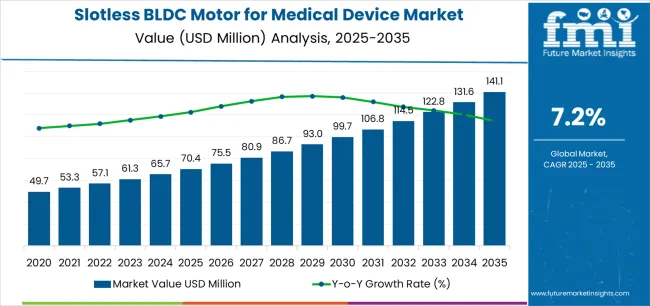

The global slotless BLDC motor for medical device market is valued at USD 70.4 million in 2025. It is slated to reach USD 141.1 million by 2035, recording an absolute increase of USD 70.7 million over the forecast period. This translates into a total growth of 100.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.2% between 2025 and 2035. The overall market size is expected to grow by nearly 2.0X during the same period, supported by increasing demand for precision medical equipment, growing adoption of minimally invasive surgical procedures, and rising emphasis on compact and efficient motor solutions across diverse medical device applications.

Medical device manufacturers are increasingly integrating slotless BLDC motors into ventilators, surgical robots, infusion pumps, and medical imaging equipment. These motors offer superior performance characteristics including reduced electromagnetic interference, minimal cogging torque, and enhanced precision control compared to conventional slotted motor designs. The absence of iron teeth in the stator construction eliminates cogging effects and enables smooth operation at low speeds, making slotless BLDC motors particularly suitable for sensitive medical applications requiring precise positioning and quiet operation.

The medical device industry continues to advance toward more sophisticated equipment designs that demand higher performance standards and compact form factors. Slotless BLDC motors address these requirements through their inherent design advantages, including improved efficiency, reduced acoustic noise, and minimal electromagnetic emissions that could interfere with sensitive medical instrumentation. The growing prevalence of chronic diseases requiring continuous medical monitoring and treatment is driving demand for reliable and precise motor solutions in portable and implantable medical devices.

Regulatory frameworks governing medical device manufacturing are becoming increasingly stringent, requiring comprehensive documentation of component reliability and performance characteristics. Slotless BLDC motors from established manufacturers typically come with extensive testing data and quality certifications that facilitate regulatory approval processes for medical device companies. This factor, combined with the motors' proven reliability in critical applications, supports their adoption across various medical device categories.

Between 2025 and 2030, the slotless BLDC motor for medical device market is projected to expand from USD 70.4 million to USD 99.0 million, resulting in a value increase of USD 28.6 million, which represents 40.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of robotic surgical systems, rising demand for portable medical devices, and growing emphasis on energy-efficient motor solutions in battery-powered medical equipment. Medical device manufacturers are expanding their slotless BLDC motor integration capabilities to address the growing demand for precision motion control solutions that ensure operational reliability and compliance with medical safety standards.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 70.4 million |

| Forecast Value in (2035F) | USD 141.1 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

From 2030 to 2035, the market is forecast to grow from USD 99.0 million to USD 141.1 million, adding another USD 42.1 million, which constitutes 59.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence integration in medical devices, the development of next-generation minimally invasive surgical platforms, and the growth of telemedicine applications requiring compact and reliable motor solutions. The growing adoption of smart medical devices with advanced sensing and control capabilities will drive demand for slotless BLDC motors with integrated feedback systems and precise motion control features.

Between 2020 and 2025, the slotless BLDC motor for medical device market experienced steady growth, driven by increasing surgical automation and growing recognition of slotless motor technology as essential for achieving superior performance in precision medical applications. The market developed as medical device engineers recognized the potential for slotless BLDC motors to eliminate cogging torque, reduce electromagnetic interference, and provide smooth operation across wide speed ranges while meeting stringent medical device requirements. Technological advancement in motor miniaturization and control electronics began emphasizing the critical importance of maintaining precise motion control and reliable operation in demanding medical environments.

Market expansion is being supported by the increasing global demand for advanced surgical robots and minimally invasive procedures driven by patient safety concerns and hospital efficiency requirements, alongside the corresponding need for precision motor solutions that can deliver smooth motion control, eliminate position errors, and maintain operational reliability across various ventilator, surgical, diagnostic, and therapeutic applications. Modern medical device manufacturers are increasingly focused on implementing slotless BLDC motor solutions that can reduce system noise, enhance positioning accuracy, and provide consistent performance in critical care environments.

The growing emphasis on patient comfort and treatment effectiveness is driving demand for slotless BLDC motors that can support quiet operation, enable precise drug delivery, and ensure comprehensive system reliability. Medical device manufacturers' preference for motor technologies that combine performance excellence with compact design and energy efficiency is creating opportunities for innovative slotless BLDC motor implementations. The rising influence of portable medical devices and home healthcare applications is also contributing to increased adoption of slotless BLDC motors that can provide superior performance characteristics without compromising battery life or operational convenience.

The expansion of surgical robotics represents a major growth driver for the slotless BLDC motor market. Robotic surgical systems require multiple precision motors to control instrument positioning, camera movement, and mechanical arm articulation. Slotless BLDC motors offer the smooth motion and precise control necessary for delicate surgical procedures where even minor vibrations or positioning errors could compromise patient outcomes. Leading surgical robot manufacturers specify slotless designs specifically to eliminate cogging torque that could cause jerky movements during critical procedures.

Ventilator applications continue to drive significant demand for slotless BLDC motors, particularly following increased focus on respiratory care equipment reliability. Modern ventilators utilize these motors in blower assemblies where consistent air delivery, quiet operation, and long-term reliability are essential requirements. The absence of cogging effects enables smooth airflow control across varying pressure and volume settings, while the motors' inherent efficiency supports extended operation in critical care scenarios. Medical equipment standards require ventilator components to demonstrate exceptional reliability, making the proven performance of slotless BLDC motors particularly valuable.

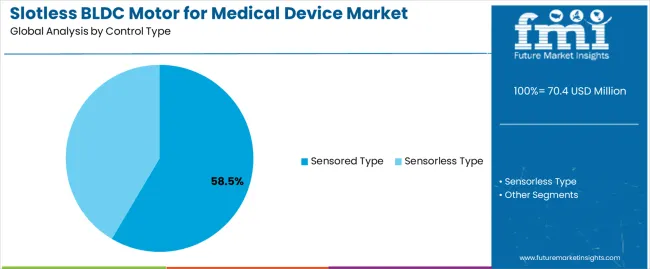

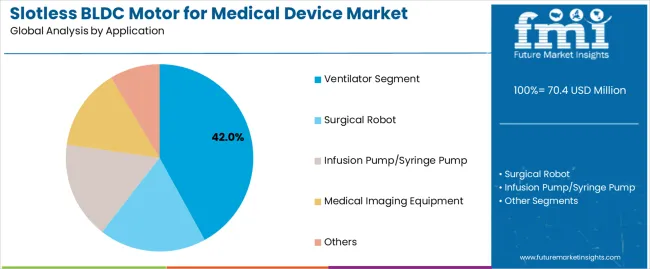

The market is segmented by control type, application, and region. By control type, the market is divided into sensored type and sensorless type. Based on application, the market is categorized into ventilator, surgical robot, infusion pump/syringe pump, medical imaging equipment, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

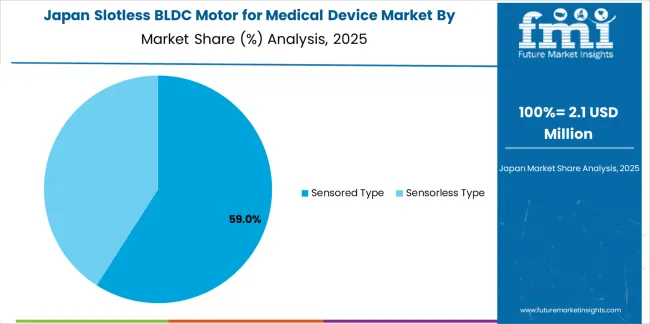

The sensored type segment is projected to maintain its leading position in the slotless BLDC motor for medical device market in 2025 with a 58.5% market share, reaffirming its role as the preferred control configuration for precision medical applications requiring accurate position feedback and reliable motion control. Medical device manufacturers increasingly utilize sensored slotless BLDC motors for their superior control accuracy, predictable startup behavior, and proven effectiveness in maintaining precise positioning while ensuring operational reliability across diverse medical equipment categories. Sensored motor technology's proven effectiveness and control precision directly address the industry requirements for accurate motion control and consistent performance across diverse medical device platforms and application scenarios.

This control type forms the foundation of modern precision medical equipment, as it represents the motor configuration with the greatest contribution to positioning accuracy and established performance record across multiple medical device applications and equipment categories. Medical device industry investments in advanced surgical systems and diagnostic equipment continue to strengthen adoption among device manufacturers and system integrators. With regulatory requirements demanding precise motion control and documented reliability, sensored slotless BLDC motors align with both safety objectives and performance requirements, making them the central component of comprehensive medical device motion control strategies.

The integration of Hall effect sensors or encoders in sensored slotless BLDC motors provides real-time rotor position information that enables precise control algorithms and ensures predictable motor behavior. This feedback capability proves essential in applications such as infusion pumps where medication delivery rates must be maintained within narrow tolerances, or surgical robots where instrument positioning accuracy directly impacts procedure outcomes. Medical device designers specify sensored configurations when application requirements prioritize control precision over system cost considerations.

The ventilator application segment is projected to represent the largest share of slotless BLDC motor demand in 2025 with a 42.0% market share, underscoring its critical role as the primary driver for slotless BLDC motor adoption across intensive care ventilators, portable ventilators, and home respiratory care equipment. Ventilator manufacturers prefer slotless BLDC motors for blower assemblies due to their exceptional smoothness characteristics, quiet operation benefits, and ability to deliver consistent airflow while supporting reliability objectives and regulatory compliance. Positioned as essential components for modern ventilator systems, slotless BLDC motors offer both performance advantages and operational benefits.

The segment is supported by continuous innovation in respiratory care technology and the growing availability of advanced motor designs that enable superior ventilator performance with enhanced reliability and reduced acoustic emissions. Ventilator manufacturers are investing in comprehensive motor integration programs to support increasingly stringent medical device regulations and patient comfort requirements for respiratory care solutions. As healthcare facilities prioritize equipment reliability and home healthcare applications expand, the ventilator application will continue to dominate the market while supporting advanced motor utilization and respiratory care equipment optimization strategies.

Ventilator blower systems demand motors that can operate continuously for extended periods while maintaining precise airflow control across varying pressure settings. Slotless BLDC motors meet these requirements through their inherent design characteristics, including reduced mechanical stress from eliminated cogging forces and improved thermal management from uniform current distribution. The motors' low acoustic noise output proves particularly important in intensive care and home settings where patient rest and recovery depend partly on minimizing environmental disturbances.

The slotless BLDC motor for medical device market is advancing steadily due to increasing demand for precision surgical equipment driven by minimally invasive procedure adoption and growing utilization of robotic systems that require specialized motor technologies providing enhanced motion control characteristics and reliability benefits across diverse surgical, diagnostic, respiratory, and therapeutic applications. The market faces challenges, including higher manufacturing costs compared to slotted motor designs, limited availability of specialized design expertise, and supply chain constraints related to precision component sourcing and production capacity limitations. Innovation in miniaturization technologies and integrated control electronics continues to influence product development and market expansion patterns.

The growing adoption of robotic surgical systems is driving demand for specialized motor solutions that address unique performance requirements including precise instrument positioning, smooth motion at low speeds, and reliable operation during extended surgical procedures. Robotic surgery platforms require advanced slotless BLDC motors that deliver superior control accuracy across multiple degrees of freedom while maintaining compact form factors and electromagnetic compatibility. Medical device manufacturers are increasingly recognizing the competitive advantages of slotless motor integration for surgical robot development and market differentiation, creating opportunities for innovative motor designs specifically optimized for next-generation surgical applications.

Modern slotless BLDC motor manufacturers are incorporating advanced position sensing technologies and intelligent control electronics to enhance motion precision, enable predictive maintenance capabilities, and support comprehensive performance monitoring through integrated feedback systems and digital communication interfaces. Leading manufacturers are developing motors with integrated encoders, implementing sophisticated commutation algorithms, and advancing control technologies that maximize positioning accuracy and operational efficiency. These technologies improve application performance while enabling new market opportunities, including smart infusion systems, adaptive ventilators, and autonomous diagnostic equipment. Advanced sensing integration also allows manufacturers to support comprehensive device validation requirements and regulatory compliance objectives beyond traditional motor performance specifications.

The expansion of home healthcare applications, portable diagnostic equipment, and implantable medical devices is driving demand for ultra-compact slotless BLDC motors with precisely controlled performance characteristics and exceptional power density. These advanced applications require specialized motor designs with stringent size limitations and battery efficiency requirements that exceed traditional medical equipment specifications, creating premium market segments with differentiated value propositions. Manufacturers are investing in advanced miniaturization capabilities and specialized winding techniques to serve emerging portable and implantable applications while supporting innovation in wearable medical devices and remote patient monitoring systems.

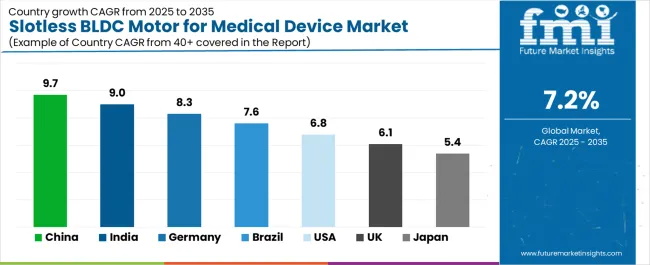

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| Brazil | 7.6% |

| United States | 6.8% |

| United Kingdom | 6.1% |

| Japan | 5.4% |

The slotless BLDC motor for medical device market is experiencing solid growth globally, with China leading at a 9.7% CAGR through 2035, driven by expanding medical device manufacturing capacity, growing domestic healthcare infrastructure, and increasing adoption of advanced surgical systems in major hospital networks. India follows at 9.0%, supported by rising medical tourism, expanding private healthcare sector, and growing investment in medical device manufacturing under government initiatives.

Germany shows growth at 8.3%, emphasizing precision medical technology development, surgical equipment innovation, and advanced manufacturing capabilities for high-specification motor solutions. Brazil demonstrates 7.6% growth, supported by expanding healthcare access, growing medical device imports, and increasing local manufacturing of respiratory care equipment.

The United States records 6.8%, focusing on surgical robotics leadership, advanced medical device innovation, and comprehensive regulatory frameworks supporting motor technology development. The United Kingdom exhibits 6.1% growth, emphasizing medical technology innovation and precision engineering capabilities. Japan shows 5.4% growth, emphasizing ultra-precision motor manufacturing and advanced medical equipment development.

The report covers an in-depth analysis of 40 countries, with top-performing countries highlighted below.

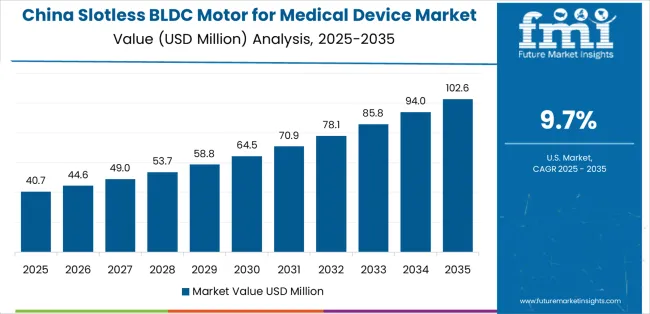

Revenue from slotless BLDC motor for medical device in China is projected to exhibit exceptional growth with a CAGR of 9.7% through 2035, driven by expanding medical device manufacturing capacity and rapidly growing healthcare infrastructure supported by government initiatives promoting domestic medical equipment production and hospital modernization programs. The country's massive healthcare sector expansion and increasing investment in advanced medical technologies are creating substantial demand for precision motor solutions. Major medical device manufacturers and international motor companies are establishing comprehensive production capabilities to serve both domestic markets and export opportunities.

Demand for slotless BLDC motor for medical device in India is expanding at a CAGR of 9.0%, supported by the country's growing medical tourism industry, expanding private healthcare sector, and increasing investment in domestic medical device manufacturing under Make in India initiatives. The country's comprehensive healthcare expansion and technological advancement are driving sophisticated motor integration capabilities throughout diverse medical equipment sectors. Leading medical device manufacturers and international companies are establishing extensive production and innovation facilities to address growing domestic and export demand.

Revenue from slotless BLDC motor for medical device in Germany is projected to grow at a CAGR of 8.3%, driven by the country's leadership in precision medical technology, established medical device manufacturing excellence, and strong emphasis on innovation in surgical equipment and diagnostic systems. Germany's automotive excellence and chemical industry leadership are driving sophisticated silica capabilities throughout industrial sectors. Leading medical device manufacturers and motor specialists are establishing comprehensive innovation programs for next-generation motor technologies.

Demand for slotless BLDC motor for medical device in Brazil is anticipated to expand at a CAGR of 7.6%, supported by the country's focus on healthcare access expansion, growing medical device imports, and increasing local manufacturing of respiratory care equipment. The nation's comprehensive healthcare development and medical equipment modernization are driving demand for reliable motor solutions. Medical device distributors and local manufacturers are investing in supply chain development and production capabilities to serve both public and private healthcare sectors.

Revenue from slotless BLDC motor for medical device in the United States is forecasted to grow at a CAGR of 6.8%, supported by the country's focus on surgical robotics development, established medical device industry, and growing emphasis on minimally invasive surgical procedures. The nation's comprehensive medical technology sector and innovation leadership are driving demand for sophisticated motor solutions. Medical device manufacturers and motor specialists are investing in production capacity expansion and technology development to serve both domestic and export markets.

Demand for slotless BLDC motor for medical device in the United Kingdom is expanding at a CAGR of 6.1%, driven by the country's medical technology innovation capabilities, precision engineering expertise, and established medical device sector supporting advanced motor development for specialized medical applications. The United Kingdom's medical technology excellence and engineering tradition are driving sophisticated motor capabilities throughout medical device sectors. Leading medical equipment manufacturers and motor specialists are establishing comprehensive innovation programs for next-generation motor technologies.

Revenue from slotless BLDC motor for medical device in Japan is growing at a CAGR of 5.4%, supported by the country's leadership in precision motor manufacturing, advanced medical equipment production, and strong emphasis on ultra-high-specification motors for sophisticated medical applications. Japan's technological sophistication and quality excellence are driving demand for premium slotless BLDC motor products. Leading motor manufacturers and medical device companies are investing in specialized capabilities for advanced medical motor applications.

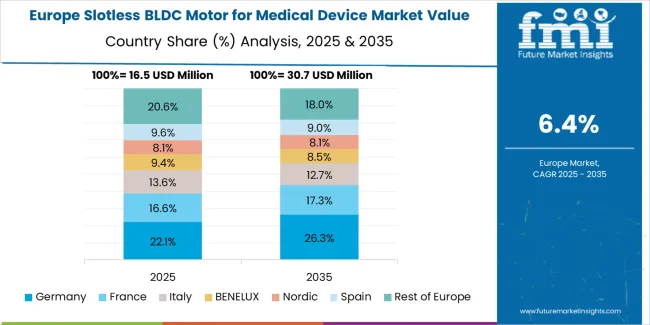

The slotless BLDC motor for medical device market in Europe is projected to grow from USD 15.8 million in 2025 to USD 28.6 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain leadership with a 32.5% market share in 2025, moderating to 31.8% by 2035, supported by precision medical device manufacturing, surgical equipment innovation, and strong export-oriented capabilities.

France follows with 18.2% in 2025, projected at 18.5% by 2035, driven by medical technology development, surgical robotics advancement, and specialized motor applications in respiratory care equipment. The United Kingdom holds 16.4% in 2025, inching up to 16.7% by 2035 on the back of medical device innovation and precision engineering expertise. Italy commands 12.8% in 2025, rising slightly to 13.0% by 2035, while Switzerland accounts for 9.6% in 2025, reaching 9.8% by 2035 aided by precision medical technology and pharmaceutical equipment applications. The Netherlands maintains 4.3% in 2025, up to 4.4% by 2035 due to medical device distribution networks and healthcare technology integration. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 6.2% in 2025 and 5.8% by 2035, reflecting steady development in medical equipment manufacturing and healthcare infrastructure modernization.

The slotless BLDC motor for medical device market is characterized by competition among established precision motor manufacturers, specialized medical motor suppliers, and diversified motion control companies. Companies are investing in miniaturization technology development, integrated sensing solutions, product portfolio expansion, and application-specific motor designs to deliver high-performance, reliable, and compact motor solutions. Innovation in advanced winding techniques, integrated control electronics, and specialized feedback systems is central to strengthening market position and competitive advantage.

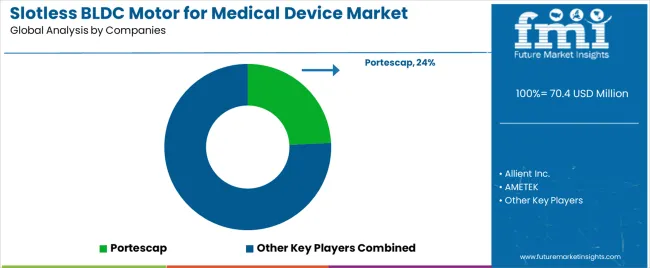

Portescap leads the market with a 24.2% share, offering comprehensive slotless motor solutions with a focus on medical applications, compact designs, and precision motion control across diverse surgical, diagnostic, and therapeutic equipment. The company provides specialized motor platforms designed specifically for medical device requirements with extensive regulatory documentation and application support. Allient Inc. provides innovative motor solutions with emphasis on custom designs and application engineering support for specialized medical equipment manufacturers.

AMETEK delivers high-performance motor products with focus on precision applications and quality manufacturing. Maxon Motor offers advanced motor technologies with comprehensive product lines serving medical robotics and surgical equipment applications. FAULHABER provides specialized miniature motors with emphasis on precision positioning and compact form factors. Moons' Industries specializes in motion control solutions with expanding medical device capabilities. Constar Micromotor focuses on compact motor designs for medical applications. Elinco International and JPC Inc. offer specialized motor solutions for specific medical equipment categories. Fulling Motor emphasizes cost-effective motor designs, while Topband Motor provides comprehensive motor solutions serving diverse market segments.

Slotless BLDC motors represent a specialized precision component segment within medical device applications, projected to grow from USD 70.4 million in 2025 to USD 141.1 million by 2035 at a 7.2% CAGR. These high-performance motor products serve as critical motion control components in ventilators, surgical robots, infusion pumps, medical imaging equipment, and therapeutic devices where smooth operation, positioning precision, and electromagnetic compatibility are essential. Market expansion is driven by increasing surgical robotics adoption, growing demand for portable medical devices, expanding respiratory care equipment requirements, and rising emphasis on precision motion control across diverse medical equipment applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 70.4 million |

| Control Type | Sensored Type, Sensorless Type |

| Application | Ventilator, Surgical Robot, Infusion Pump/Syringe Pump, Medical Imaging Equipment, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Portescap, Allient Inc., AMETEK, Maxon Motor, FAULHABER, Moons' Industries |

| Additional Attributes | Dollar sales by control type and application category, regional demand trends, competitive landscape, technological advancements in motor design, miniaturization development, sensing integration, and medical application optimization |

The global slotless BLDC motor for medical device market is estimated to be valued at USD 70.4 million in 2025.

The market size for the slotless BLDC motor for medical device market is projected to reach USD 141.1 million by 2035.

The slotless BLDC motor for medical device market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in slotless BLDC motor for medical device market are sensored type and sensorless type.

In terms of application, ventilator segment segment to command 42.0% share in the slotless BLDC motor for medical device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slotless BLDC Motor for Industrial Robots Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA