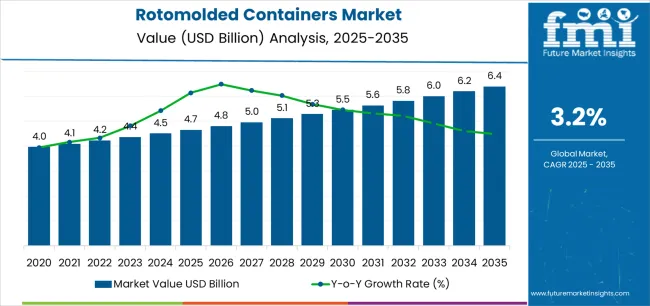

The Rotomolded Containers Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The Rotomolded Containers market is experiencing steady growth driven by the increasing demand for durable, lightweight, and cost-effective storage and transport solutions across various industries. The market outlook is supported by the expanding applications of rotomolded containers in sectors such as consumer electronics, logistics, and industrial storage. Rising awareness regarding safe and efficient handling of products is fueling investments in high-quality containers that offer resistance to impact, weather, and chemical exposure.

Advancements in manufacturing technologies have enabled the production of containers with enhanced durability and customization options, allowing businesses to meet specific storage and transportation needs. Additionally, the growing preference for sustainable and recyclable materials is shaping the future of this market.

Increasing e-commerce activity and the expansion of supply chains in emerging economies are also contributing to higher demand for rotomolded containers As industries prioritize operational efficiency, product safety, and cost optimization, the market is expected to witness continued growth in both developed and developing regions.

| Metric | Value |

|---|---|

| Rotomolded Containers Market Estimated Value in (2025 E) | USD 4.7 billion |

| Rotomolded Containers Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

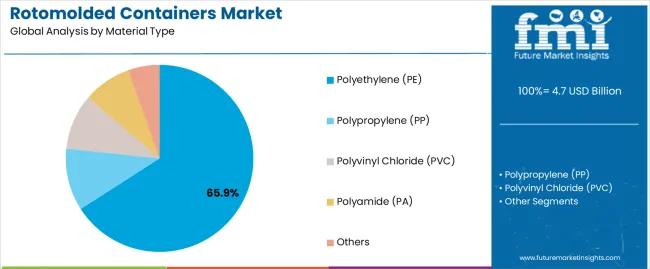

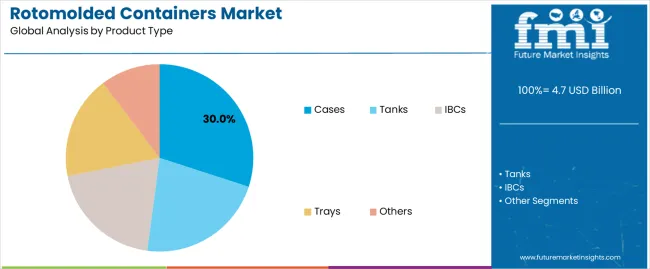

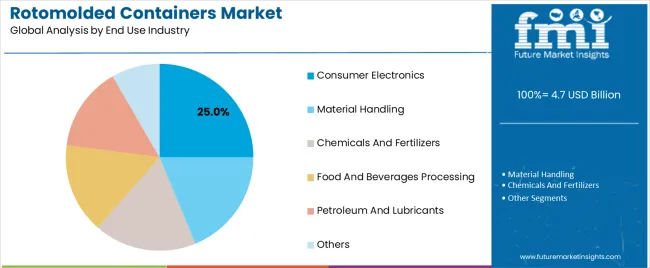

The market is segmented by Material Type, Product Type, and End Use Industry and region. By Material Type, the market is divided into Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyamide (PA), and Others. In terms of Product Type, the market is classified into Cases, Tanks, IBCs, Trays, and Others. Based on End Use Industry, the market is segmented into Consumer Electronics, Material Handling, Chemicals And Fertilizers, Food And Beverages Processing, Petroleum And Lubricants, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polyethylene (PE) material type segment is projected to hold 65.9% of the Rotomolded Containers market revenue share in 2025, making it the leading material type. This dominance is attributed to the versatility, chemical resistance, and durability of polyethylene, which ensures long-term performance in storage and transport applications.

PE containers provide lightweight solutions without compromising strength, facilitating easier handling and reducing transportation costs. The adaptability of polyethylene for molding into various shapes and sizes has also contributed to its widespread adoption.

Additionally, the material supports sustainable practices, as PE containers are recyclable and can be reused across multiple cycles, appealing to environmentally conscious industries The robust performance of polyethylene in diverse operational conditions has reinforced its preference across sectors, supporting the segment’s leading market position and encouraging further investment in PE-based rotomolded containers.

The Cases product type segment is expected to capture 30.0% of the Rotomolded Containers market revenue share in 2025, establishing it as a key product type. Growth in this segment has been driven by the increasing need for protective and modular storage solutions that ensure the safe transport of sensitive equipment.

Cases offer advantages such as stackability, ease of handling, and compatibility with specialized inserts, making them suitable for a wide range of applications. The segment has benefited from advances in rotomolding technology that allow for precise manufacturing tolerances and customization options.

Industries requiring secure and organized storage for products and components have further contributed to the adoption of cases The combination of durability, flexibility, and cost-effectiveness has solidified the segment’s leading position in the market, with continued potential for growth as industries focus on safe and efficient product handling.

The consumer electronics end-use industry segment is anticipated to account for 25.0% of the Rotomolded Containers market revenue in 2025, making it the leading industry segment. Growth in this segment has been fueled by the increasing need for secure storage and transportation of high-value and fragile electronic products.

Rotomolded containers offer protective solutions that reduce the risk of damage during shipping and handling, ensuring product integrity. The adoption of customizable inserts and shock-resistant designs has further enhanced the suitability of these containers for the electronics sector.

Additionally, the rapid expansion of e-commerce and global supply chains has amplified the demand for reliable and standardized packaging solutions Industries focused on operational efficiency, product safety, and customer satisfaction are increasingly relying on rotomolded containers, driving continued growth and reinforcing the segment’s dominant share in the market.

The table provided below presents the poised CAGR for Global rotomolded containers market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 3.1%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 3.1% (2025 to 2035) |

| H2 | 3.9% (2025 to 2035) |

| H1 | 3.0% (2025 to 2035) |

| H2 | 4.1% (2025 to 2035) |

Moving in the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.0% and expected to increase at 4.1% in the second half. In the first half (H1), the market witness a decline of 10 BPS while in the second half (H2) the market expected to witness an increase of 20 BPS

Superior Performance as Compared to Blow Molded Containers Drives the Market Adoption

Rotational molded containers tend to be far superior to their blow molded counterparts. Rotational molding has witnessed significant pace in terms of evolution in the past couple of decades. The key driver for the growth in preference for rotational molding is low cost.

Compared to blow molded containers, the production of rotomolded containers is more cost effective. Use of the blow molding process for manufacturing containers required high cost due to the requirement of different chemicals. Therefore, many manufacturers have made the switch from blow molding process as the preferred mode of production, to rotational molding.

Furthermore, rotational molding enables the production of several parts as a single piece. In contrast, blow molding produces rather weak structures in its molds. Due to high demand for sturdy and safe containers, rotational molding is employed as the preferred method, since it makes use of heat, instead of pressure, unlike blow molding process.

Therefore, the demand for rotomolded containers is anticipated to be driven mainly by growth in preference for rotational molding.

Demand for Production Methods Allowing Customization

Rotomolding is poised to witness growth in preference as the effective manufacturing process for containers, due to multiple reasons. As opposed to processes such as injection molding, in case of rotomolding, the material is not injected or forced to form a particular shape. This generates opportunities for the manufacture of containers in a diverse of styles, shapes and sizes.

Also, they allows a diverse range of sizes, with accurate and precise surface detail, together with the implementation of different colors at multiple stages of the process. This resulted to high aesthetics and the possibility to include the company’s logo on the surface of the container, without the risk of peeling off.

Consumer engagement as well as brand advertising are key factors to the success of a company, and therefore, the ability to be able to achieve that with rotomolded containers is anticipated to play a pivotal role in increasing preference for rotomolded containers, during the forecast period.

High Demand from the Food Industry to Fuel Growth of the Market

The sales of rotomolded containers are expected to acquire considerable growth due to the growing need for effective storage and transportation solutions from the food and beverage sector. The food and beverage industry needs durable and sturdy containers. The food and beverage industry is adopting these containers for diverse products such as creams, sauces, syrups, eggs and other related products.

The rotomolded containers have a good ability to prevent damage even in the harsh environment. This will ensure the manufacturers of food and beverage the safety of their products and help to increase the adoption.

Plastic materials like polyethylene and polyamides have good recyclable properties and chemical inertness. Using alternate metal-based containers has issues such as corrosion, weight and high cost of manufacture.

The plastic-based solution effective in this case has a positive impact on the market in the future and is expected to witness the same trend in the future. Manufacturers of rotomolded containers should increase the food and beverage adherence in their containers and adopt more effective solutions following regulatory frameworks.

High Competition from Advanced Technology Hamper the Market

Advanced technology such as 3-D printing has been witnessing rapid penetration for the purpose of manufacturing complex parts. Although 3-D printing was originally conceptualized to aid the product development process, it has found a wide array of applications, thereby posing a threat to the likes of rotational molding, injection molding, and blow molding processes.

3-D printing provides a quick turnaround time, with negligible to no tooling investment. The pace at which it has grown in the past few years, promises a tough competition to rotational molding.

The global market of rotomolded containers has recorded a CAGR of 2.0% during the historical period ie, 2020 to 2025. The market recorded a value of USD 4.0 billion in 2020 and has positively reached USD 4.7 billion in 2025.

Rotomolded containers are plastic containers with a hollow inside. These containers are manufactured by the rotational molding process which is commonly used for the production of bulk containers including tanks. Rotomolded containers are known for their superior quality and their efficiency in the transportation and storage of goods.

These containers have sturdy structures and are flexible to mold to diverse shapes and sizes during the manufacturing process. Recently, diverse industries have started to adopt these containers due surge in demand driven by increased production and consumption in the end-user industries.

Polyethylene-based rotomolded containers are expected to lead the market and are anticipated to grow at a CAGR of 3.9% during the forecast period. This is because the strength, recyclability and good flexibility and sturdiness of polyethylene make them a prominent choice in the manufacturers of rotomolded containers.

Also, polythene can be molded in diverse shapes and sizes during the manufacturing process further increasing the adoption. Considering product type, rotomolded IBCs are a prominent choice in the end-user industries. It is expected that the same is expected to grow at a CAGR of 4.8% during the forecast period.

IBCs due to their convenience to store and transport bulk products anticipated to be the main reason for the increased adoption. In the forecasted period, it is expected that major end users industry increase their production capacity due to the rise in population. Manufacturers of rotomolded containers should adopt industry-adhered rotomolded IBCs to acquire market growth.

Considering geography, North America is anticipated to lead the market in terms of value share. Western Europe is expected to be the second most factored region in the market. Considering the growth rate, Asia Pacific is anticipated to lead the market. Asia Pacific region is expected to be the most attractive region considering market expansion and industrial advancement.

Countries such as India, China and ASEAN are projected to witness heightened growth in the current market scenario and are expected to witness the same in the future.

North America due to the presence of a large industrial base and prominent leaders in the industry has LED to heightened sales and exports in the region while in Western Europe, the economic stability of Germany and EU countries drives the expansion of multiple end-user industries which propels the adoption.

Manufacturers can focus on this region and increase the efficiency of the manufacturing process to acquire consistency in the market.

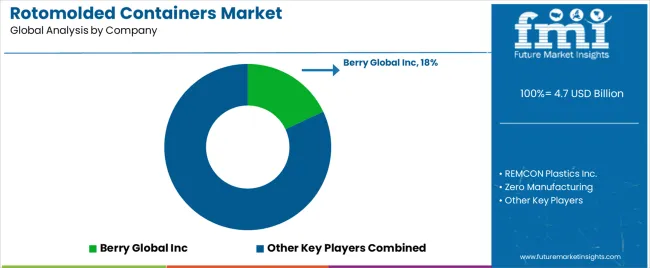

Tier 1 companies encompasses the market leaders with market revenue exceeding USD 80 million acquiring a cumulative market share of 15 to 20% of the global market. These market players are characterized by their high production capacity and strict focus on the development of innovative and efficient rotomolded containers.

Furthermore, these market leaders are known by their substantial competence in manufacturing across multiple rotomolded containers, wider distribution network across multiple regions and countries with a strong consumer presence.

These manufacturers continuously involved in the investment in development of novel rotomolded containers. Prominent companies within Tier 1 include Berry Global Inc, Pelican Products inc, Elkhart plastics, Synder industries, Dura-Cast Products inc. and others.

Tier 2 companies include mid-sized players with revenue of USD 30 to 80 million having a strong foothold in specific region and also have selected international presence. These manufacturers offer rotomolded containers for multiple end use but may not be used in specialized application. These players lack diversity in product portfolio.

Considering Tier 1 companies, Tier 2 companies will have lower global reach and lesser investment in the research and development for the development of novel products. Prominent players in Tier 2 includes Zero Manufacturing inc, Remcon Plastic Incorporated, Rotational Modling Inc, and others.

Tier 3 includes the small-scale companies or startups operating at the local presence and serving niche markets having revenue below USD 30 million. These manufacturers mainly focused on fulfilling local market demands and hence are characterized by Tier 3 companies.

They are small scale players and have limited geographical reach. Tier 3, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The contents below cover the industry analysis for the rotomolded containers market for multiple countries. Market demand analysis on key countries in multiple regions of the globe including North America, Latin America, East Asia, Western Europe and others are provided.

The United States is anticipated to be the leader in the North American rotomolded containers industry and expected to grow with a CAGR of 2.4% during the forecast period. In Europe, Germany anticipated to lead the market in terms of market share expected to grow with a CAGR of 1.8% during the forecast period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.4% |

| Germany | 1.8% |

| China | 5.1% |

| UK | 2.1% |

| India | 5.6% |

| Japan | 2.6% |

| GCC Countries | 4.4% |

| Brazil | 3.0% |

The rotomolded containers market in India expected to generate USD 4.7 million growth opportunity during the forecast period. The country is expected to capture 40% of the South Asian market in 2025.

Indian Ministry of Food Processing Industries stated that the food processing industry in India is expected to grow at a CAGR of 7.3% during the forecast period. It is expected that the market will experience considerable growth in the forecasted period due to several factors. Growing middle-class income in the country propels the heightened consumption of food and beverage items.

This will increase the high production need in the industry which propels the adoption of rotomolded containers as they offer efficacy in the storage of bulk products. Manufacturers can adopt effective rotomolded containers adhering to the requirements of the regulatory framework of the industry. By adopting novel technology standards, manufacturers can specifically focus on innovation and advancement in the industrial standards.

The China market for rotomolded containers expected to generate an incremental opportunity of USD 250.2 by the end of 2035 of the East Asia market. It is one of the attractive market for rotomolded containers.

The European Chemical Industry Council stated that the sales of chemicals in China have reached 2.4 trillion in 2025. The Country is expected to be the leading country considering adoption and growth. The chemical industry needs effective storage and transportation solutions. Certain chemicals are vulnerable to various environmental hazards such as air, moisture and other factors.

An effective storage solution that prevents these hazards from contact with the products. Also, the storage should be chemically inert with the environment. Rotomolded containers due to their superior quality and stability have LED to improved strength and quality. Manufacturers of rotomolded containers should adopt more effective solutions to adhere to the industrial standards.

USA market for rotomolded containers expected to generate an incremental opportunity of USD 636.7 million at the end of the forecast period and expected to grow at a CAGR of 2.4%. USA’s heightened advancement in the shipping and logistics industry expected to propels the adoption of novel rotomolded containers in the country.

International Trade Administration, USA Department of Commerce, stated that the USA is leading in the shipping and logistics industry across the world. The country has generated more than 8% of its GDP from this sector. The trend is because the country’s leading economic and political advancement drives improved trade and logistics.

This has resulted in the advancement in the transportation and logistics across the country. The trend has resulted in the need for effective transportation and storage of goods. Rotomolded containers due to their effectiveness in the transportation and storage of goods have resulted the heightened adoption and are expected witnessed in the country in the future as well.

The section contains information about the leading segment in the rotomolded containers market. Polyethylene based rotomolded containers expected to grow 3.9% during the forecast period. Rotomolded IBCs expected to grow at a rate of 4.8%.

| Material Type | Polyethylene (PE) |

|---|---|

| Value Share (2035) | 65.9% |

Polyethylene based rotomolded containers expected to dominate the market of rotomolded containers. The same expected to grow with a CAGR of 3.9% during the forecasted period and expected to generate an incremental opportunity of USD 6.4 billion by the end on the 2035.

Polyethylene-based rotomolded containers are expected to dominate the market driven by their cost efficacy, versatility and strength. Polyethylene-based containers are highly recyclable and hence ensure adherence with the growing regulatory framework. Leading end-user industries such as food, beverage and chemical industries need chemically resistant and safer solutions to storage and transport bulk products.

Polyethylene-based solutions are prominent solutions for these requirements and hence increase the widespread adoption. Manufacturers can offer advancement in material innovation and offer sustainable and customizable solutions to increase adoption.

Polyamide based rotomolded containers experiencing attractive growth driven by its superior stability, sturdiness and efficiency in the packaging of bulk products such as chemical and complex industrial goods. The targeted segment is anticipated to grow with a CAGR of 4.6% during the forecast period.

| Product Type | IBCs |

|---|---|

| Value CAGR (2035) | 4.8% |

Rotomolded IBCs are expected to experience attractive growth during the forecasted period and are expected to be the leading segment in the product type category. This is because the rise in economic advancement and increased disposable income on the consumer side has LED to the increased consumption of products.

This trend has made the manufacturers in the end-user industry increase overall production which impacted the need for effective bulk containers positively. IBCs are a prominent choice for the storage and transportation of goods that need efficacy in the overall process. Manufacturers can adopt these products during the forecast period to improve the market growth.

Trays made by rotational molding are expected to offer considerable growth during the forecasted period. This is because the food and beverage industry across the globe experiencing attractive growth during the forecasted period driven by heightened consumption due to increased population.

This trend has LED to safer and effective storage mechanisms for perishable food items and rotomolded trays are becoming one of the prominent choices in the industry.

Key players of the rotomolded containers market are manufacturing and launching novel products in the market. They are collaborating with multiple end user firms to expand their geographical reach.

Key Developments in Rotomolded Containers Industry

In terms of material type, the industry is divided into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyamide (PA) and others.

In terms of product type, the industry is divided into cases, tanks, IBCs, trays and others.

In terms of end use industry, the industry is divided into consumer electronics, material handling, chemicals and fertilizers, food and beverages processing, petroleum and lubricants and others.

In terms of region, the industry is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific and MEA.

The global rotomolded containers market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the rotomolded containers market is projected to reach USD 6.4 billion by 2035.

The rotomolded containers market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in rotomolded containers market are polyethylene (pe), polypropylene (pp), polyvinyl chloride (pvc), polyamide (pa) and others.

In terms of product type, cases segment to command 30.0% share in the rotomolded containers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Rotomolded Containers Market Share

PS Containers Market Size and Share Forecast Outlook 2025 to 2035

PET Containers Market Growth, Demand and Forecast from 2025 to 2035

PUR containers packaging Market

Roll Containers Market Size and Share Forecast Outlook 2025 to 2035

HDPE Containers Market Insights & Growth Outlook 2025 to 2035

Market Share Breakdown of Roll Containers Manufacturers

Foam Containers Market

Soup Containers Market

Metal Containers Market Demand & Packaging Innovations 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Smart Containers Market

Spout Containers Market

Pocket Containers Market Size and Share Forecast Outlook 2025 to 2035

Tottle Containers Market Size and Share Forecast Outlook 2025 to 2035

Sample Containers Market

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Slotted Containers Market Insights – Growth & Demand 2025 to 2035

Medical Containers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA