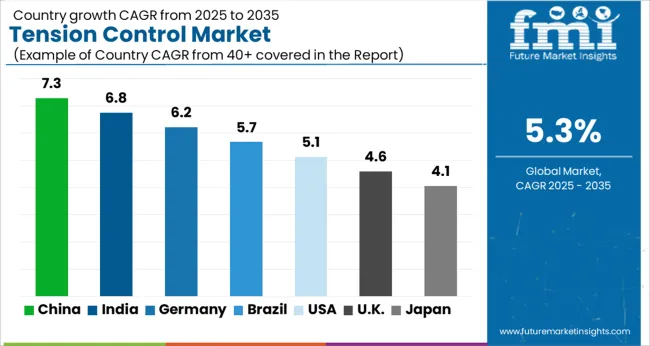

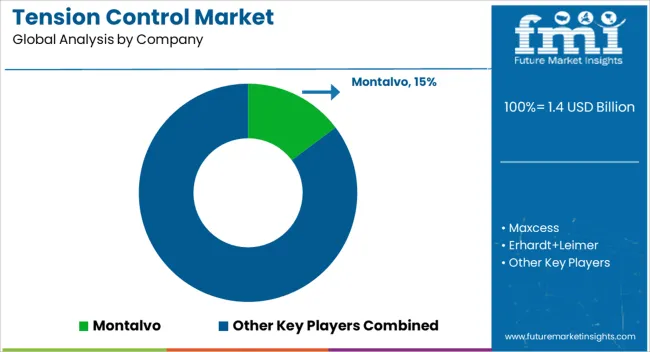

The Tension Control Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Tension Control Market Estimated Value in (2025 E) | USD 1.4 billion |

| Tension Control Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The tension control market is experiencing consistent growth, supported by rising demand for high-quality packaging, printing, and converting processes across industries. Precision in web handling has become increasingly critical as manufacturers aim to minimize material waste, improve efficiency, and enhance product quality.

Technological advancements in tension measurement and automation have facilitated real-time adjustments, ensuring operational accuracy and reducing downtime. The market is further strengthened by the adoption of smart sensors and digital monitoring systems that integrate seamlessly with modern production lines.

Industries such as flexible packaging, paper, textiles, and electronics are driving sustained demand for advanced control systems. With the expansion of high-speed manufacturing facilities and greater emphasis on productivity optimization, the market outlook remains positive, reinforced by continued automation trends and the need for consistent product standards across global supply chains.

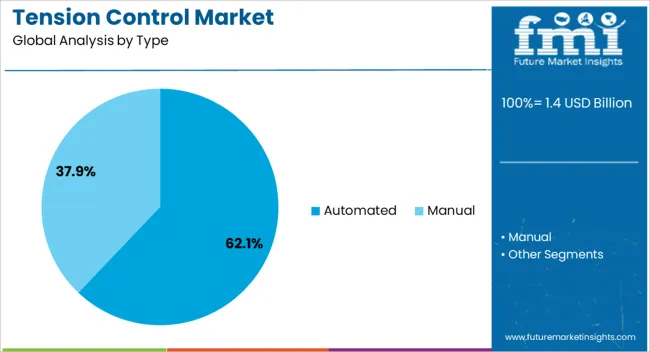

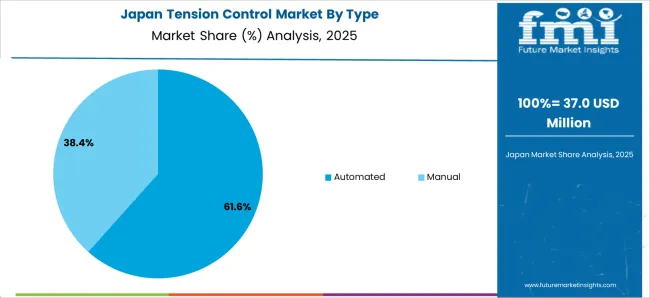

The automated segment dominates the type category, accounting for approximately 62.10% of the tension control market. Its leadership is attributed to the rising demand for accuracy, consistency, and efficiency in high-speed production environments. Automated systems provide continuous monitoring and adjustment, reducing reliance on manual interventions and ensuring uniform material tension.

This capability is critical in applications where precision directly influences product quality, such as flexible packaging and advanced printing. Integration with digital interfaces and Industry 4.0 platforms has enhanced real-time control, further improving operational performance.

The scalability and adaptability of automated solutions across diverse industrial applications have cemented their dominance. With continued advancements in smart manufacturing technologies, the automated segment is expected to sustain its leading role in the market.

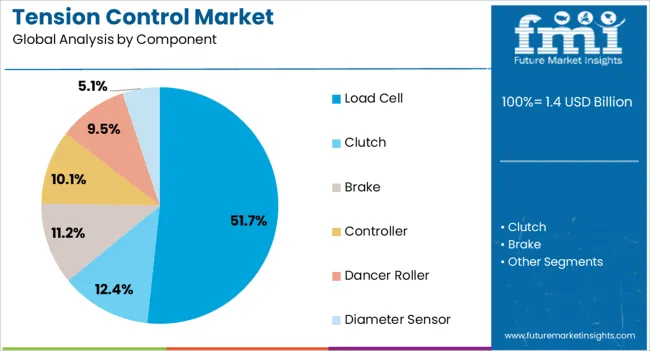

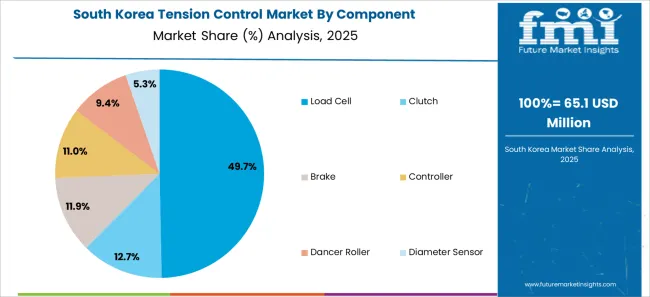

The load cell segment leads the component category with approximately 51.70% share, owing to its accuracy, reliability, and adaptability in various tension control systems. Load cells enable direct force measurement, ensuring precise feedback and control across web handling applications.

Their durability and ability to function under variable environmental conditions make them a preferred choice in demanding production lines. The segment benefits from technological improvements in miniaturization, signal stability, and digital output compatibility, which enhance performance and integration into automated systems.

Widespread use in industries such as printing, paper, and packaging has reinforced the segment’s position. As demand for high-speed, high-accuracy processes increases, load cells are expected to remain integral components in advanced tension control systems.

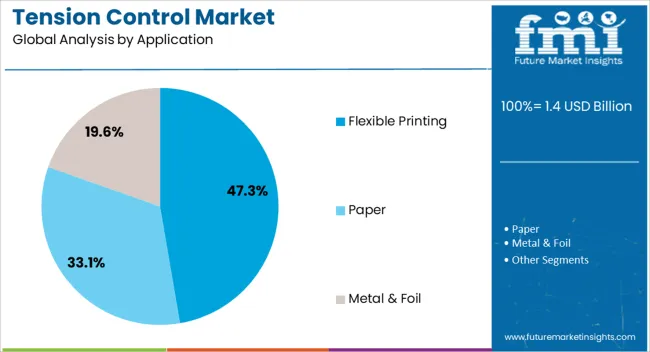

The flexible printing segment accounts for approximately 47.30% of the application category, reflecting its central role in driving demand for tension control systems. The segment benefits from the growing use of flexible packaging in food, beverage, and consumer goods industries, where precision in web alignment and print registration is essential.

High-speed printing presses require advanced tension control systems to minimize defects and ensure quality consistency. Automated monitoring and real-time adjustment technologies have further reinforced adoption in this sector.

With increasing demand for customized packaging and sustainability-driven lightweight materials, the need for accurate tension control in flexible printing is expected to remain strong, ensuring the segment’s leading position in the market.

The global demand for tension control market was estimated to reach a global market valuation of USD 1.1 million in 2020, according to a report from Future Market Insights. From 2020 to 2025, sales witnessed significant growth in the tension control market, registering a CAGR of 6.9%.

| Historical CAGR from 2020 to 2025 | 6.9% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5.4% |

With the incorporation of smart technology, Industry 4.0 principles, and an emphasis on sustainable production, the tension control market is changing quickly.

The market expansion is driven by global industrialization trends and ongoing breakthroughs in precision engineering, which provide eco-friendly, automated, and highly efficient solutions for a variety of manufacturing industries. Some important factors that will boost the market growth through 2035 are:

Due to these favorable factors, which set the market up for long-term growth, it is imperative for players to maintain both their strategic and tactical flexibility during the projection period.

Demand for Industry 4.0 Integration to Enhance Market Growth

The market for tension control is mostly driven by the growing need for solutions led by Industry 4.0. The use of automation, data analytics, and smart technology is becoming essential as industrial processes become more complex.

The accuracy and real-time monitoring provided by tension control systems make them ideal for Industry 4.0, which is why they are so widely used. Tension control systems are now positioned as essential parts of the growing field of smart and connected manufacturing processes, which also improves production efficiency.

Eco-friendly and Sustainable manufacturing Practices to Accelerate Market Growth

The market for tension control is also being driven by the increasing focus on sustainability and environmentally friendly production techniques. As environmental problems become more widely recognized, companies are looking for ways to reduce waste, energy use, and environmental effect.

Advanced tension control systems are essential for streamlining manufacturing procedures, cutting down on material waste, and guaranteeing energy-saving operations.

Growing consumer demand for products that support sustainable development objectives is driving the market and encouraging a change to more ecologically friendly and ecologically aware manufacturing techniques.

Technological Complexity to Impede the Global Market Growth

Market growth in the tension control market may be limited due to variables such as high initial investment prices for advanced systems, particularly in emerging markets. Widespread adoption may also be hampered by technological complexity and the unwillingness of existing production systems to change. Obstacles may include inconsistent industry-wide procedures and regulatory issues.

Uncertainty and economic downturns may cause capital expenditures to be postponed, which might have an effect on the potential of the market for development by influencing investment decisions in modern tension control technology.

This section focuses on providing in-depth assessments of certain market segments for tension control. The two main areas of analysis will be automated product and load cell.

During the forecast period, the automated product segment is likely to garner a 5.1% CAGR. The potential of automated products to increase productivity and decrease manual intervention makes them a promising category for growth in the global tension control market. Automation guarantees accurate tension management, reducing mistakes and raising the standard of output overall.

Automated tension control systems fit very well with smart production settings, offering real-time data and enabling remote monitoring as more businesses embrace Industry 4.0 techniques. This improves operational effectiveness while also fitting in with the larger trend of linked, modern production, which makes automated tension control solutions the better option in the evolving industrial scene.

In 2025, the load cell segment is likely to have acquired a 51.7% global market share. The precision and accuracy of the load cell component in measuring tension is expected to make it more popular in the tension control industry. Load cells offer real-time data on substance tension, allowing precise control and eliminating product flaws as companies seek for improved quality and efficiency.

Due to its adaptability to a wide range of activities, including production and conversion, load cells are considered indispensable parts. The growing acceptance of load cells in the changing field of tension control solutions is further facilitated by developments in the technology, such as wireless communication and integration with automation systems.

This section will delve into the markets for tension controls in different important countries, such as the United States, the United Kingdom, China, Japan, and South Korea. The section highlights the important factors that are propelling the market in these various spots.

The United States tension control is anticipated to gain a CAGR of 5.6% through 2035. Factors that are boosting the growth are:

The market in the United Kingdom is expected to expand with a 7% CAGR through 2035. The factors pushing the growth are:

China tension control ecosystem is anticipated to develop with a 6.3% CAGR from 2025 to 2035. The probable reasons behind this growth are:

The tension control industry in Japan is expected to reach a 4.1% CAGR from 2025 to 2035. The reasons accelerating growth are:

The South Korea advanced energy storage industry is likely to attain a 7.6% CAGR during the forecast period. The factors boosting the growth are:

Key companies in the global tension control market are continuously pursuing strategies aimed at promoting innovation and expanding their market share. These businesses make large investments in research and development in order to provide innovative tension control technologies. Partnerships and collaborations are frequent, enabling businesses to expand their product offers and include complimentary technology.

Acquisitions and mergers are common tactics to increase worldwide presence and consolidate market share. Approaches that focus on the needs of the consumer, such offering customized solutions and effective customer service, help businesses stay competitive. All things considered, the major companies in the tension control industry show a dedication to innovation, teamwork, and client pleasure. The key players in this market include:

Key market participants are making significant advancements in the tension control sector, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.4% from 2025 to 2035 |

| Market value in 2025 | USD 1.3 billion |

| Market value in 2035 | USD 2.2 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Component, Application, Region |

| Region Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Montalvo (USA); Maxcess (USA); Erhardt+Leimer (Germany); Dover Flexo Electronics (USA); Double E (USA); Nexen (USA); FMS (Switzerland); RE Controlli Industriali (Italy); Nireco (Japan) |

| Customization Scope | Available on Request |

The global tension control market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the tension control market is projected to reach USD 2.3 billion by 2035.

The tension control market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in tension control market are automated and manual.

In terms of component, load cell segment to command 51.7% share in the tension control market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Tension Tester Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA