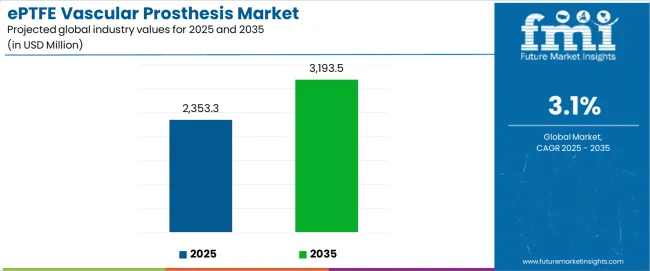

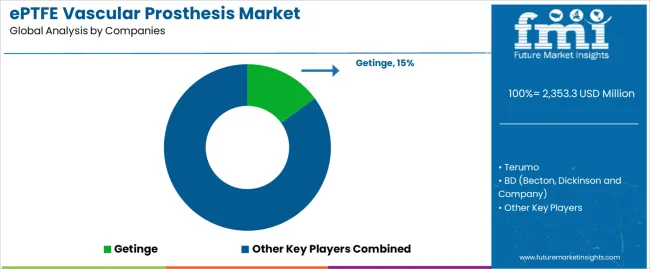

The ePTFE vascular prosthesis market stands at the threshold of a decade-long expansion trajectory that promises to reshape cardiovascular medical device technology and vascular replacement solutions. The ePTFE vascular prosthesis market's journey from USD 2,353.3 million in 2025 to USD 3,193.5 million by 2035 represents steady growth, demonstrating the consistent adoption of advanced graft technology and surgical optimization across cardiovascular facilities, hospital operations, and specialized vascular surgery centers.

The first half of the decade (2025-2030) will witness the ePTFE vascular prosthesis market climbing from USD 2,353.3 million to approximately USD 2,501.5 million, adding USD 148.2 million in value, which constitutes 18% of the total forecast growth period. This phase will be characterized by the steady adoption of enhanced ePTFE graft systems, driven by increasing cardiovascular disease prevalence and the growing need for reliable vascular replacement solutions worldwide. Advanced biocompatibility features and improved patency rates will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 2,501.5 million to USD 3,193.5 million, representing an addition of USD 692.0 million or 82% of the decade's expansion. This period will be defined by broader market penetration of next-generation graft technologies, integration with comprehensive surgical planning platforms, and seamless compatibility with existing cardiovascular infrastructure. The ePTFE vascular prosthesis market trajectory signals fundamental shifts in how vascular surgeons approach vessel replacement and bypass procedures, with participants positioned to benefit from growing demand across multiple wall thickness types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New graft sales (thin wall, standard wall) | 52% | Procedure-driven, volume-dependent purchases |

| Replacement & revision grafts | 20% | Failed graft replacements, complications | |

| Specialty & custom grafts | 15% | Complex anatomies, specialized applications | |

| Emergency & urgent procedures | 8% | Acute vascular emergencies, trauma cases | |

| Training & education services | 5% | Surgical technique training, certification | |

| Future (3-5 yrs) | Advanced biocompatible grafts | 40-45% | Enhanced patency, reduced complications |

| Minimally invasive solutions | 20-25% | Endovascular approaches, hybrid procedures | |

| Digital planning & simulation | 12-15% | Pre-operative modeling, surgical planning | |

| Specialty & complex grafts | 10-12% | Patient-specific solutions, challenging anatomies | |

| Value-based care contracts | 8-10% | Outcome-based pricing, performance guarantees | |

| Clinical data & registry services | 3-5% | Long-term outcomes tracking, quality metrics |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,353.3 million |

| Market Forecast (2035) | USD 3,193.5 million |

| Growth Rate | 3.1% CAGR |

| Leading Wall Thickness | Thin Wall Grafts |

| Primary Application | Peripheral Vascular Disease Segment |

The ePTFE vascular prosthesis market demonstrate stable fundamentals with thin wall graft systems capturing a dominant share through superior handling characteristics and surgical optimization. Peripheral vascular disease applications drive primary demand, supported by increasing aging population and cardiovascular disease burden. Geographic expansion remains concentrated in developed markets with established cardiovascular care infrastructure, while emerging economies show accelerating adoption rates driven by healthcare infrastructure development and rising surgical volumes.

Design for outcomes, not just specifications

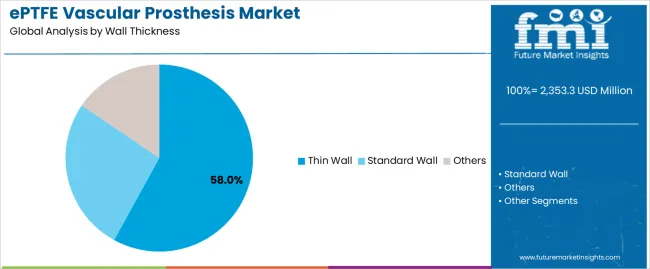

Primary Classification: The market segments by wall thickness into thin wall, standard wall, and others, representing the evolution from basic vascular grafts to specialized prosthetic solutions for comprehensive surgical optimization.

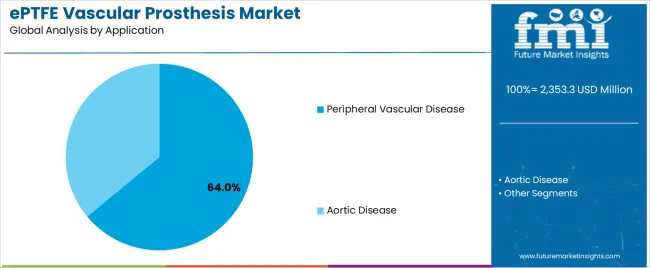

Secondary Classification: Application segmentation divides the ePTFE vascular prosthesis market into aortic disease and peripheral vascular disease categories, reflecting distinct requirements for vessel replacement, hemodynamic performance, and surgical technique standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by cardiovascular care expansion programs.

The segmentation structure reveals technology progression from standard graft configurations toward sophisticated vascular solutions with enhanced biocompatibility and surgical handling capabilities, while application diversity spans from aortic reconstruction to peripheral bypass procedures requiring specialized graft characteristics.

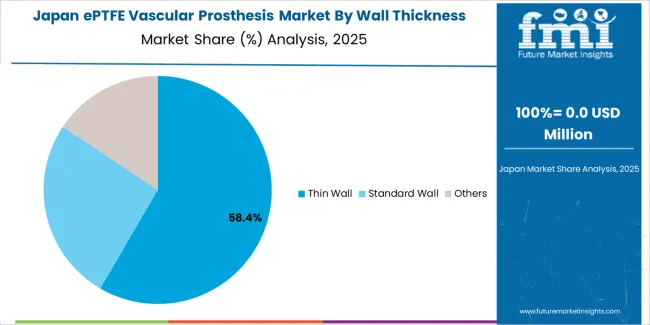

Market Position: Thin Wall grafts command the leading position in the ePTFE vascular prosthesis market with 58% market share through advanced handling features, including superior flexibility, optimal kink resistance, and surgical maneuverability that enable vascular surgeons to achieve optimal graft placement across diverse anatomical and procedural environments.

Value Drivers: The segment benefits from surgeon preference for reliable graft systems that provide consistent handling performance, reduced suturing difficulty, and hemodynamic optimization without requiring significant surgical technique modifications. Advanced design features enable improved conformability, reduced thrombogenicity, and integration with minimally invasive approaches, where surgical ease and graft performance represent critical procedural requirements.

Competitive Advantages: Thin Wall grafts differentiate through proven surgical reliability, consistent patency characteristics, and integration with modern vascular surgery techniques that enhance procedural effectiveness while maintaining optimal hemodynamic standards suitable for diverse vascular reconstruction applications.

Key market characteristics:

Standard Wall grafts maintain a 32% market position in the ePTFE vascular prosthesis market due to their proven durability properties and structural advantages. These grafts appeal to surgeons requiring robust vessel replacement with established clinical evidence for high-pressure vascular applications. Market growth is driven by aortic reconstruction needs, emphasizing reliable structural integrity and long-term patency through proven graft designs.

Other wall thickness grafts capture 10% market share through specialized surgical requirements in complex anatomies, revision procedures, and custom vascular reconstruction applications. These procedures demand flexible graft options capable of addressing unique anatomical challenges while providing effective hemodynamic capabilities and surgical adaptability.

Market Context: Peripheral Vascular Disease applications demonstrate the highest market share in the ePTFE vascular prosthesis market with 64% share due to widespread prevalence of peripheral arterial disease and increasing focus on limb salvage optimization, quality of life improvement, and surgical intervention applications that maximize patient outcomes while maintaining procedural standards.

Appeal Factors: Vascular surgeons prioritize graft patency, limb preservation success, and integration with existing surgical protocols that enable effective revascularization across diverse patient populations. The segment benefits from substantial disease burden and clinical evidence that emphasizes the importance of infrainguinal bypass procedures for peripheral vascular disease management and limb salvage applications.

Growth Drivers: Aging population trends incorporate peripheral vascular procedures as standard treatment for arterial occlusive disease, while diabetes prevalence increases demand for vascular intervention capabilities that comply with clinical guidelines and minimize amputation rates.

Market Challenges: Varying anatomical complexity and patient comorbidities may limit graft standardization across different clinical scenarios or patient populations.

Application dynamics include:

Aortic Disease applications capture 36% market share through specialized surgical requirements in aortic reconstruction, thoracic procedures, and complex vascular repairs. These surgical cases demand high-performance graft systems capable of withstanding elevated hemodynamic pressures while providing effective structural support and long-term durability capabilities.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Aging population & cardiovascular disease burden (demographic shifts, lifestyle factors) | ★★★★★ | Growing elderly population increases vascular disease prevalence; sustained demand for bypass grafts and vascular reconstruction procedures. |

| Driver | Diabetes epidemic & peripheral arterial disease (metabolic syndrome, vascular complications) | ★★★★★ | Rising diabetes rates accelerate peripheral vascular disease; demand for lower extremity bypass and limb salvage procedures expanding addressable market. |

| Driver | Minimally invasive surgery adoption (endovascular techniques, hybrid procedures) | ★★★★☆ | Surgical technique evolution requiring flexible graft solutions; demand for grafts compatible with minimally invasive approaches drives innovation. |

| Restraint | Competition from drug-eluting devices (balloons, stents, alternative technologies) | ★★★★☆ | Endovascular interventions capture market share in certain applications; reduces traditional bypass procedure volumes in specific anatomical scenarios. |

| Restraint | Graft failure & revision requirements (thrombosis, infection, structural complications) | ★★★☆☆ | Long-term patency challenges and complication rates impact surgeon confidence; revision procedures create clinical and economic burden. |

| Trend | Bioengineered & surface-modified grafts (anti-thrombogenic coatings, bioactive surfaces) | ★★★★★ | Enhanced biocompatibility and patency improvements through surface engineering; next-generation grafts with reduced complications become competitive differentiators. |

| Trend | Personalized vascular solutions (patient-specific sizing, 3D planning, custom grafts) | ★★★★☆ | Anatomical variability requiring tailored solutions; digital planning and custom manufacturing capabilities drive competitive advantage. |

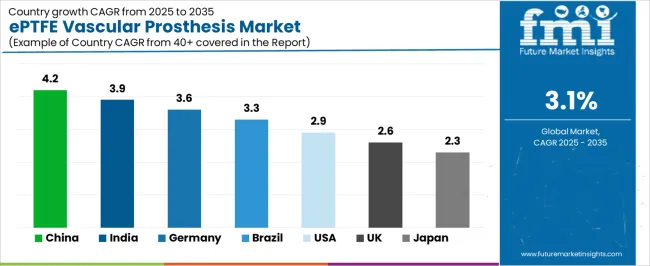

The ePTFE vascular prosthesis market demonstrates varied regional dynamics with Growth Leaders including China (4.2% growth rate) and India (3.9% growth rate) driving expansion through healthcare infrastructure development and cardiovascular care capacity building. Steady Performers encompass Germany (3.6% growth rate), Brazil (3.3% growth rate), and developed regions, benefiting from established cardiovascular surgery programs and advanced medical device adoption. Mature Markets feature United States (2.9% growth rate) and developed regions, where established vascular surgery practices and clinical evidence standards support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through cardiovascular infrastructure expansion and surgical volume development, while South Asian countries maintain strong growth supported by healthcare access improvements and disease burden increases. North American and European markets show steady expansion driven by aging demographics and surgical technique advancement.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 4.2% | Focus on hospital partnerships and clinical training | Regulatory changes; pricing pressures |

| India | 3.9% | Lead with value-based solutions and surgeon education | Infrastructure gaps; reimbursement challenges |

| Germany | 3.6% | Provide clinical evidence and premium quality | Stringent regulations; reimbursement complexity |

| Brazil | 3.3% | Value-oriented models with clinical support | Import barriers; economic volatility |

| United States | 2.9% | Offer outcome data and value-based contracts | Market maturity; competitive intensity |

| United Kingdom | 2.6% | Push clinical outcomes and NHS compatibility | Budget constraints; reimbursement pressures |

| Japan | 2.3% | Premium quality and long-term patency evidence | Aging surgeons; conservative adoption |

China establishes fastest market growth through aggressive cardiovascular care infrastructure development and comprehensive surgical capacity expansion, integrating ePTFE vascular prostheses as standard components in vascular surgery programs and hospital cardiovascular departments. The country's 4.2% growth rate reflects government healthcare initiatives promoting cardiovascular disease management and surgical capacity development that mandate the use of reliable graft systems in tertiary hospitals and specialized vascular centers. Growth concentrates in major metropolitan areas, including Beijing, Shanghai, and Guangzhou, where cardiovascular centers showcase advanced surgical capabilities that appeal to vascular surgeons seeking proven graft performance and clinical outcomes.

Chinese hospitals are developing comprehensive vascular surgery programs that combine international best practices with domestic surgical expertise, including standardized implantation techniques and enhanced post-operative monitoring capabilities. Distribution channels through medical device distributors and hospital procurement systems expand market access, while government healthcare reforms support adoption across diverse hospital tiers and regional medical centers.

Strategic Market Indicators:

In Mumbai, Delhi, and Chennai, tertiary care hospitals and specialized cardiovascular centers are implementing ePTFE vascular prostheses as standard treatment options for vascular disease management and surgical reconstruction applications, driven by increasing disease prevalence and healthcare infrastructure development programs that emphasize the importance of surgical intervention capabilities. The ePTFE vascular prosthesis market holds a 3.9% growth rate, supported by healthcare expansion initiatives and medical tourism programs that promote advanced cardiovascular surgery for domestic and international patients. Indian vascular surgeons are adopting graft systems that provide consistent clinical performance and cost-effectiveness, particularly appealing in urban regions where surgical outcomes and value considerations represent critical healthcare requirements.

Market expansion benefits from growing cardiovascular disease burden and increasing surgical expertise that enable adoption of standard vascular reconstruction techniques for diverse patient populations. Technology adoption follows patterns established in cardiac surgery, where clinical evidence and cost-effectiveness drive procurement decisions and surgical practices.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive cardiovascular care programs and advanced surgical expertise development, integrating ePTFE vascular prostheses across complex vascular reconstruction and routine bypass applications. The country's 3.6% growth rate reflects established vascular surgery traditions and mature clinical protocol adoption that supports widespread use of high-quality graft systems in university hospitals and cardiovascular centers. Growth concentrates in major medical centers, including Berlin, Hamburg, and Munich, where vascular surgery showcases sophisticated procedural capabilities that appeal to surgeons seeking proven long-term outcomes and quality standards.

German cardiovascular centers leverage established clinical networks and comprehensive outcome tracking capabilities, including registry participation and quality monitoring that create evidence generation and surgical excellence. The ePTFE vascular prosthesis market benefits from mature reimbursement systems and quality requirements that mandate clinical evidence while supporting innovation advancement and outcome optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse cardiovascular disease prevalence, including vascular surgery program development in São Paulo and Rio de Janeiro, hospital infrastructure upgrades, and healthcare expansion programs that increasingly incorporate vascular prostheses for disease management applications. The country maintains a 3.3% growth rate, driven by rising cardiovascular disease activity and increasing recognition of surgical intervention benefits, including limb salvage and quality of life improvements.

Market dynamics focus on cost-effective graft solutions that balance clinical performance with affordability considerations important to Brazilian healthcare systems. Growing cardiovascular surgery capacity creates continued demand for reliable graft systems in hospital infrastructure development and surgical program expansion.

Strategic Market Considerations:

United States establishes market leadership through comprehensive cardiovascular care programs and advanced vascular surgery infrastructure, integrating ePTFE vascular prostheses across diverse surgical applications and patient populations. The country's 2.9% growth rate reflects mature vascular surgery market and established clinical evidence that supports widespread use of proven graft systems in academic medical centers and community hospitals. Growth concentrates in major healthcare systems where vascular surgery showcases mature procedural deployment that appeals to surgeons seeking evidence-based graft selection and optimal patient outcomes.

American vascular surgeons leverage established clinical guidelines and comprehensive outcome registries, including national databases and quality programs that create evidence-based practice and outcome accountability. The ePTFE vascular prosthesis market benefits from mature reimbursement frameworks and value-based care models that mandate outcome tracking while supporting technology evaluation and clinical optimization.

Market Intelligence Brief:

United Kingdom's mature cardiovascular care system demonstrates comprehensive ePTFE vascular prosthesis deployment with documented clinical effectiveness in NHS hospitals and private healthcare facilities through integration with existing surgical protocols and quality frameworks. The country leverages established vascular surgery expertise and evidence-based practice to maintain a 2.6% growth rate. Major medical centers, including London, Manchester, and Birmingham, showcase standardized surgical approaches where graft systems integrate with comprehensive quality improvement programs and outcome monitoring systems to optimize clinical results and cost-effectiveness.

British vascular surgeons prioritize clinical evidence and cost-effectiveness in graft selection, creating demand for products with proven long-term outcomes and favorable cost-benefit profiles. The ePTFE vascular prosthesis market benefits from established NHS procurement frameworks and clinical guideline adherence that mandate evidence-based practice while supporting appropriate technology utilization.

Market Intelligence Brief:

Japan's market maintains a 2.3% growth rate through established cardiovascular surgery infrastructure and advanced medical device standards, where ePTFE vascular prostheses represent proven treatment options in university hospitals and specialized cardiovascular centers. The country benefits from comprehensive healthcare coverage and rigorous quality standards that support consistent demand for high-quality graft systems.

Market characteristics include preference for proven clinical performance, meticulous surgical techniques, and long-term outcome emphasis that align with Japanese medical practice patterns and quality expectations. Distribution through established medical device channels provides comprehensive market coverage.

Strategic Market Considerations:

The ePTFE vascular prosthesis market in Europe is projected to grow from USD 705.6 million in 2025 to USD 957.8 million by 2035, registering a CAGR of 3.1% over the forecast period. Germany is expected to maintain its leadership position with a 34.2% market share in 2025, declining slightly to 33.8% by 2035, supported by its advanced cardiovascular care infrastructure and major vascular surgery centers including university hospitals in Berlin, Munich, and Hamburg.

United Kingdom follows with a 23.8% share in 2025, projected to reach 24.1% by 2035, driven by comprehensive NHS vascular surgery programs and established clinical guidelines. France holds a 19.6% share in 2025, expected to reach 19.9% by 2035 through specialized cardiovascular centers and quality compliance requirements. Italy commands a 13.4% share, while Spain accounts for 9.0% in 2025. The rest of Europe region is anticipated to maintain stability, with its collective share moving from 6.8% to 6.9% by 2035, attributed to steady vascular surgery adoption in Nordic countries and emerging Eastern European cardiovascular programs implementing surgical capacity development.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, clinical evidence depth, surgeon education programs | Broad availability, proven outcomes, multi-region support | Innovation cycles; emerging market penetration |

| Technology innovators | R&D capabilities; bioengineered surfaces; next-generation grafts | Latest technology first; superior performance claims | Clinical evidence generation; cost justification |

| Regional specialists | Local surgeon relationships, responsive support, market knowledge | "Close to OR" service; pragmatic solutions; local regulations | Technology advancement; international evidence |

| Clinical evidence leaders | Registry data, long-term outcomes, peer-reviewed publications | Lowest complication rates; surgeon confidence; guideline inclusion | Service costs in new markets; price competition |

| Specialty procedure experts | Complex anatomy solutions, custom grafts, technical support | Win challenging cases; surgical technique expertise; problem-solving | Scalability limitations; narrow case focus |

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Wall Thickness | Thin Wall, Standard Wall, Others |

| Application | Aortic Disease, Peripheral Vascular Disease |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, Italy, Spain, and 20+ additional countries |

| Key Companies Profiled | Getinge, Terumo, BD, W. L. Gore & Associates, B.Braun, LeMaitre Vascular, Shanghai Suokang Medical Implants |

| Additional Attributes | Dollar sales by wall thickness and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with vascular device manufacturers and surgical suppliers, surgeon preferences for graft handling and patency performance, integration with surgical planning systems and outcome monitoring platforms, innovations in biocompatibility technology and surface modification, and development of next-generation graft solutions with enhanced performance and surgical optimization capabilities. |

The global ePTFE vascular prosthesis market is estimated to be valued at USD 2,353.3 million in 2025.

The market size for the ePTFE vascular prosthesis market is projected to reach USD 3,193.5 million by 2035.

The ePTFE vascular prosthesis market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in ePTFE vascular prosthesis market are thin wall, standard wall and others.

In terms of application, peripheral vascular disease segment to command 64.0% share in the ePTFE vascular prosthesis market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Expanded PTFE (ePTFE) Market Growth – Trends & Forecast 2024-2034

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vascular Boot Market Trends and Forecast 2025 to 2035

The Vascular Ulcer Treatment Market Is Segmented by Ulcer Type, Treatment and Distribution Channel from 2025 To 2035

Vascular Dementia Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Vascular Imaging Systems Market Growth - Trends & Forecast 2025 to 2035

Vascular Closure Devices Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Vascular Patches Market - Demand, Growth & Forecast 2024 to 2034

Vascular Access System Market Analysis – Demand & Forecast 2024-2034

Vascular Endothelial Growth Factor Inhibitor Market

Vascular Dressings Market

Vascular prostheses market

Vascular Screening Market

Vascular Testing Devices Market

Neovascular AMD Treatment Market Growth, Analysis & Forecast by Drug Type, Disease Type, Age Group, Gender, Stage of Disease, Distribution Channel and Region through 2035

Nonvascular Interventional Radiology Device Market Trends – Growth & Forecast 2024-2034

Endovascular Aneurysm Repair (EVAR) Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Vascular Stents Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA