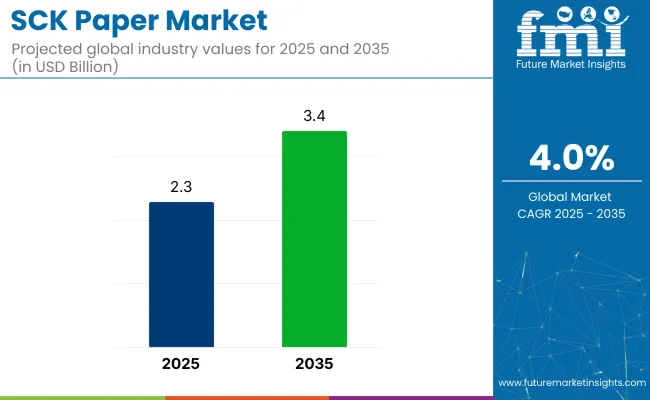

The global SCK (Super Calendered Kraft) paper market is likely to reach from USD 2.3 billion in 2025 to USD 3.4 billion by 2035, expanding at a 4.0% CAGR, driven by its superior smoothness, brightness, and strength for high-end printing and packaging applications.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 2.3 billion |

| Market Size (2035) | USD 3.4 billion |

| CAGR (2025 to 2035) | 4.0% |

Increasing demand for premium magazines, catalogs, and eco-friendly packaging alternatives is accelerating industry growth, as businesses prioritize recyclable and biodegradable materials over plastics. With its excellent printability and environmental benefits, SCK paper is becoming a preferred choice in publishing and e-commerce, aligning with global trends toward greener, high-performance paper solutions.

As of 2025, the super calendered kraft paper industry holds varying shares across its parent markets. It accounts for 18% of the Specialty Paper Market, 25% of the Label and Release Liner Market, and around 12% of the Flexible Packaging Paper Market. Within the Printing and Publishing Paper Market, it contributes about 7%, primarily for high-quality print applications.

In the broader Pulp and Paper Industry, its share is relatively niche at around 3%, given the dominance of commodity-grade paper types. SCK paper's strong performance in the label release liner segment, where it serves as a high-strength, printable substrate, drives its highest market penetration. Its specialized usage profile positions it as a critical, though smaller-volume, component across the specialty paper ecosystem.

In a 2024 interview with Paper and Packaging Digest, Mark Sutton, CEO of International Paper, stated, “SCK paper’s superior printability and strength make it indispensable for premium catalogs and magazines. As e-commerce packaging demand surges, we’re investing in SCK production to meet the need for high-performance, cost-effective solutions.” This underscores the company’s strategic focus on scaling SCK paper production to address rising demand in both print and packaging sectors.

With rising demand across publishing, packaging, and printing industries, the global SCK paper market is expected to continue its steady growth through 2035.

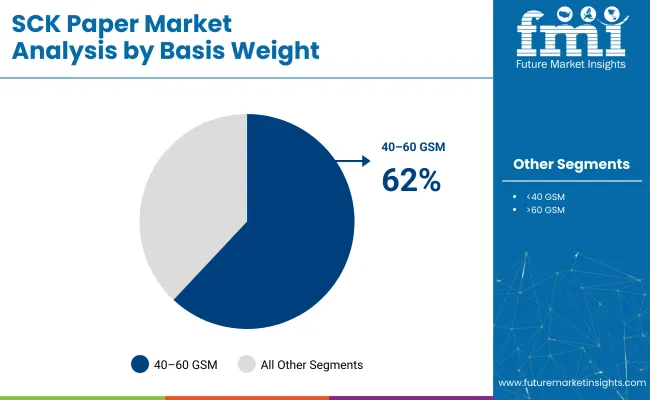

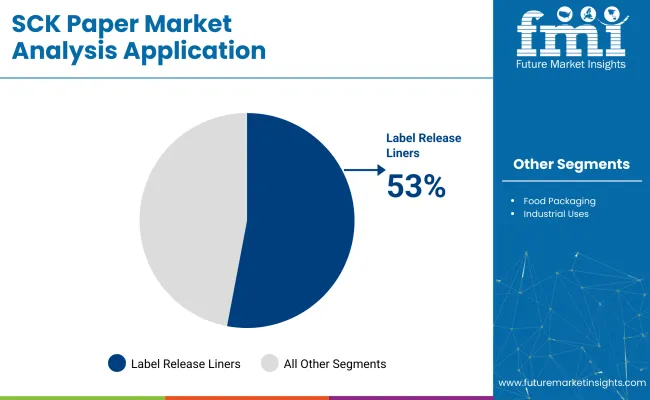

In 2025, the 40-60 GSM segment dominates the Super Calendered Kraft paper market with a 62% share due to its strength and printability. Glossy finishes hold 58%, boosting appeal in premium packaging. Label release liners account for 53% of applications, while the packaging sector consumes 48%, driven by green initiative and e-commerce growth.

The 40-60 GSM segment leads the Super Calendered Kraft paper industry, capturing a 62% share in 2025. This weight range offers a practical blend of strength and printability, favoring its use in magazines, catalog inserts, and industrial labels.

Glossy-finished SCK paper accounted for 58% of the industry in 2025. This finish type offers superior print definition and visual impact, increasing appeal in premium consumer packaging and advertising inserts.

Label release liners have captured 53% of total Super Calendered Kraft paper applications as of 2025. These liners are extensively used in pressure-sensitive adhesive systems due to their dimensional uniformity and stable caliper properties.

The packaging sector absorbs 48% of total SCK paper production by 2025. Its key applications include butter wrappers, confectionery wraps, interleaves, and electronics packaging.

Growing e-commerce and demand for high-performance labels drive SCK paper adoption. Its superior printability, durability, and cost-efficiency make it ideal for logistics, food, and luxury packaging. Key producers are expanding production to meet rising needs, while advancements in coating enhance moisture resistance and liner-release performance. The shift from plastic further accelerates market growth.

Recent Industry Trends

Challenges in the SCK Paper Market

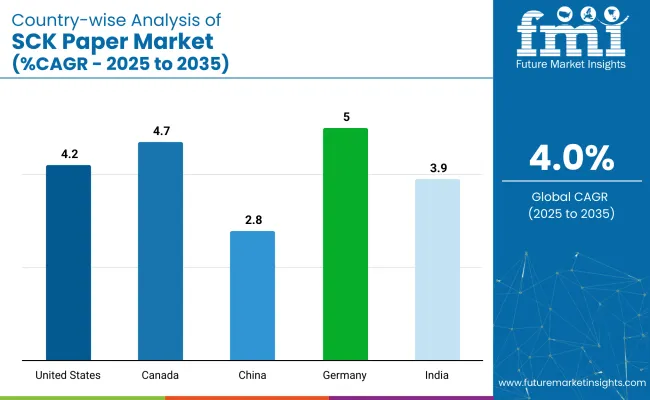

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Canada | 4.7% |

| Germany | 5.0% |

| China | 2.8% |

| India | 3.9% |

The SCK Paper Market is witnessing steady growth across both developed and emerging economies. Germany leads with a 5.0% CAGR, driven by demand in the packaging and paper industries, particularly within the European market. Canada follows with a 4.7% CAGR, supported by strong demand for paper products in packaging, especially in the consumer goods sector.

In the United States, growth is steady at 4.2% CAGR, fueled by increased use of super calendered kraft sheets in packaging and industrial applications. India shows a 3.9% CAGR, benefiting from a growing demand for packaging solutions in the expanding industrial and retail sectors. China has the slowest growth in the group at 2.8% CAGR, reflecting a more mature market and slower adoption of SCK products.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The United States super calendered kraft paper industry is forecast to grow at a 4.2% CAGR between 2025 and 2035. Growth is led by pharmaceutical packaging, logistics labeling, and retail distribution sectors that require durable, printable release liners. Federal and state policies support this trajectory.

Canada’s super calendered kraft paper industry is growing at a steady 4.7% CAGR through 2035, driven by demand in bilingual pharmaceutical labeling and temperature-resistant logistics applications. National policy and industry programs reinforce industry expansion.

Germany’s super calendared kraft paper market, expanding at 5.0% CAGR, leads Europe in growth. Industrial precision and regulatory discipline define its upward trajectory. Automotive, chemical, and logistics labeling segments fuel demand.

The super calendared kraft paper industry in China is projected to grow at 2.8% CAGR between 2025 and 2035. Controlled imports, rising domestic competition, and price pressures curb expansion. Regulatory frameworks are evolving but favor local substrates.

India’s super calendered kraft paper industry is expected to grow at a 3.9% CAGR, shaped by export-oriented pharma packaging reforms and rapid expansion in organized retail logistics. Regulatory mandates enhance the demand for reliable release liners.

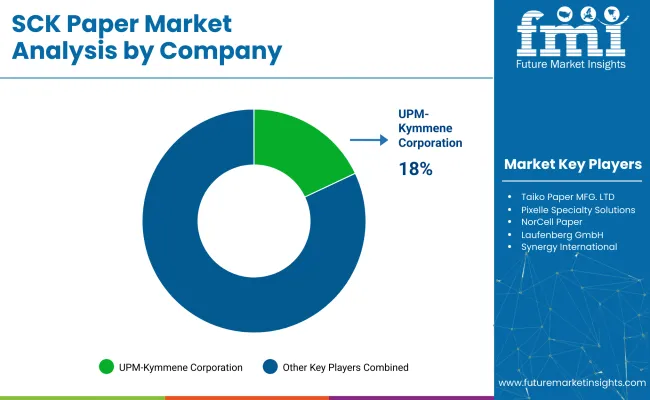

Leading suppliers such as UPM-Kymmene, Pixelle Specialty Solutions, and Kruger Specialty Papers dominate the super calendered kraft paper space through integrated production and long-standing relationships with pressure-sensitive label manufacturers. UPM expanded its SCK range in 2024 to cater to labelstock converters seeking lightweight liners. Pixelle introduced new grades for converters demanding caliper consistency in label release. Entry into this space remains difficult due to capital-intensive calendaring lines, strict quality certifications, and high raw material dependency.

Emerging players like Taiko Paper, Cotek Papers, NorCell, and Synergy International target niche markets with custom coatings and flexible order volumes. Taiko has invested in lightweight pulp alternatives, while Cotek upgraded to a wider machine suited for faster turnarounds. The market remains moderately consolidated at the top but features fragmentation across converters and regional suppliers.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.3 billion |

| Projected Market Size (2035) | USD 3.4 billion |

| CAGR (2025 to 2035) | 4.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Basis Weight Analyzed | <40 GSM, 40 - 60 GSM, >60 GSM |

| Finish Types Analyzed | Glossy, Matte, Semi-gloss |

| Applications Analyzed | Label Release Liners (Pressure Sensitive Labels, Industrial Labels), Food Packaging (Butter Wraps, Bakery Wraps, Deli Sheets), Industrial Uses (Silicon Coating Base, Barrier Applications) |

| End-Use Industries Analyzed | Packaging, Printing & Publishing, FMCG, Industrial Processing |

| Distribution Channels Analyzed | Paper Mills, Distributors, Label Converters |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Leading Players | Cheever Specialty Paper & Film, UPM- Kymmene Corporation, Taiko Paper MFG. LTD, Pixelle Specialty Solutions, NorCell Paper, Laufenberg GmbH, Synergy International, Kruger Specialty Papers, Cotek Papers, Verso |

| Additional Attributes | Dollar sales growth by application (labels, packaging), regional demand trends, competitive landscape, pricing strategies, material innovations, supply chain insights. |

<40 GSM, 40-60 GSM, >60 GSM

Glossy, Matte, Semi-gloss

Label Release Liners: Pressure Sensitive Labels, Industrial LabelsFood Packaging: Butter Wraps, Bakery Wraps, Deli SheetsIndustrial Uses: Silicon Coating Base, Barrier Applications

Packaging, Printing & Publishing, FMCG, Industrial Processing

Paper Mills, Distributors, Label Converters

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

The industry size is projected to be USD 2.3 billion in 2025 and USD 3.4 billion by 2035.

The expected CAGR is 4.0% from 2025 to 2035.

The 40-60 GSM segment dominates the industry with a 62% share in 2025.

UPM-Kymmene Corporation is the leading company with 18 % Industry share.

India is projected to grow at a CAGR of 3.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Paper Cup Lids Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Paper Paperboard Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Goods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA