The automotive gas charged shock absorber market is a sub-component of the global automotive suspension market, which includes elements that improve the stability, handling, and comfort of vehicles. These shock absorbers are an integral part of any modern car and contribute to both the safety and experience of the driving. The increased demand for advanced suspension systems, boom in vehicle production, and consumer preference towards better ride quality drive the market growth.

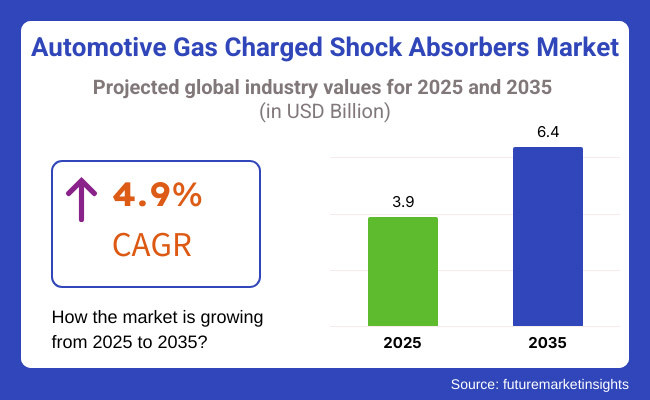

International automobile gas charged shock absorber market is projected to maintain USD 3.9 Billion worth of in 2025 and would augment at a robust pace & reach approximately USD 6.4 Billion in valuation by the end of 2035 with a compound yearly growth of 4.9% from 2025 to 2035. The expected compound annual growth rate testifies to the undying appetite for gas charged shock absorber technology, with technological improvements, an increase in vehicle production and demand for passenger comfort and safety surging interest in the field.

North America is anticipated to have a major market share in the global automotive gas charged shock absorber market due to the presence of a robust automotive sector and strong consumer demand for enhancing vehicle performance.

The major characteristics of advanced suspension technologies embraced by end-user industries in the region, coupled with the presence of leading automotive players fuel market growth in the region. Furthermore; the growing off-road & performance vehicle trend is fuelling demand for high-technology shock absorbers.

Europe holds a major market share, with countries like Germany, France, and the United Kingdom leading in automotive innovation and manufacturing. Strict vehicle safety in the continent followed by enhanced ride comfort, are the major trends that are driving higher usage of advanced suspension systems like gas charged shock absorbers. Moreover, the growing electric vehicle (EV) market in Europe calls for specialized shock absorbers to support distinct EV dynamics, which is also likely to fuel market growth further.

The automotive gas charged shock absorber market in the Asia-Pacific region is expected to grow with the highest CAGR during the forecast period due to growth in vehicle production and sales across China, Japan, and India. Higher vehicle ownership rates are driven by economic growth, urbanization and increased disposable income.

As a result, manufacturers from this region are increasingly emphasizing economical production methods and technological integration to enable them to service both domestic and global demand. Furthermore, the growth of the automotive aftermarket industry provides prospects for shock absorber manufacturers.

Challenge

Volatility in raw material prices

Volatility in raw material prices of metals and specialty gases used to manufacture products, varying material costs can affect manufacturers' costs and also affect makers' profit margins. Moreover, sustainability pressures are mounting on the industry, leading to investments in sustainable materials and technology which can supply operational cost increases.

Design and materials within shock absorbers will also need changes to support this transition toward electric vehicles, creating adaptation complications for manufacturers used to traditional combustion engine vehicles.

Opportunity

Development and adoption of advanced materials and smart suspension technologies

Increasing vehicle performance with passenger comfort is driving the automotive industry towards the adoption of innovative shock absorber solutions. New developments in materials science, including the incorporation of lightweight composites and the use of adaptive damping systems, afford manufacturers the opportunity to comply with regulations and conform to consumer demands.

The joint effort of the material suppliers, technology companies as well as automotive manufacturers can work together to bring the high performance as well as eco-friendly module of shock absorbers into the automotive sector and provide a competitive advantage.

Anticipating an Expected steady growth from 2020 to 2024 in demand for automotive gas charged shock absorber market owing to Increasing vehicle production, increasing trend for enhanced ride comfort, rising suspension technology. Rising demand for SUVs, electric vehicles (EVs), and sporty cars, on the other hand, drove demand for gas-charged shock absorbers that provide better stability, less damping lag, and increased durability as compared to conventional hydraulic shocks.

With weight elimination, aerodynamics and enhanced suspension efficiency as the new axiom for automakers, the demand for more lightweight and high-performance shock absorbers was born. Nevertheless, manufacturers faced challenges from fluctuating raw material costs, supply chain disruptions and high manufacturing costs.

Advanced suspension systems powered by AI will take charge, while integrated suspension solutions through active damping systems and smart shock absorbers will emerge with vehicle automation in 2025 to 2035. The sector is evolving with autonomous driving, AI-assisted vehicle dynamics, and energy-efficient suspension technologies at the forefront of innovation.

Also, the emergence of nanotechnology, along with self-adjusting shocks and regenerative suspension systems are expected to help shape the industry's future. Designing for sustainability, recyclability, and lighter composite suspension shock absorbers and springs will help the automaker comply with global fuel efficiency and emissions standards and optimize the vehicle running course.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with vehicle safety and emission regulations, focus on durability and performance. |

| Technology Adoption | Adoption of gas-charged twin-tube and monotone shock absorbers for improved performance. |

| Industry Adoption | Use of gas-charged shock absorbers in passenger vehicles, SUVs, and sports cars. |

| Smart & Connected Suspension Systems | Limited adoption of semi-active damping systems and electronically controlled suspensions. |

| Market Competition | Dominated by OEM suppliers, performance aftermarket brands, and global automotive component manufacturers. |

| Market Growth Drivers | Demand fuelled by growing SUV sales, electric vehicle adoption, and enhanced ride comfort expectations. |

| Sustainability and Environmental Impact | Initial steps toward lightweight materials and high-performance synthetic fluids for gas-charged shock absorbers. |

| Integration of AI & Predictive Analytics | Limited AI use in shock absorber diagnostics and suspension tuning. |

| Advancements in Manufacturing | Standardized steel-bodied and aluminium shock absorbers with nitrogen gas-charging technology. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter fuel efficiency mandates, sustainability-focused materials, and smart shock absorber standardization for autonomous vehicles. |

| Technology Adoption | Integration of AI-driven adaptive damping, self-healing shock absorbers, and predictive maintenance systems. |

| Industry Adoption | Expansion into autonomous vehicles, electric cars, and AI-assisted suspension systems for ride optimization. |

| Smart & Connected Suspension Systems | Active suspension integration, real-time shock absorber adjustments, and AI-driven ride comfort enhancements. |

| Market Competition | Increased competition from AI-driven vehicle dynamics companies, sustainable material start-ups, and 3D-printed shock absorber manufacturers. |

| Market Growth Drivers | Growth driven by autonomous driving innovations, next-gen AI suspension tuning, and regenerative shock absorber technology. |

| Sustainability and Environmental Impact | Large-scale adoption of biodegradable shock fluids, recyclable composite shocks, and energy-harvesting suspension technologies. |

| Integration of AI & Predictive Analytics | AI-powered real-time suspension optimization, predictive wear monitoring, and autonomous ride calibration. |

| Advancements in Manufacturing | Evolution of 3D-printed, carbon-fibre composite shock absorbers with embedded smart sensors for adaptive response. |

The primary automotive gas charged shock absorbers markets are in North America and the mentioned region is expected to have significant growth for automotive gas charged shock absorbers market in near future. Increased uptake of vehicles such as off-road and sports utility vehicles (SUVs), has further propelled demand in the global gas-charged shock absorbers market for stabilizing vehicles and enhancing ride comfort.

Moreover, the growing popularity of electric vehicles (EVs) is also propelling automobile manufacturers to focus on producing lightweight and energy-efficient suspension systems. Growth is further supported by strong aftermarket industry and the demand among consumers for customized and vehicle performance-enhancing components.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

UK Automotive Gas Charged Shock Absorber Market is anticipated to grow over the coming years, expected to benefit from higher investments by both the manufacturers as well as the consumers on the development of high-performance suspension systems, along with increasing electric and hybrid vehicles on road. The wearers are on a need on the road in harsh environment in the country and the very fact that the country has stringent safety and ride comfort regulations means that automakers have to implement advanced shock absorption technologies.

Another factor boosting innovation in premium gas charged shock absorbers are rising demand for luxury and - high-performance vehicles. The growth of e-commerce platforms focusing on automotive aftermarket components is further increasing market access, enabling consumers to take their vehicle suspension systems to the next level.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The European Union, comprising Germany, France, and Italy, is anticipated to observe lucrative growth in the automotive gas charged shock absorber market due to robust automotive manufacturing environment backed by a growing need for high quality ride comfort and handling. Demand for high-performance sports cars and growing production of high-end vehicles dilute the any driving force for developing advanced suspension systems.

As a result, restricting EU vehicle safety and emissions standards are making automakers invest in a lightweight energy efficient suspension system exporting solutions including that of shock absorbers. This trend is being further matched by the growth of electric and autonomous vehicles in the region, changing the scenery of advancement in gas charged shock absorber designs with focus on durability and enhanced efficiency across driving conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.8% |

The market for automotive gas charged shock absorbers in Japan is expanding due to the country's strong focus on precision engineering, vehicle efficiency, and technological innovation. Demand for high-performance suspension systems that improve energy efficiency and ride stability is being driven by the presence of key automobile manufacturers focusing on hybrid and electric vehicles.

Another factor fuelling growth of the market is the rising dominance of compact and fuel efficient automobiles, which is forcing manufacturers to create gas charged shock absorbers that are light in weight. The aftermarket is expected to surge in volume due to the rising interest of consumers in the customization of vehicles and vehicle performance enhancement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

Advancements in automotive manufacturing and investments in electric vehicle (EV) development in South Korea have made the country a prominent automotive gas charged shock absorber market. As a result, the automakers of the country are observing the latest shock absorber technologies to enhance the ride quality and vehicle handling. Also, increasing demand for premium and performance vehicles in South Korea is projected to accelerate the penetration of high quality suspension components.

Moreover, increased penetration of e-commerce channels and aftermarket industry is also making it easy for consumers to upgrade vehicles with advanced gas charged shock absorbers. The growing awareness about road safety and vehicle fuel efficiency, along with the government initiatives promoting such features, are likely to fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

OEM and Aftermarket Segments Dominate Automotive Gas Charged Shock Absorber Market as the Vehicle Manufacturers and Aftermarket Consumers Increasingly Focusing on Advanced Suspension Solutions for Ride Quality, Stability and Safety They are critical elements in ensuring vehicle handling, vibration mitigation, and overall improvement in vehicle comfort.

As the automotive industry moves toward lightweight, high-performance, and fuel-efficient vehicle components, the demand for gas-charged shock absorbers complies with across various market segments.

OEM (Original Equipment Manufacturer) shipments of gas-charged shock absorbers have been rising significantly owing to automakers catering to factory-installed, high-performance suspension parts. This can divert them from their intended course, so for gas-charged hydraulic shock absorbers, a gas-filling system that offers consistently higher damping performance and avoids aeration can reduce completely avoid damping discontinuity and vehicle instability during sudden off-roading.

Growing adoption of suspension systems among passenger cars and SUVs, along with a rise in demand for these systems by factories is anticipated to drive market growth. Gas-charged shock absorbers are standard equipment on over 70% of new vehicles thanks to their improved performance and durability, studies show.

Although, the market is propelled by the proliferation of electronically controlled suspension systems including adaptive damping systems, Artificial Intelligence (AI) based ride control, and real-time load adjustment systems.

With the incorporation of lightweight shock absorber materials such as aluminium alloys, carbon-fibre reinforcements, and high-strength polymer coatings, adoption has been made even more ready, guaranteeing better fuel efficiency as well as a decrease in overall weight of the vehicle.

Modular OEM shock absorber platforms with interchangeable damping rates, advanced spring integration, and customizable ride stiffness fields have enabled optimized market growth, enhancing adaptability across different vehicle models.

Integration of AI-powered quality control systems with real-time defect detection, automated assembly precision and predictive maintenance analytics have been also supporting market growth ensuring optimized production efficiency and enhanced product reliability.

Unlike aftermarket parts, OEM components benefit from the manufacturers being subject to long-lasting factory-quality testing that ensures performance, longevity, reliability-but they come with a high price tag and a long lead-time to market for new products, and stringent regulatory hurdle to enter due to crash safety and ecological soundness.

Nevertheless, new technological advances in terms of efficient damping mechanisms, ride comfort improvements through AI, and weight reductions in shock absorber production are leading to efficiency improvements, cost-effectiveness, and acceptance level of gas-charged shock absorbers by OEMs, thus commercially broadening the OEM gas charged shock absorbers market around the globe.

Surging consumer interest in replacement parts, performance enhancements, and low-cost upgrading of the suspension is driving aftermarket gas-charged shock absorbers into the market. 'Unlike the suspension systems that your vehicle is built with by the original manufacturer, aftermarket shock absorbers give you the freedom to customize your ride based on a number of factors including different levels of damping, ride height adjustments, and even specialized tuning for different types of terrains.

Growing rover suppliers continues to add performance based suspension as its vehicle of choice, leading to growth in off road, sports and luxury vehicles segments are increasing the demand in middle segment and suspension based on the latest technology. According to various studies, more than 60% of vehicle owners buy an aftermarket shock absorber replacement to improve how their vehicles ride, handle and last.

The booming high-performance aftermarket shock absorber business with nitrogen gas for enhanced performance and adjustable compression and remote reservoir dampening drive the market demand while modifying vehicle.

The use of long-lasting aftermarket components with materials such as corrosion-resistant coatings, hardened piston rods, and precision-machined dampening valves has also enhanced adoption rates, enabling extended product life and decreased maintenance costs.

Market growth has been maximized by the advent of user-friendly installation solutions comprising bolts-in or plug-and-play shock absorbers, adjustable damping presents and quick-release mounting brackets all networked to deliver wider access to the sensitive repairs as conducted by the passionate DIY vehicle enthusiasts and professional mechanics alike.

The implementation of digital aftermarket retailing strategies, including AI-enabled recommendation engines, virtual suspension configuration tools, and direct-to-consumer (DTC) distribution models, has bolstered market growth, providing a frictionless buying process while enhancing consumer interaction.

Though its pros propel the segment to affordability, customization, and aftermarket flexibility, cons such as counterfeit products, varied quality standards, and low consumer knowledge for high-end suspension technology present obstacles for the growth of the segment.

But the emergence of innovations such as AI-powered suspension Diagnostics, block chain-based product authentication, and interactive digital installation guides have ushered in the opportunity for improved customer trust, product reliability, and growth in aftermarket sales, ensuring gas-charged shock absorbers thrive worldwide.

The leading segment contributing to the Automotive Gas Charged Shock Absorber market includes Passenger Car and Heavy Commercial Vehicle (HCV). As data continues to integrate with technology, these vehicle categories will have a larger role to play in trend setting in the market, which will ensure the adaptation of advanced gas charged suspension system across key automotive applications.

Passenger cars have strong market penetration for gas-charged shock absorbers as they are known to improve ride quality, reduce body roll and enhance overall vehicle stability. In contrast to regular hydraulic shock absorbers gas-charged ones achieve higher response times, better damping consistency, and higher durability making them the ideal alternative for modern passenger cars.

Adoption has been driven by the increasing demand for improved driving comfort and stability, especially in compact and mid-size passenger cars. More than three-quarters of mid-line and premium passenger vehicles use gas-charged shock absorbers to help maximize the performance of the suspension and improve road handling, studies also show.

The growth of premium passenger car suspension systems with adaptive ride control, electronically adjustable damping and multi-stage gas compression has enhanced market demand to provide superior handling dynamics and driver control.

Next-generation lightweight suspension materials like aluminium-alloy shock-absorber housings, high-strength piston seals, and Nano-coated damping chambers have driven adoption even further, minimizing weight and maximizing fuel economy.

While passenger cars benefit from advantages like improved ride quality, stability, and suspension life, the segment is also plagued with issues like price sensitivity, repair complexity, and competition from shockingly conventional hydraulic dampers.

But with new innovations including AI-driven ride analysis, self-tuning shock absorbers, and intelligent suspension calibration becoming more widely available for performance, affordability, and vehicle integration, the gas-charged shock absorber has a long way to go before it runs out of road in the passenger car field across international markets.

Market growth remains exceedingly strong for HCVs, where fleet operators look for durable, load-bearing and impact-resistant suspension systems. HCVs differ in that the heavy payloads mean that gas pressurized shock absorbers must be designed packed with greater than normal tonnage to guarantee road performance and extended duty cycle before failure.

Adoption is driven by the growing need for fleet suspension durability, especially covering logistics, long-haul transport and off-road heavy-duty use. According to studies, 60% of commercial fleet operators spend in gas-charged shock absorbers to obtain vehicle uptime, maintenance cost, and road safety.

While HCV shock absorbers offer high-load resilience, extended durability, and road stability advantages, challenges for this segment include high operational costs, complex suspension calibration, and integration restrictions with legacy fleet models.

However, new advancements, such as AI-based fleet suspension analytics, automated damping control, and energy-efficient gas-charged shock absorber designs, will boost efficiency, cost benefits, and safety, helping the global heavy commercial vehicle (HCV) gas-charged shock absorber market continue its expansion.

There are several factors contributing to the growth of the Automotive Gas Charged Shock Absorber Market including advancements in vehicle suspension technology, increased demand for better ride quality and stability, and expansion of the automotive aftermarket industry.

While automakers, as well as component manufacturers, are emphasizing enhanced durability and performance, the market has been performing steadily. Some of the key trends that influence the industry are lightweight material adoption, adaptive suspension systems and incorporate smart shock absorber technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ZF Friedrichshafen AG | 12-16% |

| Tenneco Inc. | 10-14% |

| KYB Corporation | 8-12% |

| Gabriel India Ltd. | 6-10% |

| Hitachi Astemo, Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| ZF Friedrichshafen AG | Develops high-performance gas-charged shock absorbers with adaptive suspension technology. |

| Tenneco Inc. | Specializes in advanced shock absorber solutions, including electronic and semi-active damping systems. |

| KYB Corporation | Provides innovative gas-charged shock absorbers for both OEM and aftermarket applications. |

| Gabriel India Ltd. | Focuses on cost-effective, durable shock absorbers tailored for commercial and passenger vehicles. |

| Hitachi Astemo, Ltd. | Develops electronically controlled shock absorbers for improved driving stability and comfort. |

Key Company Insights

ZF Friedrichshafen AG (12-16%)

ZF leads in high-performance shock absorber technology, integrating adaptive and electronic suspension solutions.

Tenneco Inc. (10-14%)

Tenneco focuses on cutting-edge shock absorber innovations, enhancing ride comfort and handling performance.

KYB Corporation (8-12%)

KYB is a key provider of gas-charged shock absorbers, catering to both OEM and aftermarket demand with advanced damping technologies.

Gabriel India Ltd. (6-10%)

Gabriel India offers a broad portfolio of cost-efficient shock absorbers, ensuring durability and reliability for various vehicle segments.

Hitachi Astemo, Ltd. (4-8%)

Hitachi Astemo develops electronic and semi-active suspension solutions, improving vehicle handling and safety.

Other Key Players (45-55% Combined)

Several global and regional manufacturers contribute to the growing automotive gas-charged shock absorber market. These include:

The overall market size for the Automotive Gas Charged Shock Absorber market was USD 3.9 Billion in 2025.

The Automotive Gas Charged Shock Absorber market is expected to reach USD 6.4 Billion in 2035.

The demand for gas charged shock absorbers will be driven by the increasing production of passenger and commercial vehicles, rising demand for improved vehicle ride comfort and stability, and growing adoption of advanced suspension systems.

The top 5 countries driving the development of the Automotive Gas Charged Shock Absorber market are the USA, China, Germany, Japan, and India.

The Twin-Tube Shock Absorber segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Design Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Design Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Design Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Design Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Design Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Design Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Design Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Design Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Design Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Design Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Design Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Design Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Design Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Design Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Design Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Design Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA