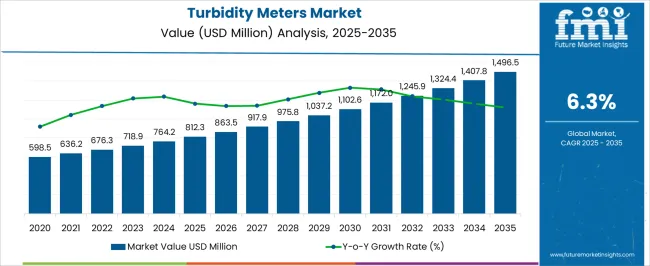

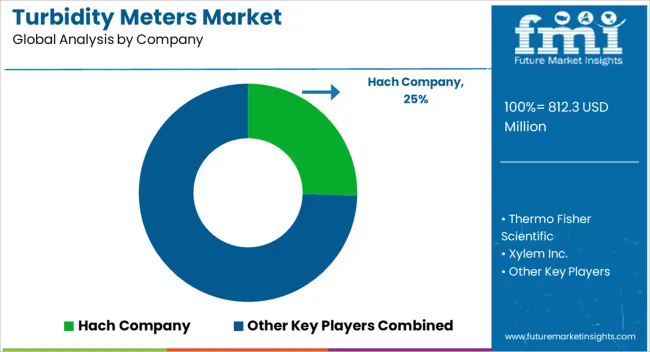

The Turbidity Meters Market is estimated to be valued at USD 812.3 million in 2025 and is projected to reach USD 1496.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Turbidity Meters Market Estimated Value in (2025 E) | USD 812.3 million |

| Turbidity Meters Market Forecast Value in (2035 F) | USD 1496.5 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Turbidity Meters market is experiencing steady growth as the demand for precise water quality monitoring continues to rise across industrial, municipal, and environmental applications. The current market scenario reflects an increasing focus on water safety standards, regulatory compliance, and sustainable water management practices. The need for efficient monitoring systems has been further emphasized by stricter government regulations and growing concerns over industrial discharge, wastewater treatment, and drinking water contamination.

The future outlook is strengthened by advancements in sensor technologies, miniaturization of equipment, and the integration of smart monitoring systems that offer real-time data analytics. Investments in upgrading aging water infrastructure and rising awareness regarding environmental protection are contributing to expanding market adoption.

Moreover, the need for portable and easy-to-use monitoring solutions is being recognized as a cost-effective method to conduct field testing and rapid assessments As urbanization and industrial activities continue to increase, turbidity meters are expected to play a critical role in ensuring water safety, operational efficiency, and sustainable resource management, presenting new growth opportunities in both established and emerging regions.

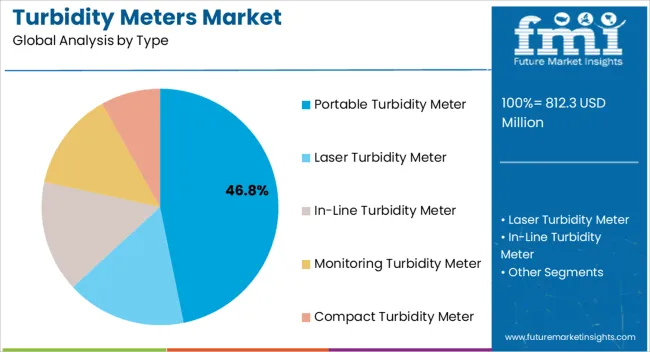

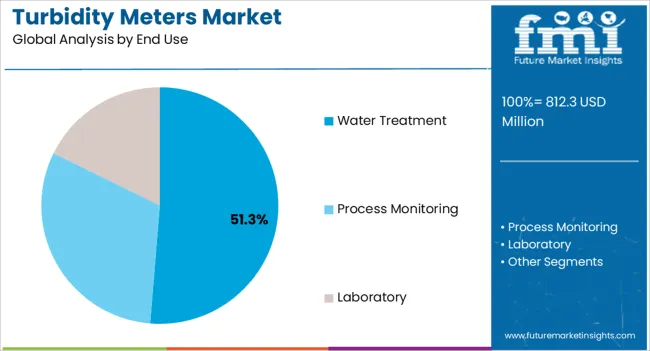

The turbidity meters market is segmented by type, end use, distribution channel, application, and geographic regions. By type, turbidity meters market is divided into Portable Turbidity Meter, Laser Turbidity Meter, In-Line Turbidity Meter, Monitoring Turbidity Meter, and Compact Turbidity Meter. In terms of end use, turbidity meters market is classified into Water Treatment, Process Monitoring, and Laboratory.

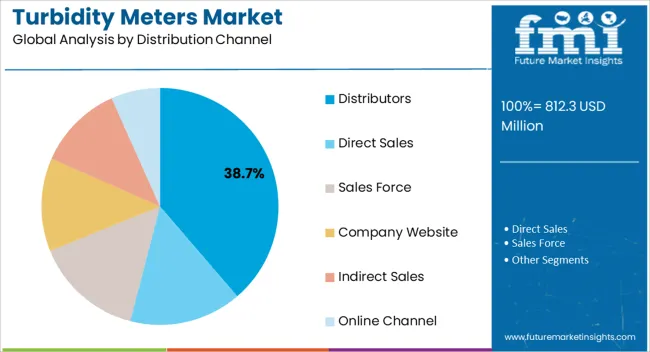

Based on distribution channel, turbidity meters market is segmented into Distributors, Direct Sales, Sales Force, Company Website, Indirect Sales, and Online Channel. By application, turbidity meters market is segmented into Water And Wastewater Treatment, Water Quality Testing, River Monitoring, Stream Measurement, Reservoir Water Quality Testing, Groundwater Measuring, Effluent, And Industrial Control, Beverage Testing, and Others.

Regionally, the turbidity meters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The portable turbidity meter segment is expected to hold 46.80% of the market revenue share in 2025, making it the leading type in the turbidity meters market. This segment’s dominance has been driven by the growing need for field-based water quality testing where access to fixed monitoring systems is limited or impractical. Portability has allowed operators to quickly measure turbidity levels at different locations, facilitating real-time assessments and faster decision-making processes.

The segment has also benefited from advances in lightweight designs, improved battery life, and wireless connectivity that enable data logging and remote reporting. The demand from industries requiring frequent monitoring, such as wastewater treatment and environmental testing, has further propelled its adoption.

Additionally, the increasing emphasis on water safety protocols and rapid incident response has made portable solutions preferable in emergency scenarios As cost-effective, user-friendly solutions are sought across sectors, the portable turbidity meter segment is expected to maintain its leadership by offering enhanced flexibility, precision, and adaptability to various monitoring environments.

The water treatment segment is anticipated to hold 51.30% of the turbidity meters market revenue share in 2025, emerging as the largest end-use application. This leadership is being attributed to the critical role turbidity measurement plays in ensuring the efficiency and safety of water treatment processes. Monitoring turbidity levels is essential for controlling filtration systems, chemical dosing, and assessing contamination risks during treatment operations.

The segment has been supported by growing regulatory requirements for treated water quality and heightened public health concerns. Increasing investments in upgrading water treatment plants and expanding access to clean water, especially in developing regions, have further boosted demand. The ability to perform accurate, continuous turbidity monitoring helps operators maintain compliance and avoid costly downtime, making these solutions indispensable in treatment facilities.

The segment’s growth has also been encouraged by rising concerns over industrial wastewater discharge and the need for sustainable water management As governments and organizations continue to invest in water infrastructure and safety initiatives, the water treatment segment is expected to remain a key driver of market expansion.

The distributors segment is projected to hold 38.70% of the market revenue share in 2025, making it the largest distribution channel within the turbidity meters market. This leading position is being driven by the increasing demand for localized support, fast delivery, and after-sales services that distributors are well-equipped to provide. Distributors have played a pivotal role in expanding market reach by offering a broad range of products from various manufacturers, allowing customers to choose from multiple options tailored to their specific requirements.

Their ability to provide technical guidance, calibration services, and field support has been critical in ensuring proper equipment usage and reliability. The segment has also benefited from the growing need for on-site installations and training, especially in sectors requiring frequent monitoring.

The expansion of distributor networks into emerging regions has facilitated market penetration where direct manufacturer presence is limited Furthermore, the distributors’ role in providing value-added services and fostering customer relationships has reinforced trust and accelerated adoption across both public and private sector projects, positioning them as vital partners in the turbidity meters market’s sustained growth.

Turbidity meters are been introduced to keep an eye on the purity of water or liquids. Turbidity meters are used to determine the concentration of suspended particles in a sample of water or liquid by measuring the incident light scattered at right angles from the sample. This is the principle of operation of the turbidity meters of any type. The turbidity meters are mostly used at breweries and water treatment plants.

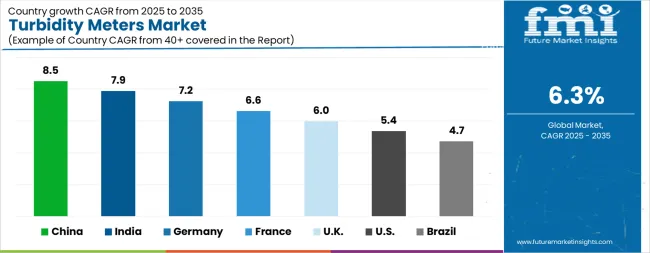

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The Turbidity Meters Market is expected to register a CAGR of 6.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.5%, followed by India at 7.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Turbidity Meters Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.2%.

The USA Turbidity Meters Market is estimated to be valued at USD 281.4 million in 2025 and is anticipated to reach a valuation of USD 474.1 million by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 42.5 million and USD 26.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 812.3 Million |

| Type | Portable Turbidity Meter, Laser Turbidity Meter, In-Line Turbidity Meter, Monitoring Turbidity Meter, and Compact Turbidity Meter |

| End Use | Water Treatment, Process Monitoring, and Laboratory |

| Distribution Channel | Distributors, Direct Sales, Sales Force, Company Website, Indirect Sales, and Online Channel |

| Application | Water And Wastewater Treatment, Water Quality Testing, River Monitoring, Stream Measurement, Reservoir Water Quality Testing, Groundwater Measuring, Effluent, And Industrial Control, Beverage Testing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hach Company, Thermo Fisher Scientific, Xylem Inc., Emerson Electric Co., LaMotte Company, Hanna Instruments, Endress+Hauser Group, Lovibond (Tintometer Group), YSI Inc., METTLER TOLEDO, Horiba Ltd., SWAN Analytical Instruments, GF Piping Systems, AQUALABO Group, KROHNE Group, Sutron Corporation, and Hack Company |

The global turbidity meters market is estimated to be valued at USD 812.3 million in 2025.

The market size for the turbidity meters market is projected to reach USD 1,496.5 million by 2035.

The turbidity meters market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in turbidity meters market are portable turbidity meter, laser turbidity meter, in-line turbidity meter, monitoring turbidity meter and compact turbidity meter.

In terms of end use, water treatment segment to command 51.3% share in the turbidity meters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ammeters Market Size and Share Forecast Outlook 2025 to 2035

Ergometers Market Size and Share Forecast Outlook 2025 to 2035

Rheometers Market Size and Share Forecast Outlook 2025 to 2035

LCR Meters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Meters Market Growth - Trends & Forecast 2025 to 2035

Manometers Market

Micrometers Market Size and Share Forecast Outlook 2025 to 2035

Viscometers Market Size and Share Forecast Outlook 2025 to 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Megohmmeters Market Size and Share Forecast Outlook 2025 to 2035

Calorimeters Market Size and Share Forecast Outlook 2025 to 2035

Gloss Meters Market

Luminometers Market

Refractometers Market Growth – Trends & Forecast 2018-2027

Inductance Meters Market Size and Share Forecast Outlook 2025 to 2035

Pocket Pedometers Market

Dial Thermometers Market

Spectrophotometers Market Size and Share Forecast Outlook 2025 to 2035

Bone Densitometers Analysis by Product Type, by Technology and by End User through 2035

Resistivity Meters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA