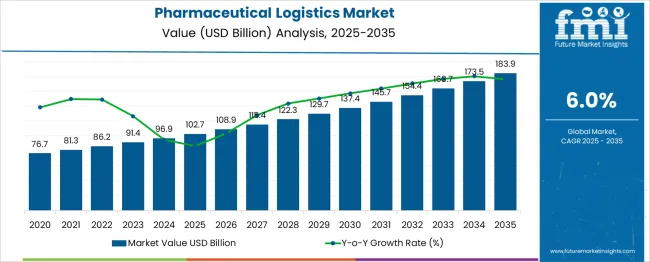

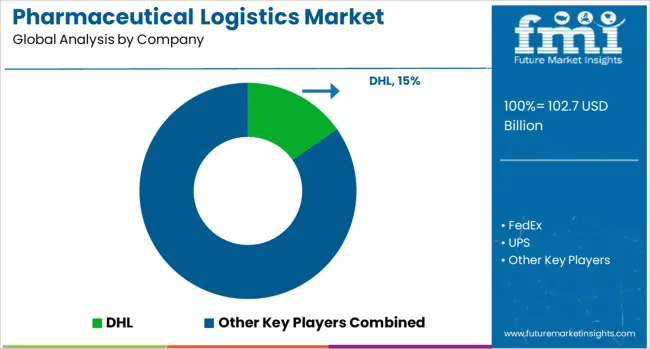

The Pharmaceutical Logistics Market is estimated to be valued at USD 102.7 billion in 2025 and is projected to reach USD 183.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The pharmaceutical logistics market is projected to generate an absolute gain of USD 81.2 billion and a growth multiplier of 1.79x over the decade. This growth, supported by a steady CAGR of 6%, is driven by increasing global pharmaceutical production, stringent regulatory requirements, and the growing need for temperature-sensitive product transport. During the first five years (2025–2030), the market is expected to rise from USD 102.7 billion to USD 137.4 billion, adding USD 34.7 billion, which accounts for 42.7% of the total incremental growth, with a 5-year multiplier of 1.34x.

The second phase (2030–2035) contributes USD 46.5 billion, representing 57.3% of incremental growth, reflecting stronger momentum driven by technological advancements in cold chain logistics, digital supply chain management, and rising pharmaceutical exports. Annual increments increase from USD 6.9 billion in the early years to USD 9.8 billion by 2035, reflecting stronger growth as logistics providers adapt to the increasing complexity of global supply chains. Manufacturers focusing on automation, regulatory compliance, and temperature-controlled logistics will capture the largest share of this USD 81.2 billion opportunity.

| Metric | Value |

|---|---|

| Pharmaceutical Logistics Market Estimated Value in (2025 E) | USD 102.7 billion |

| Pharmaceutical Logistics Market Forecast Value in (2035 F) | USD 183.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The pharmaceutical logistics market is witnessing accelerated transformation driven by the increasing complexity of drug formulations, regulatory enforcement on drug safety, and the expansion of biologics and personalized medicine. The need to maintain product integrity across global supply chains has led to the integration of temperature-controlled infrastructure, digital monitoring technologies, and real-time traceability solutions.

Key pharmaceutical manufacturers are increasingly relying on third-party logistics providers to ensure compliance with evolving GDP and GxP guidelines, particularly in cross-border operations. Strategic investments in cold chain systems, automation, and AI-enabled logistics platforms have improved distribution efficiency, minimized spoilage, and strengthened visibility across multi-modal routes.

The rising production of vaccines, insulin, gene therapies, and other biologics has further pushed logistics providers to innovate with IoT sensors, blockchain tracking, and eco-friendly packaging. As demand for healthcare access expands across emerging markets, the pharmaceutical logistics sector is expected to scale through collaborations between carriers, warehousing operators, and regulatory bodies focused on safeguarding the quality and continuity of medicinal products globally.

The pharmaceutical logistics market is segmented by offering, service, mode of transportation, application, and geographic regions. By offering, the pharmaceutical logistics market is divided into Cold chain and non-cold chain. In terms of service, the pharmaceutical logistics market is classified into Transportation, storage, and monitoring. Based on mode of transportation, the pharmaceutical logistics market is segmented into Road, Air, Sea, and Rail. By application, the pharmaceutical logistics market is segmented into Biopharma, Chemical, Specialty pharma. Regionally, the pharmaceutical logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

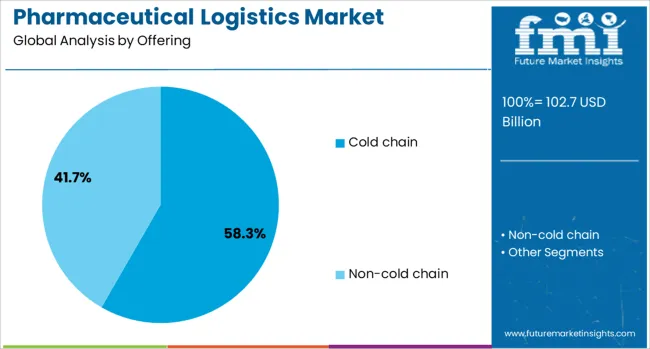

The cold chain segment is projected to hold 58.3% of the pharmaceutical logistics market revenue share in 2025, underscoring its dominant role in ensuring product integrity throughout the supply chain. The growth of this segment is being supported by the increasing distribution of temperature-sensitive therapeutics, including vaccines, monoclonal antibodies, and cell and gene therapies. Cold chain infrastructure has become indispensable in preventing spoilage and maintaining the efficacy of sensitive products during transportation and storage.

Increased enforcement of global quality standards and stringent regulatory requirements for cold chain validation have further accelerated its integration in pharmaceutical logistics. Deployment of advanced refrigeration units, real-time temperature monitoring systems, and predictive analytics has enhanced reliability and reduced risk in handling perishable medical goods.

The segment has also been strengthened by the increasing demand for decentralized clinical trials and just-in-time delivery models, which require agile and precise cold chain networks. As biologics and specialty drugs continue to expand in market share, the cold chain is expected to remain a critical pillar of pharmaceutical distribution.

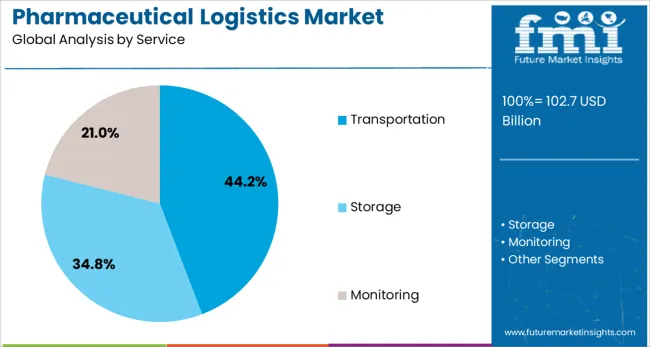

The transportation segment is anticipated to account for 44.2% of the total revenue share in the pharmaceutical logistics market by 2025, reflecting its foundational role in the movement of pharmaceutical goods across regional and international supply chains. The rising volume of pharmaceutical shipments has driven this segment’s growth, the demand for accelerated delivery timelines, and the increasing need for secure handling of high-value medications. The incorporation of GPS-enabled tracking, route optimization tools, and real-time delivery validation has improved the operational reliability of pharmaceutical transportation networks.

Regulatory pressure to ensure compliance during transit has also prompted logistics providers to invest in temperature-controlled vehicles and tamper-proof tracking solutions. Growth in e-pharmacy services, distribution to rural and underserved areas, and direct-to-patient delivery models have further strengthened the segment’s relevance.

Strategic expansion of distribution hubs and collaborations with specialized freight carriers have improved cost efficiency and reach. As the pharmaceutical industry continues to diversify its product offerings and geographies, transportation services will remain central to logistics continuity.

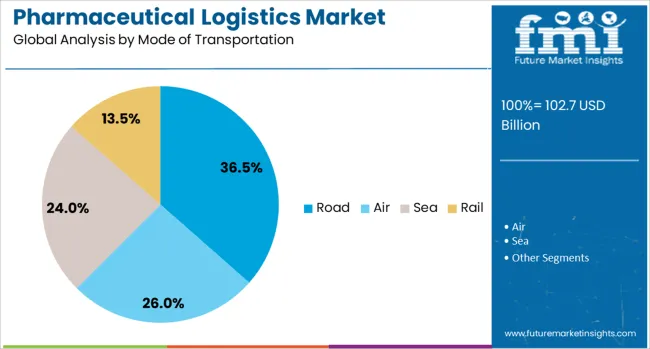

The road segment is forecast to contribute 36.5% of the total revenue share in the pharmaceutical logistics market by 2025, marking it as a key transportation mode due to its flexibility and reach. Growth in this segment has been supported by the increasing need for regional distribution networks, particularly in emerging economies where air and rail infrastructure remains limited or cost-prohibitive. Road logistics offers enhanced route adaptability and last-mile delivery capabilities, making it especially suitable for delivering both temperature-sensitive and general pharmaceutical products.

The integration of refrigerated trucks, IoT-based telematics, and geofencing technologies has enabled greater control over delivery conditions and compliance monitoring. The demand for direct-to-pharmacy and direct-to-patient delivery services has further underscored the importance of road transportation, particularly in rural and semi-urban areas.

Regulatory mandates around transportation documentation, real-time location tracking, and contamination prevention have driven the adoption of specialized pharmaceutical fleets. With evolving patient access models and increasing pharmaceutical penetration in tier-2 and tier-3 cities, road transport is expected to retain a vital role in logistics strategies.

The pharmaceutical logistics market is driven by the growing demand for efficient, secure, and temperature-controlled delivery solutions. Opportunities are emerging in the expansion of global distribution networks, particularly in emerging markets. Trends toward temperature-controlled logistics and automation are shaping the market. However, challenges such as regulatory compliance and supply chain disruptions remain significant. By 2025, addressing these challenges through enhanced infrastructure and compliance management will be critical for ensuring continued growth and efficiency in pharmaceutical logistics.

The pharmaceutical logistics market is growing due to the rising demand for efficient and reliable supply chains for pharmaceuticals. As the global pharmaceutical industry expands, the need for timely, temperature-controlled, and secure delivery of drugs is increasing. This growth is particularly driven by the rise in demand for biologics, vaccines, and temperature-sensitive drugs. By 2025, the market will continue to benefit from the need for more sophisticated logistics solutions to meet regulatory requirements and global distribution needs.

Opportunities in the pharmaceutical logistics market are emerging with the expansion of global pharmaceutical distribution networks. The growing global demand for medicines, particularly in emerging markets, has created a need for stronger logistics infrastructure. Companies are focusing on building robust networks to support the growing volume of shipments, which include a wider variety of products with specific handling requirements. By 2025, the expansion of pharmaceutical distribution networks, especially in Asia and Africa, will present substantial growth opportunities for logistics providers.

Emerging trends in pharmaceutical logistics include the growing adoption of temperature-controlled and automated logistics solutions. With increasing demand for sensitive products like vaccines and biologics, logistics companies are enhancing their cold chain capabilities to ensure product integrity. Additionally, automation technologies such as robotic process automation and AI-driven solutions are improving efficiency and reducing human error. By 2025, these advancements in temperature-controlled logistics and automation will become critical to the market’s growth, ensuring higher reliability and reducing operational costs.

The pharmaceutical logistics market faces challenges related to regulatory compliance and supply chain disruptions. Stringent regulations governing the transportation of pharmaceutical products, especially controlled substances and temperature-sensitive items, create complexities. Additionally, disruptions due to geopolitical factors or natural disasters can significantly impact the efficiency of pharmaceutical supply chains. These challenges can increase operational costs and delay product deliveries. By 2025, the ability to navigate these regulatory hurdles and mitigate supply chain risks will be crucial for market players to remain competitive.

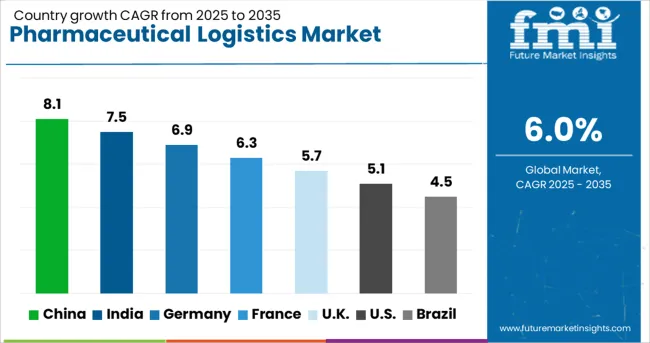

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global pharmaceutical logistics market is projected to grow at a 6% CAGR from 2025 to 2035. China leads with a growth rate of 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom records a growth rate of 5.7%, while the United States shows the slowest growth at 5.1%. These differences in growth rates are influenced by factors such as the increasing demand for pharmaceuticals, advancements in supply chain technologies, regulatory requirements, and the need for temperature-controlled logistics solutions. Emerging markets like China and India are witnessing rapid growth due to expanding healthcare needs, increasing drug production, and e-commerce-driven demand, while mature markets like the USA and the UK show steadier growth driven by established pharmaceutical industries and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pharmaceutical logistics market in China is growing rapidly, with a projected CAGR of 8.1%. China’s expanding pharmaceutical industry, driven by increasing healthcare needs, drug production, and rising e-commerce demand, is propelling the market. The country’s focus on improving healthcare infrastructure, expanding supply chains, and adopting advanced logistics technologies, including temperature-controlled transportation and automated tracking systems, is contributing to market growth. China’s investment in cold chain logistics to support the transportation of temperature-sensitive pharmaceutical products further accelerates the demand for efficient and reliable pharmaceutical logistics solutions.

The pharmaceutical logistics market in India is projected to grow at a CAGR of 7.5%. India’s growing pharmaceutical production capacity, increasing demand for medicines, and expanding healthcare infrastructure are key drivers of market growth. Additionally, India’s role as a global leader in generic drug manufacturing and rising pharmaceutical exports contribute to the need for robust logistics systems. The country’s focus on developing temperature-controlled supply chains, as well as increased investments in cold storage facilities and automated logistics technologies, is further supporting the growth of the pharmaceutical logistics market.

The pharmaceutical logistics market in Germany is projected to grow at a CAGR of 6.9%. Germany’s well-established pharmaceutical industry, coupled with its advanced logistics infrastructure, is driving steady growth in the pharmaceutical logistics market. The demand for efficient logistics solutions is further fueled by Germany’s focus on innovation, regulatory compliance, and the integration of digital technologies in pharmaceutical supply chains. The increasing need for temperature-controlled transportation to ensure the safe delivery of pharmaceuticals, including vaccines and biologics, is also a significant factor driving market growth.

The pharmaceutical logistics market in the United Kingdom is projected to grow at a CAGR of 5.7%. The UK has a well-established pharmaceutical market, with increasing demand for logistics services driven by pharmaceutical exports, e-commerce, and regulatory standards. The country’s focus on improving supply chain efficiency, integrating advanced tracking and monitoring technologies, and enhancing cold chain logistics is contributing to the steady growth of the pharmaceutical logistics market. Furthermore, the rise in demand for temperature-sensitive pharmaceuticals and the government’s emphasis on healthcare infrastructure and innovation further support market expansion.

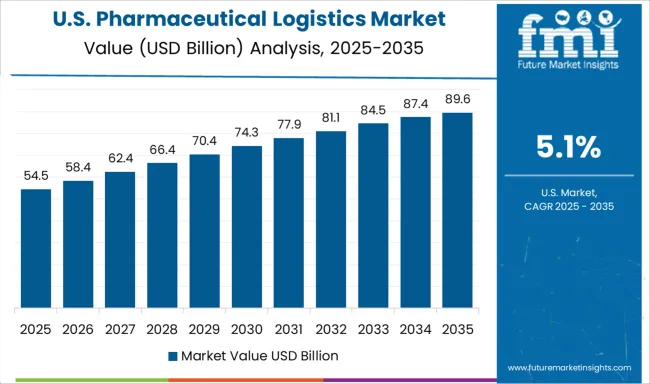

The pharmaceutical logistics market in the United States is expected to grow at a CAGR of 5.1%. The USA remains a key player in the global pharmaceutical logistics market, with a strong pharmaceutical industry and well-developed logistics infrastructure. Despite slower growth compared to emerging markets, steady demand for pharmaceutical logistics solutions continues to rise, driven by increasing pharmaceutical production, regulatory compliance, and the growing need for temperature-sensitive shipments. The USA also benefits from technological advancements in logistics, including automation, IoT-enabled tracking systems, and enhanced cold chain logistics solutions.

The pharmaceutical logistics market exhibits diverse strategies among leading players, combining historical operational strengths with forward-looking growth initiatives. DHL Supply Chain historically focused on integrated cold-chain solutions and global distribution networks, while forecast strategies emphasize digitalization, IoT-enabled temperature monitoring, and AI-driven route optimization. UPS Healthcare leveraged rapid delivery and regulatory compliance in the past and is now expanding cloud-based visibility platforms, contract clinical supply services, and partnerships with biologic manufacturers to capture specialty drug demand. FedEx Custom Critical historically prioritized high-priority, temperature-sensitive shipments, while future strategies focus on predictive analytics, risk mitigation, and global expansion in emerging pharmaceutical hubs.

Kuehne + Nagel and DB Schenker differentiate through extensive global networks, digital warehouse management, and clinical trial logistics; going forward, they are integrating real-time monitoring, blockchain-enabled serialization tracking, and sustainability-focused transport solutions. Regional players such as Rhenus Logistics, Yusen Logistics, and Kerry Logistics maintain localized regulatory expertise and last-mile capabilities; future strategies emphasize expanding cold-chain capacity, developing regional distribution centers, and forming co-development partnerships with manufacturers.

Growth opportunities lie in emerging geographies with rising pharmaceutical production, biologics and vaccine distribution, and high-value specialty drugs. Differentiation levers include technology integration, regulatory alignment, chain-of-custody transparency, and specialized cold-chain infrastructure, ensuring sustained competitive advantage across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 102.7 Billion |

| Offering | Cold chain and Non-cold chain |

| Service | Transportation, Storage, and Monitoring |

| Mode of Transportation | Road, Air, Sea, and Rail |

| Application | Biopharma, Chemical pharma, and Specialty pharma |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL, FedEx, UPS, DBSchenker, Kuehne+Nagel, CHRobinson, CEVALogistics, Maersk, DSVGlobal, and NipponExpress |

| Additional Attributes | Dollar sales by logistics type and application, demand dynamics across drug manufacturing, distribution, and healthcare sectors, regional trends in pharmaceutical logistics adoption, innovation in cold-chain and temperature-controlled transportation, impact of regulatory standards on compliance and traceability, and emerging use cases in e-commerce and direct-to-patient delivery models. |

The global pharmaceutical logistics market is estimated to be valued at USD 102.7 billion in 2025.

The market size for the pharmaceutical logistics market is projected to reach USD 183.9 billion by 2035.

The pharmaceutical logistics market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in pharmaceutical logistics market are cold chain and non-cold chain.

In terms of service, transportation segment to command 44.2% share in the pharmaceutical logistics market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA