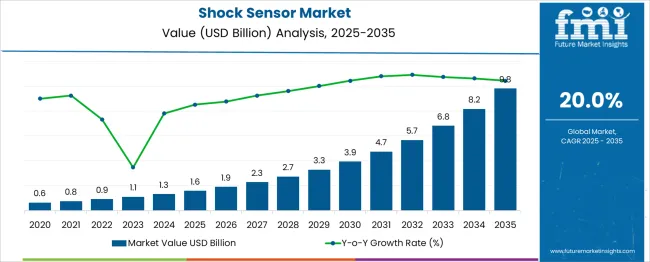

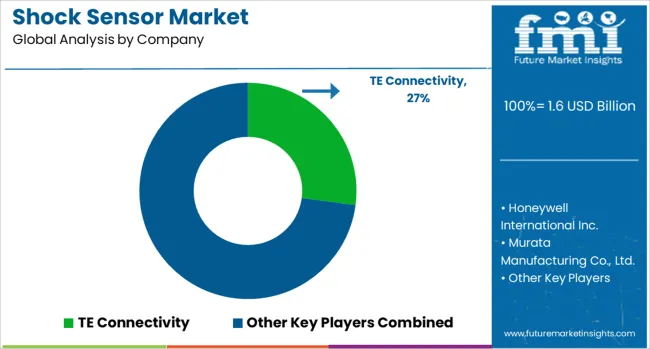

The Shock Sensor Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

| Metric | Value |

|---|---|

| Shock Sensor Market Estimated Value in (2025 E) | USD 1.6 billion |

| Shock Sensor Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The shock sensor market is expanding steadily, driven by the growing demand for reliable impact detection across various industrial and consumer applications. Improvements in sensor technologies have enhanced sensitivity and accuracy, enabling better protection of sensitive equipment and systems.

The increased focus on safety and durability in sectors such as automotive, electronics, and aerospace has accelerated the adoption of shock sensors. Furthermore, the integration of digital output types has allowed for seamless data processing and real-time monitoring, which are critical for predictive maintenance and quality control.

Rising investments in smart devices and automation have also contributed to market growth. Moving forward, demand for robust sensors that can withstand harsh environments and deliver precise measurements will continue to drive the market. Segmental growth is expected to be led by piezoelectric sensors in type, digital sensors in output type, and quartz material sensors for their reliability and stability.

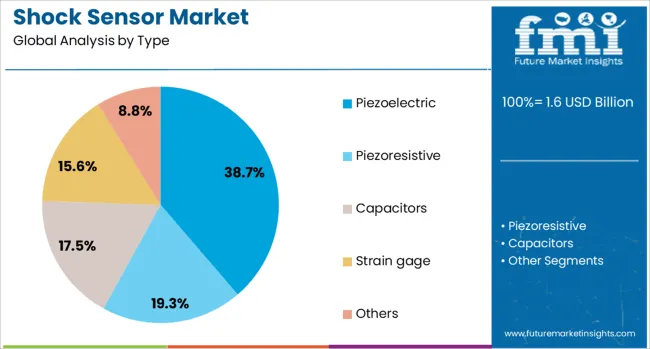

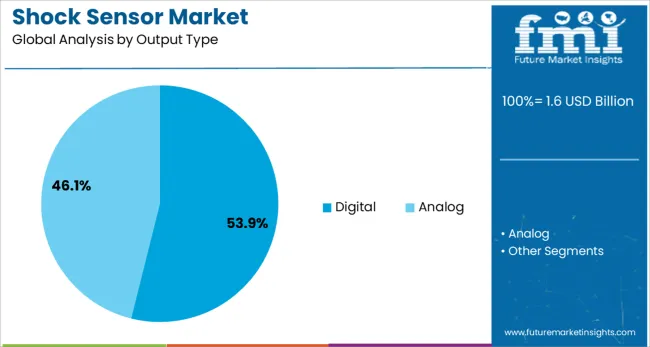

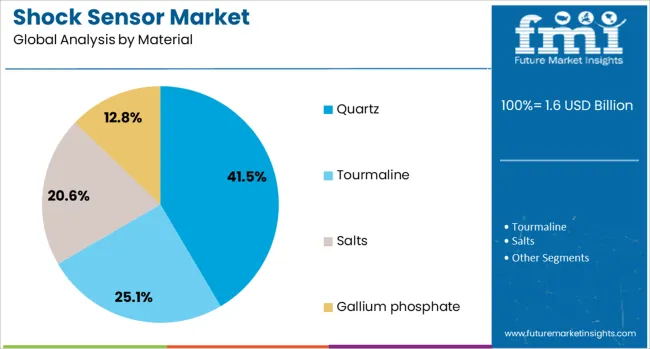

The shock sensor market is segmented by type, output type, material, application, and end use and geographic regions. The shock sensor market is divided by type into Piezoelectric, Piezoresistive, Capacitors, Strain gage, and Others. In terms of output type, the shock sensor market is classified into Digital and Analog. Based on the material of the shock sensor, the market is segmented into Quartz, Tourmaline, Salts, and Gallium phosphate. By application of the shock sensor, the market is segmented into Automotive security systems, Tap detection, Micro-drive protection, Shipping and handling, General tamper-proofing, and Others. By end use, the shock sensor market is segmented into Automotive, Aerospace, Industrial, Consumer Electronics, and Others. Regionally, the shock sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The piezoelectric segment is projected to hold 38.7% of the shock sensor market revenue in 2025, maintaining its position as the dominant type. Growth in this segment is attributed to the inherent advantages of piezoelectric materials in converting mechanical stress into electrical signals with high precision. These sensors are valued for their fast response times and durability in dynamic environments.

Industries have increasingly preferred piezoelectric sensors for applications requiring accurate impact and vibration detection. Their ability to operate effectively under extreme conditions has solidified their role in both industrial and consumer markets.

As demand for compact and reliable sensing solutions grows, the piezoelectric segment is expected to continue leading the market.

The digital output segment is expected to account for 53.9% of the shock sensor market revenue in 2025, securing its position as the leading output type. Digital sensors provide precise, easily interpretable signals that facilitate integration with modern electronic systems and enable advanced analytics.

This capability has led to widespread adoption in industries emphasizing automation and real-time condition monitoring. The clarity and reliability of digital data have improved diagnostic accuracy and enhanced decision-making processes.

Additionally, digital sensors support connectivity features crucial for IoT and smart manufacturing environments. The growing trend toward intelligent systems will further bolster the digital output segment’s growth.

The quartz material segment is projected to contribute 41.5% of the shock sensor market revenue in 2025, establishing itself as the preferred material. Quartz is prized for its excellent piezoelectric properties, chemical stability, and resistance to temperature variations, making it suitable for harsh and demanding environments.

Its consistent performance and low signal noise have made it a reliable choice for high-precision sensing applications. The robustness of quartz-based sensors has driven their adoption in sectors such as aerospace, defense, and medical devices, where accuracy is critical.

As industries continue to require dependable sensor materials, the quartz segment is expected to maintain its strong market position.

Shock sensors are being integrated with IoT platforms for real-time monitoring, predictive maintenance, and AI-driven analytics, enhancing operational efficiency across industries. Miniaturization and multi-functional designs are driving adoption in space-constrained applications like electronics, aerospace, and defense.

Shock sensors are increasingly being linked with IoT-enabled platforms for real-time tracking and analytics. Industries such as logistics, automotive, and industrial automation deploy these sensors with cloud-based systems to monitor impact events and send instant alerts. This integration has improved predictive maintenance by enabling early fault detection and reducing downtime. Supply chain operators rely on connected shock sensors to monitor high-value goods in transit, providing visibility that supports risk mitigation. The combination of sensor data with AI-driven analytics is influencing operational efficiency, making adoption more strategic. This growing reliance on connected solutions has placed strong emphasis on advanced communication protocols, leading to significant investments by manufacturers.

The trend toward smaller yet highly efficient shock sensors has gained traction across consumer electronics, aerospace, and defense applications. Miniaturized sensors provide flexibility for integration into compact devices without compromising performance. Manufacturers are introducing models with combined features such as vibration measurement, acceleration sensing, and tilt detection to cater to multiple requirements in a single unit. This approach reduces system complexity and improves cost efficiency for end users. The demand for versatile components is shaping research into materials and MEMS technology, resulting in enhanced durability and responsiveness. Industries with space-constrained environments are adopting these multi-functional sensors, indicating a strong shift in product design priorities.

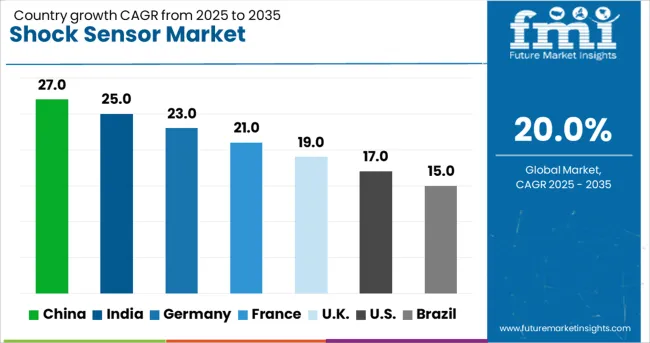

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The shock sensor industry, projected to expand at a global CAGR of 20.0% from 2025 to 2035, is witnessing strong momentum across leading nations. A 27.0% CAGR is being observed in China, a BRICS member, supported by large-scale electronics manufacturing and rapid integration of sensor-based technologies in automotive systems. India, also a BRICS member, is recording a 25.0% CAGR driven by increased adoption of safety solutions in transportation and industrial sectors. Germany is exhibiting a 23.0% CAGR as an OECD member, with demand being driven by precision engineering, smart manufacturing, and advanced automotive safety applications. The United Kingdom is posting a 19.0% CAGR due to rising deployments in defense and aerospace systems. The United States, an OECD member, is witnessing a 17.0% CAGR fueled by connected devices and predictive maintenance applications. The report provides an extensive review of 40+ countries, highlighting China and India as the fastest-growing market.

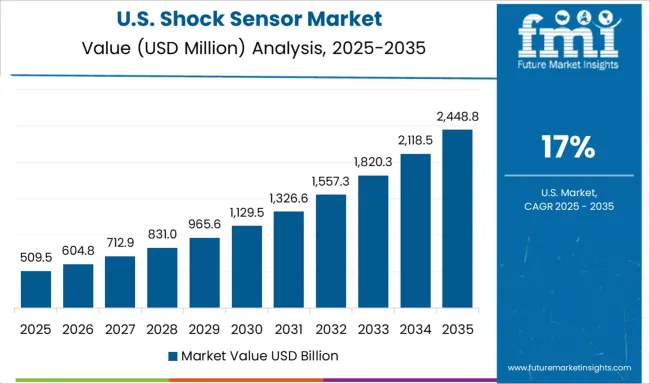

The United States is forecast to grow at a 17.0% CAGR, driven by adoption in connected vehicles, smart manufacturing, and aerospace safety systems. Automotive manufacturers integrate shock sensors into crash detection and battery protection for EVs. Industrial IoT deployment accelerates predictive maintenance applications across oil, gas, and energy sectors. Defense programs adopt advanced shock sensors for missile guidance and structural health monitoring in naval fleets. The strong consumer electronics market further supports demand for sensors in gaming devices and smart gadgets. USA-based OEMs invest in next-gen MEMS sensors offering ultra-low power consumption for portable and IoT devices.

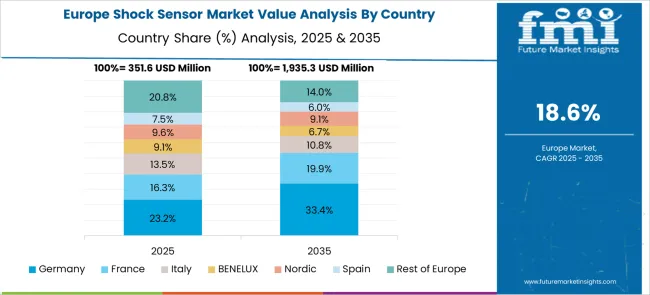

Germany is projected to grow at a 23.0% CAGR, driven by adoption in automotive, aerospace, and industrial automation sectors. German OEMs integrate shock sensors in ADAS platforms and EV battery systems to enhance safety. Smart factories implement sensor-based predictive maintenance solutions to reduce downtime. Leading European sensor manufacturers invest in miniaturized MEMS technology for robotics and high-speed rail applications. Demand from renewable energy installations, particularly wind turbines, reinforces the need for vibration and impact monitoring. Compliance with stringent EU safety standards ensures sustained adoption across industrial infrastructure and transportation systems.

The United Kingdom is anticipated to grow at a 19.0% CAGR, supported by demand in aerospace, defense, and transport safety applications. Sensor adoption in military vehicles and unmanned systems is gaining traction under defense modernization programs. Automotive players deploy shock sensors in collision detection and airbag systems. Integration of impact sensors in railway infrastructure enhances passenger safety and operational efficiency. Growth in consumer electronics and sports monitoring devices adds to demand for compact, high-performance MEMS sensors. Strategic collaborations between UK research institutes and global tech firms are driving innovation in shock-sensing solutions for mission-critical applications.

China is expected to grow at a 27.0% CAGR, the fastest globally, driven by dominance in electronics manufacturing and rapid adoption in automotive safety systems. Widespread integration of sensors in ADAS-enabled vehicles strengthens demand. Large-scale IoT deployment in industrial monitoring accelerates growth, supported by government programs promoting connected infrastructure. Domestic sensor makers emphasize low-cost MEMS shock sensors, while global players expand production partnerships in China’s tech hubs. Advanced applications in robotics, consumer electronics, and 5G-powered devices are creating additional revenue streams. Strong presence in export-driven electronics manufacturing further positions China as a key supplier in the global shock sensor ecosystem.

India is forecast to expand at a 25.0% CAGR, supported by growing investments in transportation safety, smart manufacturing, and consumer electronics. Automotive OEMs integrate shock sensors in advanced braking and collision avoidance systems. Adoption is increasing in rail safety and logistics tracking to prevent cargo damage. Domestic electronics firms are partnering with global technology providers to localize high-performance MEMS sensor production. Industrial facilities are implementing shock detection for predictive maintenance under Industry 4.0 frameworks. Government-backed initiatives for indigenous defense manufacturing also boost demand for sensors in aerospace and naval platforms.

In the shock sensor market, dominant players are focusing on advanced sensing technologies, enhanced sensitivity, and robust designs for automotive, aerospace, and industrial applications. Companies like TE Connectivity and Honeywell International Inc. are developing high-precision sensors for collision detection, asset monitoring, and predictive maintenance in connected environments. Their solutions are widely integrated into smart vehicles, defense systems, and manufacturing automation lines, ensuring high operational reliability under extreme conditions. Murata Manufacturing Co., Ltd. and Dytran Instruments, Inc. specialize in MEMS-based and piezoelectric sensors, providing miniaturized, multi-functional devices tailored for compact electronic systems. These innovations support critical applications in medical equipment, consumer electronics, and aerospace monitoring, where space and accuracy are essential. MTS Systems Corporation and Emerson Electric Co. are leveraging their expertise in industrial automation to deliver shock sensors integrated with IoT platforms. These solutions enable real-time diagnostics, improving maintenance strategies and reducing downtime in energy, transportation, and heavy machinery sectors.

In January 2024, Murata Manufacturing Co., Ltd. announced the next-generation 6DoF inertial sensor SCH16T-K01 for high-precision applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type | Piezoelectric, Piezoresistive, Capacitors, Strain gage, and Others |

| Output Type | Digital and Analog |

| Material | Quartz, Tourmaline, Salts, and Gallium phosphate |

| Application | Automotive security systems, Tap detection, Micro-drive protection, Shipping and handling, General tamper-proofing, and Others |

| End Use | Automotive, Aerospace, Industrial, Consumer electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Honeywell International Inc., Murata Manufacturing Co., Ltd., Dytran Instruments, Inc., MTS Systems Corporation, and Emerson Electric Co |

| Additional Attributes | Dollar sales, share, growth by application segments, competitive landscape, pricing trends, regional adoption rates, technology shifts like MEMS integration, key OEM partnerships, and regulatory impacts driving procurement in automotive, aerospace, and industrial sectors. |

The global shock sensor market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the shock sensor market is projected to reach USD 9.8 billion by 2035.

The shock sensor market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in shock sensor market are piezoelectric, piezoresistive, capacitors, strain gage and others.

In terms of output type, digital segment to command 53.9% share in the shock sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shock Testing System Market Size and Share Forecast Outlook 2025 to 2035

Shock Tube System Market Size and Share Forecast Outlook 2025 to 2035

Shock Data Logger Market

Shock Test Machines Market

Anti-shock Trousers Market

Motorcycle Shock Absorbers Market

High Energy Shockwave Therapy Units Market Size and Share Forecast Outlook 2025 to 2035

Cardiogenic Shock Treatment Market Analysis & Forecast for 2025 to 2035

Erectile Dysfunction Shockwave Generators Market

Automotive Gas Charged Shock Absorbers Market Growth - Trends & Forecast 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Data Analytics Market Growth - Trends & Forecast through 2034

Sensor Testing Market Analysis – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA