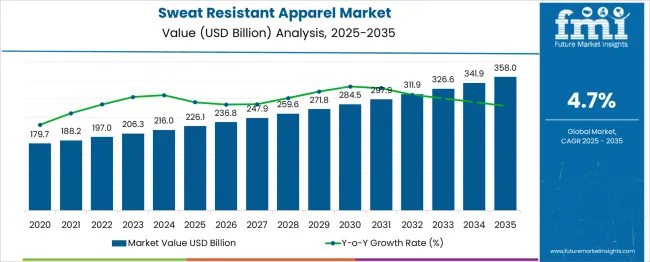

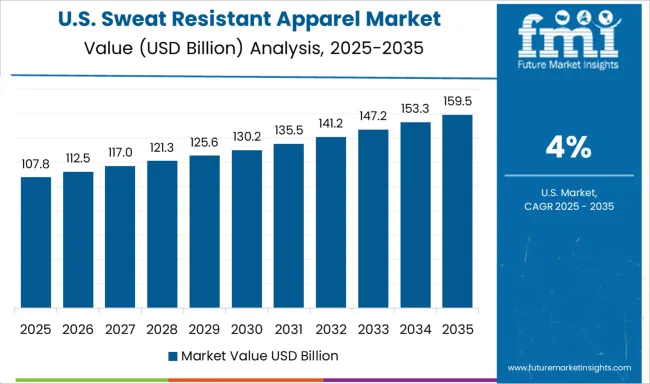

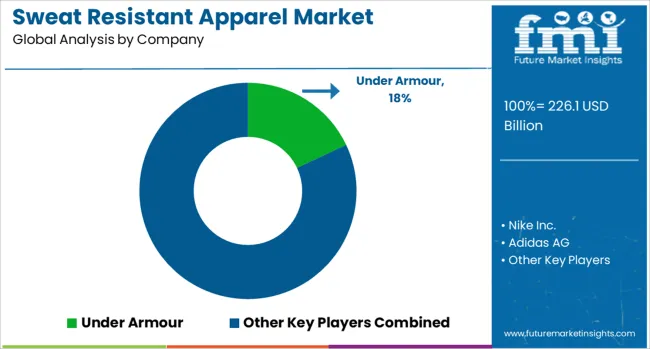

The sweat resistant apparel market is estimated to be valued at USD 226.1 billion in 2025 and is projected to reach USD 358.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. During the early phase (2025–2030), the market adds USD 58.4 billion, moving from USD 226.1 billion to USD 284.5 billion. Annual increments remain within a narrow range of USD 10.7 billion to USD 12.7 billion, indicating a stable entry trajectory. This period reflects adoption driven by fitness culture, climate-responsive apparel preferences, and material innovation. Demand is spread across both premium and mid-range product segments, supporting consistent volume sales without reliance on short-term marketing cycles. In the late phase (2031–2035), the market adds USD 73.5 billion, increasing from USD 284.5 billion to USD 358.0 billion. Yearly additions rise slightly, reaching up to USD 16.1 billion between 2034 and 2035. This acceleration, although modest, suggests that volume momentum strengthens over time. Increased demand from the workplace, travel, and casual wear categories drives broader market participation. While the early curve reflects niche and performance-focused adoption, the late curve shows diffusion across mainstream consumer segments. The overall pattern remains linear, with no abrupt inflection, indicating that growth is stable, scalable, and distributed across diversified use cases.

| Metric | Value |

|---|---|

| Sweat Resistant Apparel Market Estimated Value in (2025 E) | USD 226.1 billion |

| Sweat Resistant Apparel Market Forecast Value in (2035 F) | USD 358.0 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The market represents around 8–12% of the overall sportswear or sports apparel market, as moisture-management garments form a specialized subset. Within the broader performance or active apparel segment, its share rises to approximately 15–20%, driven by consumer demand for high-performance workout and hiking wear. In the athleisure market, which blends comfort and style, sweat resistant garments account for 10–15% of sales due to popular lifestyle crossover trends.

Within the narrower technical and moisture-wicking apparel category, typically engineered fabrics and highly breathable activewear, sweat-resistant items represent about 25–30%, since sweat management is their core functionality. Against the vast general apparel market, this segment is highly niche, comprising only 1–2% of total clothing sales. The market is growing because consumers want clothing that keeps them dry, comfortable, and odor-free during intense activity. High-performance fabric technologies feature moisture-wicking finishes, advanced capillary weaves, and antimicrobial treatments that prevent odor buildup. Brands such as Nike, Adidas, Lululemon, Craft, and Dropel focus on proprietary textile innovations that balance breathability, performance, and sustainability. Fashion and sportswear labels experiment with layered constructions, embedded vents, and lightweight mesh zones to enable dynamic breathability and efficient evaporation. Innovations include AI-powered fabrics that sense moisture levels and adjust airflow in real time. Market momentum is driven by active lifestyle trends, athleisure adoption, fast-growing e-commerce channels, and rising demand for premium functional apparel in North America, Europe, and the Asia Pacific.

Rising awareness regarding hygiene, sweat control, and odor prevention has intensified demand across both fitness-conscious individuals and everyday users. As climate patterns shift toward higher temperatures and urban lifestyles become more fast-paced, apparel with moisture-wicking and breathable properties is being adopted at a faster rate.

Brands are also investing in innovation around fabric technology, fit, and sustainability, ensuring that sweat resistant features are integrated without compromising comfort or aesthetics. Technological integration through seamless construction and smart textiles is further expanding the appeal of these products.

Moreover, a growing emphasis on wellness, coupled with a rise in outdoor and home-based fitness routines, has reinforced the market's expansion. As sustainability and performance converge, future opportunities are expected to be shaped by recyclable fabric innovations and inclusive design targeting a broader consumer base..

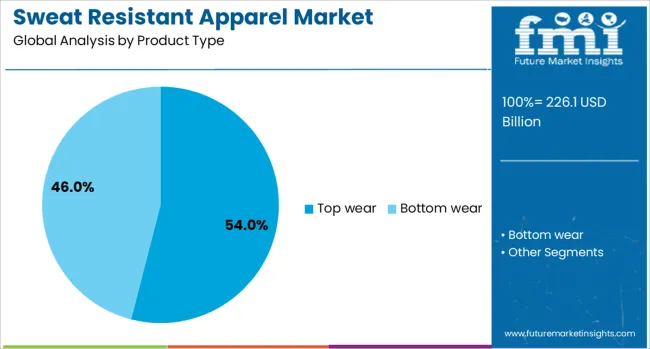

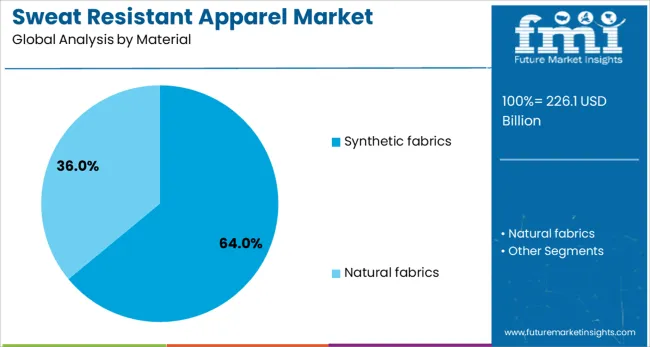

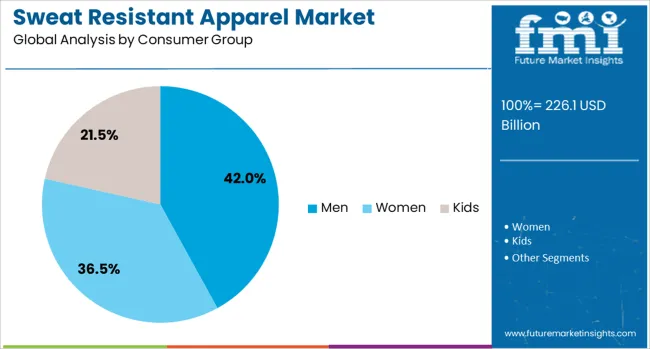

The sweat resistant apparel market is segmented by product type, material, consumer group, price, and distribution channel and geographic regions. By product type of the sweat resistant apparel market is divided into Top wear and Bottom wear. In terms of material of the sweat resistant apparel market is classified into Synthetic fabrics and Natural fabrics. Based on consumer group of the sweat resistant apparel market is segmented into Men, Women, and Kids. By price of the sweat resistant apparel market is segmented into Medium, Low, and High. By distribution channel of the sweat resistant apparel market is segmented into Online and Offline. Regionally, the sweat resistant apparel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The top wear segment is expected to account for 54% of the Sweat Resistant Apparel market revenue share in 2025, making it the leading product type. This growth has been supported by the widespread consumer need for moisture management in areas of high perspiration such as the upper body, particularly during athletic and casual daily use. Functional top wear, including t-shirts, tank tops, and performance shirts, has been preferred for its combination of breathability and sweat control.

The segment has also benefited from technological advancements that enhance comfort without sacrificing design aesthetics. Strategic brand positioning, with a focus on high-performance features in everyday clothing, has driven visibility and adoption in this category.

As awareness around active lifestyles and wellness expands, the demand for sweat resistant top wear has continued to accelerate across demographics. The ease of integrating sweat-wicking technologies into top wear garments has made this segment commercially scalable and operationally cost-efficient for manufacturers, sustaining its leadership position..

The synthetic fabrics segment is projected to hold 64% of the Sweat Resistant Apparel market revenue share in 2025, establishing it as the dominant material type. This preference has been influenced by the ability of synthetic fibers such as polyester, nylon, and spandex to provide superior moisture-wicking, quick-drying, and lightweight properties. The durability and elasticity of synthetic materials have allowed them to withstand repeated washes and maintain structural integrity, making them suitable for long-term wear.

Fabric technologies have evolved to minimize skin irritation while enhancing breathability, further increasing consumer trust in synthetic options. Manufacturers have continued to invest in fiber treatments and finishing processes that improve antimicrobial and odor-resistant performance, which are critical for sweat resistant apparel.

Additionally, the global push toward performance-driven and multi-functional clothing has elevated synthetic materials to the forefront, given their adaptability and consistent performance under varied environmental conditions. As innovation continues to address comfort and sustainability, synthetic fabrics are anticipated to remain the material of choice for both brands and consumers..

The men segment is anticipated to contribute 42% of the Sweat Resistant Apparel market revenue share in 2025, making it the leading consumer group. This segment’s dominance has been shaped by a growing emphasis among male consumers on physical fitness, personal grooming, and functional fashion. The rise of activewear culture, influenced by gym routines, sports participation, and athleisure trends, has driven significant uptake of sweat resistant clothing designed for men.

Men’s apparel preferences have shifted toward performance-based garments that offer moisture management and odor control during prolonged use. Brands have responded by tailoring product portfolios with gender-specific designs, fits, and fabric technologies that align with comfort and durability expectations.

The growing availability of sweat resistant options in both premium and mass-market channels has made such apparel more accessible and desirable. As health consciousness continues to rise among men across all age groups, the demand for technologically enhanced garments is expected to further reinforce the segment’s leadership in the market..

Demand for sweat‑resistant apparel has risen as activewear, work uniforms, and travel wear markets emphasize moisture management and hygiene. Stretchable antimicrobial fabrics represented over 38% of sport apparel shipments in 2024. Travel-optimized garments that block odor and wick moisture accounted for 29% of new female consumer purchases. Corporate uniform suppliers added sweat-resistant blends to 21% of new orders from the hospitality and healthcare sectors. Innovation in moisture‑management textiles has driven adoption among consumers in humid regions and environments frequently exposed to elevated perspiration risks.

Moisture-wicking and antimicrobial properties are increasingly required in apparel designed for high-intensity activity or extended wear. Sweat-resistant fabrics have been specified in over 46% of new fitness and activewear collections introduced in urban markets. Properties that reduce odor-causing bacteria growth and improve moisture release supported adoption across corporate sector uniforms and travel-friendly clothing. Travel garments incorporating silver-based antimicrobial finishes accounted for 28 % of new product features in leisure wear. These functional fabrics have reduced the frequency of washes by nearly 22%, supporting longer garment lifecycles. Nurses, hotel staff, and airline crew uniforms featuring these textiles benefited from lower heat-related discomfort. Customer reviews often cite improved dryness and freshness after extended wear in humid climates, reinforcing premium positioning for sweat-resistant apparel lines.

Sweat-resistant fabrics often command price premiums, with retail markup averaging 27% over standard moisture-wicking blends. Incorporation of antimicrobial finishing or dual-layer laminate structures increased material cost and manufacturing complexity. Engineering fabric breathability, durability, and washfastness added nearly 18% to production lead time. Consumer disappointment emerged in 7% of cases when anti-odor treatments degraded after repeated laundering. Supply chain complexity increased as specialized yarns, finishes, and certified antimicrobial chemicals had to be sourced from multiple suppliers. Garment compatibility challenges have also arisen, including when sweat-resistant inserts impaired stretch or fabric flexibility. These factors limited adoption in entry-level and budget apparel segments where consumers prioritize cost over performance attributes, slowing broader market penetration in certain regions.

Custom blends combining sweat-resistant panels with stretch or thermal insulation fabrics have been introduced in the athleisure and workwear segments. Those hybrid garments have captured 24 % of new product launches targeting convertible travel apparel lines. Use of sweat-activated cooling textiles is gaining traction, especially in running gear and cycling kits. Collaborations with textile tech firms have enabled the integration of moisture‑responsive color-change zones on t‑shirts and undershirts for activity feedback. Athletic training hubs and gyms have introduced branded fabrics with odor-neutralizing technology in 19% of membership apparel offerings. Corporate wellness programs and uniform programs in hot-climate regions have started deploying performance-oriented garments as perks to reduce fatigue, promoting repeat volume contracts, and creating new sustainability branding opportunities.

Smart features like odor sensors embedded in sweat-resistant garments appeared in approximately 16 % of advanced activewear collections, enabling usage tracking via mobile apps. Recyclable or plant-derived moisture-wicking yarns accounted for 22 % of new sustainable apparel releases. Modular design options, such as detachable liners or replaceable sweat panels, allowed extended garment lifespan and reduced wash cycles. Compression tops with silver-ion inlays targeted for odor control have gained share in high-end fitness gear. Fit-tracking smart shirts with textile humidity sensing and breathing rate analysis are being piloted in professional sports teams and physiotherapy programs. Packaging components such as embedded QR codes linking to care instructions and ingredient sourcing achieved traction in 19% of product lines marketed for hygiene and performance awareness.

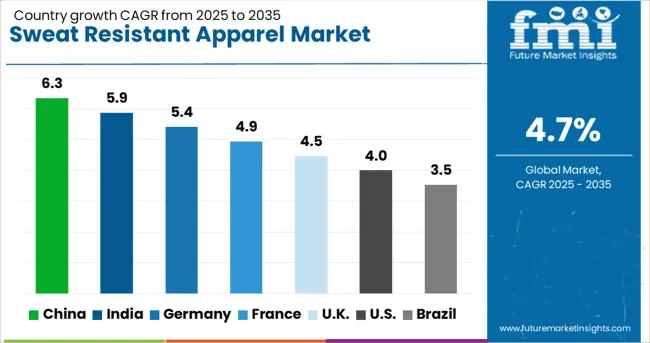

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

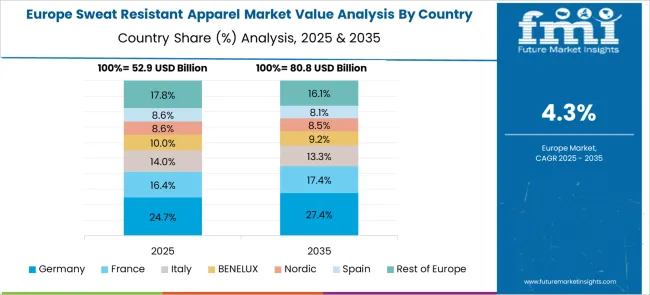

The global sweat resistant apparel market is forecast to expand at a CAGR of 4.7% between 2025 and 2035. China leads with 6.3%, outperforming the global rate by 1.34x, aided by growth in fitness retail and polyester fabric manufacturing. India follows at 5.9% (1.26x), as domestic brands introduce moisture-wicking ranges across mid-tier segments. Germany (OECD) posts 5.4%, or 1.15x, supported by increased consumer shift toward technical wear in urban commute and sports use. The United Kingdom (OECD) grows at 4.5%, nearly aligned with the global average (0.96x), while the United States (OECD) trails at 4.0%, representing only 0.85x, hindered by slower category refresh cycles in mainstream apparel chains. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 6.3% of the global sweat resistant apparel market in 2025. Increased integration of sweat-repellent technologies into fitness apparel, workwear, and school uniforms has supported expansion. Major textile hubs in Guangdong and Zhejiang saw a rise in proprietary fabric coatings engineered to enhance perspiration control. Domestic brands partnered with biotech firms to develop antibacterial layers embedded into polyester-cotton blends. New marketing strategies were aimed at workers in warm climate zones and athletes seeking odor-resistant gear. Online platforms such as Tmall promoted breathable wearables with dual-function finishes. Demand from e-commerce grew as consumers prioritized both comfort and long-wear performance across categories.

India contributed 5.9% of global share in 2025, driven by increasing consumer preference for sweat-resistant textiles suited for tropical and semi-arid regions. The market was shaped by demand for breathable casual wear in metropolitan areas, particularly Delhi, Mumbai, and Bengaluru. Mid-range and affordable brands invested in high-wick bamboo viscose, lyocell, and treated cotton that offered odor-neutralizing features. Hybrid fabric blends targeting commuters, delivery workers, and office-goers were marketed for monsoon and summer use. Offline retail chains promoted washable, stretchable, and wrinkle-free garments as year-round wardrobe staples, supported by strong visibility during seasonal sales.

Germany held 5.4% of the market in 2025. Demand was fueled by technical apparel aligned with EU textile compliance norms and consumer emphasis on performance-grade functionality. Brands invested in hybrid polyamide blends equipped with body-heat-regulated fabrics to address active lifestyles and changing weather. Regional demand was driven by cyclists, industrial workers, and environmentally aware consumers opting for high-durability wear. Sweat control features were incorporated without compromising UV protection and allergen resistance. Corporate buyers prioritized apparel with antimicrobial coatings for factory and logistics uniforms, boosting B2B consumption.

The United Kingdom accounted for 4.5% of global market activity in 2025. Growth was led by sweatproof apparel suited for unpredictable temperatures and urban commuting. Micro-perforated fabrics and hydrophobic treatments were adopted across casualwear and performance lines. Product uptake was influenced by commuter behavior, smart-casual trends, and demand for gym-to-office transition wear. British brands incorporated low-maintenance finishes that retained breathability after repeated machine washes. Demand from health-conscious millennials expanded category boundaries beyond sportswear into loungewear and travel gear, especially during spring and autumn retail cycles.

The United States represented 4.0% of global share in 2025. Sweat-resistant apparel was driven by the fusion of athleisure and functional fashion, especially for fitness enthusiasts and industrial users. Product design was focused on dual-layer polyester-spandex weaves, embedded cooling agents, and UV blocking coatings. The use of seamless design in activewear enhanced airflow, supporting growing interest in HIIT and outdoor activities. Influencer-backed brands popularized quick-dry loungewear on platforms like Instagram and TikTok. Apparel for logistics, healthcare, and hospitality workers adopted odor-reducing properties to meet practical use cases.

The sweat resistant apparel market is led by performance-driven apparel brands offering moisture-wicking fabrics, anti-odor technology, and thermoregulation features designed for athletic and active lifestyle wear. Under Armour pioneered moisture-wicking gear with its HeatGear® line, incorporating sweat-dispersing microfibers for improved drying time during high-intensity workouts. Nike Inc. integrates Dri-FIT technology across its product categories, delivering apparel that draws moisture away from the skin while maintaining breathability in variable climate conditions. Adidas AG features AEROREADY fabric in its training and running collections, promoting sweat management through quick-drying textiles and mesh zoning.

Lululemon Athletica Inc. designs sweat-resistant apparel specifically for yoga, HIIT, and studio workouts, using proprietary fabrics like Nulu™ and Everlux™ with sweat-wicking, fast-drying properties and odor control. Decathlon S.A. provides affordable, sweat-resistant gear through brands like Kalenji and Domyos, targeting beginner and recreational athletes with technical shirts, tanks, and shorts. Columbia Sportswear blends its Omni-Wick™ technology into outdoor apparel for hiking and trail activities, offering evaporative cooling without sacrificing UV protection.

Nike, Adidas, and Under Armour enhanced moisture-wicking technologies in core athletic lines, while Lululemon and Columbia advanced hybrid fabrics for active and daily wear. Mizzen+Main and Ministry of Supply popularized sweat-proof business casual shirts, targeting professionals. SAXX and Rhone introduced performance-based underlayers and dresswear with odor control and sweat resistance. Asian brands scaled sweat-resistant apparel production across warmer markets. Emerging startups focused on breathable, hydrophobic fabric treatments and targeted ventilation zones, addressing comfort, style, and high-performance wear in everyday and fitness categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 226.1 Billion |

| Product Type | Top wear and Bottom wear |

| Material | Synthetic fabrics and Natural fabrics |

| Consumer Group | Men, Women, and Kids |

| Price | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Under Armour, Nike Inc., Adidas AG, Lululemon Athletica Inc., Decathlon S.A., and Columbia Sportswear |

| Additional Attributes | Dollar sales by apparel type (t-shirts, activewear, socks) and end-use (sports, casual, workwear), demand driven by fitness, outdoor, and workplace safety, led by Asia Pacific with North America catching up, innovation in moisture wick smart fabrics and odor control. |

The global sweat resistant apparel market is estimated to be valued at USD 226.1 billion in 2025.

The market size for the sweat resistant apparel market is projected to reach USD 358.0 billion by 2035.

The sweat resistant apparel market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in sweat resistant apparel market are top wear, _shirts, _t-shirts, _jackets, _others (vests etc.), bottom wear, _leggings, _shorts, _pants, _trousers and _others (track pants etc.).

In terms of material, synthetic fabrics segment to command 64.0% share in the sweat resistant apparel market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA