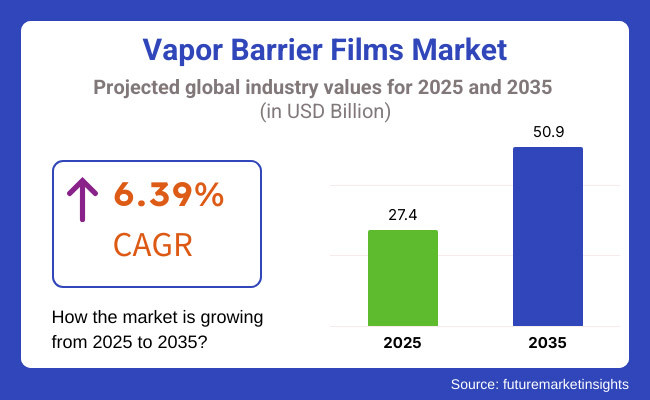

The vapor barrier films market is projected to grow from USD 27.4 billion in 2025 to USD 50.9 billion by 2035, registering a CAGR of 6.39% during the forecast period. Sales in 2024 reached USD 25.7 billion, underscoring the sector's resilience and growing demand across construction, packaging, and electronics industries.

This growth is attributed to the increasing need for moisture-resistant, durable, and sustainable barrier solutions that ensure structural integrity and product longevity. Companies are investing in expanding their production capacities and enhancing product offerings to meet the growing demand for vapor barrier films.

In March 2025, TOPPAN Holdings Inc. subsidiary TOPPAN Speciality Films Private Limited (TSF), based in India, has entered into a definitive agreement to acquire 80% of the issued shares of Irplast S.p.A., an Italian based high-performance BOPP film manufacturer, from the current majority shareholder, British-based investment fund Cheyne Strategic Value Credit (SVC). Irplast is a leading manufacturer of high-performance BOPP films, using simultaneous biaxial orientation technology to offer superior transparency, durability, and process ability, contributing to reduced environmental impact and improved recyclability.

“This acquisition represents a significant step forward in TOPPAN's business growth and technological innovation in the film business. By incorporating the advanced technologies and expertise of Irplast, we are confident that we can further enhance our sustainable solutions,” said Hiroshi Suzuki, Executive Officer of the TOPPAN Group leading the global film business. “TOPPAN remains committed to contributing to society through the pursuit of sustainable value creation and customer satisfaction.”

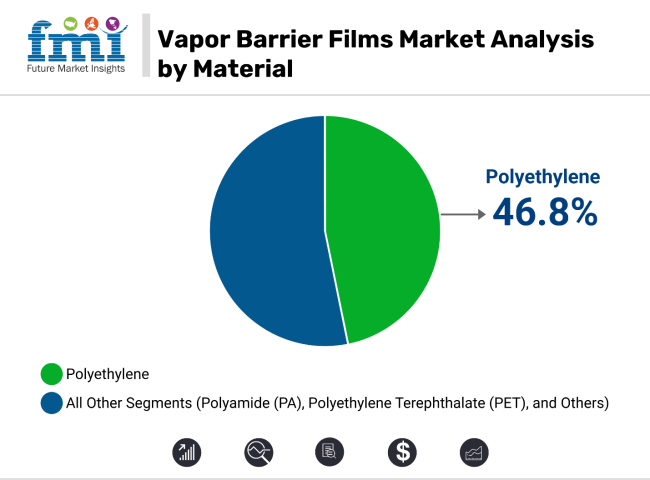

Vapor barrier films are predominantly manufactured using materials such as polyethylene (PE), polypropylene (PP), and polyamide (PA). Among these, PE-based films are most widely adopted due to their cost-effectiveness and excellent moisture resistance.

The shift towards sustainable and energy-efficient building practices is influencing the vapor barrier films market. Manufacturers are focusing on developing films that are recyclable, bio-based, and compatible with green building standards.

Innovations include the integration of nanotechnology to enhance barrier properties and the development of smart films that can adapt to environmental conditions. These advancements align with global sustainability goals and regulatory requirements, making vapor barrier films an attractive option for environmentally conscious industries.

The vapor barrier films market is poised for significant growth, driven by increasing demand in construction, packaging, and electronics industries. Companies investing in sustainable materials, advanced technologies, and innovative designs are expected to gain a competitive edge.

As global supply chains expand and environmental regulations become more stringent, the adoption of vapor barrier films is anticipated to rise, offering cost-effective and eco-friendly solutions for moisture control and energy efficiency.

Market growth is also influenced by higher innovation in high-performance and environmentally friendly barrier films, such as recyclable and bio-based solutions. The growth in food preservation technology and improved high-barrier packaging solutions are further propelling market growth.

Technological innovations in multilayer vapor barrier film compositions, for instance, thermal insulation improvements and UV-resistant coatings, are anticipated to increase the efficiency and lifespan of products.

Polyethylene (PE) is projected to dominate the material segment of the vapor barrier films market with an estimated 46.8% market share by 2025, due to its affordability, versatility, and favorable performance in moisture control. Widely adopted in construction, packaging, agriculture, and insulation applications, PE films offer high tensile strength, water resistance, and flexibility making them ideal for large-surface coverage with easy installation.

High- and low-density polyethylene (HDPE and LDPE) variants are used depending on strength, puncture resistance, and permeability requirements. LDPE, in particular, is preferred for sub-slab vapor barriers, wall wraps, and insulation facings in residential and commercial buildings. It performs well under concrete slabs, offering long-term moisture and mold prevention while remaining chemically inert.

PE vapor barrier films are also favored for their compatibility with recycled content and ability to be manufactured in mono-layer or multi-layer formats, supporting both cost-conscious and performance-critical applications.

As green building certifications and energy efficiency mandates gain traction globally, polyethylene's ease of customization, recyclability, and effective moisture-blocking capability continue to solidify its position as the material of choice across diverse sectors requiring vapor barrier performance.

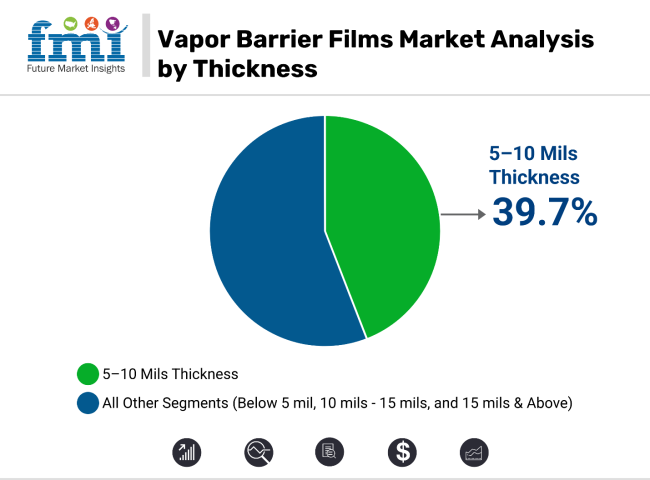

The 5-10 mils thickness range is expected to lead the vapor barrier films market by 2025, holding an estimated 39.7% market share driven by its optimal balance of mechanical durability, flexibility, and cost-efficiency for general-purpose applications.

This thickness range is particularly popular in residential and light commercial construction, where vapor control beneath concrete slabs, crawl spaces, and wall assemblies is critical to preventing moisture intrusion and mold growth.

Thicker than basic polyethylene sheeting but thinner than industrial-grade membranes, 5-10 mil films offer superior puncture resistance while remaining easy to handle, fold, and install without specialized equipment. They also provide sufficient vapor permeability ratings (perm ratings) to comply with regional building codes and energy standards.

This range is widely used in conjunction with insulation systems, HVAC ducting, and roofing underlayment’s where both structural integrity and vapor sealing are required. In addition to construction, the segment finds use in warehouse flooring, packaging liners, and agricultural moisture control applications.

With growing awareness of moisture-related structural degradation and tightening regulations around building envelope performance, the 5-10 mil vapor barrier films continue to offer an accessible, versatile, and reliable solution for builders, engineers, and facility managers across global markets.

High production costs

The manufacturing process for high-performance requires specialized materials and technology, impacting production expenses.

Regulatory restrictions on plastic waste

Government mandates are pushing for sustainable alternatives, requiring vapor barrier film manufacturers to develop recyclable and eco-friendly solutions.

Expansion into new industries

Vapor barrier films are increasingly being explored for applications in energy-efficient construction, electric vehicle batteries, and pharmaceutical packaging, offering new growth avenues.

Advancements in biodegradable and nanotechnology-based film technology

Research in lightweight, high-barrier, and moisture-resistant materials is expected to drive innovation and enhance product applications.

The USA dominates the market, driven by increasing demand for moisture-resistant and durable packaging solutions in industries such as construction, food & beverage, electronics, and healthcare. The need for superior protection against moisture and vapor transmission has encouraged manufacturers to develop high-performance vapor barrier films with enhanced barrier properties.

Additionally, government regulations promoting sustainable and energy-efficient materials are pushing companies to adopt recyclable and biodegradable. Moreover, advancements in nanotechnology-based coatings are improving moisture resistance and overall durability.

Businesses are also exploring multi-layered vapor barrier film designs to optimize product performance and efficiency. Furthermore, the increasing adoption of products in smart packaging and insulation applications is driving innovation in the sector.

Country CAGR (2025 to 2035) United States 5.2%

The UK market is expanding as businesses prioritize sustainability and compliance with environmental regulations. The rising demand for moisture-proof and energy-efficient packaging solutions has led to increased adoption across multiple industries, including construction, pharmaceuticals, and food storage.

Government initiatives promoting eco-friendly building materials and food safety regulations are further pushing companies to integrate high-performance products. Additionally, innovations in breathable and anti-fungal vapor barrier formulations are making these materials more attractive for extended storage applications.

Companies are also exploring RFID-enabled vapor barrier films for improved inventory management and traceability. Furthermore, the shift toward green building certifications is increasing the demand for products in the UK market.

Country CAGR (2025 to 2035) United Kingdom 4.7%

Japan’s market is growing steadily due to the increasing need for precision-engineered moisture protection solutions in the electronics, automotive, and healthcare industries. Companies are developing high-performance products with advanced polymer blends to enhance moisture resistance in sensitive components.

With strict regulations on packaging waste reduction, businesses are transitioning toward biodegradable and recyclable vapor barrier materials. Additionally, advancements in smart vapor barrier films, such as temperature-sensitive coatings and humidity control features, are driving demand in applications requiring real-time monitoring.

Businesses are also investing in automation-friendly vapor barrier film solutions to improve efficiency in logistics and storage. Furthermore, the rise of compact and lightweight packaging solutions in Japan is fueling demand for vapor barrier films across various industries.

Country CAGR (2025 to 2035) Japan 4.5%

South Korea's market is experiencing significant growth due to increased exports and industrial automation. The need for cost-effective and high-performance moisture protection solutions has led manufacturers to develop enhanced barrier films with improved anti-condensation properties.

Government regulations promoting energy-efficient and sustainable packaging further support market expansion. Additionally, businesses are integrating smart tracking technologies such as QR codes and RFID tags into products to improve supply chain efficiency.

The growing demand for high-barrier packaging in electronics and pharmaceuticals is further boosting adoption. Moreover, research into self-healing vapor barrier coatings is helping businesses develop specialized packaging tailored to extreme environmental conditions.

Other Key Players

The overall market size for the vapor barrier films market is USD 27.4 Billion in 2025.

The vapor barrier films market is expected to reach USD 50.9 Billion in 2035.

The market will be driven by increasing demand from construction, healthcare, and electronics industries. Sustainability trends, innovations in biodegradable materials, and improvements in vapor barrier film performance will further propel market expansion.

Key challenges include high production costs, difficulty in recycling multi-layer films, and the need for regulatory compliance in different industries. However, advancements in mono-material films and improved barrier technologies are addressing these concerns.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Thickness, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Thickness, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-use Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vaporized Hydrogen Peroxide Sterilization System Market Size and Share Forecast Outlook 2025 to 2035

Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Vapor Degreasing Solvents Market

Vapor Barriers Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Evaporative Cooling Market Size, Share, Trend & Forecast 2024-2034

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Vapor Sorption Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Evaporators Market Size, Growth, and Forecast 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Conduction Vaporizers Market Analysis by Product Type, Heating Material, Sales Channel,End-User and Region 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Short Path Evaporator for Food Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA