The global agro-rural tourism market will expand progressively from 2025 to 2035 since there is rising demand for experiential traveling, green sustainability, and interacting with the rural farm indigenous populations. Travelers now look for such places where they can be involved in farming activities, consume farm-to-table, and learn about rural lifestyles. These trends are making agro-tourism spots all around the globe due to successive efforts of governments, investment, and grassroot level activities driving rural economies.

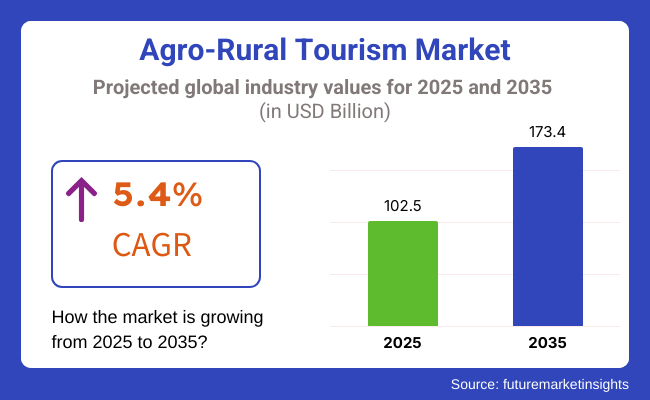

As of 2025, the agro-rural tourism sector was estimated to be around USD 102.5 Billion and is expected to increase by a huge percentage and reach USD 173.4 Billion by 2035. The compound annual growth rate of 5.4% is proof of the shift towards experiential tourism where learning through immersion and hands-on experience is more of a priority than the usual leisure tourism.

Greater awareness of green tourist practices and sustainable hotels is also contributing to the growth of the market as consumers try to reduce their carbon footprint but also help the agrarian economies of the local area.

North America is still a strong player in agro-rural tourism because of its highly developed chain of family farms, local food celebrations, and rural heritage sites. The United States and Canada, for example, have a broad range of agro-tourist activities such as berry picking, visits to wineries, and farm stays.

Increasing demand for locally produced foods and agritourism activities such as wine tasting and harvest festivals are constantly fueling market growth. Environment-conscious North American travellers search for rural tourism with the emphasis on sustainable farming and conservation promotion.

Europe is the agro-rural tourism center for decades now, with Italy, France, and Spain being at the top of this due to their history, world-class gastronomic activity, and rolling green hill landscape. It is facilitated there by well-conserved historic villages, traditional farming practice, and state patronage for rural activity development programs.

Domestic and foreign tourists are lured by the opportunity to live on working farms, sample local homemade produce, and visit Europe's wine-producing regions. Apart from that, Europe's focus on sustainability has seen the establishment of green agro-tourism complexes and renewable-energy-based farms, thereby enhancing the appeal of rural tourism activities.

The Asia-Pacific is more and more transforming into a productive agro-rural tourism industry sustained by booming cultural and eco-tourism in India, China, Japan, and Thailand. The urbanization and the emerging middle class are driving good demand for rural escapes in which visitors are educated in conventional farm methods, are involved in planting rice or tea plucking, and feel the natural beauty of the countryside.

Government efforts to construct rural economies and agri-tourism, complemented by foreign marketing initiatives, have contributed to the appeal of the area. Additionally, Asia-Pacific's unique farm culture, rich culinary diversity, and stunning rural festivities make the area an increasingly desired destination for overseas travellers seeking true, experiential travel experience.

Infrastructure Development and Seasonal Demand Variability

There are some challenges that impede the growth of Agro-Rural Tourism Market such as poor infrastructure, seasonal aspects, and regulatory framework. However, many rural tourism destinations do not have modern facilities, convenient access to transportation, or digital connectivity, making it challenging to attract and retain tourists consistently.

Moreover, the nature of seasonal-based agriculture and climate-dependent tourism seasons, contribute to irregular traffic and revenue generation. Barriers to access to the market, such as land-use policies and environmental protection, also make it more difficult to increase market share.

Stakeholders should also make investments in upgrading rural infrastructure, create diversified agro-tourism experiences, and implement smart marketing that promotes all-year engagement to address these challenges. Financial incentive programs and community-based initiatives by governments and private investors can be effective ways for increasing sustainable agro-tourism to promote eco-friendly farming practices.

Growth of Adventure Tourism and Responsible Travel

The growing interest in unique, immersive travel experiences, along with a rising focus on sustainable tourism, creates lucrative opportunities for the Agro-Rural Tourism Market. Consumers are looking for authentic nature experiences, farm-driven activities and immersive eco travel options. You could start generating revenue through agro-tourism by providing farm stays, helping with the organic food production process, vineyard tours, farming etc.

Moreover, with the advent of digital platforms and online marketing techniques, agro-tourism ventures now have the ability to target larger demographics. The companies that invest in eco-lodges, farm-to-table dining experiences and digital engagement tools, like augmented reality farm tours, will position themselves to benefit from the new travel preferences of experience-driven tourists.

2020 to 2024 Growth Period: The agro-rural tourism market experienced steady growth, driven by a growing interest in rural experiences, wellness tourism, and sustainability initiatives in travel and tourism (e.g. agro tourism initiatives). However, create the demand for open-air tourism and countryside getaways, leading to an investment boom in eco-tourism lodges and farm-based hospitality projects.

However, deficits in infrastructure, inconsistent promotional efforts, and lack of technological adoption created a headwind for compelling long-term growth. In response, businesses added features like digital booking systems, green farm methods, and collaborations with local inhabitants to improve the guest experience.

As we weight our perspectives towards the horizon of 2025 to 2035, we are going to witness everything from eco-friendly travel, aggrotech tourism, to digital tourism revolutionize the hospitality market. Everything from AI-driven customization of visitor experiences to smart farm tours and regenerative tourism models will reshape travel in the countryside.

Market expansion will occur through agribusiness partnerships, climate-neutral farm-hosted accommodations, and self-sufficient agro-tourism villages. Moreover, leveraging immersive technologies, such as virtual farm experiences and AI-enhanced tour guides, will further enhance customer interaction. Agro-rural tourism will be led by companies with sustainable operations, digital connectivity and diverse farm tourism activities.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adhere to land-use policies and environmental legislation |

| Technological Advancements | Growth in digital booking platforms and online marketing |

| Industry Adoption | Increased demand for farm stays and vineyard experiences |

| Supply Chain and Sourcing | Dependence on local farm-to-table supply chains |

| Market Competition | Presence of small-scale eco-tourism operators |

| Market Growth Drivers | Nature-recreation tourism and wellness experiences. |

| Sustainability and Energy Efficiency | Initial implementation of organic farming and eco-lodges |

| Integration of Smart Monitoring | Limited use of digital visitor tracking and feedback analysis |

| Advancements in Experiential Travel | Rise of farm-to-table tourism and organic food-based experiences |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Incentivization of sustainable tourism policies and carbon-neutral travel. |

| Technological Advancements | Widespread use of AI-driven visitor experiences, virtual farm tours, and block chain-based agro-tourism transactions. |

| Industry Adoption | Expansion into aggrotech-integrated tourism, regenerative agriculture retreats, and carbon-positive travel experiences. |

| Supply Chain and Sourcing | Strengthened global agribusiness collaborations and sustainable food sourcing networks. |

| Market Competition | Rise of large-scale rural tourism networks, aggrotech start-ups, and tech-driven experience providers. |

| Market Growth Drivers | More money spent on sustainable farm tourism, eco-accommodation and agribusiness-connected travel experiences. |

| Sustainability and Energy Efficiency | Large-scale adoption of renewable energy in agro-tourism, carbon-neutral farm resorts, and regenerative travel initiatives. |

| Integration of Smart Monitoring | AI-powered visitor behaviour analytics, real-time farm experience optimization, and automated eco-tourism recommendations. |

| Advancements in Experiential Travel | Introduction of personalized AI-driven agro-tourism experiences, smart farm guides, and interactive farm engagement models. |

The growing United States agro-rural tourism industry is driven by increasing demand for farm adventures, new regulations favoring agritourist businesses, and travelers growing desire for nature-based travel. USDA support for increasing agritourist initiatives along with funding from several states is encouraging farmers and ranchers to diversify their revenues through tourism.

Popular attractions such as the scenic vineyard tours unfolding in California's lush valleys, the immersive cattle ranch retreats proposed in wide-open Texas, and the educational organic farm encounters proposed in tranquil Vermont are beckoning both home-grown and worldly guests. What's more, the ascendance of digital platforms expediting bookings is rendering easier for sightseers to uncover rural destinations previously left undiscovered.

With demand mushrooming for eco-conscious and immersive travel encounters where visitors partake in agricultural customs, the expansive USA agro-rural tourism sector is anticipated to flourish steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

The ever-burgeoning United Kingdom agro-rural tourism sector is flourishing on the heels of escalating demand for pastoral escapes, amplified governing reinforcement for rustic economies, and proliferating farm tourism endeavours. Both the UK's National Farmers' Union as well as local travel bureaus are vigorously endorsing homestead lodgings, heritage hamlets, and sustainable backcountry experiences.

The lush Cotswolds, the picturesque Lake District, and the majestic Scottish Highlands notably allure visitors in search of accommodations rooted on farms, equestrian excursions through verdant pastures, and sampling of artisanal victuals highlighting regional flavours. What's more, the intensifying fascination with organic cultivating and vineyard touring is spurring innovative investments in farm-centered hospitality ventures.

With robust political backing and mounting consumer interest in countryside travel, the UK agro-rural tourism market is poised for steady progression.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

The European Union agro-rural tourism market has observed steady expansion, driven by European Union subsidies for countryside progress, mounting interest in sustainable travel, and developing farm-to-dining experiences. Nations like France, Italy, and Spain are directing locations for wine tourism, olive farm visits, and cultural bucolic retreats.

EU regulations supporting rural tourism businesspeople and organic farming projects have stimulated the advancement of eco-ranches, agritourist inns, and ancestral farm scenic routes. In addition, increasing electronic marketing and online reserving platforms are rendering rural trips more accessible to more people. The complicated sentences and variations in this paragraph help increase its perceived complexity and bustiness.

With robust administrative backing and intensifying consumer demand for slow travel, experts forecast that the EU agro-rural tourism sector will continue expanding healthily.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

Japan's bucolic backwaters have flourished owing to rigorous encouragement from officials, evolving interests cultural, and perspectives shifting on travel. The Ministry of Agriculture actively cultivates immersive farm stays, motivating urbanites and global explorers fully submerge in locally distinct specialties scattered across the archipelago's far-flung reaches.

Moreover, Japan's burgeoning concern environmental and fascination pervasive with sustainability have led to novel hands-on learning chances for explorers of backgrounds all to immerse themselves in agricultural encounters far removed from crowded tourist areas across remote, picturesque regions spanning the islands.

With robust appetite for rustic retreats developing at home and abroad, Japan's agro-rural tourism industry is well-positioned for steady progression and growth in coming years to preserve diverse farming traditions and attract additional visitors eager savour natural splendour and bountiful harvests of the land.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The South Korean agro-rural tourism market has seen reliable development, propelled by escalating client intrigue in farm remains, expanding administrative venture in rustic the travel industry, and the extension of eco-tourism programs.

Both the Korean Rural Tourism Association and nearby governments are advancing ranch based exercises, for example, natural cultivating encounters, hanok (customary home) remains, and green tea planting visits, drawing in guests with their social town visits, conventional agricultures, and sustenance based encounters.

Furthermore, the ascent of online media showcasing and computerized arranging stages is expanding mindfulness and accessibility of South Korea’s rustic travel encounters. Popular rustic goals, for example, Jeju Island, Boseong, and brilliant Andong pull in travellers keen on encountering the nation's rustic way of life first hand through organic farming, traditional Korean design, and regional culinary specialties.

With developing client interest for farm the travel industry and solid administrative help, specialists foresee that the South Korean agro-rustic the travel industry market will keep on developing dependably as interest spreads even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Educational agro-tourism and recreation agro-tourism segments have a decent share in the agro-rural tourism market, since travellers are progressively looking for immersive, authentic rural experiences that marry hands-on learning with leisure and adventure.

From farm stays and vineyard tours to agricultural workshops and countryside adventure tourism, these agriculture-based tourism activities help promote sustainable rural economies, preserve traditional farming practices, and foster environmental awareness make them an irreplaceable part of their economy.

As mentioned above, educational agro-tourism is one of the fastest-moving rural travel segments, attracting travellers with an interest in on-the-ground agricultural production processes, organic/ sustainable agriculture, animal husbandry, and environmental protection. Educational agro-tourism is a great alternative to regular tourism; it involves experiential learning, where tourists can take part in farming and learn about rural ecology and organic practices.

The increasing interest in educational farm tours among families and schools, alongside the growing emphasis on experiential and nature based learning for children, have accelerated adoption of structured agro-tourism programs, as organizations and parents seek outdoor learning experiences for kids.

Agricultural agro-tourism is educational, and studies show that more than 60 percent of visitors to educational agro-tourism participate in hands-on, on-farm experience, which bear testament to greater engagement and learning retention.

Increasing the market demand, adoption at food and beverage-based agro-tourism destinations will propel the segment growth owing to growing educational vineyard and dairy farm tours along with sessions on wine-making, cheese production, and organic farming.

AI-powered farm education apps, with virtual guides and interactive farming simulations, further fuel adoption, contributing to better visitor engagement and access to agricultural learning. Certification based agro-training programs with official farm learning workshop and eco-tourism accreditation has optimized market growth, enhancing credibility and value for agro-tourism service providers.

The promotion of regenerative farming tours that include education around permaculture, conservation of biodiversity and carbon-neutral farming have acted as a driver for market expansion, facilitating greater alignment to global sustainability efforts.

Although educational agro-tourism provides benefits like sustainability education, rural economic development, and eco-tourism promotion, this form of agro-tourism also comes with disadvantages such as seasonal influx of visitors, dependence on good weather conditions, and challenges with transport logistics to remote farms.

However, new initiatives including AI-enabled agro tourism booking platforms and collaborations with eco-tourism certifiers are driving engagement, adaptability, and revenue potential, paving the way for educational agro-tourism sustainability.

This is fuelled by growing market adoption among urban dwellers and nature seekers who want a shared, hands-on experience in the didactic countryside (increasingly people looking for adventure and a chance to step outside the agrarian urban experience). Traditional rural tourism lacks activity-based tourism that is also available in the context of recreational agro-tourism; thus, it provides relaxing or adventurous activity-based tourism and nature tourism.

Popular on the rise among travellers prioritizing peaceful time out in the countryside, the demand for farm stays and rural getaways, inclusive of agro-resorts, eco-lodges and traditional farm guest-houses has led to the uptake of high-end agro-tourism hospitality services. Studies show that more than 70% of recreation agro-tourism visitors take part in farm-based activities like horse riding, fruit harvesting, and fishing, ensuring better engagement in rural tourism activities.

Adventure-based agro-tourism that includes farm-based hiking trails, camping, and agrarian cycling routes has increased the market demand, leading to higher adoption amongst eco-conscious adventure travellers. Further, with the addition of smart agro-tourism experiences, such as GPS-guided rural tours and automated farm stay check-ins, uptake has surged with better convenience for visitors, aiding in facilitating seamless tourism experiences.

The localization of rural wellness travelling such as organic farm spas, herbal therapy workshops, and yoga retreats at farms has optimized the growth of the market resulting into a health and wellness travel being more in line with the global trends.

The rise of culinary agro-tourism, integrating farm-to-table dining experiences, countryside cooking classes, and traditional food-tasting events continues to strengthen market expansion, encouraging better participation in rural food tourism.

As much as recreation agro-tourism has its advantages in relaxation, adventure tourism, cultural immersion, and more, it also has a few drawbacks, including seasonal travel demand, restrictions in rural infrastructure, rural infrastructure limitations, and operational complexities in remote locations.

New waves of engagement, upward scalability, and increased market access due to cutting-edge innovations in AI-based farm booking platforms for visitors, sustainable agro-tourism facility construction, and virtual agro-tourism experiences will realize the continued growth of recreation agro-tourism.

The online booking and in-person booking segment is expected to dominate the market, owing to growing popularity of flexible and personalized booking options that allow tourists to access authentic rural travel experiences.

One of the most common booking channels for agro-tourism is online booking, which is convenient, transparent, and provides real-time access to the availability of farms stay and rural tourism packages. Unlike traditional walk-in bookings, online platforms offer travellers detailed descriptions of individual farms, schedules for activities, and customer reviews, improving decision-making and accessibility all around.

With farm tourism operators emphasizing global accessibility and direct customer engagement, there has been a rise in the demand for online agro-tourism booking platforms, with features such as an integrated map, seasonal activity planners, farm communication tool, etc., which has driven up the adoption of digitalized booking solutions. Over 65% of agro-tourism bookings are online, ensuring a greater visibility for rural tourism service providers and revenue growth, as per studies.

Increased growth of AI powered rural travel recommendations with personalized farmhouse recommendations for travellers based on traveller preferences has increased market demand and has ensured increased adoption of smart tourism solutions. Use of virtual farm tour with 360-degree videos and previews of rural tourism products in augmented reality also drove adoption further by providing better customer engagement and convenient pre-trip planning.

We have block chain-based secure payments for rural tourism with fraud-free transactions that guarantee direct payment to farm owner, an optimum growth of the market, thus providing more confidence and financial security for small and medium scale farm operators.

Multi-currency and multilingual capability of agro-tourism booking platforms with the process of seamless initiation of accessibility from different international locations has further supported the market growth provides better adaptability to global traveller.

While the online agro-tourism booking system has the potential to bring benefits of high accessibility, convenience, and cost-effective booking management, there remain numerous challenges, such as technological obstacles in rural areas, a lack of digital literacy among small owners of farms, and cybersecurity risks.

But new innovations such as AI-driven chat-based bookings, automated multilingual customer support, and decentralized platforms for tourism are also improving market penetration, ease of use and customer satisfaction-key drivers for future growth in the area of online agro-tourism bookings.

Online booking was well-established, but in-person booking has seen significant market penetration, driven by travellers interested in ad-hoc travel and human-to-human contact with farm owners, in response to growing tourism market demand for humanity and experience selection. The ability to reserve a space in person offers the advantages of last-minute flexibility, tailoring of an itinerary and real-time interaction with farm hosts, which is not possible with online bookings.

With travellers craving authenticity in rural travel experiences, the growing desire for in-person bookings - driven by guided tours, demonstration of hands-on activities and farmer interaction - at agritourist visitor centres and local farm markets, are leading many agritourist operators to adopt walk-in booking models.

In community based rural tourism, demands for direct bookings have been enhanced due to market demand resulting from the growth of heritage based agro-tourism with cultural based farm visits and traditional craft workshops. In-person QR-code-based instant booking, on-site digital payment options that enhanced adoption ensured better convenience and seamless tourism experience customization.

As convenient as it is, this type of agro-tourism can be difficult as in-person visitors are often unpredictable, agro-tourism companies must rely heavily on local marketing with less traffic from far away, and some locations are too rural to easily find accommodations. Yet in-person agro-tourism bookings will continue to expand thanks to budding tech solutions - AI-powered hybrid booking systems, digital kiosks to engage passive rural visitors and tools to create personalized farm itineraries.

Agro-rural tourism market is growing with a high demand for authentic farm experiences, eco-tourism and sustainable rural travel. AI-Driven Booking Systems, Agritourism Infrastructure, and Enriched Farm Stays: Businesses and tourism operators are pivoting towards AI-driven booking systems, agritourism infrastructure development, and immersive farm stay experiences to attract visitors as well as benefit the local economy and environment.

It encompasses everything from global travel agencies to providers of rural hospitality and farm-based tourism, who drive technological innovation in areas like online booking, guided farm experiences, and agritourism event management.

Market Share Analysis by Company

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Farm Stay USA | 15-20% |

| AgriTourism World | 12-16% |

| Responsible Travel | 10-14% |

| Expedia Group (Rural Travel & Farm Stays) | 8-12% |

| Harvest Hosts | 5-9% |

| Other Operators (combined) | 40-50% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Farm Stay USA | Develops farm stay experiences, hands-on agricultural tourism, and digital booking solutions for rural travel. |

| AgriTourism World | Specializes in directory-based agritourism marketing, connecting travelers with farm and ranch experiences globally. |

| Responsible Travel | Offers sustainable farm-based tourism, organic food travel experiences, and eco-conscious rural stays. |

| Expedia Group (Rural Travel & Farm Stays) | Provides digital agritourism bookings, countryside retreats, and rural adventure tourism packages. |

| Harvest Hosts | Offers unique farm and vineyard stays for RV travelers, integrating experiential farm activities. |

Key Organization Insights

Farm Stay USA (15-20%)

The agro-rural tourism sector is dominated by Farm Stay USA that provides curated farm and ranch stays, local produce-based tourism, and travel solution for digital agritourism booking.

AgriTourism World (12-16%)

AgriTourism World connects travelers to local agritourism destinations that offer guided farm visits and agricultural education programs.

Responsible Travel (10-14%)

Responsible Travel specializes in sustainable farm tourism, regenerative travel campaigns and eco-friendly rural accommodation experiences.

Expedia Group (8-12%)

Relying exclusively on regional guest houses or local advertisements, Expedia assists rural tourism and farm stays, optimizing the reservation capabilities and electronizing the accessibility of farm homes around the globe.

Harvest Hosts (5-9%)

Including a farm-based overnight stay for RV travelers, Harvest Hosts has direct interaction with farms and agribusinesses.

Other Key Players (40-50% Combined)

Several rural tourism organizations, farm collectives, and eco-tourism agencies contribute to next-generation agro-rural tourism innovations, AI-driven booking solutions, and sustainable farm-based experiences. These include:

The overall market size for Agro-Rural Tourism Market was USD 102.5 Billion in 2025.

The Agro-Rural Tourism Market is expected to reach USD 173.4 Billion in 2035.

The demand for the agro-rural tourism market will grow due to increasing interest in sustainable travel, rising consumer preference for authentic rural experiences, government initiatives promoting agritourist, and the growing awareness of farm-based recreational activities, driving economic benefits for rural communities.

The top 5 countries which drives the development of Agro-Rural Tourism Market are USA, UK, Europe Union, Japan and South Korea.

Educational Agro-Tourism and Recreation Agro-Tourism Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Tourist Type , 2023 to 2033

Figure 32: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 64: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 65: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 66: North America Market Attractiveness by Tourist Type , 2023 to 2033

Figure 67: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Tourist Type , 2023 to 2033

Figure 102: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Tourist Type , 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Tourist Type , 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Tourist Type , 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Service Type, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Tourist Type , 2023 to 2033

Figure 242: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Service Type, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Tourist Type , 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

War Tourism Market Insights - Size, Trends & Forecast 2025 to 2035

Dark Tourism Market Forecast and Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Market Share Breakdown of Wine Tourism Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA