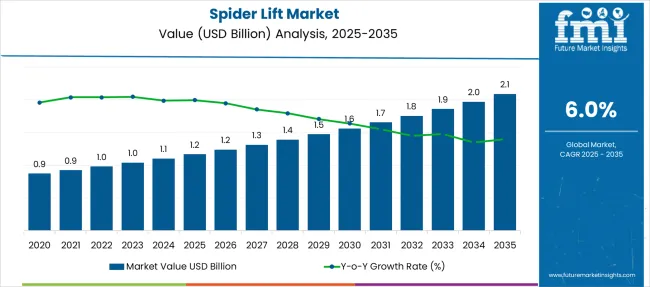

The Spider Lift Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. While CAGR appears moderate, the growth pattern shows operational scaling rather than disruptive jumps, making it ideal for long-horizon leasing companies and OEM financing arms. Trend Analysis reveals CAGR stability, but the YoY growth curve declines beyond 2030, suggesting upcoming market saturation.

Absolute incremental opportunity (2025–2030) equals USD 0.5 billion, whereas 2031–2035 contributes USD 0.7 billion, showing a late-stage cumulative edge of 58%. This market demonstrates price-sensitive procurement, highlighting OEM strategies such as telematics integration and predictive maintenance as differentiators for recurring revenue. Competitive advantage will stem from post-sale service ecosystems rather than pure hardware sales, creating scope for IoT retrofitting and remote operations models.

The market growth shows high demand for spider lifts, delivering mobility and reach in confined or uneven spaces, where conventional aerial work platforms fail. The technological adoption is anchored in urban maintenance, tree care, and infrastructure projects requiring compact access solutions.

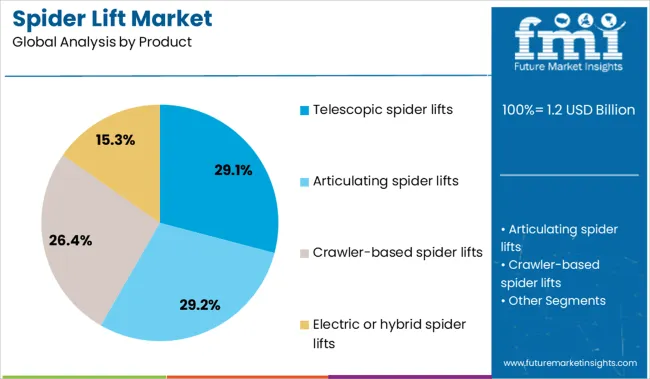

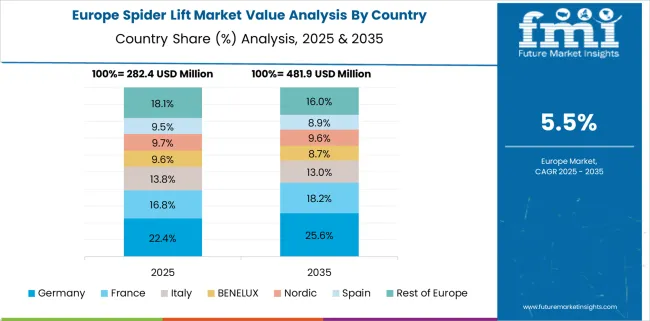

Among the product types, telescopic spider lifts contribute 29.1% of the market, benefiting from superior horizontal outreach and stability in high-rise applications. Asia-Pacific is demonstrating accelerated demand as vertical urban construction intensifies and maintenance standards tighten, while North America prioritizes spider lifts for utility work and arborist services. Europe maintains consistency due to regulatory frameworks emphasizing worker safety on elevated platforms.

Future differentiation will emerge through electrification, hybrid powertrains, and telematics integration for predictive maintenance. Manufacturers are increasingly investing in lightweight, high-strength materials and enhanced outrigger designs to deliver greater portability without sacrificing load capacity. Cost remains a limiting factor, but as lifecycle advantages and automation features gain prominence, spider lifts will become indispensable in sectors constrained by access complexity.

| Metric | Value |

|---|---|

| Spider Lift Market Estimated Value in (2025 E) | USD 1.2 billion |

| Spider Lift Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The spider lift market is gaining significant momentum as industries increasingly prioritize safe and efficient access solutions for elevated workspaces, particularly in confined and uneven terrains. Compact design, lightweight frames, and ability to operate on delicate flooring have made spider lifts indispensable in both indoor and outdoor maintenance, construction, and installation tasks.

Growing investments in urban infrastructure, smart city initiatives, and renewable energy projects have expanded the application base of spider lifts globally. Manufacturers are integrating lithium-ion battery systems and remote diagnostics to enhance sustainability and uptime, reflecting a broader trend toward electrification and smart equipment tracking.

Future demand is expected to benefit from the convergence of safety compliance mandates and workforce efficiency standards, especially in emerging economies where infrastructure modernization is accelerating. Product advancements focused on higher reach, articulation, and automatic leveling systems will continue to support market growth and deeper penetration across end-use verticals.

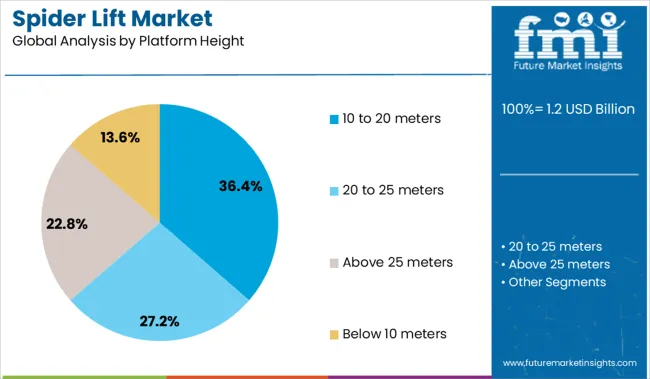

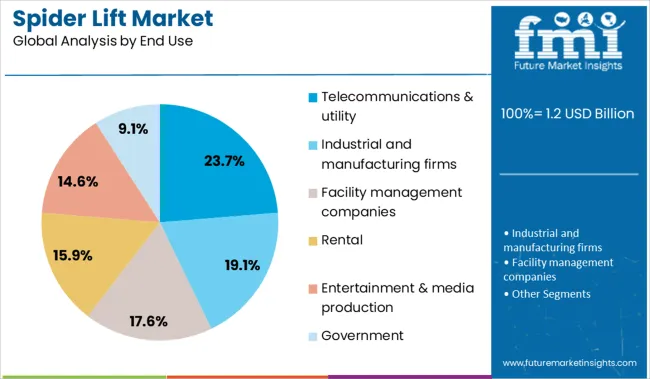

The spider lift market is segmented by product, platform height, end use, and region. By product, it includes telescopic spider lifts, articulating spider lifts, crawler-based spider lifts, and electric or hybrid spider lifts, designed to meet different operational needs. In terms of platform height, the segmentation comprises below 10 meters, 10 to 20 meters, 20 to 25 meters, and above 25 meters, offering flexibility for varied working environments. Based on end use, the market is categorized into telecommunications and utility, industrial and manufacturing firms, facility management companies, rental services, entertainment and media production, and government applications. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Telescopic spider lifts are projected to hold 29.1% of the product segment’s revenue share in 2025, positioning them as the leading lift type in the market. This dominance is attributed to their superior horizontal outreach and lifting capacity, which allow operators to access hard-to-reach areas without repositioning the equipment.

These features have been particularly beneficial in sectors where direct vertical access is limited or obstructed. The simple mechanical design and faster extension capabilities of telescopic models have enhanced their appeal in maintenance and façade work.

Additionally, their compatibility with both diesel and electric power sources provides operational flexibility in diverse environments. Manufacturers have optimized these models for weight distribution and compact storage, reinforcing their suitability for confined and indoor workspaces, thereby ensuring sustained preference across multiple application scenarios.

The 10 to 20 meters platform height range is expected to contribute 36.4% of the platform height segment revenue in 2025, making it the most utilized height category. This range offers an ideal balance between accessibility and maneuverability, catering to common industrial, facility management, and installation tasks.

Its popularity is driven by the increasing volume of medium-rise buildings and infrastructure that require routine maintenance or system upgrades. Lifts within this height category are favored for their ease of transport, reduced setup time, and ability to navigate complex layouts.

The segment has further gained traction due to its lower acquisition and maintenance cost compared to higher reach models, while still delivering the operational reach necessary for most standard commercial and industrial tasks. As modular building design and retrofitting activities expand, demand for medium-height spider lifts is expected to remain consistently high.

Telecommunications and utility applications are projected to account for 23.7% of the spider lift market revenue in 2025, making this the leading end-use segment. This is driven by ongoing global infrastructure upgrades and the expansion of telecommunication networks requiring elevated installations in narrow or uneven access points.

The segment’s growth is further supported by the increasing need for maintenance of power lines, signal towers, and roadside electrical assets. Spider lifts are particularly suited for this sector due to their ability to operate on rough terrain, cross gradients, and navigate through compact spaces without compromising stability or worker safety.

Utilities and telecom operators have prioritized fleet modernization with energy-efficient, low-emission access equipment to comply with environmental standards and improve service reliability. As broadband rollout initiatives and smart grid developments continue across both developed and emerging regions, this segment is expected to maintain its leadership position.

Spider lifts are being favored for tasks requiring compact access equipment with high reach and terrain adaptability. Growth in this segment has been influenced by maintenance work on complex structures, vegetation trimming, and indoor-outdoor facility operations. Demand has remained steady across telecom infrastructure, building restoration, and utility pole servicing. Manufacturers offering lightweight designs, flexible outrigger stabilization, and track-mounted mobility are seeing preference across varied terrain and space-constrained sites.

Spider lifts have been widely adopted in work environments where traditional boom or scissor lifts are either too bulky or limited by terrain constraints. These machines are chosen for their narrow chassis, flexible boom articulation, and ability to navigate uneven or fragile surfaces. Maintenance contractors, arborists, and facade cleaning services have consistently deployed spider lifts to access hard-to-reach vertical spaces. The segment’s reliability is further enhanced by hybrid engine options, non-marking tracks, and reduced ground pressure, making them ideal for both indoor arenas and heritage structures.

Height access flexibility with minimal footprint has allowed these lifts to be operated in courtyards, atriums, and tight urban workspaces. Demand from telecom and signage installation firms has been reinforced by the equipment’s ease of transport and quick deployment features, particularly in time-sensitive operations.

The spider lift market is seeing notable momentum from rental firms catering to short-duration projects in industrial, landscaping, and municipal sectors. Equipment providers are bundling operator training, compliance certification, and quick-maintenance support to attract new end-users. Lifts with programmable height limits, remote diagnostics, and automatic levelling systems are being selected for their multi-terrain operability. These machines are now being used in niche settings like stadium rigging, cultural monument inspection, and large facility lighting replacement. Growth has also been observed in cross-border sales of battery-electric spider lifts tailored for low-noise, low-emission indoor jobs.

Fleet managers are increasingly rotating spider lifts into general aerial platform inventories due to their return-on-investment performance in restricted access scenarios. Customization options for working envelope, jib range, and platform load capacity have created differentiated product tiers targeting specialized operational environments.

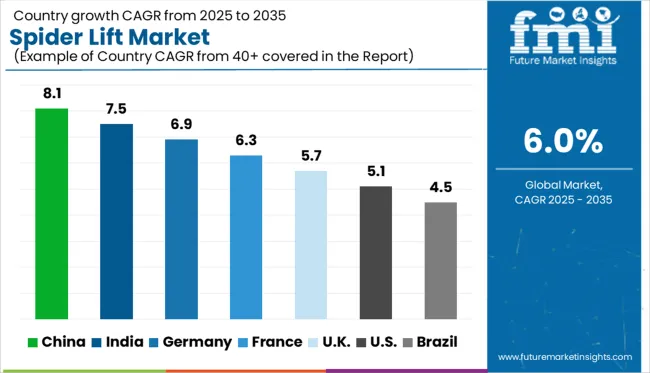

| Countries | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global spider lift market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by maintenance access needs in narrow terrains, electrification of compact aerial platforms, and growth in indoor and outdoor facility upkeep. China leads with an 8.1% CAGR, supported by infrastructure rehabilitation, compact lift integration in property maintenance, and rising solar farm installations.

India follows at 7.5%, driven by power distribution network expansion, telecom tower servicing, and airport facility upgrades. Germany grows at 6.9%, shaped by demand in high-rise facade cleaning, rental fleet upgrades, and EN-standard compliant retrofits. France posts 6.3%, led by municipal tree management, cathedral maintenance, and indoor arena servicing. The United Kingdom grows at 5.7%, influenced by electric spider lift demand in facility retrofitting and safety-regulated access work. These five markets represent key anchor points within a broader 40+ country assessment.

China is expected to grow at a CAGR of 8.1% through 2035, driven by the expansion of building maintenance systems, public sector retrofits, and solar facility upkeep. Spider lifts are increasingly deployed by local governments and infrastructure contractors for narrow-access jobs in metro stations, malls, and transportation hubs.

The shift toward electric variants is being reinforced by regulatory targets for low-emission machinery in indoor and semi-enclosed spaces. Municipal procurement frameworks are supporting integration into fire safety and public utility departments, especially in tier-1 cities. Spider lift distribution has also benefited from localized production and supply chain scaling, allowing broader penetration across provincial markets.

Demand for spider lifts in India is expanding at a CAGR of 7.5%, outpacing the global average due to growing infrastructure complexity and maintenance in confined areas. Contractors are utilizing these lifts in heritage building restoration, airport upgrades, and metro tunnel inspections. The power distribution sector is also turning to spider lifts for transformer access and cable route checks.

Local manufacturers are responding with cost-effective models tailored for domestic tenders, often bundled with basic operator training. Government-backed urban infrastructure programs are encouraging lease-based adoption in municipal settings. Terrain variability and rising safety awareness are reinforcing their utility in tier-2 and tier-3 cities.

Demand for spider lifts in Germany is forecast to expand at a 6.9% CAGR, slightly above the global rate, anchored in compliance-led access operations and heritage preservation. Spider lifts are favored in cathedral dome cleaning, concert hall servicing, and bridge deck inspection. Local municipalities and fire brigades deploy tracked models with narrow outriggers for confined locations.

Rental operators seek battery-powered variants that comply with indoor noise limitations and environmental mandates. Demand for CE-certified, dual-energy machines has increased, driven by state-level procurement frameworks. Germany’s spider lift use case remains precision-driven rather than volume-led. The country maintains a strong emphasis on machine certifications, operator safety training, and lifecycle service contracts embedded into procurement.

France is growing at a CAGR of 6.3%, in line with global projections, with spider lift usage rising across municipal landscaping, rail infrastructure, and monument restoration. Contractors involved in tree trimming, façade maintenance, and rail station upkeep are turning to compact, stabilizer-equipped lifts. These units offer better mobility in historical or densely built environments.

Bi-energy models are gaining preference due to their dual indoor-outdoor usability. Public procurement channels increasingly support leasing options, especially in budget-sensitive regions. France emphasizes mobility, safety, and integration in diverse terrains over large-scale fleet volumes.

The United Kingdom is projected to grow at a CAGR of 5.7%, slightly behind global average, with demand stemming from building maintenance, telecom tower servicing, and public infrastructure repairs. Spider lifts are being adopted in high-density urban areas, where alleyways, courtyards, and compact job sites limit traditional lift usage.

Emission-focused policies in cities like London and Birmingham have driven demand for electric models. Equipment with built-in diagnostics and stabilization features are increasingly selected by rental agencies serving industrial and educational facilities. UK buyers emphasize regulatory compliance and maneuverability, particularly in heritage or restricted-access zones.

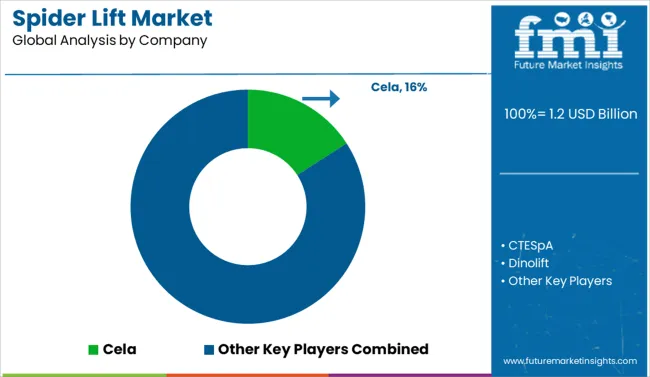

The global spider lift industry features a mix of specialized aerial work platform manufacturers and diversified access equipment firms competing across performance, weight efficiency, and terrain flexibility. Cela, an Italy-based manufacturer, is recognized for its high-reach spider lift models engineered for compact sites and rugged environments. CTE SpA and Dinolift offer lightweight, track-mounted platforms that meet requirements for both indoor use and uneven terrain.

Companies like Platform Basket and Niftylift have gained traction with hybrid and electric models, supporting their adoption in low-emission zones and heritage areas. These platforms are favored in arboriculture, facility upkeep, and telecom maintenance. Oshkosh Corporation and Terex, while operating broader aerial equipment portfolios, have retained relevance through spider lift variants targeted at construction and utility applications.

Manufacturers such as IMER Group and Hubei Goman Heavy Industry cater to mid-tier demand, offering cost-effective models for emerging market contracts and rental firms. These players prioritize reliable hydraulics, user-friendly controls, and value-engineered components suited for general maintenance applications.

Key Developments in the Spider Lift Market

Key players in the spider lift industry are advancing strategies centered on innovation, electrification, and application-specific design. Cela introduced a 30-meter hybrid spider lift in 2025 with lithium battery packs, reflecting the shift toward zero-emission solutions for restricted zones. CTE SpA emphasized compactness and performance, launching an ultra-compact tracked model with greater load capacity to address urban maintenance challenges. Dinolift focused on specialized deployment, unveiling a lightweight spider lift equipped with automated leveling systems to streamline telecom installations.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Product | Telescopic spider lifts, Articulating spider lifts, Crawler-based spider lifts, and Electric or hybrid spider lifts |

| Platform Height | 10 to 20 meters, 20 to 25 meters, Above 25 meters, and Below 10 meters |

| End Use | Telecommunications & utility, Industrial and manufacturing firms, Facility management companies, Rental, Entertainment & media production, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cela, CTESpA, Dinolift, HubeiGomanHeavyIndustryTechnology, Imer, Niftylift, OshkoshCorporation, PlatformBasket, ShandongTorosMachineryCorporation, and Terex |

| Additional Attributes | Dollar sales are segmented by platform height categories (under 20 meters, 20-30 meters, above 30 meters) and by power type (diesel, electric, hybrid), with electric and hybrid models steadily increasing their share in urban and indoor environments. Platform selection is influenced by maneuverability in confined areas, non-marking track options, and low ground pressure configurations. OEMs are expanding modular chassis offerings compatible with rental fleet specifications. Adoption is highest in Europe and Asia-Pacific, where spider lifts are integrated into infrastructure retrofits, public facility maintenance, and arboricultural services that demand compact, low-noise aerial access platforms. |

The global spider lift market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the spider lift market is projected to reach USD 2.1 billion by 2035.

The spider lift market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in spider lift market are telescopic spider lifts, articulating spider lifts, crawler-based spider lifts and electric or hybrid spider lifts.

In terms of platform height, 10 to 20 meters segment to command 36.4% share in the spider lift market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Spider Silk Fabric Market Size and Share Forecast Outlook 2025 to 2035

Spider Cranes Market Analysis based on Lifting Capacity, Operation, Control System, Application, Ownership and Region: A Forecast from 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lifting Columns Market Size and Share Forecast Outlook 2025 to 2035

Lift-off Lid Box Market

Hi Lift Jack Market Size and Share Forecast Outlook 2025 to 2035

Airlift Pump Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Airlift Bioreactors Market - Growth & Forecast 2025 to 2035

Mid-Lift Axle Market Size and Share Forecast Outlook 2025 to 2035

Hooklift Trailer Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Forklift Attachments Market Growth - Trends & Forecast 2025 to 2035

Cow Lifting Harness Market – Industry Insights & Growth 2025-2035

Forklift-Mounted Computers Market

Hook Lifts and Skip Loaders Market Size and Share Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Liftgate Market Growth - Trends & Forecast 2025 to 2035

Stair Lifts and Climbing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Stair Lift Motors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA