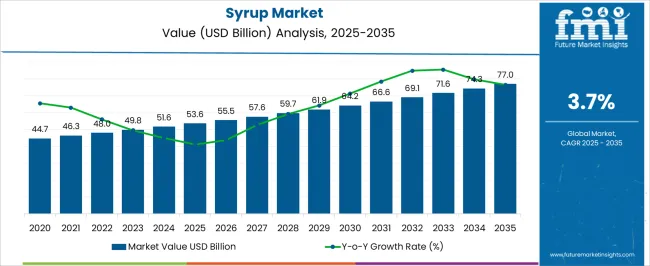

The Syrup Market is estimated to be valued at USD 53.6 billion in 2025 and is projected to reach USD 77.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period. Over the projection period, growth is steady yet moderated due to rising regulatory interventions targeting public health concerns, especially around sugar consumption and artificial additives. Governments across North America and Europe have already implemented stricter guidelines on nutritional disclosures, while Asia Pacific markets are gradually tightening standards to align with global health directives. Food safety regulations, particularly those set by agencies such as FDA and EFSA, are shaping product formulations by restricting certain sweeteners and mandating transparency in ingredient disclosures.

The sugar tax policies in countries such as the UK, Mexico, and parts of the US directly affect pricing strategies and consumer demand, prompting manufacturers to diversify into low-calorie and natural alternatives. Trade regulations and import duties also play a role in determining cost structures, especially for syrups relying on raw material imports such as corn or sugarcane. The regulatory compliance costs are rising, compelling firms to invest in reformulation, clean labeling, and sustainable sourcing. This evolving regulatory environment is expected to influence innovation, with natural syrups and plant-based options gaining a stronger share of the forecasted market growth.

| Metric | Value |

|---|---|

| Syrup Market Estimated Value in (2025 E) | USD 53.6 billion |

| Syrup Market Forecast Value in (2035 F) | USD 77.0 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The syrup market is witnessing strong growth momentum driven by rising consumer preference for versatile sweetening agents across both food and beverage categories. Syrups are increasingly being positioned as flavor enhancers and natural sweeteners in response to shifting dietary habits and evolving culinary innovations.

The expansion of quick-service restaurants, along with increasing demand for ready-to-drink and ready-to-eat products, has amplified the consumption of syrups in sauces, toppings, and carbonated drinks. Innovations in flavor combinations, coupled with health-conscious product reformulations that reduce artificial ingredients and high-fructose corn syrup, are paving the way for new market opportunities.

Industry players are focusing on product differentiation through natural sourcing, clean labeling, and sustainable packaging, aligning with broader wellness and environmental trends As the global foodservice and beverage processing sectors continue to grow, the syrup market is expected to expand further with increased penetration across both traditional retail and modern trade platforms.

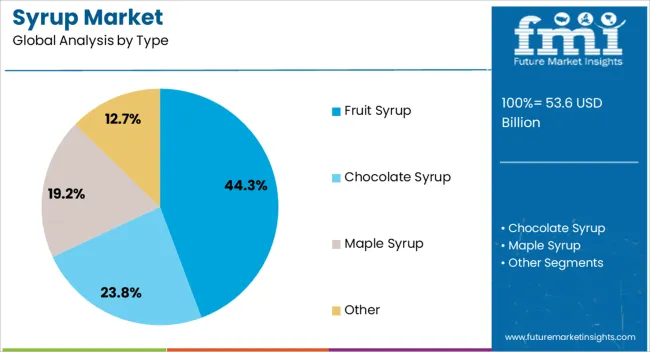

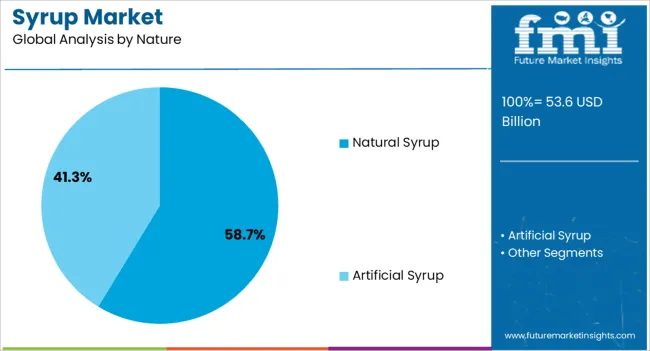

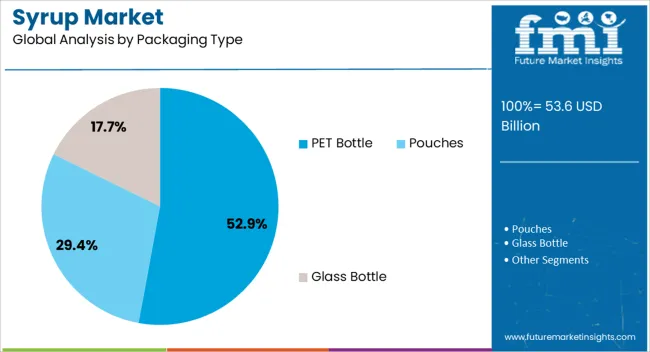

The syrup market is segmented by type, nature, packaging type, distribution channel, application, and geographic regions. By type, the syrup market is divided into Fruit Syrup, Chocolate Syrup, Maple Syrup, and Other. In terms of nature, the syrup market is classified into Natural Syrup and Artificial Syrup. Based on packaging type, the syrup market is segmented into PET bottles, Pouches, and Glass bottles. By distribution channel, the syrup market is segmented into Supermarkets / Hypermarkets, Convenience Stores, Online Retail Stores, and Other. By application, the syrup market is segmented into the Food and Beverage Industry and the Pharmaceutical Industry. Regionally, the syrup industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fruit syrup is projected to hold 44.3% of the total revenue share in the syrup market in 2025, establishing itself as the dominant type. The leading position of this segment is being driven by growing consumer preference for fruit-based flavorings across a wide range of beverage and dessert applications.

The use of fruit syrup has been increasingly favored due to its ability to deliver both sweetness and natural flavor without relying on synthetic additives. Enhanced shelf stability and compatibility with carbonated and noncarbonated beverages have further supported widespread adoption.

Manufacturers have leveraged fruit syrups to introduce innovative product lines in cocktails, flavored milk, smoothies, and frozen desserts, responding to the evolving demand for freshness and authenticity. Additionally, fruit syrup aligns well with clean label initiatives and growing interest in plant-based ingredients, strengthening its presence in both retail and foodservice channels.

Natural syrup is expected to account for 58.7% of the syrup market’s revenue share in 2025, reflecting increasing consumer demand for clean and health-conscious ingredients. The shift toward natural formulations has been influenced by rising concerns regarding artificial preservatives, high-fructose content, and synthetic flavorings. Syrup producers have responded by incorporating naturally derived sweetening agents such as agave, honey, fruit extracts, and plant-based concentrates.

The segment's growth is also supported by regulatory encouragement for transparency in ingredient labeling and reduced sugar intake, particularly in beverages. Natural syrups are being increasingly incorporated into premium offerings by food and beverage manufacturers to cater to health-aware consumers.

Their compatibility with a broad spectrum of food products and ability to meet organic and non-GMO certifications have further expanded their commercial appeal. The preference for minimally processed ingredients continues to shape procurement and product development strategies, solidifying the growth outlook for natural syrup in the market.

PET bottles are projected to contribute 52.9% of the overall revenue share in the syrup market by 2025, positioning them as the leading packaging format. This segment's dominance is being driven by the lightweight, durable, and cost-effective properties of PET materials that offer significant advantages in transportation, shelf display, and recycling.

PET bottles have become the preferred choice for syrup packaging due to their resistance to breakage, excellent barrier properties, and compatibility with various dispensing mechanisms. Their transparency enhances visual appeal, allowing consumers to assess product quality at the point of purchase.

The widespread adoption of PET bottles is also supported by advancements in sustainable PET production and closed-loop recycling programs introduced by beverage and packaging companies. In fast-moving retail environments and foodservice operations, PET bottles offer practical convenience, controlled pouring, and hygiene, reinforcing their position as the optimal packaging solution in the evolving syrup market.

The market has been influenced by diversified applications across food, beverages, pharmaceuticals, and personal care industries. Syrups have been widely utilized as sweetening, flavoring, and binding agents, driving their adoption in processed foods and functional drinks. Continuous innovation in flavors, sugar alternatives, and formulations has expanded their consumer base. Increasing interest in natural and organic variants has reshaped manufacturing practices. The market has also been driven by distribution network developments and advancements in production technologies, ensuring consistent supply across multiple regions.

The food and beverage industry has been the largest consumer of syrups, with applications extending from bakery products and confectionery to dairy and beverage formulations. Syrups have been valued for their versatility in adding texture, sweetness, and flavor. In beverage manufacturing, syrups have been utilized to create flavored sodas, juices, cocktails, and energy drinks. Bakeries and confectionery producers have integrated syrups for glazing, fillings, and sweetness enhancement. The trend toward innovative and customized flavors have stimulated demand for specialty syrups, including fruit-based and herbal blends. As processed and ready-to-drink products have gained acceptance, the reliance on syrups as essential additives has continued to strengthen.

Consumer demand has influenced the shift toward natural sweeteners and healthier alternatives, reshaping the syrup market. Traditional high-fructose syrups have been increasingly replaced by natural variants such as maple syrup, agave nectar, and honey-infused blends. Manufacturers have invested in organic certification and clean-label product development to meet rising demand for transparency. Low-calorie and sugar-free syrups formulated with stevia and monk fruit have also gained prominence in functional drinks and diet-specific products. This transition has been supported by rising health awareness and stricter labeling regulations. The appeal of natural syrups has not only broadened the market but also driven innovation in extraction, preservation, and flavor retention techniques.

Advancements in processing and production technologies have enhanced the efficiency, quality, and shelf life of syrups. Continuous filtration, vacuum concentration, and enzymatic hydrolysis have been widely adopted to maintain nutritional integrity while optimizing texture and flavor. Packaging innovations such as aseptic filling and portion-controlled dispensing have improved convenience and reduced contamination risks. Enhanced preservation methods have supported the global distribution of natural syrups without compromising freshness. Automation in manufacturing has also increased consistency, reducing batch variability. These technological enhancements have allowed manufacturers to diversify product offerings while catering to industrial-scale demands, strengthening their position in the competitive syrup market landscape.

The market has been strongly influenced by global supply chain developments and distribution networks. Export of fruit-based and specialty syrups from key producing regions has supported the availability of diverse flavors in international markets. Online retail platforms and direct-to-consumer channels have expanded the reach of syrups beyond traditional grocery outlets. Strategic collaborations between producers and distributors have facilitated timely supply to foodservice and industrial buyers. While fluctuations in raw material availability such as sugarcane, corn, and fruits have occasionally created challenges, resilient procurement strategies and regional processing hubs have ensured steady supply. Distribution efficiency has therefore played a vital role in the expansion of the syrup market worldwide.

| Countries | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

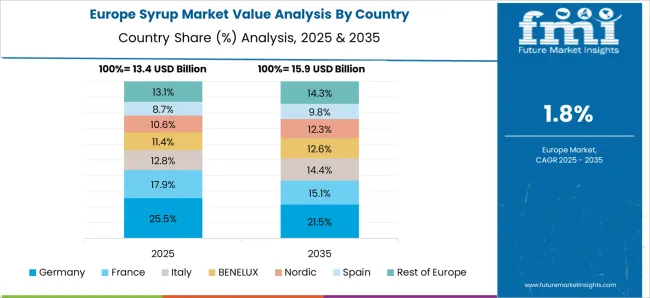

The market is expected to grow at a CAGR of 3.7% from 2025 to 2035, driven by evolving consumer preferences, product diversification, and demand from foodservice and packaged food industries. China, with a CAGR of 5.0%, leads expansion through strong consumption in beverages, confectionery, and bakery products. India, at 4.6%, scales due to rising usage of flavored syrups in quick-service restaurants and household applications. Germany, growing at 4.3%, emphasizes premium formulations, natural sweeteners, and healthier alternatives. The UK, with 3.5% growth, advances through flavored syrup adoption in café chains and home-prepared beverages. The USA, recording 3.1% CAGR, relies on stable demand from food manufacturing and growing interest in natural and reduced-sugar syrup varieties, though market maturity limits faster expansion compared with Asia. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to progress at a CAGR of 5.0%, supported by rising applications in food and beverage processing. Demand for flavored syrups in carbonated drinks, desserts, and dairy products continues to expand as consumer preferences evolve. Domestic manufacturers are investing in product innovation with natural sweeteners and low-calorie alternatives to appeal to health-conscious buyers. The growing popularity of international café chains and quick-service restaurants has further strengthened syrup utilization. Additionally, the bakery industry has been a consistent contributor to syrup demand, with fruit and chocolate-based syrups gaining traction. China’s large consumer base and urban dining culture are projected to keep syrup demand on a strong upward trajectory over the forecast period.

India is anticipated to register a CAGR of 4.6%, driven by increasing use in confectionery, dairy products, and soft drinks. Local beverage brands are incorporating syrups to diversify product portfolios, catering to shifting consumer taste preferences. Growth in ice cream parlors, bakery outlets, and ready-to-drink beverages has widened the application scope of syrups in the country. Rising consumer interest in natural flavors and indigenous fruit syrups has encouraged local production and reduced reliance on imports. Additionally, demand for functional syrups with herbal and fortified ingredients is increasing in health beverage segments. India’s diverse culinary habits and expanding food processing industry are expected to create sustained growth opportunities for syrup manufacturers.

Germany is forecast to expand at a CAGR of 4.3%, supported by a strong processed food and beverage industry. Syrup applications are widely used in confectionery, bakery, dairy, and alcoholic beverages, making Germany a consistent consumer hub. Innovation in organic and reduced-sugar syrups is shaping new product development to address health-oriented consumption trends. The rise of premium coffee culture and specialty cocktails has increased syrup demand across the hospitality sector. German manufacturers are also focusing on sustainable packaging and clean-label formulations to meet regulatory and consumer expectations. With a strong foundation in food processing, Germany continues to witness steady advancement in syrup consumption and production.

The United Kingdom market is projected to grow at a CAGR of 3.5%, influenced by rising demand from cafés, bars, and home-based consumption. Syrups are increasingly used in specialty drinks, desserts, and bakery products, supported by a strong consumer preference for premium flavors. Rising health concerns are prompting demand for sugar-free and plant-based syrups, encouraging new product launches. Seasonal consumption trends, especially during festive and holiday seasons, also contribute to sales volumes. The growing café culture and demand for artisan cocktails further drive innovation in syrup varieties. With consumers seeking versatile and indulgent flavors, the UK market is expected to maintain consistent growth in syrup usage.

The United States is expected to record a CAGR of 3.1%, shaped by a mature but steadily evolving food and beverage sector. Syrups are widely consumed in soft drinks, bakery products, frozen desserts, and alcoholic beverages. Rising consumer demand for natural and organic ingredients is boosting innovation in clean-label syrups with reduced artificial additives. The growing influence of specialty coffee and cocktail culture has enhanced demand for flavored syrups in both retail and hospitality sectors. Manufacturers are increasingly focusing on functional syrups infused with vitamins and botanicals to tap into the health-oriented segment. With a strong presence of multinational food companies and beverage chains, the USA market continues to maintain stable syrup consumption patterns.

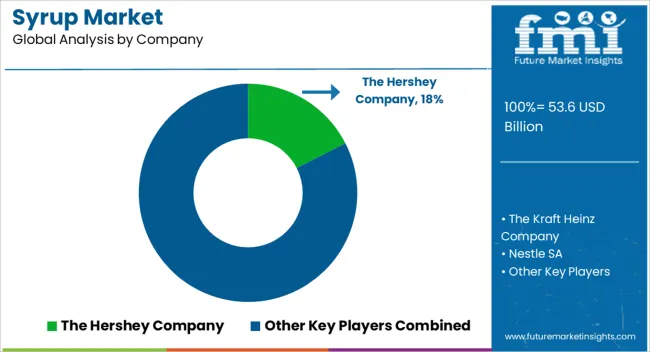

The market is characterized by a blend of global food giants and specialized producers catering to diverse consumer tastes. The Hershey Company and The Kraft Heinz Company maintain dominance through wide distribution networks and established brand equity in flavored and dessert syrups. Nestle SA and The J. M. Smucker Company extend their reach with diversified product portfolios, ranging from breakfast syrups to fruit-based options that appeal to varied consumption patterns. Premium and artisanal segments are represented by Monin Inc., Amoretti, and Sonoma Syrup Co., which focus on gourmet flavors targeted at cafes, restaurants, and mixology applications. Congara Brands Inc., Concord Foods, and Sensoryeffects Flavor Systems play a role in innovation with formulations that address both retail and foodservice requirements.

Skinny Mixes and Nature's Flavors Inc. emphasize sugar-free and natural ingredient solutions, catering to consumers seeking healthier alternatives. Traditional and niche markets remain supported by producers such as Cedarvale Maple Syrup and NutriFood, which strengthen the category with authentic and region-specific offerings. Tropicana OJ expands the competitive space by associating fruit-based beverages with syrup formulations, linking natural taste with convenience. Collectively, these companies define the syrup market by balancing mass appeal, premium positioning, and health-conscious developments.

| Item | Value |

|---|---|

| Quantitative Units | USD 53.6 Billion |

| Type | Fruit Syrup, Chocolate Syrup, Maple Syrup, and Other |

| Nature | Natural Syrup and Artificial Syrup |

| Packaging Type | PET Bottle, Pouches, and Glass Bottle |

| Distribution Channel | Supermarkets / Hypermarkets, Convenience Stores, Online Retail Stores, and Other |

| Application | Food and Beverage Industry and Pharmaceutical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Hershey Company, The Kraft Heinz Company, Nestle SA, The J. M. Smucker Company, Monin Inc., Congara Brands Inc, NutriFood, Concord Foods, Amoretti, Sonoma Syrup Co., Sensoryeffects Flavor Systems, Skinny Mixes, Nature's Flavors Inc, Cedarvale Maple Syrup, and Tropicana OJ. |

| Additional Attributes | Dollar sales by syrup type and application, demand dynamics across food, beverage, and pharmaceutical sectors, regional trends in consumption and production, innovation in flavor profiles, formulations, and health-oriented options, environmental impact of sourcing and packaging waste, and emerging use cases in functional foods and specialty beverages. |

The global syrup market is estimated to be valued at USD 53.6 billion in 2025.

The market size for the syrup market is projected to reach USD 77.0 billion by 2035.

The syrup market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in syrup market are fruit syrup, chocolate syrup, maple syrup and other.

In terms of nature, natural syrup segment to command 58.7% share in the syrup market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Syrup Bottle Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the PET Syrup Bottle Industry

Warm Syrup & Topping Dispensers Market – Enhanced Serving Solutions 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Agave Syrup Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Maple Syrup Manufacturers

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Competitive Overview of Coconut Syrup Industry Share

Glucose Syrup Market

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocktail Syrup Market Analysis by Product Type, Flavor, and Region Through 2035

Dextrose Syrup Market

Specialty Syrup Market Analysis by Type, Application and Other Types Through 2035

Chocolate Syrup Market

Sugar-Free Syrups Market Insights - Innovations & Consumer Demand 2025 to 2035

Starch Glucose Syrup Market

Clarified Rice Syrup Market

Glucose-Fructose Syrup Market – Growth, Demand & Food Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA