Table of Content

1. Executive Summary

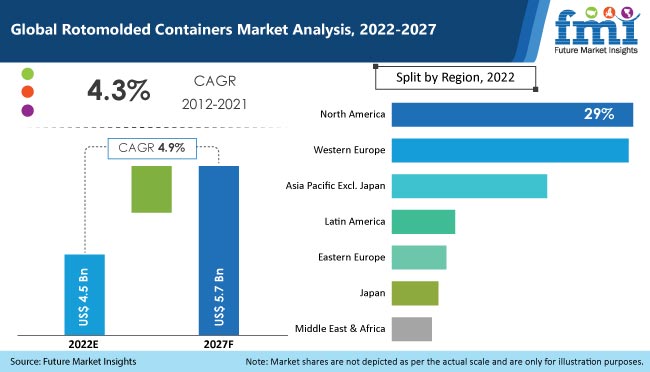

1.1. Global Market Analysis

1.2. Global Market Outlook

1.3. Analysis and Recommendations

2. Market Overview

2.1. Market Definition

2.2. Market Coverage

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

5. Global Rotomolded Containers Market Demand Analysis 2012-2021 and Forecast, 2022-2027

5.1. Historical Market Volume (‘000 Tonnes) Analysis, 2012-2021

5.2. Current and Future Market Volume (‘000 Tonnes) Projections, 2022-2027

5.3. Y-o-Y Growth Trend Analysis

6. Global Rotomolded Containers Market - Pricing Analysis

6.1. Regional Pricing Analysis, By Material

6.2. Pricing Break-up

6.3. Global Average Pricing Analysis Benchmark

7. Global Rotomolded Containers Market Demand (US$ Mn) Analysis 2012-2021 and Forecast, 2022-2027

7.1. Historical Market Value (US$ Mn) Analysis, 2012-2021

7.2. Current and Future Market Value (US$ Mn) Projections, 2022-2027

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Global Packaging Market Overview

8.2. Global Rigid Packaging Market Overview

8.3. Global Chemical Sales Outlook

8.4. Macro-Economic Factors & Co-relation Analysis

8.4.1. Global Packaging Industry Growth

8.4.2. Global Food & Beverage Industry Growth

8.4.3. Global Petroleum & Lubricants Market Overview

8.4.4. Global Chemical Consumption Overview

8.4.5. Impact of COVID-19 Pandemic

8.5. Forecast Factors - Relevance & Impact

8.5.1. Global Packaging Market Growth

8.5.2. Global Rigid Packaging Market Outlook

8.5.3. Global Plastic Industry Growth

8.5.4. Global Chemicals & Fertilizers Market Growth

8.5.5. Segmental Revenue Growth of Key Players

8.5.6. Global Consumer Electronics Market Growth

8.6. Value Chain Analysis

8.6.1. Key Participants

8.6.1.1. Raw Material Suppliers

8.6.1.2. Rotomolded Container Manufacturers

8.6.1.3. End Use Industry

8.6.2. Profitability Margin

8.7. Market Dynamics

8.7.1. Drivers

8.7.2. Restraints

8.7.3. Opportunity Analysis

9. Impact of COVID-19

9.1. Current Statistics and Probable Future Impact

9.2. Impact of COVID-19 on Rotomolded Containers Market

10. Global Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027, By Material

10.1. Introduction

10.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis, By Material, 2012-2021

10.3. Current and Future Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis and Forecast, By Material, 2022-2027

10.3.1. Polyethylene (PE)

10.3.2. Polypropylene (PP)

10.3.3. Polyvinyl Chloride (PVC)

10.3.4. Polyamide (PA)

10.3.5. Others

10.4. Market Attractiveness Analysis, By Material

11. Global Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027, By Product

11.1. Introduction

11.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis, By Product, 2012-2021

11.3. Current and Future Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis and Forecast, By Product, 2022-2027

11.3.1. Cases

11.3.2. Tanks

11.3.3. IBCs

11.3.4. Trays

11.3.5. Others

11.4. Market Attractiveness Analysis, By Product

12. Global Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027, By End Use Industry

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis, By End Use Industry, 2012-2021

12.3. Current and Future Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis and Forecast, By End Use Industry, 2022-2027

12.3.1. Consumer Electronics

12.3.2. Material Handling

12.3.3. Chemicals & Fertilizers

12.3.4. Food & Beverages Processing

12.3.5. Petroleum & Lubricants

12.3.6. Others

12.4. Market Attractiveness Analysis, By End Use Industry

13. Global Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027, By Region

13.1. Introduction

13.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis, by Region, 2012-2021

13.3. Current Market Size (US$ Mn) and Volume (‘000 Tonnes) Analysis and Forecast, by Region, 2022-2027

13.3.1. North America

13.3.2. Latin America

13.3.3. Western Europe

13.3.4. Eastern Europe

13.3.5. Asia Pacific excluding Japan (AJEJ)

13.3.6. Middle East and Africa (MEA)

13.3.7. Japan

13.4. Market Attractiveness Analysis, by Region

14. North America Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

14.1. Introduction

14.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

14.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

14.3.1. By Country

14.3.1.1. U.S.

14.3.1.2. Canada

14.3.2. By Material

14.3.3. By Product

14.3.4. By End Use Industry

14.4. Market Attractiveness Analysis

14.4.1. By Country

14.4.2. By Material

14.4.3. By Product

14.4.4. By End Use Industry

15. Latin America Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

15.1. Introduction

15.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

15.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

15.3.1. By Country

15.3.1.1. Brazil

15.3.1.2. Mexico

15.3.1.3. Argentina

15.3.1.4. Rest of Latin America

15.3.2. By Material

15.3.3. By Product

15.3.4. By End Use Industry

15.4. Market Attractiveness Analysis

15.4.1. By Country

15.4.2. By Material

15.4.3. By Product

15.4.4. By End Use Industry

16. Western Europe Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

16.1. Introduction

16.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

16.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

16.3.1. By Country

16.3.1.1. Germany

16.3.1.2. Italy

16.3.1.3. France

16.3.1.4. U.K.

16.3.1.5. Spain

16.3.1.6. BENELUX

16.3.1.7. Nordics

16.3.1.8. Rest of Western Europe

16.3.2. By Material

16.3.3. By Product

16.3.4. By End Use Industry

16.4. Market Attractiveness Analysis

16.4.1. By Country

16.4.2. By Material

16.4.3. By Product

16.4.4. By End Use Industry

17. Eastern Europe Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

17.1. Introduction

17.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

17.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

17.3.1. By Country

17.3.1.1. Russia

17.3.1.2. Poland

17.3.1.3. Rest of Eastern Europe

17.3.2. By Material

17.3.3. By Product

17.3.4. By End Use Industry

17.4. Market Attractiveness Analysis

17.4.1. By Country

17.4.2. By Material

17.4.3. By Product

17.4.4. By End Use Industry

18. Asia Pacific excluding Japan (AJEJ) Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

18.1. Introduction

18.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

18.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

18.3.1. By Country

18.3.1.1. China

18.3.1.2. India

18.3.1.3. Australia & New Zealand

18.3.1.4. ASEAN

18.3.1.5. Rest of Asia Pacific excluding Japan (AJEJ)

18.3.2. By Material

18.3.3. By Product

18.3.4. By End Use Industry

18.4. Market Attractiveness Analysis

18.4.1. By Country

18.4.2. By Material

18.4.3. By Product

18.4.4. By End Use Industry

19. Japan Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

19.1. Introduction

19.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

19.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

19.3.1. By Material

19.3.2. By Product

19.3.3. By End Use Industry

19.4. Market Attractiveness Analysis

19.4.1. By Material

19.4.2. By Product

19.4.3. By End Use Industry

20. Middle East and Africa Rotomolded Containers Market Analysis 2012-2021 and Forecast 2022-2027

20.1. Introduction

20.2. Historical Market Size (US$ Mn) and Volume (‘000 Tonnes) Trend Analysis, by Market Taxonomy, 2012-2021

20.3. Market Size (US$ Mn) and Volume (‘000 Tonnes) Forecast, by Market Taxonomy, 2022-2027

20.3.1. By Country

20.3.1.1. GCC Countries

20.3.1.2. South Africa

20.3.1.3. Northern Africa

20.3.1.4. Rest of Middle East and Africa

20.3.2. By Material

20.3.3. By Product

20.3.4. By End Use Industry

20.4. Market Attractiveness Analysis

20.4.1. By Country

20.4.2. By Material

20.4.3. By Product

20.4.4. By End Use Industry

21. Rotomolded Containers Market Country wise Analysis

21.1. U.S. Rotomolded Containers Market Analysis

21.1.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.1.1.1. By Material

21.1.1.2. By Product

21.1.1.3. By End Use Industry

21.2. Canada Rotomolded Containers Market Analysis

21.2.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.2.1.1. By Material

21.2.1.2. By Product

21.2.1.3. By End Use Industry

21.3. Brazil Rotomolded Containers Market Analysis

21.3.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.3.1.1. By Material

21.3.1.2. By Product

21.3.1.3. By End Use Industry

21.4. Mexico Rotomolded Containers Market Analysis

21.4.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.4.1.1. By Material

21.4.1.2. By Product

21.4.1.3. By End Use Industry

21.5. Germany Rotomolded Containers Market Analysis

21.5.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.5.1.1. By Material

21.5.1.2. By Product

21.5.1.3. By End Use Industry

21.6. Spain Rotomolded Containers Market Analysis

21.6.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.6.1.1. By Material

21.6.1.2. By Product

21.6.1.3. By End Use Industry

21.7. Italy Rotomolded Containers Market Analysis

21.7.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.7.1.1. By Material

21.7.1.2. By Product

21.7.1.3. By End Use Industry

21.8. France Rotomolded Containers Market Analysis

21.8.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.8.1.1. By Material

21.8.1.2. By Product

21.8.1.3. By End Use Industry

21.9. U.K. Rotomolded Containers Market Analysis

21.9.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.9.1.1. By Material

21.9.1.2. By Product

21.9.1.3. By End Use Industry

21.10. Russia Rotomolded Containers Market Analysis

21.10.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.10.1.1. By Material

21.10.1.2. By Product

21.10.1.3. By End Use Industry

21.11. China Rotomolded Containers Market Analysis

21.11.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.11.1.1. By Material

21.11.1.2. By Product

21.11.1.3. By End Use Industry

21.12. India Rotomolded Containers Market Analysis

21.12.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.12.1.1. By Material

21.12.1.2. By Product

21.12.1.3. By End Use Industry

21.13. Australia & New Zealand Rotomolded Containers Market Analysis

21.13.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.13.1.1. By Material

21.13.1.2. By Product

21.13.1.3. By End Use Industry

21.14. GCC Countries Rotomolded Containers Market Analysis

21.14.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.14.1.1. By Material

21.14.1.2. By Product

21.14.1.3. By End Use Industry

21.15. South Africa Rotomolded Containers Market Analysis

21.15.1. Market Volume (‘000 Tonnes) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

21.15.1.1. By Material

21.15.1.2. By Product

21.15.1.3. By End Use Industry

22. Market Structure Analysis

22.1. Market Analysis, by Tier of Rotomolded Containers Companies

22.2. Market Share Analysis of Top Players

22.3. Market Presence Analysis

23. Competition Analysis

23.1. Competition Dashboard

23.2. Competition Benchmarking

23.3. Competition Deep Dive

23.3.1. Remcon Plastics Incorporated

23.3.1.1. Overview

23.3.1.2. Product Portfolio

23.3.1.3. Profitability by Market Segments

23.3.1.4. Sales Footprint

23.3.1.5. Strategy Overview

23.3.1.5.1. Marketing Strategy

23.3.1.5.2. Product Strategy

23.3.1.5.3. Channel Strategy

23.3.2. Zero Manufacturing Inc.

23.3.2.1. Overview

23.3.2.2. Product Portfolio

23.3.2.3. Profitability by Market Segments

23.3.2.4. Sales Footprint

23.3.2.5. Strategy Overview

23.3.2.5.1. Marketing Strategy

23.3.2.5.2. Product Strategy

23.3.2.5.3. Channel Strategy

23.3.3. Dura-Cast Products, Inc.

23.3.3.1. Overview

23.3.3.2. Product Portfolio

23.3.3.3. Profitability by Market Segments

23.3.3.4. Sales Footprint

23.3.3.5. Strategy Overview

23.3.3.5.1. Marketing Strategy

23.3.3.5.2. Product Strategy

23.3.3.5.3. Channel Strategy

23.3.4. SKB Corporation Inc.

23.3.4.1. Overview

23.3.4.2. Product Portfolio

23.3.4.3. Profitability by Market Segments

23.3.4.4. Sales Footprint

23.3.4.5. Strategy Overview

23.3.4.5.1. Marketing Strategy

23.3.4.5.2. Product Strategy

23.3.4.5.3. Channel Strategy

23.3.5. Granger Plastics Company

23.3.5.1. Overview

23.3.5.2. Product Portfolio

23.3.5.3. Profitability by Market Segments

23.3.5.4. Sales Footprint

23.3.5.5. Strategy Overview

23.3.5.5.1. Marketing Strategy

23.3.5.5.2. Product Strategy

23.3.5.5.3. Channel Strategy

23.3.6. Myers Industries (Elkhart Plastics, Inc.)

23.3.6.1. Overview

23.3.6.2. Product Portfolio

23.3.6.3. Profitability by Market Segments

23.3.6.4. Sales Footprint

23.3.6.5. Strategy Overview

23.3.6.5.1. Marketing Strategy

23.3.6.5.2. Product Strategy

23.3.6.5.3. Channel Strategy

23.3.7. Ameripack Inc.

23.3.7.1. Overview

23.3.7.2. Product Portfolio

23.3.7.3. Profitability by Market Segments

23.3.7.4. Sales Footprint

23.3.7.5. Strategy Overview

23.3.7.5.1. Marketing Strategy

23.3.7.5.2. Product Strategy

23.3.7.5.3. Channel Strategy

23.3.8. Francis Ward

23.3.8.1. Overview

23.3.8.2. Product Portfolio

23.3.8.3. Profitability by Market Segments

23.3.8.4. Sales Footprint

23.3.8.5. Strategy Overview

23.3.8.5.1. Marketing Strategy

23.3.8.5.2. Product Strategy

23.3.8.5.3. Channel Strategy

23.3.9. Snyder Industries

23.3.9.1. Overview

23.3.9.2. Product Portfolio

23.3.9.3. Profitability by Market Segments

23.3.9.4. Sales Footprint

23.3.9.5. Strategy Overview

23.3.9.5.1. Marketing Strategy

23.3.9.5.2. Product Strategy

23.3.9.5.3. Channel Strategy

23.3.10. R & R Technologies LLC

23.3.10.1. Overview

23.3.10.2. Product Portfolio

23.3.10.3. Profitability by Market Segments

23.3.10.4. Sales Footprint

23.3.10.5. Strategy Overview

23.3.10.5.1. Marketing Strategy

23.3.10.5.2. Product Strategy

23.3.10.5.3. Channel Strategy

23.3.11. Rotational Molding, Inc.

23.3.11.1. Overview

23.3.11.2. Product Portfolio

23.3.11.3. Profitability by Market Segments

23.3.11.4. Sales Footprint

23.3.11.5. Strategy Overview

23.3.11.5.1. Marketing Strategy

23.3.11.5.2. Product Strategy

23.3.11.5.3. Channel Strategy

23.3.12. Stern Companies Inc.

23.3.12.1. Overview

23.3.12.2. Product Portfolio

23.3.12.3. Profitability by Market Segments

23.3.12.4. Sales Footprint

23.3.12.5. Strategy Overview

23.3.12.5.1. Marketing Strategy

23.3.12.5.2. Product Strategy

23.3.12.5.3. Channel Strategy

23.3.13. Advanced Packaging, Inc.

23.3.13.1. Overview

23.3.13.2. Product Portfolio

23.3.13.3. Profitability by Market Segments

23.3.13.4. Sales Footprint

23.3.13.5. Strategy Overview

23.3.13.5.1. Marketing Strategy

23.3.13.5.2. Product Strategy

23.3.13.5.3. Channel Strategy

23.3.14. Xiamen Mellow Rotomolding Co., Ltd.

23.3.14.1. Overview

23.3.14.2. Product Portfolio

23.3.14.3. Profitability by Market Segments

23.3.14.4. Sales Footprint

23.3.14.5. Strategy Overview

23.3.14.5.1. Marketing Strategy

23.3.14.5.2. Product Strategy

23.3.14.5.3. Channel Strategy

23.3.15. Gemstar Manufacturing

23.3.15.1. Overview

23.3.15.2. Product Portfolio

23.3.15.3. Profitability by Market Segments

23.3.15.4. Sales Footprint

23.3.15.5. Strategy Overview

23.3.15.5.1. Marketing Strategy

23.3.15.5.2. Product Strategy

23.3.15.5.3. Channel Strategy

23.3.16. Pelican Products, Inc.

23.3.16.1. Overview

23.3.16.2. Product Portfolio

23.3.16.3. Profitability by Market Segments

23.3.16.4. Sales Footprint

23.3.16.5. Strategy Overview

23.3.16.5.1. Marketing Strategy

23.3.16.5.2. Product Strategy

23.3.16.5.3. Channel Strategy

24. Assumptions and Acronyms Used

25. Research Methodology

List of Tables

Table 01: Global Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 02: Global Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 03: Global Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 04: Global Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 05: Global Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 06: Global Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 07: Global Rotomolded Containers Market Value (US$ Mn) Analysis, by Region, 2012H-2027F

Table 08: Global Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Region, 2012H-2027F

Table 09: North America Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 10: North America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 11: North America Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 12: North America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 13: North America Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 14: North America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 15: North America Rotomolded Containers Market Value (US$ Mn) Analysis, by Country, 2012H-2027F

Table 16: North America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Country, 2012H-2027F

Table 17: Latin America Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 18: Latin America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 19: Latin America Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 20: Latin America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 21: Latin America Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 22: Latin America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 23: Latin America Rotomolded Containers Market Value (US$ Mn) Analysis, by Country, 2012H-2027F

Table 24: Latin America Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Country, 2012H-2027F

Table 25: Western Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 26: Western Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 27: Western Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 28: Western Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 29: Western Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 30: Western Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 31: Western Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by Country, 2012H-2027F

Table 32: Western Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Country, 2012H-2027F

Table 33: Eastern Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 34: Eastern Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 35: Eastern Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 36: Eastern Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 37: Eastern Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 38: Eastern Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 39: Eastern Europe Rotomolded Containers Market Value (US$ Mn) Analysis, by Country, 2012H-2027F

Table 40: Eastern Europe Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Country, 2012H-2027F

Table 41: APEJ Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 42: APEJ Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 43: APEJ Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 44: APEJ Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 45: APEJ Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 46: APEJ Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 47: APEJ Rotomolded Containers Market Value (US$ Mn) Analysis, by Country, 2012H-2027F

Table 48: APEJ Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Country, 2012H-2027F

Table 49: Japan Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 50: Japan Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 51: Japan Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 52: Japan Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 53: Japan Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 54: Japan Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 55: MEA Rotomolded Containers Market Value (US$ Mn) Analysis, by Material, 2012H-2027F

Table 56: MEA Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Material, 2012H-2027F

Table 57: MEA Rotomolded Containers Market Value (US$ Mn) Analysis, by Product, 2012H-2027F

Table 58: MEA Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Product, 2012H-2027F

Table 59: MEA Rotomolded Containers Market Value (US$ Mn) Analysis, by End Use Industry, 2012H-2027F

Table 60: MEA Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by End Use Industry, 2012H-2027F

Table 61: MEA Rotomolded Containers Market Value (US$ Mn) Analysis, by Country, 2012H-2027F

Table 62: MEA Rotomolded Containers Market Volume (‘000 Tonnes) Analysis, by Country, 2012H-2027F

List of Charts

Figure 01: Global Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 02: Global Rotomolded Containers Market Y-o-Y Growth Analysis by Material, 2019H-2027F

Figure 03: Global Rotomolded Containers Market Attractiveness Analysis by Material, 2022E-2027F

Figure 04: Global Rotomolded Containers Market Share Analysis by Product, 2022E & 2027F

Figure 05: Global Rotomolded Containers Market Y-o-Y Growth Analysis by Product, 2019H-2027F

Figure 06: Global Rotomolded Containers Market Attractiveness Analysis by Product, 2022E-2027F

Figure 07: Global Rotomolded Containers Market Share Analysis by End Use Industry, 2022E & 2027F

Figure 08: Global Rotomolded Containers Market Y-o-Y Growth Analysis by End Use Industry, 2019H-2027F

Figure 09: Global Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 10: Global Rotomolded Containers Market Share Analysis by Region, 2022E & 2027F

Figure 11: Global Rotomolded Containers Market Y-o-Y Growth Analysis by Region, 2019H-2027F

Figure 12: Global Rotomolded Containers Market Attractiveness Analysis by Region, 2022E-2027F

Figure 13: North America Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 14: North America Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 15: North America Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 16: North America Rotomolded Containers Market Value Share Analysis by Country 2022(E)

Figure 17: Latin America Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 18: Latin America Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 19: Latin America Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 20: Latin America Rotomolded Containers Market Value Share Analysis by Country 2022(E)

Figure 21: Western Europe Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 22: Western Europe Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 23: Western Europe Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 24: Western Europe Rotomolded Containers Market Value Share Analysis by Country 2022(E)

Figure 25: Eastern Europe Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 26: Eastern Europe Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 27: Eastern Europe Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 28: Eastern Europe Rotomolded Containers Market Value Share Analysis by Country 2022(E)

Figure 29: APEJ Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 30: APEJ Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 31: APEJ Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 32: APEJ Rotomolded Containers Market Value Share Analysis by Country 2022(E)

Figure 33: Japan Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 34: Japan Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 35: Japan Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 36: MEA Rotomolded Containers Market Share Analysis by Material, 2022E & 2027F

Figure 37: MEA Rotomolded Containers Market Share Analysis by Product 2022(E)

Figure 38: MEA Rotomolded Containers Market Attractiveness Analysis by End Use Industry, 2022E-2027F

Figure 39: MEA Rotomolded Containers Market Value Share Analysis by Country 2022(E)

Figure 40: U.S. Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 41: U.S. Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 42: U.S. Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 43: Canada Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 44: Canada Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 45: Canada Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 46: Brazil Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 47: Brazil Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 48: Brazil Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 49: Mexico Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 50: Mexico Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 51: Mexico Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 52: Germany Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 53: Germany Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 54: Germany Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 55: Spain Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 56: Spain Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 57: Spain Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 58: Italy Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 59: Italy Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 60: Italy Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 61: France Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 62: France Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 63: France Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 64: UK Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 65: UK Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 66: UK Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 67: Russia Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 68: Russia Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 69: Russia Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022E)

Figure 70: China Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 71: China Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 72: China Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 73: India Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 74: India Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 75: India Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 76: Australia & New Zealand Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 77: Australia & New Zealand Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 78: Australia & New Zealand Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 79: GCC Countries Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 80: GCC Countries Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 81: GCC Countries Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)

Figure 82: South Africa Rotomolded Containers Market Value Share Analysis, by Material, 2022(E) & 2027(F)

Figure 83: South Africa Rotomolded Containers Market Value Share Analysis, by Product, 2022(E)

Figure 84: South Africa Rotomolded Containers Market Value Share Analysis, by End Use Industry, 2022(E)