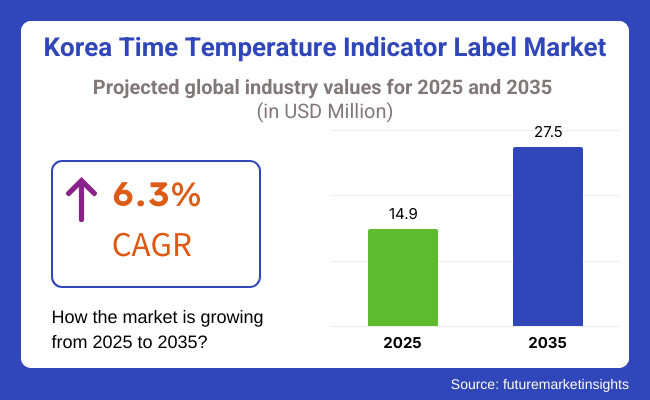

The Korea Time Temperature Indicator Label is estimated to account for USD 14.9 million in 2025. It is anticipated to grow at a CAGR of 6.3% during the assessment period and reach a value of USD 27.5 million by 2035.

Industry Outlook

The Korea TTI label market is poised for continued growth, buoyed by increasing demand across industries such as pharmaceuticals, food, and logistics. The pharmaceutical sector's focus on accurate temperature control of drugs and vaccines will fuel the adoption of TTIs in supply chains. Furthermore, innovations like IoT-based smart packaging will improve real-time monitoring, further propelling adoption.

Government incentives and regulation favoring food safety and minimizing waste will create an auspicious market climate. Moreover, as consumer taste trends emerge in the direction of fresh and lower costs of processing foods, industries and consumers will increasingly employ TTIs to confirm rather than jeopardize the quality of the products. Under such conditions, the industry is poised to grow steadily between the 2025 to 2035 period.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Adoption of passive and basic TTIs was prevalent, with limited real-time tracking and data analytics. | IoT-enabled TTIs and AI-powered analytics will enhance real-time tracking, supply chain efficiency, and regulatory compliance. |

| The pharmaceutical and food industries were the primary users, but adoption was mainly regulatory-driven. | Demand will be market-driven, with logistics, retail, and high-end food packaging also integrating TTIs for enhanced quality control. |

| Regulatory bodies started implementing guidelines to promote TTIs in food safety and pharmaceuticals. However, enforcement was not widespread. | Governments may mandate stricter regulations for TTI usage, especially in perishable goods and vaccine distribution, encouraging broader adoption. |

| Consumers had low to moderate awareness of TTIs, with minimal demand for visible temperature tracking on packaging. | Awareness will increase significantly, with consumers demanding transparent, smart packaging that ensures product safety and freshness. |

| TTIs were used selectively, mainly by larger companies with global supply chains, while smaller businesses were slow to adopt. | TTIs will become standard practice across industries, driven by cost reductions, government incentives, and efficiency improvements. |

| Investments in R&D were limited, with a focus on cost-effective, basic indicators. | Higher investments in R&D will lead to multi-functional TTIs, capable of integrating with blockchain and smart logistics. |

| High costs, lack of standardization, and limited awareness were major barriers to adoption. | Price reduction, standardization, and integration with digital technologies will help overcome past challenges, making TTIs more accessible. |

| Focus was on basic compliance rather than actively using TTIs to reduce waste in the supply chain. | TTIs will play a key role in reducing food and pharmaceutical waste, aligning with global sustainability initiatives. |

Demand for Fresh and Safe Food Products

Korean consumers put a greater premium on freshness and food safety, driving demand for time temperature indicator (TTI) labeling of perishable foods. As consumers increasingly focus on the risk of foodborne disease and contamination, they look for simple, real-time temperature indicators that confirm food has been stored in ideal conditions. Food companies and retailers comply by placing TTIs on packaging for meat, dairy, seafood, and ready-to-eat foods, assuring quality and shelf life.

Smart Packaging and Digital Integration

Korean consumers embrace smart packaging technology, compelling manufacturers to integrate IoT-enabled TTIs with QR and smartphone connectivity. Consumers want to scan labels and receive real-time temperature history, freshness, and expiration notifications. It is due to Korea's tech-savvy population, where technology interaction and ingredient transparency lead to what consumers buy. The market continues to expand with the need for smart packaging solutions, and TTIs become a standard feature in premium and export offerings.

Increased Emphasis on Pharmaceutical Safety

Increased online pharmacy shopping and home delivery translate into consumers demanding temperature-assured drug packaging to ensure drug effectiveness. With more individuals receiving temperature-sensitive vaccines and biologics, trust in cold chain integrity is a significant buying influence. TTIs in pharma packaging enable patients and medical professionals to confirm storage conditions, ensuring medication efficacy and establishing pharmaceutical brand confidence.

Sustainability and Waste Reduction Awareness

Korean consumers actively seek out eco-friendly packaging alternatives, pushing brands to adopt biodegradable or recyclable TTIs. As concerns about sustainability increase, TTIs prevent food and pharmaceutical waste by indicating freshness beyond printed expiration dates. Consumers favor waste-reducing innovations and prefer brands that employ TTIs to avoid unnecessary disposal of still-consumable products. This is in line with Korea's drive towards zero-waste efforts and sustainable consumption.

Preference for Imported and Premium Products

As Korean consumers spend more on premium and imported goods, they look for authenticity and quality assurance. Imported specialty foods, wine, cosmetics, and health specialty foods need strict temperature control, and leading brands now employ sophisticated TTIs that track temperature in real-time from factory to hand. Consumers want high-end products to have clear safety assurances, supporting TTIs as a must-have utility in luxury and international markets.

E-commerce and Direct-to-Consumer Cold Chain Growth

Online food ordering and direct-to-consumer meal delivery growth fuel the demand for TTIs in cold chain logistics. Consumers who order fresh produce, frozen foods, and specialty beverages must have temperature monitoring to guarantee safe transportation. TTIs guarantee that products stayed within safe temperatures, which builds customer confidence in online food and beverage retailers.

Based on the type of product, the market is divided into colour-based and barcode-based. Color-based and barcode-based time-temperature indicator (TTI) labels are the most prominent forms that are used to monitor temperature-sensitive goods in Korea. Color-based TTIs have extensive use in the food and pharmaceutical industries due to the fact that they are easy to use and visually readable.

Color-shifting TTIs change color with the progress of time or at threshold temperatures, so consumers and businesses will be aware instantaneously if a product has undergone harmful temperatures. They are utilized primarily in fresh food packaging, vaccine transportation, and temperature-sensitive pharmaceuticals, where immediate color indication is important for quality assurance and safety.

Barcode-style TTIs are catching up with digitalization and smart packaging solutions in vogue in Korea. They are barcoded or have QR-coded links with temperature-monitoring databases so companies and consumers can scan and get real-time temperature data.

It makes supply chain visibility and therefore valid for companies that require accurate temperature history and regulatory requirements such as pharmaceutical distribution, high-end food exports, and online e-commerce cold chain freight. Thanks to penetration of smartphones, which is good in Korea, and robust technology infrastructure, bar code-based TTIs are coming to be increasingly adopted as the preferred option among firms seeking to incorporate IoT, AI-powered analysis, and blockchain-based traceability in their value chains.

Based on the information label, the market is categorized into Critical Temperature Indicators (CTI), Time Temperature Indicators (TTI), and Critical Time Temperature Indicators (CTTI).

Critical Temperature Indicators (CTI), Time Temperature Indicators (TTI), and Critical Time Temperature Indicators (CTTI) are increasingly being used in Korea in industries that require precise temperature measurement for sensitive and perishable products. They each perform a specific function that renders them more apt to be used depending on the need of regulation, supply chain demands, and technological innovation.

Critical Temperature Indicators (CTI) are extensively applied in pharmaceuticals and high-value food products since they give a certain, irreversible indication when a product has attained a specific temperature level. CTIs are mandatory in Korea for vaccine storage, biologics, and specialty foods such as seafood and dairy, which ensure uniform temporary exposure to dangerous temperatures is indicated. Their ease of use and dependability make them the favorite of regulatory compliance and consumer trust.

Technologically, the market can be segmented into microbiological, diffusion, polymer-based, photochemical, and enzymatic. Polymer-based and enzymatic time temperature indicator (TTI) labels are commonly used in Korea due to their cost-effectiveness, accuracy, and suitability for integration with existing packaging and supply chain infrastructures.

Polymer-based TTIs have widespread applications in food and pharmaceutical uses due to their ability to deliver slow, irreversible color responses with regard to time and temperature exposure. They work through the use of polymer degradation or phase change to monitor cumulative temperature exposure, and they are best applied to track temperature-sensitive perishable food, frozen foods, and vaccine transport. As Korea's cold chain logistics continue to grow rapidly and demand for fresh and minimally processed foods increases, polymer-based TTIs are preferred for their easy-to-understand, simple visual signals and low cost.

Based on end-use industry, the market is divided into pharmaceutical, food & beverage, and chemical & fertilizers. Pharmaceutical industry in Korea utilizes time temperature indicator (TTI) labels most extensively because of the rigorous regulatory conditions, high-value items, and absolute necessity of temperature control for storing and transporting medicines.

Since the country is focusing on precision medicine, vaccines, and biopharmaceuticals, TTIs play an important role to ensure that the drug, biologics, and vaccine effectiveness remains intact during supply. MFDS has rigorous controls for cold chain management, and TTIs are essential to measure temperature changes and ensure drug efficacy is not adversely affected. Additionally, the burgeoning Korean pharmaceutical export market also creates an added demand for TTIs in a bid to meet up with international requirements.

As per FMI analysis, the Korean time temperature indicator (TTI) label market is moderately concentrated, with major players controlling the pharmaceutical and food sectors. Top players emphasize technology development, incorporating IoT and intelligent packaging solutions to improve temperature monitoring. The companies have a competitive advantage through R&D expenditure, regulatory adherence, and industry collaborations.

Pharmaceutical TTIs spur market concentration as strict cold chain regulations oblige leading manufacturers to embrace sophisticated monitoring technology. The biopharmaceutical industry, which involves vaccines and biologics, depends on accurate TTIs, with high barriers to entry for small players. Established players are buoyed by long-term deals with hospitals, logistics companies, and international exporters, solidifying market dominance.

The food and beverage industry experiences moderate competition, with both international and local companies providing TTIs for perishable items and exports. With increasing demand for fresh food and e-commerce cold chain logistics, new players bring cost-efficient and intelligent TTIs. Nevertheless, larger players retain leadership through brand loyalty and better technology integration.

The fertilizers and chemical segment is still highly fragmented, with selective adoption of TTIs in temperature-sensitive chemical storage. Market concentration is low, as there are few industrial users that need TTIs. Most firms use conventional temperature control measures, keeping demand for specialized TTI solutions low and minimizing dominance by large TTI producers.

The competitive landscape for time temperature indicator (TTI) labels in Korea includes global and domestic players focusing on pharmaceutical, food, and chemical industries. Leading companies prioritize technological innovation, integrating smart packaging and IoT-enabled solutions. Market leaders consolidate their positions through regulatory compliance, R&D investment, and strategic industry partnerships to secure product reliability.

Pharma-centered TTI companies are market leaders because of intense cold chain legislation. These are the providers of high-precision TTIs to biopharmaceuticals, vaccines, and temperature-sensitive medicine. Strong players have long-term agreements with government agencies, logistic companies, and hospitals, developing high barriers of entry for local players. Competitiveness further increases with new innovation in temperature tracking using digital technology.

In the food and beverage sector, competition is moderate with global and domestic companies providing TTIs for perishables, exports, and e-commerce shipping. The larger companies dominate the market by providing affordable, scalable, and environmentally friendly TTIs, while smaller companies differentiate with customized solutions and specialty use in fresh food monitoring.

The fertilizers and chemical industry experiences low market concentration, as TTI adoption is restricted to niche applications. Only a few industrial chemical and agrochemical firms incorporate TTIs for temperature-sensitive products. Large TTI suppliers target high-value industrial customers, while smaller companies grapple with lower demand and dependence on conventional monitoring techniques.

With increased adoption of smart packaging, rivalry strengthens among organizations implementing IoT-based TTIs, blockchain monitoring, and digital tracking platforms. Next-generation TTIs have advanced capabilities for real-time access to data, compelling businesses that want greater supply chain transparency and efficiency. Technologically advanced Korean companies drive the movement toward next-generation TTIs, creating trends in both local and foreign markets.

With respect to product type, the market is classified into colour-based and barcode-based.

In terms of label of information, the market is segmented into Critical Temperature Indicators (CTI), Time Temperature Indicators (TTI), and Critical Time Temperature Indicators (CTTI).

In terms of technology, the market is divided into microbiological, diffusion, polymer-based, photochemical, and enzymatic.

In terms of end-use industry, the market is divided into pharmaceutical, food & beverage, and chemical & fertilizers.

In terms of province, the market is segmented into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea.

The market is anticipated to reach USD 14.9 million in 2025.

The market is predicted to reach a size of USD 27.5 million by 2035.

Prominent players include 3M Company, CCL Industries Inc., TIP Temperature Products, and others.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Label Information, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Label Information, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Technology, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by End-use Industry, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Label Information, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Label Information, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Technology, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by End-use Industry, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Label Information, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Label Information, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Technology, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End-use Industry, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Label Information, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Label Information, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Technology, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End-use Industry, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Label Information, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Label Information, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Technology, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Units) Forecast by End-use Industry, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Label Information, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Label Information, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Technology, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Units) Forecast by End-use Industry, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Label Information, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Technology, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Label Information, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Label Information, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Label Information, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Label Information, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Technology, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by End-use Industry, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Label Information, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Technology, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Label Information, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Technology, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Label Information, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Label Information, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Label Information, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Label Information, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Technology, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by End-use Industry, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Label Information, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Technology, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Label Information, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Technology, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Label Information, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Label Information, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Label Information, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Label Information, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Technology, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End-use Industry, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Label Information, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Technology, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Label Information, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Technology, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Label Information, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Label Information, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Label Information, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Label Information, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Technology, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End-use Industry, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Label Information, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Technology, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Label Information, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by Technology, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Label Information, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Label Information, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Label Information, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Label Information, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Technology, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Units) Analysis by End-use Industry, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Label Information, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Technology, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Label Information, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by Technology, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Label Information, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Label Information, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Label Information, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Label Information, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Technology, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Units) Analysis by End-use Industry, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Label Information, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by Technology, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA