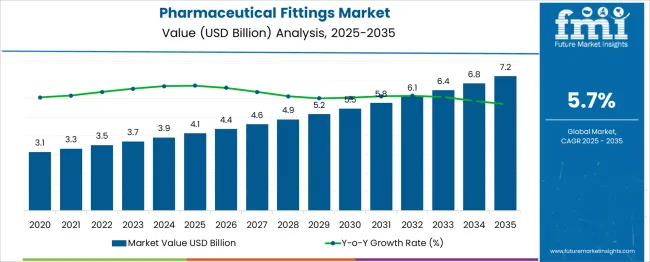

The Pharmaceutical Fittings Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. This growth is supported by a steady CAGR of 5.7%, driven by increasing demand for high-quality pharmaceutical production components and the growing pharmaceutical industry. In the first five-year phase (2025–2030), the market is expected to reach USD 5.3 billion, adding USD 1.2 billion, which accounts for 38.7% of the total incremental growth, as advancements in pharmaceutical manufacturing processes increase the need for precision fittings. The second phase (2030–2035) contributes USD 1.9 billion, representing 61.3% of incremental growth, as pharmaceutical production continues to grow globally and the need for compliant, durable, and high-performance fittings expands. Annual increments will increase from USD 0.2 billion in early years to USD 0.4 billion by 2035, reflecting the rising demand for pharmaceutical formulations, packaging, and sterilization equipment. Manufacturers focusing on precision, compliance with regulatory standards, and sustainable solutions will capture the largest share of this USD 3.1 billion opportunity.

| Metric | Value |

|---|---|

| Pharmaceutical Fittings Market Estimated Value in (2025 E) | USD 4.1 billion |

| Pharmaceutical Fittings Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The increasing stringency of regulatory standards across the pharmaceutical manufacturing landscape has contributed to the widespread adoption of high-quality fittings, particularly in sterile and cleanroom applications. As global pharmaceutical output scales up in response to rising chronic disease burdens and aging populations, investments in advanced manufacturing infrastructure have intensified.

Manufacturers are focusing on modular facility design and seamless fluid handling, where fittings play a critical role in maintaining operational integrity. Moreover, the trend toward continuous manufacturing and automation has further reinforced the need for reliable, corrosion-resistant, and validated fitting solutions.

Future growth is expected to be supported by innovations in aseptic processing, biotech drug production, and stricter global GMP compliance, all of which are placing fittings at the center of modern pharmaceutical systems. These structural shifts are projected to strengthen the long-term outlook for the market..

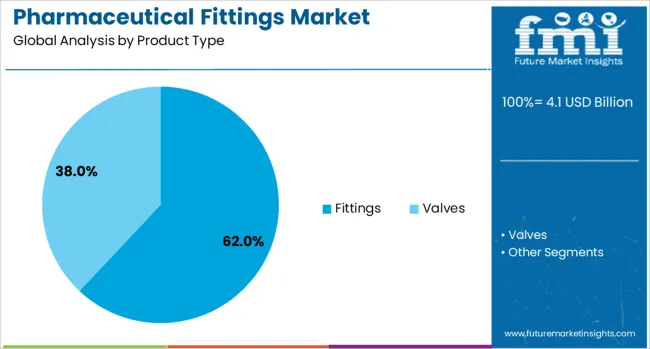

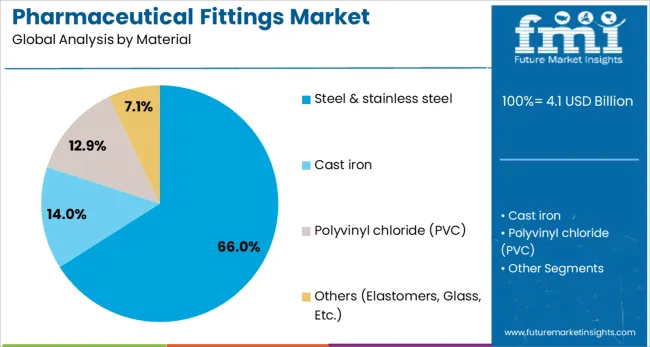

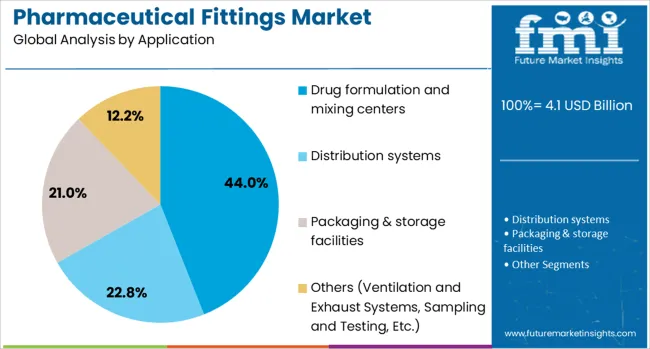

The pharmaceutical fittings market is segmented by product type, material, application, distribution channel, and geographic regions. By product type, the pharmaceutical fittings market is divided into Fittings and Valves. In terms of material, the pharmaceutical fittings market is classified into Steel & stainless steel, Cast iron, Polyvinyl chloride (PVC), and Others (Elastomers, Glass, etc.). The pharmaceutical fittings market is segmented into Drug formulation and mixing centers, Distribution systems, Packaging & storage facilities, and Others (Ventilation and Exhaust Systems, Sampling and Testing, etc.). The distribution channel of the pharmaceutical fittings market is segmented into Offline and Online. Regionally, the pharmaceutical fittings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fittings segment is projected to account for 62% of the Pharmaceutical Fittings market revenue share in 2025, making it the leading product type. This growth has been driven by the fundamental role fittings play in connecting and securing pipelines in sterile production environments. Their importance in maintaining uninterrupted and contamination-free fluid transfer has made them indispensable across every stage of pharmaceutical manufacturing.

The widespread application of fittings in high-pressure, high-purity, and cleanroom processes has reinforced their demand. Furthermore, the adaptability of fittings to various systems, including single-use and stainless steel process lines, has enhanced their functional relevance.

The growing adoption of automated and continuous manufacturing platforms has also increased the reliance on robust, leak-proof fittings that ensure mechanical integrity while allowing modular expansion. As pharmaceutical plants continue to modernize, fittings have become essential for optimizing flow control, reducing downtime, and complying with industry-specific validation requirements, thereby sustaining their leading position in the product landscape..

The steel and stainless steel segment is expected to capture 66% of the Pharmaceutical Fittings market revenue share in 2025, establishing it as the dominant material type. This leadership has been shaped by the superior chemical resistance, durability, and hygienic performance offered by stainless steel alloys, particularly in high-purity pharmaceutical applications. Their proven compatibility with cleaning agents, steam sterilization, and aggressive drug ingredients has made them the material of choice for fittings used in critical production zones.

Stainless steel fittings are also known for their strength under high-pressure and high-temperature conditions, which aligns with the operational demands of drug formulation and aseptic processing. Their long lifecycle and compliance with industry standards such as ASME BPE and FDA regulations further enhance their adoption.

Additionally, the material’s corrosion resistance and low reactivity ensure product safety and minimize contamination risks, which are critical to maintaining the integrity of drug batches. These factors collectively support the sustained preference for stainless steel across pharmaceutical manufacturing environments..

The drug formulation and mixing centers segment is projected to represent 44% of the Pharmaceutical Fittings market revenue share in 2025, making it the leading application segment. This dominance has been attributed to the central role that fittings play in ensuring sterile, efficient, and accurate transfer of ingredients during drug compounding and solution preparation. In these high-sensitivity zones, fittings are essential for maintaining closed-loop systems that prevent contamination and meet stringent cGMP protocols.

As the complexity of drug formulations increases, particularly with biologics and personalized therapies, the demand for precision fluid management has intensified. Drug formulation environments rely heavily on fittings that support quick changeovers, clean-in-place protocols, and resistance to both high temperatures and corrosive agents.

With increased pressure to shorten production cycles and reduce product loss, high-performance fittings have become critical to ensuring batch consistency and operational reliability. The growing use of modular and single-use systems in mixing operations has further reinforced the need for fittings that offer both sterility assurance and flexible integration..

The pharmaceutical fittings market is driven by the growing demand for reliable equipment in pharmaceutical manufacturing and the expansion of biopharmaceutical and vaccine production. Opportunities are rising in the demand for high-precision, customizable solutions. However, high manufacturing costs and stringent regulatory compliance present significant challenges. By 2025, overcoming these obstacles through cost-efficient production and regulatory strategies will ensure continued market growth.

The pharmaceutical fittings market is experiencing growth due to the increasing demand for reliable and precise equipment in the pharmaceutical manufacturing industry. These fittings are crucial in ensuring the safe transfer of liquids and gases in production processes, particularly in the production of injectables and biologics. As pharmaceutical manufacturing continues to scale up globally, the need for high-quality fittings is expected to rise. By 2025, the market is poised for further growth, driven by regulatory standards and demand for safe, efficient production.

Opportunities in the pharmaceutical fittings market are growing, particularly with the expansion of biopharmaceutical and vaccine production. The global need for vaccines and biologics is accelerating, requiring specialized equipment and fittings for sterile and efficient manufacturing. Additionally, increasing investments in biologics and personalized medicine are expected to drive demand for pharmaceutical fittings designed for high-precision applications. By 2025, the biopharmaceutical sector will present substantial growth opportunities for manufacturers of pharmaceutical fittings.

Emerging trends in the pharmaceutical fittings market highlight the growing demand for customizable and high-precision fittings. These components are increasingly designed to meet specific requirements in pharmaceutical manufacturing, such as minimizing contamination risks and ensuring seamless integration into production lines. The trend toward automation and higher operational efficiency is pushing manufacturers to develop more tailored solutions. By 2025, these trends will dominate the market, with a focus on achieving higher precision and flexibility in pharmaceutical production.

Despite the market's growth, the pharmaceutical fittings market faces challenges related to high manufacturing costs and regulatory compliance. Fittings used in pharmaceutical applications must meet stringent quality and regulatory standards, which often result in higher production costs. Additionally, the complexity of adhering to these standards across various markets can hinder growth. By 2025, addressing these challenges will be critical for manufacturers to remain competitive while ensuring product quality and compliance with global regulations.

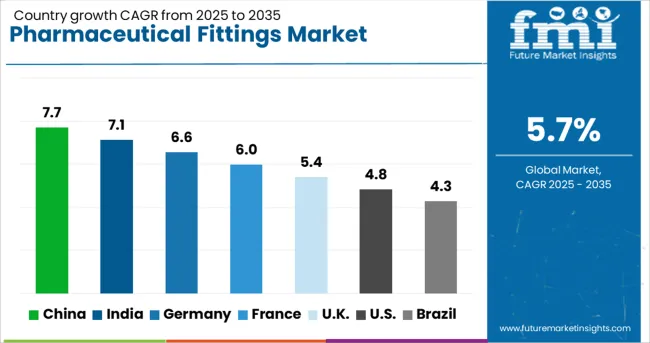

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global piezoelectric materials market is projected to grow at a 7.5% CAGR from 2025 to 2035. China leads with a growth rate of 10.1%, followed by India at 9.4%, and Germany at 8.6%. The United Kingdom records a growth rate of 7.1%, while the United States shows the slowest growth at 6.4%. These differences in growth rates are influenced by factors such as increasing demand for sensors, actuators, and advanced materials in automotive, electronics, and industrial applications. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, technological advancements, and rising demand for piezoelectric devices, while more mature markets like the USA and the UK show steady growth driven by established industries and increasing adoption of smart technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The piezoelectric materials market in China is growing at an impressive pace, with a projected CAGR of 10.1%. As China continues to expand its manufacturing and electronics sectors, the demand for piezoelectric materials, used in sensors, actuators, and energy harvesting devices, is increasing rapidly. The country’s focus on advancing smart technologies, including IoT, robotics, and automotive applications, further accelerates the adoption of piezoelectric materials. Additionally, China’s strong investments in renewable energy and environmental monitoring systems are driving the demand for piezoelectric devices in energy harvesting and sensor applications, supporting robust market growth.

The piezoelectric materials market in India is projected to grow at a CAGR of 9.4%. India’s growing demand for piezoelectric materials in industrial applications, healthcare devices, and consumer electronics is contributing significantly to market growth. The rise in smart infrastructure, automotive innovation, and the adoption of piezoelectric materials in industrial sensors and actuators are further boosting the market. Additionally, government initiatives promoting technological innovation in manufacturing, along with the increasing focus on energy efficiency, are expected to fuel the demand for piezoelectric materials, making India a key growth market in the Asia-Pacific region.

The piezoelectric materials market in Germany is projected to grow at a CAGR of 8.6%. Germany’s well-established manufacturing and automotive industries, combined with its strong focus on advanced technologies, are driving demand for piezoelectric materials. The increasing use of piezoelectric sensors, actuators, and energy harvesting devices in automotive systems, industrial automation, and robotics is further contributing to market growth. Additionally, Germany’s strong commitment to sustainability and renewable energy sources boosts the need for piezoelectric materials in energy harvesting applications. The country’s investments in smart manufacturing technologies and automation ensure continued growth in the piezoelectric materials market.

The piezoelectric materials market in the United Kingdom is projected to grow at a CAGR of 7.1%. The UK continues to focus on developing advanced sensor technologies for industrial applications, which drives demand for piezoelectric materials. With growing investments in the automotive sector and a rising adoption of IoT devices, piezoelectric materials are becoming increasingly important in the production of sensors and actuators. The UK government’s focus on sustainability and the integration of smart technologies across industries also supports the market. However, the growth is relatively slower compared to emerging economies, due to a more mature market and established infrastructure.

The piezoelectric materials market in the United States is expected to grow at a CAGR of 6.4%. Despite being a mature market, the USA continues to see steady demand for piezoelectric materials driven by the automotive, electronics, and healthcare industries. The increasing use of piezoelectric sensors and actuators in applications such as robotics, medical devices, and smart systems contributes to market growth. Additionally, the USA government’s emphasis on advancing manufacturing technologies, coupled with ongoing investments in energy-efficient solutions, further supports the demand for piezoelectric materials. However, growth in the USA is slower compared to emerging markets due to market maturity.

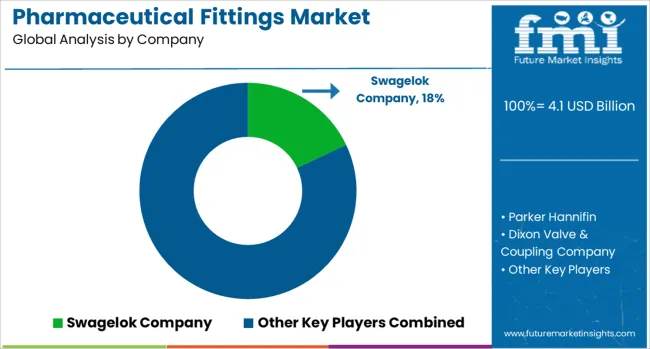

The pharmaceutical fittings market is dominated by Swagelok Company, which leads with its high-quality, precision-engineered fittings designed for use in pharmaceutical, biotechnology, and chemical processing industries. Swagelok’s dominance is supported by its reputation for providing reliable, leak-tight fittings that meet stringent regulatory standards and ensure safety in critical fluid and gas applications. Key players such as Parker Hannifin, Dixon Valve & Coupling Company, and Saint-Gobain Performance Plastics maintain significant market shares by offering durable and corrosion-resistant fittings that are essential for pharmaceutical manufacturing and processing environments.

These companies focus on providing innovative solutions for fluid handling systems, ensuring compliance with industry regulations, and offering superior performance in high-purity applications. Emerging players like Dockweiler AG are expanding their market presence by providing specialized fittings for niche pharmaceutical applications, including aseptic connections, high-pressure systems, and bioprocessing equipment. Their strategies include enhancing product quality, improving manufacturing flexibility, and offering customized solutions to meet the specific needs of pharmaceutical and healthcare customers. Market growth is driven by the increasing demand for high-quality, reliable fluid management systems, the expansion of pharmaceutical production, and the need for safer, more efficient systems in drug manufacturing. Innovations in materials, sanitation technology, and automation are expected to continue shaping competitive dynamics and drive growth in the global pharmaceutical fittings market.

Stainless steel fittings held approximately 42% of the pharmaceutical fittings market share and are expected to grow at a CAGR of 6.3% through 2032. Their resistance to corrosion and chemical exposure makes them crucial for pharmaceutical environments, where equipment faces harsh chemicals and frequent cleaning.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Product Type | Fittings and Valves |

| Material | Steel & stainless steel, Cast iron, Polyvinyl chloride (PVC), and Others (Elastomers, Glass, Etc.) |

| Application | Drug formulation and mixing centers, Distribution systems, Packaging & storage facilities, and Others (Ventilation and Exhaust Systems, Sampling and Testing, Etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Swagelok Company, Parker Hannifin, Dixon Valve & Coupling Company, Saint-Gobain Performance Plastics, and Dockweiler AG |

| Additional Attributes | Dollar sales by fitting type and application, demand dynamics across pharmaceutical manufacturing, biotechnology, and research sectors, regional trends in pharmaceutical fitting adoption, innovation in corrosion-resistant and contamination-free materials, impact of regulatory standards on quality and safety, and emerging use cases in aseptic processing and sterile environments. |

The global pharmaceutical fittings market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the pharmaceutical fittings market is projected to reach USD 7.2 billion by 2035.

The pharmaceutical fittings market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in pharmaceutical fittings market are fittings, _tees, _elbows, _adapters, _caps & plugs, _others (flanges, bushings, etc.), valves, _flanged valves, _threaded valves and _others (welded, union, etc.).

In terms of material, steel & stainless steel segment to command 66.0% share in the pharmaceutical fittings market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA