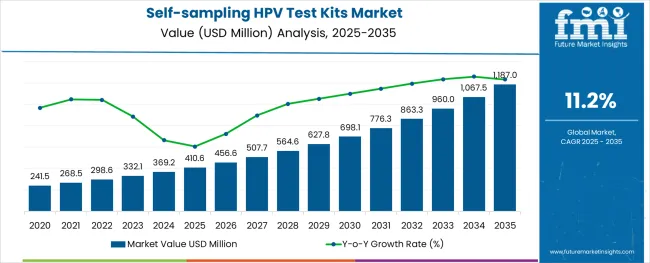

The self-sampling HPV test kits market is anticipated to rise from USD 410.6 million in 2025 to USD 1,187.0 million by 2035, growing at a robust CAGR of 11.2%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 410.6 million |

| Industry Value (2035F) | USD 1,187.0 million |

| CAGR (2025 to 2035) | 11.2% |

This sharp growth reflects a global shift toward early cervical cancer detection and greater emphasis on women’s preventive healthcare.

By 2025, nearly 28% of HPV testing in high-income countries is expected to be conducted via self-collection kits. Adoption is particularly strong in countries with national screening mandates, such as Australia and the UK, where pilot programs have demonstrated improved participation rates among under-screened populations. Digital health integration and mail-in testing models are further enabling access in rural and underserved regions.

Between 2026 and 2035, the market is poised for rapid expansion across Latin America, India, and Southeast Asia as public health programs shift toward scalable, decentralized screening strategies. The challenges such as cost reimbursement, cultural barriers, and test accuracy concerns in low-resource settings may restrict uptake. Continued WHO backing and evidence from implementation trials will be critical for broader adoption.

The self-sampling HPV test kits market is playing an increasingly important role across multiple healthcare sectors. In the global cervical cancer screening market, valued at over USD 10 billion, these kits make up 6-8% due to their convenience and patient-led sample collection.

Within the USD 20 billion at-home diagnostics industry, around 4-5% is contributed by self-collection HPV tests, reflecting rising consumer trust in remote health solutions. In women’s health diagnostics, a segment worth more than USD 30 billion, nearly 3-4% is attributed to these kits, driven by early detection efforts.

Personalized healthcare, currently valued at USD 150 billion, allocates 1-2% to self-screening tools. Even public health programs are directing 5-7% of HPV prevention efforts toward self-sampling initiatives for wider outreach.

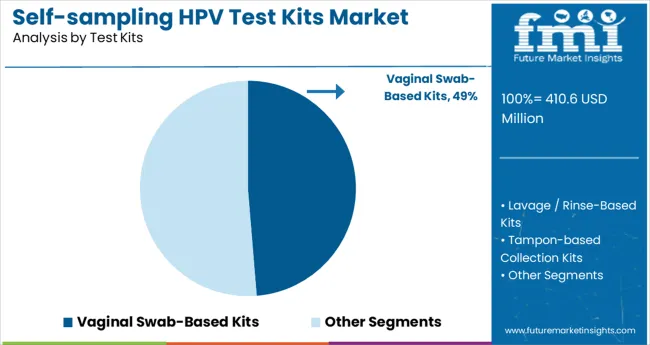

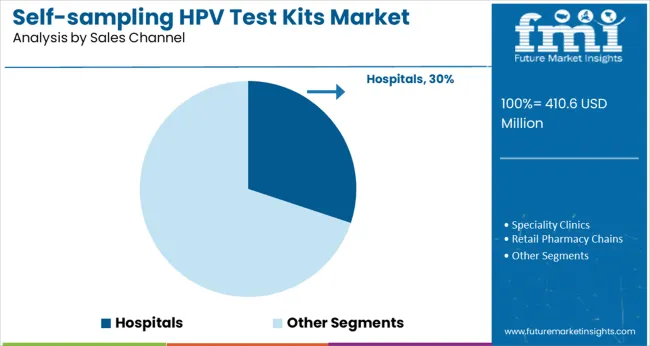

The self-sampling HPV test kits market is witnessing strong traction across vaginal swab-based kits, cervical cancer screening applications, and hospital distribution channels. Growth is supported by rising focus on early detection, patient convenience, and public health initiatives.

Vaginal swab-based kits are projected to capture 49% share of the market by 2025. Their ease of use, privacy benefits, and accuracy make them the preferred option for home-based HPV testing. Rising awareness around cervical health and early screening has pushed adoption across both developed and emerging nations.

Cervical cancer screening accounts for a dominant 88.0% of the application segment. Self-sampling kits play a critical role in increasing screening coverage, especially in underserved or rural populations. These kits help overcome social stigma and logistical challenges tied to traditional testing.

Hospitals account for 30% of the sales channel in 2025, driven by integrated diagnostics and physician recommendation. Patients who visit hospitals for general checkups are more likely to purchase or receive test kits on-site.

The global market is gaining traction due to higher screening uptake among under-screened populations, growing telehealth integration, and validated clinical equivalence with clinician-collected samples. Demand is shifting toward mail-in kits with high DNA yield and compatibility with PCR platforms, accelerating early detection in decentralized healthcare systems.

Screening Uptake Expands Through Mail-Based Distribution

Self-sampling HPV kit distribution through national screening programs rose 46% YoY, especially in low-screening regions across North America and Europe. Return compliance reached 68% when prepaid mailers and SMS follow-ups were used. Programs deploying dry flocked swab kits saw a 33% improvement in DNA stability after 10 days in transit.

Labs reported 96% concordance with clinician-collected samples, enabling regulatory endorsement for population-level use. Urban centers using opt-in digital enrollment boosted participation among women aged 30-49 by 41%. These logistics-driven efficiencies have positioned mail-based HPV self-tests as core tools for eliminating screening disparities in underserved and hard-to-reach groups.

PCR-Compatible Kits Drive Lab Integration and Accuracy

Demand for PCR-compatible self-sampling HPV kits rose 38% in 2025 as reference labs standardized workflows for high-throughput genotyping. Kits using wet media preserved DNA integrity above 95% across a 7-day window, enabling batch processing without re-extraction. Automated liquid handlers processed up to 1,200 self-collected samples/day, reducing turnaround time by 27%.

Labs reported genotype detection sensitivity above 98% for HPV-16 and HPV-18 using validated self-collected specimens. Integration with e-referral platforms cut administrative load by 22% per case. These metrics are accelerating insurer and public health adoption of PCR-grade kits for longitudinal screening programs, especially in Asia-Pacific and Northern Europe.

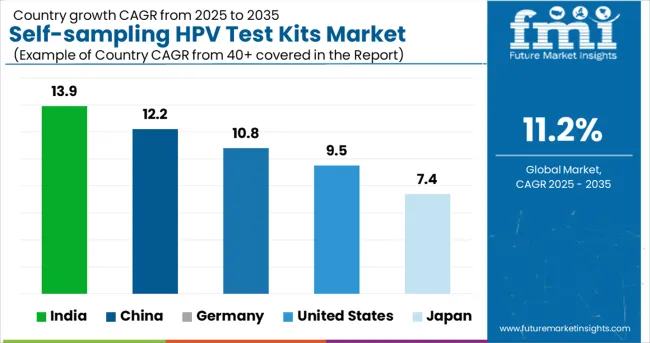

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 13.9% |

| China | 12.2% |

| Germany | 10.8% |

| United States | 9.5% |

| Japan | 7.4% |

The global market is anticipated to grow at a CAGR of 11.2% between 2025 and 2035. India, a key BRICS nation, leads the pack with a projected CAGR of 13.9%, fueled by rising public health campaigns and increasing accessibility in tier-2 and tier-3 cities. China follows with 12.2%, supported by domestic manufacturing and broad adoption across urban clinics.

Both outperform the global average, underscoring the momentum in emerging markets. Germany, part of the OECD bloc, posts a slightly below-average CAGR of 10.8% as adoption aligns with regulatory integration and structured national screening programs. The USA trails at 9.5%, affected by slower regulatory approvals and existing preferences for clinician-led testing.

Japan reports the lowest CAGR at 7.4%, reflecting demographic constraints and slower cultural uptake. This growth disparity highlights contrasting healthcare infrastructure readiness and consumer acceptance across developed and developing economies.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India is expected to witness strong growth at a CAGR of 13.9% through 2035. Between 2020 and 2024, awareness and availability of HPV testing remained low, primarily confined to metros and pilot public health programs. Over the next decade, government-led cervical cancer screening drives and mobile health outreach are scaling access in Tier 2 and rural zones. Local manufacturers are rapidly introducing low-cost kits tailored for regional languages and home delivery.

China is projected to grow at a CAGR of 12.2% from 2025 to 2035. From 2020 to 2024, uptake of self-sampling kits was modest, driven mainly by urban consumers in Shanghai and Beijing. Looking forward, policy emphasis on early detection, along with expanding e-commerce channels, is fostering adoption in suburban and peri-urban zones. Regulatory support is accelerating approval cycles for AI-integrated at-home testing platforms.

Germany is forecast to expand at a CAGR of 10.8% during the assessment period. Between 2020 and 2024, conventional physician-led screening dominated the HPV diagnostics landscape. The evolving consumer preferences, rising telemedicine consultations, and privacy-centric healthcare policies are catalyzing a shift toward self-sampling. Digital pharmacies and direct-to-consumer lab brands are also gaining traction.

The United States is estimated to grow at a CAGR of 9.5% from 2025 to 2035. During 2020 to 2024, adoption was primarily driven by COVID-era home testing trends and broader awareness of at-home diagnostics. Moving ahead, partnerships with women’s health platforms and integrations with employer health benefits are making self-testing more accessible. FDA-backed innovations and fast-track approvals are also supporting wider distribution.

Japan is projected to grow at a CAGR of 7.4% over the next decade. Between 2020 and 2024, cultural reservations and reliance on clinic-based gynecological visits limited market penetration. In contrast, 2025 to 2035 will benefit from changing generational attitudes, government-funded pilot projects, and integration of self-testing into workplace health programs.

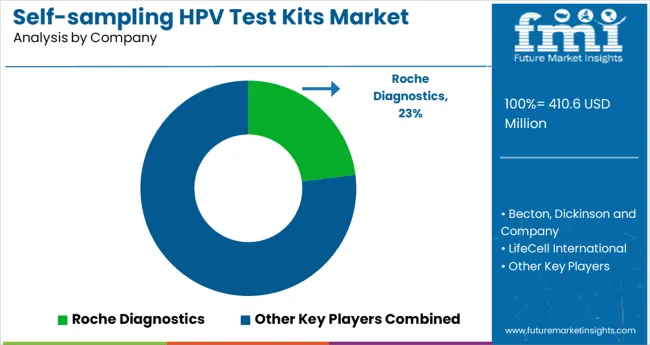

The self-sampling HPV test kits market is led by Roche Diagnostics, which maintains a significant presence with its Cobas self-collection system approved in multiple major markets. Roche is estimated to hold a 20-25% share of the global self-sampling segment, supported by its strong clinical validation and integration with established laboratory workflows.

Becton, Dickinson and Company follows with approximately 10-12% market share through its Onclarity HPV assay, which is FDA- and CE-approved for self-collected samples. Everlywell, though relatively smaller, has captured an estimated 2-4% share via DTC distribution and partnerships with CLIA-certified labs.

Companies like LifeCell International, Quest Diagnostics, and Teal Health are expanding reach in India, the USA, and emerging markets by offering tailored self-sampling kits and digital result platforms.

Recent Self-Sampling HPV Test Kits Market

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 410.6 million |

| Projected Market Size (2035) | USD 1,187.0 million |

| CAGR (2025 to 2035) | 11.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Test Kits Analyzed (Segment 1) | Vaginal Swab-Based Kits, Lavage/Rinse-Based Kits, Tampon-Based Collection Kits, Brush-Based Kits, POC Integrated Kits |

| Applications Analyzed (Segment 2) | Cervical Cancer Screening, Vaginal/Vulvar Screening Programs |

| Sales Channels Analyzed (Segment 3) | Hospitals, Specialty Clinics, Retail Pharmacy Chains, Direct-to-Consumer (DTC) Platforms, Online Sales Channels |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Becton, Dickinson and Company, Roche Diagnostics, LifeCell International, Trinity Medical Centre, Pragmatech Healthcare Solutions Pvt. Ltd., Daiichi Biotech Services Sdn Bhd., Everlywell, Ultrassay BioTech Co., Ltd, Winnergy Medical Public Company Limited, Teal Health, Inc, Quest Diagnostics, Medico Technology Co., Ltd., IOTA Diagnostic |

| Additional Attributes | Dollar sales by kit type and channel, rising adoption in cervical screening programs, growing popularity of home-based testing, and increased DTC distribution driving early detection initiatives. |

Segmented into vaginal swab-based kits, lavage/rinse-based kits, tampon-based collection kits, brush-based kits, and POC integrated kits.

Applied primarily in cervical cancer screening and vaginal/vulvar screening programs.

Distributed through hospitals, specialty clinics, retail pharmacy chains, direct-to-consumer (DTC) platforms, and online sales channels.

The market is expected to reach USD 1,187.0 million by 2035.

The market is valued at USD 410.6 million in 2025.

The market is set to grow at a CAGR of 11.2% during the forecast period.

Vaginal swab-based kits lead the segment with a 49% market share in 2025.

India is projected to grow at the highest CAGR of 13.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Audio Kits Market

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

Lavage Kits Market

Organoids Kits Market

Capacitor Kits Market

Connector Kits Market

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DIY Haircut Kits Market - Trends, Growth & Forecast 2025 to 2035

EMI, Filter Kits Market

Nephelometry Kits Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Chilled Meal Kits Market

1-Step RT-PCR Kits Market Size and Share Forecast Outlook 2025 to 2035

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Antibody Pair Kits Market

Skin Traction Kits Market

Grease Fitting Kits Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA