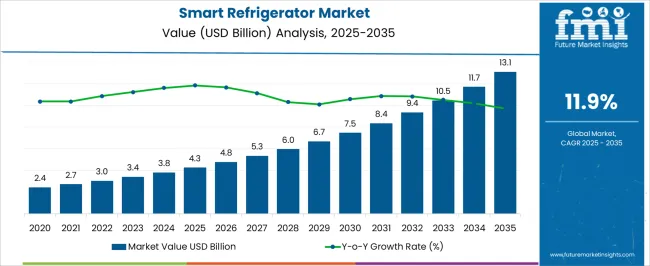

The Smart Refrigerator Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 11.9% over the forecast period. The adoption lifecycle demonstrates an initial period of gradual acceptance, driven by tech-savvy consumers and early adopters seeking connectivity, energy efficiency, and intelligent food management features.

From 2025 to 2027, the market grows moderately from USD 4.3 billion to USD 5.3 billion, reflecting early adopter penetration, while manufacturers refine functionalities, enhance IoT integration, and optimize user experience to drive broader acceptance. Between 2028 and 2032, the market experiences accelerated adoption, rising from USD 6.0 billion to USD 9.4 billion, indicative of the transition into the early majority stage. During this period, increased consumer awareness, declining costs of smart technologies, and integration with smart home ecosystems enhance market penetration.

By 2033 to 2035, with values approaching USD 13.1 billion, the market enters the late majority phase, characterized by widespread consumer familiarity and mainstream adoption, supported by improved connectivity standards, predictive maintenance features, and interoperability with household appliances. The market exhibits a typical S-curve, beginning with niche early adoption, transitioning to rapid growth through mainstream acceptance, and moving toward maturity as technological innovations stabilize and consumer adoption saturates. Strategic focus on feature differentiation, ecosystem integration, and affordability will determine competitive positioning and sustained market expansion.

| Metric | Value |

|---|---|

| Smart Refrigerator Market Estimated Value in (2025 E) | USD 4.3 billion |

| Smart Refrigerator Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 11.9% |

The smart refrigerator market is advancing steadily due to increased integration of IoT-enabled features, energy-efficient cooling systems, and consumer preference for connected appliances. As smart homes become more prevalent, smart refrigerators are evolving into multifunctional devices that offer real-time inventory management, predictive maintenance alerts, and personalized user interfaces. These innovations have been supported by enhanced sensor technologies and AI-based food management systems that optimize energy consumption while improving user convenience.

Additionally, growing awareness around sustainability and government regulations encouraging the use of energy-efficient appliances have encouraged both consumers and manufacturers to transition toward smart alternatives. Voice assistant integration, touchscreen displays, and Wi-Fi connectivity are becoming standard features in mid-range and premium models, further accelerating market penetration.

The market is also benefiting from rising disposable incomes and rapid urbanization in emerging economies, which is increasing the demand for technologically advanced home appliances Over the coming years, growth will be further fueled by strategic collaborations between electronics companies and cloud service providers aimed at enhancing interoperability across smart home ecosystems.

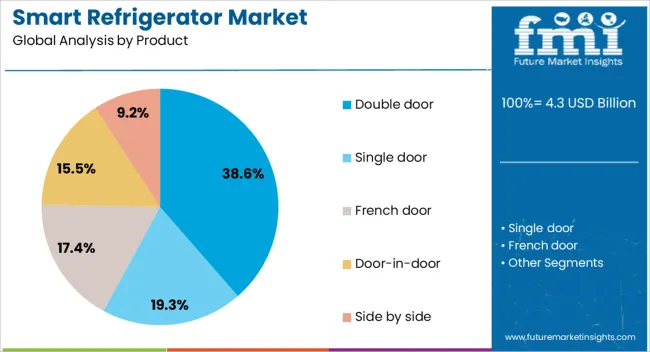

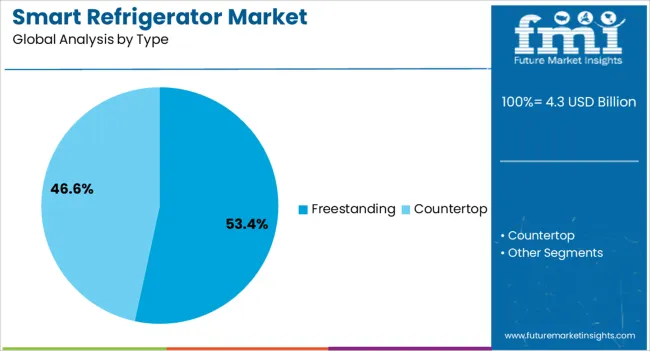

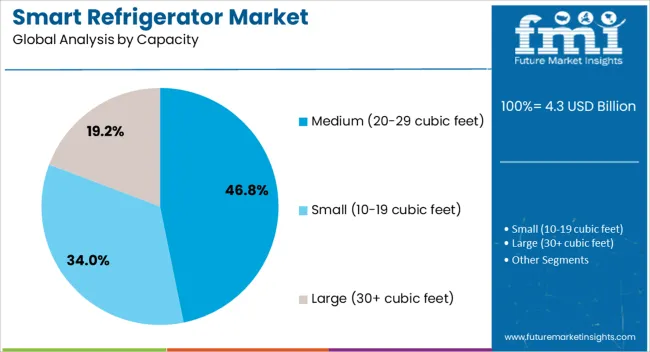

The smart refrigerator market is segmented by product, type, capacity, end user, distribution channel, and geographic regions. By product, the smart refrigerator market is divided into double-door, single-door, French door, Door-in-door, and side-by-side. In terms of type, the smart refrigerator market is classified into Freestanding and Countertop. Based on capacity, the smart refrigerator market is segmented into Medium (20-29 cubic feet), Small (10-19 cubic feet), and Large (30+ cubic feet). By end user, the smart refrigerator market is segmented into Residential and Commercial. By distribution channel, the smart refrigerator market is segmented into Online and Offline. Regionally, the smart refrigerator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The double door product segment is anticipated to hold 38.6% of the smart refrigerator market revenue share in 2025, reflecting its broad appeal among mid to large-sized households. This dominance is being driven by its balanced design that offers separate compartments for refrigeration and freezing, catering to diverse storage needs. The format supports enhanced organization and reduces energy loss by limiting the frequency of full-door openings.

Manufacturers have increasingly incorporated smart features such as humidity control, touch panels, and adaptive defrosting into double door models, making them a preferred choice for tech-savvy consumers. The segment's adoption has been further influenced by the availability of mid-capacity configurations that suit urban homes without occupying excessive kitchen space.

As more consumers seek appliances that offer a blend of efficiency, technology, and space optimization, the double door configuration is being positioned as a practical solution with embedded AI features. The growing focus on remote temperature monitoring and smart diagnostics has also supported its leading position in the product category.

The freestanding type segment is expected to account for 53.4% of the total revenue share in the smart refrigerator market in 2025, indicating its dominance in terms of installation preference. The popularity of freestanding models has been attributed to their ease of installation, flexibility in placement, and lower upfront cost compared to built-in alternatives. These models are widely adopted across residential settings, especially in urban environments where kitchen layouts often demand versatile appliance placement.

The segment’s growth has been reinforced by the integration of advanced features such as smart alerts, door-in-door storage, and Wi-Fi-enabled control panels that cater to a wide demographic of consumers. Freestanding smart refrigerators have also gained traction due to their compatibility with modular kitchens and standardized dimensions that simplify purchase decisions.

Manufacturers are increasingly introducing freestanding variants with sophisticated sensors and AI algorithms that adjust cooling based on food type and usage patterns. As smart appliance adoption grows, freestanding models are expected to remain the preferred choice among first-time buyers and retrofit consumers.

The medium capacity segment, defined as models with a storage range between 20 and 29 cubic feet, is projected to capture 46.8% of the revenue share in the smart refrigerator market in 2025. This segment’s leading position is driven by its ideal balance between storage volume and spatial efficiency, making it suitable for most average-sized households.

Consumers have favored medium capacity refrigerators due to their ability to accommodate daily grocery needs without consuming excessive kitchen space. The integration of smart technologies such as inventory tracking, AI-powered freshness management, and energy usage reporting has been heavily concentrated in this capacity range, as it aligns with mass-market demand.

Manufacturers are also targeting this segment with mid-premium offerings that combine affordability with feature richness, including app connectivity and voice assistant integration As consumer behavior shifts toward healthier eating and bulk grocery storage, medium capacity smart refrigerators are positioned to deliver optimal value in terms of functionality, smart features, and energy performance, ensuring sustained market leadership.

The market has been expanding due to growing demand for connected, energy-efficient, and feature-rich refrigeration solutions in households, commercial kitchens, and foodservice sectors. Smart refrigerators have been valued for their ability to monitor temperature, track inventory, and integrate with IoT ecosystems for remote management. Market growth has been reinforced by technological innovations such as touchscreen interfaces, AI-assisted food management, and energy optimization. Rising consumer awareness, adoption of smart home systems, and demand for convenient, sustainable refrigeration solutions have further strengthened market demand globally.

The market has been primarily driven by rising integration of connected appliances in smart homes. Refrigerators equipped with Wi-Fi connectivity, AI-powered inventory tracking, and remote control features have allowed users to monitor food freshness, set temperature zones, and receive notifications for restocking. Demand has been fueled by the growth of smart home ecosystems, mobile applications, and home automation systems. Energy-efficient models with adaptive cooling, humidity control, and intelligent defrosting have been preferred due to reduced electricity consumption and optimized food preservation. Consumers in urban areas and high-income households have increasingly sought convenience, real-time monitoring, and integration with voice assistants, reinforcing the adoption of smart refrigerators. Retailers and manufacturers have focused on feature differentiation, offering models with touchscreen interfaces, recipe suggestions, and camera-enabled internal views to meet consumer expectations and enhance kitchen management globally.

Technological advancements have strengthened the market by improving functionality, connectivity, and energy performance. AI algorithms, machine learning, and IoT integration have enabled real-time food management, automatic inventory alerts, and predictive maintenance notifications. Voice control compatibility with digital assistants has enhanced usability, while high-resolution touchscreens have facilitated interaction and multimedia integration. Innovations in adaptive cooling, multi-zone temperature control, and humidity regulation have improved food preservation across diverse product types. Energy optimization features, including smart compressors and eco-modes, have reduced operational costs and environmental impact. Manufacturers have also integrated internal cameras and barcode scanning to track food consumption patterns, supporting intelligent shopping recommendations. These technological enhancements have reinforced the importance of smart refrigerators in modern kitchens, enabling convenience, energy efficiency, and improved food management worldwide.

The market has been reinforced by adoption in commercial kitchens, restaurants, and retail outlets, where temperature monitoring and inventory management are critical. Refrigerators with connected sensors have allowed operators to maintain optimal food storage conditions, reduce spoilage, and comply with food safety standards. Integration with inventory management software, cloud-based reporting, and automated alerts has improved operational efficiency. Retailers have utilized smart refrigerators for cold chain management and product traceability, ensuring compliance with regulatory requirements and minimizing losses. The connected display and merchandising refrigerators have enhanced customer experience by providing real-time product information. The consistent demand for quality, operational efficiency, and compliance in commercial applications has strengthened market growth, positioning smart refrigerators as essential solutions across foodservice and retail environments globally.

Despite growth, the market has faced challenges associated with high costs, cybersecurity, and technological complexity. Smart models have required advanced sensors, communication modules, and AI integration, increasing manufacturing and retail prices compared to conventional refrigerators. Connectivity risks, data privacy concerns, and vulnerability to cyberattacks have influenced adoption, particularly in enterprise and cloud-connected deployments. Software updates, integration with smart home ecosystems, and compatibility with legacy appliances have posed technical challenges. Manufacturers have addressed these issues through secure communication protocols, user-friendly interfaces, and warranty services. Continuous improvements in affordability, cybersecurity, and interoperability have remained critical to sustain market adoption while balancing consumer expectations, energy efficiency, and connected appliance functionality worldwide.

| Countries | CAGR |

|---|---|

| China | 16.1% |

| India | 14.9% |

| Germany | 13.7% |

| France | 12.5% |

| UK | 11.3% |

| USA | 10.1% |

| Brazil | 8.9% |

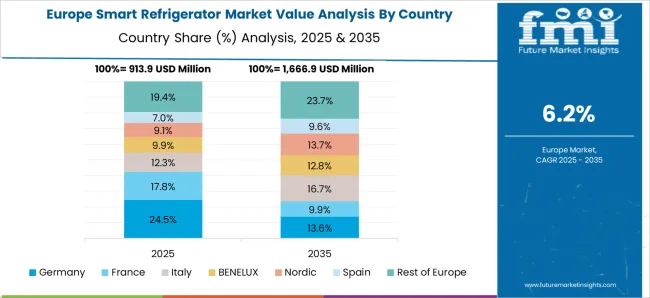

The market is anticipated to expand at a CAGR of 11.9% from 2025 to 2035, driven by growing smart home adoption, IoT integration, and energy-efficient appliance demand. China leads with a 16.1% CAGR, producing and deploying connected appliances at scale to meet urban household requirements. India follows at 14.9%, expanding rapidly due to rising middle-class income and smart home awareness. Germany, at 13.7%, benefits from technological expertise in appliance automation and energy efficiency. The UK, growing at 11.3%, innovates through AI-enabled and connected kitchen solutions, while the USA, at 10.1%, experiences steady demand from tech-savvy households. This report includes insights on 40+ countries; the top markets are shown here for reference.

The Smart Refrigerator Market in China is expected to expand at a country-specific CAGR of 16.1% during the forecast period, driven by rising consumer adoption of smart home appliances and connected devices. Advanced refrigeration systems with IoT connectivity, energy efficiency, and remote monitoring features are gaining traction among households and commercial establishments. Manufacturers are focusing on integrating AI-based temperature management, inventory tracking, and smart notification systems to enhance convenience and reduce food wastage. Urban residential projects and the growth of premium housing are increasing demand for technologically advanced appliances. Partnerships between local appliance makers and global technology providers support innovation in features, user interfaces, and connectivity options. Government incentives for energy-efficient appliances further boost market penetration and consumer preference.

In India, the Smart Refrigerator Market is projected to grow at a CAGR of 14.9%, reflecting strong demand for connected appliances in urban and semi-urban households. Consumers increasingly seek refrigerators with smart temperature controls, energy-saving modes, and remote connectivity through mobile applications. Manufacturers are introducing feature-rich products with voice control, AI-powered food tracking, and automated defrosting mechanisms. Expanding organized retail networks and e-commerce platforms facilitate wider product availability and faster adoption. Awareness campaigns highlighting energy savings and convenience benefits are contributing to market growth. Additionally, infrastructure improvements in smart homes and residential complexes further accelerate the adoption of high-tech refrigeration solutions.

Germany’s Market is expected to witness steady growth at a CAGR of 13.7%, driven by high consumer preference for energy-efficient, connected appliances. Companies are focusing on premium smart refrigerators with features such as touch interfaces, app-based control, and food freshness monitoring. Regulatory policies encouraging energy conservation and low carbon footprint devices incentivize the production and purchase of advanced refrigeration solutions. Technological innovations in AI-based inventory management and predictive maintenance enhance product value and usability. Consumers in Germany are increasingly adopting smart home ecosystems, where integrated appliances form a key component. The market is further supported by partnerships between appliance manufacturers and tech startups to deliver innovative solutions.

The Market in the United Kingdom is forecasted to grow at a CAGR of 11.3%, driven by consumer demand for energy-efficient and feature-rich kitchen appliances. Retailers are promoting smart refrigerators with app-based temperature control, inventory alerts, and automated defrosting systems. Expansion of smart home technologies in urban residential areas further accelerates adoption. Companies are innovating in user-friendly interfaces, connectivity options, and AI-powered food management features. The trend toward sustainable appliances are encouraging the use of eco-friendly refrigerants and recyclable materials. Market growth is also supported by seasonal promotions, trade shows, and consumer awareness campaigns emphasizing convenience and energy savings.

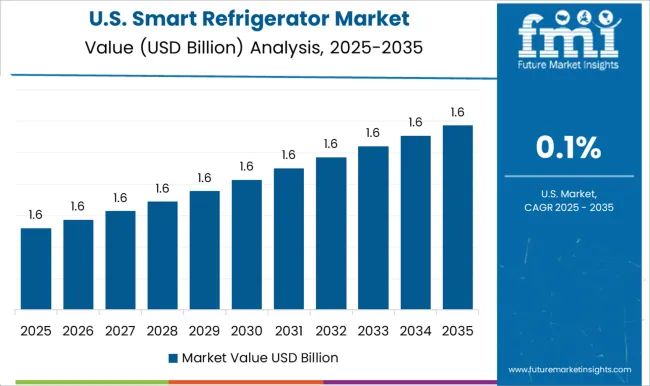

In the United States, the Market is anticipated to expand at a CAGR of 10.1%, fueled by rising adoption of smart kitchen appliances and connected home technologies. Consumer preference is shifting toward refrigerators with AI-driven inventory tracking, remote monitoring, and voice control capabilities. E-commerce and brick-and-mortar retail channels enable easy accessibility of feature-rich models across urban and suburban households. Manufacturers are focusing on energy-efficient designs, improved storage organization, and integration with smart home systems. Collaboration between appliance brands and technology providers supports innovation in smart functionalities, while marketing strategies emphasize convenience, energy savings, and lifestyle benefits. Seasonal promotions and product launches further drive market growth.

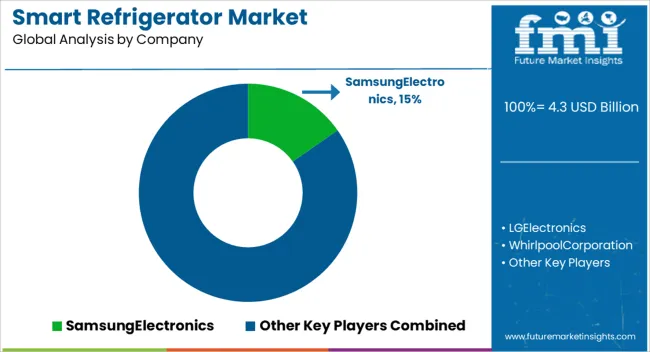

The market has experienced rapid adoption due to growing consumer demand for connected home appliances that combine convenience, energy efficiency, and advanced technology. Key players such as Samsung Electronics, LG Electronics, and Whirlpool Corporation lead the market by offering models with Wi-Fi connectivity, touchscreen interfaces, and integration with smart home ecosystems. These providers emphasize features like remote monitoring, inventory management, and AI-powered temperature control, catering to tech-savvy consumers seeking seamless kitchen experiences. Haier Smart Home, Bosch Home Appliances, Panasonic Corporation, Hisense Group, and Electrolux AB enhance the market with innovative solutions that focus on energy savings, smart diagnostics, and ergonomic designs. Their product portfolios include refrigerators with adaptive cooling, voice control compatibility, and enhanced food preservation technology, appealing to households that prioritize convenience and sustainability. GE Appliances, Sharp Corporation, Siemens Home Appliances, Miele & Cie., and Fisher & Paykel Appliances further contribute with high-performance refrigerators that integrate smart sensors, IoT-enabled features, and customizable storage options, ensuring optimized functionality and user satisfaction. Beko and Sony Corporation complement the market with compact and premium smart refrigerator solutions targeting niche segments, emphasizing modern design, digital interfaces, and efficient energy management. Collectively, these leading smart refrigerator providers drive innovation, enhance consumer lifestyles, and shape the global smart home appliance market with technology-driven solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Product | Double door, Single door, French door, Door-in-door, and Side by side |

| Type | Freestanding and Countertop |

| Capacity | Medium (20-29 cubic feet), Small (10-19 cubic feet), and Large (30+ cubic feet) |

| End User | Residential and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SamsungElectronics, LGElectronics, WhirlpoolCorporation, HaierSmartHome, BoschHomeAppliances, PanasonicCorporation, HisenseGroup, ElectroluxAB, GEAppliances, SharpCorporation, SiemensHomeAppliances, Miele&Cie., Fisher&PaykelAppliances, Beko, and SonyCorporation |

| Additional Attributes | Dollar sales by refrigerator type and feature set, demand dynamics across residential and commercial segments, regional trends in smart appliance adoption, innovation in energy efficiency, connectivity, and AI-based management, environmental impact of refrigerant use and electronic waste, and emerging use cases in remote monitoring and automated inventory management. |

The global smart refrigerator market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the smart refrigerator market is projected to reach USD 13.1 billion by 2035.

The smart refrigerator market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in smart refrigerator market are double door, single door, french door, door-in-door and side by side.

In terms of type, freestanding segment to command 53.4% share in the smart refrigerator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Smart Pill Box Market Size and Share Forecast Outlook 2025 to 2035

Smart Medical Mattress Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA