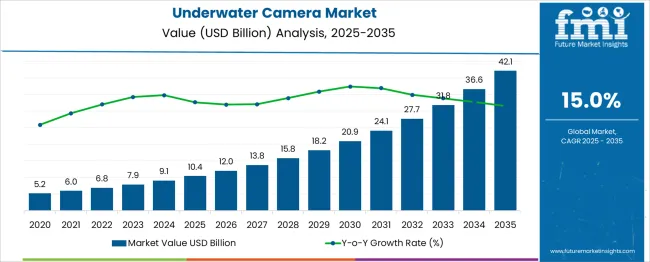

The Underwater Camera Market is estimated to be valued at USD 10.4 billion in 2025 and is projected to reach USD 42.1 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

The underwater camera market is forecast to achieve an absolute gain of USD 31.7 billion and a remarkable growth multiplier of 4.05x. This trajectory reflects a strong CAGR of 15%, driven by rising demand for professional-grade imaging in marine research, adventure tourism, defense, and underwater cinematography. In the first half of the forecast period (2025–2030), the market advances from USD 10.4 billion to USD 20.9 billion, adding USD 10.5 billion, or 33% of total growth, delivering a 5-year multiplier of 2.01x as interest in recreational diving and social media-driven photography grows globally.

The second half (2030–2035) sees accelerated momentum, contributing USD 21.2 billion, which represents 67% of the incremental opportunity, as technological enhancements like AI-driven image stabilization, 8K video capability, and IoT-enabled connectivity gain mainstream adoption. Yearly increments rise from USD 1.6 billion in early years to over USD 5.5 billion in the final phase, signaling strong late-cycle acceleration. Manufacturers focusing on rugged, lightweight designs, extended depth ratings, and cloud-integrated storage solutions will dominate in this USD 31.7 billion growth window, capitalizing on opportunities in marine exploration, fisheries monitoring, and emerging underwater VR content production.

| Metric | Value |

|---|---|

| Underwater Camera Market Estimated Value in (2025 E) | USD 10.4 billion |

| Underwater Camera Market Forecast Value in (2035 F) | USD 42.1 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The underwater camera market holds a specialized yet expanding role across several imaging and adventure-focused sectors. In the digital camera market, its share is approximately 4–5%, as standard DSLR and mirrorless cameras dominate consumer and professional photography. Within the action camera market, its contribution is higher at around 10–12%, given that many underwater cameras are designed for extreme sports and diving enthusiasts.

In the consumer electronics market, the share is minimal at about 1–2%, as this segment encompasses a wide range of devices, including smartphones, laptops, and home entertainment products. For the professional photography equipment market, underwater cameras represent about 3–4%, mainly serving niche segments like underwater cinematography and wildlife photography. In the marine and adventure sports equipment market, their share is significant at nearly 15–18%, driven by growing demand for diving and snorkeling experiences.

Market growth is supported by increasing popularity of water-based tourism, social media-driven photography trends, and technological innovations such as 4K video recording, enhanced waterproofing, and integration with wireless connectivity. As consumer preference shifts toward durable, compact, and high-performance devices, underwater cameras are expected to strengthen their position across these parent markets, particularly in leisure travel and professional content creation industries worldwide.

Manufacturers have been focusing on enhancing durability, depth of resistance, and image clarity while maintaining compact and user-friendly designs. Rising popularity of marine tourism, underwater sports, and wildlife documentation has further expanded the consumer base. Future growth is expected to be supported by the integration of AI-based features, improved low-light performance, and growing online communities sharing underwater content.

Increasing accessibility through mid-range offerings and rising awareness about ocean conservation are also creating opportunities for broader adoption and product innovation.

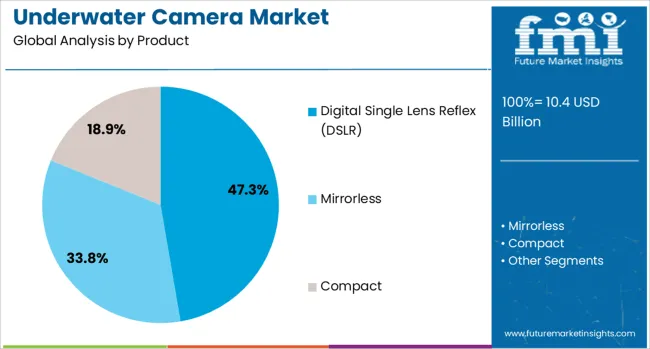

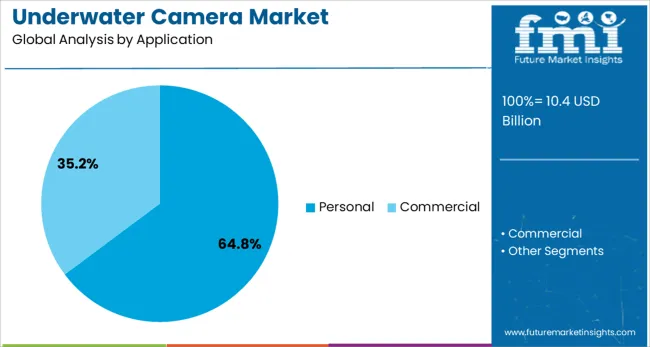

The underwater camera market is segmented by product, application, distribution channel, and geographic regions. The underwater camera market is divided into Digital Single Lens Reflex (DSLR), Mirrorless, and Compact. The underwater camera market is classified into Personal and Commercial Applications. The distribution channel of the underwater camera market is segmented into Online and Offline.

Regionally, the underwater camera industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, the digital single lens reflex DSLR segment is projected to hold 47.3% of the total market revenue in 2025, making it the leading product category. This dominance has been attributed to its superior image quality, versatility in changing lenses, and robustness under challenging underwater conditions.

The ability to capture high-resolution stills and videos with enhanced dynamic range and sharpness has positioned DSLR cameras as the preferred choice for professional divers and serious hobbyists. Manufacturers have optimized underwater housings and controls to make these cameras more accessible and reliable for deep water usage.

Durability, compatibility with advanced lighting systems, and continued innovation in sensor technology have reinforced the DSLR segment’s leadership in high-performance underwater imaging.

Segmenting by application shows that the personal segment is expected to command 64.8% of the market revenue in 2025, securing its position as the leading application area. This leadership has been driven by the growing enthusiasm for underwater photography among recreational divers, travelers, and social media users.

Consumers have been increasingly adopting underwater cameras to document personal experiences, share content online, and explore creative photography. Compact designs, affordability of entry-level models, and user-friendly interfaces have expanded accessibility to a wider audience.

The emotional value of capturing memorable underwater moments, combined with growing awareness of marine ecosystems, has further fueled demand in the personal segment. Continuous improvement in waterproofing technologies and ease of use has strengthened its prominence as the dominant application within the market.

The underwater camera market is driven by growing interest in recreational diving, water-based tourism, and marine research. Compact, high-resolution designs and rising social media sharing of underwater content are supporting expansion. Opportunities are emerging in eco‑friendly camera models and systems designed for underwater drones and ROVs. Key trends include integration of AI-based image processing, higher frame-rate video capture, and low-light endurance. Yet obstacles such as high device cost, battery limitations, and competition from waterproof smartphones persist. Suppliers focusing on rugged, feature‑rich, and compact underwater imaging solutions are set to lead through 2025.

The underwater camera market has expanded due to strong uptake in diving, snorkeling, and marine biology sectors. In 2024, the popularity of underwater photography was reflected in higher unit sales and broader geographic usage spanning Asia-Pacific adventure tourism and North American coastal research. High-definition sensors and deeper waterproofing capabilities have been emphasized in newer models. It is widely believed that social media influence and wider accessibility to diving locations have increased demand for purpose‑built underwater cameras rather than standard action models.

Opportunities are being seen in environmentally designed underwater cameras and integration with autonomous underwater vehicles. In early 2025, a leading brand launched an eco‑friendly model using recyclable housing materials paired with advanced depth sensing. Concurrently, camera systems were adopted for marine drones used in seabed surveying and offshore infrastructure inspection. It is considered that camera manufacturers providing marine‑grade devices compatible with ROV or drone platforms will capture strong interest from industrial users and research institutions.

An emerging trend is the embedding of AI‑based image reconstruction and ultra-low-light performance into underwater devices. In 2024, a new lens‑less prototype was demonstrated that uses deep‑learning reconstruction to enhance clarity in turbid water. Additional models introduced in 2025 included super slow‑motion video capture and real-time noise reduction via onboard processors. It is strongly viewed that suppliers offering AI‑enhanced photography and video capture capable of handling challenging underwater conditions will clearly differentiate themselves amid growing competition.

Key restraints include elevated product costs, limited battery life, and competition from waterproof smartphones. In 2024, premium underwater models were priced significantly higher than mainstream action cameras. Battery endurance under prolonged submersion remained constrained in professional units, limiting usage duration per dive. Furthermore, advanced waterproof smartphones with basic underwater modes eroded entry‑level demand. It is considered that unless lower‑cost, longer‑runtime variants are developed, a segment of casual users may remain underserved.

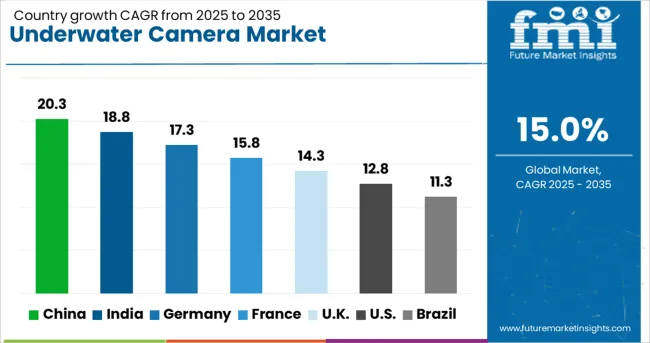

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

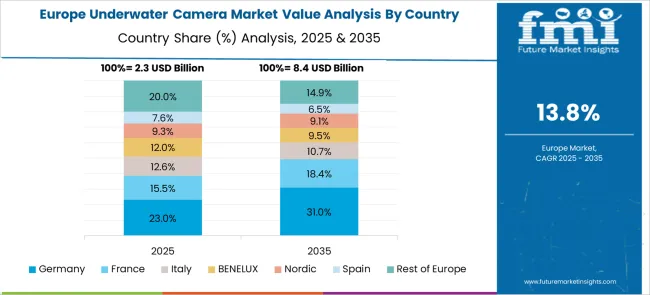

The global underwater camera market is projected to grow at a CAGR of 15% from 2025 to 2035. China leads with 20.3%, followed by India at 18.8% and Germany at 17.3%. France records 15.8%, while the United Kingdom posts 14.3%. Growth is driven by rising interest in marine tourism, underwater sports, wildlife photography, and ocean exploration initiatives. China and India dominate due to growing recreational diving and content creation industries, while Germany focuses on advanced imaging systems. France and the UK prioritize ruggedized designs and AI-based image stabilization for premium consumer and professional markets.

The underwater camera market in China is projected to grow at 20.3%, driven by surging demand for marine adventure tourism and professional underwater photography. Compact action cameras dominate recreational applications. Manufacturers integrate 4K resolution, AI-based color correction, and real-time image enhancement. Expansion of e-commerce platforms accelerates the distribution of premium waterproof imaging devices.

The underwater camera market in India is forecast to grow at 18.8%, fueled by an increase in scuba diving tourism and influencer-driven content creation. Waterproof compact cameras dominate usage in coastal regions and resorts. Manufacturers introduce lightweight, battery-optimized designs for extended underwater sessions. Strategic partnerships with travel companies enhance adoption in adventure tourism packages.

The underwater camera market in Germany is expected to grow at 17.3%, supported by advanced imaging technology adoption in marine research and professional cinematography. High-resolution DSLR and mirrorless underwater housings dominate premium segments. Manufacturers invest in precision-engineered housings for greater depth resistance. Rising interest in documentary filmmaking and marine biodiversity projects drives market expansion.

The underwater camera market in France is forecast to grow at 15.8%, driven by consumer interest in snorkeling, underwater vlogging, and heritage preservation projects. Action-oriented cameras dominate mass-market adoption for tourism. Manufacturers introduce dual-lens systems for 360-degree underwater shooting. Government-backed marine conservation programs further boost demand for high-quality imaging solutions.

The underwater camera market in the UK is projected to grow at 14.3%, driven by rising adventure travel and demand for content-driven consumer electronics. Compact 4K action cameras dominate both recreational and professional sectors. Manufacturers focus on integrating real-time Wi-Fi streaming capabilities for instant sharing. Growth in underwater sports events further accelerates premium camera adoption.

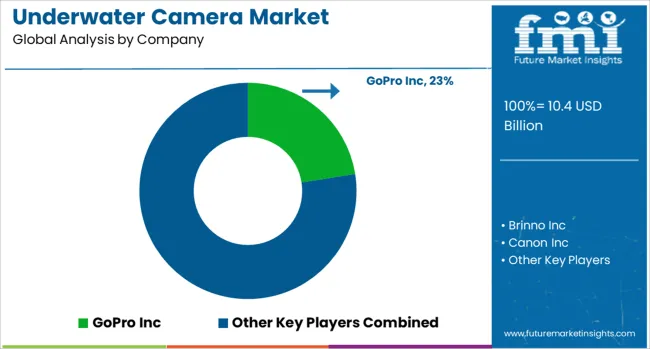

The underwater camera market is moderately consolidated, with GoPro Inc. recognized as a leading player due to its robust product portfolio, advanced waterproof action cameras, and strong brand presence among professional divers and adventure enthusiasts. The company’s focus on high-resolution imaging, durability, and connectivity features has reinforced its leadership globally.

Key players include Brinno Inc., Canon Inc., Fujifilm Holdings Corporation, Garmin Ltd., Nikon Corporation, Ocean Systems, Inc., Olympus Corporation, Panasonic Corporation, Ricoh Company Ltd., Sony Corporation, Steinsvik, and Subsea Tech. These companies offer a wide range of underwater cameras and imaging systems, including compact cameras, action cameras, and professional-grade underwater rigs for recreational, industrial, and scientific applications. Market growth is being driven by rising interest in water sports, marine exploration, underwater filmmaking, and research applications. Manufacturers are focusing on innovations such as 4K and 8K video capabilities, image stabilization, AI-driven scene optimization, and integration with wireless connectivity for real-time sharing.

Industrial and defense sectors are adopting specialized underwater imaging systems for inspection, surveillance, and subsea operations. Emerging trends include miniaturized designs for wearable underwater cameras, increased adoption of rugged cameras for extreme environments, and demand for eco-friendly housings and long-battery-life solutions. Asia-Pacific is witnessing strong growth due to booming tourism and marine research, while North America and Europe remain key markets for professional and recreational underwater photography.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 Billion |

| Product | Digital Single Lens Reflex (DSLR), Mirrorless, and Compact |

| Application | Personal and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GoPro Inc, Brinno Inc, Canon Inc, Fujifilm Holdings Corporation, Garmin Ltd, Nikon Corporation, Ocean Systems, Inc, Olympus Corporation, Panasonic Corporation, Ricoh Company Ltd, Sony Corporation, Steinsvik, and Subsea Tech |

| Additional Attributes | Dollar sales segmented by camera type (DSLR, mirrorless, compact/action) and application (recreational diving, marine research, commercial). Regional demand is strongest in North America and Europe, with APAC showing fastest growth. Innovations include AI-based stabilization, depth-rated housings, cloud-enabled image processing, and seamless integration with VR/content creation platforms. |

The global underwater camera market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the underwater camera market is projected to reach USD 42.1 billion by 2035.

The underwater camera market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in underwater camera market are digital single lens reflex (dslr), mirrorless and compact.

In terms of application, personal segment to command 64.8% share in the underwater camera market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Underwater Light Market Size and Share Forecast Outlook 2025 to 2035

Underwater Hotel Market Forecast and Outlook 2025 to 2035

Underwater Welding Consumable Market Size and Share Forecast Outlook 2025 to 2035

Underwater Modems Market Size and Share Forecast Outlook 2025 to 2035

Underwater Bikes Market Size and Share Forecast Outlook 2025 to 2035

Underwater Pelletizing Market Size and Share Forecast Outlook 2025 to 2035

Underwater Connectors Market Size and Share Forecast Outlook 2025 to 2035

Underwater Acoustic Communication Market Growth - Trends & Forecast 2025 to 2035

Underwater Welding Equipment Market Growth – Trends & Forecast 2024-2034

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Camera Case Market Trends & Industry Growth Forecast 2024-2034

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

TDI Camera Market Growth - Trends & Forecast 2025 to 2035

Intracameral Antibiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CMOS Camera Market Size and Share Forecast Outlook 2025 to 2035

GigE Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA