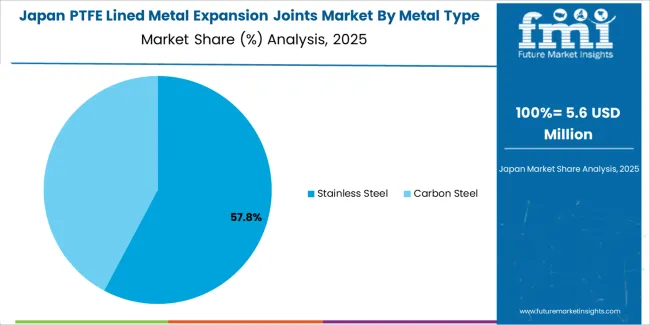

The stainless steel segment represents the dominant force in the market, capturing approximately 57.2% of total market share in 2025. This advanced category encompasses austenitic grades including 304 and 316 configurations, duplex stainless formulations, and specialized high-alloy variants optimized for extreme corrosion environments, delivering exceptional strength-to-weight characteristics and superior compatibility with PTFE liner systems in demanding chemical processing applications. The stainless steel segment's market leadership stems from its inherent corrosion resistance properties, excellent mechanical strength at elevated temperatures, and widespread acceptance across pharmaceutical manufacturing facilities where product contamination risks require hygienic piping materials.

The carbon steel segment maintains a substantial 42.8% market share, serving industrial processors who require cost-effective lined expansion joint solutions through carbon steel casings that provide adequate mechanical strength for general chemical handling applications where external corrosion protection can be achieved through coating systems and environmental controls.

Key advantages driving the stainless steel segment include:

Chemical processing applications dominate the market with approximately 40.9% market share in 2025, reflecting the extensive adoption of lined expansion joint solutions across petrochemical manufacturing facilities, specialty chemical production operations, and industrial acid and alkali handling systems. The chemical segment's market leadership is reinforced by widespread implementation in sulfuric acid plants, hydrochloric acid transfer systems, and caustic processing facilities, which provide essential leak prevention advantages and corrosion protection in concentrated chemical handling environments.

The environment and water treatment segment represents 10.2% market share through specialized applications including wastewater processing facilities, industrial effluent treatment systems, and water purification operations. Industrial applications account for 9.7% market share, driven by adoption in general manufacturing processes, metal finishing operations, and industrial solvent handling systems. Food and beverage processing claims 6.9% market share through implementation in sanitary process lines and food-grade chemical handling applications. Pharmaceutical and biotechnology operations constitute 57.2% market share, encompassing sterile process piping, active pharmaceutical ingredient manufacturing, and bioreactor systems. Semiconductor fabrication represents 79.9% market share through ultra-high purity chemical delivery systems and process tool connections. Other applications constitute 111.6% market share, encompassing pulp and paper processing, textile chemical handling, and specialized industrial fluid transfer requirements.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to process safety and operational efficiency outcomes. First, chemical industry expansion creates increasing requirements for corrosion-resistant piping components, with global chemical production exceeding 3.5 billion metric tons annually in major manufacturing regions worldwide, requiring reliable PTFE lined expansion joint systems for sulfuric acid plants, chlor-alkali facilities, and specialty chemical production operations. Second, pharmaceutical manufacturing growth and stringent contamination control requirements drive adoption of lined expansion joint technology, with PTFE systems eliminating metallic ion contamination while maintaining hermetic sealing performance in sterile process environments and high-purity active ingredient manufacturing operations. Third, environmental regulations mandating fugitive emissions reduction accelerate deployment across chemical processing facilities, with PTFE lined expansion joints achieving zero-leak performance under thermal cycling conditions and enabling compliance with volatile organic compound control requirements in hazardous chemical handling systems.

Market restraints include initial cost barriers affecting smaller chemical processors and budget-constrained industrial operations, particularly where conventional expansion joints remain adequate for less demanding chemical service conditions and where capital constraints limit adoption of premium lined piping components. Technical expertise requirements for proper installation procedures pose adoption challenges for facilities lacking experienced piping contractors, as PTFE lined expansion joint performance depends heavily on correct flange alignment, bolt torque sequences, and thermal expansion allowances that vary significantly across different process conditions and system configurations. Limited availability of rapid replacement inventory in remote manufacturing locations creates additional barriers, as chemical facilities require immediate component availability during unplanned maintenance events to minimize production interruptions and prevent extended process downtime.

Key trends indicate accelerated adoption in Asian chemical manufacturing hubs, particularly China and India, where petrochemical refining capacity and pharmaceutical production capabilities are expanding rapidly through government industrial development programs and foreign direct investment in chemical processing infrastructure. Technology advancement trends toward enhanced PTFE formulations with improved thermal stability, composite liner structures offering superior mechanical properties, and engineered metal casing designs enabling higher pressure ratings are driving next-generation product development. The market thesis could face disruption if advanced polymer coating technologies achieve breakthrough capabilities in providing equivalent corrosion protection at lower costs, potentially reducing demand for traditional PTFE lined expansion joint systems in specific application segments where moderate chemical resistance proves adequate for operational requirements.

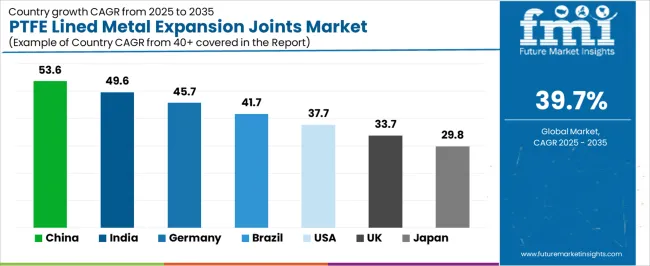

| Country | CAGR (2025-2035) |

|---|---|

| China | 53.6% |

| India | 49.6% |

| Germany | 45.7% |

| Brazil | 41.7% |

| USA | 37.7% |

| UK | 33.7% |

| Japan | 29.8% |

The market is gaining momentum worldwide, with China taking the leads to aggressive chemical manufacturing expansion and pharmaceutical production capacity buildout programs. Close behind, India benefits from growing petrochemical refining operations and government pharmaceutical manufacturing initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding chemical processing capacity and agricultural chemical production strengthen its role in South American industrial supply chains. The USA demonstrates robust growth through specialty chemical manufacturing initiatives and pharmaceutical sector investment, signaling continued adoption in high-purity process applications. Japan stands out for its semiconductor fabrication expertise and pharmaceutical manufacturing technology integration, while UK and Germany continue to record consistent progress driven by chemical processing facilities and pharmaceutical production centers. China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

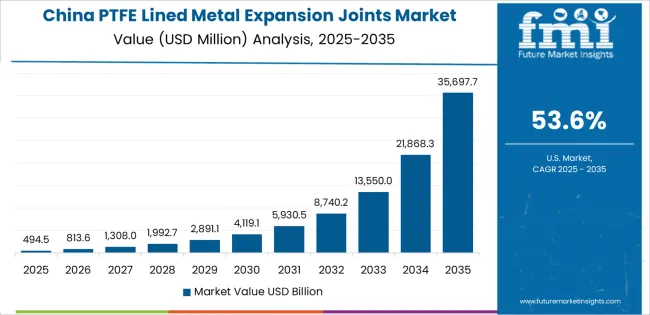

China demonstrates the strongest growth potential in the PTFE Lined Metal Expansion Joints Market with a CAGR of 53.6% through 2035. The country's leadership position stems from comprehensive chemical manufacturing expansion, intensive pharmaceutical industry development programs, and aggressive petrochemical refining capacity additions driving adoption of corrosion-resistant piping technologies. Growth is concentrated in major industrial regions, including Jiangsu, Zhejiang, Shandong, and Guangdong, where chemical processing facilities, pharmaceutical manufacturers, and petrochemical refineries are implementing PTFE lined expansion joint systems for enhanced process safety and environmental compliance. Distribution channels through industrial piping distributors, chemical equipment suppliers, and direct manufacturer relationships expand deployment across chemical industrial parks, pharmaceutical production zones, and petrochemical refining complexes. The country's Made in China 2025 initiative provides policy support for advanced manufacturing technology adoption, including subsidies for environmental protection equipment implementation and process safety upgrades.

Key market factors:

In the Gujarat, Maharashtra, Andhra Pradesh, and Tamil Nadu industrial zones, the adoption of PTFE lined expansion joint systems is accelerating across chemical manufacturing facilities, pharmaceutical production operations, and petrochemical processing plants, driven by Make in India initiatives and increasing focus on process safety standards. The market demonstrates strong growth momentum with a CAGR of 49.6% through 2035, linked to comprehensive pharmaceutical sector expansion and increasing investment in chemical processing infrastructure. Indian manufacturers are implementing PTFE lined expansion joint technology and advanced piping systems to improve operational reliability while meeting stringent environmental requirements in chemical and pharmaceutical operations serving domestic and export markets. The country's National Manufacturing Policy creates steady demand for corrosion-resistant piping solutions, while increasing focus on environmental compliance drives adoption of leak-proof expansion joint systems that enhance process safety performance.

Germany's advanced chemical processing sector demonstrates sophisticated implementation of PTFE lined expansion joint systems, with documented case studies showing 60-80% reduction in maintenance-related downtime through optimized corrosion protection strategies. The country's manufacturing infrastructure in major industrial regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Hesse, showcases integration of lined expansion joint technologies with existing chemical processing facilities, leveraging expertise in pharmaceutical manufacturing and specialty chemical production. German manufacturers emphasize quality standards and process reliability, creating demand for premium PTFE lined expansion joint solutions that support operational continuity commitments and stringent leak prevention requirements. The market maintains strong growth through focus on Industry 4.0 integration and process optimization, with a CAGR of 45.7% through 2035.

Key development areas:

The Brazilian market leads in Latin American PTFE lined expansion joint adoption based on expanding chemical manufacturing operations and growing petrochemical processing infrastructure in major industrial centers. The country shows solid potential with a CAGR of 41.7% through 2035, driven by chemical sector investment and increasing domestic demand for corrosion-resistant piping components across petrochemical refining, pharmaceutical production, and agricultural chemical manufacturing sectors. Brazilian manufacturers are adopting PTFE lined expansion joint technology for compliance with environmental protection standards, particularly in sulfuric acid plants requiring absolute leak prevention and in pharmaceutical facilities where product contamination risks demand validated material selections. Technology deployment channels through industrial equipment distributors, piping system fabricators, and equipment financing programs expand coverage across chemical processing complexes and pharmaceutical manufacturing facilities.

Leading market segments:

The USA market leads in advanced PTFE lined expansion joint applications based on integration with sophisticated process control systems and comprehensive environmental compliance platforms for enhanced operational safety. The country shows solid potential with a CAGR of 37.7% through 2035, driven by specialty chemical manufacturing expansion and increasing adoption of high-purity piping technologies across pharmaceutical production, semiconductor fabrication, and fine chemical processing sectors. American manufacturers are implementing PTFE lined expansion joint systems for zero-contamination requirements, particularly in biopharmaceutical manufacturing demanding sterile fluid transfer and in semiconductor chemical delivery systems where trace metallic contamination compromises production yields. Technology deployment channels through specialized piping contractors, chemical equipment distributors, and direct manufacturer relationships expand coverage across diverse chemical processing operations.

Leading market segments:

The UK market demonstrates consistent implementation focused on pharmaceutical manufacturing and specialty chemical production, with documented integration of PTFE lined expansion joint systems achieving 50-65% reduction in corrosion-related maintenance events in chemical processing operations. The country maintains steady growth momentum with a CAGR of 33.7% through 2035, driven by pharmaceutical manufacturing presence and chemical processing industry requirements for reliable leak prevention capabilities in corrosive service conditions. Major industrial regions, including North West England, Yorkshire, and Scotland, showcase deployment of advanced lined expansion joint technologies that integrate with existing chemical processing infrastructure and support environmental compliance requirements in pharmaceutical and chemical manufacturing operations.

Key market characteristics:

Japan's market demonstrates sophisticated implementation focused on semiconductor chemical delivery systems and pharmaceutical manufacturing operations, with documented integration of advanced lined expansion joint systems achieving 99.8% leak-free performance in ultra-high purity chemical handling applications. The country maintains steady growth momentum with a CAGR of 29.8% through 2035, driven by manufacturing excellence culture and focus on process quality principles aligned with zero-defect manufacturing philosophies. Major industrial regions, including Kanagawa, Osaka, Aichi, and Fukuoka, showcase advanced deployment of precision-engineered lined expansion joint technologies that integrate seamlessly with automated chemical delivery systems and comprehensive contamination control protocols.

Key market characteristics:

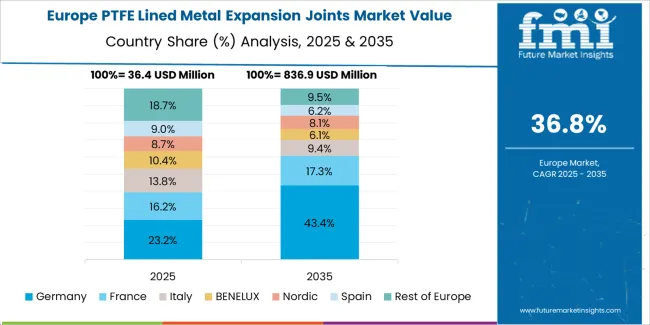

The PTFE lined metal expansion joints market in Europe is projected to grow from USD 77.1 million in 2025 to USD 2,260.9 million by 2035, registering a CAGR of 40.2% over the forecast period. Germany is expected to maintain its leadership position with a 35.8% market share in 2025, declining slightly to 34.6% by 2035, supported by its extensive chemical processing infrastructure and major pharmaceutical manufacturing centers, including North Rhine-Westphalia, Bavaria, and Baden-Württemberg production regions.

France follows with a 19.4% share in 2025, projected to reach 20.1% by 2035, driven by comprehensive specialty chemical production and pharmaceutical manufacturing programs in major industrial regions. The United Kingdom holds a 15.7% share in 2025, expected to reach 16.2% by 2035 through pharmaceutical manufacturing facilities and chemical processing operations. Italy commands a 12.8% share in both 2025 and 2035, backed by specialty chemical production and pharmaceutical component manufacturing. Spain accounts for 8.9% in 2025, rising to 9.3% by 2035 on chemical processing expansion and pharmaceutical sector growth. The Rest of Europe region is anticipated to hold 7.4% in 2025, expanding to 7.6% by 2035, attributed to increasing PTFE lined expansion joint adoption in Nordic chemical facilities and emerging Central & Eastern European pharmaceutical manufacturing operations.

The Japanese market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of stainless steel lined expansion joint systems with existing ultra-high purity chemical delivery infrastructure across semiconductor fabrication facilities, pharmaceutical production operations, and precision chemical manufacturing centers. Japan's focus on manufacturing quality and contamination control drives demand for premium lined expansion joint components that support zero-defect commitments and stringent purity requirements in regulated manufacturing environments. The market benefits from strong partnerships between international lined piping component providers and domestic industrial distributors including major trading companies, creating comprehensive service ecosystems that prioritize technical installation support and application engineering programs. Industrial centers in Kanagawa, Osaka, Aichi, and other major manufacturing areas showcase advanced chemical handling implementations where PTFE lined expansion joint systems achieve 99.9% leak-free performance through optimized installation procedures and comprehensive quality verification protocols.

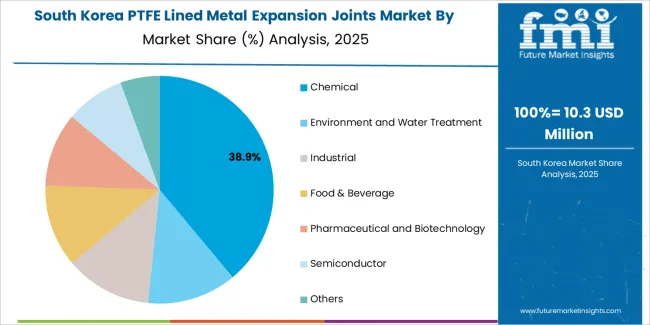

The South Korean market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and application engineering capabilities for semiconductor chemical delivery systems and pharmaceutical manufacturing applications. The market demonstrates increasing focus on contamination prevention and process reliability, as Korean manufacturers increasingly demand advanced lined expansion joint solutions that integrate with domestic semiconductor fabrication equipment and sophisticated process control systems deployed across major industrial complexes. Regional piping component distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including technical installation training programs and application-specific component selections for semiconductor and pharmaceutical production operations. The competitive landscape shows increasing collaboration between multinational lined piping companies and Korean industrial equipment specialists, creating hybrid service models that combine international product development expertise with local technical support capabilities and rapid response systems.

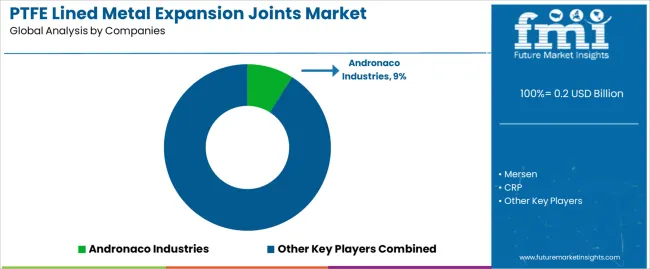

The market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 22-26% of global market share through established distribution networks and comprehensive technical support capabilities. Competition centers on chemical resistance performance consistency, installation reliability, and application engineering expertise rather than price competition alone. Andronaco Industries leads with approximately 9.0% market share through its comprehensive PTFE-lined piping solutions portfolio and global chemical processing industry presence.

Market leaders include Andronaco Industries, Mersen, and CRP, which maintain competitive advantages through global distribution infrastructure, advanced PTFE molding technology, and deep expertise in chemical processing applications across multiple industrial sectors, creating trust and reliability advantages with chemical processors and pharmaceutical manufacturing operations. These companies leverage research and development capabilities in liner bonding optimization and ongoing technical support relationships to defend market positions while expanding into emerging chemical manufacturing markets and specialized semiconductor fabrication segments.

Challengers encompass Galaxy Thermoplast and NICHIAS, which compete through specialized product offerings and strong regional presence in key chemical manufacturing markets. Product specialists, including SGL Carbon, STENFLEX Rudolf Stender, and BAUMMEISTER, focus on specific expansion joint configurations or regional markets, offering differentiated capabilities in custom engineering solutions, rapid fabrication services, and competitive pricing structures for standard product configurations.

Regional players and emerging PTFE component manufacturers create competitive pressure through localized fabrication advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to chemical processing clusters provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven leak prevention performance with comprehensive application engineering offerings that address the complete piping system lifecycle from material selection through installation procedures and performance validation protocols.

PTFE lined metal expansion joints represent advanced piping components that enable chemical processors to achieve 50-70% reduction in maintenance downtime compared to conventional unlined expansion joints, delivering superior corrosion resistance and operational reliability with zero-leak performance and extended service life in demanding chemical handling applications. With the market projected to grow from USD 0.2 billion in 2025 to USD 5.7 billion by 2035 at a 39.7% CAGR, these corrosion-resistant piping components offer compelling advantages including leak prevention, chemical compatibility, and environmental compliance, making them essential for chemical processing applications (40.9% market share), pharmaceutical manufacturing operations, and industrial facilities seeking alternatives to conventional expansion joints that compromise process safety through corrosion-related failures and fugitive emissions.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 0.2 billion |

| Metal Type | Stainless Steel, Carbon Steel |

| Application | Chemical, Environment and Water Treatment, Industrial, Food & Beverage, Pharmaceutical and Biotechnology, Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Andronaco Industries, Mersen, CRP, Galaxy Thermoplast, NICHIAS, SGL Carbon, STENFLEX Rudolf Stender, BAUMMEISTER, MEGAFLEX, Kipflex, SEIRIS SAS, Kadant, Pacific Hoseflex, Allied Supreme, DuFlon, Bonde LP, Italprotec Industries, Hi-Tech Applicator, Diflon Technology, Engiplas, MB Plastics Europe BV, ALMARC Engineering, J-Flon Products, ALL FLUORO |

| Additional Attributes | Dollar sales by metal type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with PTFE component manufacturers and distribution networks, chemical processing facility requirements and specifications, integration with industrial piping systems and process equipment, innovations in PTFE molding technology and liner bonding systems, and development of specialized expansion joint solutions with enhanced chemical resistance and leak prevention capabilities. |

The global ptfe lined metal expansion joints market is estimated to be valued at USD 0.2 billion in 2025.

The market size for the ptfe lined metal expansion joints market is projected to reach USD 5.7 billion by 2035.

The ptfe lined metal expansion joints market is expected to grow at a 39.7% CAGR between 2025 and 2035.

The key product types in ptfe lined metal expansion joints market are stainless steel and carbon steel.

In terms of application, chemical segment to command 40.9% share in the ptfe lined metal expansion joints market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PTFE Membrane Market

PTFE Lined Expansion Joint Market Size and Share Forecast Outlook 2025 to 2035

PTFE and PFA Lined Valves Market Size and Share Forecast Outlook 2025 to 2035

ePTFE Filter Film Market Size and Share Forecast Outlook 2025 to 2035

ePTFE Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

ePTFE Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Expanded PTFE (ePTFE) Market Growth – Trends & Forecast 2024-2034

Polytetrafluoroethylene (PTFE) Market Size and Share Forecast Outlook 2025 to 2035

Lined Dip Pipes Market Size and Share Forecast Outlook 2025 to 2035

Lined Valve Market Growth – Trends & Forecast 2024-2034

Lined lug caps Market

Cone Lined Caps Market

Bubble Lined Courier Bags Market Size and Share Forecast Outlook 2025 to 2035

Rotary and RF Rotary Joints Market Size and Share Forecast Outlook 2025 to 2035

Expansion Valve Market Size and Share Forecast Outlook 2025 to 2035

Bridge Expansion Joints Market Growth - Trends & Forecast 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA