The Plumbing Fittings & Fixtures Market demand will see significant development within the following ten years resulting from enhanced urbanization, expansion in infrastructure development, and raised water solution requirements efficiency. They constitute an imperative aspect of plumbing fixtures and appliances found in residences, businesses, and industries in that they present a means through which water will be conveyed effectively and safely.

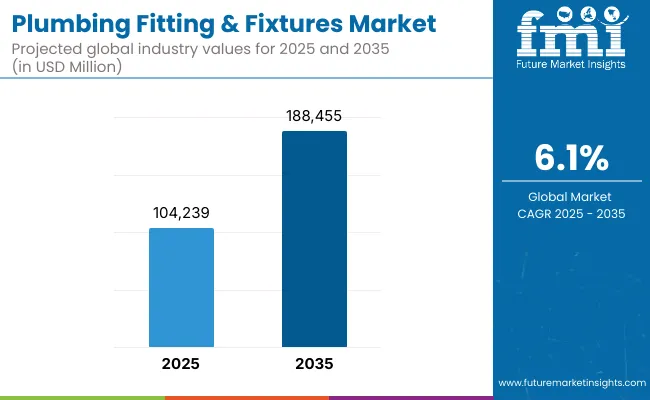

By 2025, there will be estimated growth in this demand to be around USD 104,239 million. It is expected to increase around USD 188,455 million by 2035 at a compound annual growth rate (CAGR) of 6.1% during the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 104,239 million |

| Projected Market Size in 2035 | USD 188,455 million |

| CAGR (2025 to 2035) | 6.1% |

Market growth is fueled by the increase in the adoption of smart plumbing technologies, renovation activities, and stringent regulations mandating water conservation. Design innovation and material innovation are also enhancing the performance and aesthetics of plumbing fixtures, further driving consumer demand.

North America is one of the prominent market share owners in the plumbing fittings and fixtures sector due to a strong construction industry and increased usage of intelligent home systems. Water conservation and the trend toward sustainable buildings propel demand for high-end plumbing solutions in the region.

Growth in the market of Europe is fuelled by stringent environmental regulations and tremendous concern for energy-efficient buildings. Green and high-tech plumbing products are being demanded more and more, particularly in Germany, France, and the United Kingdom.

Asia-Pacific will have the highest growth rate during the forecast period due to urbanization, infrastructure development, and increasing disposable incomes in India and China. Government initiatives toward smart cities and the rapidly growing construction sector are propelling the demand for advanced plumbing fittings and fixtures.

Environmental Regulations, Price Fluctuation in Raw Materials, and Unavailability of Quality Labor

The plumbing fixtures and fittings market is faced with the issues of stringent environmental regulations to conserve water and render the market sustainable. Raw material price volatility can potentially impact cost of production and profitability. Further, a lack of skilled labor in the plumbing trade has the ability to impede sophisticated plumbing system installation.

Technological Innovations, Smart Plumbing Solutions, and Emerging Markets

Technological advancements can make smart plumbing fixtures with improved water efficiency and user-friendliness. Incorporation of the Internet of Things (IoT) in plumbing allows real-time monitoring and maintenance to reduce water loss. The rapidly developing economies of Asia and Africa offer enormous opportunities for expansion through increasing urbanization and infrastructure growth.

During 2020 to 2024, the demand for plumbing fixtures and fittings increased steadily with increasing construction and an increased emphasis on water conservation. The time period saw a steady shift towards intelligent plumbing solutions and eco-friendly materials. Supply chain disruptions and fluctuations in raw material prices, however, influenced market dynamics.

Entering the following decade, i.e., 2025 to 2035, the market will undergo transformative changes. Technological innovations will witness the creation of new-generation plumbing fittings and fixtures with superior performance and environmental sustainability. Rapid expansion in developing economies will introduce fresh opportunities for expansion on the back of high-speed urbanization and infrastructure development. Growth in the use of smart cities and green building will also create demand for high-performance plumbing fittings and fixtures, propelling the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on water conservation codes and building safety standards. |

| Consumer Trends | Preference for affordable and durable plumbing solutions. |

| Industry Adoption | Integration in new housing developments and infrastructure projects. |

| Supply Chain and Sourcing | Reliance on regional suppliers for metal-based components. |

| Market Competition | Led by traditional manufacturers and wholesale distributors. |

| Market Growth Drivers | Driven by urbanization, renovation trends, and commercial real estate development. |

| Sustainability and Environmental Impact | Adoption of water-efficient fixtures and lead-free fittings. |

| Integration of Smart Technologies | Introduction of sensor faucets and dual-flush systems. |

| Advancements in Equipment Design | Development of minimalist, modular fixture designs. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Enforcement of green building certifications and smart water management regulations. |

| Consumer Trends | Rising demand for smart, touchless, and aesthetic fittings in urban households. |

| Industry Adoption | Widespread use in smart buildings, modular homes, and wellness-focused bathrooms. |

| Supply Chain and Sourcing | Shift toward composite and recyclable materials with localized and agile supply chains. |

| Market Competition | Entry of D2C brands and eco-conscious sanitaryware innovators. |

| Market Growth Drivers | Fueled by smart city initiatives, aging infrastructure upgrades, and health awareness. |

| Sustainability and Environmental Impact | Emphasis on net-zero plumbing solutions and greywater recycling systems. |

| Integration of Smart Technologies | Expansion of IoT-enabled leak detection, temperature control, and usage analytics. |

| Advancements in Equipment Design | Innovation in anti-bacterial surfaces, self-cleaning technologies, and ergonomic designs. |

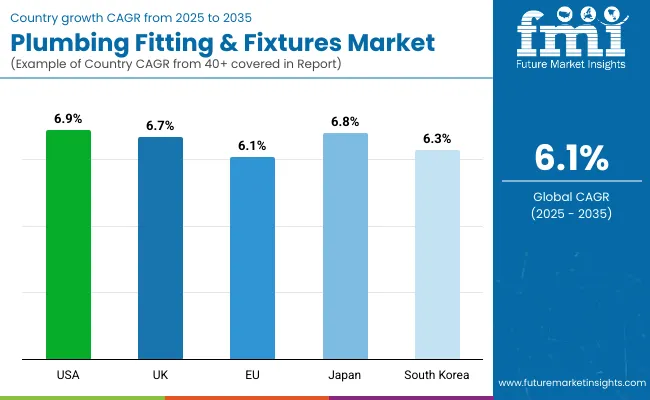

The USA market for plumbing fixtures and fittings is changing very rapidly due to the high demand for retrofitting owing to renovation and high adoption of smart home technology. WaterSense-certified showerheads, sensor faucets, and high-efficiency toilets are in demand among consumers. Plumbing retrofits of existing buildings and wellness-driven trends in home design are driving demand for technology-facilitated and ergonomic fixtures.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

Water conservation pressure and new infrastructure in the UK are driving plumbing fittings and fixtures growth. Urban flat compact solution trend and more use of thermostatic mixers and multi-functional showers are transforming demand. Low-flow plumbing products-friendly regulations and green housing support are complementing market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.7% |

Throughout the world, the plumbing fixtures market is being boosted by government policies supporting water-efficient domestic systems and environmentally certified buildings in the EU. Germany and the Netherlands are witnessing massive substitution of conventional systems with hygienic and sensor-controlled ones. EU's circular economy policy is causing the development of fixtures that are built from recyclable and low-impact materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.1% |

Japan's market thrives with technologically advanced, high-efficiency plumbing fixtures that are appropriate for residential spaces, fueled by technology, culture, and space needs. As its citizens live healthier lives with high-tech toilets, touch faucets, smart toilets, and antibacterial fittings increasingly in demand. Aging society and aging population place more demands on safe and accessible fittings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

South Korea is adopting high-tech, trendy plumbing fixtures as a significant component of its smart living movement. High technology and urbanization and technology-savvy population render sensor-based and water-efficient toilet and shower technologies more mainstream in broader terms. Bathroom fixture demand has also been fueled by popularity for K-design interiors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

| By Product Type | Market Share (2025) |

|---|---|

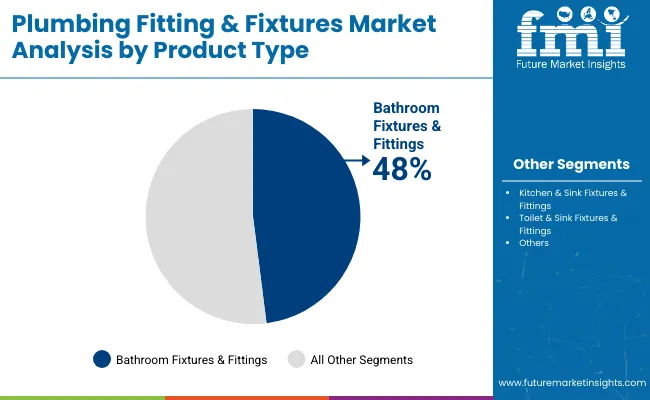

| Bathroom Fixtures & Fittings | 48% |

Plumbing fixtures & fittings will lead the market for plumbing fixtures & fittings, representing 48% of the overall market share in 2025. This is due to the fact that customers are increasingly worried about slim designs and water-saving technology in bathroom areas. For instance, businesses like Kohler and Grohe have developed intelligent showers, touch-free faucets, and dual-flush toilets so as to develop a good experience for the consumers and to green the devices.

The luxury renovation market in residential and hospitality segments also creates demand for luxury bathroom products. Real estate developers of luxury properties now include stylish bathrooms as an additional selling feature, creating more demand for designer sinks, chrome-plated faucets, and concealed cisterns.

| By Application | Market Share (2025) |

|---|---|

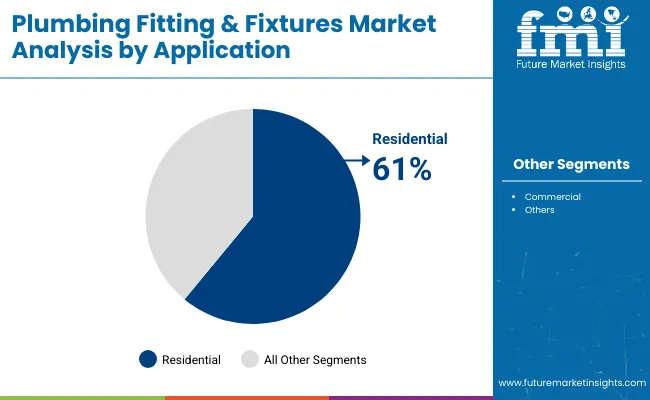

| Residential | 61% |

Residential is expected to hold 61% market share of plumbing fittings & fixtures by 2025. Urban expansion and rising disposable incomes across emerging economies have induced a housing construction boom and remodelling. The boom is particularly observed in metro cities, where space-efficient and sleek plumbing systems are popular among booming high-rise apartments.

Furthermore, homeowners in developed markets are spending money on home renovation projects, adding contemporary, low-flow fixtures to bathrooms and kitchens in order to cut utility bills. Companies like Delta Faucet and American Standard have expanded their product lines to accommodate DIY-conscious and eco-conscious homeowners, further boosting residential application segment growth.

Increased smart home compatibility, saving fittings, and module plumbing fittings are revolutionizing the plumbing fittings & fixtures industry. With buildings and homes looking for LEED certification and going green, the companies are making sensor-activated faucets, rapid connect fittings, and rust-proof components. Firms are also integrating IoT water system monitoring to avoid leaks and improve efficiency.

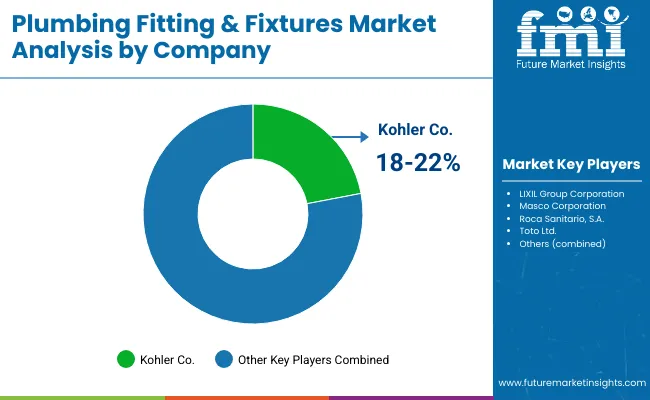

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kohler Co. | 18-22% |

| LIXIL Group Corporation | 16-20% |

| Masco Corporation | 12-16% |

| Roca Sanitario, S.A. | 8-12% |

| Toto Ltd. | 6-10% |

| Other Companies (combined) | 20-28% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kohler Co. | In 2024, launched touchless faucets with Wi-Fi enabled water flow analytics. In 2025, partnered with builders to offer embedded leak detection in fixtures for multi-family units. |

| LIXIL Group Corporation | In 2024, expanded its INAX product line with anti-bacterial surface coatings. In 2025, introduced quick-assembly shower systems for the Southeast Asian market. |

| Masco Corporation | In 2024, debuted water-saving Delta faucets with adaptive pressure sensors. In 2025, acquired a startup focused on AI-driven home water usage forecasting. |

| Roca Sanitario, S.A. | In 2024, launched ceramic cartridges with improved flow resistance. In 2025, opened a sustainability-focused design lab for fixture lifecycle testing. |

| Toto Ltd. | In 2024, rolled out “WASHLET+” bidet toilets with auto-deodorizing tech. In 2025, expanded smart toilet offerings with app-controlled temperature and pressure settings. |

Key Company Insights

Kohler Co. (18-22%)

Kohler leads through innovation in water-saving and digital plumbing solutions. Its integration of Wi-Fi in fixtures for usage tracking positions it well in smart home-focused markets.

LIXIL Group (16 to 20%)

LIXIL’s success comes from modular, hygiene-centric products that cater to both emerging and developed regions. Its quick-assembly designs meet fast urban construction needs.

Masco Corporation (12-16%)

Masco leverages tech to deliver smart, adaptive solutions like AI-enhanced faucets, targeting tech-forward consumers and green infrastructure developers.

Roca Sanitario (8-12%)

Roca emphasizes material science and durability, making it a strong player in institutional and high-traffic installations across Europe and Latin America.

Toto Ltd. (6-10%)

Toto’s innovation in bidet systems and personalized comfort fixtures has strengthened its brand across Asia and North America, especially in wellness-focused installations.

Other Key Players (20-28% Combined)

The overall market size for plumbing fitting & fixtures market was USD 104,239 million in 2025.

The plumbing fitting & fixtures market is expected to reach USD 188,455 million in 2035.

The increasing demand driven by urbanization, infrastructure development, and adoption of water-efficient fixtures fuels plumbing fitting & fixtures market during the forecast period.

The top 5 countries which drives the development of plumbing fitting & fixtures market are USA, China, India, Germany, and Japan.

On the basis of application, residential to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plumbing Drain Cleaning Service Market Size and Share Forecast Outlook 2025 to 2035

Plumbing Fixtures Market

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Low Flow Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Gas Fittings & Components Market – Market Demand & Safety Insights 2025 to 2035

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size and Share Forecast Outlook 2025 to 2035

Virtual Fitting Room Market

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Fittings Market Growth - Trends & Forecast 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Railway Track Fittings Market Growth - Trends & Forecast 2025 to 2035

Pharmaceutical Fittings Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Instrumentation Valve and Fitting Market Trends & Forecast for 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Compact Pneumatic Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Salt for Tires Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Based Laser Cladding Powder Market Size and Share Forecast Outlook 2025 to 2035

Cavity Drainage Membrane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA