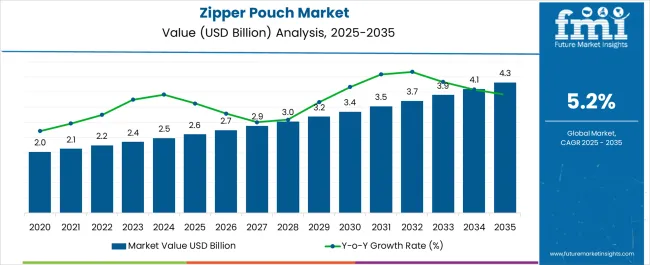

The Zipper Pouch Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Product designers evaluate zipper pouch specifications based on closure reliability performance, material transparency characteristics, and dimensional versatility when developing storage solutions for cosmetic brands, office supply retailers, and travel accessory manufacturers requiring consumer-friendly organization products. Design selection involves analyzing zipper track durability, fabric strength parameters, and printing surface compatibility while considering manufacturing cost optimization, shelf presentation appeal, and end-user convenience factors necessary for competitive market positioning. Development decisions balance material costs against functionality enhancement, incorporating brand differentiation potential, consumer satisfaction improvement, and market appeal optimization benefits that justify specialized pouch construction through measurable retail performance advancement.

Manufacturing processes require precision zipper attachment, material cutting accuracy, and quality validation protocols that achieve consumer product standards while maintaining cost competitiveness throughout high-volume production environments serving retail, promotional, and private label markets. Production coordination involves managing fabric sourcing, zipper component procurement, and assembly operations while addressing print registration control, seam strength optimization, and packaging efficiency requirements specific to zipper pouch manufacturing. Quality assurance encompasses closure testing, material durability assessment, and dimensional verification that ensure specification compliance while supporting customer quality expectations and retail display requirements throughout varying usage scenarios.

Technology advancement prioritizes material innovation, closure mechanism enhancement, and manufacturing automation that improve zipper pouch performance while reducing production costs and environmental impact throughout consumer product applications. Innovation encompasses recyclable material integration, antimicrobial treatments, and enhanced closure systems that optimize product functionality while enabling sustainability claims and performance differentiation. Advanced manufacturing includes automated cutting systems, precise assembly equipment, and quality monitoring technologies that enhance production efficiency while maintaining consistent product quality and cost competitiveness.

Application diversification addresses cosmetic travel kits requiring leak-proof containment, electronic accessory storage needing protective properties, and promotional gifts demanding customization capability that leverage zipper pouch advantages for specific consumer organization challenges. Pouch manufacturers coordinate with cosmetic brands, electronics retailers, and promotional product companies to establish comprehensive packaging solutions addressing customer-specific market requirements while maintaining competitive positioning and consumer appeal. Specialized applications encompass medical supply organization, craft storage systems, and food packaging alternatives that require enhanced barrier properties and specialized safety features.

Retail relationships involve coordination between pouch manufacturers, brand marketers, and retail buyers to establish comprehensive product programs that address merchandising requirements, consumer education, and performance optimization throughout zipper pouch market development. Partnership agreements include design collaboration, quality specifications, and promotional support provisions that protect brand investments while ensuring product performance and market acceptance achievement. Strategic alliances encompass collaboration with material suppliers, printing companies, and retail analytics organizations to advance zipper pouch technology while supporting market development and consumer preference understanding.

| Metric | Value |

|---|---|

| Zipper Pouch Market Estimated Value in (2025 E) | USD 2.6 billion |

| Zipper Pouch Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The zipper pouch market is experiencing robust growth driven by rising demand for convenient, lightweight, and re-sealable packaging solutions across food, beverage, personal care, and pharmaceutical sectors. Increasing consumer preference for portion control, portability, and sustainable packaging formats is accelerating adoption.

Technological advancements in barrier films, recyclable substrates, and digital printing are enabling manufacturers to deliver high-quality, functional, and brand-centric pouch formats. Regulatory initiatives focused on reducing single-use plastics are further strengthening the transition toward eco-friendly zipper pouches.

The future outlook remains positive as industries continue to prioritize packaging solutions that extend shelf life, enhance consumer convenience, and support brand differentiation in increasingly competitive retail environments.

The stand-up zipper pouch segment is expected to account for 57.30% of the total revenue by 2025 within the product type category, making it the leading segment. Its dominance is attributed to superior shelf presentation, ease of storage, and space efficiency in retail environments.

The format supports multiple consumer applications while providing re-sealability that preserves product freshness. Stand-up zipper pouches are increasingly adopted across food, beverages, and household goods due to their ability to combine branding flexibility with functional performance.

This combination of usability and visual appeal has reinforced their leadership in the product type category.

The plastic segment is projected to hold 48.60% of market revenue by 2025 within the material type category. This position is supported by the durability, cost efficiency, and versatility of plastic films in delivering high-barrier protection for perishable goods.

Plastic-based zipper pouches provide extended shelf life, resistance to moisture and contaminants, and compatibility with advanced printing technologies. Despite increasing focus on sustainable alternatives, plastic continues to dominate due to its established supply chain, adaptability to various pouch formats, and widespread consumer acceptance.

As recyclability initiatives expand, the segment is expected to maintain its leadership in the material category.

The slider zip segment is forecasted to represent 63.20% of market revenue by 2025 within the closure type category, making it the largest segment. Its prominence is linked to the enhanced consumer convenience it provides, ensuring easy opening and re-sealing even for larger pouches.

The slider mechanism has gained preference in packaging for snacks, frozen food, and pet products due to its user-friendly design and reliability in maintaining product integrity. Additionally, the slider closure improves reusability and product preservation, aligning with consumer demand for functionality and waste reduction.

This combination of practicality and performance has established slider zip as the dominant closure format in the zipper pouch market.

The global zipper pouch market is driven by the exponential expansion of the packaged and processed foods industry. According to the FMI, the market is anticipated to rise at 5.2% CAGR between 2025 and 2035 as compared to the 3.4% CAGR registered during 2020 to 2025.

Marketers and producers of fast-moving consumer goods have increased their focus on offering hassle-free packaging solutions to end-users. Easy-to-open packaging is the primary attribute that modern-day consumers expect in today’s marketplace. The ease of opening and re-sealing offered by zipper pouches makes them unique.

Globally, the demand for ready-to-eat meals is on the rise and premium packaging of such food items for visual impact will support the adoption of zipper pouches. Such factors are fueling the demand for zipper pouches to pack meat, cheese, and vegetables which are easy to peel.

| Year | 2020 to 2025 |

|---|---|

| CAGR | 3.4% |

| Value | USD 2 billion (2020) |

| Year | 2020 to 2025 |

|---|---|

| CAGR | 3.4% |

| Value | USD 2.5 billion (2024) |

| Year | 2020 to 2025 |

|---|---|

| CAGR | 3.4% |

| Value | USD 2.6 billion (2025) |

| Year | 2025 to 2035 |

|---|---|

| CAGR | 5.2% |

| Value | USD 2.6 billion (2025) |

| Year | 2025 to 2035 |

|---|---|

| CAGR | 5.2% |

| Value | USD 4.3 billion (2035) |

| Year | 2025 to 2035 |

|---|---|

| CAGR | 5.2% |

| Value | USD 4.30 billion (2035) |

Short Term (2025 to 2029): The growth in the food and beverage industry is expected to drive market growth. The convenience offered by zipper pouches in terms of easy opening and closing is projected to continue to make them a popular choice among consumers.

Medium Term (2029 to 2035): The use of zipper pouches in the e-commerce sector is anticipated to fuel market expansion. Additionally, the introduction of advanced manufacturing processes and materials in the production of zipper pouches is likely to drive market growth. The demand for zipper pouches in the pharmaceutical and cosmetic industries is also expected to increase leading to market growth.

Long Term (2035 to 2035): The demand for eco-friendly zipper pouches made from sustainable materials is expected to increase in the long term as sustainability becomes more important to consumers. The healthcare industry is also enduring rapid growth. Therefore, the demand for zipper pouches for medical devices, surgical instruments, and other medical supplies is anticipated to grow concurrently.

These factors are anticipated to support a 1.65X increase in the zipper pouch market between 2025 and 2035. The market is projected to be worth USD 4.30 billion by the end of 2035, according to FMI analysts.

| Market Statistics | Details |

|---|---|

| Jan to Jun (H1), 2024 (A) | 3.2% |

| Jul to Dec (H2), 2025 (A) | 3.4% |

| Jan to Jun (H1),2025 Projected (P) | 3.4% |

| Jan to Jun (H1),2025 Outlook (O) | 3.7% |

| Jul to Dec (H2), 2025 Outlook (O) | 3.2% |

| Jul to Dec (H2), 2025 Projected (P) | 3.3% |

| Jan to Jun (H1), 2025 Projected (P) | 3.6% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | 50 |

| BPS Change : H1,2025 (O) - H1,2024 (A) | 30 |

| BPS Change: H2, 2025 (O) - H2, 2025 (P) | (-) 10 ↓ |

| BPS Change: H2, 2025 (O) - H2, 2025 (A) | (-) 20 ↓ |

Organized retailers are dominating the retail sector across North America and Europe. With the growing convenience of packaging, the demand for packaged food is soaring. This sector largely uses flexible materials that enhances brand awareness and shelf life.

Retail e-commerce sales are luring consumers with increasing usage of mobile internet. With growth in the retail market, the demand for zipper pouches is set to rise strongly over the forecast period.

The growth of the market is spurred by the increasing demand from retailers to bolster product visibility. The need is aptly fulfilled by zipper pouches. For example, stand-up zipper pouches can be hung on pegs or stands instead of store shelves.

Features such as zip locks make usage convenient and can provide manufacturers with an additional advantage to boost sales. Though penetration remains low, pouches are making inroads into developing markets. However, the availability of a wide range of products, including sauces and condiments, cereals, biscuits and sweet spreads adds to the popularity of this packaging format.

| Country | Market Value (2025) |

|---|---|

| United States | USD 502.3 million |

| Germany | USD 89.8 million |

| China | USD 251.4 million |

| India | USD 181.6 million |

| United Kingdom | USD 77.4 million |

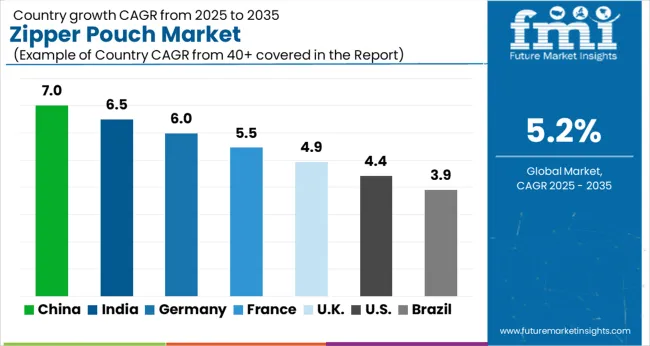

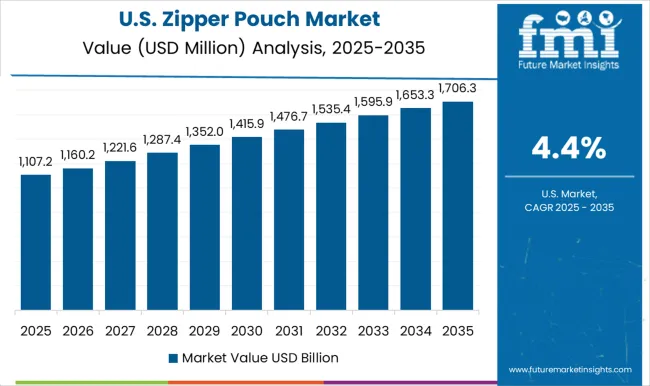

North America is the second leading market for zipper pouches. As per FMI, the United States zipper pouch market held more than 22% of the global market in 2025.

As per the Title 21 of United States Code of Federal Regulations (21 CFR) the material in which food is to be packaged must not have any allergic effects or contribute to the deterioration of the quality of eatables packed inside it.

Moreover, the government has made it compulsory to use partly or fully recycled materials for producing packaging materials for food and beverage products. On the back of this regulations, key players are focusing on the production of zipper pouches that will comply with food safety regulations through material composition.

The United States is one of the leading markets for pharmaceuticals and zipper pouches have emerged as a preferred re-sealable packaging solution for global pharmaceutical giants in the country.

The United Kingdom zipper pouch market is foreseen to expand at a 3.7% CAGR over the upcoming decade. The market is estimated to surpass USD 4.3 million by 2035. The rise in consumption of bakery and confectionary items is expected to rise significantly between the years 2025 and 2035.

As per FMI’s survey, the ready-to-eat food and fast-food consumption in the United Kingdom is increased by 30% in the last five years. This increase has had a positive impact on the demand for zipper pouches in the United Kingdom, as they offer easy packing-unpacking while consuming lesser processing time.

End users are considering zipper pouches as a primary choice of packaging as it keeps the freshness and aroma of food intact. Leading food processing companies are expanding their footprints in domestic markets, which indicates growth in consumption of zipper pouches.

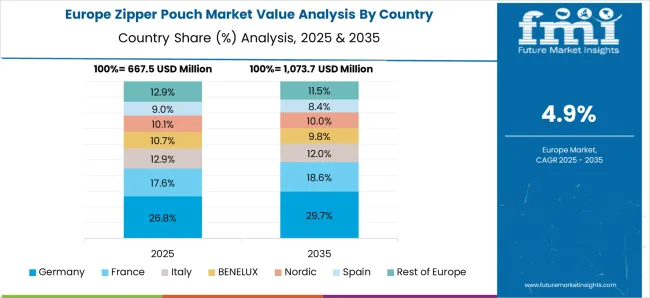

As per Future Market Insights, Germany accounted for about 3.9% of global market in 2025. Growing environmental awareness and organizations encouraging the use of re-usable and eco-friendly packaging support the demand for zipper pouches.

Government regulations banning usage of single use plastics and harmful pollutant materials in packaging, makes zipper pouches made up from recyclable plastics and paper an environment friendly alternative to non-biodegradable packaging alternatives.

India expected to hold more than 30% sales of zipper pouches in the Asia-Pacific excluding Japan market, making it the second leading market in the region. The entry of global food and beverage brands in the country are resulting in convenient packaging solutions for consumable products and offerings.

According to the FSSAI (Food Safety and Standards Authority of India) the packaging used to pack food and beverages must be of food grade quality conforming to the quality standards set by the BIS (Bureau of Indian Standards). All zipper pouches made meet these legal requirements.

Development of uninterrupted supply chains makes it possible for producers and end users to meet the requirements of untapped markets. Zipper pouches provide that extra shelf life required to keep products fresh and prevents contamination. On the back of these factors, the India zipper pouch market is projected to develop at 7.7% CAGR during the forecast period, reaching USD 354.4 million by 2035.

The China zipper pouch market is expected to register progression at a CAGR of 6.9% over the upcoming decade, making it a lucrative country for zipper pouch manufacturers. The market is anticipated to reach USD 460.2 million by 2035.

Fast paced growth of industrial infrastructure and growth of organized manufacturers in the country has resulted in low-cost and high-volume production of zipper pouches. The presence of global giants along with domestic manufacturers drives up the prospects here.

Easy availability of raw materials, cheap labor and usage of up-to-date technology enables manufacturers to produce the premium quality of zipper pouches at the economical rates.

| Segment | Product Type |

|---|---|

| Attributes | Stand Up Zipper Pouch |

| Details (Market Share in 2025) | 79.0% |

| Segment | Material Type |

|---|---|

| Attributes | Plastic |

| Details (Market Share in 2025) | 52.3% |

Stand-up zipper pouches provide convenience and ease of use. The stand-up feature allows the pouch to remain upright, making it easy to fill, store, and transport. Additionally, the zipper closure allows for easy opening and reclosing, which helps to preserve the freshness and quality of the products inside.

These pouches are also very versatile and can be used for different products, such as food, pet food, pharmaceuticals, and other consumer goods. The packaging format offers a large printable surface area which can be utilized for branding and product information. Marketers and retailers try to attract consumers with packaging design and aesthetics, making stand up zipper pouches a popular choice.

Stand-up zipper pouches are a more sustainable packaging option compared to rigid packaging as they require less material. These pouches also take up less space during transportation and storage. Hence, these pouches help in reducing the carbon footprint as well.

Materials such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) are used to manufacture re-sealable zipper pouches. Plastic zipper pouches are typically more affordable to produce and purchase than other materials. This makes them an attractive option for both manufacturers and consumers as they offer a cost-effective solution for packaging and storing different products.

Plastic zipper pouches can be used to package and store food, cosmetics, pharmaceuticals, and other items. This makes zipper pouches made from plastic material an attractive option for several industries.

Plastic zipper pouches are also durable and can withstand different temperatures and conditions. They are resistant to moisture, odor, and punctures which makes them ideal for packaging and storing products that require protection from external factors.

While plastic is not a sustainable material, technological advancements have made it possible to produce more environmentally friendly options such as recycled and biodegradable plastics. This has made plastic zipper pouches a more sustainable option for both key players and consumers who are concerned about the environmental impact of their packaging choices. Zipper pouches made up of plastics are recyclable and offer great profit margins to manufacturers. Using developed machinery solutions, key players are able to produce more with minimal wastage of raw materials.

The food segment is anticipated to hold significant of market share over the upcoming decade. Bakery and confectionary, meat, poultry, & sea food packaging applications are also holding a significant value share in 2025.

The pet food segment is expected to reflect rapid growth over the forecast period. Zipper pouches keep eatable products safe from harsh weather, moisture, and tampering. Processed and packaged food manufacturers use zipper pouches for packaging fruits, vegetables, meat, dairy products, cereals, pet food and bakery and confectionary products.

Re-sealability offered by this format provides convenience by supporting extended shelf life even after the seal is open. Press to close stand-up pouches is widely used in packaging pharmaceutical drugs, cosmetics and personal care items to facilitate easy storage and movement of finished goods.

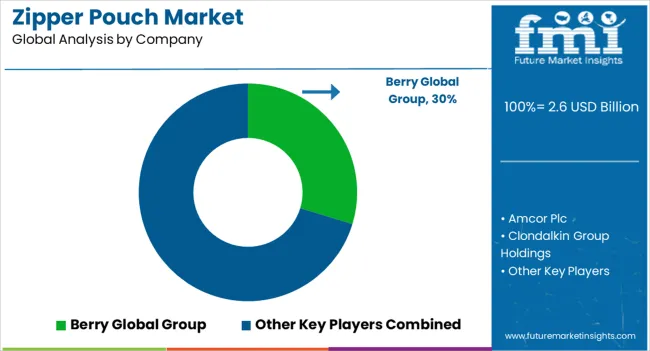

The Zipper Pouch Market is witnessing robust growth due to rising demand for flexible, lightweight, and resealable packaging solutions across the food, pharmaceutical, and personal care industries. Major players such as Berry Global Group Inc., Amcor plc, and Clondalkin Group Holdings B.V. are leading innovation with advanced material technologies and sustainability-driven pouch designs. Glenroy Inc. and Novolex Holdings LLC are focusing on recyclable and compostable zipper pouches to align with global sustainability goals, while ProAmpac Holdings Inc. and Winpak Ltd. are enhancing product differentiation through high-barrier, customizable packaging formats.

Companies like Flair Flexible Packaging Corporation, Bryce Corporation, and Transcontinental Inc. (TC Transcontinental) are integrating digital printing and smart packaging features to cater to brand visibility and consumer convenience. European manufacturers such as Dsmart GmbH, Gruber-Folien GmbH & Co. KG, and Pentaflex Inc. are contributing to regional innovation in eco-efficient flexible packaging. Meanwhile, UFlex Ltd., Rengo Co. Ltd., C.I. Takiron Corporation, and Maruto Sangyo Co. Ltd. are expanding their portfolios to serve Asia’s rapidly growing food packaging demand.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 2.6 billion |

| Product Type | Stand-Up Zipper Pouch, Flat Zipper Pouch, Quad-Seal Zipper Pouch, Other Custom Formats |

| Material Type | Plastic, Paper, Aluminum Foil, Bioplastic, Multi-layer Laminates |

| Closure Type | Slider Zip, Press-to-Close, Hook & Loop, Spout, Others |

| End Use | Food & Beverages, Personal Care & Cosmetics, Healthcare & Pharmaceuticals, Household Products, Industrial Goods |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, India, Japan, South Korea, and 40+ countries |

| Key Companies Profiled | Berry Global Group Inc., Amcor plc, Clondalkin Group Holdings B.V., Glenroy Inc., Novolex Holdings LLC, ProAmpac Holdings Inc., Winpak Ltd., Flair Flexible Packaging Corporation, Bryce Corporation, Transcontinental Inc. (TC Transcontinental), Pentaflex Inc., Dsmart GmbH, Gruber-Folien GmbH & Co. KG, UFlex Ltd., Rengo Co. Ltd., C.I. Takiron Corporation, Maruto Sangyo Co. Ltd., Paras Printpack |

| Additional Attributes | Dollar sales by product type, material type, closure type, and end-use categories; regional adoption trends across North America, Asia Pacific, and Europe; technological integration in flexible packaging and resealable formats; competitive landscape with global packaging converters and regional manufacturers. |

The global zipper pouch market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the zipper pouch market is projected to reach USD 4.3 billion by 2035.

The zipper pouch market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in zipper pouch market are stand-up zipper pouch and flat zipper pouch.

In terms of material type, plastic segment to command 48.6% share in the zipper pouch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pre-zippered Pouches Market

Stand-up Zipper Pouches Market Analysis – Trends & Forecast 2025 to 2035

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Zipper Bag Market Trends & Growth Forecast 2024-2034

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Zippered Bottle Suit Market

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA