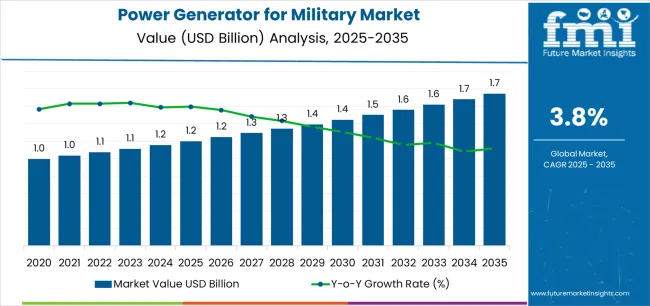

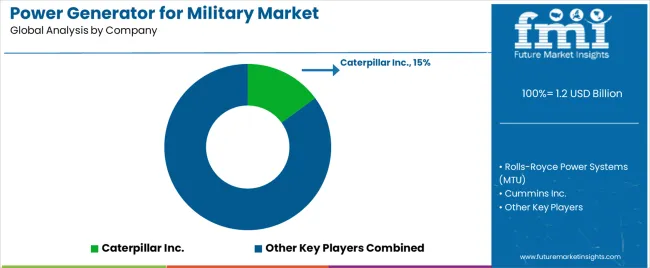

The power generator for military market is valued at USD 1.2 billion in 2025 and is projected to reach USD 1.7 billion by 2035, advancing at a CAGR of 3.8%. Demand for military-grade generators is growing as armed forces expand their reliance on electronic warfare platforms, real-time communication networks, and advanced surveillance equipment. All of these technologies require uninterrupted electricity, often in off-grid or tactically sensitive environments. The first phase of growth, covering the period through 2030, will be shaped by increased defense infrastructure spending and modernization of existing bases. Procurement priorities are shifting toward compact and energy-efficient units capable of rapid deployment across rugged terrains. Adoption of hybrid systems, where diesel or gas generators are supplemented by renewable sources such as solar, is beginning to gain traction. These systems reduce fuel dependency, improve operational flexibility, and ease the logistics burden of transporting supplies into forward areas. For military planners, mobility, resilience, and fuel efficiency are becoming as important as raw power output.

Sales of advanced portable units are expected to rise significantly in this period. Manufacturers are introducing lightweight designs, modular architectures, and intelligent control features that enable predictive maintenance and real-time energy optimization. Such advancements improve durability and lower operating costs, while reducing downtime in mission-critical settings. Units engineered for extreme weather conditions, high-altitude operations, and challenging terrains will be particularly attractive to defense agencies managing geographically diverse operations. The market is also being shaped by evolving battlefield doctrines. Silent operation, reduced thermal footprints, and stealth-oriented designs are increasingly valued in tactical scenarios. As adoption of hybrid power grows, these features are being integrated with renewable energy sources to deliver systems that are both efficient and strategically discreet.

Strategic collaborations between defense agencies and private technology providers are reinforcing this trajectory. Joint development programs are targeting the integration of renewable energy, modular construction, and digital monitoring capabilities that align with the needs of next-generation militaries. Manufacturers that focus on innovation in these areas are expected to capture larger procurement contracts and strengthen their competitive positioning. By 2035, sales of military power generators will reflect not only combat requirements but also wider defense activities, including training facilities, humanitarian operations, and peacekeeping missions. Adoption of intelligent and hybrid systems will define the next era, ensuring that militaries have access to resilient, flexible, and efficient power solutions.

Where revenue comes from - now vs next (industry-level view)

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Diesel generator sales (new units) | 48% | Battlefield-proven, JP-8 compatible |

| Spare parts & maintenance contracts | 22% | Critical uptime, field service support | |

| Auxiliary power units (APUs) | 15% | Vehicle-mounted, mobile platforms | |

| Specialty fuel variants (gas, propane) | 10% | Alternative fuels, logistics flexibility | |

| Rental & leasing programs | 5% | Exercise support, temporary deployments | |

| Future (3-5 yrs) | Hybrid diesel-battery-solar systems | 35-40% | Fuel reduction, silent watch capability |

| Containerized power modules | 18-22% | Rapid deploy, microgrid integration | |

| Low-signature tactical generators | 12-15% | SOF operations, reduced IR/acoustic | |

| Service & condition monitoring | 10-14% | Predictive maintenance, remote diagnostics | |

| Traditional diesel units | 8-12% | Legacy platforms, austere environment | |

| Alternative fuels & bi-fuel systems | 6-8% | HVO, biodiesel, multi-fuel capability | |

| Energy storage integration | 4-6% | Li-ion, VRLA upgrades, peak shaving |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast (2035) | USD 1.7 billion |

| Growth Rate | 3.8% CAGR |

| Leading Capacity Technology | 61-250 kW |

| Primary Application | Communication Systems (C4ISR) |

The market demonstrates strong fundamentals with medium-capacity generator systems capturing dominant share through advanced tactical power capabilities and military operations optimization. Communication systems applications drive primary demand, supported by increasing C4ISR infrastructure requirements and operational connectivity needs. Geographic expansion remains concentrated in developed markets with established defense budgets, while emerging economies show accelerating adoption rates driven by border security initiatives and rising defense modernization standards.

Design for mission flexibility, not just power output

Primary Classification: The market segments by capacity into up to 60 kW, 61-250 kW, 251-500 kW, 501-1000 kW, and above 1000 kW categories, representing the evolution from tactical portable systems to high-capacity base power solutions for comprehensive military energy optimization.

Secondary Classification: Output type segmentation divides the market into AC and DC power systems, reflecting distinct requirements for equipment compatibility, operational efficiency, and mission-specific power standards.

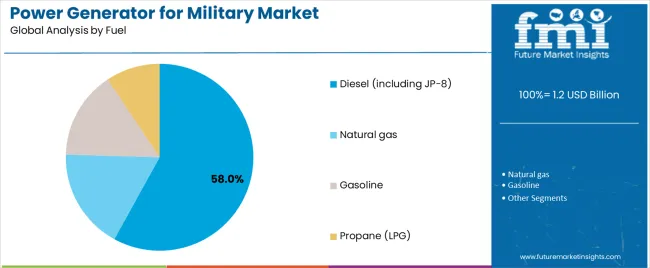

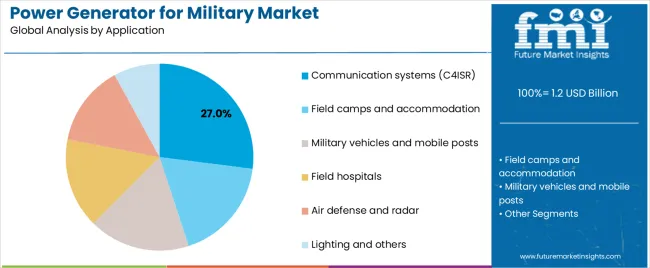

Tertiary Classification: Fuel type segmentation covers diesel (including JP-8), natural gas, gasoline, and propane (LPG), while application segments span communication systems (C4ISR), field camps and accommodation, military vehicles and mobile posts, field hospitals, air defense and radar, and lighting and other applications.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading procurement while emerging economies show accelerating growth patterns driven by defense modernization expansion programs.

The segmentation structure reveals technology progression from standard diesel generators toward sophisticated hybrid power systems with enhanced fuel efficiency and signature reduction capabilities, while application diversity spans from communication infrastructure to field hospital operations requiring reliable mission-critical power solutions.

.webp)

Market Position: The 61-250 kW capacity segment commands the leading position in the power generator for military market with 36.0% market share through optimal power output features, including balanced capacity range, operational versatility, and tactical deployment optimization that enable military forces to achieve reliable power supply across diverse field operations and forward operating base environments.

Value Drivers: The segment benefits from military preference for flexible power systems that provide adequate capacity for command posts, communication nodes, and field facilities without excessive fuel consumption or transportation burden. Advanced design features enable modular deployment capabilities, parallel operation, and integration with existing tactical infrastructure, where operational reliability and mission adaptability represent critical force requirements.

Competitive Advantages: 61-250 kW generator systems differentiate through proven field reliability, balanced power-to-weight characteristics, and compatibility with standard military logistics that enhance operational effectiveness while maintaining optimal fuel efficiency suitable for diverse tactical and base support applications.

Key market characteristics:

Up to 60 kW capacity maintains a 28.0% market position in the power generator for military market due to its lightweight portability properties and tactical advantages. These systems appeal to forces requiring mobile power solutions with man-portable or light vehicle transport for special operations applications. Market growth is driven by special forces expansion, emphasizing low-signature power solutions and operational flexibility through optimized compact designs.

251-500 kW capacity captures 18.0% market share through medium base power requirements in established forward operating bases, battalion headquarters, and logistics hubs. These installations demand reliable power systems capable of supporting multiple facilities while providing effective energy supply and operational scalability.

501-1000 kW capacity holds 11.0% market share for large facility support, while above 1000 kW systems account for 7.0% through major base infrastructure, naval vessels, and strategic installations requiring maximum power output capabilities.

Market Context: AC output demonstrates the dominant market position in the power generator for military market with 68.0% market share due to widespread adoption of standard electrical systems and increasing focus on equipment compatibility, conventional infrastructure integration, and universal power applications that maximize operational versatility while maintaining standard voltage specifications.

Appeal Factors: AC output users prioritize equipment compatibility, infrastructure integration, and availability of standard military electrical systems that enable coordinated power distribution across multiple facilities and equipment types. The segment benefits from substantial installed base of AC-powered military equipment and standardization programs that emphasize the compatibility of conventional systems for operational simplicity and logistics optimization applications.

Growth Drivers: Military modernization programs maintain AC output as standard for facility operations, while NATO standardization increases demand for interoperable power capabilities that comply with alliance specifications and minimize operational complexity.

Market Challenges: Increasing electronic warfare systems and specialized DC requirements may drive niche demand for alternative output configurations.

Application dynamics include:

DC output captures 32.0% market share through specialized requirements in communication systems, electronic warfare equipment, and vehicle-mounted applications requiring direct current power supply and battery charging capabilities.

Market Position: Diesel fuel including JP-8 commands dominant market position with 58.0% market share through military logistics compatibility and battlefield-proven fuel infrastructure.

Value Drivers: This fuel type provides the fundamental advantage of single-fuel logistics using JP-8 (military jet fuel) across aviation, vehicles, and generators, meeting requirements for supply chain simplification, cold weather reliability, and combat zone safety without multi-fuel inventory complexity.

Growth Characteristics: The segment benefits from established military fuel distribution systems, NATO standardization on JP-8 compatibility, and proven operational reliability that support widespread adoption and logistics efficiency.

Natural gas captures 18.0% market share through permanent base installations and domestic operations. Gasoline accounts for 12.0% share, while Propane (LPG) holds 12.0% through alternative fuel requirements and specialized deployment scenarios.

Market Context: Communication Systems (C4ISR) dominate the market with 27.0% market share, reflecting the primary power demand for command, control, communications, computers, intelligence, surveillance, and reconnaissance operations.

Business Model Advantages: C4ISR applications provide mission-critical power requirements for modern networked warfare, driving demand for reliable, clean power that supports sensitive electronic equipment and continuous operational capability.

Operational Benefits: Communication system applications include tactical networks, satellite communications, data processing, and surveillance equipment that drive consistent demand for stable power while requiring low electromagnetic interference and high reliability standards.

Field camps and accommodation facilities capture 22.0% market share through base life support requirements. Military vehicles and mobile posts hold 16.0%, Field hospitals account for 12.0%, Air defense and radar systems represent 11.0%, while Lighting and other applications maintain 12.0% of the market.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Defense modernization & C4ISR expansion (network-centric warfare, remote operations, border surveillance) | ★★★★★ | Modern military operations require continuous, reliable power for communication and surveillance systems; C4ISR infrastructure driving consistent demand for tactical generators. |

| Driver | Forward operating base electrification (remote deployments, expeditionary forces, humanitarian missions) | ★★★★★ | Deployed forces need self-sufficient power in austere environments; FOB requirements creating demand for containerized, rapid-deploy generator solutions. |

| Driver | Fuel logistics optimization pressure (supply chain vulnerability, convoy risks, operational costs) | ★★★★☆ | Fuel convoys represent major vulnerability and cost burden; hybrid systems reducing diesel consumption by 30-50% gaining traction for risk mitigation. |

| Restraint | Budget constraints & procurement cycles (defense spending pressures, lengthy acquisition processes) | ★★★★☆ | Extended procurement timelines and budget limitations slowing adoption of advanced hybrid systems; price sensitivity affecting premium technology uptake. |

| Restraint | Maintenance complexity in field conditions (hybrid system servicing, specialized training, spare parts logistics) | ★★★☆☆ | Advanced hybrid and renewable systems require specialized maintenance skills; field serviceability concerns limiting adoption in some operational scenarios. |

| Trend | Hybrid diesel-battery-solar integration (silent watch modes, fuel reduction, signature management) | ★★★★★ | Multi-source power systems reducing fuel consumption and acoustic/thermal signatures; battery integration enabling silent operation for covert positions and special operations. |

| Trend | Low-signature & tactical stealth systems (reduced IR/acoustic emissions, special operations support) | ★★★★☆ | Special forces and forward observers need minimal detection risk; quiet generator technology and signature suppression driving specialized product development. |

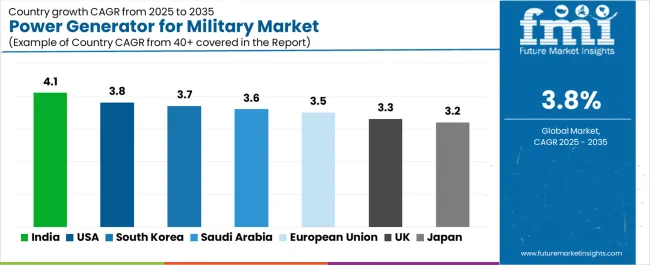

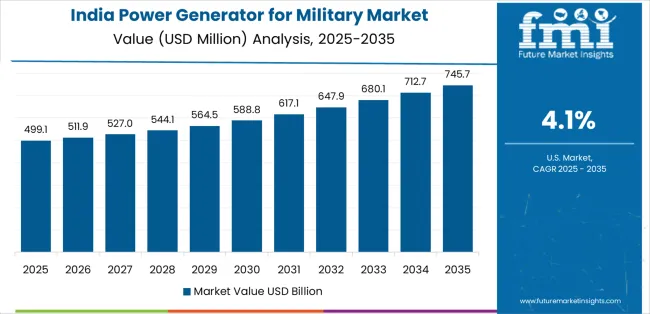

The power generator for military market demonstrates varied regional dynamics with Growth Leaders including India (4.1% growth rate) and South Korea (3.7% growth rate) driving expansion through border security initiatives and defense infrastructure development. Steady Performers encompass United States (3.8% growth rate), Saudi Arabia (3.6% growth rate), and developed regions, benefiting from established defense industries and advanced tactical power adoption. Developed Markets feature European Union (3.5% growth rate), United Kingdom (3.3% growth rate), and Japan (3.2% growth rate), where defense modernization and sustainability integration trends support consistent growth patterns.

Regional synthesis reveals South Asian markets leading adoption through military infrastructure expansion and border electrification, while North American forces maintain strong procurement supported by hybrid technology advancement and operational sustainability requirements. European markets show moderate growth driven by NATO interoperability and emission reduction standards.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| India | 4.1% | Focus on high-altitude solutions | Supply chain dependencies; domestic content rules |

| United States | 3.8% | Lead with hybrid technology | Budget volatility; lengthy procurement |

| South Korea | 3.7% | Automated load management | Regional tensions; export restrictions |

| Saudi Arabia | 3.6% | Hot-weather hardened units | Project execution; specification changes |

| European Union | 3.5% | NATO interoperability focus | Fragmented procurement; emission compliance |

| United Kingdom | 3.3% | Low-profile expeditionary | MOD budget pressures; sustainability mandates |

| Japan | 3.2% | Dual-use disaster response | Pacifist constraints; import dependency |

India establishes fastest market growth through aggressive border infrastructure programs and comprehensive military modernization development, integrating advanced power generators as standard components in remote border posts and high-altitude installations. The country's 4.1% growth rate reflects government initiatives promoting defense self-reliance and operational readiness that mandate the use of reliable power systems in forward areas and tactical facilities. Growth concentrates in strategic border regions, including Ladakh, Arunachal Pradesh, and Siachen Glacier, where military infrastructure development showcases ruggedized generator deployment that appeals to defense operators seeking proven cold-weather capabilities and altitude performance applications.

Indian defense forces are procuring climate-specific generator solutions that combine extreme environment performance with domestic manufacturing advantages, including high-altitude optimization and cold-start capabilities. Distribution channels through defense equipment suppliers and indigenous manufacturing programs expand procurement access, while government Atmanirbhar Bharat initiatives support adoption across diverse military and paramilitary segments.

Strategic Market Indicators:

United States establishes market leadership through comprehensive forward operating base electrification programs and advanced hybrid technology development, integrating power generators across expeditionary and domestic military applications. The country's 3.8% growth rate reflects established defense procurement systems and mature tactical power adoption that supports widespread use of advanced generator systems in deployed forces and installation facilities. Procurement concentrates in major operational commands, including US Army, Marine Corps expeditionary units, and Special Operations Command, where tactical technology showcases hybrid deployment that appeals to military operators seeking fuel reduction capabilities and signature management applications.

American defense contractors leverage established supply chain networks and comprehensive testing capabilities, including MIL-SPEC validation programs and operational trials that create procurement relationships and performance advantages. The market benefits from mature military requirements and operational sustainability mandates that drive hybrid generator adoption while supporting technology advancement and energy optimization.

Market Intelligence Brief:

In DMZ border areas, Seoul metropolitan defense, and island installations, military facilities are implementing advanced power generators as standard equipment for surveillance and communication applications, driven by increasing border security requirements and automated systems deployment programs that emphasize the importance of reliable power. The market holds a 3.7% growth rate, supported by defense modernization initiatives and border infrastructure development programs that promote advanced generator systems for tactical and surveillance facilities. Korean defense forces are adopting power systems that provide consistent operational performance and automated load management features, particularly appealing in border regions where continuous operation and system reliability represent critical operational requirements.

Market expansion benefits from strong domestic manufacturing capabilities and technology development that enable locally-produced generator solutions for military applications. Procurement follows patterns established in defense equipment, where reliability and indigenous production drive acquisition decisions and operational deployment.

Market Intelligence Brief:

In Saudi military bases, air defense sites, and border installations, defense facilities are implementing advanced power generators as standard equipment for operational readiness and equipment support applications, driven by increasing defense capability investment and infrastructure modernization programs that emphasize the importance of climate-hardened systems. The market holds a 3.6% growth rate, supported by Vision 2030 defense sector initiatives and military infrastructure development programs that promote advanced generator systems for base and tactical facilities. Saudi defense forces are adopting power systems that provide reliable hot-weather performance and dust-resistant features, particularly appealing in desert regions where extreme temperatures and environmental conditions represent critical operational challenges.

Market expansion benefits from substantial defense procurement budgets and preference for proven international systems adapted for local climate conditions. Technology adoption follows patterns established in defense equipment, where contractor support and operational reliability drive acquisition decisions and facility-wide deployment.

Market Intelligence Brief:

European Union's defense cooperation initiatives demonstrate coordinated power generator procurement with documented operational effectiveness in multinational exercises and expeditionary operations through NATO interoperability standards and combined logistics. The region leverages collective procurement expertise and environmental regulations to maintain a 3.5% growth rate. Military centers, including German Bundeswehr facilities, French Army installations, and multinational brigade headquarters, showcase standardized deployments where generator systems integrate with alliance-wide logistics platforms and facility management systems to optimize operational coordination and fuel efficiency.

European defense forces prioritize emission compliance and hybrid technology in generator procurement, creating demand for low-emission systems with advanced features, including renewable integration and containerized microgrid solutions. The market benefits from established NATO standardization agreements and willingness to invest in sustainable military technologies that provide long-term operational benefits and compliance with environmental directives.

Market Intelligence Brief:

United Kingdom's expeditionary defense posture demonstrates sophisticated power generator deployment with documented operational effectiveness in rapid-deploy scenarios and special operations through integration with existing tactical systems and logistics infrastructure. The country leverages defense technology expertise and operational experience to maintain a 3.3% growth rate. Military operations, including Royal Marines deployments, Army field exercises, and overseas base operations, showcase low-profile installations where generator systems integrate with force protection and signature management to optimize tactical effectiveness and operational security.

British defense procurement prioritizes rapid deployment capability and sustainability in generator acquisition, creating demand for compact systems with advanced features, including reduced acoustic signatures and comprehensive environmental performance. The market benefits from MOD sustainability roadmap and willingness to adopt innovative military technologies that provide operational advantages and environmental compliance.

Market Intelligence Brief:

.webp)

Japan's defense and disaster response requirements demonstrate sophisticated power generator deployment with documented operational effectiveness in humanitarian assistance and island defense through Self-Defense Force operations and civil-military cooperation. The country maintains a 3.2% growth rate, driven by disaster preparedness mandates and defense capability enhancement.

Market dynamics focus on compact, low-signature generator solutions that serve both military readiness and disaster response requirements. Island defense scenarios and urban deployment considerations create consistent demand for quiet, efficient power systems in mobile configurations.

Strategic Market Considerations:

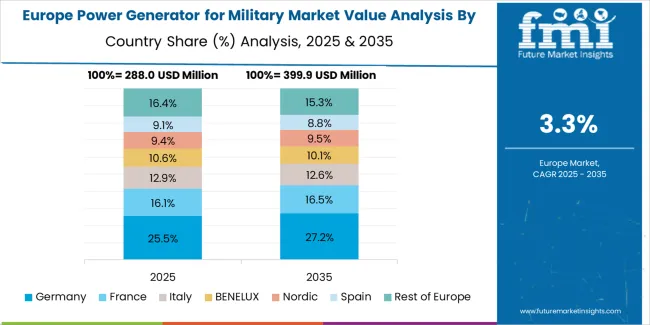

The European power generator for military market is projected to grow from USD 0.4 billion in 2025 to USD 0.5 billion by 2035, registering a CAGR of approximately 2.9% over the forecast period. Germany is expected to lead with a 22.0% market share in 2025, maintaining its position through 2035 on modernization and NATO readiness programs.

France follows with an 18.0% share in 2025, driven by expeditionary force requirements and overseas deployment support. United Kingdom holds a 17.0% share in 2025, supported by Royal Armed Forces procurement and sustainability initiatives. Italy accounts for a 12.0% share in 2025 through military base modernization and peacekeeping mission support. Spain represents a 9.0% share in 2025 with base infrastructure upgrades. Nordics region maintains an 8.0% share in 2025 through cold-weather capability requirements and NATO contributions. Rest of Europe accounts for 14.0% in 2025 through Central and Eastern European defense modernization and border security programs, with growth anchored by hybrid diesel-battery-photovoltaic kits for temporary bases, VRLA-to-lithium-ion transitions to reduce weight and maintenance, and containerized, low-signature units used in multinational exercises and rapid-deploy missions.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global defense platforms | MIL-SPEC certification, global service network, proven reliability | Broad capability, combat-proven, multi-region support | Innovation speed; hybrid technology integration |

| Technology innovators | R&D capabilities; hybrid systems; signature reduction solutions | Latest features first; fuel efficiency advantage | Field service density; ruggedization validation |

| Regional specialists | Local defense relationships, rapid field service, climate adaptation | "Close to forces" support; regional expertise; climate optimization | Technology gaps; global scalability |

| Hybrid-focused ecosystems | Renewable integration, battery systems, microgrid solutions | Fuel reduction credentials; future-ready technology | Combat validation; field maintenance complexity |

| Established industrial OEMs | Production scale, engine technology, supply chain depth | Cost efficiency; proven engines; parts availability | Military customization; signature management |

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Capacity (kW) | Up to 60 kW, 61-250 kW, 251-500 kW, 501-1000 kW, Above 1000 kW |

| Output | AC, DC |

| Fuel | Diesel (including JP-8), Natural gas, Gasoline, Propane (LPG) |

| Application | Communication systems (C4ISR), Field camps and accommodation, Military vehicles and mobile posts, Field hospitals, Air defense and radar, Lighting and others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, South Korea, Saudi Arabia, Canada, Brazil, France, Australia, and 25+ additional countries |

| Key Companies Profiled | Caterpillar Inc., Rolls-Royce Power Systems (MTU), Cummins Inc., KOHLER-SDMO, Generac Power Systems, Himoinsa (Yanmar), Atlas Copco, Kirloskar Oil Engines, Volvo Penta, Wärtsilä |

| Additional Attributes | Dollar sales by capacity and fuel type categories, regional procurement trends across South Asia Pacific, North America, and East Asia, competitive landscape with defense equipment manufacturers and tactical power suppliers, military operator preferences for reliability and fuel compatibility, integration with renewable energy systems and microgrid platforms, innovations in hybrid technology and signature reduction, and development of ruggedized power solutions with enhanced performance and operational sustainability capabilities. |

The global power generator for military market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the power generator for military market is projected to reach USD 1.7 billion by 2035.

The power generator for military market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in power generator for military market are 61-250 kw, up to 60 kw, 251-500 kw, 501-1000 kw and above 1000 kw.

In terms of output, ac segment to command 68.0% share in the power generator for military market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA