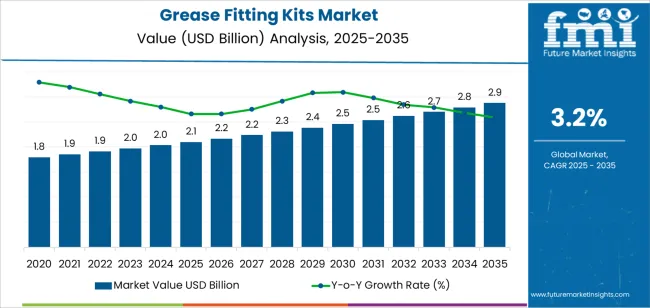

The global grease fitting kits market is projected to grow from USD 2.1 billion in 2025 to approximately USD 2.9 billion by 2035, recording an absolute increase of USD 780.89 million over the forecast period. This translates into a total growth of 37.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing industrial equipment maintenance requirements, growing adoption of preventive lubrication programs across manufacturing facilities, and rising demand for reliable fastening solutions in automotive and heavy machinery applications.

The market expansion reflects fundamental shifts in industrial maintenance practices, where systematic lubrication protocols replace reactive maintenance approaches. Modern grease fitting kits provide comprehensive solutions for diverse equipment types, enabling efficient lubricant delivery to critical bearing surfaces, joints, and moving components. These kits support standardized maintenance procedures across facilities while reducing equipment downtime and extending operational lifespans through consistent lubrication practices.

Product development continues to address industrial requirements for durability and compatibility across harsh operating environments. Manufacturers offer fitting kits in various angle configurations, thread sizes, and material specifications that accommodate different equipment designs and installation constraints. Corrosion-resistant coatings and precision manufacturing ensure reliable performance under extreme temperature, pressure, and contamination conditions common in industrial settings. Standardization efforts through industry organizations facilitate interchangeability and simplify inventory management for maintenance operations.

Regional dynamics demonstrate varied adoption patterns influenced by industrial base maturity, manufacturing activity levels, and maintenance practice sophistication. Developed markets show steady replacement demand and incremental upgrades, while emerging economies experience accelerated adoption as manufacturing capacity expands and maintenance culture evolves. Construction equipment proliferation, agricultural mechanization, and automotive aftermarket growth create sustained demand across different geographies with varying equipment density and maintenance infrastructure maturity.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.1 billion |

| Market Forecast Value (2035) | USD 2.9 billion |

| Forecast CAGR (2025-2035) | 3.2% |

| INDUSTRIAL MAINTENANCE DRIVERS | EQUIPMENT PROLIFERATION | QUALITY STANDARDS |

|---|---|---|

| Preventive Maintenance Adoption | Manufacturing Expansion | Performance Requirements |

| Industrial facilities implementing systematic lubrication programs reducing unplanned downtime and extending equipment service intervals. | Growing manufacturing capacity across emerging markets creating sustained demand for maintenance components and lubrication systems. | Industry standards establishing specifications for fitting performance, durability, and compatibility across equipment categories. |

| Equipment Complexity Growth | Construction Activity | Certification Programs |

| Advanced machinery incorporating increased bearing points and articulation requiring comprehensive lubrication fitting coverage. | Infrastructure development and construction equipment deployment driving demand for replacement and maintenance fitting components. | Quality certification requirements ensuring fitting reliability and performance consistency across industrial applications. |

| Operational Efficiency Focus | Agricultural Mechanization | Material Specification Standards |

| Cost reduction initiatives prioritizing equipment reliability and maintenance efficiency through proper lubrication component selection. | Farm equipment modernization and mechanized agriculture expansion requiring systematic maintenance including lubrication fitting replacement. | Material and coating specifications addressing corrosion resistance, pressure ratings, and environmental compatibility requirements. |

| Category | Segments Covered |

|---|---|

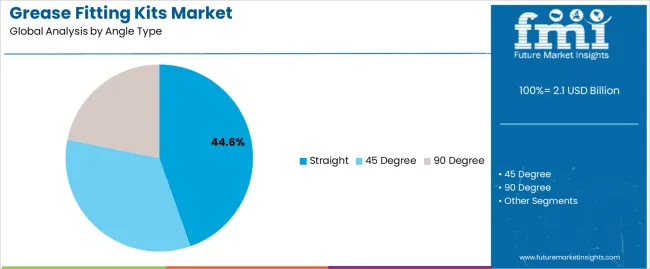

| By Angle Type | Straight, 45 Degree, 90 Degree |

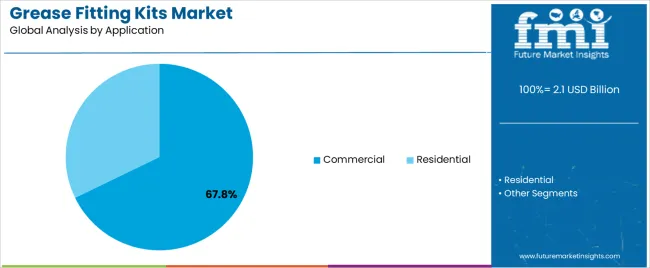

| By Application | Residential, Commercial |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Straight |

|

| 45 Degree |

|

| 90 Degree |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Commercial |

|

| Residential |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Industrial Equipment Growth | Sealed Component Competition | Corrosion-Resistant Coatings |

| Expanding manufacturing capacity and equipment installations creating sustained demand for lubrication fitting components across industrial facilities. | Increasing adoption of sealed bearings and pre-lubricated components reducing maintenance requirements and fitting replacement frequency. | Advanced coating technologies improving fitting durability and corrosion resistance in harsh operating environments and marine applications. |

| Preventive Maintenance Culture | Cost Optimization Pressure | Standardization Initiatives |

| Growing implementation of systematic maintenance programs emphasizing proper lubrication practices and regular fitting inspection and replacement. | Budget constraints and procurement optimization efforts driving price sensitivity and alternative sourcing strategies across maintenance operations. | Industry standardization efforts facilitating interchangeability and simplifying inventory management across multi-brand equipment fleets. |

| Construction Sector Expansion | Alternative Lubrication Methods | Material Innovation |

| Infrastructure development and construction activity growth driving heavy equipment deployment and corresponding maintenance component demand. | Emerging lubrication technologies including automatic systems and centralized delivery reducing manual fitting requirements in some applications. | Development of advanced materials and manufacturing processes improving fitting performance characteristics and extending service intervals. |

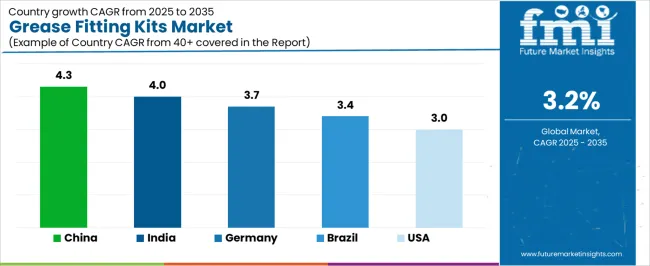

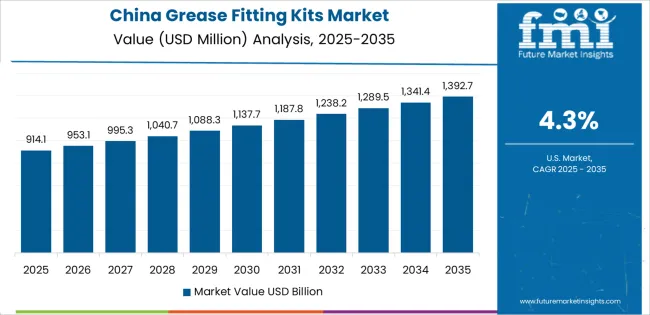

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| United States | 3.0% |

Revenue from grease fitting kits in China is projected to exhibit strong growth with substantial market value by 2035, driven by comprehensive manufacturing capacity expansion and industrial equipment proliferation creating sustained demand for maintenance components across diverse industrial sectors. The country's position as global manufacturing hub and ongoing industrial modernization programs are creating substantial opportunities for fastener and fitting suppliers. Major industrial zones in Guangdong, Jiangsu, Zhejiang, and inland manufacturing centers maintain extensive equipment fleets requiring systematic maintenance.

Manufacturing sector growth and equipment investment programs are supporting widespread adoption of preventive maintenance practices incorporating regular fitting replacement. Government initiatives promoting industrial quality improvement and equipment reliability are creating demand for higher-specification fitting components. Construction equipment market expansion and infrastructure development programs are driving heavy machinery maintenance requirements. Agricultural mechanization advancement and farm equipment modernization are creating opportunities for fitting kit suppliers serving rural and agricultural markets throughout provincial regions.

Revenue from grease fitting kits in India is expanding substantially by 2035, supported by manufacturing sector development and infrastructure investment programs creating sustained demand across metropolitan and emerging industrial centers. The country's Make in India initiatives and industrial corridor development are driving equipment installations requiring maintenance component supply chains. Major manufacturing regions including Maharashtra, Gujarat, Tamil Nadu, and Karnataka maintain growing industrial bases.

Construction sector expansion and infrastructure development programs are facilitating heavy equipment deployment requiring regular maintenance component replacement. Agricultural sector mechanization and farm equipment adoption are creating demand for fitting components in rural markets. Automotive aftermarket growth and commercial vehicle fleet expansion are supporting maintenance component consumption. Industrial cluster development and manufacturing capacity additions are enhancing requirements for reliable fitting supply throughout major industrial regions.

Demand for grease fitting kits in Germany is projected to reach substantial levels by 2035, supported by the country's advanced manufacturing sector and comprehensive industrial maintenance standards requiring high-quality fitting components. German industrial facilities maintain rigorous maintenance protocols with emphasis on equipment reliability and operational efficiency. The market is characterized by focus on product quality, precision manufacturing, and compliance with industrial standards.

Automotive manufacturing and machinery production sectors prioritize reliable lubrication components supporting preventive maintenance programs. Industrial equipment suppliers and maintenance service providers maintain comprehensive fitting inventories addressing diverse equipment specifications. Precision engineering standards and quality requirements favor premium fitting solutions demonstrating superior performance and durability. Export-oriented manufacturing operations and industrial service networks are creating sustained demand for fitting components throughout major industrial regions.

Revenue from grease fitting kits in Brazil is growing substantially by 2035, driven by industrial development and agricultural sector expansion creating opportunities for maintenance component suppliers. The country's manufacturing base development and mining sector operations are creating demand for fitting components. Major industrial centers in São Paulo, Minas Gerais, and Rio Grande do Sul maintain equipment fleets requiring regular maintenance.

Construction equipment market growth and infrastructure investment programs are facilitating heavy machinery deployment requiring fitting component replacement. Agricultural machinery market expansion and mechanized farming adoption are creating demand in rural regions. Industrial maintenance market development and aftermarket service network expansion are supporting fitting component distribution. Mining operations and heavy industrial facilities are creating opportunities for durable fitting solutions throughout resource extraction regions.

Demand for grease fitting kits in the United States is expanding to reach substantial levels by 2035, driven by extensive equipment installed base and mature aftermarket distribution networks creating sustained replacement demand. The country's diversified industrial sector and agricultural equipment market support consistent fitting component consumption. Manufacturing facilities, construction contractors, and agricultural operations maintain comprehensive maintenance programs.

Automotive aftermarket strength and commercial vehicle fleet maintenance requirements are driving fitting component demand through distribution channels. Industrial MRO market maturity and established supply chains support efficient component availability. Construction equipment rental market growth and fleet maintenance programs are creating systematic replacement demand. Agricultural equipment market sophistication and precision farming technology adoption are sustaining component requirements across rural and agricultural regions.

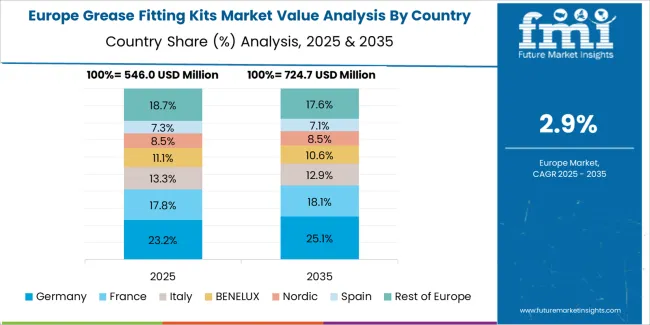

The grease fitting kits market in Europe is projected to grow from USD 541.28 million in 2025 to USD 739.54 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 33.7% market share in 2025, growing slightly to 34.1% by 2035, supported by advanced manufacturing infrastructure and comprehensive industrial maintenance culture across automotive, machinery, and heavy equipment sectors.

France follows with a 21.4% share in 2025, projected to reach 21.6% by 2035, driven by industrial modernization programs and construction equipment market development. The United Kingdom holds a 17.8% share in 2025, expected to maintain 17.6% through 2035 reflecting steady industrial activity and maintenance component demand. Italy commands a 15.3% share in 2025, while Spain accounts for 11.8% in 2025, both maintaining stable positions through ongoing industrial operations and equipment maintenance requirements. The Rest of Europe region maintains approximately 10.0% share, attributed to manufacturing activity in Nordic countries and Eastern European industrial development supporting maintenance component consumption.

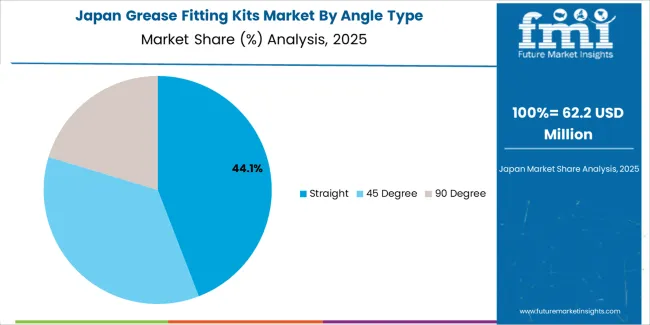

Japanese grease fitting kit operations reflect the country's precision manufacturing standards and comprehensive equipment maintenance culture. Industrial facilities maintain rigorous maintenance protocols emphasizing reliability and operational continuity. The regulatory environment and industry standards establish performance specifications for fitting components used across automotive, machinery, and industrial equipment applications.

Manufacturing facilities prioritize component quality and consistency, with procurement decisions emphasizing proven suppliers demonstrating reliable product performance. Major industrial distributors provide comprehensive inventory management and technical support services essential for maintenance operations. The Japanese market demonstrates preference for precision-manufactured fittings with superior corrosion resistance and dimensional accuracy. Industrial maintenance practices emphasize systematic lubrication schedules and proper fitting selection, creating demand for high-quality components supporting equipment reliability objectives across manufacturing and industrial facilities.

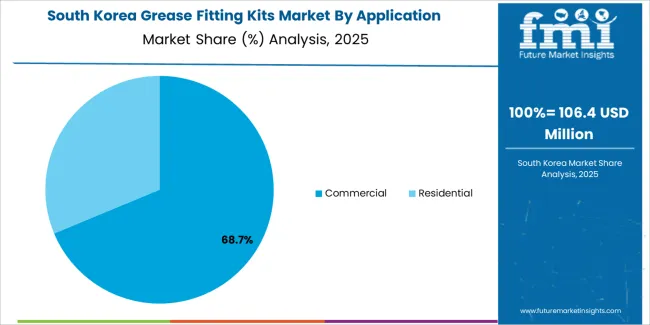

South Korean grease fitting kit operations reflect the country's advanced manufacturing sector and growing industrial maintenance sophistication. Major industrial complexes including automotive manufacturing, shipbuilding, and heavy machinery production maintain comprehensive maintenance programs. Industrial supply chains provide efficient distribution of maintenance components supporting equipment reliability requirements.

Manufacturing facilities prioritize component reliability and compatibility with diverse equipment specifications. Procurement strategies emphasize quality certification and supplier reliability for critical maintenance components. The market benefits from industrial development policies supporting manufacturing sector growth and equipment investment. Local manufacturers and international suppliers compete across segments, with market dynamics favoring products demonstrating consistent quality and availability supporting systematic maintenance programs in high-volume industrial environments.

Market structure reflects fragmentation across regional suppliers and global fastener manufacturers with diverse product portfolios. Value creation centers on manufacturing efficiency, distribution network coverage, and product range addressing varied application requirements. Leading suppliers maintain competitive positions through comprehensive catalogs offering multiple angle configurations, thread specifications, and material options that simplify procurement for maintenance operations managing diverse equipment fleets.

Profit pools concentrate in commercial segments where volume consumption and systematic replacement cycles generate predictable revenue streams. Specialty fittings for harsh environments or premium applications command higher margins, while standard configurations compete primarily on price and availability. Distribution partnerships and inventory management services create customer relationships extending beyond individual product transactions. Private label programs and OEM supply agreements provide stable volume commitments supporting manufacturing efficiency.

Competitive dynamics demonstrate emphasis on supply chain reliability and product availability as key differentiators beyond technical specifications. Suppliers invest in distribution network expansion and inventory positioning enabling rapid fulfillment of maintenance requirements. Technical support services and application guidance enhance customer relationships in complex industrial environments. Quality consistency and manufacturing precision create performance differentiation in applications where fitting failure impacts equipment availability and operational costs.

Market consolidation occurs through acquisitions targeting geographic expansion and product line complementarity. Global fastener manufacturers acquire regional fitting specialists to strengthen market coverage and customer relationships. Distribution partnerships provide market access in regions requiring local inventory and technical support capabilities. Vertical integration into raw material sourcing and coating operations supports cost competitiveness and quality control in high-volume manufacturing operations.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.1 billion |

| Angle Type | Straight, 45 Degree, 90 Degree |

| Application | Residential, Commercial |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

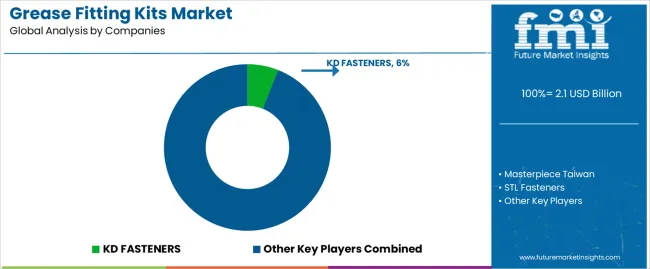

| Key Companies Profiled | KD FASTENERS, Masterpiece Taiwan, STL Fasteners, American Bolt & Screw, Fasteners Inc., Helix Steel Products Corporation, ASM, J.I. Morris, National Bolt & Nut Corporation, Fuji Fastener, Leland Industries, Asia Bolts Industries, Viraj, PCC Fasteners, Buckeye Fasteners Company, Schmeck Verbindungstechnik GmbH |

| Additional Attributes | Dollar sales by angle type and application, regional demand across North America, Europe, Asia Pacific, competitive landscape, corrosion-resistant coating advancement, standardization initiatives, and industrial maintenance culture driving fitting component quality improvement, inventory optimization, and equipment reliability enhancement |

The global grease fitting kits market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the grease fitting kits market is projected to reach USD 2.9 billion by 2035.

The grease fitting kits market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in grease fitting kits market are straight, 45 degree and 90 degree.

In terms of application, commercial segment to command 67.8% share in the grease fitting kits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Greaseproof Sheets Market Size and Share Forecast Outlook 2025 to 2035

Greaseproof paper sheets Market Size, Share & Forecast 2025 to 2035

Grease Analyzer Market Growth - Trends & Forecast 2025 to 2035

Grease Gun Market Growth – Trends & Forecast 2025 to 2035

Market Share Insights for Greaseproof Sheets Providers

Grease Pump Market

Grease Market

Marine Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Polyurea Greases Market

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Grease Market

Industrial Degreaser Market

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

Automotive Part Cleaners and Degreasers Market Size and Share Forecast Outlook 2025 to 2035

Gas Fittings & Components Market – Market Demand & Safety Insights 2025 to 2035

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size and Share Forecast Outlook 2025 to 2035

Virtual Fitting Room Market

Plumbing Fitting & Fixtures Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA