The Marine Grease Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. During the early adoption phase from 2020 to 2024, the market grew steadily from USD 1.6 billion to USD 1.9 billion, as marine operators increasingly recognized the benefits of advanced grease formulations, including enhanced corrosion resistance and temperature stability. Adoption was initially driven by commercial shipping and recreational boating sectors, with early innovators prioritizing high-performance products to extend maintenance cycles and comply with stricter environmental regulations. By 2025, market readiness for broader scaling was evident.

In the scaling phase from 2025 to 2030, the market accelerated, growing from USD 2.0 billion to USD 2.4 billion. Wider adoption across global marine fleets and improved supply chain penetration supported growth. From 2030 to 2035, the consolidation phase saw the market mature, reaching USD 2.9 billion. Leading players strengthened their presence through product innovation, cost optimization, and enhanced distribution networks, while smaller suppliers focused on niche applications. Overall, the market transitioned from early adoption to scaling and then consolidation, reflecting a stabilizing competitive landscape with steady, sustainable growth.

| Metric | Value |

|---|---|

| Marine Grease Market Estimated Value in (2025 E) | USD 2.0 billion |

| Marine Grease Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The marine grease market is experiencing consistent expansion as shipping, offshore operations, and naval applications increasingly prioritize high-performance lubrication solutions. As marine vessels operate under extreme pressure, salinity, and variable temperature conditions, the need for durable, water-resistant, and oxidation-stable grease has grown substantially. Global trade intensification and modernization of fleets have accelerated demand for marine-grade lubricants that offer extended service intervals and equipment longevity.

Moreover, the growing emphasis on environmental compliance, especially the use of environmentally acceptable lubricants (EALs), is pushing manufacturers to innovate and deliver synthetic, biodegradable, and non-toxic marine grease alternatives. Integration of advanced base oils and thickening agents is allowing for better load-bearing performance and superior resistance to washout.

Commercial shipping, fishing fleets, and naval defense operations are key adopters, as they require uninterrupted performance of critical components including winches, bearings, cranes, and steering gear The trend toward predictive maintenance and digital ship management is expected to further boost usage, as grease selection increasingly aligns with reliability-centered maintenance strategies across marine assets.

The marine grease market is segmented by type, application, end-use sector, performance characteristics, and geographic regions. By type, marine grease market is divided into Synthetic Marine Grease, Petroleum-Based Marine Grease, and Bio-Based Marine Grease. In terms of application, marine grease market is classified into Deck Equipment Lubrication, Hull Protection, Main Propulsion Systems, and Electrical Systems.

Based on end-use sector, marine grease market is segmented into Commercial Shipping, Oil and Gas, Recreational Marine, and Military and Defense. By performance characteristics, marine grease market is segmented into Water Resistance, Rust and Corrosion Protection, Extreme Temperature Resistance, and Shear Stability. Regionally, the marine grease industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Synthetic marine grease is projected to account for 44.6% of the total revenue share in the marine grease market in 2025, making it the most dominant type segment. Its leading position is being driven by the superior performance benefits it offers over conventional mineral-based grease, particularly in terms of thermal stability, load-carrying capacity, and resistance to water washout.

The ability of synthetic formulations to maintain consistency under high and low temperature extremes has made them ideal for marine environments, where machinery is frequently exposed to saltwater and varying operational loads. Synthetic grease is also compatible with longer relubrication intervals, which reduces downtime and enhances overall vessel efficiency.

Compliance with marine emission norms and environmental safety regulations has further encouraged the use of synthetic variants, particularly in ecologically sensitive shipping lanes. Enhanced oxidative stability, extended shelf life, and minimal residue formation are additional attributes that have positioned synthetic marine grease as the preferred choice for fleet operators focused on high performance and reduced maintenance costs.

Deck equipment lubrication is anticipated to represent 38.2% of the overall marine grease market revenue in 2025, indicating its strong contribution to application-based demand. This segment's prominence has been shaped by the critical operational role of deck components such as winches, cranes, hatch covers, and anchor handling systems, all of which require consistent and effective lubrication to avoid failure under heavy load and corrosive conditions.

Deck equipment is routinely exposed to moisture, salt spray, and dynamic mechanical stresses, making specialized grease essential for maintaining performance and preventing metal-to-metal contact. The trend toward automation and the use of hydraulic-driven deck systems in modern vessels has intensified the demand for grease that can withstand high-pressure environments and fluctuating speeds.

The shift toward centralized and remote lubrication systems has further reinforced the need for grease formulations that maintain consistency and adhesion under prolonged exposure. The use of grease tailored for deck applications also supports longer equipment life, operational safety, and reduced maintenance intervention, all of which align with the evolving requirements of modern maritime operations.

The commercial shipping segment is forecast to contribute 47.9% of the marine grease market’s revenue in 2025, establishing it as the largest end-use sector. This dominant share is attributed to the extensive use of marine grease across propulsion systems, auxiliary machinery, and deck equipment on cargo vessels, tankers, bulk carriers, and container ships. The emphasis on reliability, operational efficiency, and compliance with international maritime regulations has led commercial fleet operators to adopt premium-grade grease solutions that reduce mechanical failures and extend service intervals.

The increase in global seaborne trade volumes, driven by economic activity and expanding maritime routes, has directly influenced lubricant consumption patterns. In addition, evolving fuel-efficiency standards and emissions mandates have compelled vessel owners to optimize every mechanical process, including lubrication strategies.

With large vessels spending prolonged periods at sea, marine grease used in commercial fleets must endure long operating cycles under intense mechanical and environmental stress. The adoption of synthetic and semi-synthetic grease blends tailored to commercial marine applications is expected to sustain the segment’s leadership in the market.

The marine grease market is growing steadily due to increasing global shipping, offshore oil and gas operations, and recreational boating. Essential for protecting engines, propeller shafts, and deck machinery, marine greases prevent corrosion and wear under harsh conditions. Innovations in lithium, calcium sulfonate, and polyurea-based greases improve high-temperature performance and water resistance. Environmental regulations are driving adoption of biodegradable formulations. Asia-Pacific shows rapid growth due to expanding maritime trade. Manufacturers focus on high-performance, eco-friendly, and customized greases for specialized marine applications.

Marine equipment operates under extreme conditions, including saltwater exposure, high loads, and fluctuating temperatures. Marine grease must maintain viscosity, adhere to surfaces, and resist washout under these harsh conditions. Traditional greases may fail in high-speed propellers or deep-sea drilling machinery, requiring specialized additives such as extreme pressure (EP) agents, anti-wear compounds, and rust inhibitors. Manufacturers invest in research to enhance thermal stability, oxidation resistance, and water tolerance. Advances like polyurea and calcium sulfonate greases offer longer service life and reduced maintenance intervals, improving operational efficiency for shipping fleets and offshore rigs. Until universally high-performance formulations are widely adopted, marine operators face trade-offs between cost and reliability, making product innovation a key competitive differentiator in the market.

Environmental regulations are shaping marine grease formulations, particularly in coastal and protected marine areas. Authorities such as the International Maritime Organization (IMO) and regional environmental agencies restrict discharge of petroleum-based greases into waterways. Biodegradable and low-toxicity greases are increasingly required for environmentally sensitive operations, including ports, harbors, and inland waterways. Compliance demands investment in alternative base oils, additives, and certification processes. Companies that successfully produce eco-friendly marine greases gain access to restricted markets and strengthen their environmental credibility. While sustainable greases may be costlier, rising demand from shipping companies, cruise operators, and regulatory-mandated projects is accelerating adoption. Until fully biodegradable, high-performance solutions become standardized, the balance between environmental compliance, performance, and cost will remain a defining factor for market growth.

The growth of offshore oil and gas exploration, deep-sea mining, and global shipping directly boosts marine grease demand. Grease is essential for equipment reliability on offshore platforms, cranes, winches, and drilling machinery exposed to water and salt corrosion. Increasing global maritime trade and fleet expansion further drive consumption. Specialized marine greases designed for high-pressure, high-temperature, and submerged environments ensure longer equipment lifespan and reduced downtime. As offshore operations expand into harsher environments like deep-sea or Arctic waters, demand for advanced, long-lasting greases rises. Companies developing greases tailored to extreme operational conditions secure contracts with shipping operators, offshore companies, and defense agencies, reinforcing their market position. Until shipping and offshore industries stabilize post-global economic fluctuations, demand will continue to be influenced by operational expansion and equipment reliability requirements.

The marine grease market is competitive, with multinational lubricant manufacturers, regional suppliers, and specialty chemical producers vying for contracts. Differentiation relies on additive technology, biodegradability, corrosion protection, and high-temperature performance. Niche applications such as naval vessels, luxury yachts, and offshore rigs demand customized greases, allowing manufacturers to command premium pricing. Supply chain management is critical due to dependency on base oils, thickeners, and specialty additives, which may fluctuate in price and availability. Strategic partnerships with OEMs, fleet operators, and port authorities help secure long-term supply agreements. Companies focusing on R&D, product customization, and performance validation in real-world marine environments gain a competitive advantage. Until base oil availability, additive technology, and performance reliability converge, competition will remain intense, with innovation and tailored solutions driving market leadership.

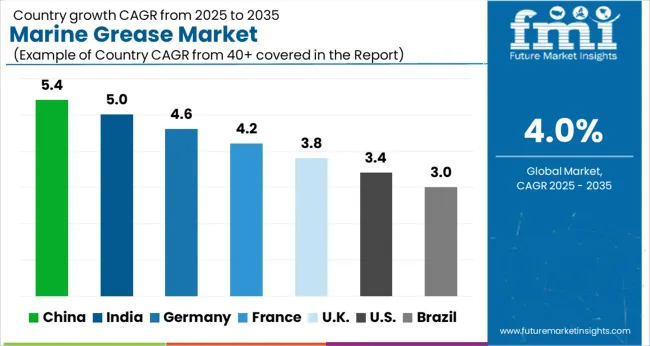

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global Marine Grease Market is projected to grow at a CAGR of 4.0% through 2035, supported by increasing demand across shipping, maritime, and industrial lubrication applications. Among BRICS nations, China has been recorded with 5.4% growth, driven by large-scale production and deployment in marine vessels and industrial machinery, while India has been observed at 5.0%, supported by rising utilization in shipping and maritime operations. In the OECD region, Germany has been measured at 4.6%, where production and adoption for marine and industrial lubrication have been steadily maintained. The United Kingdom has been noted at 3.8%, reflecting consistent use in shipping and marine operations, while the USA has been recorded at 3.4%, with production and utilization across maritime, shipping, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The marine grease market in China is expanding at a CAGR of 5.4%, driven by increasing shipbuilding activities, port infrastructure development, and rising maritime trade. Demand for high-performance marine greases is fueled by the need to protect ship engines, propulsion systems, and deck machinery from corrosion, wear, and extreme environmental conditions. Chinese manufacturers are investing in advanced formulations that offer water resistance, high-temperature stability, and long-lasting lubrication. Growth in commercial shipping, offshore oil and gas exploration, and fishing fleets supports consistent demand. Technological advancements in synthetic and biodegradable marine greases enhance performance and compliance with environmental regulations. Government initiatives to strengthen maritime infrastructure and improve vessel efficiency further stimulate market growth. China’s focus on modernizing port facilities and expanding its merchant fleet ensures steady adoption of marine grease products across the country.

The marine grease market in India is growing at a CAGR of 5.0%, supported by expanding commercial shipping, fishing fleets, and port modernization projects. Indian manufacturers focus on producing water-resistant and high-temperature stable greases to protect engines, bearings, and deck machinery in marine environments. Rising maritime trade and offshore oil and gas operations increase demand for reliable lubrication solutions. Government programs promoting maritime infrastructure development, shipbuilding modernization, and environmental compliance further support market expansion. Technological advancements in synthetic and biodegradable greases improve product efficiency while meeting international environmental standards. Adoption is particularly high in coastal regions with significant industrial and shipping activity. The combination of fleet expansion, regulatory support, and increasing awareness of preventive maintenance ensures steady growth of the marine grease market in India.

The marine grease market in Germany is growing at a CAGR of 4.6%, driven by stringent quality and environmental standards in maritime operations. German manufacturers focus on high-performance greases that provide wear protection, corrosion resistance, and thermal stability for ships, offshore platforms, and port machinery. Rising international shipping activities and offshore energy projects drive demand for reliable lubrication solutions. Technological developments in biodegradable and synthetic marine greases ensure compliance with European environmental regulations. Adoption is widespread in commercial shipping, defense vessels, and port handling equipment. Investments in advanced port infrastructure, fleet modernization, and industrial maintenance contribute to market expansion. Germany’s emphasis on sustainable maritime operations and industrial efficiency ensures continued steady growth of the marine grease market, particularly for high-quality and environmentally friendly formulations.

The marine grease market in the United Kingdom is expanding at a CAGR of 3.8%, driven by demand from commercial shipping, offshore oil and gas operations, and naval vessels. Greases with water resistance, thermal stability, and long-lasting lubrication are preferred to protect engines, bearings, and deck machinery. Government initiatives promoting maritime safety, port upgrades, and fleet modernization support market growth. Adoption of synthetic and eco-friendly greases aligns with environmental regulations and sustainability goals. Technological innovations improve performance under extreme marine conditions, ensuring reliable operation and reduced maintenance costs. Coastal industrial hubs and major shipping routes encourage consistent demand for high-quality marine greases. Increasing awareness of preventive maintenance and vessel efficiency further supports market expansion.

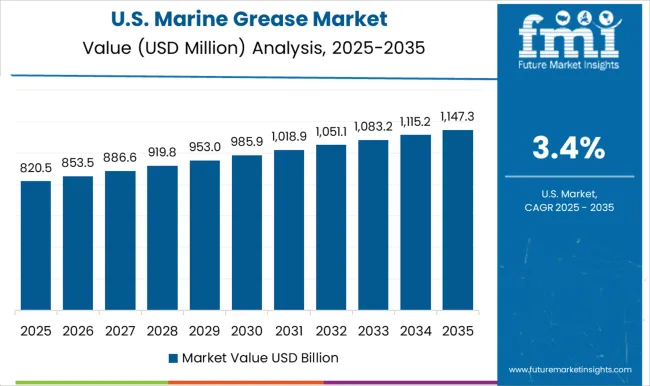

The marine grease market in the United States is growing at a CAGR of 3.4%, fueled by industrial shipping, offshore energy projects, and naval vessel operations. Demand for high-quality greases ensures protection of engines, propulsion systems, bearings, and deck equipment in challenging marine environments. USA manufacturers focus on synthetic and biodegradable greases that combine performance, durability, and environmental compliance. Growth in commercial ports, defense operations, and offshore oil and gas exploration drives consistent adoption. Technological advancements in high-temperature stability, water resistance, and extended lubrication cycles improve operational efficiency. Government programs supporting maritime infrastructure, fleet modernization, and environmental protection further enhance market growth. Coastal industrial activity and rising awareness of preventive maintenance contribute to steady expansion of the marine grease market in the United States.

The marine grease market is experiencing steady growth driven by the increasing need for high-performance lubricants in maritime vessels, offshore platforms, and port machinery. Marine greases are essential for reducing friction, preventing corrosion, and ensuring the longevity of mechanical components exposed to harsh saltwater and extreme weather conditions.

Key suppliers in this market include TotalEnergies, Shell, and ExxonMobil, recognized globally for their extensive lubricant portfolios and R&D capabilities in high-performance marine applications. Castrol and Chevron are also prominent players, offering a range of greases engineered for extreme pressures, high loads, and temperature stability. BP and FUCHS provide advanced formulations emphasizing environmental compliance and sustainability, addressing the growing regulatory focus on eco-friendly marine lubricants.

Specialized manufacturers like Nye Lubricants, SKF, and Molykote focus on high-precision and synthetic grease solutions for critical marine equipment, such as bearings, propulsion systems, and deck machinery. Chevron Oronite, Timken, SKF Lubricants, and Petroliam Nasional Berhad (Petronas) complement the market with additives, industrial-grade greases, and regional distribution strength.

Market growth is further supported by increasing global shipping activities, modernization of naval fleets, and stricter maintenance standards for offshore oil and gas operations. Innovation in long-lasting, corrosion-resistant, and biodegradable greases continues to drive adoption, with suppliers emphasizing performance, sustainability, and compliance with international maritime regulations.

The marine grease market is poised for continued expansion as manufacturers and maritime operators seek reliable, high-efficiency lubrication solutions to enhance equipment life, minimize downtime, and improve operational safety across commercial and defense applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Type | Synthetic Marine Grease, Petroleum-Based Marine Grease, and Bio-Based Marine Grease |

| Application | Deck Equipment Lubrication, Hull Protection, Main Propulsion Systems, and Electrical Systems |

| End-Use Sector | Commercial Shipping, Oil and Gas, Recreational Marine, and Military and Defense |

| Performance Characteristics | Water Resistance, Rust and Corrosion Protection, Extreme Temperature Resistance, and Shear Stability |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TotalEnergies, Shell, ExxonMobil, Castrol, Chevron, BP, FUCHS, NyeLubricants, SKF, Molykote, ChevronOronite, Timken, SKFLubricants, and PetroliamNasionalBerhad |

| Additional Attributes | Dollar sales vary by grease type, including lithium-based, calcium-based, polyurea, and synthetic marine greases; by application, such as propulsion systems, deck machinery, bearings, and steering systems; by end-use, spanning commercial shipping, recreational boating, and offshore oil & gas; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by increasing maritime activities, stringent maintenance standards, and demand for high-performance lubricants. |

The global marine grease market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the marine grease market is projected to reach USD 2.9 billion by 2035.

The marine grease market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in marine grease market are synthetic marine grease, petroleum-based marine grease and bio-based marine grease.

In terms of application, deck equipment lubrication segment to command 38.2% share in the marine grease market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine Winch Motors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA