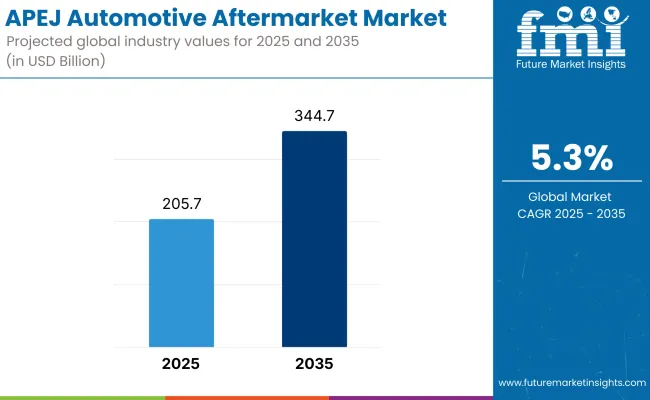

The Asia Pacific excluding Japan (APEJ) automotive aftermarket is expected to grow from USD 205.7 billion in 2025 to USD 344.7 billion by 2035. The market is poised to expand at a CAGR of 5.3% during the forecast period.

This growth is driven by increasing vehicle ownership, aging vehicle fleet, and rising demand for affordable, accessible repair and maintenance solutions. Countries such as India, Indonesia, Vietnam, and Thailand are seeing a surge in private and commercial vehicle use, fueling the need for replacement parts, diagnostic tools, tires, and lubricants.

As ride-hailing, delivery services, and commercial fleets expand, vehicle uptime becomes critical, further supporting the demand for frequent aftermarket servicing. This trend is accompanied by a growing consumer focus on preventive maintenance and cost-effective service alternatives outside authorized dealership networks.

Additionally, the market is undergoing rapid transformation due to the integration of digital platforms, new service formats, and supply chain localization. Leading companies are expanding their footprints through multi-brand workshops, digital service aggregators, and e-commerce platforms that offer both convenience and competitive pricing.

Brands like Bosch, Denso, and TVS Automotive Solutions are streamlining part distribution, introducing predictive diagnostics, and forming strategic alliances with local garages to boost aftermarket service quality and accessibility.

The rise of regional e-retailers and direct-to-garage models is making it easier for customers in remote areas to access genuine parts and standardized services. These developments are reshaping the aftermarket into a more formalized and organized sector, with improved transparency, reliability, and consumer trust across urban and rural markets.

Furthermore, the market is expected to benefit from regulatory changes, fleet electrification, and growing environmental compliance requirements. The rise of electric vehicles is prompting new demand for battery servicing, EV diagnostics, and thermal management components.

Government policies enforcing emission standards, safety inspections, and vehicle scrappage programs are boosting demand for compliant aftermarket components such as sensors, exhaust systems, and emission-control units. As vehicle technologies evolve and end-users seek safer, more sustainable mobility solutions, the APEJ automotive aftermarket is emerging as a key enabler of long-term vehicle performance, cost efficiency, and compliance across a rapidly changing transportation landscape.

The table below presents the annual growth rates of the APEJ Automotive Aftermarket market from 2025 to 2035.

With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 5.1% in H1-2024. In H2, the growth rate increases to CAGR of 5.3%.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.1% (2024 to 2034) |

| H2 2024 | 5.3% (2024 to 2034) |

| H1 2025 | 5.2% (2025 to 2035) |

| H2 2025 | 5.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly increase to 5.2% in the first half and relatively increase to 5.4% in the second half. In the first half (H1) and second half (H2), the sector saw a similar increase of 10 BPS.

The APEJ automotive aftermarket is segmented based on category, vehicle type, and region. By category, the market is segmented into parts, accessories, and services. Parts are further segmented into tires, batteries, filters, starters and alternators, lighting, exhaust components, spark plugs, lubricants, collision body, and wear & tear parts.

Accessories are segmented into interior and exterior. Services are further segmented into general automotive repair and automotive transmission. Based on vehicle type, the market is categorized into passenger cars and commercial vehicles. Regionally, the market is classified into China, India, South Korea, Australia and New Zealand, and the Rest of APEJ.

The parts segment is projected to be the fastest-growing category in the APEJ automotive aftermarket, expected to register a CAGR of 6.2% between 2025 and 2035. This growth is driven by the increasing vehicle park and a rising focus on timely repairs and maintenance. As vehicles age across countries like India, Indonesia, and Vietnam, demand for essential components such as brake pads, filters, suspension parts, and drive belts is rising significantly. The growth of independent garages and multi-brand service outlets is also making part replacement more accessible in both urban and rural markets.

The accessories segment continues to see steady demand, led by rising consumer interest in vehicle customization, infotainment upgrades, and interior enhancements. Meanwhile, the services category, including general automotive repair and transmission maintenance, is expanding rapidly as vehicle owners seek affordable alternatives to authorized dealerships, particularly for routine and mid-life servicing needs.

| Category | CAGR (2025 to 2035) |

|---|---|

| Parts | 6.2% |

The passenger cars segment is expected to be the fastest-growing vehicle type in the APEJ automotive aftermarket, projected to grow at a CAGR of 5.7% from 2025 to 2035. This segment’s expansion is supported by rising car ownership across developing countries, improving road infrastructure, and greater consumer preference for personal mobility. Compact and mid-sized cars, in particular, are contributing to increased consumption of tires, filters, spark plugs, and accessories in urban and suburban areas. Growing consumer awareness regarding fuel efficiency and engine longevity is also boosting demand for regular service and part replacements.

Commercial vehicles remain an essential component of the aftermarket, with their intensive usage driving high-frequency maintenance needs. Demand for products such as batteries, lubricants, and wear-and-tear parts remains strong in logistics, last-mile delivery, and public transport segments. Increasing vehicle uptime expectations are also driving growth in aftermarket services like general automotive repair and transmission system servicing.

| Vehicle Type | CAGR (2025 to 2035) |

|---|---|

| Passenger Cars | 5.7% |

Increased vehicle ownership in APEJ fueling the demand for regular maintenance and repair services

As vehicle ownership continues to rise across APEJ, the need for regular maintenance and repair services is becoming more critical. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle sales in Asia-Pacific have steadily increased, with China and India seeing significant growth in car ownership.

With more vehicles on the road, there is a growing demand for routine maintenance services like oil changes, brake repairs, and tire replacements.

The increase in vehicle ownership also means more vehicles require specialized repair services as they age. For example, in India, with over 250 million vehicles on the road, the demand for spare parts and repair services has grown considerably. As a result, service centers are busy keeping up with repairs, creating opportunities for the automotive aftermarket industry to expand and cater to these growing needs.

The growing focus on vehicle longevity and performance driving the need for quality replacement parts

In APEJ, vehicle owners are increasingly focused on improving vehicle longevity and performance. As vehicles age, the need for quality replacement parts becomes crucial to ensure smooth operation and prevent costly breakdowns. According to the Indian Ministry of Road Transport and Highways, the average age of vehicles in India has been rising, further increasing the demand for high-quality aftermarket parts.

Consumers now prioritize parts that enhance engine efficiency, fuel economy, and vehicle durability. For instance, a focus on high-performance filters, better lubricants, and durable suspension parts helps extend a vehicle’s lifespan. As the demand for long-lasting parts grows, suppliers are continuously developing products that provide better functionality. This trend highlights the need for specialized replacement parts, which supports the growth of the aftermarket services sector in the region.

The rise of electric vehicles in APEJ presents opportunities for specialized aftermarket parts and services

Electric vehicles (EVs) are gaining significant traction across APEJ, creating a new and exciting opportunity for specialized aftermarket parts and services. According to the China Association of Automobile Manufacturers (CAAM), China's EV sales have surged, with electric vehicles accounting for a substantial portion of total car sales. This shift presents unique opportunities for companies that provide EV-specific services such as battery replacement, electric motor repairs, and charging infrastructure.

As more consumers embrace EVs, demand for related aftermarket services will rise. For example, battery maintenance and replacement will become critical as EV ownership increases. Companies focusing on EV-specific parts, such as charging stations, battery packs, and specialized tire types, will see growing demand for their products and services. This transition to electric mobility opens a new sector within the automotive aftermarket in APEJ, helping to shape the future of vehicle ownership in the region.

Integration of advanced diagnostics tools in workshops enhancing the efficiency of vehicle repairs

The integration of advanced diagnostic tools in workshops is improving the efficiency and accuracy of vehicle repairs across APEJ. Tools like computer-based diagnostic systems and advanced scan tools enable service centers to identify and address vehicle issues more quickly.

For example, in countries like South Korea, workshops are increasingly using digital platforms to diagnose engine malfunctions and electrical system issues, reducing repair time and improving customer satisfaction.

These tools not only speed up the repair process but also help service providers perform repairs with greater precision. With vehicles becoming more complex, diagnostic tools provide real-time data, allowing technicians to identify problems earlier and offer solutions more effectively. This innovation has made automotive workshops in APEJ more efficient and capable of handling the growing volume of vehicle repairs and maintenance requests.

The rapid pace of technological advancements is challenging service providers to keep up with complex repairs

The rapid pace of technological advancements in vehicles is creating challenges for service providers in APEJ. As cars become more sophisticated with features like autonomous driving systems, hybrid engines, and advanced safety mechanisms, repair shops are finding it difficult to keep up with the complexities of modern vehicles. For example, vehicles now include complex software that controls engine management, braking systems, and even suspension adjustments.

Technicians need continuous training to understand and repair these advanced systems, which often require specialized tools and equipment. The Indian Automotive Service Providers Association (IASPA) reports that many service centers struggle to find skilled labor capable of handling high-tech systems. As these technologies continue to evolve, service providers must invest in upskilling their workforce and upgrading their equipment to remain competitive in the changing landscape of automotive repairs in APEJ.

The Automotive Aftermarket recorded a CAGR of 4.5% during the historical period between 2020 and 2024. The growth of Automotive Aftermarket was positive as it reached a value of USD 195.3 billion in 2024 from USD 162.5 billion in 2020.

From 2020 to 2024, the demand for automotive parts and services in APEJ grew steadily as vehicle ownership increased and the number of older cars on the road rose. More cars meant higher demand for replacement parts like tires, batteries, filters, and exhaust components. Services such as general repairs, maintenance, and transmission work also saw growth.

In countries like India and China, more people bought vehicles, leading to a rise in the need for affordable, quality parts and services. The improvement in living standards also led to higher spending on car upgrades and accessories.

Looking ahead to 2025 to 2035, the rise of electric vehicles will bring new opportunities for the automotive sector in APEJ. Electric cars require specialized parts like batteries, electric motors, and charging equipment. As vehicles become more connected and autonomous, there will be a growing need for advanced diagnostic tools and expert repair services. Workshops will need to adopt new technologies and provide more training for technicians to keep up with these changes.

Over time, there will be a stronger demand for eco-friendly and lightweight parts, as concerns about the environment continue to grow and governments introduce stricter rules.

Tier-1 companies account for around 20-30% of the overall market with a product revenue from the Automotive Aftermarket market of more than USD 100 million. The Tier-1 manufacturers like Firestone, Pep Boys, Autoliv, Midas and other players would have prominent share in the market.

Tier-2 and Local Players and other companies such Advance Auto Parts, Napa Auto Parts and other players are projected to account for 70-80% of the overall market with the estimated revenue under the range of USD 100 million through the sales of Automotive Aftermarket.

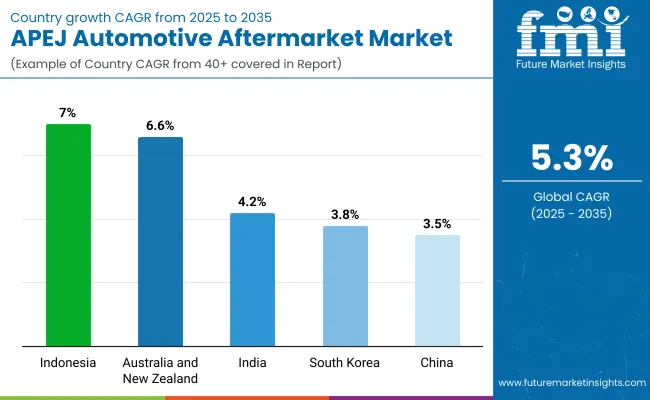

The section below covers the industry analysis for APEJ Automotive Aftermarket in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Indonesia | 7.0% |

| Australia and New Zealand | 6.6% |

| India | 4.2% |

| South Korea | 3.8% |

| China | 3.5% |

The Automotive Aftermarket in China is projected to reach USD 120.7 billion and is estimated to grow at a 3.5% CAGR by 2035.

China's automotive repair and service network has seen rapid expansion in recent years, supporting the growth of aftermarket parts and services. The increasing number of service centers, repair shops, and auto part retailers across the country has made it easier for vehicle owners to access necessary repairs and replacements. With the rise of digital platforms, consumers can now easily find service providers, compare prices, and get parts delivered, driving convenience and accessibility. This network expansion is particularly important in tier-2 and tier-3 cities, where vehicle ownership has been growing steadily.

The availability of low-cost parts and services is encouraging more people to maintain their vehicles and extend their lifespan, contributing to higher demand for tires, batteries, filters, and other common aftermarket products. As the vehicle park grows and older vehicles stay on the road longer, the demand for regular maintenance, parts, and repairs will continue to rise.

The demand in India for Automotive Aftermarket is projected to reach USD 62.1 billion by 2035 and is predicted to grow at an 4.2% CAGR.

India's automotive sector has seen a surge in vehicle sales, making it one of the fastest-growing automotive hubs. In 2023, the country witnessed a substantial rise in vehicle ownership, with millions of new cars joining the roads. As the vehicle fleet grows, the need for replacement parts, repairs, and vehicle accessories expands. The increasing availability of affordable aftermarket parts, combined with the growing number of service centers, has made vehicle maintenance more accessible to a wide range of consumers.

Moreover, the rise in commercial vehicle sales, driven by the expansion of e-commerce and logistics, has further increased the demand for reliable parts and services. India's focus on developing its infrastructure, such as improved road networks and increased investments in transportation, supports the growing need for automotive aftermarket solutions.

The Automotive Aftermarket in the Germany is projected to reach USD 82.5 billion and grow at a CAGR of 3.8% by 2035.

South Korea’s rapid adoption of new technologies in the automotive sector has created a steady demand for aftermarket products. As one of the leading countries in automotive innovation, South Korea has a high vehicle ownership rate, with millions of vehicles on the road that require regular maintenance and parts replacement. The rise in demand for advanced vehicle components such as sensors, electric vehicle parts, and high-tech accessories reflects the country’s shift toward more technologically sophisticated vehicles.

Companies like Hyundai and Kia are leading the charge in producing vehicles that need specialized parts, and as these brands gain popularity globally, so does the demand for aftermarket products. With an increasing number of consumers opting for vehicle upgrades and customization, the demand for performance parts and accessories is expected to grow, further fueling the aftermarket sector in South Korea.

Advancements in technology are transforming the automotive aftermarket in the APEJ region. Workshops are embracing sophisticated diagnostic tools powered by AI and IoT, allowing for more accurate and efficient vehicle repairs.

As electric vehicles become more common, there is a rising demand for specialized parts, such as batteries and charging systems. Components like tires, spark plugs, and exhaust systems are being made with lightweight, durable materials, contributing to better vehicle performance and longevity. The increasing integration of connected vehicle technologies is also driving the need for smart parts and remote diagnostics, further shaping the region's automotive aftermarket landscape.

Recent Industry Developments:

The Automotive Aftermarket was valued at USD 195.3 billion in 2024.

The demand for Automotive Aftermarket is set to reach USD 205.7 billion in 2025.

Growing interest in vehicle customization, expansion of repair services, rising demand for electric vehicle parts, and increased government regulations will drive APEJ automotive aftermarket growth.

The Automotive Aftermarket demand is projected to reach USD 344.7 billion by 2035.

Automotive Parts is expected to lead during the forecast period.

Table 1: Market Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Market Value (US$ million) Forecast by Category, 2017 to 2033

Table 3: Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 4: Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 5: Market Value (US$ million) Forecast by Category, 2017 to 2033

Table 6: Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Figure 1: Market Value (US$ million) by Category, 2023 to 2033

Figure 2: Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 3: Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Market Value (US$ million) Analysis by Region, 2017 to 2033

Figure 5: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Market Value (US$ million) Analysis by Category, 2017 to 2033

Figure 8: Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 9: Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 10: Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 11: Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 13: Market Attractiveness by Category, 2023 to 2033

Figure 14: Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 15: Market Attractiveness by Region, 2023 to 2033

Figure 16: Market Value (US$ million) by Category, 2023 to 2033

Figure 17: Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 18: Market Value (US$ million) by Country, 2023 to 2033

Figure 19: Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 20: Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: Market Value (US$ million) Analysis by Category, 2017 to 2033

Figure 23: Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 24: Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 25: Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 26: Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 27: Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 28: Market Attractiveness by Category, 2023 to 2033

Figure 29: Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 30: Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Coolant Aftermarket Growth - Trends & Forecast 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Wheel Bearing Aftermarket Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Wheel Hub Bearing Aftermarket Analysis by Product Type, Inner Diameter, Vehicle Type, Sales Channel, and Region Forecast through 2035

Automotive Exhaust Components Aftermarket Market

Automotive Bearing and Clutch Component Aftermarket Size and Share Forecast Outlook 2025 to 2035

APAC Automotive Bearing Market Growth – Trends & Forecast 2022-2032

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA