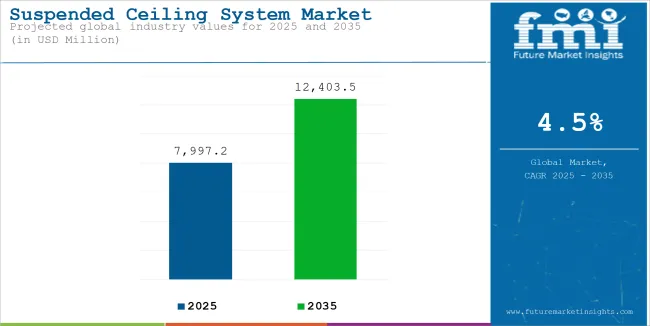

The global suspended ceiling system market reached USD 6,781.9 million in 2020. Worldwide demand for suspended ceiling system saw a 3.6% year-on-year growth in 2025, suggesting an expansion of the market to USD 7,997.2 million in 2025. Projections for the period between 2025 and 2035 indicate a 4.5% compound annual growth rate (CAGR) for global suspended ceiling system sales, resulting in a market size of USD 12,403.5 million by the end of 2035.

Stud ceiling type is growing at an exponential rate owing to its higher adoption across residential, commercial, and industrial application. Stud ceiling system are cost effective solution as compared to other ceiling types/systems.

Over the past decades there have been significant advancements in earthquake engineering in building design, resulting in stronger, more resilient, and safer structures. However, over the same period there has been more limited development of improvement in other areas concerning building safety, especially in the performance of non-structural building components during earthquakes. A modern structure designed in accordance with current building codes can be expected to survive a significant earthquake, remaining intact even though it may suffer a controlled amount of damage.

A suspended ceiling is typically attached to the underside of a floor slab in a multi-storey high-rise building. The acceleration motion imparted to the suspended ceiling is influenced by the building’s dynamic vibration characteristics and its response to the earthquake ground motions at its foundations. Stud ceiling systems are proven to offer high resistance towards seismic and earthquakes.

Several advancements such as adoption of lighter materials that have high impact absorption capability are used in stud ceiling systems, thus ensuring durability and safety during earthquakes.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 7,997.2 million |

| Projected Size (2035) | USD 12,403.5 million |

| Value-based CAGR (2025 to 2035) | 4.5% |

The growth trajectory of concealed direct fix ceiling is anticipated to grow at fastest CAGR in the forecast period and is expected to account for CAGR of 5.6% in 2025 to 2035.

Enhanced acoustic property, high fire resistance, and adoption of lightweight & eco-friendly materials are the key trends in the direct fix ceiling system. Ceiling systems have evolved from merely structural components to dynamic design elements that define a space. Modern ceilings enhance aesthetics and impact functionality through acoustics, lighting, and technology integration. As architects and designers continually explore innovative techniques, several noteworthy trends have emerged in ceiling system design.

Trends in the direct fix ceiling system:

The annual growth rates of the suspended ceiling system market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 3.5% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.5% (2024 to 2034) |

| H2 2024 | 3.6% (2024 to 2034) |

| H1 2025 | 3.6% (2025 to 2035) |

| H2 2025 | 3.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 3.6% in the first half and grow to 3.7% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 10 BPS each.

Between 2020 and 2024, the target market registered growth rate of 3.3% by reaching a value of USD 7,718.3 million in 2024 from USD 6,781.9 million in 2020.

As the demand for eco-conscious and sustainable construction practices continues to surge, finding innovative and responsible solutions for modern construction components is paramount.

Metal frame (MF) ceiling is a versatile and functional system designed to enclose and enhance the space between the structural framework of a building and it’s interior. Comprising a network of metal channels and components, an MF ceiling forms a concealed grid that supports panels, lighting fixtures, and other elements while providing a seamless visual appearance. MF ceiling systems offer a wide range of design options, allowing for the integration of utilities as well as acoustic insulation.

Functional and visually appealing MF suspended ceiling with minimal environmental impact gained popularity in the historic period owing to integration of eco-friendly materials during ceiling system production. Several suspended ceiling system manufacturers adopted recycled and renewable materials, such as aluminium or steel with high recycled content. Moreover, low-volatile organic compounds (VOC) finishes such as powder or wax coatings and water-based paints were used to improve the indoor air quality.

Ventilation integration was also another crucial factor that increased the demand for suspended ceiling system market in 2020-2024. These ceiling systems are designed to accommodate ventilation systems effectively. This in turn will increase air circulation and help maintain indoor air quality. Effective ventilation ensures pollutants are removed from indoor and outdoor air and maintains a fresh indoor environment. Properly designed ventilation systems improve indoor air quality by reducing the concentration of contaminants.

All these factors have played pivotal role in expanding the demand for suspended ceiling system industry in 2020-2024.

Looking ahead to 2025-2035, the market is anticipated to grow faster, propelled by light-shelf integration, lightning control integration, and adoption of Skylights and clerestory windows within suspended ceiling.

Suspended ceiling systems have the space for incorporating light shelves above windows to reflect and distribute natural light deeper into the interior space. Light shelves reflect sunlight deeper into interior spaces, effectively distributing natural light and diminishing the risk of glare while enhancing overall illumination.

Several key players are also providing design option for integration of skylights or clerestory windows into the ceiling design to introduce additional natural light. Skylights and clerestory windows introduce direct sunlight from above, illuminating areas that might not receive adequate daylight through conventional windows. Naturally, this can help to create a dynamic and inviting atmosphere.

Design flexibility is another pivotal factor anticipated to increase the demand for suspended ceiling system industry. For example, integration of lighting controls that adjust artificial lighting levels based on available natural light. Proper integration of lighting controls based on available natural light helps maintain consistent lighting levels. This reduces energy consumption and creates a warm lighting environment.

Polymers have been integral to human civilization in recent years due to their attractive properties such as lightweight, high modulus, and insulation properties. Polymers' low cost, corrosion resistance, and availability have enticed manufacturers to develop dependable alternative materials for contemporary applications. However, their strength when compared to metals could be considered as a setback in some load bearing applications where specific properties are required. This led to the idea of reinforcing polymers with fibers, particles, and whiskers for high strength applications.

Furthermore, in recent decades, polymer composites with improved properties have been embraced as a result of their strength to weight advantage, enhanced hardness, wear, and thermal properties. Another distinct benefit of developing polymer composites lies in their ability to retain the attractive properties of parent materials. Synthetic fibers like aramid, carbon and glass fibers have been reported to improve the properties of polymeric materials.

Thus, these sustainable materials are widely adopted in the construction of suspended ceiling thereby driving the market growth.

The development of suspended ceiling systems produced a shift in thinking about the function of a ceiling in construction. A ceiling simply had been regarded as a single-plane, fire-protective, finished element overhead. Suddenly, with the introduction of a suspension system, the ceiling also offered access to plumbing, electrical and mechanical components in overhead runs.

Today’s suspended ceiling systems offer even more advantages for building construction, including a range of acoustical control options, fire protection, esthetic appearance, flexibility in lighting and HVAC delivery, budget control and optional use of overhead space. International policy, legal and regulatory developments. Key components for suspended acoustical ceilings are suspension grid and acoustical panels. Composition of each can vary depending on the end-use application.

The grid system becomes a structural component in the ceiling. It must Implications carry the loads of lighting, air distribution and ceiling panels in a safe manner. Through the hanger wires that suspend the ceiling, these loads are transferred to the building structure. The performance of the grid system is dependent upon the integrity of the product as well as its proper installation. There are standards that must be met in order to assure the integrity of the installed ceiling.

ASTM Standard C-635 governs the structural and quality standards of the grid. ASTM Standard C-636 provides for proper installation to assure the load-carrying and general structural integrity of the ceiling. Load compliance of CGC grid products is certified by Underwriters Laboratories Inc., per ASTM C635.

The construction industry, encompassing real estate, infrastructure, and industrial structures, is the largest global economic sector, contributing 13% to the world’s GDP. This industry achieves remarkable feats, from creating iconic cityscapes and foundational infrastructure to driving sustained innovation. Residential building construction, a vital segment of the construction sector, significantly impacts a nation’s economy—directly influencing GDP through construction, maintenance, and renovation, and indirectly through associated activities like banking transactions and notarial acts. In many economies, residential construction serves as a key driver of growth and a stabilizing force in economic development.

In the USA, the construction industry has consistently outperformed GDP growth in recent business cycles, owing to its extensive vertical supply chain and horizontal linkages with complementary sectors. Both residential and non-residential construction benefit from large economic multipliers, yielding significant returns on investment. With its high labor intensity, substantial payroll effects, and value-added contributions per worker, this industry supports a wide range of businesses, from small firms to large enterprises, thereby reinforcing local market dynamics.

These robust industry fundamentals and the expanding construction activities globally are expected to propel the demand for suspended ceiling systems during the forecast period.

Suspended ceilings serve a wide range of purposes in a building, including sound and fire protection, aesthetic benefits, a safe and clean finish over the engineering systems and services in plenum space. Consequently, the uninterrupted performance of these components is necessary for the inhabitability of buildings after an earthquake.

Damage to suspended ceilings has proven to cause significant financial loss in the form of direct damage as well as downtime. This form of damage can also pose a risk to the lives of building occupants. One approach towards prevention of such losses is to identify the capacity and weaknesses of the system and attempt to strengthen it. Another approach can involve minimizing the demands transmitted to the system.

In case of suspended ceilings, which are sensitive to acceleration, one solution is isolating the ceilings from the structural components that transmit acceleration i.e. walls and floors by eliminating the stiff connections between the structural components and the suspended ceiling. A fully-floating ceiling, as opposed to a perimeter-fixed or braced ceiling, is a system with no stiff lateral restraints to the supporting structure.

The ceiling is hung from the floor above via vertical steel hanger wires and is provided with gaps on perimeters. Provided that these gaps are sufficient to accommodate the deflections resulting from earthquakes, there should be no/minimal contact between the ceiling edge and perimeter walls. As a result, there can be no interaction with the walls and ultimately no damage should occur in the ceiling or perimeter walls.

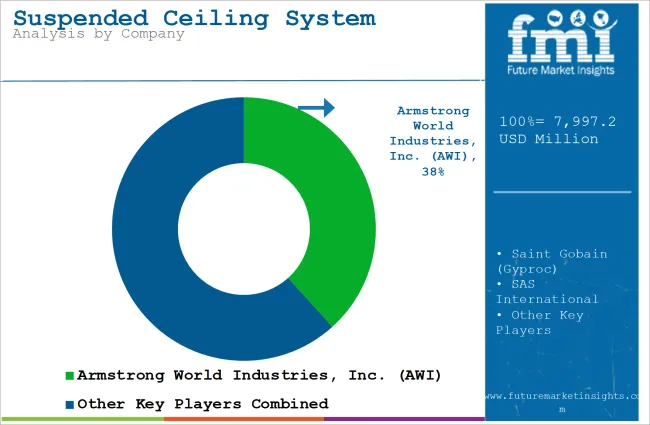

Tier 1 companies comprise players with a revenue of above USD 500 million capturing a significant share of 40-45% in the global market. These players are characterized by high production capacity and a wide product portfolio. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple suspended ceiling system applications and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include Armstrong World Industries, Inc. (AWI),Saint Gobain (Gyproc), SAS International, Knauf, ROCKWOOL A/S (Rockfon), and other players.

Tier 2 companies include mid-size players with revenue of below USD 500 million having a presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Rondo Building Services Pty Ltd., USG Corporation, Etex Building Performance Limited, Zenita, Kingston India, and other player.

The section below covers the industry analysis for suspended ceiling system demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided.

China will hold 63.6% in East Asia due to rapid urbanization and extensive infrastructure development have led to an increased demand for suspended ceiling systems. The USA will capture 76.1% in North America. The USA has a highly developed construction and infrastructure sector, with significant demand for suspended ceiling systems in commercial, residential, and industrial buildings.

Germany will lead Western Europe with 43.1%. Germany is known for its technological advancements and emphasis on high-quality, energy-efficient building materials. The country's strong focus on sustainability and cutting-edge technology in construction supports the adoption of advanced suspended ceiling systems.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Spain | 5.6% |

| India | 5.1% |

| Brazil | 6.3% |

| Germany | 4.7% |

| China | 4.1% |

The demand for suspended ceiling system industry in China is projected to reach USD 2,019.5 million.

In recent years, China has made significant strides in advancing ceiling system technologies, enhancing factors such as acoustic performance, energy efficiency, and design aesthetics. Manufacturers are now able to offer ceiling systems that provide superior sound absorption, which is particularly important in commercial spaces such as offices, shopping malls, and theaters. These improvements not only address noise control but also contribute to creating more comfortable and productive environments.

There has been a growing emphasis on energy-efficient ceiling systems. Innovations such as the integration of insulation and sustainable materials have helped create systems that reduce energy consumption by improving thermal regulation. Furthermore, modern ceiling systems are being designed with more aesthetically pleasing finishes and customizable features, making them a popular choice for architects and designers seeking both functionality and style in their building projects.

The demand for suspended ceiling system market in the USA is projected to reach USD 2,690.1 million by 2035. Over the forecast period, demand for suspended ceiling system industry within the USA is predicted to grow at an 5.1% CAGR.

The USA boasts a highly developed construction and infrastructure sector, which is a key driver of the demand for suspended ceiling systems. As the construction industry expands, particularly in commercial, residential, and industrial sectors, there is a growing need for ceiling solutions that meet both functional and aesthetic requirements.

Suspended ceiling systems offer a variety of benefits, including improved acoustics, which are crucial in spaces like offices, schools, and healthcare facilities, where noise reduction is important for comfort and productivity. Additionally, these systems are favored for their versatility, allowing architects and designers to integrate them seamlessly into different building styles and enhance the visual appeal of interiors.

The demand for suspended ceiling system in Germany is projected to reach USD 561.3 million and grow at a CAGR of 4.7% by 2035.

Germany, as the largest economy in Western Europe, enjoys a strong economic position that directly supports the demand for suspended ceiling systems. The country’s robust economic performance enables substantial investment in infrastructure projects, both public and private, which drives continuous construction activity across various sectors.

From residential buildings to commercial complexes and industrial facilities, Germany’s diverse construction needs rely heavily on advanced building materials, including suspended ceiling systems. These systems not only enhance the aesthetic appeal and functionality of structures but also meet the high standards of energy efficiency and safety that are integral to Germany's building regulations.

The country’s strong economic foundation fosters a stable environment for ongoing growth in the construction sector, which translates into a consistent need for ceiling systems in both new developments and renovation projects. As Germany invests in modernizing its infrastructure and expanding urban spaces, the demand for suspended ceiling systems continues to grow, making it a key segment in the overall building materials market..

The section explains the market share analysis of the leading segments in the industry. In terms of ceiling type, the stud ceiling will likely dominate and generate a share of around 39.3% in 2025.

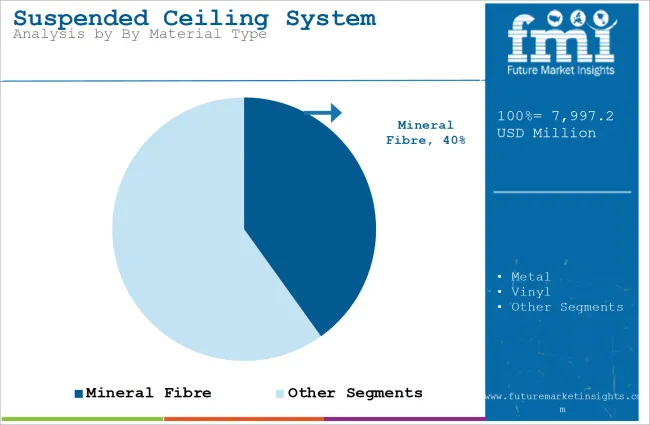

Based on the material type, the mineral fiber segment is projected to hold a major share of 40.1% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value Share (2025) |

|---|---|

| Stud Ceiling (Ceiling Type) | 39.3% |

Stud ceiling system is widely used in both residential and commercial buildings due to its versatility, ease of installation, and cost-effectiveness. Stud ceilings are supported by a framework of metal studs, which offer excellent support and are adaptable for various ceiling designs.

Their robust structure makes them ideal for a range of applications, including large commercial spaces, offices, and homes. These ceilings are also known for their soundproofing capabilities and ability to conceal pipes, cables, and other utilities, making them a popular choice in modern architectural designs.

| Segment | Value Share (2025) |

|---|---|

| Mineral Fiber (Material Type) | 40.1% |

Mineral fiber holds the largest market share in the suspended ceiling system market, primarily due to its affordability, lightweight nature, and excellent acoustic properties. This material is widely used in commercial and institutional buildings such as offices, schools, hospitals, and shopping malls, where reducing noise levels and controlling acoustics are crucial.

The material's ability to absorb sound helps create quieter environments, which is a significant advantage in areas with high foot traffic or where concentration is necessary, like in office spaces or classrooms. Furthermore, mineral fiber ceilings are highly cost-effective, which makes them an attractive option for large-scale projects with budget constraints.

The growing demand for efficient and aesthetically pleasing ceiling solutions is driving the growth of the stud ceiling market. As building projects become more complex and require flexible, cost-effective installation methods, stud ceilings continue to gain prominence. Additionally, the ability to integrate lighting, air conditioning systems, and other components within the framework of stud ceilings further enhances their appeal.

With rising urbanization, especially in commercial construction, the stud ceiling segment is expected to maintain its dominance, as it offers both practical benefits and the flexibility required for various design considerations in both new builds and renovations.

Key companies engaged in suspended ceiling system slightly consolidate the market with about 50-55% share that are prioritizing technological advancements, integrating advanced production technology, and expanding their footprints in the region. Customer satisfaction remains paramount, with a keen focus on producing suspended ceiling system to meet diverse applications. These industry leaders actively foster collaborations to stay at the forefront of innovation, ensuring their suspended ceiling system align with the evolving demands and maintain the highest standards of quality and adaptability.

Recent Industry Developments:

The Ceiling Type segment is further categorized into Concealed Suspended Ceiling, Concealed Direct Fix Ceiling, and Stud Ceiling.

The Material Type segment is classified into Mineral Fiber, Metal, Vinyl, Fiberglass, and Others.

The Application segment is classified into Commercial Construction, Industrial Construction, and Residential Construction.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 10: Global Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 11: Global Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 12: Global Market Volume (Units) Forecast by Size, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 18: North America Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 20: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 21: North America Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 22: North America Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 23: North America Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 24: North America Market Volume (Units) Forecast by Size, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 28: Latin America Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 30: Latin America Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 31: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 32: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 33: Latin America Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 34: Latin America Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 35: Latin America Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 36: Latin America Market Volume (Units) Forecast by Size, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 40: Europe Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 41: Europe Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 42: Europe Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 43: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 44: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 45: Europe Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 46: Europe Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 47: Europe Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 48: Europe Market Volume (Units) Forecast by Size, 2017 to 2032

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 51: East Asia Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 52: East Asia Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 53: East Asia Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 54: East Asia Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 56: East Asia Market Volume (Units) Forecast by Application, 2017 to 2032

Table 57: East Asia Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 58: East Asia Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 59: East Asia Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 60: East Asia Market Volume (Units) Forecast by Size, 2017 to 2032

Table 61: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 63: South Asia & Pacific Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 64: South Asia & Pacific Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 65: South Asia & Pacific Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 66: South Asia & Pacific Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 67: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 68: South Asia & Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 69: South Asia & Pacific Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 70: South Asia & Pacific Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 71: South Asia & Pacific Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 72: South Asia & Pacific Market Volume (Units) Forecast by Size, 2017 to 2032

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 74: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by System Type, 2017 to 2032

Table 76: Middle East and Africa Market Volume (Units) Forecast by System Type, 2017 to 2032

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 78: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2017 to 2032

Table 81: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2017 to 2032

Table 82: Middle East and Africa Market Volume (Units) Forecast by End-User, 2017 to 2032

Table 83: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2017 to 2032

Table 84: Middle East and Africa Market Volume (Units) Forecast by Size, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by System Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by End-User, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Size, 2022 to 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 8: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 12: Global Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 15: Global Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 16: Global Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 20: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 23: Global Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 24: Global Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 25: Global Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 27: Global Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 28: Global Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 31: Global Market Attractiveness by System Type, 2022 to 2032

Figure 32: Global Market Attractiveness by Material Type, 2022 to 2032

Figure 33: Global Market Attractiveness by Application, 2022 to 2032

Figure 34: Global Market Attractiveness by End-User, 2022 to 2032

Figure 35: Global Market Attractiveness by Size, 2022 to 2032

Figure 36: Global Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Market Value (US$ Million) by System Type, 2022 to 2032

Figure 38: North America Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 39: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 40: North America Market Value (US$ Million) by End-User, 2022 to 2032

Figure 41: North America Market Value (US$ Million) by Size, 2022 to 2032

Figure 42: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 44: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 48: North America Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 49: North America Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 51: North America Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 52: North America Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 55: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 56: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 59: North America Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 60: North America Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 61: North America Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 63: North America Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 64: North America Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 67: North America Market Attractiveness by System Type, 2022 to 2032

Figure 68: North America Market Attractiveness by Material Type, 2022 to 2032

Figure 69: North America Market Attractiveness by Application, 2022 to 2032

Figure 70: North America Market Attractiveness by End-User, 2022 to 2032

Figure 71: North America Market Attractiveness by Size, 2022 to 2032

Figure 72: North America Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) by System Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 75: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 76: Latin America Market Value (US$ Million) by End-User, 2022 to 2032

Figure 77: Latin America Market Value (US$ Million) by Size, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 84: Latin America Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 87: Latin America Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 88: Latin America Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 91: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 92: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 95: Latin America Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 96: Latin America Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 99: Latin America Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 100: Latin America Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 103: Latin America Market Attractiveness by System Type, 2022 to 2032

Figure 104: Latin America Market Attractiveness by Material Type, 2022 to 2032

Figure 105: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 106: Latin America Market Attractiveness by End-User, 2022 to 2032

Figure 107: Latin America Market Attractiveness by Size, 2022 to 2032

Figure 108: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 109: Europe Market Value (US$ Million) by System Type, 2022 to 2032

Figure 110: Europe Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 111: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) by End-User, 2022 to 2032

Figure 113: Europe Market Value (US$ Million) by Size, 2022 to 2032

Figure 114: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 116: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Europe Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 120: Europe Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 121: Europe Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 122: Europe Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 123: Europe Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 124: Europe Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 125: Europe Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 127: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 128: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 129: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 131: Europe Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 132: Europe Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 133: Europe Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 134: Europe Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 135: Europe Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 136: Europe Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 137: Europe Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 139: Europe Market Attractiveness by System Type, 2022 to 2032

Figure 140: Europe Market Attractiveness by Material Type, 2022 to 2032

Figure 141: Europe Market Attractiveness by Application, 2022 to 2032

Figure 142: Europe Market Attractiveness by End-User, 2022 to 2032

Figure 143: Europe Market Attractiveness by Size, 2022 to 2032

Figure 144: Europe Market Attractiveness by Country, 2022 to 2032

Figure 145: East Asia Market Value (US$ Million) by System Type, 2022 to 2032

Figure 146: East Asia Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 147: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 148: East Asia Market Value (US$ Million) by End-User, 2022 to 2032

Figure 149: East Asia Market Value (US$ Million) by Size, 2022 to 2032

Figure 150: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 151: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 152: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: East Asia Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 156: East Asia Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 157: East Asia Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 159: East Asia Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 160: East Asia Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 163: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 164: East Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 167: East Asia Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 168: East Asia Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 171: East Asia Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 172: East Asia Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 175: East Asia Market Attractiveness by System Type, 2022 to 2032

Figure 176: East Asia Market Attractiveness by Material Type, 2022 to 2032

Figure 177: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 178: East Asia Market Attractiveness by End-User, 2022 to 2032

Figure 179: East Asia Market Attractiveness by Size, 2022 to 2032

Figure 180: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: South Asia & Pacific Market Value (US$ Million) by System Type, 2022 to 2032

Figure 182: South Asia & Pacific Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 183: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 184: South Asia & Pacific Market Value (US$ Million) by End-User, 2022 to 2032

Figure 185: South Asia & Pacific Market Value (US$ Million) by Size, 2022 to 2032

Figure 186: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 187: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 188: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 189: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 190: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: South Asia & Pacific Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 192: South Asia & Pacific Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 193: South Asia & Pacific Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 194: South Asia & Pacific Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 195: South Asia & Pacific Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 196: South Asia & Pacific Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 197: South Asia & Pacific Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 198: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 199: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 200: South Asia & Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 201: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 202: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 203: South Asia & Pacific Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 204: South Asia & Pacific Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 205: South Asia & Pacific Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 206: South Asia & Pacific Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 207: South Asia & Pacific Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 208: South Asia & Pacific Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 209: South Asia & Pacific Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 210: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 211: South Asia & Pacific Market Attractiveness by System Type, 2022 to 2032

Figure 212: South Asia & Pacific Market Attractiveness by Material Type, 2022 to 2032

Figure 213: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 214: South Asia & Pacific Market Attractiveness by End-User, 2022 to 2032

Figure 215: South Asia & Pacific Market Attractiveness by Size, 2022 to 2032

Figure 216: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 217: Middle East and Africa Market Value (US$ Million) by System Type, 2022 to 2032

Figure 218: Middle East and Africa Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 219: Middle East and Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 220: Middle East and Africa Market Value (US$ Million) by End-User, 2022 to 2032

Figure 221: Middle East and Africa Market Value (US$ Million) by Size, 2022 to 2032

Figure 222: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 224: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 225: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 226: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 227: Middle East and Africa Market Value (US$ Million) Analysis by System Type, 2017 to 2032

Figure 228: Middle East and Africa Market Volume (Units) Analysis by System Type, 2017 to 2032

Figure 229: Middle East and Africa Market Value Share (%) and BPS Analysis by System Type, 2022 to 2032

Figure 230: Middle East and Africa Market Y-o-Y Growth (%) Projections by System Type, 2022 to 2032

Figure 231: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 232: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 235: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 236: Middle East and Africa Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 237: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 238: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 239: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2017 to 2032

Figure 240: Middle East and Africa Market Volume (Units) Analysis by End-User, 2017 to 2032

Figure 241: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2022 to 2032

Figure 242: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2022 to 2032

Figure 243: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2017 to 2032

Figure 244: Middle East and Africa Market Volume (Units) Analysis by Size, 2017 to 2032

Figure 245: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2022 to 2032

Figure 246: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2022 to 2032

Figure 247: Middle East and Africa Market Attractiveness by System Type, 2022 to 2032

Figure 248: Middle East and Africa Market Attractiveness by Material Type, 2022 to 2032

Figure 249: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 250: Middle East and Africa Market Attractiveness by End-User, 2022 to 2032

Figure 251: Middle East and Africa Market Attractiveness by Size, 2022 to 2032

Figure 252: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

The global suspended ceiling system market for stud ceiling was valued at USD 3,142.9 million in 2025.

The demand for suspended ceiling system industry is set to reach USD 12,403.5 million in 2035.

Rising demand for commercial & residential construction and advancements in acoustic and aesthetic solutions drives the demand for suspended ceiling system industry.

The suspended ceiling system industry demand was valued at USD 6,781.9 in 2020 and is projected to reach USD 12,403.5 million by 2035 growing at CAGR of 4.5% in the forecast period.

Commercial construction application is expected to lead during the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.